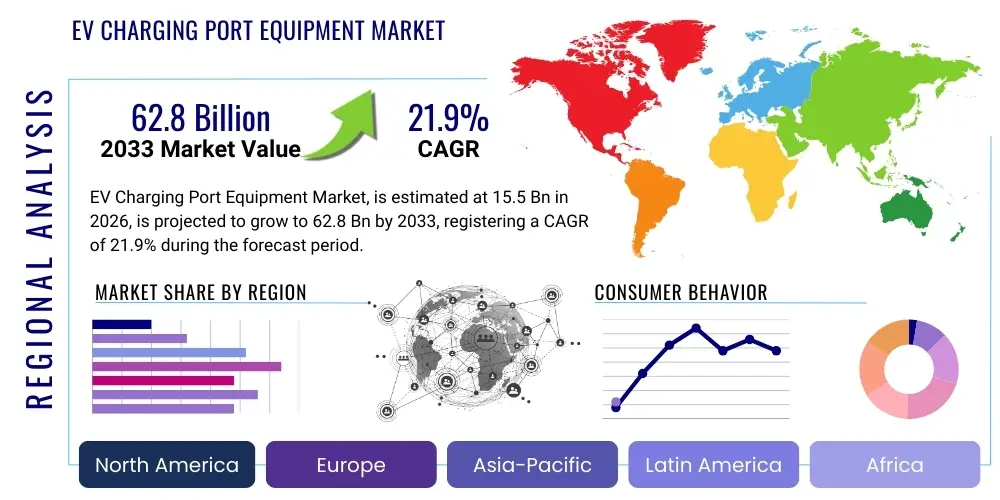

EV Charging Port Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441888 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

EV Charging Port Equipment Market Size

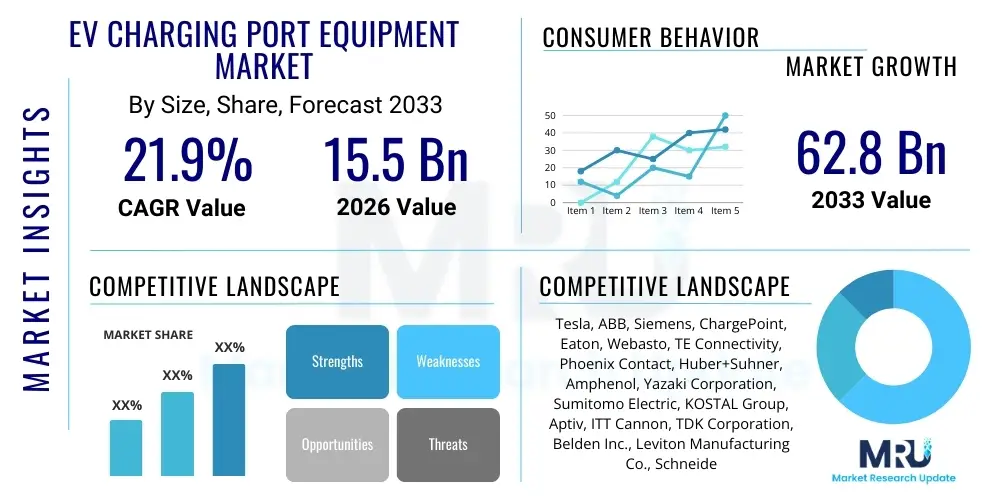

The EV Charging Port Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.9% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 62.8 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by aggressive global targets for decarbonization, coupled with significant governmental incentives promoting the adoption of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The necessity for robust and ubiquitous charging infrastructure to support the rapidly growing EV fleet mandates high investment in sophisticated port equipment, including connectors, cables, relays, and associated power electronics.

EV Charging Port Equipment Market introduction

The EV Charging Port Equipment Market encompasses the specialized hardware components essential for transferring electrical energy from the charging station or grid to the electric vehicle’s battery system. Key equipment includes charging plugs, inlets, sockets, cables, and various protective and communication components mandated by standards such as CCS, CHAdeMO, and NACS. This infrastructure is critical for the seamless operation of electric mobility, providing the physical interface necessary for reliable, safe, and efficient power transfer, irrespective of the charging level (Level 1, Level 2, or DC Fast Charging). Major applications span across public charging networks, commercial fleet depots, residential garages, and workplace charging solutions, acting as the fundamental backbone of the global EV transition.

The principal benefit of advanced charging port equipment lies in its ability to support higher power outputs and bidirectional charging capabilities, enhancing vehicle-to-grid (V2G) functionality and improving grid stability. The rapid evolution of battery technology necessitates concurrent innovation in port equipment design to handle increasing current and voltage requirements while ensuring thermal management and interoperability across diverse vehicle models and geographic standards. Furthermore, robust port equipment significantly minimizes downtime and maintenance costs for charging service providers, contributing to the overall reliability of the charging ecosystem, which is a crucial factor in consumer EV adoption.

Driving factors for this market include stringent regulatory mandates phasing out internal combustion engine (ICE) vehicles, coupled with substantial governmental subsidies directed towards infrastructure development, particularly in high-density urban areas and along major transportation corridors. The growing trend of electrification in commercial fleets, encompassing buses and heavy-duty trucks, demands high-power DC charging ports, accelerating the development and deployment of durable, liquid-cooled cable and connector systems. Standardization efforts, particularly the increasing dominance of the Combined Charging System (CCS) and the emerging North American Charging Standard (NACS), also drive investment and innovation in compatible port components.

EV Charging Port Equipment Market Executive Summary

The global EV Charging Port Equipment Market is experiencing dynamic shifts, characterized by strong governmental support, increasing standardization, and technological convergence toward ultra-fast charging capabilities. Business trends highlight strategic partnerships between automotive manufacturers and charging infrastructure providers (Charge Point Operators - CPOs) to secure reliable supply chains and accelerate the deployment of high-voltage DC charging stations, particularly in the premium and commercial vehicle segments. Consolidation among component suppliers focusing on advanced thermal management solutions and high-durability materials is also prevalent, aiming to meet the rigorous demands of public charging environments. Furthermore, cybersecurity integration within the port communication modules is becoming a critical business differentiator, addressing concerns related to data integrity and secure charging transactions.

Regionally, Asia Pacific (APAC), led by China, dominates the market share due to unparalleled domestic EV production and massive state-sponsored deployment of public charging points. Europe exhibits rapid growth, driven by ambitious EU climate targets and legislative frameworks like the Alternative Fuels Infrastructure Regulation (AFIR), which mandates specific charging station densities along major transport routes, favoring standardized CCS technology. North America is poised for significant expansion, largely due to the U.S. National Electric Vehicle Infrastructure (NEVI) program and the accelerating standardization push towards the NACS connector, necessitating substantial retooling and modification of existing and future port equipment supply lines.

Segment trends reveal a pronounced shift toward DC charging port components, driven by the increasing consumer demand for rapid charging and the electrification of medium and heavy-duty commercial fleets, which require high-power (>150 kW) connections. The component segment is seeing high growth in sophisticated power electronics, especially smart relays and circuit breakers designed to handle high current switching safely. Furthermore, the material science segment is prioritizing lighter, more durable, and heat-dissipating materials for cables and connectors, crucial for maintaining efficiency and longevity in extreme operating conditions.

AI Impact Analysis on EV Charging Port Equipment Market

Common user questions regarding AI's impact on EV charging port equipment often revolve around predictive maintenance capabilities, optimization of charging infrastructure utilization, and intelligent grid interaction. Users frequently ask how AI can prevent equipment failure, manage load balancing across multiple ports, and ensure interoperability between smart vehicles and diverse charging standards. Based on this analysis, the key themes are focused on leveraging machine learning algorithms to enhance the reliability and longevity of the physical charging port infrastructure, moving beyond simple power transfer to holistic system management. There is a strong expectation that AI will transform reactive maintenance models into predictive ones, significantly reducing operational costs for CPOs and improving the overall user charging experience by preemptively addressing potential failures, such as connector overheating or relay wear.

The integration of artificial intelligence tools is fundamentally changing how charging port equipment operates and is maintained. AI algorithms analyze vast datasets streaming from installed charging ports—including temperature readings, voltage fluctuations, session durations, and usage frequency—to model component degradation and predict potential equipment failures before they occur. This transition to predictive maintenance maximizes the uptime of expensive DC fast chargers, which rely heavily on sophisticated, high-power port components. Furthermore, AI enables dynamic load management at charging hubs, ensuring that the total energy demand does not exceed grid capacity, protecting the underlying port equipment from thermal stress and excessive wear associated with unstable power delivery.

Beyond maintenance, AI influences the design and deployment strategies of charging ports. Machine learning models optimize the physical placement of different charger types (AC vs. DC) by analyzing real-time traffic patterns, energy costs, and anticipated EV adoption rates in specific micro-geographies. This data-driven deployment ensures that the right type of charging port equipment is installed where it is most economically and functionally effective. In the future, embedded AI in the charging port itself will facilitate seamless Vehicle-to-Grid (V2G) communication, managing bidirectional power flow safely through the port’s high-power relays and ensuring compliance with rapidly evolving smart grid protocols.

- Enhanced Predictive Maintenance: AI analyzes thermal and electrical data to forecast equipment failure (e.g., connector degradation, relay burnout), maximizing uptime.

- Optimized Load Management: Machine learning dynamically adjusts power delivery across multiple ports to prevent overloading and protect internal components from stress.

- Improved Interoperability and Standardization: AI facilitates real-time communication protocol translation between diverse vehicle and charger standards (CCS, NACS).

- Intelligent Fault Detection: Algorithms quickly isolate and diagnose specific component issues within the port equipment, speeding up repair times.

- Dynamic Pricing and Energy Routing: AI optimizes charging sessions based on grid pricing, extending the operational lifespan of the power electronics within the port assembly.

DRO & Impact Forces Of EV Charging Port Equipment Market

The EV Charging Port Equipment Market is profoundly shaped by a combination of powerful drivers stemming from regulatory urgency and technological advancement, mitigated by significant restraints related to standardization fragmentation and initial high infrastructure costs. Opportunities primarily lie in the nascent but rapidly expanding segments of high-power charging for commercial vehicles and the development of robust, smart components compatible with Vehicle-to-Grid (V2G) systems. These impact forces collectively dictate the market’s trajectory, pushing component manufacturers toward high-durability, standardized solutions while necessitating considerable capital investment in infrastructure rollout and grid modernization.

Key drivers include substantial global governmental incentives and mandates aimed at electrifying transportation fleets, which directly necessitate the mass deployment of charging infrastructure. Technological breakthroughs in battery energy density and faster charging capabilities compel manufacturers to develop charging port equipment capable of reliably handling ultra-high power (350 kW+) and liquid cooling solutions to manage intense thermal loads, ensuring safety and efficiency. Furthermore, the increasing consumer preference for EVs, spurred by lower operating costs and enhanced vehicle performance, creates persistent underlying demand for reliable and accessible charging points, driving volume requirements for port components globally.

Restraints primarily revolve around the initial high capital expenditure required for deploying fast-charging infrastructure, particularly the costs associated with grid upgrades necessary to support numerous high-power ports. A major challenge is the ongoing fragmentation of charging standards (e.g., the transition in North America from CCS to NACS alongside existing CHAdeMO), which creates uncertainty for manufacturers regarding long-term component investment and necessitates maintaining inventory for multiple incompatible standards. Opportunities, however, are abundant in the development of modular and flexible port equipment designs that can be easily upgraded or adapted to future standards, alongside significant potential in the development of specialized components for extreme weather environments and high-utilization commercial applications.

- Drivers:

- Governmental mandates supporting EV adoption and infrastructure funding (e.g., NEVI, AFIR).

- Rapid advancements in high-power charging technology requiring robust port components.

- Decreasing cost of EV batteries stimulating mass consumer EV purchases.

- Restraints:

- High initial capital outlay for establishing DC fast-charging stations and associated grid connections.

- Continued fragmentation and evolving landscape of global charging standards (CCS, NACS, CHAdeMO).

- Supply chain vulnerabilities affecting the availability of critical electronic components and high-grade materials.

- Opportunities:

- Explosion of the commercial fleet electrification sector (buses, trucks) demanding high-durability, specialized ports.

- Development and standardization of bidirectional (V2G/V2H) charging components and protocols.

- Untapped potential in emerging markets in Southeast Asia and Africa requiring basic Level 2 charging equipment deployment.

- Impact Forces:

- The standardization shift toward NACS in North America is forcing suppliers to rapidly redesign and retool production lines.

- Increased focus on cybersecurity within the charging port’s communication module to ensure secure transactions.

- Pressure to integrate advanced thermal management systems (liquid cooling) directly into high-power connectors and cables.

Segmentation Analysis

The EV Charging Port Equipment Market is primarily segmented based on the component type, charging level, and application, allowing for a detailed understanding of demand dynamics across different end-user needs. Component segmentation differentiates between the physical interfaces (inlets, plugs, cables) and the integrated power and communication electronics (relays, sensors, controllers). This granularity is vital because the failure points and technological requirements for high-power DC charging cables, for example, are vastly different from those of standard AC charging inlets designed for residential use. The market's complexity demands specialized production capabilities across these distinct component categories, impacting manufacturing investment and supply chain specialization.

The segmentation by charging level—Level 1, Level 2 (AC), and DC Fast Charging—is perhaps the most influential driver of component specification and value. DC Fast Charging mandates significantly more complex, durable, and expensive port equipment due to the high voltages and currents involved, requiring advanced thermal management systems and specialized safety protocols integrated directly into the connector assembly. Conversely, Level 2 charging components focus more on cost-effectiveness, compact design, and reliability for long-duration residential or public charging. The ongoing exponential growth in DC fast charging infrastructure deployment globally means that the component segment supporting this level is experiencing the highest growth rate and technological innovation focus.

Application segmentation, separating residential, commercial, and public charging uses, highlights distinct material and durability requirements. Public charging ports, subject to high frequency of use, potential vandalism, and extreme weather conditions, require components made from highly robust, weather-resistant, and tamper-proof materials. Commercial fleet applications, such as bus depots, often necessitate bespoke, heavy-duty components tailored for consistent high-utilization cycles and specific fleet requirements. Understanding these segment dynamics is crucial for manufacturers to tailor product specifications, achieve regulatory compliance, and position themselves competitively within the rapidly evolving landscape of electric vehicle infrastructure.

- By Component Type:

- Charging Inlets/Sockets

- Charging Plugs/Connectors

- Charging Cables (Standard, Liquid-CCooled)

- Power Electronics (Relays, Contactors, Fuses)

- Communication and Control Modules

- Thermal Management Systems (Integrated into Port)

- By Charging Level:

- Level 1 AC Charging Equipment

- Level 2 AC Charging Equipment

- DC Fast Charging Equipment (Up to 150 kW)

- Ultra-Fast DC Charging Equipment (Above 150 kW)

- By Application/End-User:

- Residential Charging (Home Garages)

- Commercial Charging (Workplaces, Retail Centers)

- Public Charging Stations (Highway Corridors, Urban Centers)

- Fleet Charging (Bus Depots, Logistics Centers)

- By Standardization Protocol:

- CCS (Combined Charging System)

- CHAdeMO

- NACS (North American Charging Standard)

- Type 2 (AC European Standard)

Value Chain Analysis For EV Charging Port Equipment Market

The value chain for EV Charging Port Equipment is complex and highly specialized, beginning with the upstream supply of fundamental raw materials and specialized electronic components. Upstream activities involve sourcing high-purity copper for cables, specialized plastics and polymers for connector housings, and sophisticated semiconductors for power electronics and communication modules. Dependence on global suppliers for these high-grade materials and components, particularly microprocessors and high-voltage relays, introduces significant geopolitical and supply chain risks, necessitating robust risk mitigation strategies by major equipment manufacturers. Success in this stage is defined by securing long-term supply agreements and maintaining stringent quality control over conductive and insulating materials.

The midstream involves the design, manufacturing, and assembly of the charging port equipment. Manufacturers must invest heavily in R&D to adhere to rigorous safety standards (UL, CE) and rapidly evolving charging protocols (NACS, CCS). This stage includes precision engineering for thermal management systems embedded within high-power connectors and the production of robust, weather-sealed enclosures. OEMs, who are the primary buyers of these components, demand high volume, guaranteed interoperability, and long-term durability, positioning component specialization and lean manufacturing processes as competitive advantages in the midstream segment.

Downstream activities focus on distribution, installation, and maintenance. Distribution channels are primarily bifurcated into direct sales to large Charge Point Operators (CPOs) and EV OEMs, and indirect sales through specialized electrical distributors and system integrators who procure components for installation projects. The installation phase often requires certified electricians and specialized contractors due to the high-voltage nature of DC fast charging systems. Post-installation support, including maintenance and eventual replacement of high-wear components like cables and connectors, forms a crucial part of the downstream value, ensuring operational reliability for the end-users—EV drivers and fleet managers.

EV Charging Port Equipment Market Potential Customers

The primary end-users and buyers of EV Charging Port Equipment are diverse, ranging from infrastructure developers to automotive original equipment manufacturers (OEMs). Charge Point Operators (CPOs) and Energy Service Companies (ESCOs) constitute a major customer segment, as they require reliable, high-volume components to build and expand public and commercial charging networks. Their purchasing decisions are driven by total cost of ownership (TCO), component durability, standardization compliance, and the ability to integrate with various backend software management platforms. These customers prioritize components that minimize maintenance downtime and maximize energy transfer efficiency, especially for DC fast charging deployments along high-traffic corridors.

Another significant customer base comprises automotive OEMs, who require charging inlets (sockets) integrated into the vehicles themselves. As global automakers commit to electric transitions, they purchase millions of standardized inlets annually, driven by stringent safety regulations and adherence to regional charging standards (e.g., NACS adoption in North America). Fleet operators, including logistics companies, municipal transport authorities, and taxi services, represent a rapidly growing segment, demanding specialized, ruggedized charging port equipment optimized for high-utilization, heavy-duty cycles typical of commercial operations. These customers often focus on liquid-cooled cable assemblies and durable connector housings that can withstand rigorous daily use in depot environments.

Finally, residential consumers and utilities represent the third tier of customers. While residential buyers typically purchase fully integrated Level 2 chargers, the internal components (relays, contactors) are ultimately specified by the charger manufacturers. Utility companies and smart grid operators are becoming increasingly critical customers due to their involvement in V2G projects, requiring specialized port equipment capable of secure, reliable bidirectional power flow management. Their purchasing criteria are heavily influenced by grid integration capabilities, cybersecurity robustness, and long-term asset management considerations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 62.8 Billion |

| Growth Rate | 21.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, ABB, Siemens, ChargePoint, Eaton, Webasto, TE Connectivity, Phoenix Contact, Huber+Suhner, Amphenol, Yazaki Corporation, Sumitomo Electric, KOSTAL Group, Aptiv, ITT Cannon, TDK Corporation, Belden Inc., Leviton Manufacturing Co., Schneider Electric, General Electric (GE) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EV Charging Port Equipment Market Key Technology Landscape

The technological landscape of the EV Charging Port Equipment Market is rapidly advancing, moving beyond simple conductive interfaces toward intelligent, thermally managed, and highly durable systems. A critical area of innovation is in Thermal Management Systems (TMS), particularly for DC fast charging ports (350 kW and above). To prevent overheating and potential safety hazards at extreme power levels, manufacturers are integrating sophisticated liquid-cooling technology directly into the charging cables and connector heads. This requires precision engineering of internal micro-channels and high-reliability sealing mechanisms, which dramatically improves power transfer efficiency, reduces charging time, and extends the operational lifespan of the equipment, constituting a major technological differentiator among component suppliers.

Another significant technological trend is the standardization and implementation of advanced communication protocols. The transition toward smart charging necessitates robust, secure communication between the vehicle's Battery Management System (BMS) and the charging station's control unit (CSU), often leveraging protocols like ISO 15118. This protocol is foundational for features such as Plug & Charge, which automates authorization and billing, and for enabling future Vehicle-to-Grid (V2G) functionality. The port equipment must house increasingly complex and reliable communication chips and power line communication (PLC) hardware to ensure seamless data exchange, moving the component closer to a sophisticated network node rather than just a power conduit.

Furthermore, material science innovations are crucial, focusing on developing lighter, more flexible, and highly durable materials for cable insulation and connector housings. The industry is adopting high-performance engineering plastics and elastomers that offer superior resistance to environmental factors (UV exposure, extreme temperatures) and mechanical stress. The emphasis on ruggedization, especially for public and fleet charging applications, requires materials that can withstand frequent misuse and high-cycle connections. This includes the development of self-cleaning or anti-icing coatings for charging inlets and plugs, enhancing user convenience and minimizing maintenance requirements in diverse climate zones globally.

Regional Highlights

Regional dynamics are critical in the EV Charging Port Equipment Market, driven by differential rates of EV adoption, varying governmental support levels, and fragmented standardization efforts across major economic blocs. Each region presents a unique set of demands and growth opportunities for equipment manufacturers, necessitating tailored strategies concerning product design and supply chain optimization.

- Asia Pacific (APAC): APAC is the dominant market globally, primarily fueled by massive infrastructure deployment in China, which commands the largest share of the world's EV fleet and public charging points. The focus in this region is on high-volume, cost-effective manufacturing of standardized components, predominantly adhering to GB/T standards in China, although CCS adoption is increasing in markets like South Korea and Japan. India and Southeast Asian countries represent major emerging growth areas, driven by two-wheeler and commercial vehicle electrification, requiring robust, simple, and scalable AC charging components. Government policies in China, focusing on urban charging density, ensure sustained demand for both public and residential port equipment.

- Europe: Europe exhibits strong, regulated growth, mandated by the EU's aggressive decarbonization goals and the Alternative Fuels Infrastructure Regulation (AFIR). This region mandates the CCS Type 2 connector as the standard, leading to high specialization among component suppliers focused on this protocol. Growth is concentrated in the deployment of ultra-fast charging corridors across major highways and significant investment in Vehicle-to-Grid (V2G) capable equipment, particularly in nations like Germany, the Nordics, and the UK. The market emphasizes high safety standards, modularity, and compliance with strict environmental directives regarding material usage.

- North America: The North American market is undergoing a transformative period marked by the accelerated shift from CCS to the proprietary North American Charging Standard (NACS), spurred by key industry commitments and government incentives (NEVI program). This transition necessitates rapid R&D and retooling by manufacturers to produce NACS-compliant charging ports, plugs, and inlets, creating a substantial demand surge for standardized equipment. The market is highly lucrative for DC fast charging component suppliers due to the long distances between major population centers, necessitating high-power infrastructure deployment along interstate highways and urban centers in the U.S. and Canada.

- Latin America (LATAM): While smaller in absolute terms, the LATAM market is showing nascent but promising growth, concentrated mainly in metropolitan areas of Brazil, Mexico, and Chile. The market is primarily driven by pilot programs for electric buses and last-mile logistics fleets. Demand here favors robust, less complex charging equipment, often relying on imported technology but gradually moving toward local assembly and standardization efforts. Infrastructure development remains challenging due to grid stability issues, requiring port equipment designed with enhanced voltage protection features.

- Middle East and Africa (MEA): This region is heavily reliant on ambitious governmental clean energy strategies, particularly in the UAE and Saudi Arabia, which are investing heavily in smart city development and EV fleet adoption. The hot climate presents unique technological challenges, driving demand for charging port equipment with advanced thermal dissipation and climate-resistant materials. South Africa leads the African continent in early-stage infrastructure deployment, primarily focusing on Level 2 and initial DC fast charging points in major urban hubs. The growth trajectory is tied to oil revenue diversification strategies and sustainable mobility initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EV Charging Port Equipment Market.- TE Connectivity

- Phoenix Contact

- Huber+Suhner

- Yazaki Corporation

- Sumitomo Electric Industries, Ltd.

- Amphenol Corporation

- Aptiv PLC

- ITT Cannon

- KOSTAL Group

- Webasto Group

- Tesla (Supplier of NACS components)

- ABB Ltd.

- Siemens AG

- ChargePoint Holdings, Inc. (Focus on component integration)

- Schneider Electric SE

- Eaton Corporation plc

- Leviton Manufacturing Co., Inc.

- General Electric (GE)

- TDK Corporation

- Belden Inc.

Frequently Asked Questions

Analyze common user questions about the EV Charging Port Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift towards high-power DC charging port equipment?

The primary driver is consumer and commercial demand for rapid charging capabilities, which necessitate high-voltage and high-current power transfer. This shift requires sophisticated DC port equipment with integrated liquid cooling systems and advanced safety relays to manage power levels exceeding 150 kW efficiently and safely.

How does the NACS standardization impact manufacturers of EV charging components?

The growing adoption of the North American Charging Standard (NACS) requires component manufacturers to rapidly redesign and retool production lines, phasing out older CCS components or offering dual compatibility solutions, particularly for charging inlets and connector heads, to maintain relevance in the lucrative North American market.

What role does thermal management play in the design of modern charging ports?

Thermal management is critical for high-power DC charging ports (above 100 kW). Integrated liquid cooling systems prevent component overheating, ensuring cable and connector longevity, maximizing charging efficiency, and safeguarding against thermal runaway, which is essential for compliance with safety standards.

Which geographical region holds the largest market share for EV Charging Port Equipment?

The Asia Pacific (APAC) region, predominantly driven by the robust EV ecosystem and massive infrastructure deployment in China, currently holds the largest market share globally due to the sheer volume of electric vehicles and associated charging points deployed.

What are the main applications for Vehicle-to-Grid (V2G) capable charging port technology?

V2G-capable charging port equipment, which allows bidirectional power flow, is primarily used for grid stabilization, peak shaving, and selling excess stored energy back to the grid. Key applications include utilizing parked commercial fleets or aggregated residential EVs as virtual power plants (VPPs) to support renewable energy integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager