Facial Cosmetic Surgery Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440983 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Facial Cosmetic Surgery Products Market Size

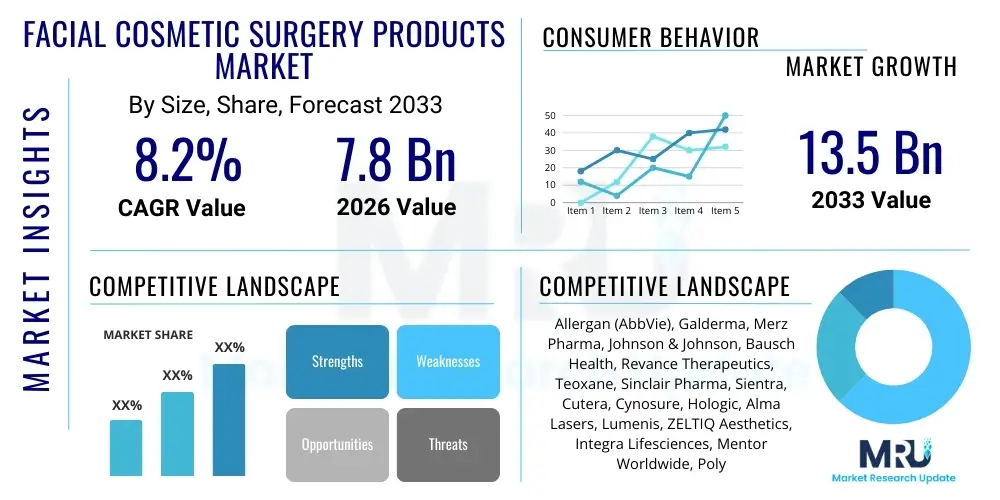

The Facial Cosmetic Surgery Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Facial Cosmetic Surgery Products Market introduction

The Facial Cosmetic Surgery Products Market represents a dynamic and highly lucrative segment within the broader medical aesthetics industry, dedicated to providing solutions for the alteration, enhancement, or reconstruction of facial features. This market encompasses a sophisticated array of instruments, specialized materials, and biotechnology-derived products that facilitate both invasive surgical interventions and, increasingly, non-surgical minimally invasive treatments. The core offerings span from complex surgical tools used in rhytidectomy and rhinoplasty, to advanced injectable substances such as highly cross-linked hyaluronic acid dermal fillers, specialized biodegradable sutures used in thread lifts, and purified botulinum neurotoxin products designed to temporarily mitigate muscle-induced wrinkles. The market's consistent expansion is intrinsically linked to improvements in procedural safety, enhanced material biocompatibility, and the sustained consumer desire for durable yet natural-looking aesthetic outcomes across all age groups. Manufacturers are continuously focused on maximizing product longevity while minimizing adverse event profiles, driving significant investment into biomaterial research and clinical validation protocols to secure competitive advantages.

Product deployment within this sector covers a broad spectrum of aesthetic concerns. Major applications include facial volume restoration to counteract age-related bone and soft tissue atrophy, targeted wrinkle reduction in dynamic areas such as the glabella and perioral region, and structural augmentation for features like the chin, cheeks, and nose to improve facial harmony and proportionality. While the foundational surgical procedures remain relevant, particularly for significant tissue excess or structural adjustments, the accelerated penetration of non-invasive technologies—specifically energy-based devices (Radiofrequency, HIFU, and fractional lasers)—has democratized facial enhancement, offering accessible, low-downtime alternatives. The functional benefits extend beyond mere visual improvement; treatments often restore self-confidence and quality of life for patients affected by scarring, asymmetry, or the psychological distress associated with visible signs of aging. The increasing integration of combination therapies, mixing injectables with energy treatments, represents a critical application trend aiming for synergistic, superior results that address multiple layers of facial aging simultaneously.

Several potent factors are driving the substantial market growth trajectory. Firstly, global demographic trends reveal an expanding cohort of aging individuals (the "silver tsunami") possessing substantial purchasing power and actively seeking treatments to maintain a youthful appearance. Secondly, the proliferation and global influence of digital media and video conferencing have amplified aesthetic self-awareness, normalizing and encouraging the pursuit of cosmetic procedures across younger demographics, often referred to as the "prejuvenation" trend. Furthermore, ongoing technical advancements have resulted in the market availability of novel, safer, and longer-lasting injectable products, reducing the frequency of maintenance treatments and enhancing the return on investment for the consumer. Regulatory environments are simultaneously becoming more mature, providing clear guidelines that, while challenging, ultimately bolster consumer confidence in the quality and safety of approved facial cosmetic products. Economic prosperity in key emerging regions, translating into higher disposable income allocated towards elective aesthetic enhancements, provides a robust, underlying financial foundation for sustained market volume expansion throughout the forecast period.

Facial Cosmetic Surgery Products Market Executive Summary

The strategic landscape of the Facial Cosmetic Surgery Products Market is characterized by intense consolidation and vertical integration, where large pharmaceutical and medical device conglomerates are actively acquiring specialized niche players, particularly those holding patents for advanced bio-stimulatory injectables or proprietary energy delivery systems. A major business trend involves the shift towards subscription-based models for certain recurring treatments (like neurotoxins), guaranteeing recurring revenue streams for both manufacturers and aesthetic clinics, thereby improving financial predictability. Furthermore, there is a pronounced emphasis on comprehensive physician training and education as a core competitive tool, with leading companies establishing global centers of excellence to ensure standardized, high-quality application techniques, which directly correlates with positive patient outcomes and brand loyalty, crucial for maintaining premium pricing in a crowded field.

Regionally, the market exhibits distinct consumption patterns. North America, specifically the United States, remains the financial and innovation powerhouse, dictating global trends through swift technological adoption and high acceptance rates for novel, high-cost treatments. However, the Asia Pacific (APAC) region is rapidly gaining ground, propelled by staggering growth in procedural volumes, largely concentrated in East Asia. This growth is driven by a strong cultural emphasis on specific facial features, leading to high demand for specialized products used in procedures such as V-line contouring and double eyelid surgery. European market dynamics are heavily influenced by the rigorous regulatory framework established by the MDR, which favors large manufacturers capable of meeting stringent clinical data requirements, leading to slower, but more quality-assured, product introductions across the continent, focusing heavily on brand heritage and established safety records.

Segmentation analysis confirms the enduring dominance of the Injectables market, which serves as the primary entry point for new consumers into aesthetic medicine, accounting for the largest revenue share and fastest procedural growth rate. Within this segment, novel formulations of neurotoxins with faster onset and extended duration are key performance differentiators. Concurrently, the Energy-Based Devices segment is witnessing a transition toward multi-platform systems that combine different modalities (e.g., combining RF microneedling with deep dermal heating) to address multiple layers of facial aging in a single session, challenging the traditional necessity for surgical lifts. The focus on regenerative medicine products, which harness the body’s own healing mechanisms (such as high-purity exosomes and specialized platelet concentrates), represents a high-potential segment trend that promises to revolutionize tissue repair and long-term aesthetic maintenance, commanding premium pricing due to perceived biological superiority and long-term benefits.

AI Impact Analysis on Facial Cosmetic Surgery Products Market

User inquiries concerning the integration of Artificial Intelligence (AI) in the Facial Cosmetic Surgery Products Market predominantly revolve around practical clinical benefits, safety enhancement, and the potential for hyper-personalization. Key concerns include the reliability of AI to interpret complex anatomy (e.g., vascular mapping before filler injection), the potential for algorithmic bias in aesthetic recommendations across diverse ethnic groups, and how AI tools can assist in the selection of the optimal product (e.g., viscosity or particle size of filler) for a given facial region and patient skin quality. There is strong user expectation that AI will standardize outcomes by providing objective measurements of success and failure, thereby minimizing the subjectivity inherent in aesthetic judgments. This indicates a deep-seated desire among both patients and practitioners for quantifiable data to back up aesthetic decisions, positioning AI as a critical tool for risk management and evidence-based practice within a highly specialized medical field.

- Algorithmic Treatment Personalization: AI systems use deep learning models to process millions of patient images, demographic data, and anatomical measurements to recommend optimal product volumes and injection vectors, ensuring aesthetic symmetry tailored to individual facial proportions and bone structure.

- Real-Time Safety Enhancement: Deployment of AI-powered ultrasound guidance or near-infrared spectroscopy systems integrated with injection platforms, allowing for immediate, automated detection of vital anatomical structures, significantly reducing the risk of vascular occlusion and nerve damage during deep injection procedures.

- Optimized Inventory and Forecasting: Machine learning models analyze seasonal demand, procedural trends, and regional demographic data to forecast inventory needs for specific facial implants or high-demand injectable products, minimizing stockouts and reducing storage costs across distribution centers.

- Quality Control in Manufacturing: AI-driven visual inspection systems monitor the production lines for consistency in implant structure, filler syringe filling accuracy, and material purity, ensuring every product batch meets the ultra-high standards required for medical-grade devices and injectables.

- Enhanced Patient Consultation and Education: Generative AI creates dynamic, three-dimensional simulations demonstrating potential post-procedure results based on chosen products and techniques, drastically improving patient comprehension and managing expectations before commitment.

- Clinical Trial Acceleration: AI accelerates the analysis of complex clinical data related to product longevity, adverse event reporting, and biocompatibility testing for new materials, speeding up the regulatory approval process and time-to-market for innovative facial products.

- Automated Outcome Measurement: Utilizing computer vision to objectively quantify changes in skin texture, wrinkle depth, and volume displacement post-procedure, providing unbiased data for efficacy studies and treatment refinement far surpassing manual assessment scales.

DRO & Impact Forces Of Facial Cosmetic Surgery Products Market

The market’s momentum is powerfully sustained by several interconnected drivers, centered predominantly on technological superiority and societal acceptance. The primary driving force is the relentless pursuit of non-surgical rejuvenation, fueled by new generations of highly sophisticated dermal fillers that promise long-term structural benefits through bio-stimulation, rather than temporary filling. Furthermore, the global rise in social media use and celebrity culture acts as a massive promotional engine, normalizing aesthetic procedures and accelerating their adoption among diverse socioeconomic groups. Economic factors, such as increased accessibility to financing options and the development of high-quality, mid-range priced products targeting value-conscious consumers in emerging markets, ensure that demand remains robust even amidst moderate global economic fluctuations, fundamentally strengthening market resilience and expanding the addressable population base beyond traditional luxury consumers.

Conversely, significant restraints challenge market expansion and operational efficiency. The high initial capital outlay required for advanced energy-based devices (e.g., sophisticated RF micro-needling systems) often restricts adoption in smaller clinics or developing economies, concentrating market power among large institutional purchasers. Moreover, the stringent and constantly evolving regulatory frameworks in major markets, particularly the exhaustive clinical requirements under the EU MDR, significantly increase the R&D expenditure and prolong the time required for new product introduction, creating substantial barriers to entry for smaller innovative firms. Public perception risks, often stemming from negative media coverage of botched procedures or reports of severe complications, can rapidly erode consumer confidence in specific product categories, necessitating continuous proactive risk communication and practitioner education efforts by leading market players.

Opportunities for exponential growth are concentrated in two primary areas: geographic expansion and therapeutic diversification. Geographically, significant opportunities exist in untapped secondary cities within large emerging economies, where localized training and distribution channels are essential to capture new consumer segments previously inaccessible due to infrastructure deficits. Therapeutically, the market can diversify revenue by leveraging existing aesthetic products for certified medical indications; for instance, expanding neurotoxin use for medical conditions like hyperhidrosis, chronic migraines, and muscular spasms provides stable, non-elective revenue streams independent of aesthetic cycles. This therapeutic expansion broadens market relevance and justifies further R&D. The increasing consumer interest in holistic wellness and "natural" beauty also presents an opportunity for manufacturers to promote products that work synergistically with the body’s natural processes, such as advanced platelet-rich fibrin (PRF) systems and genetically tailored skincare adjuncts, enhancing overall treatment longevity and outcome satisfaction.

The most pervasive impact force is the accelerating pace of technological obsolescence, particularly in the energy-based device sector, where breakthroughs in wavelength specificity and thermal delivery systems render older generations of equipment less competitive within short cycles, forcing clinics to invest continuously in upgrades. Furthermore, the influence of competitive intellectual property (IP) protection is a major force; companies that successfully secure patents on novel cross-linking technologies for fillers or unique pulsed delivery systems for lasers gain substantial, temporary monopolies, enabling them to command premium prices and control key segments until the IP expires or new competitive technology emerges. Finally, the socio-cultural impact of digital media—specifically platforms that enable peer-to-peer discussions and transparent reviews—significantly influences brand reputation and drives procedural volume, demanding that market players maintain exceptionally high ethical standards and consistent product performance to thrive in a highly connected, transparent marketplace.

Segmentation Analysis

The segmentation of the Facial Cosmetic Surgery Products Market provides a detailed perspective on product consumption, end-user characteristics, and application specificity, which is vital for strategic market positioning. The segmentation by product type reflects the stark difference between consumables (injectables and sutures) characterized by high transactional frequency and predictable revenue streams, and capital equipment (lasers and RF systems) involving large, upfront investments but providing long-term service revenue potential. Analyzing these segments helps stakeholders understand capital expenditure cycles within clinics and forecast revenue based on procedure type and product lifespan. The continuous innovation in materials science dictates the competitive intensity within the product segments, where even marginal improvements in longevity or safety can capture significant market share rapidly, especially within the fiercely contested neurotoxin category where molecular structure optimization is key to brand loyalty.

Application segmentation differentiates between the primary settings where cosmetic procedures are performed, illustrating the decentralization of aesthetic treatments away from traditional inpatient hospital settings. Specialized Aesthetic Clinics and dermatology centers, equipped with state-of-the-art non-invasive devices and staffed by specialized personnel, dominate the non-surgical market, benefiting from consumer preference for boutique, personalized environments and efficient outpatient services. Hospitals, while less dominant for purely elective non-surgical treatments, remain crucial for complex facial reconstructive surgery, major facelifts, and procedures requiring general anesthesia, utilizing advanced implants and surgical systems. Understanding this delineation is crucial for distribution strategies, as product requirements (e.g., sterilization protocols, packaging volume) differ significantly based on the final setting, necessitating tailored sales and logistics operations for each application environment.

End-user segmentation highlights the evolving demographic landscape of aesthetic consumers. While the Female demographic historically generates the overwhelming majority of revenue, the Male segment is experiencing a statistically significant surge in growth rate. Male consumers are increasingly seeking treatments focused on structural enhancement, such as jawline contouring, chin augmentation, and specialized neurotoxin injections to minimize frown lines while maintaining masculine facial characteristics. Furthermore, procedure type segmentation reveals the highest volumes in quick, low-downtime procedures like Lip Augmentation and Non-Surgical Facial Contouring (using fillers and neurotoxins), demonstrating the market’s response to societal demands for immediate aesthetic gratification. Manufacturers must design marketing campaigns that recognize the nuanced motivations and procedural preferences of these distinct end-user groups, utilizing demographic-specific clinical trials to validate product efficacy across all targeted populations, ensuring maximum market penetration and responsible product deployment.

- By Product Type:

- Injectables:

- Dermal Fillers (Hyaluronic Acid (HA) – Monophasic, Biphasic; Calcium Hydroxylapatite (CaHA); Poly-L-Lactic Acid (PLLA); Polymethylmethacrylate (PMMA))

- Botulinum Neurotoxin Type A and B (BTX-A, BTX-B)

- Fat Grafting Supplies (Micro-cannulas, Filtration Systems)

- Energy-Based Devices:

- Laser Systems (Fractional CO2, Erbium, Q-Switched, Picosecond)

- Radiofrequency (RF) Devices (Monopolar, Bipolar, RF Microneedling)

- High-Intensity Focused Ultrasound (HIFU) Systems

- Intense Pulsed Light (IPL) Devices

- Facial Implants:

- Malar (Cheek) Implants (Silicone, Porous Polyethylene)

- Mandibular (Chin and Jawline) Implants

- Nasal Implants

- Periocular Implants

- Support Products:

- Absorbable Sutures (PDO, PLLA) for Thread Lifts

- Specialized Surgical Instruments and Micro-Cannulas

- Topical Anesthetics and Recovery Kits

- By Application:

- Aesthetic Clinics and Dermatology Centers (Focus on non-surgical, high-frequency procedures)

- Hospitals (Focus on complex surgical and reconstructive cases)

- Specialty Cosmetic Surgery Centers (Hybrid model)

- By End-User:

- Female (Dominant consumer base, high demand for maintenance treatments)

- Male (Rapidly growing segment, focus on structural contouring)

- By Procedure Type:

- Rhytidectomy (Surgical and Non-Surgical Facelifts)

- Blepharoplasty (Upper and Lower Eyelid Surgery)

- Rhinoplasty (Surgical and Non-Surgical Nose Adjustments)

- Lip Augmentation and Perioral Rejuvenation

- Mid-Facial Volume Restoration and Contouring

Value Chain Analysis For Facial Cosmetic Surgery Products Market

The upstream segment of the value chain is highly capital-intensive, defined by extensive R&D cycles focusing on biocompatibility, longevity, and clinical safety of materials. For injectables, the synthesis and cross-linking of specialized polymers, such as high molecular weight hyaluronic acid or purified neurotoxin proteins, require pharmaceutical-grade infrastructure and adherence to Good Manufacturing Practices (GMP). Key suppliers of raw materials, including specialized chemical intermediates, pharmaceutical excipients, and medical-grade silicone/polyethylene for implants, must meet rigorous certification standards, granting them significant leverage in pricing negotiations. Manufacturers prioritize the vertical integration of intellectual property surrounding novel material formulations and proprietary device delivery mechanisms, ensuring differentiation and protection against generic competition. Crucial activities also include packaging development—such as pre-filled, sterile syringes or complex device casings—where ergonomic design and safety features are paramount for practitioner adoption and risk mitigation during use.

The midstream involves the core manufacturing, quality assurance, and initial distribution logistics. Due to the high value and controlled nature of many products (especially temperature-sensitive neurotoxins), distribution networks must adhere to strict cold chain logistics and specialized security protocols to maintain product efficacy and prevent counterfeiting. Manufacturers often utilize large, centralized distribution centers and partner with specialized third-party logistics (3PL) providers experienced in handling high-value medical devices. Sales and marketing activities at this stage are heavily focused on scientific advocacy, leveraging clinical trial data, and sponsoring Continuing Medical Education (CME) programs to educate practitioners on best practices and new procedural techniques. Establishing credible relationships with global and regional Key Opinion Leaders (KOLs) is indispensable for driving initial market acceptance and creating demand among the prescribing physician base.

Downstream operations connect the products directly to the end-user (the aesthetic clinic/hospital). Distribution channels exhibit a dual structure: direct sales forces are typically employed for high-cost capital equipment (lasers, RF machines) to manage complex installations, provide technical support, and handle ongoing maintenance contracts, ensuring high customer lifetime value. Conversely, consumables, such as fillers and neurotoxins, frequently utilize robust indirect distribution networks comprising authorized, regional medical distributors who manage smaller order volumes, localized inventory, and faster delivery cycles. The final step involves the administration of the product by the certified practitioner, whose skill level and technical proficiency critically influence the consumer outcome and subsequent repurchase cycle. The patient’s willingness to pay is directly proportional to the perceived value derived from the combined product quality and the administering professional’s expertise, making the clinical setting the ultimate revenue realization point in the value chain, where service quality reinforces product demand.

Facial Cosmetic Surgery Products Market Potential Customers

The core potential customer base for facial cosmetic surgery products can be segmented into two symbiotic groups: the institutional purchaser (the service provider) and the aesthetic consumer (the patient). Institutional buyers include a wide array of specialized medical practices: high-volume, multi-specialty cosmetic surgery centers, independent dermatology clinics specializing in non-invasive aesthetic procedures, large hospital networks managing trauma and reconstructive cases, and medical spas supervised by licensed physicians. These customers prioritize vendors who offer not only clinically superior products with strong safety records but also comprehensive business support, including practice management software integration, patient retention strategies, and favorable financing terms for expensive capital equipment. Decision-making units within these institutions are often sophisticated, involving purchasing managers, lead physicians, and finance departments scrutinizing cost-per-procedure, efficacy longevity, and overall return on investment (ROI) before product adoption.

The ultimate end-user—the aesthetic consumer—is increasingly segmented by age, procedural interest, and psychological motivation. Younger consumers (25-40 years) are often seeking 'prejuvenation' (preventative neurotoxin use) and feature harmonization (lip, chin, jawline contouring), highly influenced by digital media and immediate gratification. Middle-aged consumers (40-60 years) focus on volume loss restoration and skin laxity correction, representing the highest spend per treatment cycle, typically opting for combination therapies involving fillers, deep-penetrating energy devices, and surgical consultations. Older demographics (60+) typically seek more dramatic, surgical interventions (facelifts) complemented by robust skin quality improvement protocols. Manufacturers must develop specific product lines (e.g., highly flexible fillers for dynamic areas, high-viscosity fillers for deep volume) and tailored educational materials that resonate with the distinct aesthetic goals and risk tolerance of each age cohort, optimizing product market fit and maximizing consumer satisfaction.

Niche customer segments include patients with specific medical needs requiring aesthetic products for non-elective purposes, such as patients with facial paralysis benefiting from neurotoxins for muscle balance, or patients requiring customized facial implants following oncological or trauma-related resection. These specialized customer groups often rely on insurance reimbursement, shifting the value proposition toward clinical necessity and long-term functional restoration, demanding highly reliable, biocompatible, and FDA/CE-approved materials. Furthermore, the global proliferation of medical tourism has created a customer base that transcends national borders, seeking both affordability and access to specialized surgeons in countries offering high-quality, regulated products at competitive prices. Targeting these transient customers requires strong international branding, multi-lingual marketing materials, and partnerships with reputable medical travel facilitators, ensuring the product's safety profile is globally recognized and transferable across varied healthcare systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allergan (AbbVie), Galderma, Merz Pharma, Johnson & Johnson, Bausch Health (Solta Medical), Syneron Candela, Alma Lasers, Cutera, Cynosure (Hologic), Sientra, Mentor Worldwide LLC, Hansbiomed, Fotona, Revance Therapeutics, Teoxane, Sinclair Pharma, Implant Silicone, Implantech, Zimmer Biomet, BTL Aesthetics, Lumenis (A part of Boston Scientific), Dermaroller GmbH, Integra LifeSciences, Fosun Pharma (Sisram Medical), MicroAire Surgical Instruments |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Facial Cosmetic Surgery Products Market Key Technology Landscape

The current technology landscape is deeply integrated across material science, precision engineering, and digital analytics, pushing the boundaries of minimally invasive facial rejuvenation. In the injectable domain, the proprietary cross-linking technologies used in Hyaluronic Acid (HA) fillers are highly sophisticated, focusing on increasing the G-prime (rigidity) for structural support in deep tissue, while maintaining rheological flexibility (smooth flow) for superficial injections. Next-generation bio-stimulatory products, leveraging high-purity microparticles of PLLA or CaHA, are engineered with refined manufacturing processes to ensure uniform particle size and concentration, maximizing fibroblast stimulation and resulting in consistent, natural collagenesis over a period of 12-24 months. Furthermore, advanced neurotoxin development is focused on optimizing molecular complex size and purity, aiming for reduced immunogenicity and extended duration of effect, exemplified by new molecules challenging the traditional market dominance through optimized protein stability and faster patient onset times.

Within energy-based devices, the trend is unequivocally toward multi-modal platforms that offer synergistic treatment effects. Radiofrequency (RF) technology has evolved into highly precise fractional delivery systems, often coupled with micro-needling, allowing for targeted thermal injury and subsequent remodeling of deep dermal collagen with minimal downtime compared to traditional ablative lasers. High-Intensity Focused Ultrasound (HIFU) systems are becoming smarter, incorporating real-time imaging (e.g., deep ultrasound visualization) to ensure accurate energy delivery to the critical SMAS layer, providing non-surgical lifting effects equivalent to superficial surgery, demanding sophisticated transducer technology and highly accurate depth control. Laser technology is advancing with picosecond and ultrafast pulsed lasers, which leverage photoacoustic effects rather than pure heat, significantly improving the treatment of pigmentation and complex skin textures across a wider range of Fitzpatrick skin types with dramatically reduced risk of post-inflammatory hyperpigmentation.

Ancillary technological innovations are transforming procedural standardization and safety. Robotics and AI-guided systems are emerging, particularly for complex fat grafting procedures or large-volume filler placement, offering reproducible precision that minimizes the variance caused by human factors (e.g., hand tremor, injection speed variability). Furthermore, the widespread adoption of high-definition 3D facial imaging and simulation software allows practitioners to create quantifiable treatment plans, moving the aesthetic practice towards a metric-driven, engineering-based methodology. These digital tools not only aid in physician training but also enhance patient engagement by visually demonstrating personalized projected outcomes. Biometric feedback systems, used during energy-based treatments, automatically adjust power levels based on real-time tissue impedance and temperature readings, representing a critical safety technology that ensures optimal therapeutic efficacy while meticulously guarding against the potential for thermal damage to surrounding tissue, solidifying the market's commitment to patient safety and predictable procedural outcomes.

Regional Highlights

- North America (NA): Represents the largest revenue generator, characterized by an exceptionally high consumer expenditure on elective aesthetic procedures and a regulatory environment (FDA) that drives global standards for clinical efficacy. The market is saturated with high-end technology and characterized by fierce competition among key players (Allergan, Galderma, Merz). Key market drivers include the pervasive influence of celebrity culture, advanced marketing strategies utilizing digital platforms, and the highest per capita density of board-certified aesthetic specialists globally. Non-surgical procedures, particularly the combination of neurotoxins and HA fillers for dynamic and static wrinkle correction, continue to generate the majority of market revenue, supported by robust insurance coverage for reconstructive aspects of facial surgery.

- Europe: A mature and competitive market driven by demand for scientifically validated, quality products, particularly in Western European nations like Germany, France, and the UK. While highly regulated (especially following the introduction of the EU Medical Device Regulation, MDR), the market shows strong growth in bio-stimulatory fillers and energy-based aesthetic devices. Italy and Spain exhibit high procedural volume for facelifts and body contouring integration. The European market is sensitive to the origin and clinical backing of the products, prioritizing scientifically endorsed brands and emphasizing safety over rapid innovation, leading to sustained, moderate growth rates driven by patient trust and professional specialization.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally, APAC is driven by colossal population size, rapid economic expansion, and a rising middle class with disposable income allocation directed towards self-enhancement. East Asia, especially South Korea and China, acts as the epicenter of innovation and consumption, with high cultural acceptance of procedures like V-line surgery, surgical rhinoplasty, and unique blepharoplasty techniques. The market favors products tailored to specific Asian facial morphologies (e.g., lower G-prime fillers for softer contours). The immense market potential is tempered slightly by the widespread issue of counterfeit products, necessitating stringent import controls and local regulatory enforcement to ensure consumer safety and protect licensed manufacturers' intellectual property rights.

- Latin America (LATAM): A traditionally procedure-heavy region, led by Brazil and Mexico, known for high volumes of surgical cosmetic interventions. The market is defined by price sensitivity combined with a demand for reliable, large-volume products. Brazilian surgeons are highly influential globally, often setting trends for fat grafting and body contouring, which frequently integrate with facial procedures. Market growth relies heavily on reducing the cost barrier for premium injectable products and establishing stronger localized manufacturing or distribution partnerships to counteract high import duties and fluctuating economic conditions that often challenge investment in expensive capital equipment.

- Middle East and Africa (MEA): Growth is primarily concentrated in the highly affluent GCC states (UAE, Qatar, Saudi Arabia), where consumers exhibit a strong preference for aesthetic services, often seeking treatment in specialized, internationally accredited clinics. The high incidence of sun damage drives demand for advanced laser resurfacing, pigmentation correction, and deep dermal hydration treatments using HA fillers. The market in this region is characterized by high spending per patient but is comparatively smaller in volume. Growth in the African continent is restricted but shows promise in regional medical hubs like South Africa, capitalizing on the demand for advanced aesthetic technology and high-quality imported consumables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Facial Cosmetic Surgery Products Market.- Allergan (AbbVie)

- Galderma

- Merz Pharma

- Johnson & Johnson

- Bausch Health (Solta Medical)

- Syneron Candela

- Alma Lasers

- Cutera

- Cynosure (Hologic)

- Sientra

- Mentor Worldwide LLC

- Hansbiomed

- Fotona

- Revance Therapeutics

- Teoxane

- Sinclair Pharma

- Implant Silicone

- Implantech

- Zimmer Biomet

- BTL Aesthetics

- Lumenis (A part of Boston Scientific)

- Dermaroller GmbH

- Integra LifeSciences

- Fosun Pharma (Sisram Medical)

- MicroAire Surgical Instruments

- Laboratoires VIVACY

- Zydus Lifesciences

Frequently Asked Questions

Analyze common user questions about the Facial Cosmetic Surgery Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Facial Cosmetic Surgery Products Market?

The primary driver is the accelerating consumer shift towards minimally invasive and non-surgical aesthetic procedures, notably dermal fillers and botulinum neurotoxins, which offer reduced recovery time and lower associated risks compared to traditional surgical interventions. This preference is strongly reinforced by continuous technological improvements in injectable longevity and safety.

Which product segment holds the largest market share and why?

The Injectables segment, encompassing dermal fillers (Hyaluronic Acid, CaHA) and neurotoxins, holds the largest market share due to their high efficacy, ease of administration, temporary nature encouraging high repeat usage rates, and continuous innovation extending product longevity and safety profiles across various facial planes.

How is AI technology expected to influence facial aesthetic outcomes?

AI is expected to significantly improve aesthetic outcomes by enabling highly personalized treatment planning, utilizing sophisticated 3D imaging for ultra-precise product placement, predicting patient response to specific materials, and enhancing procedural safety through real-time vascular mapping and anatomical guidance, leading to standardized, predictable results.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapidly increasing disposable incomes, massive procedural volumes in aesthetic hubs like South Korea and China, and growing cultural acceptance of facial aesthetic procedures, especially structural and feature-enhancing surgeries.

What are the major restraints affecting market expansion?

Major restraints include the high capital cost required for advanced energy-based devices, the lengthy and resource-intensive regulatory approval processes (e.g., EU MDR compliance), and the persistent market challenge of counterfeit products and unregulated use by non-specialized practitioners, posing significant risks to consumer safety and brand integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager