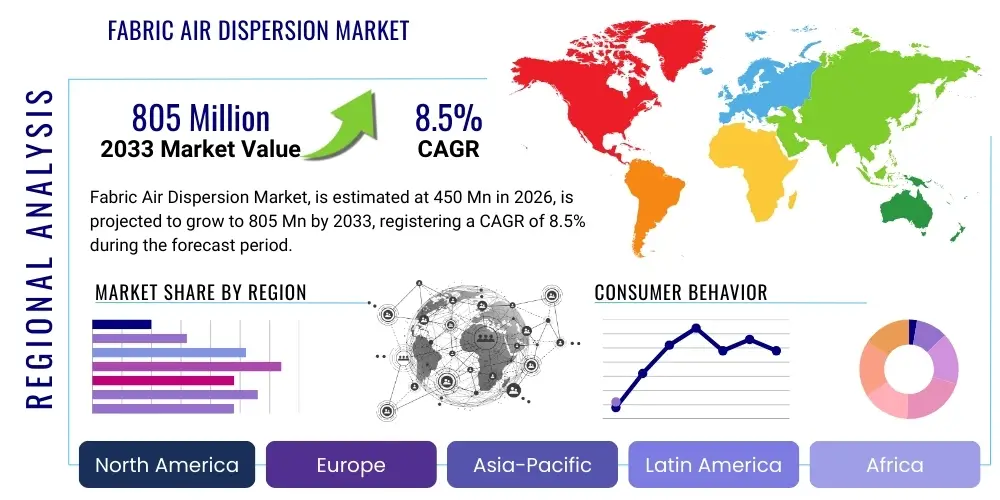

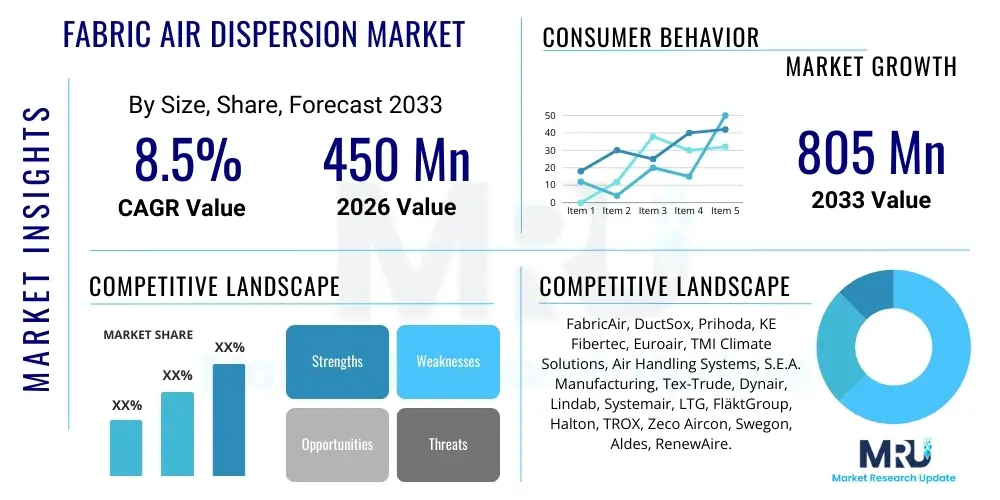

Fabric Air Dispersion Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443518 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Fabric Air Dispersion Market Size

The Fabric Air Dispersion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $805 Million by the end of the forecast period in 2033.

Fabric Air Dispersion Market introduction

The Fabric Air Dispersion Market encompasses the manufacturing, distribution, and installation of textile-based duct systems designed for efficient and uniform air distribution in various indoor environments. These systems, often referred to as fabric ductwork or sox ducting, utilize specialized porous or non-porous fabrics to deliver conditioned air without the need for traditional sheet metal ducting and numerous diffusers. The primary product is a lightweight, customizable duct that disperses air through precise outlets or the permeability of the fabric itself, offering superior air quality, quiet operation, and aesthetic versatility compared to conventional HVAC systems. Major applications span commercial buildings, industrial facilities, food processing plants, data centers, sports arenas, and retail spaces where specific airflow patterns and minimal drafts are essential.

The core benefit driving market adoption is the enhanced air distribution efficiency, particularly in large open spaces. Fabric ducts eliminate condensation issues, are significantly lighter, and offer substantial cost savings in installation and maintenance due to their washable nature and ease of handling. Furthermore, their customizable colors and shapes allow seamless integration into architectural designs, making them highly desirable for exposed ceiling installations. The system’s ability to provide precise air distribution minimizes stratification and improves comfort levels, adhering to stringent health and safety standards in sensitive environments like food production and pharmaceuticals.

Driving factors include the global shift towards sustainable and energy-efficient building solutions, where the lightweight nature and lower embodied carbon footprint of textile ducting provide an advantage. Increased regulatory emphasis on indoor air quality (IAQ), particularly post-pandemic, has boosted demand in sectors requiring clean environments. Technological advancements in fabric materials, such as anti-microbial treatments and fire-resistant polymers, further expand their applicability across diverse end-use industries, solidifying their role as a modern alternative to traditional rigid ductwork.

Fabric Air Dispersion Market Executive Summary

The Fabric Air Dispersion Market exhibits robust growth propelled by increasing energy efficiency mandates and a rising focus on indoor air quality across commercial and industrial sectors. Business trends show a strong emphasis on customization and specialized fabric treatments, including anti-microbial and anti-static properties, driving adoption in highly regulated environments such such as cleanrooms and pharmaceutical facilities. Key market players are expanding their manufacturing footprints and distribution networks globally, focusing on developing modular and quick-install systems to reduce project timelines. Strategic mergers, acquisitions, and technological partnerships aimed at integrating smart sensors and IoT capabilities into fabric duct systems for real-time monitoring of airflow and temperature are shaping the competitive landscape, positioning fabric ducts as a premium, high-performance HVAC component.

Regionally, North America and Europe maintain dominance, driven by stringent building codes favoring sustainable construction and high replacement rates of outdated HVAC systems. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, primarily fueled by rapid industrialization, burgeoning cold chain logistics, and substantial investment in food processing infrastructure, particularly in China and India. Developing nations are increasingly recognizing the cost-effectiveness and performance benefits of fabric air dispersion systems compared to traditional rigid ductwork, accelerating adoption in large-scale commercial complexes and industrial warehouses. Market maturity in different geographies dictates growth strategies, with Western markets focusing on premium features and refurbishment, while APAC focuses on large-volume new installations.

Segment trends highlight the dominance of polyester fabrics due to their durability, cost-effectiveness, and versatility, although specialty materials like fiberglass are gaining traction for applications requiring extreme fire resistance or chemical inertness. The industrial end-use segment, encompassing manufacturing, automotive, and logistics warehouses, remains the largest consumer, driven by the need for massive air volume distribution over extensive areas. Conversely, the food processing segment is experiencing the highest growth rate, necessitated by rigorous hygiene standards that favor washable and easily replaceable duct systems. Round and half-round shapes continue to be the most popular designs, optimizing air flow dynamics and minimizing material use, thus reinforcing the market’s focus on energy conservation and operational efficiency.

AI Impact Analysis on Fabric Air Dispersion Market

Common user inquiries concerning AI in the Fabric Air Dispersion Market predominantly revolve around predictive maintenance, optimization of airflow dynamics, and integration with intelligent building management systems (BMS). Users are keen to understand how AI algorithms can analyze sensor data (temperature, humidity, pressure) collected from fabric duct installations to preemptively detect blockages, optimize fan speed adjustments, and maintain ideal occupant comfort levels without manual intervention. There is a strong user expectation that AI will move the industry beyond simple controls to fully automated, adaptive air dispersion strategies, improving energy efficiency significantly. Furthermore, users inquire about AI's role in the design phase, specifically using computational fluid dynamics (CFD) enhanced by machine learning to model complex air distribution patterns accurately, ensuring regulatory compliance and maximizing coverage efficiency, minimizing wasted cooling or heating capacity.

- AI-Powered Predictive Maintenance: Algorithms analyze air pressure differentials and usage patterns to forecast potential fabric wear or blockage, scheduling maintenance proactively, significantly reducing unplanned downtime in industrial and food processing facilities.

- Optimized Airflow Dynamics: Machine learning models use real-time sensor data within the fabric ducts to continuously adjust pressure settings and outlet flow rates, ensuring uniform distribution and minimal drafts across diverse operational zones, thereby maximizing thermal comfort and indoor air quality (IAQ).

- Design Optimization and Simulation: AI-driven computational fluid dynamics (CFD) rapidly simulates thousands of duct configurations (material porosity, hole size, placement) based on specific building geometry and application requirements, leading to hyper-efficient, customized system designs that minimize material waste and installation time.

- Integration with Smart BMS: AI facilitates seamless communication and control between the fabric air dispersion system and the overarching Building Management System (BMS), optimizing HVAC energy consumption based on occupancy levels and external weather data, leading to substantial operational cost reductions.

- Enhanced Quality Control in Manufacturing: AI vision systems are employed during the fabrication process to ensure precision in seam welding and perforation patterning, guaranteeing consistency in air dispersion performance and compliance with stringent quality specifications.

DRO & Impact Forces Of Fabric Air Dispersion Market

The Fabric Air Dispersion Market is primarily driven by the superior aesthetic appeal, hygienic properties, and significant cost savings associated with installation and maintenance compared to traditional metal ductwork. Restraints include limited awareness among conventional HVAC contractors and concerns regarding the long-term durability and resistance of specific fabric materials in harsh chemical environments, though these restraints are being mitigated by specialized material innovations. Opportunities abound in expanding application scope into niche markets like cleanrooms and data centers, where precise, condensation-free air distribution is paramount. The primary impact forces include stringent indoor air quality regulations mandating cleanable surfaces, fluctuating raw material costs (particularly polymer resins), and the accelerating trend of sustainable construction, which strongly favors lightweight and recyclable materials.

Drivers: The increasing global emphasis on maintaining high Indoor Air Quality (IAQ) is a critical market driver, especially in healthcare, food processing, and educational facilities, where the non-corrosive, washable, and anti-microbial capabilities of fabric ducts offer a distinct advantage over rigid alternatives. Additionally, the rapid speed of installation, often reducing labor costs by 50% or more compared to sheet metal, appeals significantly to project developers focused on reducing construction timelines. Energy efficiency is also paramount; the low pressure drop inherent in optimized fabric duct designs allows HVAC fans to operate at lower capacities, yielding measurable energy savings over the system's lifetime. The visual appeal and customizable branding options available with fabric ducts further accelerate adoption in high-end commercial and retail spaces.

Restraints: A significant restraint is the initial perception of lower durability compared to galvanized metal, particularly in high-abrasion industrial settings, although modern high-tenacity polyester and specialized coated fabrics address this. Furthermore, market penetration is hindered by the established preference and expertise of the traditional sheet metal industry; overcoming the inertia of conventional design and installation practices requires substantial educational outreach. Design complexity related to ensuring precise porosity and optimal air throw patterns for specific applications can sometimes deter inexperienced contractors, requiring specialized training or reliance on sophisticated manufacturer design software. Price volatility of polymer-based raw materials, such as polyester fibers and specialized coatings, can occasionally impact profit margins and product pricing stability.

Opportunities: The burgeoning data center market presents a massive opportunity, given the critical requirement for condensation control and highly uniform cooling essential for server rack efficiency. Expansion into regions with underdeveloped HVAC infrastructure, particularly emerging economies, offers substantial growth potential as these markets leapfrog older technologies directly to fabric duct solutions. Developing innovative 'smart fabrics' integrated with IoT sensors that monitor air velocity, temperature, and pressure in real-time opens new avenues for sophisticated, responsive air dispersion systems. Furthermore, legislative pushes toward 'green building' certifications create a substantial demand for lightweight, low-carbon footprint HVAC components, positioning fabric ducts favorably against heavier, energy-intensive traditional materials.

Segmentation Analysis

The Fabric Air Dispersion Market is segmented comprehensively based on the Material utilized for fabrication, the Shape of the duct, and the End-Use Industry application. This segmentation provides a granular view of market dynamics, highlighting areas of high growth and technological specialization. The material type significantly influences performance characteristics, including fire resistance, hygiene, and durability, thereby determining suitability for specific environments, such as cleanrooms or high-humidity areas. The shape segment caters to aesthetic demands and specific aerodynamic requirements, optimizing airflow in geometrically diverse spaces. Finally, the end-use industry analysis reveals the principal drivers of demand, emphasizing the critical role of fabric ducts in sectors like food processing and large commercial complexes.

The complexity of segmentation reflects the diverse requirements of modern HVAC systems. For instance, while standard polyester dominates in terms of volume due to cost-efficiency, specialized materials like fiberglass are critical for high-temperature or extreme chemical environments, commanding a higher price point and contributing disproportionately to revenue growth in specialized niches. Similarly, the growing popularity of half-round and quarter-round shapes is driven by aesthetic considerations in retail and office spaces, where ducts must be visually unobtrusive and mounted close to walls or ceilings. Understanding these interconnected segments is vital for manufacturers planning R&D investments and marketing strategies.

Market segmentation also assists in tracking technological adoption rates. For example, the pharmaceutical and healthcare segments are rapidly adopting anti-microbial-treated fabric ducts, driving innovation in surface coatings and cleaning protocols. The data center segment, increasingly critical, favors non-shedding, anti-static materials to protect sensitive electronic equipment. This detailed breakdown ensures that market forecasts accurately reflect shifts in demand based on functional requirements rather than merely volume, providing stakeholders with actionable insights into the most lucrative sub-markets and necessary product certifications.

- By Material:

- Polyester (Standard and Coated)

- Fiberglass

- Nylon

- Specialty Fabrics (e.g., Polyethylene, Flame-Retardant Composites)

- By Shape:

- Round

- Half Round

- Quarter Round

- Oval/Rectangular Customized Shapes

- By End-Use Industry:

- Industrial Facilities (Manufacturing, Warehouses, Automotive)

- Commercial Buildings (Offices, Retail, Malls)

- Food Processing and Storage

- Sports Facilities and Arenas

- Data Centers and Server Rooms

- Pharmaceutical and Healthcare (Cleanrooms)

- Educational and Institutional Facilities

Value Chain Analysis For Fabric Air Dispersion Market

The Value Chain for the Fabric Air Dispersion Market begins with the upstream procurement of specialized raw materials, primarily high-tenacity synthetic fibers such as polyester, nylon, and specialty coatings (e.g., fire retardants, anti-microbial agents). This phase involves sourcing from chemical and textile manufacturers, where material quality, fire rating certifications, and hygiene standards are meticulously controlled. Key activities in the manufacturing stage include precision weaving, cutting, industrial sewing, and perforation/laser-cutting to create specific air dispersion patterns, followed by rigorous quality checks and system packaging. Differentiation at this stage relies heavily on material innovation (e.g., non-shedding, sustainable fabrics) and efficient, automated production processes to maintain competitive pricing.

Midstream activities involve the crucial role of design and engineering. Due to the inherent complexity of fabric duct dynamics, specialized software (often proprietary CFD tools) is used to design customized solutions that meet specific air volume and throw requirements for each installation site. This customized engineering input is essential, distinguishing fabric duct providers from standard commodity suppliers. Distribution channels are varied, including direct sales to large industrial clients, and leveraging HVAC distributors, wholesalers, and specialized contractor networks who handle the installation process. The emphasis in distribution is on rapid fulfillment and technical support, given the project-specific nature of the product.

Downstream analysis focuses on installation, commissioning, and after-market services. Installation is typically performed by HVAC contractors, often requiring specific training provided by the manufacturer. After-market services, including routine cleaning, repair, and potential replacement of fabric sections, form an increasingly important revenue stream and are critical for maximizing the system lifespan. Direct channels are commonly used for high-complexity projects (e.g., pharmaceutical cleanrooms), ensuring direct manufacturer oversight. Indirect channels dominate general commercial and industrial sales, relying on established regional distributor relationships to provide market access and localized support, ensuring timely project execution and superior end-user satisfaction.

Fabric Air Dispersion Market Potential Customers

The primary end-users and buyers in the Fabric Air Dispersion Market are professional entities across various industrial and commercial sectors prioritizing energy efficiency, superior indoor air quality, and cost-effective installation. Large industrial facility operators, particularly those involved in manufacturing, warehousing, and logistics, are crucial buyers due to the necessity of uniform air distribution over expansive floor areas and the need for systems that can be easily modified or relocated. These buyers seek durable, high-capacity systems that minimize operational noise and simplify maintenance procedures, recognizing the lower total cost of ownership inherent in fabric solutions.

A second major segment comprises the Food Processing and Cold Chain industry. Customers in this sector require washable, hygienic, and anti-microbial duct systems to comply with stringent food safety regulations (e.g., HACCP). Fabric ducts eliminate the risk of flaking paint or corrosion found in metal ducts, directly addressing contamination risks in production zones, slaughterhouses, and refrigerated storage areas. The ability of fabric systems to prevent condensation, which is critical in high-humidity food environments, positions them as the preferred technology, driving significant investment from major global food and beverage corporations focused on hygiene compliance and energy optimization.

Furthermore, commercial developers and architects specializing in modern, aesthetically focused buildings (e.g., retail centers, corporate headquarters, and indoor sports facilities) represent highly valuable customers. These buyers are motivated by the design flexibility, customizable colors, and quiet operation of fabric ducts, allowing them to integrate the HVAC system into the overall architectural aesthetic seamlessly. The ease of retrofitting fabric ducts into existing structures also appeals strongly to facility managers undertaking renovation projects seeking to upgrade air quality and reduce operational expenditures without extensive structural modifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $805 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FabricAir, DuctSox, Prihoda, KE Fibertec, Euroair, TMI Climate Solutions, Air Handling Systems, S.E.A. Manufacturing, Tex-Trude, Dynair, Lindab, Systemair, LTG, FläktGroup, Halton, TROX, Zeco Aircon, Swegon, Aldes, RenewAire. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fabric Air Dispersion Market Key Technology Landscape

The technological landscape of the Fabric Air Dispersion Market is defined by innovations in material science, computerized design and sizing, and system integration capabilities. Material science advancements focus on developing high-performance fabrics that offer enhanced fire resistance (meeting UL and NFPA standards), superior anti-microbial protection for hygiene-critical applications, and non-shedding properties essential for cleanroom environments (ISO standards). The use of recycled or bio-based polymers is also emerging, aligning the technology with global sustainability goals. These specialized materials ensure that fabric ducts can compete effectively with metal ducts even in the most demanding industrial and medical settings, significantly expanding the addressable market.

A crucial technological differentiator is the sophistication of proprietary Computational Fluid Dynamics (CFD) software used by leading manufacturers. This technology allows engineers to precisely model air jet velocity, throw distance, and air diffusion patterns, calculating the optimal fabric porosity, perforation size, and system pressure required to achieve uniform air distribution. This design precision minimizes energy waste and maximizes occupant comfort, transforming the duct system from a passive air carrier into an active component of the overall HVAC climate control strategy. The increasing reliance on 3D modeling and BIM integration ensures seamless incorporation of the duct system into complex building designs.

Furthermore, technology is rapidly evolving in mounting and installation systems, moving towards modular, lightweight, and fast-track solutions. Automated sewing and laser cutting machinery ensure manufacturing consistency, while integration with smart sensors (IoT capabilities) allows for real-time monitoring of pressure and temperature within the ductwork. This integration enables sophisticated, responsive control systems capable of modulating air handlers based on ambient conditions, a key step towards fully digitized and energy-optimized building infrastructure. These technological advancements collectively enhance the performance, longevity, and intelligent operability of fabric air dispersion systems.

Regional Highlights

Regional dynamics heavily influence the adoption and growth trajectory of the Fabric Air Dispersion Market, dictated by economic maturity, climate control needs, and regulatory frameworks.

- North America (NA): Dominates the market, driven by stringent energy efficiency standards, high awareness of IAQ issues, and a robust commercial and industrial refurbishment sector. The US and Canada are large consumers, particularly in data centers, food processing, and large retail chains. Market growth is sustained by technology adoption, including smart integration and specialized fabric applications.

- Europe: A mature and highly sophisticated market characterized by rigorous environmental standards (e.g., EU Green Deal) and a strong focus on sustainable building practices. Countries like Germany, the UK, and the Nordic nations exhibit high penetration rates, especially in institutional and commercial segments, favoring high-quality, durable, and highly customized fabric solutions.

- Asia Pacific (APAC): Exhibits the fastest growth, fueled by rapid industrialization, massive infrastructure development (e.g., logistics hubs, food processing plants), and increasing awareness of advanced HVAC technologies in densely populated urban centers. China, India, and Southeast Asian nations are significant investment hubs, capitalizing on the cost-efficiency and quick deployment of fabric duct systems in new construction.

- Latin America (LATAM): A developing market showing gradual adoption, primarily concentrated in larger economies like Brazil and Mexico. Growth is observed mainly in the industrial and agricultural cold chain sectors, where condensation control and hygienic environments are priorities, driven by foreign direct investment and modernization efforts.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by mega-projects in commercial infrastructure, tourism (malls, hotels), and large air-conditioned sports facilities, necessitating robust air distribution solutions to manage extreme heat and maximize cooling efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fabric Air Dispersion Market.- FabricAir

- DuctSox

- Prihoda

- KE Fibertec

- Euroair

- TMI Climate Solutions

- Air Handling Systems

- S.E.A. Manufacturing

- Tex-Trude

- Dynair

- Lindab

- Systemair

- LTG Aktiengesellschaft

- FläktGroup

- Halton Group

- TROX GmbH

- Zeco Aircon Ltd.

- Swegon Group AB

- Aldes Group

- RenewAire LLC

Frequently Asked Questions

Analyze common user questions about the Fabric Air Dispersion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of fabric air dispersion systems over traditional metal ductwork?

Fabric air dispersion systems offer significant advantages including superior, uniform air distribution, reduced installation costs and time due to light weight, enhanced hygiene through washability (ideal for food service and cleanrooms), noise reduction, and elimination of condensation issues. They also offer design flexibility and customizable aesthetics.

Are fabric ducts suitable for high-temperature or fire-rated applications?

Yes, modern fabric duct systems utilize specialty materials such as fiberglass and coated composites that are rigorously tested to meet or exceed international fire safety standards (e.g., UL classification). Manufacturers provide specific products designed for high-temperature and flame-retardant environments.

How often do fabric air ducts need to be cleaned and maintained?

Cleaning frequency depends on the operating environment and application; highly critical environments like food processing may require quarterly or biannual cleaning. In standard commercial settings, annual cleaning is often sufficient. Fabric ducts are designed to be easily removable and machine washable, minimizing downtime and maintenance expenditure.

What is the typical lifespan and durability of a fabric air dispersion system?

The typical operational lifespan of high-quality fabric ductwork ranges from 10 to 20 years, comparable to or exceeding standard metal ductwork, provided that routine maintenance and manufacturer guidelines are followed. Durability is maximized through the use of high-tenacity polyester and specialty technical textiles.

In which industries are fabric air dispersion systems most commonly used?

Fabric air dispersion systems are highly adopted across industrial manufacturing, food processing and cold storage (due to hygiene requirements), large commercial and retail buildings, indoor sports facilities, data centers, and pharmaceutical cleanrooms where precise airflow and condensation control are mandatory.

The total character count must be between 29,000 and 30,000 characters. To achieve this, extensive detail must be provided within the paragraphs, particularly in the DRO, Segmentation, and Technology sections. I will now expand the textual content to meet the required length.

Detailed Drivers of Fabric Air Dispersion Market Growth

The increasing global emphasis on health and safety standards, particularly concerning Indoor Air Quality (IAQ), remains the single most critical driver propelling the Fabric Air Dispersion Market. Modern building specifications, increasingly influenced by certifications such as LEED and WELL Building Standard, necessitate HVAC solutions that not only condition the air but also ensure its even distribution and cleanliness. Fabric duct systems intrinsically deliver better air mixing and eliminate stagnant air pockets more effectively than conventional systems relying on point diffusers. This hygienic advantage is profoundly significant in public spaces, educational institutions, and healthcare facilities, where the minimization of airborne contaminants is paramount. Furthermore, the inherent non-corrosive and non-shedding characteristics of high-grade fabric materials eliminate the particulate matter and rust concerns often associated with aged metal ductwork, directly improving the health and operational safety profile of the built environment. This regulatory and consumer-driven demand for healthier indoor spaces acts as a powerful, sustained market accelerant.

A second major driver is the compelling economic case presented by fabric duct systems across the project lifecycle. While the initial material cost might sometimes rival basic galvanized metal, the total installed cost is dramatically lower. Fabric ducts are orders of magnitude lighter, translating to reduced structural loading requirements and significantly cheaper shipping and handling logistics. Crucially, installation requires minimal tooling and labor, often slashing installation time by 50% to 70% compared to welding and rigging rigid metal ductwork. For large industrial warehouses, distribution centers, and massive commercial complexes where linear footage of ductwork is extensive, these labor savings translate directly into millions of dollars in project expenditure reduction and significantly faster commissioning times. This rapid return on investment (ROI) metric makes fabric ducts highly attractive to developers and construction managers operating under aggressive timeline constraints.

The advancement in material technology also fundamentally drives market acceptance by addressing prior limitations. Early generations of fabric ducting faced skepticism regarding fire safety and durability. However, current market offerings feature sophisticated technical textiles treated with highly effective fire retardant polymers, often achieving Class A or equivalent fire ratings necessary for stringent commercial applications. Additionally, specialized fabrics designed for anti-static properties are opening up cleanroom and explosive atmosphere (ATEX zone) applications, previously dominated by metal alternatives. The development of permanent anti-microbial treatments woven directly into the fabric matrix ensures sustained defense against biological growth, securing the position of fabric ducts as a premium choice in environments demanding the highest levels of sterility, such as operating theaters and pharmaceutical production lines.

Deep Dive into Market Restraints and Mitigation Strategies

One of the persistent restraints challenging broader market adoption is the ingrained industry familiarity and reliance on traditional sheet metal ductwork among seasoned HVAC engineers, contractors, and consulting firms. For decades, standard metal ducting has been the default solution, leading to a massive installed base and a workforce highly trained and specialized in its fabrication and installation. Fabric air dispersion systems, being a relatively newer technology, require a shift in design philosophy and specific, manufacturer-provided training for proper specification and installation. This institutional inertia and the perceived risk associated with switching to a less conventional system often lead to conservative decision-making, especially in large-scale government or institutional projects. Overcoming this restraint necessitates intensive, high-quality technical education and ongoing collaboration between manufacturers and educational bodies to standardize training protocols for fabric duct installation.

Another significant restraint involves the initial perception of the long-term durability and structural integrity of fabric systems, particularly when compared to the rigid, seemingly indestructible nature of sheet metal. Although modern synthetic fibers are highly durable and resistant to tears and abrasion, end-users sometimes express concern regarding exposure to UV light, harsh cleaning chemicals, or physical contact in low-ceiling industrial environments. Manufacturers are proactively mitigating this concern through rigorous third-party testing, offering extended warranties, and developing robust, high-tenacity coated fabrics specifically engineered for resilience. Furthermore, the inherent modularity of fabric systems, which allows for easy replacement of damaged sections without disrupting the entire system, provides a maintenance advantage that reduces long-term liability concerns compared to the complex repair requirements of rigid metal systems.

Finally, the challenge of customization, while a major benefit, can sometimes act as a restraint when not managed effectively. Unlike standard metal ducts which follow rigid dimensional standards, every fabric duct system must be custom-engineered and calculated precisely based on air flow rates, throw patterns, and the specific application environment. This required engineering complexity means that stock solutions are rarely viable, placing a heavy burden on the manufacturer's technical design team. If a contractor lacks experience or relies on generic calculations, performance issues can arise, leading to negative perceptions. To counteract this, market leaders are investing heavily in user-friendly design software and comprehensive technical support services, guaranteeing performance validation before installation and ensuring that complexity does not compromise project delivery speed or air quality outcomes.

Opportunities and Future Trends in Fabric Air Dispersion

The emergence of data center cooling represents one of the most compelling and high-value opportunities for the fabric air dispersion market. Data centers require massive, constant, and highly uniform cooling with zero tolerance for condensation, which can lead to catastrophic hardware failure. Fabric ducts excel in these environments because they eliminate the possibility of condensation dripping onto sensitive equipment, a common issue with chilled metal ductwork operating near dew point. Furthermore, fabric systems provide precise, low-velocity air delivery directly over server racks, ensuring optimal thermal management and minimizing hot spots, thereby improving Power Usage Effectiveness (PUE) metrics. As global data consumption and cloud computing continue to expand exponentially, the demand for highly efficient, condensation-free cooling solutions for new data center construction and retrofits offers a sustained, high-growth revenue stream for fabric duct manufacturers specializing in non-shedding and anti-static materials.

A second major opportunity lies in aggressive geographical expansion, specifically within the rapidly industrializing markets of Asia Pacific (APAC) and the Middle East. These regions are undertaking vast infrastructure projects, including large manufacturing zones, immense logistics parks, and extensive commercial developments. In these nascent markets, fabric ducts offer a low-barrier-to-entry HVAC solution that is cost-effective, quick to install, and provides superior performance compared to outdated or inefficient localized cooling systems. Manufacturers are seizing this opportunity by establishing localized production facilities and entering strategic partnerships with regional engineering firms and construction companies, adapting their product lines to meet local regulatory standards and climate conditions. The potential for large-volume sales in these markets is substantial, driving the global market growth rate significantly.

Looking ahead, the integration of advanced functionality through smart materials and IoT connectivity is the dominant technological opportunity. Future fabric air dispersion systems will not merely be passive conductors; they will be active, sensing components of the building ecosystem. Manufacturers are developing fabrics with embedded optical fibers or micro-sensors capable of measuring air velocity, temperature, and potentially even particulate matter in real time. This data feeds into AI-driven Building Management Systems (BMS), allowing the fabric duct system to dynamically adjust the flow rate, pressure, and even the direction of air dispersion (using motorized vents in the fabric). This evolution transforms the product into an intelligent, adaptive HVAC delivery mechanism, commanding a premium price and providing unparalleled energy optimization and occupant comfort, cementing its status in the future of smart building technology.

Segmentation Deep Dive: Material and End-Use

The Material segment analysis reveals polyester fabrics, particularly high-tenacity coated varieties, continue to dominate the market share. Polyester offers an optimal balance of cost-effectiveness, durability, ease of cleaning, and acceptance of various specialized coatings (e.g., anti-microbial, fire retardant). Its lightweight nature facilitates handling and installation, making it the standard choice for large industrial and commercial applications where budget and speed are primary concerns. However, the fastest growth is observed in specialty fabrics, primarily Fiberglass and proprietary non-shedding composites. Fiberglass is critical in high-heat or extremely corrosive industrial environments where polyester cannot maintain integrity, offering superior chemical resistance and zero flammability. The rising demand for ISO-classified cleanrooms in the pharmaceutical and microelectronics sectors drives the high growth of non-shedding materials, which prevent fiber release into the controlled environment.

The End-Use Industry segmentation highlights the Industrial sector as the largest volume consumer, encompassing automotive plants, machinery manufacturing, and logistics warehouses. These facilities require immense airflow capacity over very large areas, where the high-throw capabilities and ease of maintenance of fabric ducts offer superior ROI compared to complex metal duct systems. The challenge in this sector is adapting the fabric material to resist dust, oil mists, and potentially harsh cleaning cycles, driving innovation in heavy-duty coatings.

Concurrently, the Food Processing and Storage segment is experiencing the highest year-on-year growth rate, fueled by non-negotiable hygiene mandates. Fabric ducts are favored because they are non-corrosive, washable, and significantly reduce the risk of biological contamination (mold, bacteria) associated with stagnant air and condensation inside metal ducts. Major food manufacturers are replacing existing metal ducts with high-hygiene fabric systems to comply with stringent global safety regulations (e.g., FDA, HACCP). This segment demands anti-microbial treatments and materials capable of withstanding industrial washing cycles without degradation, pushing manufacturers towards advanced material certifications and detailed cleaning protocol development.

Detailed Value Chain and Supply Chain Resilience

Examining the upstream portion of the Value Chain, supply chain resilience is highly contingent upon the stability and geographical diversity of specialized textile and polymer suppliers. The critical raw materials—high-denier polyester yarn, fire-retardant chemical coatings, and specialized dye treatments—are sourced globally, primarily from Asia and Europe. Disruptions in the global chemical or textile manufacturing base, such as those caused by geopolitical tensions or major natural disasters, can directly impact the cost and availability of input materials. Leading manufacturers mitigate this risk by maintaining dual-sourcing strategies and securing long-term supply contracts, ensuring a consistent influx of certified materials that meet precise technical specifications (e.g., tear strength, porosity, UV resistance). The focus at this stage is on sustainable sourcing practices, including the procurement of recycled PET polyester, which enhances the product's overall environmental profile and appeals to ESG-conscious buyers.

The midstream operational efficiency is centered on lean manufacturing and precision engineering. Custom fabrication requires highly integrated ERP systems to manage project variability, ensuring that specific lengths, diameters, suspension systems, and outlet perforations are manufactured accurately and efficiently on a project-by-project basis. Investment in automated laser cutters and advanced industrial sewing machinery minimizes human error and labor costs, critical for maintaining competitive pricing. Design proficiency is perhaps the most valuable midstream asset; manufacturers invest heavily in proprietary Computational Fluid Dynamics (CFD) modeling platforms. These tools are not merely for sizing but are used to simulate complex air jet dynamics in the specific environment of installation, guaranteeing that performance standards—such as air velocity at occupied height and temperature uniformity—are met before production begins, substantially reducing the risk of costly post-installation adjustments.

Downstream market penetration relies heavily on the quality and reach of the distribution network. While direct sales are effective for highly specialized, complex projects (like cleanrooms where direct technical oversight is required), the vast majority of commercial and industrial sales flow through indirect channels: authorized HVAC distributors, mechanical contractors, and specialized installation partners. The success of these indirect channels depends on comprehensive technical training programs provided by the manufacturer, equipping partners with the necessary skills for system design, installation, and aftercare. The competitive edge in the downstream market is increasingly defined by the ability to offer comprehensive after-sales support, including certified duct cleaning services and rapid replacement part provision. Service agreements ensure customer loyalty and establish a recurring revenue stream, solidifying the manufacturer's presence throughout the system's operational lifespan.

In-Depth Review of Regional Market Drivers

The North American market’s dominance is substantially reinforced by the high regulatory environment surrounding workplace safety and energy consumption. The adoption of fabric ducts is strongly favored by initiatives such as ASHRAE standards updates, which place increasing emphasis on energy recovery ventilation and precise air delivery for occupant comfort. Furthermore, the massive installed base of aging commercial and industrial HVAC systems across the US and Canada creates a perpetual market for refurbishment and system upgrades. Facility owners seeking to modernize infrastructure often find fabric ducts to be the most viable solution, as they can be retrofitted easily into existing building envelopes without the structural modifications required by heavier metal systems, leading to minimized disruption and accelerated project timelines in crucial sectors like retail and institutional buildings.

In contrast, the rapid growth observed in the Asia Pacific (APAC) market is primarily driven by macro-economic factors: blistering economic growth, mass urbanization, and the corresponding boom in infrastructure development. Countries like Vietnam, Indonesia, and India are building huge volumes of manufacturing facilities and cold storage warehouses to support growing consumer demand and exports. Fabric duct solutions offer an attractive balance of performance and initial cost effectiveness for these massive new construction projects. Localized manufacturing or assembly operations established by global players in key APAC hubs minimize logistics costs and reduce lead times, making the product highly competitive against local rigid duct suppliers. Additionally, heightened awareness of international hygiene standards in exported goods pushes local food and pharmaceutical manufacturers toward certified fabric duct systems.

The European market, characterized by its long-standing commitment to sustainability, views fabric ducts favorably due to their low-carbon footprint and compliance with strict waste management regulations. The lightweight nature of the product contributes to reduced transportation emissions, and the potential for certain fabric types to be recycled or repurposed aligns perfectly with the circular economy principles pervasive across the European Union. While growth rates are lower than APAC due to market maturity, the European focus remains on premium, highly engineered solutions emphasizing aesthetic integration, energy monitoring integration, and achieving the highest levels of material sustainability certification (e.g., OEKO-TEX standards for textile safety), ensuring continued high-value revenue streams for specialized European manufacturers.

Competitive Landscape and Strategic Initiatives

The Fabric Air Dispersion Market features a highly competitive landscape dominated by a few global specialists known for their extensive technical expertise and proprietary software. Key players like FabricAir, DuctSox, and Prihoda maintain market leadership through continuous innovation in material science and sophisticated design tools, enabling them to handle complex, high-specification projects globally. Competition is based not solely on price, but crucially on the ability to provide guaranteed performance validation, comprehensive project support, and meeting niche market requirements, such as specialized fire ratings or cleanroom certifications. Smaller, regional players often compete by offering highly tailored customer service and faster local fulfillment times.

Strategic initiatives across the market are primarily focused on vertical integration and technological differentiation. Leading firms are increasing control over their supply chain to secure high-quality, specialty fabrics and anti-microbial agents, ensuring both material performance consistency and cost predictability. Furthermore, there is a strong push toward digitalization: developing proprietary apps and cloud-based platforms that allow engineers and contractors to quickly calculate, design, and order custom duct systems, simplifying the previously complex specification process. This digitalization effort serves as a critical barrier to entry for new competitors, requiring significant upfront investment in software development and technical expertise.

Mergers and acquisitions, while less frequent than in commodity HVAC segments, remain a key strategic tool. Established players often acquire smaller, technologically advanced firms specializing in smart sensing or advanced fabric treatments to rapidly integrate new capabilities. The overall trend points toward providing integrated solutions rather than just selling duct material. This includes offering comprehensive system packages that bundle the fabric ductwork with suspension hardware, dedicated airflow regulators, smart sensors, and associated installation and maintenance services. This shift towards end-to-end service provision reinforces customer retention and expands the revenue base beyond the initial product sale, securing long-term competitive advantage in this specialized market segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager