Fabric Protector Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442123 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Fabric Protector Market Size

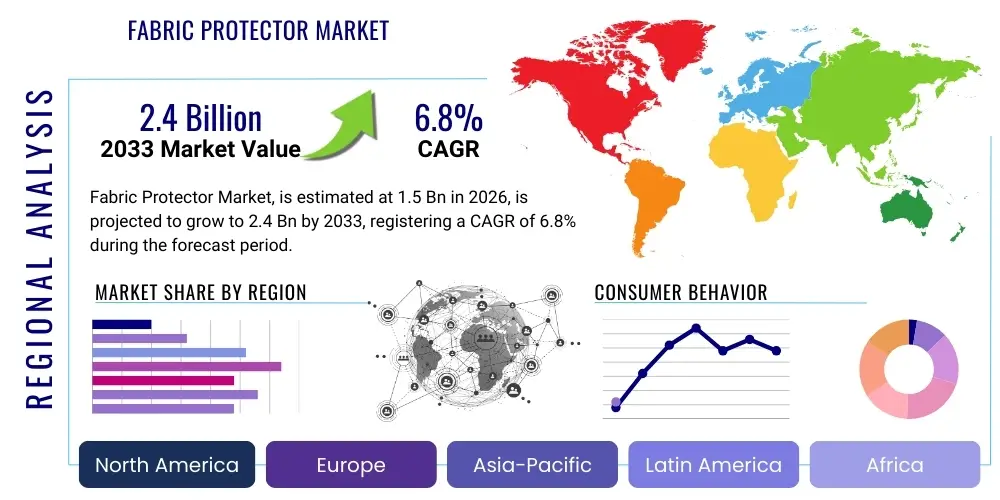

The Fabric Protector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 billion in 2026 and is projected to reach USD 2.4 billion by the end of the forecast period in 2033.

Fabric Protector Market introduction

The Fabric Protector Market encompasses specialized chemical formulations designed to impart essential functional properties, such as stain resistance, water and oil repellency, and protection against UV degradation, to a vast array of textile substrates. These protectors function by creating an invisible, molecular barrier on the surface of fibers, significantly enhancing the durability and extending the aesthetic lifespan of materials without negatively altering the fabric's natural hand or breathability. The core market drivers stem from the increasing consumer and industrial prioritization of material longevity and ease of maintenance across high-value goods, alongside stringent regulatory pressures demanding the adoption of environmentally safer chemical alternatives. Products range from consumer-grade aerosols used for home DIY applications to industrial concentrates applied during the textile finishing process for sectors like automotive and performance apparel.

Major applications of these protective coatings are highly diversified, reflecting the ubiquitous nature of textiles in modern life. The home furnishings sector utilizes protectors extensively for carpets, upholstery, and draperies, where minimizing damage from everyday spills and maximizing cleanability are paramount requirements. In industrial and technical textile domains, fabric protectors provide critical performance attributes necessary for protective clothing, military gear, and geotextiles, demanding superior resistance to harsh chemicals, abrasion, and intense weather exposure. Crucially, the automotive industry relies on specialized fabric protectors to maintain the pristine condition of interior fabrics, protecting them from oil, dirt, and long-term fading caused by prolonged sunlight exposure, thereby preserving the vehicle's residual market value and enhancing the owner experience.

The benefits derived from employing advanced fabric protectors are comprehensive, extending beyond mere stain defense to include enhanced resistance to microbial growth and reduced fading caused by UV light. This comprehensive protection translates directly into lower long-term maintenance costs for end-users, reduced frequency of replacements, and sustained aesthetic appeal, justifying the premium often associated with treated fabrics. Driving factors for market expansion include the rapid globalization of the textile and automotive manufacturing bases, particularly in the Asia Pacific region, coupled with continuous innovation in non-fluorinated chemistry (NFC) which is overcoming previous performance limitations. Furthermore, increased regulatory oversight in mature markets, mandating the phase-out of traditional C8 fluoropolymers, actively pushes manufacturers toward next-generation sustainable formulations, guaranteeing a cycle of technological advancements and market growth.

Fabric Protector Market Executive Summary

The Fabric Protector Market is experiencing structural shifts driven by strong business trends centered on sustainability, regulatory compliance, and functional performance optimization. Current business strategies heavily prioritize the rapid commercialization of specialized, short-chain fluorochemicals (C6) and robust non-fluorine chemistries (NFCs), moving away from legacy C8 compounds which face global restrictions. Major chemical suppliers are focusing on vertical integration, establishing deeper partnerships with large-scale textile processors and key automotive OEMs to embed protection treatments early in the production cycle. This ensures standardized application and higher market share capture. R&D investments are concentrated on developing cost-effective, durable, water-based formulations to meet the increasing demand for low-VOC products while maintaining performance parity with traditional solvent systems, creating a highly competitive innovation landscape.

Regional trends indicate that the Asia Pacific (APAC) region is poised to maintain its trajectory as the primary market growth catalyst, fueled by booming construction sectors, massive textile export volumes, and a rapidly expanding middle class that is increasingly able to afford higher-quality, protected home and automotive goods. Conversely, North America and Europe, characterized by highly mature markets and rigorous regulatory environments (such as REACH), are the primary drivers of technological innovation, demanding the highest standards for environmental safety and specialized performance. European market growth is intrinsically linked to the successful deployment of certified bio-based and C6-compliant formulations, establishing a premium segment focused on eco-labeling and certified material safety, which influences material procurement specifications globally.

Segmental dynamics highlight a clear preference shift toward nano-based and water-based fabric protectors across both consumer and industrial applications, primarily motivated by safety and ease of handling concerns. The Automotive application segment remains a cornerstone of volume demand, requiring robust, integrated protection against wear and contaminants. However, the fastest revenue growth is observed within the high-performance Apparel and Technical Textiles segment, where innovative protectors must deliver superior water repellency (DWR) without hindering crucial fabric properties like moisture wicking or breathability, creating specialized, high-value opportunities. Overall, the market's trajectory is defined by the critical balance required between achieving regulatory mandated sustainability targets and delivering the uncompromising performance demanded by end-users in critical applications, forcing continuous refinement of polymerization and application technology.

AI Impact Analysis on Fabric Protector Market

User inquiries frequently concern how Artificial Intelligence (AI) and Machine Learning (ML) can resolve the complex performance-versus-sustainability conundrum currently challenging the Fabric Protector Market. A key focus is on AI’s ability to drastically shorten the development cycle for non-fluorinated chemistries (NFCs), which historically required extensive, time-consuming laboratory testing to achieve reliable stain and water repellency comparable to restricted fluorochemicals. Users are also keen to understand how AI optimizes the application process in textile mills, specifically addressing variables like substrate porosity, curing temperature, and chemical concentration to maximize the protective efficacy while minimizing chemical usage and associated waste, thereby improving the economic viability of sustainable alternatives.

AI is fundamentally revolutionizing the initial stages of chemical synthesis and material science within the fabric protection sector. Predictive modeling algorithms leverage vast datasets encompassing polymer structures, surface energy measurements, and environmental degradation rates to simulate and predict the performance of novel molecular formulations virtually. This computational approach allows R&D teams to identify high-potential candidates for water and oil repellency before physical synthesis is attempted, dramatically accelerating the transition away from regulated PFAS compounds. By systematically evaluating thousands of potential silicone, polyurethane, or bio-polymer architectures, AI ensures that newly developed protectors meet stringent performance benchmarks while adhering to modern sustainability criteria, positioning companies that adopt this technology at the forefront of the green chemistry movement.

In the manufacturing domain, the deployment of AI-powered quality control systems and process optimization tools is enhancing efficiency and product consistency. Machine learning models analyze real-time data collected from inline sensors—such as infrared spectroscopy readings and weight measurements—during the fabric finishing process. If deviations in coating thickness or chemical absorption are detected, the AI system immediately adjusts parameters like roller pressure or liquid flow rate, ensuring uniform application across enormous fabric batches. This precision minimizes off-spec products, reduces chemical material consumption, and guarantees that the finished textile meets the specified durability and protection standards. Moreover, AI aids in predictive maintenance of complex application machinery, reducing costly downtime in high-volume textile operations.

- Accelerated discovery of sustainable, non-fluorinated chemical formulations via predictive modeling.

- Optimization of manufacturing processes using ML for precise, real-time control of coating application uniformity.

- Enhanced quality assurance through automated defect detection and parameter adjustment in textile finishing lines.

- Predictive supply chain management and demand forecasting for key raw materials (e.g., specialized polymers, solvents).

- Development of personalized product recommendations based on consumer fabric type and usage environment data.

- Improved environmental compliance tracking and lifecycle assessment reporting through sophisticated data analysis.

- Simulation of fabric-chemical interaction at the nanoscale to design superior barrier properties.

- Automation of regulatory compliance screening for new formulations across diverse global markets.

DRO & Impact Forces Of Fabric Protector Market

The dynamics of the Fabric Protector Market are highly influenced by intertwined Drivers, Restraints, and Opportunities (DRO), generating powerful impact forces that dictate strategic market direction. Key drivers include the ever-increasing global consumer expectation for product durability and longevity, particularly in high-investment areas like home furnishings and automobiles, directly translating into demand for highly effective protective treatments. Furthermore, the single most critical market driver is the global regulatory momentum, especially in the EU and North America, pushing for the mandated phase-out of traditional, long-chain fluorochemicals (C8). This regulatory pressure creates a compelling, non-negotiable demand for innovation in sustainable chemistry, regardless of immediate cost implications, compelling manufacturers to invest heavily in C6 alternatives and robust non-fluorinated compounds to ensure continued market access.

Conversely, the primary restraints confronting market expansion relate to the persistent cost differential; sustainable, high-performance replacements often require more complex synthesis routes, resulting in higher raw material and production costs compared to legacy solutions. This elevated price point can hinder adoption in highly price-sensitive emerging markets. Another restraint is the technical challenge of achieving performance parity—replicating the exceptional oil repellency of C8 fluoropolymers using non-fluorinated alternatives remains a significant hurdle. Opportunities are concentrated in the rapid commercialization of advanced nanotechnology, which offers superior performance profiles and the development of multi-functional protectors (e.g., combining stain, microbial, and fire resistance). The untapped potential of bio-based chemistry derived from renewable resources provides a long-term opportunity for sustainable market leadership and brand differentiation in environmentally conscious markets.

The collective impact forces are currently dominated by regulatory restrictions and consequential technological advancement. The strong governmental push against persistent organic pollutants (POPs) accelerates the technology adoption cycle, quickly rendering older chemistries obsolete and driving a market premium for certified sustainable products. Economic volatility, particularly concerning the supply and cost of petrochemical feedstocks used in polymer production, represents an external economic force that can intermittently restrain overall market growth and compress margins. However, the powerful societal impact force emphasizing environmental corporate responsibility ensures sustained investment in greener research, effectively positioning sustainability as a fundamental competitive necessity rather than a marginal market niche, guiding strategic decisions across the entire value chain from synthesis to application.

Segmentation Analysis

Segmentation analysis provides a crucial framework for understanding the diverse consumption patterns and technological needs within the Fabric Protector Market, allowing for targeted product development and focused distribution strategies. The market is dissected across multiple axes, including the chemical base (Type), the specific material being treated (Application), the industry purchasing the product (End-Use), and the specific chemical components employed (Chemistry). This granularity is essential because the performance requirements for a protective treatment on a military tent fabric, demanding extreme weather resistance, differ fundamentally from those applied to a residential microfiber sofa, where soft touch and spill protection are the main priorities, dictating varied formulation and concentration requirements.

Segmentation by Type reveals the ongoing shift toward lower environmental impact solutions. Water-based protectors are the fastest-growing segment, preferred for their safety, low VOC content, and widespread applicability in residential and commercial settings where application safety is critical. Solvent-based systems are declining but remain relevant in niche industrial applications requiring specialized compatibility with certain synthetic materials or demanding rapid drying times. Nano-based protectors represent the premium segment, utilizing cutting-edge material science to deliver unparalleled durability and protection with minimal impact on fabric aesthetics, increasingly adopted by the luxury automotive and high-end technical apparel sectors seeking maximum value addition.

The Application segmentation underscores the market's high dependency on the Automotive and Home Furnishings sectors, which consume vast volumes of material requiring long-term, integrated protection against abrasion and soiling. The fastest expansion, however, is observed within the Apparel & Textiles segment, specifically driven by functional textiles like outdoor performance wear, where consumer expectations for durable water repellency (DWR) must be met sustainably. Analyzing the End-Use Industry further clarifies demand streams, differentiating between high-volume, performance-driven Automotive OEM purchases and recurrent, specialized needs of Commercial establishments (hotels, hospitals) which prioritize antimicrobial properties alongside standard stain resistance, thereby necessitating chemically distinct product offerings and specialized technical support for application.

- By Type: Water-based, Solvent-based, Nano-based.

- By Application: Apparel & Textiles (Outdoor Gear, Daily Wear), Automotive, Furniture & Upholstery, Home Furnishings (Carpets, Drapes), Industrial Applications (Tents, Awnings, Geotextiles).

- By End-Use Industry: Residential (Consumer DIY), Commercial (Hospitality, Healthcare, Office), Industrial, Automotive OEM and Aftermarket.

- By Chemistry: Fluoropolymers (PTFE, PFOA-free alternatives/C6), Silicones, Hydrocarbon Waxes, Acrylics and Resins, Bio-based formulations.

Value Chain Analysis For Fabric Protector Market

The Value Chain for the Fabric Protector Market begins with the upstream procurement of complex chemical raw materials. This stage involves sourcing specialized monomers, high-purity solvents, surfactants, and polymer precursors, such as fluorinated and non-fluorinated building blocks (e.g., silicone resins or acrylic polymers). Raw material supply is susceptible to global petrochemical price volatility and requires strict quality control to ensure the high purity necessary for sophisticated chemical synthesis. Competitive advantage at the upstream level often relies on proprietary synthesis techniques that minimize the formation of regulated byproducts and efficient feedstock management, ensuring consistent supply of essential ingredients like C6 fluorinated telomers or advanced silanes crucial for nano-coating bases.

The midstream phase centers on the core manufacturing and formulation processes carried out by major chemical companies. This involves synthesizing specialty polymers, blending them with proprietary additives (stabilizers, UV absorbers), and formulating the final product into application-ready formats (concentrates, emulsions, aerosols). Distribution channels from the manufacturer to the end-user are dual-tracked: direct and indirect. Direct sales are vital for high-volume transactions with industrial consumers, such as large textile finishing houses or Tier 1 automotive suppliers. This approach allows chemical companies to provide essential technical services, customized concentration recommendations, and application equipment consultation, ensuring optimal product performance and strong client retention through integrated technical partnership.

Downstream activities encompass application and final consumption. Indirect distribution utilizes a network of specialty chemical distributors, wholesalers, and mass-market retailers for consumer-grade products, focusing on reach and accessibility. The application process itself is a critical value-adding step; in industrial settings, protective chemicals are applied via high-tech padding, spraying, or coating equipment, followed by specific curing processes to chemically bond the protector to the fabric fibers. For the end-user, the realized value is long-term protection, reduced cleaning frequency, and maintained fabric integrity. Continuous value chain optimization is aimed at improving logistical efficiency, reducing hazardous material transport complexity, and utilizing blockchain technology to ensure verifiable compliance and sourcing transparency for increasingly regulated chemical products.

Fabric Protector Market Potential Customers

The Fabric Protector Market caters to a wide and distinct base of potential customers, segmented broadly into industrial manufacturers, commercial service providers, and individual consumers. Industrial manufacturers, particularly those within the global textile finishing sector, represent the largest volume purchasers. These mills integrate fabric protection as a mandatory, final step for high-volume fabric production destined for apparel, home goods, and medical applications. They require industrial-strength concentrates, often customized for specific fabric blends (e.g., polyester, nylon, cotton), focusing heavily on cost-per-square-meter coverage, application stability, and verifiable compliance with international safety and environmental standards.

Major automotive Original Equipment Manufacturers (OEMs) and their component suppliers are critical, high-value customers demanding specialized, highly durable protective coatings for vehicle interiors. These formulations must meet extremely rigorous specifications regarding resistance to heat, UV degradation, mechanical wear, and a variety of common vehicle contaminants like oils and fuels, ensuring longevity throughout the vehicle's lifespan. These transactions are typically B2B, involve long-term supply contracts, and often necessitate joint development agreements with chemical suppliers to ensure seamless integration into automotive production lines. The quality and proven durability of the protector directly influence the perceived quality and warranty claims associated with the vehicle brand itself.

The commercial and professional services segment forms another significant customer base, encompassing professional carpet and upholstery cleaning companies, facility management firms, and hospitality groups (hotels, cruise lines). These professional entities purchase highly concentrated, effective fabric protectors for application on high-traffic, frequently soiled institutional furnishings. Their purchasing criteria center on rapid drying times, minimal odor, superior restorative capabilities, and certification for use in public, often sensitive environments (like healthcare facilities). Finally, the consumer segment purchases ready-to-use, often aerosol or pump-spray, products through retail channels for DIY protection of footwear, clothing, and household furniture, driven largely by brand recognition, ease of use, and immediate perceived protective efficacy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, DuPont de Nemours Inc., BASF SE, Shin-Etsu Chemical Co. Ltd., Daikin Industries Ltd., Solvay S.A., Clariant AG, Huntsman Corporation, Dow Inc., Momentive Performance Materials Inc., Wacker Chemie AG, Granda Inc., ITW Global Brands, Guardsman Corporation, S.C. Johnson & Son Inc., Green Guard Inc., Nanotex LLC, KAO Corporation, TFL Ledertechnik GmbH, Chemours Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fabric Protector Market Key Technology Landscape

The current technology landscape in the Fabric Protector Market is predominantly defined by the strategic migration away from legacy C8 (long-chain) fluorochemicals toward more compliant, high-performance alternatives, marking a transition toward sustainable chemistry. This shift necessitated significant R&D in two primary areas: optimizing short-chain (C6) fluoropolymers to maintain effective oil and water repellency while meeting environmental standards, and the intensive development of Non-Fluorinated Chemistries (NFCs). NFCs, typically involving advanced silicone macrostructures, specialized polyurethane dispersions, and customized hydrocarbon waxes, are engineered to achieve high water contact angles and mechanical robustness, attempting to bridge the performance gap left by C8 restrictions through novel polymer architecture design and surface modification techniques.

Nanotechnology represents the cutting-edge of innovation, offering the potential for unparalleled protection with minimal alteration to the fabric’s tactile properties. Nano-based protectors, utilizing durable components like silica nanoparticles or functionalized silanes, create ultra-thin, highly dense protective meshes that chemically bond to the fiber. This technology not only offers superior stain and water resistance but often allows for the integration of secondary functions, such as durable antimicrobial properties or enhanced UV stability, meeting the complex demands of medical and high-performance technical textiles. Furthermore, the application technology is evolving toward plasma-based surface treatments and supercritical fluid processing, which drastically reduce the need for VOC-emitting solvents and excessive water usage, aligning manufacturing processes with stringent green production mandates.

Looking forward, the technology trajectory is heavily focused on bio-based and enzymatic solutions derived from renewable sources, such as natural waxes and bio-polymers, aiming for complete circularity and biodegradability. This nascent technology area requires significant investment but promises the ultimate solution to environmental concerns associated with synthetic chemicals. Simultaneously, the application of smart coating technology, incorporating self-healing polymers or active release mechanisms in response to environmental cues, is emerging. These developments aim to create 'active' textiles that can dynamically maintain their protective capabilities over extended periods, extending product lifespan and solidifying the market's transition toward highly sophisticated, integrated material science solutions.

Regional Highlights

- Asia Pacific (APAC): APAC is undeniably the fastest-growing and largest market due to its dominance in global textile manufacturing and rapidly escalating domestic consumption patterns, driven by robust economic expansion in China, India, and Vietnam. The region's growth is fueled by increasing industrial output and rising consumer demand for protected home furnishings and mass-market automotive textiles. While cost-effectiveness traditionally drives purchasing decisions, stricter environmental standards are gradually being adopted, particularly in export-focused operations, promoting the accelerated use of compliant, water-based formulations.

- North America: North America represents a mature, high-value market characterized by early adoption of premium, nano-based, and performance-focused fabric protectors. The demand here is largely driven by sophisticated consumer preferences for long-lasting performance in technical apparel, luxury automotive interiors, and high-end residential furnishings. Stringent state-level regulations, particularly regarding PFAS and VOC emissions, ensure that manufacturers in this region are primary consumers and innovators in C6 and NFC technologies, maintaining a strong focus on certified environmental safety and product transparency.

- Europe: The European market operates under the most rigorous regulatory framework globally, notably the REACH regulation, making it a critical hub for innovation in green chemistry. Europe shows the highest penetration rates for non-fluorinated, bio-based, and sustainable fabric protector solutions, often setting the global standard for chemical safety and environmental responsibility. Key markets like Germany, the UK, and Scandinavia show disproportionately high demand for ecological certifications, driving significant competitive advantage for suppliers who can guarantee product compliance and minimal ecological footprint, particularly within the automotive and high-fashion textile sectors.

- Latin America (LATAM): LATAM is experiencing moderate but accelerating growth, primarily linked to the growth of its regional automotive production base (Mexico and Brazil) and increasing foreign investment in infrastructure and hospitality sectors. The market is still highly sensitive to pricing, favoring mid-range, proven technology. However, as global textile supply chains penetrate deeper, there is a gradual shift toward international quality standards, pulling demand toward more reliable, though often imported, compliant fabric protection chemistries to meet export requirements and rising domestic quality expectations.

- Middle East and Africa (MEA): Market expansion in the MEA is localized, concentrated around the Gulf Cooperation Council (GCC) countries due to significant luxury construction projects (hotels, residential complexes) and substantial imports of high-end vehicles. Demand is highly specific, requiring protectors that offer excellent resistance to intense UV radiation and extreme heat, alongside standard water and oil repellency. The focus is on specialized formulations that combat fading and material degradation unique to harsh arid climates, creating niche opportunities for highly tailored, high-performance chemical treatments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fabric Protector Market.- 3M Company

- DuPont de Nemours Inc.

- BASF SE

- Shin-Etsu Chemical Co. Ltd.

- Daikin Industries Ltd.

- Solvay S.A.

- Clariant AG

- Huntsman Corporation

- Dow Inc.

- Momentive Performance Materials Inc.

- Wacker Chemie AG

- Granda Inc.

- ITW Global Brands

- Guardsman Corporation

- S.C. Johnson & Son Inc.

- Green Guard Inc.

- Nanotex LLC

- KAO Corporation

- TFL Ledertechnik GmbH

- Chemours Company

FAQ

Analyze common user questions about the Fabric Protector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between fluorocarbon and non-fluorocarbon fabric protectors?

Fluorocarbon protectors (PFC/PFAS-based) traditionally offer superior oil and water repellency due to very low surface energy, but face increasing regulatory scrutiny due to environmental persistence. Non-fluorocarbon alternatives (silicone, acrylic, bio-based) are environmentally safer, focusing primarily on water resistance and satisfactory stain protection, driving future sustainable market growth.

Is nano-technology utilized in modern fabric protectors safe and effective?

Yes, nano-technology protectors, often based on silica or silane structures, are highly effective, providing thin, durable, and breathable protective layers. Safety concerns regarding nanoparticle inhalation are rigorously addressed through specialized application processes (B2B industrial use) and formulation engineering, ensuring stability and non-release in consumer products.

How do global environmental regulations like REACH impact the Fabric Protector Market?

REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) mandates are the primary catalyst forcing the market to phase out long-chain (C8) fluoropolymers and transition to safer, short-chain (C6) and completely non-fluorinated alternatives. This drives significant R&D investment and structural changes in supply chains, increasing the overall focus on green chemistry.

Which end-use industry contributes most significantly to the demand for fabric protectors?

The Automotive industry and Home Furnishings sector collectively contribute the largest demand volume. Automotive OEMs require highly durable, UV-resistant treatments for upholstery and interiors, while Home Furnishings (carpets, sofas) necessitate effective stain and spill protection for high-traffic residential and commercial spaces.

What role does Artificial Intelligence play in the future development of fabric protectors?

AI is crucial for accelerating the discovery of novel sustainable chemicals by predicting molecular performance and optimizing formulation recipes, significantly reducing laboratory time and costs. AI also improves manufacturing efficiency by enabling real-time process control and ensuring uniform application quality during high-volume textile finishing operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager