Examination Gloves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442783 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Examination Gloves Market Size

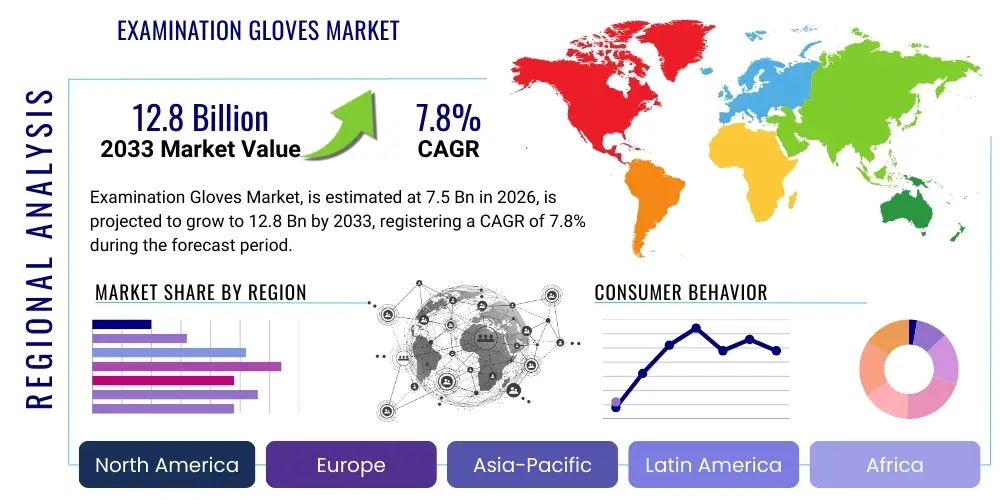

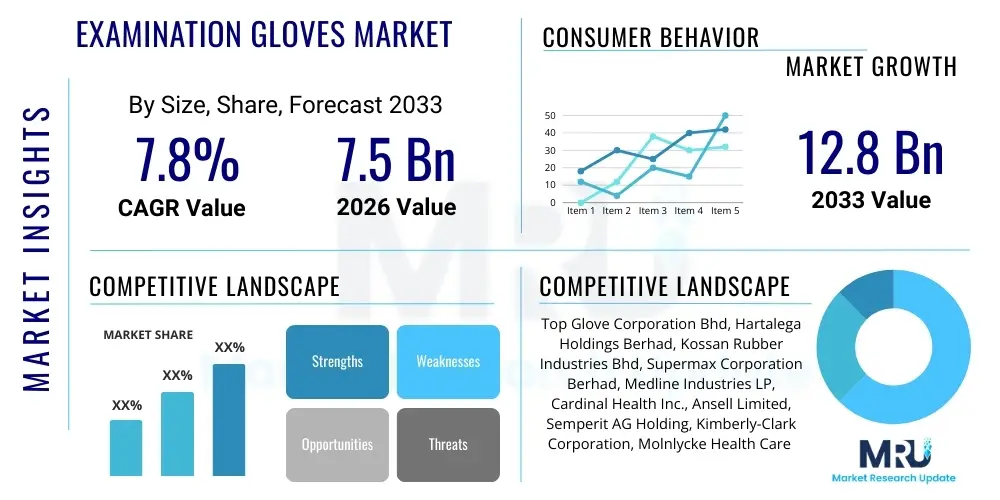

The Examination Gloves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033.

Examination Gloves Market introduction

The Examination Gloves Market encompasses the global production, distribution, and consumption of thin, disposable gloves worn by healthcare professionals during medical examinations, diagnostic procedures, and minor treatments. These gloves serve as a critical barrier between the caregiver and the patient, mitigating the risk of cross-contamination and the transmission of infectious agents, adhering strictly to established infection control protocols. The primary product segments include gloves made from various polymers such as nitrile, natural rubber latex, vinyl, and neoprene, each offering distinct advantages in terms of puncture resistance, tactile sensitivity, and allergen compatibility. Nitrile gloves, specifically, have rapidly gained prominence due to their superior performance characteristics and the declining utilization of latex products owing to allergy concerns.

Major applications for examination gloves span across the entire healthcare continuum, including hospitals, specialized clinics, ambulatory surgical centers, dental practices, laboratories, and long-term care facilities. Beyond clinical settings, these gloves find significant use in non-healthcare environments such as food processing, cleanroom operations, and forensic investigations where sanitation and barrier protection are paramount. The benefits derived from the widespread adoption of high-quality examination gloves are substantial, centering on enhanced safety for both the medical staff and the patient, reduced incidence of healthcare-associated infections (HAIs), and compliance with stringent international regulatory frameworks governing protective equipment.

The market’s expansion is primarily driven by several overarching factors, most notably the sustained increase in global healthcare expenditure, the burgeoning geriatric population requiring frequent medical interventions, and heightened public awareness regarding hygiene standards, particularly post-pandemic. Furthermore, rigorous mandates imposed by organizations like the FDA, WHO, and regional public health bodies requiring the mandatory use of personal protective equipment (PPE) in all patient-facing roles act as powerful market accelerators. Technological advancements, focusing on developing thinner, yet stronger materials with enhanced tactile feel and biodegradability, are also fueling innovation and driving replacement cycles across established medical institutions, ensuring a robust market outlook.

Examination Gloves Market Executive Summary

The Examination Gloves Market is currently characterized by intense competition and a significant shift in material preference, moving decisively away from powdered latex towards synthetic polymers, predominantly nitrile. Global business trends highlight the critical importance of supply chain resilience, a lesson learned profoundly from recent global health crises, leading major manufacturers to diversify their geographic production bases beyond traditional APAC hubs. Mergers and acquisitions focusing on vertical integration—securing raw material sources and streamlining distribution networks—are common strategies employed by market leaders to maintain cost efficiencies and ensure stable supply, thereby influencing overall pricing dynamics and market stability.

Regionally, Asia Pacific (APAC) remains the dominant manufacturing epicenter, leveraging low operational costs and high production capacities, but North America and Europe represent the largest consumption markets, driven by sophisticated healthcare infrastructure and mandatory compliance protocols. The APAC region is also emerging as a high-growth consumer market, fueled by expanding universal healthcare coverage and rising disposable incomes leading to greater access to medical care. Conversely, regulatory harmonization challenges across different regions present hurdles, particularly concerning product certification and quality control, which necessitates tailored market entry strategies for multinational corporations.

Segmentation trends indicate that the non-sterile segment holds the majority share, reflecting its use in general examinations and low-risk procedures, while the sterile segment commands a premium for surgical use. Among material types, nitrile is expected to record the highest compound annual growth rate, displacing vinyl and traditional latex across clinical environments globally due to increasing awareness of latex protein allergies among patients and staff. End-user segmentation shows hospitals maintaining the largest demand volume, although the rapid growth of ambulatory surgical centers (ASCs) and outpatient clinics is increasingly decentralizing procurement, requiring manufacturers to adapt their packaging and bulk sales strategies to accommodate smaller, yet highly specific, order sizes.

AI Impact Analysis on Examination Gloves Market

User questions regarding the impact of Artificial Intelligence (AI) on the Examination Gloves Market largely center around optimizing manufacturing efficiency, enhancing quality control processes, and improving supply chain predictability. Users frequently inquire if AI can reduce the current high cost variability seen in raw material procurement, and whether automated vision systems powered by AI can completely eliminate human errors in defect detection during high-speed production runs. There is considerable interest in how machine learning models could forecast demand fluctuations for different glove types (e.g., nitrile vs. vinyl) across specific geographies, enabling manufacturers to adjust production proactively rather than reactively, thus stabilizing pricing and inventory levels. Key concerns also revolve around the potential for predictive maintenance in complex glove dipping lines to minimize costly downtime and maximize throughput without compromising the structural integrity of the final product.

The application of AI and sophisticated machine learning algorithms is profoundly reshaping the operational landscape of examination glove manufacturing, moving it towards 'Smart Manufacturing' paradigms. In the production phase, AI-driven quality assurance systems, using high-resolution cameras and deep learning models, are deployed to analyze the uniformity of the glove film thickness, detect micro-pinholes, and identify structural imperfections at speeds unattainable by traditional human inspection, thereby drastically improving the consistency and reliability of the final product. This level of automated quality control is crucial, especially for sterile gloves where the risk of barrier failure must be minimized to near zero. Furthermore, AI helps optimize the complex dipping and curing process parameters, such as controlling chemical concentrations and oven temperatures, to ensure optimal polymerization for different synthetic materials like nitrile and vinyl.

Beyond the factory floor, AI's most potent influence is observed in supply chain management and demand forecasting. Predictive analytics utilizes historical sales data, seasonal variations, public health reports, and even real-time news regarding infectious outbreaks to generate highly accurate demand forecasts, allowing companies to strategically manage inventory buffers and optimize logistics routes. This proactive approach helps mitigate the extreme inventory volatility and sudden price spikes that plagued the market during the initial phases of the recent pandemic. Furthermore, AI algorithms are being integrated into warehousing and distribution systems to optimize picking, packing, and shipping processes, ensuring faster delivery and reduced handling costs, which ultimately benefits the end-user by providing stable access to essential PPE.

- AI-driven Predictive Maintenance: Minimizing downtime in high-speed dipping and curing lines.

- Automated Quality Assurance: Utilizing machine vision for high-precision, real-time defect detection (e.g., micro-pinholes) in manufactured gloves.

- Supply Chain Optimization: Machine learning models predicting regional demand fluctuations based on epidemiological data and consumption patterns.

- Raw Material Cost Forecasting: Using AI to analyze commodity market trends (e.g., acrylonitrile butadiene) to optimize procurement timing and strategy.

- Process Parameter Control: Employing AI to adjust chemical mixture ratios and curing temperatures for enhanced material strength and flexibility.

DRO & Impact Forces Of Examination Gloves Market

The dynamics of the Examination Gloves Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate strategic direction and profitability. Key drivers include the mandatory increase in infection control measures globally, amplified by regulatory bodies enforcing strict usage guidelines across all clinical settings, coupled with sustained growth in surgical procedures and outpatient visits worldwide. However, the market faces significant restraints, primarily stemming from fluctuating raw material costs, especially for nitrile butadiene rubber (NBR), intense price competition among large Asian manufacturers leading to margin compression, and persistent logistical bottlenecks impacting timely delivery. These forces necessitate a continuous focus on operational efficiency and vertical integration to maintain a competitive edge.

Significant opportunities exist in emerging markets, where rapid healthcare infrastructure development and increasing governmental investment in public health systems are creating massive untapped demand pools for disposable PPE. Furthermore, the development of specialized gloves addressing niche market requirements, such as chemotherapy-rated gloves, low-dermatitis formulations, and sustainable or biodegradable options, presents pathways for premium product differentiation and higher profit margins outside of the high-volume general examination segment. The ongoing structural shift away from latex further solidifies the opportunity for nitrile and next-generation polymer manufacturers to capture substantial market share by offering superior comfort and strength.

The cumulative impact forces strongly favor market expansion, albeit with increased scrutiny on environmental impact and ethical sourcing practices. The convergence of heightened regulatory pressure (Driver) and the volatility of NBR pricing (Restraint) forces manufacturers to invest heavily in process automation and securing long-term supply agreements (Opportunity). The overriding impact is one of consolidation, where companies with diversified geographical manufacturing footprints and advanced automation capabilities are best positioned to absorb cost shocks and capitalize on sustained demand growth driven by global health consciousness and ongoing preparedness for future public health crises. This environment elevates supply chain resilience from a merely operational function to a core strategic advantage.

Segmentation Analysis

The Examination Gloves Market is comprehensively segmented based on material, form, usage, sterility, and end-user, providing a granular view of market dynamics and consumer preferences across the global landscape. The material segment remains the most influential differentiator, determining performance characteristics, cost structure, and target market suitability, with nitrile commanding increasing dominance. The segmentation allows manufacturers to tailor their product offerings and marketing strategies precisely, ensuring specific performance requirements, such as tactile sensitivity for surgical procedures or heavy-duty resistance for forensic applications, are optimally met across diverse clinical and non-clinical environments globally.

Analysis by form (powdered vs. powder-free) shows a clear global trend favoring powder-free gloves, driven primarily by health concerns related to starch powder acting as a carrier for airborne allergens and chemicals, leading to respiratory issues. The shift is accelerated by regulatory bans and guidelines promoting safer work environments in developed economies. Usage segmentation, covering disposable and reusable gloves, overwhelmingly favors the disposable category in healthcare settings due to stringent infection control protocols requiring single-use application, ensuring maximum hygiene and minimizing cross-contamination risks inherent in reusable alternatives.

The market also heavily relies on end-user segmentation, as procurement strategies and volume requirements vary drastically among institutions. Hospitals constitute the single largest consuming segment due to their high patient volumes and complexity of procedures, demanding vast quantities of both sterile and non-sterile varieties. Conversely, laboratories and research facilities require specialized, often chemically resistant gloves, creating a niche market for high-specification products. Understanding these consumption patterns is crucial for forecasting production volumes and optimizing distribution networks to ensure timely supply to critical healthcare providers globally.

- By Material:

- Nitrile

- Latex (Natural Rubber)

- Vinyl (PVC)

- Neoprene

- Others (e.g., Polyisoprene)

- By Form:

- Powdered

- Powder-Free

- By Sterility:

- Sterile

- Non-Sterile

- By Usage:

- Disposable

- Reusable

- By End-User:

- Hospitals

- Clinics and Physician Offices

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Laboratories

- Long-Term Care Facilities (LTCFs)

- Others (e.g., Dental, Emergency Services, Food Industry)

Value Chain Analysis For Examination Gloves Market

The Value Chain for the Examination Gloves Market begins with the upstream procurement of raw materials, primarily synthetic rubbers like Acrylonitrile Butadiene Rubber (NBR) for nitrile gloves, and natural rubber latex. This stage is highly susceptible to commodity price volatility and geopolitical factors affecting supply, dictating the eventual manufacturing cost. Key upstream activities involve the chemical processing of these polymers and the integration of additives, accelerators, and colorants required for the dipping formulation. Efficiency at this stage relies heavily on long-term supplier contracts and strategic inventory management to mitigate sudden price fluctuations and ensure a consistent quality of input materials for high-volume manufacturing processes.

The core manufacturing process constitutes the midstream activities, involving the complex, multi-stage production of gloves via automated dipping lines, encompassing coagulation, vulcanization, leaching, beading, and ultimately, stripping and packaging. Significant value is added here through process engineering, automation, and adherence to stringent quality control standards (e.g., AQL levels). Distribution channels represent the downstream segment, involving the flow of finished products from large centralized manufacturing hubs—predominantly in Southeast Asia—to global consumption points. This downstream network is complex, utilizing both direct sales models for large healthcare systems and indirect channels through global distributors and regional medical supply retailers.

The distribution ecosystem is characterized by the co-existence of direct and indirect channels. Large-scale manufacturers often engage in direct selling to massive integrated delivery networks (IDNs) or national healthcare purchasing organizations, facilitating better control over pricing and supply assurance. However, the indirect channel, leveraging global medical device distributors like Medline and McKesson, handles the vast majority of smaller and decentralized orders, including those for clinics, ASCs, and laboratories. Effective value capture across the chain requires manufacturers to master both operational cost control in the midstream and logistical efficiency in the downstream, ensuring products meet local regulatory compliance upon arrival in disparate international markets.

Examination Gloves Market Potential Customers

The primary consumers and end-users of examination gloves are institutions within the regulated healthcare sector, where the utilization of PPE is mandated by federal and international safety standards. Hospitals, encompassing general wards, operating rooms (ORs), emergency departments (EDs), and various specialized units, represent the largest volume consumers due to the high turnover rate of disposable gloves necessitated by patient-to-patient transitions and invasive procedures. Their procurement decisions are often centralized, focused intensely on bulk pricing, long-term supply contracts, and adherence to specific performance criteria, such as dexterity and barrier protection integrity, ensuring standardization across large systems.

A rapidly expanding customer base includes outpatient facilities such as Ambulatory Surgical Centers (ASCs), specialized clinics (e.g., dental, dermatology), and physician offices. While these entities order smaller volumes individually compared to mega-hospitals, their collective growth, driven by the shift of lower-acuity procedures out of traditional hospital settings, makes them a vital target segment. These customers often prioritize quick replenishment cycles and consistent product availability through local or regional distributors, placing a premium on reliable and efficient logistics services over maximizing bulk discounts.

Beyond the direct patient care sector, other crucial potential customers include diagnostic laboratories, pharmaceutical research facilities, and the expansive global food handling and processing industry. Laboratories require specialized gloves resistant to chemicals and solvents, often dictating the use of thicker, chemically graded nitrile gloves. Furthermore, emergency services (paramedics, first responders) and public health agencies maintain significant stockpiles, driven less by day-to-day consumption and more by governmental preparedness planning and immediate response capabilities during public health emergencies, representing a unique, intermittent, but highly critical purchasing segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Top Glove Corporation Bhd, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Supermax Corporation Berhad, Medline Industries LP, Cardinal Health Inc., Ansell Limited, Semperit AG Holding, Kimberly-Clark Corporation, Molnlycke Health Care AB, Dynarex Corporation, Halyard Health (now part of Owens & Minor), Unigloves (UK) Limited, SHIELD Scientific B.V., Rubberex Corporation (M) Berhad, YTY Group, Adventa Berhad, WRP Asia Pacific, Smart Glove Corporation Sdn Bhd, Tan Sin Lian Industries Sdn Bhd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Examination Gloves Market Key Technology Landscape

The technological landscape of the Examination Gloves Market is primarily focused on three core areas: material science innovation, advanced manufacturing automation, and enhancing product safety features. In material science, the most significant shift involves developing high-performance synthetic polymers that can mimic the elasticity and tactile sensitivity of natural rubber latex while offering superior puncture resistance and eliminating allergen risk. Research is heavily invested in formulations of advanced nitrile compounds (e.g., thinner films with enhanced tensile strength) and proprietary vinyl blends that offer improved barrier protection at a competitive cost point, addressing the continuous market demand for optimized cost-to-performance ratio gloves.

Manufacturing technology has undergone substantial modernization, moving towards fully automated dipping lines characterized by reduced human intervention and increased speed. Key technological advancements include sophisticated process control systems that precisely regulate chemical bath compositions, drying times, and curing temperatures to ensure uniform glove quality across millions of units per day. Furthermore, integrated robotic stripping and stacking systems minimize physical damage during the removal of gloves from the formers and accelerate the packaging process, directly contributing to massive economies of scale necessary for profitability in this highly commoditized market segment. This automation is critical for maintaining competitiveness against low-cost labor markets.

In terms of safety and end-user performance, the integration of specialized coatings and testing methodologies represents a crucial technological frontier. Innovations include interior coatings (e.g., polymer or hydrogel) designed to facilitate easier donning, especially with wet hands, and hypoallergenic treatments to minimize skin irritation among healthcare workers who wear gloves for extended periods. Furthermore, enhanced testing protocols, often utilizing sophisticated AI-backed vision systems, are employed to achieve increasingly stringent Acceptable Quality Limits (AQLs) for pinholes and barrier integrity, ensuring the gloves consistently meet the demanding requirements for both clinical and surgical use globally.

Regional Highlights

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Malaysia, Thailand, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

North America currently holds the largest revenue share in the Examination Gloves Market, primarily driven by exceptionally high healthcare spending, mandatory compliance with stringent infection control standards (enforced by bodies like the CDC and OSHA), and the rapid transition away from latex products due to high allergy prevalence. The United States market is characterized by high consumption per capita, dominated by large Group Purchasing Organizations (GPOs) that dictate procurement volumes and price points for major integrated delivery networks (IDNs). The shift towards premium, high-quality nitrile gloves is most pronounced here, supporting continuous innovation in barrier technology and ergonomic design, leading manufacturers to prioritize high-spec products for this lucrative region.

Europe represents another mature and substantial market, marked by diverse regulatory requirements among member states and a strong commitment to environmental sustainability and ethical sourcing. Countries such as Germany, the UK, and France maintain high standards for PPE usage across public and private healthcare systems, ensuring consistent, high-volume demand. The European market exhibits a slightly slower, but steady, adoption curve for non-latex alternatives compared to the US, although the focus on medical device regulation (MDR) compliance adds complexity and cost for manufacturers seeking market access. Sustainability initiatives, including demand for biodegradable or reduced-environmental-impact synthetic gloves, are increasingly influencing procurement decisions within the EU.

Asia Pacific (APAC) is the undisputed global hub for examination glove manufacturing, owing to the presence of industry giants in Malaysia, Thailand, and China, which benefit from favorable raw material access (especially for natural rubber latex) and massive economies of scale. While APAC's manufacturing dominance is critical, the region is rapidly evolving into a major consumption market as well. This growth is fueled by massive investments in public health infrastructure, increasing urbanization, rising awareness of hygiene, and the expansion of national health coverage programs, particularly in emerging economies like India and China. The domestic consumption increase in APAC is a critical growth driver for the future, shifting the regional dynamics from merely an export base to a significant end-user base.

Latin America and the Middle East and Africa (MEA) currently hold smaller, but high-potential, market shares. Latin American growth is often linked to governmental healthcare budget allocations and economic stability, with Brazil and Mexico being key consumer nations. The adoption rate of advanced PPE technologies in this region is accelerating as healthcare systems modernize, often mirroring trends established in North America. The MEA region, particularly the GCC countries, is witnessing substantial market expansion due to high government spending on sophisticated medical tourism facilities and improving standards of care. Challenges in MEA and Latin America include regulatory fragmentation, currency volatility, and reliance on imports, making reliable logistics and strong distributor relationships essential for successful market penetration.

Specifically within the APAC region, the concentration of global manufacturing power—with Malaysian and Thai companies dominating global output—creates unique supply chain risks and opportunities. A localized disruption in Southeast Asia can immediately trigger global supply chain shocks, highlighting the critical nature of this region to global healthcare resilience. Conversely, the rising middle class and increasing demand for private medical services in countries like Vietnam, Indonesia, and the Philippines signal robust long-term consumption growth. This dual role of APAC as both the primary producer and a rapidly expanding consumer market underscores its fundamental importance to the overall stability and growth trajectory of the global examination gloves industry.

Furthermore, European nations are highly sensitive to product sourcing and quality standards, making certification (such as CE marking and specific national approvals) a prerequisite for market entry. The emphasis on worker safety standards also dictates specific requirements for glove ergonomics and chemical hazard protection, ensuring that products marketed in the EU are not only effective barriers but also comfortable for prolonged clinical use. This focus on premium quality and sustainability differentiates the European market from other regions, where cost-effectiveness often remains the predominant purchasing criterion in bulk tenders. Manufacturers must navigate these layered compliance requirements to maximize market penetration across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Examination Gloves Market.- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Medline Industries LP

- Cardinal Health Inc.

- Ansell Limited

- Semperit AG Holding

- Kimberly-Clark Corporation

- Molnlycke Health Care AB

- Dynarex Corporation

- Halyard Health (now part of Owens & Minor)

- Unigloves (UK) Limited

- SHIELD Scientific B.V.

- Rubberex Corporation (M) Berhad

- YTY Group

- Adventa Berhad

- WRP Asia Pacific

- Smart Glove Corporation Sdn Bhd

- Tan Sin Lian Industries Sdn Bhd

Frequently Asked Questions

Analyze common user questions about the Examination Gloves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material dominates the examination gloves market?

Nitrile rubber currently dominates the examination gloves market, driven by its high puncture resistance, superior protection against chemicals, and the imperative to eliminate Type I allergic reactions associated with natural rubber latex across healthcare settings globally.

What is the primary factor driving the high growth rate of the examination gloves market?

The primary factor driving high growth is the strict enforcement of infection prevention and control (IPC) protocols worldwide, combined with the structural expansion of global healthcare infrastructure and continuous preparedness for future endemic or pandemic events requiring high volumes of PPE.

How is the Examination Gloves Market addressing sustainability concerns?

The market is addressing sustainability concerns through increased research and development into biodegradable and compostable glove materials, optimizing manufacturing processes to reduce water and energy consumption, and implementing recycling programs for non-hazardous medical waste.

Which geographical region is the largest consumer of examination gloves?

North America is the largest consumption region for examination gloves, attributed to high per capita healthcare spending, advanced medical services, and mandatory governmental standards ensuring consistent, high-volume usage of disposable protective equipment in all clinical environments.

What role does automation play in the future of glove manufacturing?

Automation, particularly utilizing robotic systems and AI-powered quality control vision systems, is essential for future glove manufacturing. It ensures massive scale production, maintains exceptionally high quality (low AQL levels), and mitigates the impact of volatile labor costs and supply chain disruptions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Nitrile Examination Gloves Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (4-Mil Nitrile Exam Gloves, 5-Mil Nitrile Exam Gloves, 6-Mil Nitrile Exam Gloves), By Application (Critical and Noncritical Care Units, Laboratory, Pharmacy / Oncology, Environmental Services), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Disposable Medical Examination Gloves Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Nitrile Gloves, Vinyl Gloves, Neoprene Gloves, Others), By Application (Hospitals & Clinics, Diagnostic/Pathology Labs, Dental Clinics, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager