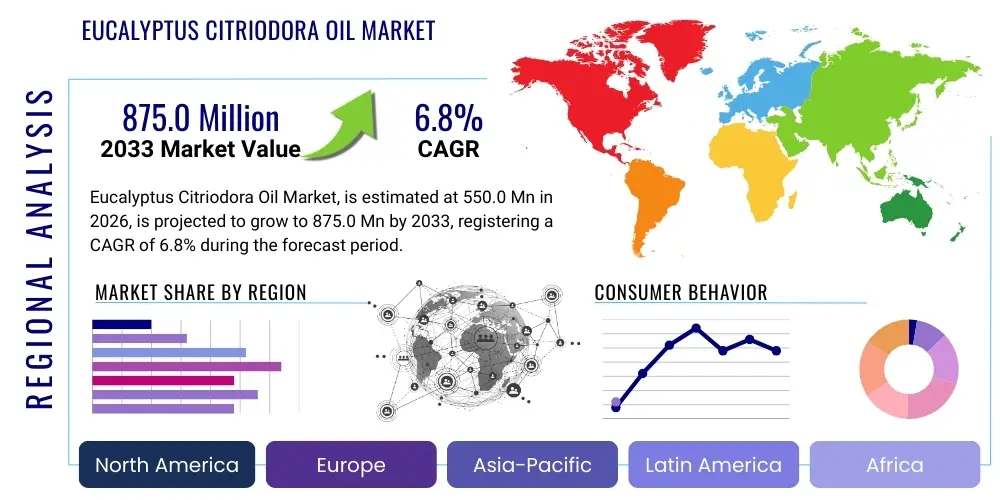

Eucalyptus Citriodora Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441870 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Eucalyptus Citriodora Oil Market Size

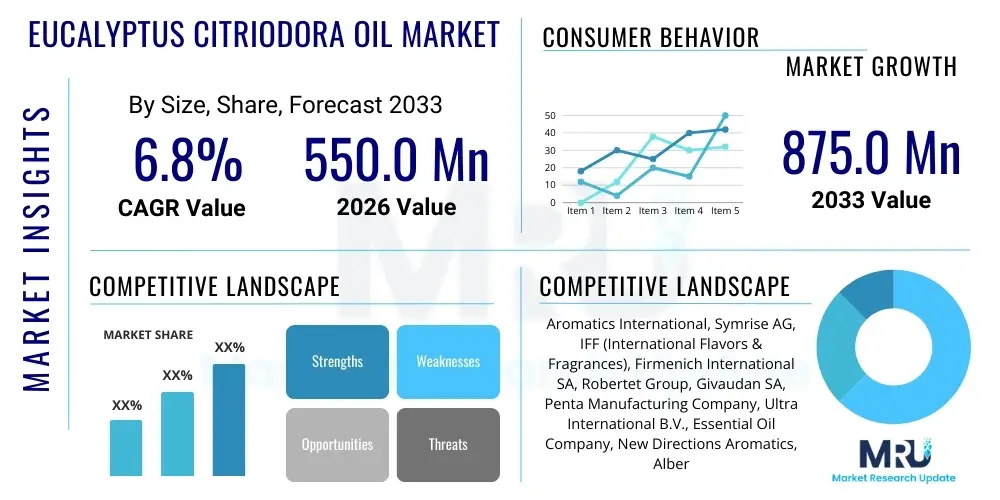

The Eucalyptus Citriodora Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 550.0 Million in 2026 and is projected to reach USD 875.0 Million by the end of the forecast period in 2033.

Eucalyptus Citriodora Oil Market introduction

Eucalyptus Citriodora Oil, commonly known as Lemon Eucalyptus Oil, is a natural essential oil derived from the leaves and twigs of the Corymbia citriodora tree, historically classified as Eucalyptus citriodora. This oil is highly valued across diverse industries due to its distinctive strong, fresh, and sweet lemon-like aroma, coupled with potent therapeutic properties. The oil's primary chemical constituent is citronellal, which often accounts for 70% to 90% of its composition, making it particularly effective as a natural insect repellent and a key ingredient in fragrance formulations.

Major applications for Eucalyptus Citriodora Oil span the personal care, pharmaceutical, and flavor industries. In personal care and cosmetics, it is prized for its deodorizing capabilities and use in soaps, lotions, and perfumes. Therapeutically, it is recognized for its anti-inflammatory, analgesic, and antimicrobial actions, leading to its inclusion in topical pain relief formulations and cold remedies. Furthermore, the oil's efficacy as a bio-pesticide, particularly against mosquitoes, drives significant demand in public health and consumer protection products globally, often marketed as a safer alternative to synthetic chemicals like DEET.

The market is predominantly driven by the increasing consumer preference for natural, plant-based ingredients over synthetic compounds, especially in wellness and personal care sectors. Regulatory support for natural bio-pesticides, coupled with growing awareness of the health benefits associated with aromatherapy, further catalyzes market expansion. Developing regions, particularly in Asia Pacific and Latin America, are witnessing heightened adoption of these essential oils due to abundant natural resources and rising disposable incomes fueling demand for premium natural products.

Eucalyptus Citriodora Oil Market Executive Summary

The Eucalyptus Citriodora Oil market is currently characterized by robust business trends centered on sustainability and product diversification, primarily focused on high-purity, certified organic grades to meet stringent consumer and regulatory demands in North America and Europe. Key industry players are investing heavily in advanced extraction techniques, such as supercritical fluid extraction (SFE), to maximize citronellal yield and maintain the oil's high quality profile, thereby appealing to the premium fragrance and therapeutic segments. Strategic partnerships between growers in source regions (like Brazil and China) and large international flavor and fragrance houses are securing supply chains and mitigating price volatility, ensuring consistent availability for large-scale industrial applications.

Regionally, Asia Pacific is emerging as the fastest-growing market, propelled by expanding traditional medicine practices and the rapid growth of the domestic cosmetics industry, especially in countries like India and China, where sourcing of raw materials is localized. North America and Europe remain the largest revenue contributors, driven by stringent quality standards and high per capita spending on aromatherapy and natural insect repellents. These mature markets dictate global trends, emphasizing traceability and ethical sourcing, forcing suppliers to enhance transparency throughout the value chain.

In terms of segmentation, the Insect Repellent application segment holds the dominant market share due to the oil’s well-documented efficacy and CDC recommendation, particularly in malaria and dengue-prone areas. Simultaneously, the Therapeutic Grade segment, characterized by high purity levels, is forecast to experience the fastest growth, mirroring the global shift towards natural medicinal alternatives. Distribution channels are undergoing transformation, with e-commerce platforms increasingly dominating sales, offering consumers direct access to niche brands and specialized therapeutic formulations, bypassing traditional retail intermediaries and allowing for tailored marketing strategies based on specific geographic health concerns.

AI Impact Analysis on Eucalyptus Citriodora Oil Market

User queries regarding the impact of Artificial Intelligence (AI) on the Eucalyptus Citriodora Oil market often revolve around efficiency gains in cultivation, optimization of extraction yields, and the precise formulation of end products. Users are keenly interested in how machine learning can predict optimal harvesting times based on meteorological data and soil conditions to maximize citronellal content. Furthermore, concerns frequently arise about AI's role in synthesizing or identifying highly effective natural alternatives, potentially disrupting traditional essential oil markets. The expectation is that AI will primarily enhance operational efficiencies and quality control, ensuring consistent supply and purity, which is critical for high-value applications like pharmaceuticals and certified organic products. However, there is also interest in AI-driven consumer behavior analysis to forecast demand for specific product blends containing Eucalyptus Citriodora Oil in regional markets.

- AI-driven optimization of agricultural practices, including predictive modeling for climate-resilient cultivation and maximizing oil yield per hectare.

- Implementation of machine learning algorithms to fine-tune supercritical fluid extraction (SFE) and distillation parameters, ensuring optimal purity and concentration of citronellal.

- Enhanced quality control through spectroscopic analysis and AI pattern recognition to detect adulteration or variation in chemical composition quickly and accurately.

- AI-powered R&D assisting in screening and formulating complex flavor and fragrance blends, predicting stability and consumer acceptance of new products incorporating the oil.

- Automated supply chain management and inventory forecasting, minimizing waste and optimizing logistics for global distribution networks based on real-time demand signals.

- Leveraging natural language processing (NLP) to analyze scientific literature and patent databases, accelerating the discovery of novel therapeutic applications derived from the oil’s components.

DRO & Impact Forces Of Eucalyptus Citriodora Oil Market

The market trajectory for Eucalyptus Citriodora Oil is significantly influenced by a powerful combination of drivers, restraints, and opportunities, culminating in defining impact forces. A primary driver is the escalating global demand for natural and eco-friendly products, pushing manufacturers across personal care, household cleaning, and pest control sectors to replace synthetic chemicals with proven botanical alternatives. This shift is deeply rooted in widespread consumer skepticism concerning synthetic ingredients and a growing commitment to environmental sustainability. However, this growth is simultaneously tempered by restraints such as high dependency on specific geographical regions for cultivation, leading to supply chain vulnerabilities associated with climate variability, political instability, and inconsistent quality across different harvests. Furthermore, the volatility in pricing for raw materials due to seasonal fluctuations presents ongoing operational challenges for major processors.

Opportunities for expansion are substantial, primarily focused on capitalizing on the proven efficacy of the oil as a bio-based insect repellent, particularly through product registration and deployment in regions facing heightened vector-borne disease risks. There is also an emerging opportunity in the integration of the oil into functional food and beverage formulations as a natural flavoring agent, leveraging its unique profile. Research into novel therapeutic benefits, such as advanced anti-fungal or antiviral applications, represents another critical avenue for future market penetration, provided regulatory hurdles can be efficiently navigated.

The combined impact forces reflect a transition toward premiumization and certification. The strongest force impacting the market is the regulatory environment favoring natural pesticides, which substantially enhances market access compared to synthetic alternatives, particularly in developed economies. Conversely, the challenge of maintaining scalability and cost-efficiency while ensuring therapeutic-grade purity acts as a critical limiting force. The overall trend suggests that markets focused on certified organic, traceable, and high-purity oils will capture premium value, while industrial grades face intense price competition, necessitating continuous process innovation to remain profitable.

Segmentation Analysis

The Eucalyptus Citriodora Oil market is meticulously segmented based on application, grade, and distribution channel, providing a granular view of consumption patterns and growth pockets. Segmentation reveals that end-user demand is heavily diversified, ranging from highly purified therapeutic uses requiring minimal contaminants to bulk industrial applications such as cleaning products and basic fragrance components. Understanding these segments is crucial for manufacturers to tailor production capabilities and marketing strategies, ensuring compliance with varied regulatory standards globally, especially concerning purity thresholds required for internal consumption versus external application.

- By Application:

- Fragrance & Perfumery: Utilization in high-end perfumes, colognes, and industrial odor masking due to its fresh, lemony note.

- Aromatherapy: Essential use in diffusers, massage oils, and bath preparations for stress relief, rejuvenation, and mood enhancement.

- Pharmaceuticals & Therapeutics: Inclusion in medicinal balms, topical anti-inflammatory creams, and traditional cold and cough remedies.

- Cosmetics & Personal Care: Incorporation into soaps, shampoos, skin creams, and natural deodorants for cleansing and odor control properties.

- Flavoring Agents: Limited but growing use in confectionery and beverages, mainly as a natural modifier, requiring highly regulated food-grade purity.

- Insect Repellent: The largest segment, driven by the oil's efficacy against mosquitos and other biting insects, used in lotions, sprays, and candles.

- By Grade:

- Therapeutic Grade: Highest purity level (typically >85% citronellal), used in direct aromatherapy, pharmaceuticals, and premium wellness products; focused on strict quality control.

- Cosmetic Grade: Moderate purity, suitable for mass-market cosmetics, soaps, and lotions, balancing efficacy and cost-efficiency.

- Industrial Grade: Lower purity, utilized in household cleaning products, detergents, and industrial masking agents where odor and basic anti-microbial properties are the primary requirements.

- By Distribution Channel:

- Direct Sales: Large volume contracts between primary producers/distillers and major flavor/fragrance houses (e.g., IFF, Givaudan).

- Distributors: Bulk sales through specialized chemical and essential oil distributors catering to medium-sized cosmetic or pharmaceutical manufacturers.

- E-commerce: Rapidly expanding channel targeting individual consumers, small businesses, and aromatherapy practitioners; offering certified organic and niche brands.

- Retail Stores: Includes pharmacies, supermarkets, and specialty health stores carrying branded insect repellents and personal care products.

Value Chain Analysis For Eucalyptus Citriodora Oil Market

The value chain for Eucalyptus Citriodora Oil is characterized by a series of integrated steps, starting from agricultural cultivation and culminating in specialized end-user applications. The upstream segment is dominated by the cultivation and harvesting of Corymbia citriodora trees, primarily centered in tropical and subtropical regions such as China, Brazil, and parts of Africa. This phase involves managing sustainable forestry practices and ensuring high-quality leaf material, which directly impacts the resultant oil's citronellal concentration. Immediate processing, usually via steam distillation, often takes place near the cultivation sites to reduce transportation costs and preserve the freshness of the raw material. This initial phase requires substantial investment in agricultural infrastructure and localized distillation equipment.

The midstream phase involves essential oil processors and refiners who take the crude oil and perform purification, fractionation, and standardization to meet specific industry grade requirements (Therapeutic, Cosmetic, or Industrial). Large flavor and fragrance corporations often integrate backwards into this refinement stage to ensure proprietary blends and purity levels. Distribution channels then play a crucial role, moving the refined oil globally. Direct sales channels are preferred for bulk transactions with major multinational corporations that require high volumes and consistent quality contracts. Indirect channels, including specialized essential oil distributors and modern e-commerce platforms, manage smaller volumes and cater to niche markets such as independent aromatherapists and health food stores, where product knowledge and certification documentation are paramount.

Downstream analysis focuses on the formulation and incorporation of the oil into finished consumer products. Manufacturers of insect repellents, pharmaceuticals, and personal care items represent the primary consumers. The final stage involves marketing and retail, where brand identity, sustainability claims (e.g., organic certification, ethical sourcing), and efficacy claims (e.g., duration of insect protection) drive consumer purchasing decisions. The efficiency of the entire chain relies heavily on traceability systems to link the final product back to sustainable upstream sourcing, a requirement increasingly demanded by discerning consumers and regulatory bodies in developed markets.

Eucalyptus Citriodora Oil Market Potential Customers

The potential customer base for Eucalyptus Citriodora Oil is remarkably diverse, spanning sectors that value its potent fragrance profile, anti-microbial properties, and proven insect-repelling efficacy. The largest segment of end-users consists of major Flavor and Fragrance (F&F) houses, such as Givaudan, IFF, and Symrise, which utilize bulk quantities of the oil as a foundational component in their proprietary blends for perfumes, air fresheners, and household cleaning products. These companies seek consistent supply of industrial and cosmetic grade oils at competitive prices, prioritizing stable supply chains and compliance with global fragrance standards, notably those set by IFRA.

The second major group includes Pharmaceutical and Natural Therapeutic manufacturers. These customers require high-purity, therapeutic-grade oil for incorporation into topical analgesic preparations, anti-fungal treatments, and products registered under herbal or traditional medicine categories. They prioritize oils backed by detailed Certificates of Analysis (CoA) demonstrating specific citronellal concentration and absence of heavy metals or pesticides, making sourcing traceability a non-negotiable factor. The rising interest in botanical drug development further solidifies this segment as a key growth area for premium oil producers.

Finally, Cosmetics and Personal Care companies, ranging from multinational corporations producing mass-market insect repellents to niche artisanal soap makers, constitute a perpetually growing customer group. Manufacturers of natural insect repellents, driven by public health advisories concerning vector-borne diseases, represent a particularly resilient and high-volume demand segment. These customers often require oil processed into specific derivatives, such as Citriodiol, for maximum effectiveness and product registration compliance, indicating a continuous need for innovation and specialized processing capabilities within the supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Million |

| Market Forecast in 2033 | USD 875.0 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aromatics International, Symrise AG, IFF (International Flavors & Fragrances), Firmenich International SA, Robertet Group, Givaudan SA, Penta Manufacturing Company, Ultra International B.V., Essential Oil Company, New Directions Aromatics, Albert Vieille, NHR Organic Oils, doTERRA International, Young Living Essential Oils, Mountain Rose Herbs, Vigon International, Ernesto Ventós S.A., AOS Products Private Limited, Kanta Enterprises Private Limited, Shiv Sales Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eucalyptus Citriodora Oil Market Key Technology Landscape

The technological landscape surrounding the Eucalyptus Citriodora Oil market is centered on enhancing extraction efficiency, ensuring product purity, and developing advanced methods for derivative creation. The primary and most established technology remains steam distillation, but modern producers are increasingly implementing low-pressure and fractional distillation techniques to selectively separate volatile compounds, thereby concentrating the critical component, citronellal, and achieving ultra-high purity required for therapeutic applications. Optimization of these traditional methods through automated temperature and pressure controls allows for minimal degradation of the oil’s quality, preserving its therapeutic efficacy and aromatic profile, which commands a premium price point in the global market.

Beyond traditional distillation, Supercritical Fluid Extraction (SFE), particularly using CO2, represents an advanced technology gaining traction. SFE allows for solvent-free extraction at low temperatures, yielding a cleaner, higher-quality oil profile that retains more of the subtle volatile compounds often lost during steam processing. This technique is especially critical for producing food-grade and therapeutic-grade oils where solvent residues are strictly prohibited. Furthermore, analytical technologies like Gas Chromatography-Mass Spectrometry (GC-MS) are indispensable for quality control. GC-MS ensures that every batch meets specific chemical profile standards, verifying citronellal concentration, detecting adulterants, and confirming the absence of unauthorized pesticides, thus providing the necessary documentation for global regulatory compliance.

Innovation also focuses on the downstream processing, particularly the chemical modification of citronellal into p-Menthane-3,8-diol (PMD), which is the active ingredient in many highly effective, CDC-approved natural insect repellents (often branded as Citriodiol). Technologies for efficient catalytic conversion of citronellal to PMD are crucial for manufacturers targeting the public health sector. Additionally, integration of Internet of Things (IoT) sensors and data analytics platforms within large-scale cultivation and processing facilities allows for real-time monitoring of raw material quality and process variables. This technological adoption enhances traceability, reduces operational variability, and supports the stringent quality demands placed upon key suppliers by global Flavor & Fragrance (F&F) houses.

Regional Highlights

The global Eucalyptus Citriodora Oil market exhibits significant regional disparities in both production capacity and consumption patterns, influenced by local climate, consumer preferences, and regulatory frameworks.

- North America (United States and Canada): Dominated by high demand for certified organic aromatherapy products and natural insect repellents. The US market dictates global trends concerning safety and transparency. High per capita spending on wellness and clean-label products drives demand for premium, therapeutic-grade oils.

- Europe (Germany, France, UK): A mature market characterized by stringent regulations (e.g., REACH compliance) regarding chemical safety and environmental impact. Strong growth is observed in the cosmetics and perfumery sectors, fueled by consumers seeking natural alternatives to synthetic fragrances. Germany leads consumption in the therapeutic segment due to strong herbal medicine traditions.

- Asia Pacific (APAC) (China, India, Brazil, Australia): Emerging as the fastest-growing region, APAC is both a major production hub (China and India) and a rapidly expanding consumer base. Abundant raw material availability and lower production costs drive high export volumes. Domestic consumption is accelerating due to rising disposable incomes and expanding local traditional medicine and cosmetics industries.

- Latin America (Brazil, Argentina): Brazil is a crucial global supplier due to optimal growing conditions. The regional market sees increasing domestic use in localized insect repellent campaigns driven by endemic vector-borne diseases (e.g., Zika, Dengue). This region represents a high-potential market for direct sales of processed oils for public health initiatives.

- Middle East and Africa (MEA): Growth is primarily concentrated in the aromatherapy and regional fragrance sectors, particularly in the Gulf Cooperation Council (GCC) countries known for high expenditure on luxury perfumes. Africa holds significant potential for cultivation and production, while simultaneously serving as a critical market for natural insect repellents due to high disease burden.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eucalyptus Citriodora Oil Market.- Aromatics International

- Symrise AG

- IFF (International Flavors & Fragrances)

- Firmenich International SA

- Robertet Group

- Givaudan SA

- Penta Manufacturing Company

- Ultra International B.V.

- Essential Oil Company

- New Directions Aromatics

- Albert Vieille

- NHR Organic Oils

- doTERRA International

- Young Living Essential Oils

- Mountain Rose Herbs

- Vigon International

- Ernesto Ventós S.A.

- AOS Products Private Limited

- Kanta Enterprises Private Limited

- Shiv Sales Corporation

- S.D. Pharmacy

- Indo-Australian Chemical Co.

Frequently Asked Questions

Analyze common user questions about the Eucalyptus Citriodora Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the Eucalyptus Citriodora Oil market growth?

The primary driver is the accelerating global consumer shift towards natural, plant-based ingredients, particularly its recognized efficacy as a natural insect repellent (due to the high citronellal content) and its utilization in the expanding clean-label personal care industry.

How is Eucalyptus Citriodora Oil different from standard Eucalyptus Oil?

Eucalyptus Citriodora Oil (Lemon Eucalyptus Oil) is distinct because its major component is citronellal (up to 90%), giving it a strong lemon scent and making it highly effective as a repellent. Standard Eucalyptus Oil (Eucalyptus Globulus) is primarily composed of eucalyptol (1,8-cineole) and is traditionally used for respiratory relief.

Which geographical region dominates the supply of Eucalyptus Citriodora Oil?

The Asia Pacific region, specifically China and India, dominates the global supply landscape due to favorable climate conditions, extensive cultivation capacity, and established distillation infrastructure, making them key sourcing hubs for international F&F companies.

What is p-Menthane-3,8-diol (PMD) and why is it important to this market?

PMD is a highly effective derivative synthesized from the citronellal found in Eucalyptus Citriodora Oil. It is crucial because PMD is the active ingredient recommended by public health agencies, including the CDC, for natural and safe protection against mosquitoes and ticks, driving demand in the insect repellent segment.

How does the therapeutic grade segment influence market trends?

The therapeutic grade segment demands the highest quality, characterized by strict purity standards and advanced analytical testing (GC-MS). This segment sets the benchmark for quality control and pricing, driving manufacturers to invest in cleaner extraction technologies like Supercritical Fluid Extraction (SFE) to meet premium consumer expectations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager