Excavator Rubber Track Pads Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442737 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Excavator Rubber Track Pads Market Size

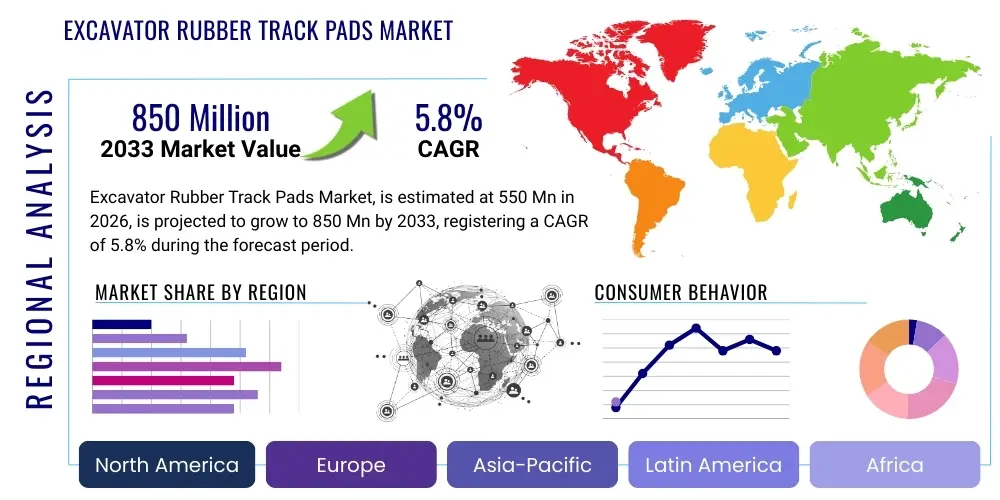

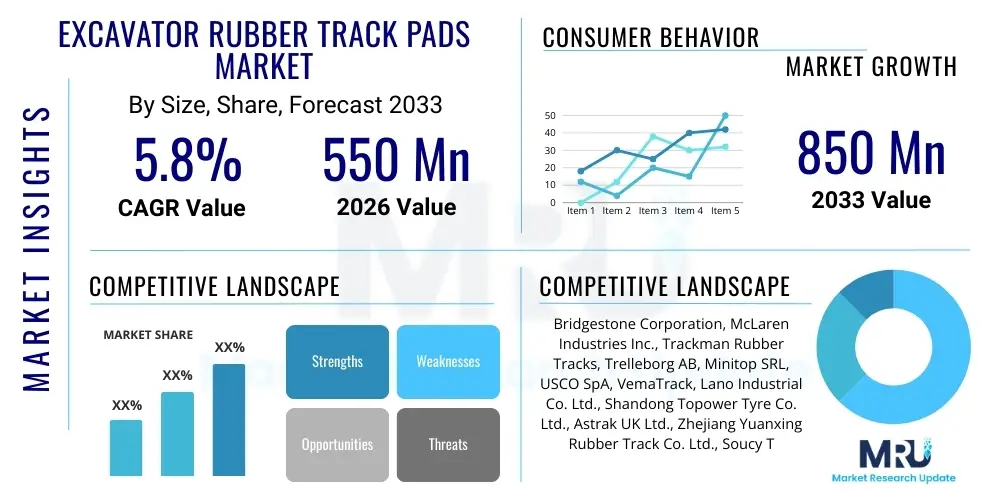

The Excavator Rubber Track Pads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 850 Million by the end of the forecast period in 2033.

Excavator Rubber Track Pads Market introduction

The Excavator Rubber Track Pads Market comprises specialized components designed to be affixed to the steel tracks of excavators and other tracked construction machinery. These pads serve a critical function by providing necessary traction while simultaneously protecting delicate ground surfaces, such as paved roads, finished landscaping, or sensitive utility areas, from damage typically inflicted by bare steel tracks. They are essentially shock absorbers and protective layers, significantly reducing noise pollution and vibration during operation, thereby enhancing site safety and operator comfort. The core product incorporates high-grade rubber or polyurethane compounds vulcanized onto a steel frame or plate, ensuring durability and secure attachment to the existing track system. The increasing global emphasis on urban infrastructure development and the mandatory requirement for surface preservation during construction activities are major factors propelling the demand for these essential aftermarket and OEM components.

Excavator Rubber Track Pads are classified primarily based on their attachment mechanisms, including bolt-on, clip-on, and chain-on types, catering to various machine specifications and operational requirements. The primary application sectors are intensely driven by cyclical investment in infrastructure and construction projects globally, particularly in residential, commercial, and utility installation domains. Furthermore, the specialized use of compact excavators in dense urban environments necessitates the consistent application of rubber pads to comply with strict municipal noise ordinances and prevent costly road repairs. The intrinsic benefits, such as extended track lifespan due to reduced abrasion and minimized operational downtime associated with switching equipment for surface-sensitive jobs, cement their position as indispensable accessories in modern construction fleets.

The market expansion is fundamentally driven by several macroeconomic factors, including robust government spending on public works, a persistent rise in the adoption of compact and mini excavators that frequently operate on paved surfaces, and stringent environmental regulations demanding lower noise and ground disturbance. Continuous product innovation, focusing on enhanced material resilience against harsh operating conditions like temperature extremes and abrasive materials, further stimulates replacement demand and market penetration. As construction practices become more specialized and urbanized, the functional necessity of rubber track pads transitions from optional accessories to mandatory operational equipment, ensuring sustained market growth throughout the forecast period.

Excavator Rubber Track Pads Market Executive Summary

The Excavator Rubber Track Pads market exhibits strong resilience, underpinned by persistent global infrastructure investment and the cyclical demand for machinery fleet renewal and maintenance. Key business trends indicate a definitive shift toward specialized, high-performance materials, particularly hybrid rubber-polyurethane blends, designed to offer superior longevity and operational flexibility across diverse terrains. Manufacturers are increasingly prioritizing supply chain efficiency and implementing advanced manufacturing techniques, such as automated vulcanization and enhanced bonding processes, to meet the growing global demand for durable and standardized products. Consolidation among smaller regional players by large international corporations focused on expanding their aftermarket presence is a notable strategic trend, aiming to capture the highly profitable replacement segment of the market.

Regionally, the Asia Pacific (APAC) stands as the undisputed engine of growth, largely attributed to massive government-backed infrastructure projects, rapid urbanization in countries like China and India, and the expansion of residential and commercial real estate sectors. While North America and Europe represent mature markets characterized by strict quality standards and a high propensity for premium, environmentally compliant products, demand here is steady, driven primarily by replacement cycles and maintenance of aging fleets. Emerging markets in Latin America and the Middle East & Africa (MEA) are showing accelerated growth, fueled by nascent infrastructure development and the increasing adoption of modern construction equipment, though challenges related to distribution and local manufacturing capabilities persist.

Segmentation trends highlight the dominance of the bolt-on track pad segment due to its superior stability and suitability for heavier machinery and high-duty applications. However, the clip-on segment is gaining traction, especially in the compact and mini excavator category, owing to its ease of installation and replacement, which minimizes machine downtime. From an application perspective, the general construction and utilities sectors remain the largest consumers, demanding large volumes of standard pads, while niche applications like forestry and specialized landscaping drive demand for customized, higher-traction designs. The market is increasingly competitive, compelling key players to invest heavily in robust distribution networks, particularly in the aftermarket segment, to maintain market share and visibility.

AI Impact Analysis on Excavator Rubber Track Pads Market

User queries regarding the impact of Artificial Intelligence on the Excavator Rubber Track Pads Market primarily center around predictive maintenance schedules, optimization of rubber compounding formulations, and enhanced quality control during manufacturing. Users frequently ask if AI-driven machine learning models can accurately predict track pad failure based on operational data (e.g., hours used, ground friction, temperature profiles), thereby maximizing lifespan and minimizing unexpected downtime. Another significant theme revolves around how AI can optimize the raw material mix—analyzing input cost variables, performance requirements, and regulatory compliance—to create superior, cost-effective rubber compounds. Furthermore, there is considerable interest in the integration of AI-powered vision systems on manufacturing lines for immediate defect detection, ensuring unparalleled consistency and quality across high-volume production batches, ultimately driving down warranty claims and improving product reliability metrics.

- AI-driven predictive maintenance algorithms significantly extend track pad lifespan by alerting users to wear patterns before catastrophic failure, optimizing replacement timing.

- Machine learning optimizes raw material formulation, analyzing complex variables (polymer types, carbon black fillers, curing agents) to reduce production costs and enhance durability.

- Autonomous excavator operations, supported by AI navigation, utilize sensor data to modulate track torque and movement, reducing abrasive wear on rubber pads.

- AI-powered vision inspection systems ensure stringent quality control on manufacturing lines, detecting minute defects in bonding or vulcanization processes instantaneously.

- Optimization of supply chain and logistics through AI forecasting reduces inventory holding costs for manufacturers and aftermarket distributors, ensuring timely availability of pads.

DRO & Impact Forces Of Excavator Rubber Track Pads Market

The dynamics of the Excavator Rubber Track Pads Market are influenced by a complex interplay of internal and external forces summarized as Drivers, Restraints, and Opportunities (DRO). The principal market drivers include robust global infrastructure spending, particularly in urbanization projects where surface protection is paramount, and the resultant high demand for compact and mini excavators. Regulations mandating reduced noise and ground disturbance in dense urban areas further amplify demand. Conversely, significant restraints stem from the volatile pricing of key raw materials, primarily synthetic rubber polymers and steel components, which impacts production costs and profit margins. Additionally, intense competition from low-cost manufacturers, sometimes offering inferior quality products that dilute market pricing, poses a continual challenge. However, substantial opportunities exist in the development of sustainable, eco-friendly materials and specialized pads designed for the emerging electric and hybrid tracked machinery segment, alongside geographical expansion into rapidly industrializing regions.

The impact forces influencing the market trajectory are multifaceted. Technological forces are strong, driving innovation in vulcanization processes and bonding agents to improve the structural integrity and longevity of the pads. Economic forces, tied directly to construction spending and interest rate environments, dictate the pace of new equipment purchase and subsequent aftermarket demand. Regulatory forces, particularly those related to environmental protection (noise, vibration, material disposal), necessitate continuous compliance and product refinement. Social forces, emphasizing site safety and minimizing localized construction nuisance, also contribute to the adoption of high-quality rubber pads. Finally, competitive forces mandate aggressive pricing strategies and strong investment in distribution and after-sales service to maintain brand loyalty among fleet managers and operators.

Specific market pressures related to raw material sourcing and manufacturing complexity heavily dictate the competitive landscape. As crude oil prices fluctuate, the cost of synthetic rubber polymers like Styrene-Butadiene Rubber (SBR) and Polybutadiene Rubber (PBR) sees corresponding instability, placing manufacturers under constant pressure to optimize production yields and minimize waste. Furthermore, the specialized nature of the steel core bonding process requires significant capital investment in advanced machinery and quality control, acting as a moderate barrier to entry for new players. The sustained growth of rental fleets globally represents a major driver, as these operators prioritize durable components that withstand multiple users and diverse applications, thus favoring premium track pad brands with proven longevity and high-impact resistance capabilities, creating a preference for quality over immediate cost savings.

Segmentation Analysis

The Excavator Rubber Track Pads Market is segmented along several critical dimensions that reflect diverse end-user needs, operational environments, and equipment types. The primary segmentation revolves around the attachment mechanism, which determines installation complexity and suitability for different track systems. Further analysis includes the material composition, separating natural rubber from synthetic compounds and hybrid formulations, each offering distinct performance characteristics regarding abrasion resistance, load-bearing capacity, and longevity. The application segment is defined by the end-use industry, ranging from high-volume general construction to specialized sectors like forestry, utility maintenance, and agricultural drainage projects. Understanding these segments is crucial for manufacturers to tailor their product offerings and distribution strategies effectively, ensuring maximum penetration into profitable niche markets.

The By Type segmentation (Attachment Mechanism) is paramount, with bolt-on pads offering maximum stability and load distribution, making them preferred for mid-to-large size excavators engaged in heavy-duty excavation tasks where stability cannot be compromised. Clip-on pads, conversely, dominate the compact and mini-excavator segment, valued for their quick installation and ease of removal, which minimizes machine downtime—a crucial factor for rental companies. The third category, chain-on pads, integrates directly into the track chain structure and is often used by Original Equipment Manufacturers (OEMs) for specific machine models, providing a highly durable, integrated solution, albeit at a higher initial cost and greater complexity in repair. The dynamics between these attachment types reflect the continuous trade-off between installation convenience and operational robustness, guiding procurement decisions across the industry.

Segmentation by Application is equally vital, highlighting the varying demands placed on the product. General construction, encompassing large civil engineering and commercial building projects, accounts for the largest market share, requiring standard, high-durability pads. The utilities sector, including water, gas, and telecommunications installations, necessitates pads that ensure minimal ground disturbance near existing infrastructure, driving demand for softer, high-grip rubber compounds. Specialized applications, such such as tunneling or pipeline construction in challenging terrains, often require hybrid pads that balance the protective qualities of rubber with the aggressive traction capabilities of steel. This detailed segmentation allows producers to optimize their supply chain to meet predictable cyclical demand from construction while capitalizing on the steadier, specialized demand from utilities and infrastructure maintenance providers, ensuring diversified revenue streams and market stability.

- By Type (Attachment Mechanism):

- Bolt-on Pads

- Clip-on Pads (or Road Liner Pads)

- Chain-on Pads

- By Material:

- Natural Rubber Pads

- Synthetic Rubber Pads (e.g., SBR, PBR)

- Hybrid/Polyurethane Compounds

- By Application:

- Construction and Infrastructure

- Utilities and Municipal Services

- Forestry and Logging

- Mining and Quarrying (Limited Use)

- Agriculture and Landscaping

- By Equipment Size:

- Mini/Compact Excavators (Up to 6 Tons)

- Mid-Sized Excavators (6 to 20 Tons)

- Heavy Excavators (Above 20 Tons)

Value Chain Analysis For Excavator Rubber Track Pads Market

The value chain for the Excavator Rubber Track Pads Market begins with upstream activities involving the sourcing and processing of raw materials. This includes the procurement of specialized polymers (synthetic and natural rubber), reinforcing fillers such as carbon black and silica, various chemical additives for vulcanization, and high-quality mild or alloy steel plates for the core structure. The cost and quality volatility of these raw materials, especially petrochemical-derived polymers, directly influence subsequent manufacturing costs. Key suppliers in the upstream segment are petrochemical companies, steel mills, and specialty chemical producers. Efficient negotiation and long-term contracts with stable suppliers are critical for manufacturers to maintain competitive pricing and consistent product quality amidst fluctuating global commodity markets. Logistics associated with transporting heavy raw inputs also constitute a significant cost element in this initial phase.

The midstream phase focuses on manufacturing and production. This involves sophisticated processes such as metal fabrication (cutting and shaping the steel plates), compounding the rubber mixture (mixing polymers and additives), and the complex vulcanization process where the rubber is chemically bonded under high pressure and temperature to the steel core. Quality control in the manufacturing stage is paramount, as defects in bonding lead to premature pad separation and failure. The distribution channel, linking production to end-users, involves both direct and indirect routes. Direct distribution often involves sales to major Original Equipment Manufacturers (OEMs) who install the pads on new machinery or to large national rental fleets. Indirect distribution is managed through a complex network of authorized regional distributors, specialized construction equipment dealers, and online aftermarket platforms, which cater primarily to smaller contractors and individual equipment owners seeking replacement parts.

Downstream activities center on aftermarket sales, installation, usage, and eventual replacement or recycling. The aftermarket segment generates a substantial portion of the market's revenue, driven by the inherent lifespan limitations of rubber products subjected to intense friction and wear. End-users evaluate pads based on factors like ease of installation (favoring clip-on in certain applications), durability, and cost-per-hour of operation. The rapid rate of wear necessitates frequent replacement, making robust distributor inventory and efficient logistics crucial for minimizing machine downtime. Environmental pressures are gradually integrating the final stage—recycling and disposal—into the value chain, pushing manufacturers towards developing products utilizing reclaimed materials or those that are more easily deconstructed at end-of-life, influencing future material procurement and manufacturing design choices.

Excavator Rubber Track Pads Market Potential Customers

The primary customer base for Excavator Rubber Track Pads is highly diverse, spanning various sectors involved in construction, infrastructure development, and specialized groundworks. The largest and most predictable segment consists of large-scale civil engineering and general construction firms that operate extensive fleets of excavators, ranging from mini models used in detailed site work to heavy machines for foundational digging. These customers prioritize durability, reliability, and guaranteed supply, often procuring pads directly from OEMs or major authorized distributors under long-term supply contracts. Their procurement decisions are heavily influenced by the pads' wear rate and the total cost of ownership, making quality and lifespan essential metrics.

Another critical customer segment includes equipment rental and leasing companies. These firms manage diverse fleets serving numerous smaller contractors and require components that are quick and easy to replace, such as clip-on pads, to maximize machine utilization and minimize maintenance intervals. Their focus is on robust, standardized products that can withstand frequent changes in operators and working environments. Furthermore, specialized utility contractors—engaged in laying fiber optic cables, gas lines, or maintaining electrical infrastructure—constitute a focused customer group. Since their work often takes place on existing paved surfaces in urban areas, the use of protective rubber pads is not merely a preference but a contractual requirement to prevent damage to public property, driving steady, non-cyclical demand.

Finally, governmental agencies, municipal departments, and specialized sectors like landscaping and large-scale agriculture also serve as important potential customers. Municipalities use excavators for road repairs, snow removal, and public works maintenance, where minimizing surface damage is critical. Agricultural contractors employ tracked machines for drainage and land preparation, seeking pads that offer adequate traction without excessively damaging topsoil. This group often purchases through local dealerships, valuing immediate availability and local service support. Manufacturers must tailor their marketing and distribution strategies to address the distinct needs, purchasing cycles, and quality standards demanded by each of these varied end-user groups, from high-volume corporate clients to smaller, localized governmental entities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 850 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, McLaren Industries Inc., Trackman Rubber Tracks, Trelleborg AB, Minitop SRL, USCO SpA, VemaTrack, Lano Industrial Co. Ltd., Shandong Topower Tyre Co. Ltd., Astrak UK Ltd., Zhejiang Yuanxing Rubber Track Co. Ltd., Soucy Track, GMT International, Jinan Rila Track Pad Co. Ltd., Global Track Warehouse. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Excavator Rubber Track Pads Market Key Technology Landscape

The technological landscape of the Excavator Rubber Track Pads Market is characterized by continuous refinement in material science and bonding techniques, rather than revolutionary breakthroughs. A primary focus is on developing advanced rubber compounding formulations that enhance crucial performance parameters such as abrasion resistance, ozone resistance, and thermal stability. Manufacturers are increasingly utilizing sophisticated synthetic polymers, often blended with natural rubber, and optimizing the dispersion of carbon black and silica fillers to achieve superior longevity under severe operating conditions. The introduction of high-durometer rubber compounds provides better structural integrity and load-bearing capabilities, crucial for large excavators, while specialized anti-static or oil-resistant formulations cater to specific industrial or utility applications, broadening the market scope and applicability.

Another key technological area involves the steel-to-rubber bonding process. The quality of this bond is the most critical determinant of the pad's overall lifespan, as premature de-bonding (delamination) is a common mode of failure. Modern manufacturing utilizes highly specialized adhesive agents and rigorously controlled vulcanization cycles, employing temperature and pressure mapping to ensure consistent chemical adhesion across the entire surface interface. Techniques such as plasma surface treatment of the steel backing plate before bonding are being adopted to improve surface roughness and chemical reactivity, resulting in significantly stronger and more reliable structural integrity. Automation in the molding and bonding stages, monitored by computer numerical control (CNC) systems, minimizes human error and ensures repeatable quality standards across high-volume production batches, addressing global demand for standardized quality.

Furthermore, technology related to sustainability and smart integration is emerging. Research into utilizing recycled rubber materials in the core or base layers of the pads seeks to reduce environmental impact and raw material costs without compromising surface performance. The development of modular track systems and enhanced fastener designs (e.g., self-tightening bolts, quick-release mechanisms) represents technological progress focused purely on user experience, minimizing installation time and complexity. While rubber pads are essentially passive components, future trends point toward the integration of embedded sensors (Internet of Things or IoT technology) in high-end pads. These sensors would monitor operational conditions—such as pressure distribution and internal temperature—feeding data back to the machine’s telematics system for real-time wear assessment and proactive maintenance alerts, thus aligning the market with the broader trend of digitized construction site management.

Regional Highlights

- Asia Pacific (APAC): Dominates the market, fueled by unprecedented investment in national infrastructure projects (e.g., China's Belt and Road Initiative, India's large-scale urbanization). High volume sales are driven by both new equipment purchases and extensive replacement demand stemming from long operating hours in often abrasive conditions. APAC manufacturers benefit from lower production costs and proximity to raw material sources, though quality consistency remains a competitive differentiator.

- North America: Characterized by high technological adoption and stringent regulatory adherence (OSHA, EPA). The market is mature, driven primarily by the replacement cycle in vast commercial construction and utilities sectors. Customers prioritize premium, durable products and specialized pads designed for cold weather operation and high-speed road use. Strong demand from equipment rental fleets is a consistent regional driver.

- Europe: Exhibits strong demand due to high environmental standards and dense urban operating environments, necessitating noise reduction and ground protection. Western European countries are leaders in adopting specialized, sustainable, and higher-cost polyurethane/hybrid pads. The market is highly sensitive to EU machinery directives and focuses on high-quality, long-lasting components to reduce overall lifecycle costs.

- Latin America (LATAM): Represents an emerging growth opportunity, supported by expanding mining operations (requiring highly durable pads) and localized infrastructure development in countries like Brazil and Mexico. Market growth is often volatile, tied to commodity price fluctuations and political stability, but the long-term trend indicates increasing mechanization and modernization of construction fleets.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) states due to massive giga-project construction and oil & gas infrastructure buildout. Operational environments here, characterized by extreme heat and sandy/rocky terrain, demand highly heat-resistant and abrasion-proof compounds. African markets are developing slowly, relying primarily on imported, often budget-friendly, aftermarket pads.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Excavator Rubber Track Pads Market.- Bridgestone Corporation

- McLaren Industries Inc.

- Trelleborg AB

- Trackman Rubber Tracks

- Minitop SRL

- USCO SpA

- VemaTrack

- Lano Industrial Co. Ltd.

- Shandong Topower Tyre Co. Ltd.

- Astrak UK Ltd.

- Zhejiang Yuanxing Rubber Track Co. Ltd.

- Soucy Track

- GMT International

- Jinan Rila Track Pad Co. Ltd.

- Global Track Warehouse

- Superior Rubber Tracks

- DRB Infracore

- Continental AG (indirectly)

- Titan International, Inc.

- Camso (now part of Michelin)

Frequently Asked Questions

Analyze common user questions about the Excavator Rubber Track Pads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan of an excavator rubber track pad?

The lifespan of a rubber track pad generally ranges from 1,000 to 2,500 operating hours, highly dependent on the pad material, operating environment (abrasiveness of ground), machine weight, and operator technique. Hybrid pads often offer greater longevity than standard synthetic rubber compounds.

How do I choose between bolt-on, clip-on, and chain-on track pads?

Selection depends on machine requirements and application. Bolt-on pads offer maximum stability for heavy excavators but require drilling. Clip-on pads are ideal for mini/compact machines and rental fleets due to fast installation. Chain-on pads are typically OEM integrated for high durability and track integrity.

Are rubber track pads interchangeable across different excavator brands?

No, while pads are generally designed for specific track widths, the pitch (spacing between links) and the attachment mechanism interface vary significantly between excavator brands and models. It is critical to match the pad specifications precisely to the machine's steel track system for secure fitting.

What are the key benefits of using hybrid (rubber/polyurethane) track pads?

Hybrid pads combine the flexibility of rubber with the rigidity and superior abrasion resistance of polyurethane, resulting in better load distribution, reduced chipping, and extended life compared to standard rubber pads, justifying their higher initial cost in severe applications.

How does raw material volatility affect the pricing of rubber track pads?

Since rubber polymers (derived from petrochemicals) and steel constitute the primary cost components, fluctuations in crude oil and global steel prices directly impact manufacturing expenses. Manufacturers often pass these costs to the aftermarket, leading to periodic price adjustments for end-users.

The preceding analysis confirms that the Excavator Rubber Track Pads Market remains a structurally critical component segment within the global construction equipment sector. Its sustained growth trajectory is intrinsically linked to macro-economic drivers, including urbanization and infrastructure renewal initiatives across developing and mature economies alike. The essential function of these pads—protecting expensive hard surfaces while ensuring operational stability and mitigating environmental disturbance—cements their mandatory role in modern, regulated construction environments. Competitive differentiation is increasingly driven by technological enhancements in material science, focusing on achieving superior longevity and resistance to abrasive wear, offering compelling value propositions beyond simple cost metrics. The future landscape is poised for further integration of digital maintenance solutions and adherence to stricter sustainability mandates, guiding product innovation towards eco-friendlier composite materials and optimized lifecycle management. The dominance of the Asia Pacific region, coupled with the consistent replacement demand from established markets in North America and Europe, assures robust activity throughout the forecast period, positioning the aftermarket segment as the most dynamic and strategically important area for key global players seeking reliable revenue streams.

Furthermore, the segmentation analysis underscores the nuanced demand profile within the market. While the high-volume, general construction sector provides baseline demand, specialized applications such as utility installation and forestry require customized pad designs tailored for specific performance attributes, necessitating flexible manufacturing and targeted product development efforts. The challenge posed by raw material volatility necessitates proactive supply chain management and forward contracting, especially for manufacturers relying heavily on synthetic rubber compounds. Strategic investments in localized distribution networks are paramount, particularly in emerging markets where timely access to replacement parts minimizes machine downtime, a critical factor influencing purchasing decisions among equipment owners and fleet operators. Continuous research into polymer chemistry remains the core technological advantage, enabling manufacturers to incrementally improve product performance and maintain competitive edges against low-cost market entrants who often rely on less sophisticated, generic formulations. The market’s evolution is less about dramatic product changes and more about incremental, highly specialized improvements that optimize total cost of ownership for the end-user, ensuring long-term market stability and profitability for high-quality manufacturers.

In conclusion, the Excavator Rubber Track Pads Market exhibits fundamental growth drivers that are resilient to minor economic fluctuations, owing to the essential nature of the product for modern construction practices. The integration of AI for predictive maintenance represents a significant future disruption, promising enhanced efficiency and reduced unscheduled expenditure for end-users, thus favoring manufacturers who can successfully integrate their product data into broader telematics platforms. Strategic focus for market participants must center on capitalizing on the strong replacement cycle, expanding geographical presence into rapidly industrializing nations, and prioritizing material innovation to meet rising expectations regarding pad life and environmental compliance. The formal structure of the market, dictated by specific machine interfaces and regulatory requirements, ensures that technical expertise and established relationships with global OEMs remain crucial determinants of long-term market leadership. Navigating the balance between optimizing production costs and meeting rigorous quality standards will define competitive success in the coming decade, solidifying the market's trajectory towards its projected valuation by 2033.

This detailed report provides a comprehensive overview of the market dynamics, technological landscape, and strategic considerations essential for understanding the future growth potential and competitive forces shaping the Excavator Rubber Track Pads industry over the defined forecast period. The data presented is synthesized to assist stakeholders in making informed business decisions related to market entry, product development, and geographic expansion strategies, optimizing their position within this vital construction component sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager