Excavator Rippers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440958 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Excavator Rippers Market Size

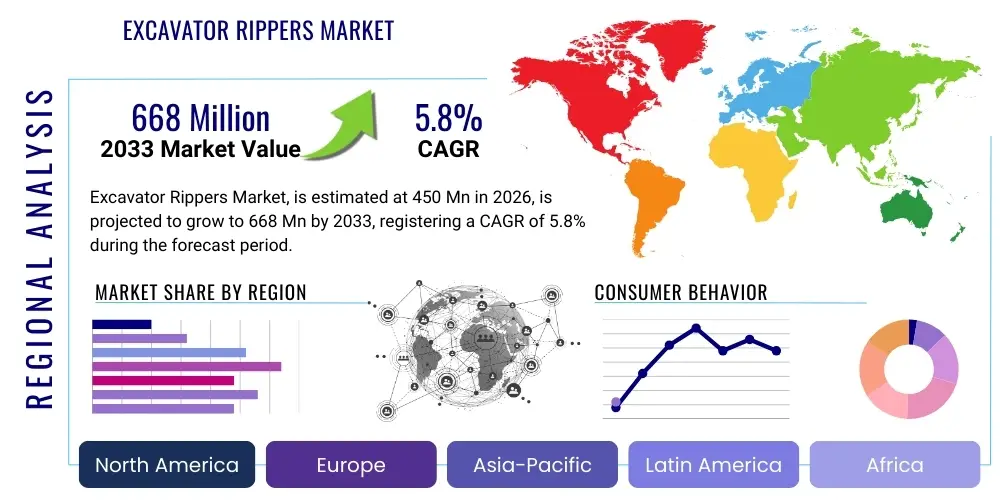

The Excavator Rippers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Excavator Rippers Market introduction

The Excavator Rippers Market encompasses specialized heavy-duty attachments designed for breaking up hard, compacted ground, rock, asphalt, and frozen earth that standard excavator buckets cannot efficiently penetrate. These robust tools are essential in preparatory earthmoving, quarrying, mining, and civil construction projects, significantly enhancing the operational capabilities of hydraulic excavators. The fundamental design involves a large, robust shank attached to the excavator’s arm, often featuring replaceable teeth or points made from high-abrasion resistance materials like manganese steel or specialized alloys. This market segment's growth is inherently linked to global infrastructure spending and the cyclical nature of the construction and mining industries, where efficiency and material breakdown speed directly translate to project profitability. The shift towards mechanized ripping over traditional blasting techniques in sensitive environments further stimulates demand for specialized, high-performance ripper attachments.

Excavator rippers are categorized primarily by their mechanical design, including parallel rippers, which maintain a consistent angle of attack during operation, and radial rippers, which pivot, offering deeper penetration capabilities but requiring greater hydraulic force. Major applications span large-scale land development, heavy-duty trenching for pipeline laying in extremely hard soil, and overburden removal in surface mining operations, particularly coal and iron ore mines. The primary benefit of employing high-performance rippers is the ability to mechanically fracture materials that would otherwise require expensive, complex, and time-consuming blasting techniques. This capability reduces environmental impact, mitigates safety risks associated with explosives handling, and accelerates overall project timelines significantly. Manufacturers are continually innovating, focusing on hydraulic articulation, integrated shock absorption, and rapid coupler compatibility to maximize versatility across varied geological environments.

Driving factors for this market include the global surge in mineral extraction activities, particularly in emerging economies where large infrastructure deficit reduction requires massive earthmoving projects and efficient site preparation. Furthermore, significant technological advancements in material science have led to the development of lighter, yet substantially stronger, steel alloys for ripper shanks and tips, allowing for increased penetration depth, reduced structural fatigue, and minimized wear-and-tear downtime. The increased focus across the heavy machinery sector on cost-effective material preparation, combined with regulatory pressures shifting away from explosives use in urban and densely populated areas, solidly establishes the ripper’s role as a vital, high-utility attachment. The market dynamics are highly influenced by consistent demand from large rental fleet operators, who require versatile attachments for their diverse client base, and Original Equipment Manufacturers (OEMs) who offer rippers as integrated solutions with high-capacity excavator models.

Excavator Rippers Market Executive Summary

The Excavator Rippers Market is currently characterized by robust growth driven fundamentally by global infrastructure investment, particularly concentrated in the Asia Pacific region due to urbanization and rapid industrial expansion. Business trends indicate a pronounced shift towards specialized, hydraulic rippers optimized for quick coupling systems, reflecting the construction industry's paramount need for operational flexibility and minimizing equipment downtime. Key players are increasingly focusing on vertical integration and developing advanced wear parts using sophisticated metallurgy to extend product lifecycles and penetration capability, thereby addressing the high maintenance costs associated with ripping abrasive materials. Furthermore, there is a growing consolidation trend among small and medium-sized regional manufacturers, often acquired by global heavy machinery giants seeking to expand their attachment portfolio and distribution network reach across key emerging markets.

Regionally, the market exhibits divergent maturity levels. North America and Europe demonstrate steady demand driven primarily by replacement cycles and specialized applications in demolition and remediation projects, demanding environmentally compliant and precision-engineered rippers. Conversely, the Asia Pacific, anchored by robust mining activity in Australia and large-scale infrastructure development in China and India, represents the highest growth potential and volume demand. This regional growth is characterized by the uptake of heavy-duty, multi-shank rippers designed for fracturing hard basalt and granite. Latin America, particularly countries rich in mineral resources such as Brazil and Chile, presents a strong long-term opportunity, contingent upon stable commodity prices driving mining capital expenditure, focusing on large-scale rippers for overburden removal in open-pit operations.

Segmentation analysis reveals that the Heavy-Duty Excavator segment (machines above 40 metric tons) dominates the market share due to the severe duty cycle requirements in mining and large quarry operations, where penetration force is paramount. However, the Mini/Compact Excavator ripper segment is experiencing the fastest growth rate, fueled by increased urban construction, utility trenching, and landscaping projects requiring smaller, more maneuverable equipment. From a product perspective, the Single-Shank Parallel Ripper remains the most widely adopted due to its simplicity, cost-effectiveness, and reliability, although the sophisticated Multi-Shank Ripper is gaining traction in applications requiring maximum productivity and width coverage in softer sedimentary rock formations. The aftermarket parts segment, encompassing ripper tips, protectors, and shanks, forms a critical revenue stream, highly dependent on competitive pricing and quality control.

AI Impact Analysis on Excavator Rippers Market

User inquiries regarding AI's impact on the Excavator Rippers Market frequently revolve around two primary themes: the optimization of ripping operations and the advancement of predictive maintenance for high-wear components. Users commonly question how AI algorithms can interpret geological data (e.g., density, fracture patterns) gathered by sensors to automatically adjust ripper attack angles, penetration depth, and hydraulic pressure in real-time, thereby maximizing efficiency and minimizing machine stress. A significant concern is the capability of AI-driven diagnostics to predict catastrophic failure of critical ripper components—shanks and tips—well before they occur, reducing expensive unscheduled downtime. The expectation is that integrating machine learning into telematics systems will transition ripper maintenance from reactive schedules to precise, condition-based interventions, fundamentally altering how these rugged attachments are managed and operated on site, potentially increasing productivity by up to 15-20% through optimized force application.

- AI-driven operational optimization: Real-time adjustment of ripping parameters (angle, depth, velocity) based on instantaneous geological feedback, maximizing material fragmentation efficiency.

- Predictive maintenance analytics: Utilizing machine learning models trained on vibration and stress sensor data to forecast wear rates of ripper tips and shanks, preempting mechanical failure.

- Enhanced fleet management: Integration of ripper status and performance metrics into centralized telematics platforms, optimizing equipment allocation and reducing idle time across large project sites.

- Autonomous ripping cycles: Developing self-operating systems where AI controls the entire ripping sequence, improving precision and consistency, particularly in controlled mining environments.

- Design optimization simulation: Using AI to rapidly simulate stress distribution under various ground conditions, informing manufacturers on optimal material selection and geometry for new ripper designs.

DRO & Impact Forces Of Excavator Rippers Market

The dynamics of the Excavator Rippers Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively magnified by key impact forces derived from macro-economic and technological shifts. The primary driver is the accelerating global need for infrastructure development, coupled with regulatory shifts favoring mechanical ripping over blasting methods due to environmental and safety concerns. However, the market faces significant restraints, chiefly characterized by the high initial capital expenditure required for heavy-duty rippers and their associated rapid wear rate in highly abrasive environments, necessitating frequent and expensive replacement of wear parts. The main opportunities lie in penetrating emerging markets with specialized rippers for specific material types and the integration of smart technologies for superior operational control and predictive maintenance. These factors collectively push innovation in materials science and system automation, defining the competitive landscape.

Impact forces significantly shape market trends. Economic volatility, particularly fluctuating commodity prices (e.g., iron ore, coal, copper), directly affects the capital expenditure budgets of mining companies, consequently impacting demand for new heavy ripper attachments. Technological innovation acts as a powerful enabling force; advancements in high-strength steel alloys and the integration of hydraulic control systems enhance the ripper's efficiency and lifespan, making them a more viable alternative to drilling and blasting. Furthermore, stringent environmental regulations in mature markets necessitate the use of quieter, lower-emission methods of rock breaking, strongly favoring mechanical rippers. The competitive rivalry is intense, focused not just on the price of the attachment but critically on the durability and cost-per-hour of the replaceable wear parts, establishing aftermarket dominance as a key strategic battleground.

The primary driver influencing market adoption is the compelling economic benefit derived from mechanized material preparation. Ripping offers better cost predictability and reduces the logistical complexity associated with handling, storing, and deploying explosives, which is a major advantage for remote project sites. Restraints are often linked to operational limitations; rippers are only effective up to a certain rock hardness and fracture pattern, meaning they cannot fully replace blasting in all geological settings, limiting their universal application potential. Opportunities are expanding through tailored solutions, such as specialized frost rippers for seasonal construction in cold climates or dedicated asphalt rippers for road rehabilitation, opening niche market segments that require specific, high-precision tools outside of traditional mining or quarrying applications. This balance of push and pull factors necessitates strategic diversification from manufacturers.

Segmentation Analysis

The Excavator Rippers Market is highly segmented based on the product type, the size of the excavator they are designed for, and the ultimate application, reflecting the diverse operational requirements across construction, mining, and quarrying sectors. Analyzing these segments provides critical insights into purchasing trends and technological demands. Product segmentation distinguishes between single-shank and multi-shank rippers, with the former prioritized for deep penetration and extreme rock hardness, and the latter preferred for high volume material displacement in softer or stratified rock layers. Further delineation is achieved based on the material used in manufacturing the shank and tips, typically high-tensile steel or specialized abrasion-resistant alloys, which directly correlate with the attachment's durability and price point. Market penetration varies significantly across these classifications, reflecting the capital budget allocation and specific project needs of end-users.

- By Product Type:

- Single-Shank Ripper (Dominant in heavy-duty mining and trenching requiring maximum penetration force)

- Multi-Shank Ripper (Preferred for high production output in stratified or softer material)

- Parallel Ripper (Known for consistent force application)

- Radial Ripper (Offers deeper, leveraged penetration)

- Frost Ripper (Specialized for frozen ground applications)

- By Excavator Weight Capacity:

- Mini/Compact Excavator Ripper (Up to 10 Metric Tons)

- Medium Excavator Ripper (10 to 40 Metric Tons)

- Heavy-Duty Excavator Ripper (Above 40 Metric Tons - Highest Revenue Share Segment)

- By Application (End-Use):

- Mining and Quarrying (Largest application, focusing on overburden removal and primary breaking)

- Construction and Infrastructure (Trenching, road rehabilitation, site preparation)

- Forestry and Agriculture (Land clearing, stump removal)

- Demolition and Recycling (Concrete and asphalt breaking)

- By Material:

- High-Tensile Steel Ripper

- Abrasion-Resistant Alloy Ripper

- Cast Steel Ripper

- By Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket and Independent Suppliers

Value Chain Analysis For Excavator Rippers Market

The Value Chain for the Excavator Rippers Market begins with the upstream sourcing of specialized raw materials, primarily high-grade, abrasion-resistant steel and manganese alloys crucial for manufacturing the ripper shank and tips. This stage requires rigorous quality control and specialized metallurgical processes to ensure material integrity and durability under extreme stress. Key upstream activities include forging, casting, and heat treatment, which significantly influence the final product’s performance lifespan. Manufacturers must maintain robust relationships with specialized steel suppliers to ensure a consistent supply of custom-engineered materials that meet stringent performance specifications. Efficiency at this stage is vital for mitigating production costs and controlling the overall quality of the attachment.

The midstream phase involves the design, manufacturing, and assembly of the ripper attachments. Major OEMs often integrate ripper production in-house, leveraging their extensive engineering capabilities for hydraulic systems and structural integrity, ensuring seamless compatibility with their heavy equipment lines. Conversely, specialized attachment manufacturers focus exclusively on optimizing ripper design for third-party excavators, often excelling in bespoke solutions and rapid innovation in wear parts. Distribution channels form a critical linkage to the downstream market. Direct distribution is common for high-value, heavy-duty rippers sold alongside new excavators through OEM dealer networks. These networks provide essential after-sales support, including installation, training, and warranties, offering a significant competitive advantage.

The downstream segment primarily involves sales to end-users (mining companies, large construction firms) and extensive aftermarket support. Indirect distribution, leveraging independent equipment distributors and third-party spare parts retailers, is crucial for penetrating regional markets and serving the replacement parts demand. The aftermarket for ripper tips and cutting edges is substantial and highly competitive, driven by the need for quick replacement to minimize machine downtime. Success in the downstream market hinges on efficient logistics, widespread service availability, and competitive pricing for consumables. The robust service component, including maintenance contracts and wear analysis, adds significant value and longevity to the manufacturer-customer relationship.

Excavator Rippers Market Potential Customers

Potential customers for excavator rippers are entities requiring efficient and powerful methods for breaking hard materials without resorting to traditional blasting, thereby encompassing a wide array of heavy industries globally. The primary end-users are large-scale mining operations, especially those involved in surface mining of coal, copper, and iron ore, who utilize heavy-duty rippers extensively for overburden removal and pre-conditioning rock formations before excavation. Furthermore, global construction and civil engineering firms constitute a major customer base, particularly those engaged in critical infrastructure projects such as highway development, airport construction, large-scale utility pipeline laying, and dam construction where they encounter hard rock layers or highly compacted soils that require mechanical fracture. These buyers prioritize attachments that offer superior penetration, longevity, and seamless integration with their existing heavy equipment fleet to maximize site productivity.

A rapidly expanding customer segment includes specialized earthmoving contractors and equipment rental companies. Rental fleets require versatile, durable rippers that can be quickly adapted to different excavator models and geological conditions to meet diverse client demands across multiple short-term projects. These customers place a high value on low maintenance requirements and quick coupler compatibility. Utility companies and municipal bodies also represent potential customers, utilizing smaller rippers attached to compact excavators for trenching and repair work in urban environments, prioritizing noise reduction and minimal ground disturbance. Finally, specialized agricultural and forestry enterprises purchase rippers for heavy land clearing, stump removal, and deep soil preparation, focusing on models optimized for organic and root-intensive material handling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Doosan Corporation, John Deere, Liebherr Group, Sandvik AB, Atlas Copco, Hyundai Construction Equipment, CNH Industrial, Esco Corporation, Amulet Manufacturing, JRB Attachments, Paladin Attachments, Pemberton, Leading Edge Attachments, Hensley Industries, Ransome Attachments, AMI Attachments, Geith International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Excavator Rippers Market Key Technology Landscape

The technological landscape of the Excavator Rippers Market is continuously evolving, focusing intensively on material science, hydraulic control integration, and telematics-based performance monitoring to enhance efficiency and longevity. The fundamental technology revolves around advanced metallurgy, specifically the development and application of proprietary high-strength, low-alloy (HSLA) steels and specialized carbide inserts for ripper tips. These materials dramatically increase resistance to impact, abrasion, and fatigue, extending the service life in highly destructive environments like granite or basalt quarrying. Furthermore, manufacturers are increasingly implementing advanced welding and heat treatment processes, ensuring the structural integrity of the ripper shank, which is subjected to immense bending and torsional forces during operation, thereby minimizing the risk of catastrophic failure and ensuring operator safety.

A crucial technological advancement involves the integration of sophisticated hydraulic systems, particularly in hydraulically adjustable rippers. These systems allow operators to precisely control the angle of attack and penetration depth dynamically from the cab, optimizing ripping efficiency as geological conditions change. This integration enhances fuel efficiency by reducing wasted effort and unnecessary strain on the excavator's hydraulic pump and engine. The adoption of rapid coupler technology is also central, enabling quick, secure, and tool-free attachment changes. This technology significantly improves machine utilization rates, a critical factor for rental companies and high-production contractors managing diverse tasks on a single site. The ease of switching between a ripper and a bucket allows for seamless transitioning between breaking and loading operations.

The emerging technological frontier is the incorporation of sensors and telemetry systems for performance data acquisition. Rippers equipped with internal sensors can monitor forces, vibration levels, and hydraulic pressures in real-time, transmitting this data to cloud-based analytical platforms. This capability supports advanced predictive maintenance models (as discussed in the AI section), alerting maintenance teams to potential issues before failure occurs. Moreover, this data feeds back into design iteration cycles, allowing engineers to refine geometry and material deployment based on actual field performance data, accelerating the development of next-generation, optimally balanced ripper attachments. The use of 3D scanning technology for mapping geological features also aids in pre-planning ripping strategies, further increasing operational effectiveness.

Regional Highlights

The regional analysis reveals distinct market maturity and growth dynamics, heavily influenced by local economic factors, regulatory environments, and the dominant type of heavy industry present in each geographic area. The Asia Pacific (APAC) region stands out as the global growth engine, commanding the largest market share and exhibiting the highest Compound Annual Growth Rate (CAGR). This expansion is fundamentally underpinned by massive government investments in transportation infrastructure (roads, rail, ports) and the continued aggressive expansion of the mining sector in nations like Australia, Indonesia, and India. The sheer volume of urbanization projects across China and Southeast Asia necessitates continuous large-scale earthmoving operations, driving persistent demand for heavy-duty, high-capacity rippers capable of working through varied and often challenging substrates.

North America and Europe represent mature markets characterized by steady replacement demand and a strong emphasis on specialized applications, particularly demolition, remediation, and smaller-scale utility work. In North America, demand is driven by aging infrastructure repair and energy pipeline projects, requiring highly reliable rippers with minimal environmental impact. European markets, particularly Germany and the Nordic countries, focus heavily on technological compliance and precision, favoring rippers that integrate smoothly with advanced machine control systems (GPS/GNSS) for highly accurate trenching and site preparation. The regulatory environment in these regions often mandates adherence to strict noise and vibration standards, influencing manufacturers to develop optimized, less intrusive ripping solutions.

Latin America and the Middle East & Africa (MEA) offer substantial future growth potential, directly correlated with the stability of global commodity prices and foreign direct investment into resource extraction. Latin America, rich in mineral deposits, sees demand concentrated in large-scale mining activities in countries such as Chile (copper) and Brazil (iron ore), where massive excavators require the largest class of rippers for efficient overburden management. The MEA region, particularly driven by large-scale oil and gas pipeline construction in the Gulf States and infrastructure development in Sub-Saharan Africa, represents a burgeoning market where the need for reliable, robust equipment capable of handling diverse desert and hard rock conditions is paramount, often sourcing rippers through large international construction consortiums.

- Asia Pacific (APAC): Highest volume demand and growth rate; dominated by mining (Australia, Indonesia) and vast infrastructure development (China, India). Key focus is on cost-effectiveness and heavy-duty reliability.

- North America: Mature market; stable demand driven by infrastructure replacement, energy projects, and environmental remediation. High uptake of technology-integrated and specialized rippers (e.g., frost rippers).

- Europe: Focus on specialized small-to-medium size rippers for urban renewal and utility work; stringent regulatory environment emphasizes quiet operation and precision machine control compatibility.

- Latin America: Growth tied strongly to global mineral commodity prices; concentrated demand for large, robust rippers for open-pit mining operations in Brazil, Chile, and Peru.

- Middle East & Africa (MEA): Emerging market; driven by extensive oil and gas infrastructure, general civil engineering projects, and raw material extraction; demand centers on extreme durability in arid, abrasive environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Excavator Rippers Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Doosan Corporation

- John Deere

- Liebherr Group

- Sandvik AB

- Atlas Copco

- Hyundai Construction Equipment

- CNH Industrial

- Esco Corporation

- Amulet Manufacturing

- JRB Attachments

- Paladin Attachments

- Pemberton

- Leading Edge Attachments

- Hensley Industries

- Ransome Attachments

- AMI Attachments

- Geith International

Frequently Asked Questions

Analyze common user questions about the Excavator Rippers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Excavator Rippers Market?

The primary factor driving market growth is the global acceleration of infrastructure and civil engineering projects, coupled with increased mining activities worldwide, necessitating efficient mechanical methods for breaking up hard, compacted materials.

How do single-shank rippers differ from multi-shank rippers in terms of application?

Single-shank rippers are used for maximum penetration force required in extremely hard rock or deep trenching, while multi-shank rippers are utilized for high production and wider coverage in softer, stratified rock or compacted soil layers.

What role does material technology play in the performance of excavator rippers?

Advanced material technology, particularly high-strength, low-alloy (HSLA) steels and tungsten carbide inserts, is crucial as it significantly enhances the ripper's resistance to abrasion and impact, directly extending the service life and reducing downtime for wear part replacement.

Which geographical region holds the largest market share for excavator rippers?

The Asia Pacific (APAC) region currently holds the largest market share, driven by rapid urbanization, extensive government infrastructure spending, and substantial mining operations across key countries like China, India, and Australia.

What are the main advantages of using a hydraulic ripper over a standard mechanical ripper?

Hydraulic rippers offer superior control, allowing operators to dynamically adjust the angle of attack and penetration depth from the cab, optimizing efficiency, reducing strain on the excavator, and enhancing performance across varied geological conditions.

Is the aftermarket for ripper wear parts a significant market segment?

Yes, the aftermarket for consumables such as ripper tips, adapters, and protectors is a highly significant segment due to the high rate of wear experienced in ripping operations, creating continuous demand for replacement parts.

How does the implementation of AI affect ripper maintenance strategies?

AI is transforming ripper maintenance by enabling predictive analytics through sensor data, allowing operators to shift from time-based maintenance schedules to condition-based interventions, thus preventing unplanned failures and maximizing uptime.

Are excavator rippers a viable alternative to blasting in all rock types?

No, rippers are effective up to a certain rock hardness and fracture pattern (usually defined by the R.I.P. index). For extremely hard igneous or non-fractured metamorphic rock formations, traditional drilling and blasting methods may still be necessary.

What factors influence the choice between a parallel and a radial ripper design?

The choice depends on the application; parallel rippers are preferred for consistent angle of attack and precision in trenching, while radial rippers provide better leverage for deeper penetration and lifting capacity, suitable for heavy rock breaking.

What are the key operational restraints limiting market expansion?

Key operational restraints include the high initial capital investment required for specialized heavy-duty attachments and the substantial maintenance costs associated with the rapid wear of ripper tips and shanks in abrasive environments.

Which application segment provides the highest revenue share in the rippers market?

The Mining and Quarrying application segment generates the highest revenue share, primarily due to the intense and continuous requirement for large-scale overburden removal and primary material preparation using heavy-duty rippers.

What is a Frost Ripper and where is it typically utilized?

A Frost Ripper is a specialized attachment designed with a specific, acute geometry optimized for breaking and fracturing frozen ground, utilized extensively in cold climate regions for winter construction, utility work, and permafrost areas.

How do stringent environmental regulations influence ripper demand?

Environmental regulations often restrict the use of explosives (blasting) near populated areas, strongly favoring mechanical ripping as a safer, quieter, and more environmentally friendly method for rock and ground material preparation.

What are OEMs prioritizing in their ripper design innovations?

OEMs are prioritizing seamless integration with excavator machine control systems, enhanced hydraulic efficiency, and the development of proprietary alloys that maximize durability and reduce the cost-per-operating-hour for the end-user.

Is the market experiencing consolidation among key players?

Yes, the market is showing trends of consolidation, where major equipment manufacturers frequently acquire smaller, specialized attachment producers to rapidly expand their product portfolio and enhance vertical integration in the attachments segment.

How important are rental companies as end-users in the rippers market?

Rental companies are highly important as end-users, requiring versatile rippers compatible with various excavator models to serve a diverse client base across numerous short-term projects, valuing durability and quick-change capabilities.

What is the forecasted CAGR for the Excavator Rippers Market between 2026 and 2033?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven by sustained global heavy construction and mining activity.

What is the significance of rapid coupler technology for ripper adoption?

Rapid coupler technology is critical because it minimizes machine downtime by allowing operators to quickly and safely switch the ripper attachment with other tools, significantly increasing the overall utilization rate and flexibility of the excavator.

What is the primary challenge in supplying ripper attachments to the Latin American market?

The primary challenge in Latin America is the dependence on stable global commodity prices, as capital expenditure for heavy equipment, including rippers, often fluctuates directly with the profitability of regional mining operations.

Beyond construction and mining, what are niche applications for excavator rippers?

Niche applications include specialized tasks like deep tillage in agriculture, large-scale stump removal in forestry, utility trenching in challenging rocky terrain, and controlled demolition of concrete structures.

How is the value chain influenced by aftermarket demand?

The value chain is heavily influenced downstream by aftermarket demand, as manufacturers and third-party suppliers focus intensely on logistics and competitive pricing for replaceable wear parts, which constitute a continuous and necessary revenue stream.

In the context of the Excavator Rippers Market, what does GEO (Generative Engine Optimization) aim to achieve?

GEO aims to structure content to be highly relevant and easily extractable by generative AI models, ensuring the report's insights are accurately synthesized and presented in AI-driven summaries and answer boxes, maximizing visibility and authoritative perception.

Why are heavy-duty excavator rippers (above 40 tons) dominant in terms of market share?

Heavy-duty rippers are dominant because they are essential for severe-duty cycles in large-scale mining and quarrying, where maximum penetration force and continuous operation capacity are required, commanding higher unit prices and persistent replacement cycles.

What type of metallurgical process is critical in the upstream segment of the ripper value chain?

Heat treatment and specialized forging/casting processes are critical in the upstream segment to impart necessary hardness, toughness, and resistance to impact and abrasion into the high-grade steel alloys used for ripper shanks and tips.

How is the shift towards smarter construction impacting ripper design?

The shift towards smarter construction is pushing ripper design toward integrated sensor technology and telematics compatibility, facilitating remote monitoring and integration with overall site data for performance optimization and preventive maintenance.

What defines the competitive rivalry in the Excavator Rippers Market?

Competitive rivalry is primarily defined by the technological superiority of proprietary wear materials, the efficiency of global distribution networks (especially for replacement parts), and the integration capability of the attachment with diverse excavator brands and models.

What is the estimated market size of the Excavator Rippers Market in 2033?

The market size for Excavator Rippers is projected to reach USD 668 Million by the end of the forecast period in 2033, reflecting consistent demand across key industrial sectors globally.

Why is Europe more focused on smaller ripper applications compared to APAC?

Europe's market focus is driven by higher urban density and stringent regulations, resulting in a demand profile skewed towards smaller, more maneuverable rippers suitable for utility work, trenching, and infrastructure maintenance rather than large greenfield mining operations typical of APAC.

What primary constraint prevents rippers from achieving universal replacement of blasting?

The primary constraint is the physical limit of the material's rippability (hardness and fracturing characteristics); some extremely dense igneous rocks simply require explosive force to fracture efficiently, exceeding the capacity of even the largest hydraulic rippers.

How do distribution channels differ between OEM rippers and independent aftermarket rippers?

OEM rippers are typically sold directly through established dealer networks alongside new excavators, ensuring guaranteed fit and service, while independent aftermarket rippers rely on broad third-party distributors and specialized online retailers to reach a wider, often budget-conscious, customer base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager