Exterior Structural Glazing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441329 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Exterior Structural Glazing Market Size

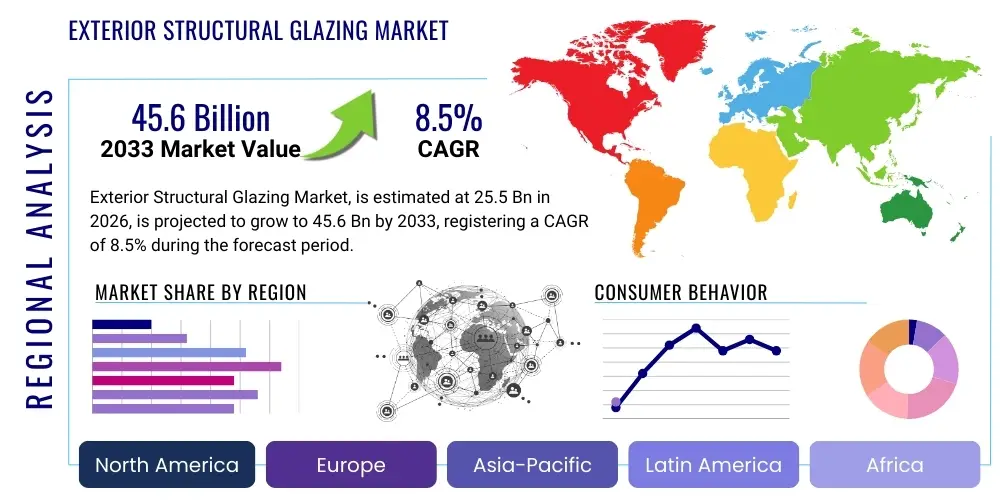

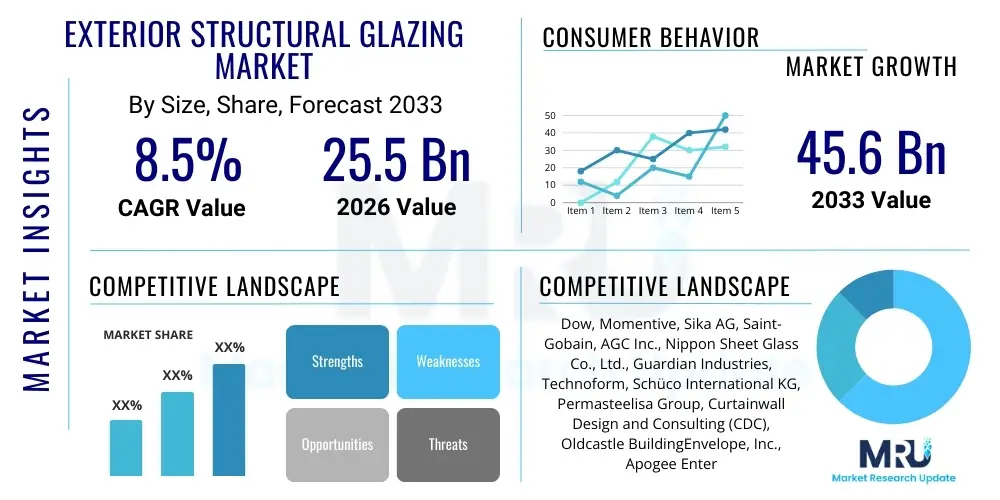

The Exterior Structural Glazing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 45.6 Billion by the end of the forecast period in 2033.

Exterior Structural Glazing Market introduction

The Exterior Structural Glazing Market encompasses the design, production, and installation of curtain wall systems where the glass panels are bonded or secured to the structure using high-strength structural sealants, eliminating the need for visible exterior mechanical fasteners or framing elements. This specialized facade construction method offers architects unparalleled design flexibility, allowing for large, seamless glass expanses that enhance building aesthetics, maximize natural light penetration, and improve overall thermal performance. The principal product is the structural sealant, typically silicone, which bears the load and withstands environmental stresses, differentiating this system from traditional captured curtain walls. The market growth is intricately linked to global trends in high-rise commercial construction and the persistent demand for energy-efficient building envelopes, particularly in densely populated urban centers where premium architectural finishes are paramount for competitive differentiation.

Major applications of exterior structural glazing span across the commercial, institutional, and high-end residential sectors. Commercial office towers, luxury hotels, educational campuses, and large public infrastructure projects like airports and museums constitute the core demand base, driven by the desire for contemporary, minimalist aesthetics that structural glazing delivers. The integration of advanced glazing technologies, such as low-emissivity (low-E) coatings and electrochromic or dynamic glass, is further expanding the market's applicability, turning building facades into active elements that manage solar heat gain and daylighting automatically. These benefits are critical for achieving modern green building standards and certifications, such as LEED and BREEAM, placing structural glazing systems at the forefront of sustainable construction practices worldwide.

The primary driving factors propelling the market include rapid global urbanization leading to extensive commercial real estate development, stringent regulatory mandates emphasizing thermal efficiency and energy conservation in new construction, and technological advancements enhancing the durability and load-bearing capacity of structural silicone adhesives. Furthermore, the aesthetic appeal of frameless facades, coupled with the long-term cost benefits derived from reduced maintenance and improved building energy performance, significantly contributes to the high adoption rate among developers and asset managers. The inherent ability of structural glazing to accommodate sophisticated designs and complex geometries further solidifies its position as the preferred facade solution in architecturally ambitious projects across mature and emerging economies.

Exterior Structural Glazing Market Executive Summary

The global Exterior Structural Glazing Market is characterized by robust growth, primarily fueled by massive infrastructure investments in Asia Pacific and the continued renovation and modernization cycles in mature markets like North America and Europe. Key business trends indicate a strong shift towards unitized curtain wall systems over stick-built systems, driven by the need for faster on-site installation, greater quality control achieved through factory fabrication, and enhanced performance specifications required for high-rise buildings subjected to intense wind loads and seismic activity. Suppliers are focusing intensely on developing highly specialized structural silicones and integrating smart technologies, such as self-cleaning glass and photovoltaic panels, into the glazing units, positioning the facade not merely as a boundary but as an energy-generating and climate-responsive component of the building structure. Consolidation among major fabricators and strategic partnerships between material suppliers and installation specialists are defining the competitive landscape, aiming to deliver end-to-end facade solutions that meet increasingly complex project requirements.

Regionally, Asia Pacific maintains the highest growth momentum, led by accelerated urbanization and large-scale commercial and mixed-use development projects in China, India, and Southeast Asian nations. North America and Europe, while demonstrating slower volume growth, command higher average selling prices due to stringent energy codes and a greater adoption rate of premium, high-performance, triple-glazed, and vacuum insulating glass (VIG) technologies necessary for extreme climate mitigation. Segment trends reveal that the commercial sector, specifically high-rise office and corporate campuses, remains the dominant revenue generator, emphasizing insulated glass units (IGU) bonded with two-sided or four-sided structural glazing applications. Furthermore, the repair and maintenance segment is emerging as a critical revenue stream, given the long service life requirements of these specialized facade systems, necessitating periodic inspection and resealing of structural joints to ensure long-term integrity and performance against environmental degradation.

In terms of technology and materials, the market is undergoing a transition driven by sustainability mandates. There is a discernible trend toward low-VOC (Volatile Organic Compounds) structural sealants and a focus on glazing systems designed for end-of-life recycling. The adoption of advanced glazing coatings (e.g., spectral selectivity) to optimize visible light transmission while reducing infrared heat gain is becoming standard practice, particularly in hot climates. The competitive environment is intensifying, prompting manufacturers to invest heavily in certifications and specialized engineering services to provide design assistance and structural validation, moving beyond simple product supply to integrated solution provision. This focus on performance, sustainability, and complete system reliability underscores the sophisticated nature of the structural glazing market dynamics in the current global economic climate.

AI Impact Analysis on Exterior Structural Glazing Market

User inquiries regarding AI's influence on the Exterior Structural Glazing Market typically center on three core themes: optimization of complex facade design and engineering, enhancement of manufacturing precision and automation, and improvement in post-installation monitoring and predictive maintenance. Users frequently ask how AI can handle the immense computational load associated with structural analysis for uniquely shaped, geometrically complex facades, particularly concerning wind load distribution and thermal stress modeling. Furthermore, there is significant interest in how machine learning algorithms can refine the quality control processes during the factory fabrication of unitized panels, ensuring the precise application and curing of structural silicone to minimize failure risks. Finally, users seek information on AI-driven diagnostics for installed systems, expecting predictive analytics to schedule proactive maintenance before structural integrity is compromised by weather or material fatigue, thereby extending the lifespan and reliability of the high-value building envelope.

- AI-driven optimization of facade structural design, minimizing material use while maximizing performance specifications related to acoustics and thermal bridging.

- Machine learning algorithms improving the quality control of silicone bonding applications during the manufacturing of insulated and laminated structural glazing units (IGUs/LGUs).

- Predictive maintenance analytics using sensor data (IoT) embedded in the facade to detect sealant degradation, glass stress fractures, or excessive movement, preempting costly structural failures.

- Automation of complex computational fluid dynamics (CFD) analysis for advanced aerodynamics and wind load simulation on super-tall structures utilizing structural glazing systems.

- AI assistance in material selection and inventory management, predicting material requirements and potential supply chain bottlenecks for custom-engineered glazing components.

- Robotic installation guidance systems utilizing computer vision and AI for precise placement and alignment of large, heavy structural glass panels on challenging building geometries, enhancing site safety.

DRO & Impact Forces Of Exterior Structural Glazing Market

The Exterior Structural Glazing Market is significantly propelled by robust Drivers (D) such as global urbanization and the rising demand for aesthetically superior, energy-efficient building envelopes. Simultaneously, the market faces notable Restraints (R), primarily high initial investment costs and the dependency on highly skilled labor for precise installation, particularly in stick-built systems. Opportunities (O) arise from advancements in smart glass technology, the proliferation of large-scale public infrastructure projects, and increasing regulatory pressure for sustainable construction practices across developed and emerging nations. These forces interact to create a dynamic impact landscape, where the demand for premium architectural solutions clashes with cost sensitivity and execution complexity, requiring specialized facade engineering firms to constantly innovate and optimize system integration for high-performance outcomes.

The primary impact forces manifest as: 1) Intensity of Competition, driven by regional fabricators competing on price and specialized certifications; 2) Threat of Substitution, moderated by the superior aesthetic and performance of structural glazing compared to traditional cladding but facing competition from advanced metal panel systems; 3) Bargaining Power of Buyers, which is high due to the custom nature of projects and the long-term warranty requirements; and 4) Bargaining Power of Suppliers, which is moderate, concentrated among specialized suppliers of structural silicone and high-performance glass substrates. The high capital expenditure and specialized engineering required act as significant barriers to entry for new players, ensuring that established market leaders maintain a strong competitive edge based on proven track record, quality assurance, and global operational capacity to undertake mega-projects.

Market sustainability is increasingly influenced by the regulatory environment, particularly concerning fire safety standards and wind load resistance specific to structural glazing in seismic zones. While the drive for net-zero energy buildings acts as a powerful driver compelling adoption of advanced, highly insulated structural glazing systems, the complexity of designing and certifying these custom envelopes often slows the procurement process (a restraint). The long-term performance benefits, including reduced operational energy costs and superior daylighting, ultimately reinforce the positive impact forces, solidating structural glazing as a necessary component for future-proof, high-value commercial and institutional real estate development globally.

Segmentation Analysis

The Exterior Structural Glazing Market is comprehensively segmented based on the type of system employed, the material composition of the glass used, the key end-user application, and the geographic region. This segmentation provides crucial insights into market dynamics, revealing that the unitized system segment is rapidly outpacing the stick-built segment due to its efficiency and reliability in complex projects. Material segmentation highlights the dominance of insulated glass units (IGU) driven by stringent energy efficiency standards, although laminated glass is gaining traction, particularly for enhanced safety and security requirements in public buildings. Analyzing these segments helps stakeholders tailor product development, marketing strategies, and operational efficiencies to target the most promising and highest-growth sub-markets within the vast global construction sector.

- By System Type:

- Two-sided Structural Glazing (Vertical or Horizontal)

- Four-sided Structural Glazing (Total Structural)

- Point-Fixed Structural Glazing (Spider Glazing)

- Unitized Curtain Wall Systems

- Stick-Built Systems

- By Glazing Material:

- Insulated Glass Units (IGU)

- Laminated Glass

- Tempered Glass

- Coated Glass (Low-E, Reflective)

- Smart Glass (Electrochromic, Thermochromic)

- By End-User:

- Commercial (Office Buildings, Retail, Hospitality)

- Residential (High-Rise Apartments, Custom Homes)

- Institutional (Government, Education, Healthcare)

- Infrastructure (Airports, Railway Stations, Public Facilities)

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa)

Value Chain Analysis For Exterior Structural Glazing Market

The Value Chain for the Exterior Structural Glazing Market is highly complex, beginning with the Upstream activities centered around the production of core raw materials: float glass manufacturing, specialized coatings application, and the formulation of high-performance structural silicone sealants. These primary inputs are then sourced by specialized component fabricators who perform the crucial steps of cutting, tempering, laminating, and assembling the glass into insulated units (IGUs) or laminated glass units (LGUs). Downstream analysis focuses on the engineering and execution phase, involving facade consultants, system designers, specialized fabricators who assemble the unitized panels, and finally, the professional facade installation contractors responsible for site deployment and structural bonding validation. This vertical integration or intense collaboration is essential, as the performance and longevity of the final product depend heavily on the quality and compatibility of materials used across all stages, especially the structural sealant bond which constitutes the critical link in the system.

The distribution channel is predominantly direct or project-specific, especially for large commercial and institutional projects. Unitized systems are typically fabricated off-site by specialized facade manufacturers (Tier 1 suppliers) and delivered directly to the construction site for rapid installation by certified contractors. Indirect distribution occurs mainly for smaller projects or replacement markets, involving general contractors procuring standard glass units and structural sealants through established building material distributors. Key players in the upstream segment, such as major chemical companies providing structural silicones (e.g., Dow, Momentive), often maintain tight control over product specifications and provide technical support to ensure correct application, thus influencing the quality standards across the entire value chain. The complexity mandates high levels of quality assurance (QA) throughout the supply process, making technical expertise a crucial competitive advantage.

The reliance on specialized engineering firms and certified installers highlights the technical service orientation of the distribution phase. Direct engagement between architects, developers, and facade engineers during the early design stage is critical, defining the required performance characteristics that dictate the material sourcing (upstream) and manufacturing precision (midstream). The unitized facade fabricator acts as the central pivot, integrating inputs from material suppliers and translating design intent into factory-produced modules. This centralization ensures maximum quality control, minimizing on-site construction risks and delays. The inherent high value and bespoke nature of structural glazing systems necessitate a highly controlled, direct, and collaborative value chain structure to ensure adherence to stringent building codes and warranty requirements demanded by end-users.

Exterior Structural Glazing Market Potential Customers

The primary consumers and end-users of Exterior Structural Glazing systems are entities involved in the development, ownership, and management of high-value commercial and public real estate assets. This includes large-scale commercial real estate developers specializing in Class A office towers and mixed-use complexes, seeking premium aesthetics and superior energy performance to attract high-paying tenants. Furthermore, the hospitality sector, encompassing luxury hotel chains and convention centers, represents a significant customer base, valuing the expansive, unobstructed views and modern design elements provided by structural glazing. Institutional clients, such as government entities and public sector organizations developing flagship cultural centers, hospitals, and educational facilities, also constitute major purchasers, driven by requirements for long-term durability, low maintenance, and energy efficiency compliance.

A rapidly expanding customer segment includes the owners and asset managers of existing commercial properties undergoing extensive refurbishment or retrofit projects. As aging buildings require upgrades to meet contemporary energy codes and competitive aesthetic standards, structural glazing systems offer a high-impact solution for facade modernization. Infrastructure developers, particularly those building or renovating major international airports and high-speed rail terminals, are substantial consumers, prioritizing the resilience, safety (laminated structural glass), and open, naturally lit environments afforded by these systems. These customers consistently prioritize proven system performance, longevity, and adherence to specialized facade engineering standards over generalized material costs, leading them to partner exclusively with vendors capable of providing extensive technical validation and comprehensive warranty packages specific to structural glazing applications.

Finally, the high-end residential market, specifically developers of luxury high-rise condominium buildings and bespoke architectural homes, represents a smaller but high-value customer base. These developers seek the minimalist aesthetic and floor-to-ceiling glass features that structural glazing enables, maximizing natural light and capitalizing on scenic views. The decision-making process for these potential customers is heavily influenced by architectural specifications, requiring facade solutions that meet stringent thermal comfort, sound attenuation, and security criteria. As sustainability reporting becomes mandatory for corporate real estate portfolios, the demand from major corporations seeking LEED/BREEAM certified buildings utilizing high-performance structural glazing is projected to intensify, solidifying their role as cornerstone potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 45.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow, Momentive, Sika AG, Saint-Gobain, AGC Inc., Nippon Sheet Glass Co., Ltd., Guardian Industries, Technoform, Schüco International KG, Permasteelisa Group, Curtainwall Design and Consulting (CDC), Oldcastle BuildingEnvelope, Inc., Apogee Enterprises, Inc., Alumil S.A., Vitro Architectural Glass, Tremco, H.B. Fuller, Enclos Corp., Yuanda China Holdings Limited, Fletcher Building. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Exterior Structural Glazing Market Key Technology Landscape

The technology landscape in the Exterior Structural Glazing Market is predominantly characterized by advancements in two core areas: the composition and performance of the glass itself, and the chemistry and application methodology of the structural sealants. Within glazing materials, the focus has shifted heavily towards achieving superior thermal performance through multi-pane insulated glass units (IGUs) incorporating advanced spacers, such as warm edge technology, and inert gas fills (argon or krypton) to minimize heat transfer. Furthermore, sputter coating technologies enable the precise application of metallic layers (low-E coatings) that selectively reflect infrared radiation while maximizing visible light transmission, critical for energy saving in both hot and cold climates. The trend towards larger, heavier glass panels necessitates robust handling and installation technologies, including vacuum lifting systems and high-precision robotic machinery used in the fabrication facilities for assembling unitized facades with micron-level accuracy.

The second critical technology pillar involves structural silicone sealants (SSS). These specialized silicones, typically two-part systems, must possess exceptional durability, UV resistance, high mechanical strength, and long-term elasticity to accommodate building movement and thermal expansion over decades. Recent technological breakthroughs focus on developing sealants with improved compatibility with complex coated and reflective glass types, as well as formulations that achieve faster cure times without compromising structural integrity, thereby accelerating the manufacturing and installation cycles. Certification and testing standards, such as those governed by organizations like ASTM and EOTA, dictate the rigorous performance requirements for these materials, pushing manufacturers to continuously invest in R&D to enhance adhesion properties and fire resistance capabilities, ensuring the facade meets stringent safety regulations, especially in high-rise applications where structural reliability is paramount.

Emerging technologies, often referred to as 'Smart Facade' elements, are rapidly entering the mainstream, influencing the design of structural glazing systems. These include electrochromic glass, which dynamically changes tint in response to electric current, optimizing interior lighting and solar heat gain without requiring mechanical shading devices, and Building Integrated Photovoltaics (BIPV) embedded within the glazing units to generate renewable energy. The integration of Internet of Things (IoT) sensors into the structural glazing units allows for real-time monitoring of pressure, temperature, and facade movement, providing valuable data for facility management and predictive maintenance scheduling. This shift transforms the glazing system from a passive barrier into an active, energy-managing component of the building, significantly increasing the complexity, value, and technical specifications required from manufacturers and installers alike, emphasizing the market's trajectory towards highly engineered, digitally integrated building solutions.

Regional Highlights

- Asia Pacific (APAC): This region is the epicenter of growth in the Exterior Structural Glazing Market, primarily driven by explosive urbanization rates, massive investments in commercial infrastructure, and the construction of numerous new high-rise residential and mixed-use development projects, particularly in metropolitan hubs in China, India, and Southeast Asia. The demand here is volume-driven, with increasing adoption of unitized systems to meet tight construction schedules. Government initiatives supporting sustainable urban development and the growing demand for world-class corporate architecture fuel the consumption of high-performance IGUs and structural silicone systems.

- North America: Characterized by a mature market with high regulatory standards, North America focuses on premium structural glazing systems, emphasizing extremely high thermal performance (often double or triple-glazed) to address severe climate variability. The market is fueled by the continuous renovation and retrofit cycle of existing commercial building stock, alongside new construction that rigorously adheres to stringent energy codes like ASHRAE 90.1 and local green building mandates, driving the adoption of smart glass and advanced low-E coatings.

- Europe: Europe exhibits a strong focus on sustainability and aesthetic integration, driven by EU directives for near-zero energy buildings (NZEB). This mandates the use of highly insulating and structurally robust glazing systems. Western European nations, especially Germany and the UK, are pioneers in developing highly efficient aluminum profiles and integrating point-fixed systems for architecturally distinct projects, prioritizing durability, minimal visual intrusion, and long service life over initial cost savings.

- Middle East and Africa (MEA): The MEA region, particularly the GCC countries, represents a high-value market segment due to extreme climatic conditions necessitating specialized, high-performance structural glazing systems designed for maximum solar heat reflection and UV resistance. Large-scale government-backed projects, including massive commercial complexes, luxury hospitality developments, and new smart city constructions, are the primary demand drivers, often featuring bespoke, technologically advanced facade solutions.

- Latin America: This region presents an emerging opportunity, with growth concentrated in major urban centers like São Paulo and Mexico City. The market is increasingly adopting structural glazing to modernize older commercial properties and for new developments seeking modern, earthquake-resistant architectural designs. Cost sensitivity remains a factor, but the long-term benefits of energy efficiency are gradually shifting preference towards quality structural systems over conventional facades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Exterior Structural Glazing Market.- Dow

- Momentive

- Sika AG

- Saint-Gobain

- AGC Inc.

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Guardian Industries

- Schüco International KG

- Permasteelisa Group

- Oldcastle BuildingEnvelope, Inc.

- Apogee Enterprises, Inc.

- Vitro Architectural Glass

- Tremco

- H.B. Fuller

- Technoform

- Alumil S.A.

- Enclos Corp.

- Yuanda China Holdings Limited

- Fletcher Building

- Kawneer (Arconic)

Frequently Asked Questions

Analyze common user questions about the Exterior Structural Glazing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between structural glazing and traditional curtain wall systems?

The primary difference lies in the absence of visible exterior mechanical fasteners or metal frames in structural glazing. The glass panels are bonded directly to the structural frame using high-strength structural silicone sealants, creating a smooth, seamless glass facade, unlike traditional captured curtain walls which rely on exterior capping or pressure plates.

What are the key structural integrity concerns associated with exterior structural glazing?

Key structural integrity concerns involve the long-term durability and performance of the structural silicone sealant bond under constant exposure to UV radiation, extreme temperature fluctuations, and cyclic wind loading. Proper installation, adhesion validation, and quality control of the silicone are paramount to prevent bond line failure and ensure facade safety.

Which end-user segment drives the highest demand in the structural glazing market globally?

The Commercial Real Estate sector, particularly the construction of high-rise office buildings, corporate campuses, and large retail centers, generates the highest revenue due to the stringent requirements for premium aesthetics, maximizing natural light, and achieving superior thermal performance ratings in competitive urban environments.

How do energy efficiency mandates influence the choice of structural glazing materials?

Energy efficiency mandates, such as LEED and NZEB standards, strongly favor the adoption of high-performance Insulated Glass Units (IGU) featuring low-E coatings and thermal breaks. These materials significantly reduce solar heat gain and minimize thermal transmission, directly contributing to lower operational energy consumption of the building.

What role do unitized curtain wall systems play in the market growth?

Unitized curtain wall systems accelerate market growth by facilitating faster construction times, enabling factory-controlled quality assurance for structural silicone application, and offering enhanced performance reliability, making them the preferred choice for complex, time-sensitive, and tall building projects worldwide, especially in densely populated areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager