Explosive Ordnance Disposal (EOD) Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441200 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Explosive Ordnance Disposal (EOD) Equipment Market Size

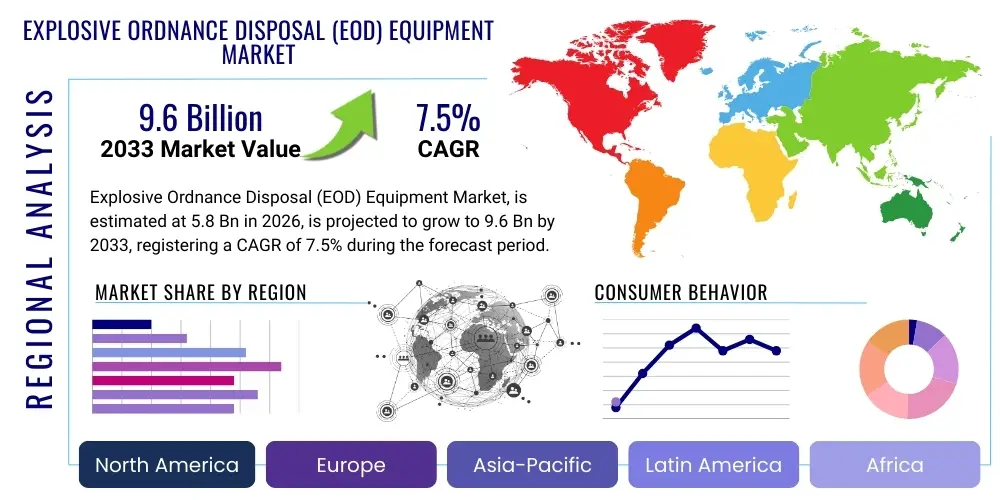

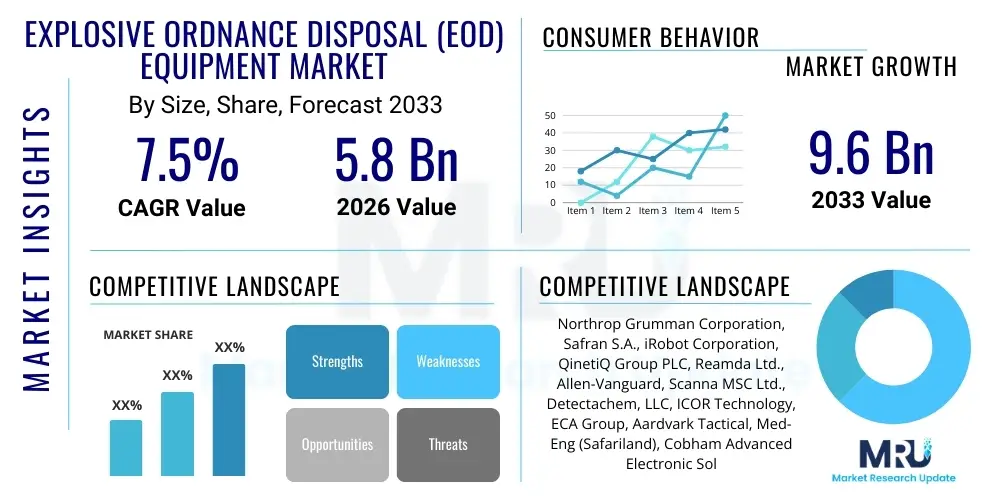

The Explosive Ordnance Disposal (EOD) Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $9.6 Billion by the end of the forecast period in 2033.

Explosive Ordnance Disposal (EOD) Equipment Market introduction

The Explosive Ordnance Disposal (EOD) Equipment Market encompasses specialized tools, devices, and protective gear designed to safely detect, assess, access, render safe, and dispose of conventional and unconventional explosive ordnance. This essential equipment is critical for military personnel, law enforcement agencies, and security organizations tasked with neutralizing Improvised Explosive Devices (IEDs), unexploded ordnance (UXO), and other hazardous materials. The core product categories include sophisticated robotic systems, advanced sensors and detectors, protective bomb suits, specialized disruption tools, and remote handling mechanisms, all engineered to minimize human risk during high-stakes operations. The growing necessity for counter-terrorism measures and the residual effects of historical conflicts, leading to widespread contamination by UXO, are central factors driving demand across global defense and security sectors.

The operational landscape for EOD equipment is continuously evolving, demanding innovation in lightweight, durable, and highly effective systems. Key applications span military operations, where EOD teams clear battlefields or supply routes; homeland security, focusing on public safety and critical infrastructure protection; and civilian bomb squads handling domestic threats. The primary benefits derived from modern EOD technology include dramatically improved standoff capabilities, higher success rates in rendering explosives safe without detonation, and critically, enhanced protection for EOD technicians. Furthermore, miniaturization and advanced communication technologies are enabling quicker deployment and real-time decision-making capabilities, which are paramount in time-sensitive threat neutralization scenarios.

Driving factors for market expansion include escalating global geopolitical tensions, the persistent threat posed by transnational terrorist organizations that utilize complex IED designs, and substantial governmental investments in modernizing defense and internal security capabilities. Moreover, increased focus on international safety standards and collaborative efforts between allied nations regarding knowledge and equipment sharing further stimulate procurement cycles. The shift towards highly autonomous or semi-autonomous robotic platforms capable of carrying heavier payloads and operating in complex urban environments represents a significant technological impetus accelerating market growth. These systems not only reduce risk but also offer superior fidelity in threat assessment through integrated high-definition optics and non-destructive evaluation tools.

Explosive Ordnance Disposal (EOD) Equipment Market Executive Summary

The Explosive Ordnance Disposal (EOD) Equipment Market exhibits robust growth, primarily fueled by rising global instability and the modernization initiatives undertaken by leading defense ministries. Business trends indicate a clear preference for robotics and unmanned ground vehicles (UGVs) capable of increasing standoff distance and minimizing operator exposure, driving significant research and development investments into autonomous capabilities and sensor integration. Suppliers are increasingly focusing on modular designs that allow EOD teams to quickly reconfigure payloads and tools based on mission requirements, moving away from single-purpose, rigid systems. Furthermore, the convergence of AI and machine learning into threat recognition and decision support systems is emerging as a critical competitive differentiator, particularly in complex EOD scenarios involving sophisticated camouflage or counter-measures.

Regionally, North America maintains its dominance due to high defense spending, early adoption of cutting-edge technology, and the presence of major industry incumbents. However, the Asia Pacific region is projected to register the highest growth rate, driven by territorial disputes, modernization of large militaries like India and China, and extensive UXO clearance programs in Southeast Asian nations affected by historical conflicts. Europe’s market growth is stable, supported by consistent procurement cycles to counter domestic terrorism threats and maintain NATO readiness standards. The Middle East and Africa represent a crucial, yet volatile, market segment, with demand driven by post-conflict stabilization efforts and ongoing internal security challenges related to insurgency and IED usage.

Segment trends highlight the Robotic EOD Systems segment as the fastest growing, overshadowing traditional protective gear in terms of investment focus. Within the technology segment, advanced sensor technology, including ground-penetrating radar (GPR) and advanced chemical/explosive trace detection (ETD), is experiencing elevated demand due to the requirement for rapid and non-invasive threat confirmation. Applications show military and defense consistently holding the largest market share, but the law enforcement and homeland security applications are demonstrating accelerated growth, reflecting the transfer of sophisticated EOD technologies from military environments to civilian bomb squads to handle increasing urban threats. The portable and lightweight equipment category is also gaining traction, catering to dismounted teams and quick-reaction forces requiring rapid deployment capabilities.

AI Impact Analysis on Explosive Ordnance Disposal (EOD) Equipment Market

Users frequently inquire about AI's potential to revolutionize threat detection speed, enhance decision-making accuracy under pressure, and enable truly autonomous disposal operations, specifically asking if AI can significantly reduce the cognitive load and physical risk faced by EOD technicians. The core themes revolve around automated object recognition and classification of complex IEDs, predicting explosive behavior based on integrated sensor data, and optimizing robotic pathfinding in hazardous or GPS-denied environments. Concerns often center on the reliability of autonomous systems in novel or ambiguous threat scenarios, the ethical implications of granting autonomous decision authority in life-or-death situations, and the integration challenges associated with retrofitting AI capabilities onto existing EOD platforms. Expectations are high that AI will move EOD operations from reactive processes to predictive, real-time assessment and neutralization strategies.

- AI-enhanced pattern recognition algorithms significantly improve the classification accuracy of disguised or buried explosive devices, reducing false alarms.

- Machine learning optimizes robotic movement and manipulation, allowing EOD UGVs to execute complex disarming tasks with greater precision and efficiency.

- Predictive threat analytics, powered by AI, analyze sensor inputs (e.g., thermal, chemical, magnetic) instantaneously, providing EOD technicians with real-time risk assessments.

- Autonomous navigation and mapping capabilities allow robotic systems to operate effectively in non-line-of-sight environments and complex urban terrain without continuous human joystick control.

- AI supports fusion of multi-sensor data, creating a comprehensive operational picture for command centers, thereby facilitating rapid remote authorization for disposal procedures.

- Training simulations utilizing AI provide realistic, adaptive scenarios, improving technician preparedness for complex and novel IED designs.

- Automated diagnostics and maintenance scheduling for EOD equipment, minimizing downtime and ensuring operational readiness.

DRO & Impact Forces Of Explosive Ordnance Disposal (EOD) Equipment Market

The market is primarily driven by escalating global security concerns, specifically the proliferation of sophisticated Improvised Explosive Devices (IEDs) used by non-state actors, which necessitates continuous technological upgrades in detection and disposal capabilities. Substantial increases in military and internal security budgets across North America and Asia, earmarked for counter-terrorism and EOD modernization programs, act as a crucial market driver. However, the market faces restraints such as high initial procurement costs for advanced robotic systems, lengthy governmental certification and acquisition cycles, and persistent challenges related to interoperability between systems from different vendors. Opportunities lie primarily in developing highly autonomous systems, integrating advanced AI for threat recognition, and expanding specialized training and service contracts, particularly in emerging economies where indigenous EOD capabilities are underdeveloped. The impact forces are characterized by moderate regulatory impact due to strict safety standards, high competitive intensity focused on technological leapfrogging in robotics, and significant influence from defense funding cycles which dictate market volume and timing.

Segmentation Analysis

The Explosive Ordnance Disposal (EOD) Equipment Market is comprehensively segmented based on the type of equipment utilized, the underlying technology incorporated, and the specific application areas where the equipment is deployed. This segmentation provides a granular view of market dynamics, highlighting areas of high growth and technological saturation. The equipment types range from personal protective gear to complex vehicle-mounted systems, reflecting the varied operational environments—from confined spaces requiring lightweight gear to open battlefields demanding robust, long-range robotic capabilities. Understanding these segments is vital for vendors to align their product portfolios with evolving military and law enforcement requirements.

The market analysis further breaks down the technological components driving innovation. Modern EOD operations rely heavily on sensor technology, including non-linear junction detectors and explosive trace detectors, alongside the critical role of specialized tools like waterjet disruptors and portable X-ray systems for rapid threat assessment. The application segmentation clearly delineates the demand profiles of primary end-users, with Military & Defense remaining the largest consumer due to scale and mission complexity, while Homeland Security and Civilian Operations increasingly require smaller, more agile equipment suitable for urban environments and specialized tasks such as forensic evidence collection post-incident.

- By Type:

- Portable EOD Equipment

- Vehicle-Mounted EOD Equipment

- Robotic EOD Systems (UGVs)

- By Technology:

- Remote Operated Vehicles (ROVs) / UGVs

- Protective Suits and Helmets (Bomb Suits)

- Detection Equipment (Sensors, X-Ray Systems, ETD)

- Disruption Equipment (Waterjet Disruptors, De-armers)

- Accessories and Tools (Hooks, Lines, Specialized Kits)

- By Application:

- Military & Defense

- Law Enforcement

- Homeland Security

- Civilian Operations and UXO Clearance

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Explosive Ordnance Disposal (EOD) Equipment Market

The value chain for the EOD Equipment market is highly specialized and begins with upstream analysis encompassing the supply of highly sensitive components, including advanced sensors, specialized composites for protective gear, high-end electronics, and proprietary robotic components such as actuators and communication modules. Key suppliers in this stage are typically specialized material science companies and defense electronics manufacturers, operating under stringent quality control and security regulations. The technological complexity of EOD systems means that relationships between original equipment manufacturers (OEMs) and these Tier 1 suppliers are often long-term and strategic, focusing on custom solutions for weight reduction and increased ruggedness necessary for combat environments.

The midstream involves the core manufacturing, integration, and assembly carried out by major EOD system providers. This stage involves significant R&D investment to integrate disparate technologies—like robotic platforms, multi-spectral sensors, and proprietary software—into a cohesive, mission-ready system. Downstream analysis focuses on distribution and end-user engagement. Due to the sensitive nature of the equipment, the distribution channel is predominantly direct, involving government contracts, international arms sales agreements, and direct negotiations with military procurement agencies and specialized law enforcement units. Indirect channels, such as specialized defense integrators or local agents, are sometimes utilized in foreign markets to navigate complex import/export regulations and provide local technical support.

The market heavily relies on robust post-sales support, including maintenance, repair, and overhaul (MRO) services, alongside extensive operator training programs. This service element constitutes a significant portion of the value delivered downstream, ensuring the longevity and reliability of high-cost EOD assets. The value chain is characterized by high barriers to entry due to the necessity for deep defense industry knowledge, extensive certification, and the requirement for highly specialized labor and manufacturing capabilities. Successful players differentiate themselves not just through product innovation but also through comprehensive lifecycle support, maximizing the operational readiness of the equipment for defense and security end-users worldwide.

Explosive Ordnance Disposal (EOD) Equipment Market Potential Customers

Potential customers for EOD equipment primarily consist of government and quasi-governmental entities with mandates pertaining to national security, counter-terrorism, and public safety. The most significant buyers are the defense establishments, including army, navy, and air force EOD units globally, which require the highest level of protective gear and most sophisticated robotic systems for conflict zones and specialized missions. These customers frequently issue large, multi-year contracts focused on platform standardization and long-term logistical support, placing a high premium on proven reliability and interoperability with existing military infrastructure.

The second major segment includes national and regional law enforcement agencies, such as police bomb squads, SWAT teams, and federal agencies responsible for domestic counter-terrorism (e.g., FBI, Department of Homeland Security equivalents). These groups prioritize smaller, more agile, and rapidly deployable equipment suited for urban settings, focusing on portable X-ray systems and miniature UGVs. Their procurement cycles are often dependent on departmental budgets and localized threat assessments, driving demand for cost-effective yet high-performance solutions capable of dealing with criminal and terrorist threats within civilian infrastructure.

Additionally, specialized customers include humanitarian organizations engaged in Unexploded Ordnance (UXO) and mine clearance, particularly in post-conflict regions of Africa, Southeast Asia, and Eastern Europe. These non-military buyers often seek durable, robust, and often donated or specifically priced equipment designed for extensive, long-duration field operations. Critical infrastructure protection sectors, such as major airport and railway security teams, also represent a growing niche, requiring high-throughput, reliable detection equipment for checkpoint and perimeter security applications, emphasizing speed and minimal operational disruption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $9.6 Billion |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Northrop Grumman Corporation, Safran S.A., iRobot Corporation, QinetiQ Group PLC, Reamda Ltd., Allen-Vanguard, Scanna MSC Ltd., Detectachem, LLC, ICOR Technology, ECA Group, Aardvark Tactical, Med-Eng (Safariland), Cobham Advanced Electronic Solutions, Teledyne FLIR LLC, Chemring Group, Elbit Systems Ltd., Mistral Inc., Logos Technologies LLC, L3Harris Technologies, Precision Remotes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Explosive Ordnance Disposal (EOD) Equipment Market Key Technology Landscape

The technological landscape of the EOD equipment market is characterized by rapid advancements focused on increasing standoff capability, precision, and data fidelity while simultaneously reducing the size and weight of operational systems. A key technology is the development of next-generation Remote Operated Vehicles (ROVs) and Unmanned Ground Vehicles (UGVs). These platforms are moving beyond basic teleoperation toward increased autonomy, incorporating advanced features like simultaneous localization and mapping (SLAM), articulated arms with improved dexterity, and standardized interfaces for modular payloads. The focus here is on platforms that can operate reliably in harsh, radio-frequency-denied environments, often integrating redundant communication links and enhanced battery technology for extended mission endurance, critical for prolonged counter-IED operations.

Another crucial area involves advanced detection and imaging technologies. This includes the deployment of high-resolution, portable digital radiography (X-ray) systems that provide clear, immediate internal images of suspicious packages, significantly aiding in identification without disturbing the device. Furthermore, explosive trace detection (ETD) sensors are becoming more sensitive and specific, capable of identifying minute chemical signatures of various explosive compounds, including homemade explosives (HME). The integration of multi-sensor fusion, combining data from GPR, electromagnetic induction (EMI), and chemical sensors, provides EOD operators with a much more reliable and comprehensive picture of the threat embedded within complex, noisy environments, dramatically lowering the incidence of false positive indications.

Finally, protective technologies continue to evolve, despite the growing reliance on robotics. Modern bomb suits and helmets utilize lightweight, high-performance materials such as aramid fibers and sophisticated ceramic plating to maximize blast mitigation while improving technician mobility and reducing heat stress. Integration of cooling systems and advanced communication interfaces, including heads-up displays (HUDs) and noise-canceling technology, ensure technicians maintain peak operational effectiveness during prolonged periods of high stress. The technological trajectory emphasizes human-machine teaming, where sophisticated robotics and AI serve as force multipliers, but the underlying protective gear remains essential for scenarios requiring manual intervention or close-quarters assessment, necessitating continuous material science innovation.

Regional Highlights

- North America: This region dominates the global EOD equipment market, primarily driven by substantial and continuous investments from the US Department of Defense and Homeland Security in modernizing EOD capabilities, particularly in advanced robotics and integrated sensor systems. The presence of numerous global market leaders and a robust defense industrial base ensures early adoption of cutting-edge technologies, maintaining regional market maturity and high per capita defense technology spending.

- Europe: Characterized by stable growth, the European market is fueled by the persistent threat of domestic terrorism and the need for NATO member states to maintain interoperable EOD standards. Key drivers include procurement programs focused on upgrading national police and military bomb disposal units, with a strong emphasis on portable and lightweight EOD tools suitable for urban counter-terrorism responses.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, stimulated by rapidly modernizing militaries (especially India, South Korea, and Japan) and significant long-term commitments to clearing vast areas contaminated by Unexploded Ordnance (UXO) in countries like Vietnam, Laos, and Cambodia. Increased geopolitical tensions and maritime security requirements are also driving demand for advanced EOD systems.

- Middle East and Africa (MEA): This region is a high-demand area driven by ongoing conflicts, post-conflict stabilization efforts, and the widespread use of IEDs by insurgent groups. Procurement is often episodic and dependent on defense aid and immediate security crises, focusing heavily on proven, ruggedized robotic platforms and reliable protective gear for use in extreme climatic conditions.

- Latin America (LATAM): The LATAM market holds a smaller share but shows consistent demand primarily focused on internal security, counter-narcotics operations, and managing unexploded ordnance left from internal conflicts. Procurement often centers on cost-effective, durable equipment suitable for various terrains, with governmental agencies slowly beginning to incorporate smaller robotic platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Explosive Ordnance Disposal (EOD) Equipment Market.- Northrop Grumman Corporation

- Safran S.A.

- iRobot Corporation (now part of Amazon, but historically relevant for EOD)

- QinetiQ Group PLC

- Reamda Ltd.

- Allen-Vanguard

- Scanna MSC Ltd.

- Detectachem, LLC

- ICOR Technology

- ECA Group

- Aardvark Tactical

- Med-Eng (Safariland)

- Cobham Advanced Electronic Solutions

- Teledyne FLIR LLC

- Chemring Group

- Elbit Systems Ltd.

- Mistral Inc.

- Logos Technologies LLC

- L3Harris Technologies

- Precision Remotes

Frequently Asked Questions

Analyze common user questions about the Explosive Ordnance Disposal (EOD) Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the EOD Equipment Market?

The Explosive Ordnance Disposal (EOD) Equipment Market is projected to grow at a steady Compound Annual Growth Rate (CAGR) of 7.5% between the forecast years 2026 and 2033, driven by global security modernization efforts.

Which segment of the EOD Equipment Market is experiencing the fastest growth?

The Robotic EOD Systems segment, encompassing Unmanned Ground Vehicles (UGVs) and Remote Operated Vehicles (ROVs), is currently the fastest-growing segment due to increased focus on maximizing standoff distance and integrating advanced AI capabilities for threat neutralization.

What are the primary drivers of demand for EOD equipment?

Key demand drivers include the escalating sophistication and proliferation of Improvised Explosive Devices (IEDs) by non-state actors, heightened global counter-terrorism spending, and extensive governmental programs dedicated to clearing unexploded ordnance (UXO) in post-conflict regions.

How is Artificial Intelligence (AI) impacting EOD technology?

AI is primarily enhancing EOD technology through automated threat recognition, rapid multi-sensor data fusion, and optimizing the autonomous navigation and manipulation capabilities of robotic platforms, thereby improving precision and reducing operator cognitive load.

Which geographical region holds the largest market share for EOD equipment?

North America currently holds the largest market share in the global EOD Equipment Market, largely attributed to substantial defense budgets in the United States and Canada dedicated to high-tech military procurement and homeland security enhancements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager