Eye Health Ingredients Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441327 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Eye Health Ingredients Market Size

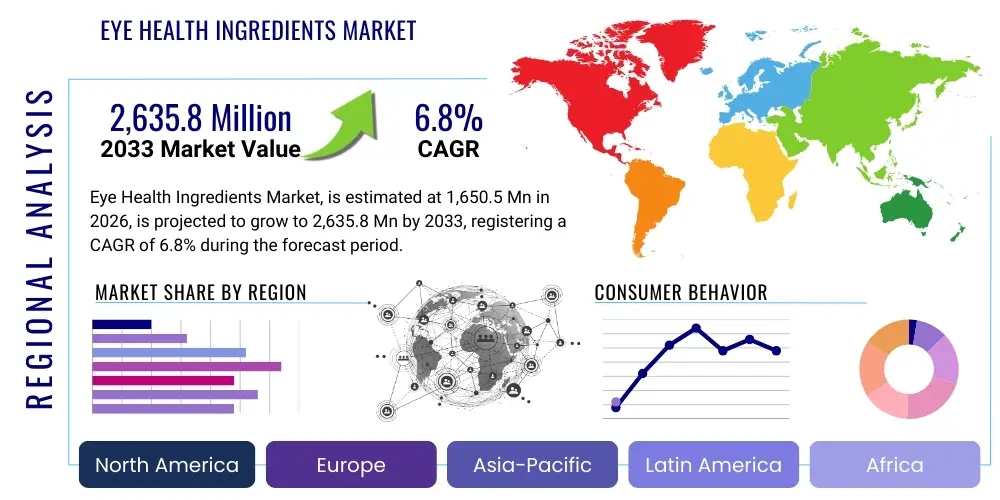

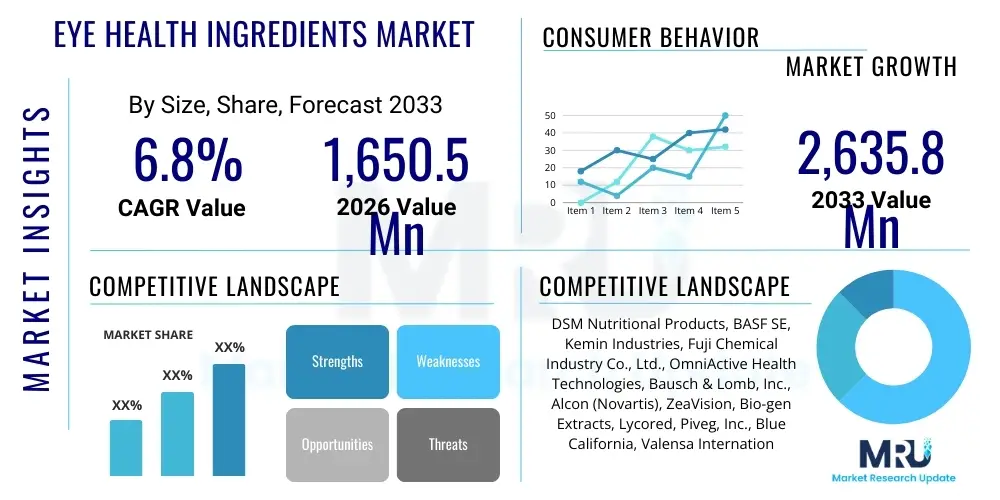

The Eye Health Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1,650.5 Million in 2026 and is projected to reach USD 2,635.8 Million by the end of the forecast period in 2033.

Eye Health Ingredients Market introduction

The Eye Health Ingredients Market encompasses essential bioactive compounds utilized in the formulation of dietary supplements, functional foods, and pharmaceutical products specifically designed to maintain or improve visual function and prevent ocular diseases. Key ingredients driving this market include carotenoids such as Lutein and Zeaxanthin, Omega-3 fatty acids (DHA and EPA), various vitamins (A, C, E), minerals (Zinc, Copper), and powerful antioxidants. The rapid acceleration of digital device usage globally, leading to increased exposure to blue light and subsequent eye strain, serves as a primary driver for consumer demand for preventative and supportive eye health solutions.

The product portfolio within this market addresses a broad spectrum of ophthalmic concerns, ranging from chronic conditions like Age-related Macular Degeneration (AMD) and cataracts to more prevalent issues like dry eye syndrome, digital eye fatigue (asthenopia), and protection against oxidative stress. Lutein and Zeaxanthin, derived primarily from marigold flowers or synthesized chemically, are critical as they accumulate in the macula, filtering harmful blue light and neutralizing free radicals. Furthermore, Omega-3 fatty acids, particularly DHA, are crucial structural components of retinal cell membranes, vital for maintaining proper retinal function and mitigating inflammation associated with chronic dry eye.

Major applications for eye health ingredients span across the nutraceutical sector, targeting an aging demographic increasingly concerned with preventative health measures, and the clinical nutrition segment, focusing on therapeutic dietary intervention for diagnosed eye conditions. The market’s sustained growth is fundamentally underpinned by technological advancements in ingredient extraction and formulation, enabling enhanced bioavailability and stability of sensitive compounds. Growing awareness among the general population regarding the links between nutrition and long-term ocular health, coupled with favorable regulatory frameworks supporting health claims for established ingredients, further solidifies the market's positive trajectory.

Eye Health Ingredients Market Executive Summary

The Eye Health Ingredients Market is characterized by robust business trends centered on premiumization, diversification of delivery formats, and strategic vertical integration among ingredient manufacturers and end-product developers. Manufacturers are increasingly focusing on sustainable sourcing and clean-label verification, catering to sophisticated consumer preferences that prioritize natural and ethically produced supplements. A crucial trend involves the formulation of synergistic blends—combining carotenoids with specific ratios of Omega-3s and antioxidants—to maximize efficacy against multifactorial ocular diseases, moving beyond single-ingredient offerings to comprehensive ocular support systems.

Regionally, North America maintains the dominant market share, driven by high consumer awareness, advanced healthcare infrastructure, and significant spending on dietary supplements, particularly targeting AMD prevention and digital eye strain relief. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rapidly aging populations in countries like Japan and China, increasing disposable incomes, and the widespread adoption of Western-style preventative health practices. European markets show stable growth, heavily influenced by stringent regulatory standards concerning ingredient safety and efficacy claims, promoting high-quality, scientifically backed formulations.

Segment trends reveal that the Lutein and Zeaxanthin segment, categorized under Carotenoids, remains the largest ingredient category due to established clinical evidence supporting their role in macular pigment density enhancement and blue light filtration. Application-wise, the Dietary Supplements segment holds the largest share, although Functional Foods and Beverages are gaining momentum as manufacturers incorporate ingredients into everyday consumable items like fortified juices, dairy products, and specialized nutritional bars. This shift reflects a broader market movement toward convenient, food-based delivery systems for proactive health management.

AI Impact Analysis on Eye Health Ingredients Market

Common user questions regarding AI's influence on the Eye Health Ingredients Market often revolve around its application in personalized nutrition recommendations, its role in accelerating ingredient discovery, and its capacity to refine clinical trial analysis for proving ingredient efficacy. Users are concerned with how AI can tailor dosages and ingredient combinations based on individual genetic profiles, lifestyle data, and specific disease risk markers identified through large-scale data analysis. There is significant interest in AI models that can predict the bioavailability and optimal formulation stability of new eye health compounds, reducing the traditional time and cost associated with research and development. Furthermore, users question AI's ability to analyze real-world evidence and patient reported outcomes (PROs) to provide better substantiation for ingredient health claims, thereby building greater trust in the efficacy of eye health supplements.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the R&D pipeline for eye health ingredients. AI algorithms can efficiently sift through vast genomic and metabolomic data sets to identify novel bioactive compounds or optimal synergistic combinations that target specific pathways related to ocular aging and disease, such as inflammation or oxidative stress. This predictive modeling capability allows manufacturers to prioritize ingredients with the highest potential for clinical success, significantly streamlining the drug and supplement development cycle, moving the industry toward precision nutrition formulations rather than generalized recommendations.

Beyond ingredient discovery, AI enhances market efficiency through predictive demand forecasting and supply chain optimization. By analyzing consumer trends, search queries, and demographic shifts in real-time, AI can accurately forecast demand for specific ingredients like high-purity Astaxanthin or specialized microalgae-derived DHA, allowing manufacturers to manage sourcing, inventory, and production more effectively, thus ensuring a stable supply chain despite fluctuating global demand. Additionally, AI-powered diagnostic tools in ophthalmology, by detecting early signs of conditions like diabetic retinopathy or AMD, indirectly drive the ingredients market by creating a pool of informed patients seeking preventative nutritional interventions.

- AI accelerates the identification of novel therapeutic compounds and synergistic ingredient matrices.

- Machine Learning optimizes clinical trial design and analyzes large-scale patient data (Real-World Evidence) to validate ingredient efficacy.

- AI enables personalized eye health nutrition recommendations based on genetic markers and environmental risk factors.

- Predictive analytics enhance supply chain management, ensuring stable sourcing of specialty ingredients like Lutein and Zeaxanthin.

- AI-driven image analysis tools in ophthalmology indirectly boost consumer demand for preventative nutritional supplements.

DRO & Impact Forces Of Eye Health Ingredients Market

The trajectory of the Eye Health Ingredients Market is defined by a powerful interplay of drivers, constraints, and opportunities, summarized by the need to address an aging global demographic and the pervasive influence of digital screens. The primary drivers include the escalating prevalence of chronic eye disorders such as AMD and cataracts, driven by increased longevity, and the unprecedented growth in digital device usage, which necessitates proactive nutritional strategies against blue light damage and digital eye strain. These forces collectively create a sustained, non-cyclical demand for protective and restorative ingredients, pushing manufacturers towards high-potency, clinically validated offerings. Opportunities arise from expanding research into novel sources, such as microalgae and sustainable botanicals, and the burgeoning trend of personalized nutrition, utilizing genetic testing to tailor ingredient regimes to individual needs.

However, the market faces significant restraints, notably the high cost associated with sourcing and extracting premium ingredients, such as high-purity, sustainably sourced Omega-3s or specialized carotenoids. Furthermore, regulatory hurdles, particularly in obtaining verifiable and approved health claims in strict jurisdictions like the European Union (EFSA), pose a challenge, requiring extensive clinical validation which is costly and time-consuming. Consumer skepticism surrounding the efficacy of dietary supplements, often fueled by marketing misinformation, also acts as a restraint, emphasizing the industry's need for transparent, science-backed communication.

The key impact forces highlight the market's sensitivity to scientific breakthroughs and consumer education initiatives. Positive clinical trial results validating ingredient efficacy can instantly reshape market dynamics and consumer confidence. Conversely, supply chain disruptions, especially concerning raw materials like marigold extracts or fish oil, due to geopolitical instability or climate change, represent a potent negative impact force that threatens pricing stability and availability. Ultimately, the market success hinges on the convergence of robust scientific substantiation, regulatory clarity, and effective communication strategies that bridge the gap between nutritional science and mainstream consumer understanding.

Segmentation Analysis

The Eye Health Ingredients Market is meticulously segmented across key dimensions: Ingredient Type, Formulation, Disease Indication, and Application. Analyzing these segments provides a granular view of market dynamics, revealing where investment and innovation are concentrated. The diversity of ingredient types—ranging from well-established carotenoids and vitamins to emerging ingredients like anthocyanins and specialized phospholipids—reflects the complex biological requirements of the eye and the multifaceted nature of ocular diseases. Understanding the growth rate of specific segments, such as the rapid adoption of ingredients aimed at blue light filtering, is essential for strategic market positioning.

The market segmentation by application further distinguishes the end-use sectors, with dietary supplements dominating due to their accessibility and strong marketing campaigns emphasizing preventative health. However, the rapidly expanding segment of functional foods and beverages represents a major long-term growth avenue, integrating eye health benefits into everyday consumption habits. Furthermore, segmentation by disease indication highlights the therapeutic focus, showing high demand for ingredients proven to mitigate Age-related Macular Degeneration (AMD) and reduce symptoms associated with chronic dry eye, conditions heavily impacting quality of life for the elderly population.

Formulation segmentation reflects the consumer preference for convenience and palatability, with capsules and softgels currently holding the largest share, prized for their ability to deliver fat-soluble ingredients like Omega-3s and Lutein effectively. However, the burgeoning demand for liquid drops, gummies, and chewable tablets, particularly appealing to pediatric and geriatric populations who face difficulties swallowing pills, indicates an important shift toward novel and patient-friendly delivery systems, requiring innovation in ingredient stabilization and taste masking technologies.

- Ingredient Type:

- Carotenoids (Lutein, Zeaxanthin, Astaxanthin)

- Omega-3 Fatty Acids (DHA, EPA)

- Antioxidants (Vitamins C and E, Beta-Carotene)

- Minerals (Zinc, Copper, Selenium)

- Others (Anthocyanins, Bilberry Extract, Beta Glucan)

- Formulation:

- Capsules and Softgels

- Tablets

- Powders and Premixes

- Liquid and Gummy Formulations

- Application:

- Dietary Supplements

- Functional Foods and Beverages

- Animal Feed

- Pharmaceuticals

- Disease Indication:

- Age-Related Macular Degeneration (AMD)

- Cataract Prevention

- Dry Eye Syndrome

- Diabetic Retinopathy

- General Eye Wellness and Fatigue Reduction

Value Chain Analysis For Eye Health Ingredients Market

The value chain for the Eye Health Ingredients Market initiates with the upstream analysis, focusing on the sourcing and initial processing of raw materials. This stage is critical as it dictates the purity, potency, and sustainability profile of the final ingredient. Raw materials range from agricultural sources like marigold flowers (for Lutein/Zeaxanthin) and specialized berries (for anthocyanins) to marine sources (fish/algae for Omega-3s). Key activities here include cultivation, harvesting, rigorous extraction processes (often using supercritical CO2 or organic solvents), and standardization to achieve precise concentration levels. Major challenges at this stage involve ensuring consistent quality, managing environmental impact, and securing certifications (e.g., Non-GMO, sustainable fishing practices).

Midstream activities involve sophisticated manufacturing and formulation. Ingredient manufacturers receive the standardized extracts and transform them into bioavailable forms, often through microencapsulation, emulsification, or crystallization techniques to enhance stability, shelf-life, and absorption rates within the human body. This stage involves significant R&D investment to develop proprietary delivery systems that overcome the inherent challenges of delivering fat-soluble nutrients. Direct and indirect distribution channels then move these bulk ingredients to downstream participants, which are primarily supplement and functional food manufacturers who integrate the ingredients into final consumer products, adhering to strict regulatory standards.

The downstream analysis centers on the distribution to end-users. Direct channels include manufacturers selling finished products through their own e-commerce platforms or specialized health clinics. Indirect channels, which dominate the market, involve distribution through pharmacies, drug stores, mass-market retailers, online supplement marketplaces (e.g., Amazon, specialized nutraceutical websites), and health food stores. End-user engagement is significantly influenced by healthcare professionals (optometrists, ophthalmologists) who often recommend specific ingredients or branded formulations. The effectiveness of the supply chain depends heavily on maintaining cold chain integrity for sensitive ingredients like Omega-3s and providing robust documentation regarding traceability and efficacy claims to retailers and consumers alike.

Eye Health Ingredients Market Potential Customers

The primary potential customers and end-users of eye health ingredients are diverse, spanning multiple demographics and industrial segments. The most significant segment comprises consumers over the age of 50, who are actively seeking preventative and mitigating solutions against Age-related Macular Degeneration (AMD), cataracts, and general presbyopia. This demographic is characterized by high rates of health awareness and greater willingness to invest in premium supplements that offer scientifically validated benefits, often purchasing through pharmacy chains or specialized healthcare recommendations. Furthermore, the rapidly expanding group of young adults and children who spend extensive hours utilizing digital screens (tablets, smartphones) represents a burgeoning customer base for ingredients focused on blue light protection and the reduction of digital eye strain (asthenopia).

Beyond the direct consumer, major industrial buyers include global nutraceutical companies, both large pharmaceutical conglomerates diversifying into the wellness space and dedicated supplement manufacturers, who procure bulk ingredients for encapsulation and formulation under their own brands. These buyers prioritize ingredient purity, consistency, and the availability of strong clinical research dossiers supporting the material's efficacy, as their marketing claims rely heavily on scientific substantiation. Innovation in product formats, such as gummies and functional beverages, attracts these industrial buyers seeking to differentiate their offerings in a crowded market.

A third, high-value customer segment includes manufacturers in the functional food and beverage industry, seeking ingredients that can be easily incorporated into matrices like energy bars, fortified dairy products, and specialized infant formulas without compromising taste, texture, or stability. For this segment, ingredients that are highly water-soluble or encapsulated for minimal sensory impact are highly desirable. Additionally, the clinical nutrition and medical food sectors represent niche but important customers, requiring ingredients that meet stringent purity and quality standards for use in prescribed dietary regimens targeting specific clinical conditions under medical supervision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,650.5 Million |

| Market Forecast in 2033 | USD 2,635.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DSM Nutritional Products, BASF SE, Kemin Industries, Fuji Chemical Industry Co., Ltd., OmniActive Health Technologies, Bausch & Lomb, Inc., Alcon (Novartis), ZeaVision, Bio-gen Extracts, Lycored, Piveg, Inc., Blue California, Valensa International, EID Parry, Döhler Group, Vidya Herbs, Chr. Hansen Holding A/S, Novozymes, AstaReal, IFF (DuPont Nutrition & Biosciences). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eye Health Ingredients Market Key Technology Landscape

The technology landscape in the Eye Health Ingredients Market is primarily driven by innovations aimed at enhancing the bioavailability, stability, and sensory profile of potent bioactive compounds, many of which are highly susceptible to oxidation and degradation. Microencapsulation and nanoencapsulation technologies represent foundational breakthroughs, enabling the protection of sensitive ingredients like Lutein, Zeaxanthin, and especially Omega-3 fatty acids (DHA/EPA) from heat, light, and oxygen during processing and storage. These technologies not only extend shelf life but also allow for seamless integration into complex food matrices, masking the unpleasant odors or tastes often associated with marine-derived oils, thereby expanding the application scope into functional foods and beverages.

Another crucial technological advancement involves proprietary extraction and purification methods. Supercritical Fluid Extraction (SFE) is increasingly adopted, particularly for extracting carotenoids and essential fatty acids, due to its ability to yield high-purity, solvent-free ingredients while maintaining environmentally friendly characteristics. Furthermore, advancements in specialized formulation techniques, such as cold-water soluble powders and self-emulsifying drug delivery systems (SEDDS), are critical for improving the intestinal absorption rate of fat-soluble vitamins and carotenoids, ensuring that the consumer receives the maximum possible nutritional benefit, moving the industry toward superior clinical performance.

The convergence of biotechnology and ingredient sourcing also marks a significant technological shift. Genetic engineering and advanced cultivation techniques, particularly in microalgae and specialized yeast strains, allow for the sustainable and consistent production of high-value compounds like Astaxanthin and Omega-3 DHA, bypassing reliance on traditional, potentially over-fished marine sources or weather-dependent agriculture. These controlled bioreactor environments ensure superior quality, traceability, and batch-to-batch consistency, which are vital for meeting the rigorous standards required by both the nutraceutical and pharmaceutical sectors globally, guaranteeing the efficacy and safety profiles demanded by modern consumers and regulatory bodies.

Regional Highlights

The global consumption and production of eye health ingredients show significant regional variances dictated by demographic factors, regulatory environments, and consumer spending power. North America, encompassing the United States and Canada, stands as the most mature and dominant market, primarily driven by a high awareness level regarding preventative eye care, substantial healthcare expenditure, and the widespread presence of chronic conditions like AMD in an aging population. The robust penetration of dietary supplements and the early adoption of new formulations, especially those addressing digital eye strain, characterize this region.

Europe represents a stable, high-value market, constrained but also defined by stringent quality control standards enforced by the European Food Safety Authority (EFSA). Growth here is consistent, driven by consumer trust in high-quality, scientifically proven ingredients. Key markets such as Germany, the UK, and France show strong demand for certified natural and organic formulations, particularly Omega-3s and antioxidant blends, emphasizing traceability and clinical documentation for product claims.

Asia Pacific (APAC) is projected to be the fastest-growing market globally, propelled by rapidly increasing middle-class populations, significant growth in internet and device usage, and a dramatic demographic shift toward older populations in major economies like Japan, South Korea, and China. This region is witnessing a rapid adoption of Western dietary supplement habits, alongside a strong tradition of herbal eye care, creating a unique hybrid market. Manufacturers are keenly focused on investing in APAC due to its massive consumer base and increasingly favorable regulatory outlook toward innovative ingredients.

- North America (NA): Market leader due to high consumer spending on preventative health, robust clinical research infrastructure, and high prevalence of age-related eye conditions. Focus on premium, clinically validated Lutein/Zeaxanthin formulas.

- Europe (EU): Characterized by stringent regulatory oversight (EFSA), leading to strong demand for ingredients with clear scientific substantiation. Emphasis on sustainable sourcing and high-purity Omega-3s.

- Asia Pacific (APAC): Highest projected CAGR driven by massive aging populations, rising disposable income, and rapid uptake of functional foods incorporating eye health benefits, particularly in China and India. Strong growth in Astaxanthin and traditional herbal extracts.

- Latin America (LATAM): Emerging market showing high potential, driven by improving economic conditions and increased awareness of nutraceutical benefits, although ingredient standardization remains a challenge. Brazil and Mexico are key growth hubs.

- Middle East and Africa (MEA): Growth potential exists primarily in affluent Gulf Cooperation Council (GCC) countries, driven by imported high-end supplements and rising lifestyle diseases that affect eye health, such as diabetes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eye Health Ingredients Market.- DSM Nutritional Products

- BASF SE

- Kemin Industries

- Fuji Chemical Industry Co., Ltd.

- OmniActive Health Technologies

- Bausch & Lomb, Inc.

- Alcon (Novartis)

- ZeaVision

- Bio-gen Extracts

- Lycored

- Piveg, Inc.

- Blue California

- Valensa International

- EID Parry

- Döhler Group

- Vidya Herbs

- Chr. Hansen Holding A/S

- Novozymes

- AstaReal

- IFF (DuPont Nutrition & Biosciences)

- NutriScience Innovations

- Koninklijke DSM N.V.

Frequently Asked Questions

Analyze common user questions about the Eye Health Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most effective ingredients for preventing Age-related Macular Degeneration (AMD)?

The most effective ingredients for mitigating the progression of Age-related Macular Degeneration (AMD) are Lutein and Zeaxanthin, often combined with Omega-3 fatty acids (DHA and EPA), along with specific ratios of Zinc, Copper, and Vitamins C and E, as established by key clinical studies like the Age-Related Eye Disease Study (AREDS2). These nutrients work synergistically to increase macular pigment density and reduce oxidative stress in the retina.

How does digital screen usage increase demand for eye health ingredients?

Prolonged exposure to digital screens, particularly the high-energy blue light emitted, increases oxidative damage and causes digital eye strain (asthenopia) and dry eye symptoms. Ingredients like Lutein, Zeaxanthin, and Astaxanthin are critical as they filter harmful blue light before it reaches the photoreceptors and possess strong antioxidant properties, directly supporting the visual performance and overall comfort of heavy screen users.

Which delivery formats are currently dominating the Eye Health Ingredients Market?

Capsules and softgels currently dominate the market, primarily because they are highly efficient for delivering fat-soluble ingredients such as Omega-3s and carotenoids, ensuring stability and precise dosing. However, market growth is increasingly shifting towards innovative formats like gummies, chewable tablets, and liquid formulations to improve consumer compliance, especially among children and older adults.

What is the significance of Omega-3 DHA in eye health formulations?

Docosahexaenoic Acid (DHA) is crucial as it constitutes a major structural component of the retinal cell membranes, vital for signal transmission and optimal retinal function. Supplementation with high-purity DHA is directly linked to supporting visual development in infants and maintaining eye moisture and reducing inflammation associated with chronic dry eye syndrome in adults.

How is sustainability impacting the sourcing of key eye health ingredients?

Sustainability is a major driver, particularly affecting the sourcing of marine Omega-3s and certain botanical extracts. Manufacturers are increasingly moving toward sustainable alternatives, such as microalgae-derived DHA (eliminating reliance on fish stocks) and implementing certified sustainable harvesting practices for botanicals like marigold, ensuring traceability, environmental responsibility, and maintaining ethical supply chains to meet growing consumer demand for clean-label products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager