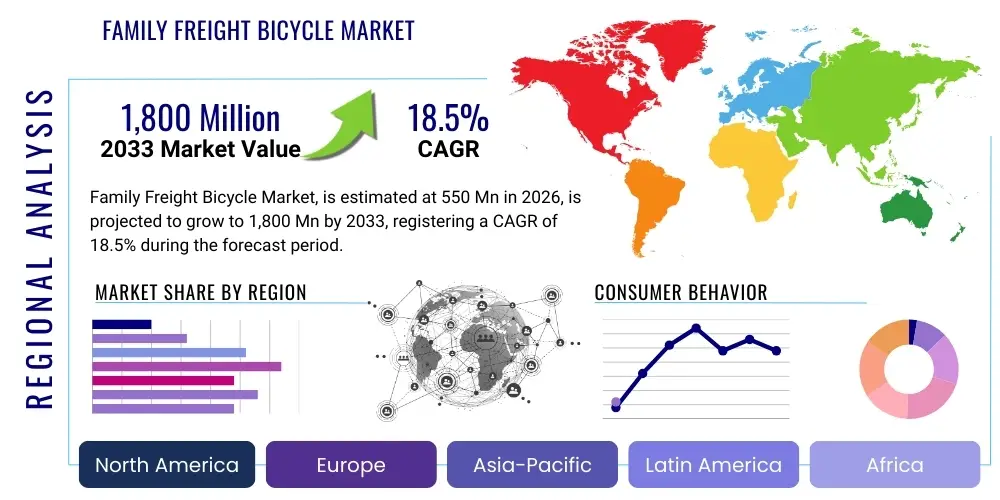

Family Freight Bicycle Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442752 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Family Freight Bicycle Market Size

The Family Freight Bicycle Market is experiencing robust expansion driven by increasing urbanization, environmental consciousness, and the desire for practical, sustainable urban mobility solutions. This market encompasses purpose-built bicycles designed to transport children, groceries, pets, and various goods, serving as viable replacements for second cars in urban households. The ongoing regulatory support for cycling infrastructure across major economies further bolsters market growth, making family freight bicycles increasingly appealing for daily commuting and utility tasks.

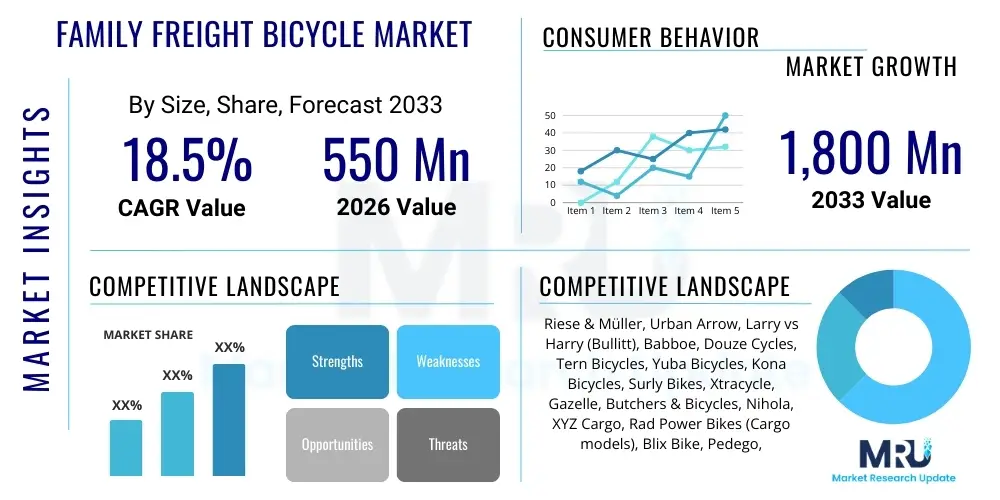

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. This significant growth rate reflects the high adoption of electric-assist models (e-cargo bikes), which mitigate range anxiety and terrain challenges, making these bicycles accessible to a wider demographic, including older adults and those with heavier cargo requirements. Technological advancements, particularly in battery life, motor efficiency, and lightweight frame materials, are key enablers of this accelerating adoption curve across Europe and North America.

The market is estimated at $550 Million in 2026 and is projected to reach $1,800 Million by the end of the forecast period in 2033. This substantial increase is heavily influenced by the shifting consumer perception of freight bicycles from niche items to mainstream, sustainable family vehicles. Furthermore, the rise in fuel prices and traffic congestion in metropolitan areas positions these bikes as economically sound and time-efficient alternatives, solidifying their role in the future of urban transport planning.

Family Freight Bicycle Market introduction

The Family Freight Bicycle Market centers on specialized cycling equipment engineered for utilitarian purposes, primarily focusing on the safe and efficient transport of passengers—especially children—and significant cargo within urban and suburban environments. These vehicles, often incorporating large front or rear cargo boxes, reinforced frames, and advanced stability features, offer a sustainable and health-conscious alternative to traditional automotive transport for short to medium distances. The market's foundational product range includes versatile options such as two-wheeled long johns (bakfiets) and stable three-wheeled tricycles, meeting diverse family needs ranging from the daily school run to weekly grocery haulage and recreational outings. Key applications revolve around replacing second car trips, enhancing mobility independence for families without driver’s licenses, and supporting small, local businesses by facilitating last-mile deliveries of goods, thereby integrating seamlessly into modern sustainable urban living models.

The primary benefits driving the surging demand for family freight bicycles include zero emissions, reduced operating costs (compared to car ownership), substantial health benefits derived from cycling, and the unparalleled convenience of navigating congested city centers and utilizing dedicated cycle paths. They represent a tangible solution to the problems of urban air quality and traffic congestion, aligning perfectly with municipal mandates promoting green infrastructure. Furthermore, the modern integration of electric assist (e-cargo technology) has dramatically broadened the market appeal, enabling riders to carry heavy loads effortlessly over hills and longer distances, effectively democratizing the utility cycling experience and transforming these bikes into genuine automotive substitutes for daily family logistics. This convergence of practicality, sustainability, and technological enhancement is positioning the family freight bicycle as an essential component of the contemporary eco-conscious family unit.

Major driving factors include supportive government policies offering purchase subsidies and tax incentives, especially prevalent in European nations like Germany, the Netherlands, and Denmark, which are historical hubs of cycling culture. The exponential growth of dedicated cycling infrastructure, making routes safer and more accessible, further encourages adoption. Societal trends emphasizing sustainable consumption and active lifestyles also play a critical role, fostering an environment where cycling is prioritized over driving. As urban density increases globally, the inherent advantages of maneuverability and parking ease associated with family freight bicycles become paramount, positioning them as essential tools for managing the complexities of modern city life, thereby cementing their sustained market viability and growth trajectory throughout the forecast period.

Family Freight Bicycle Market Executive Summary

The Family Freight Bicycle Market is characterized by vigorous growth, predominantly fueled by the widespread adoption of electric cargo bike variants which address performance limitations previously associated with traditional pedal-powered models. Current business trends indicate a strong focus on customization and modular design, allowing users to switch between child seats, cargo boxes, and utility platforms, enhancing the versatility and perceived value of the products. Strategic collaborations between bicycle manufacturers and specialized component suppliers (e.g., Bosch, Shimano for drive systems) are accelerating innovation in battery technology and safety features, establishing higher industry benchmarks for reliability and performance. Key market players are actively expanding their distribution networks, moving beyond specialized cycle shops to integrate digital direct-to-consumer models and forming partnerships with mobility service providers to offer rental or subscription services, thus broadening market penetration and accessibility to urban consumers unfamiliar with the segment.

Regionally, Europe remains the undisputed core of the Family Freight Bicycle Market, commanding the largest share due to deeply entrenched cycling cultures, mature infrastructure, and proactive government subsidies. North America, while starting from a smaller base, is exhibiting the highest growth trajectory, particularly in major metropolitan areas such as New York, Seattle, and Vancouver, where increased investment in protected bike lanes is rapidly transforming urban mobility habits. The Asia Pacific region, though dominated by traditional scooter use, shows burgeoning potential in developed markets like Japan, Singapore, and parts of Australia, where environmental regulations and high population density favor compact, sustainable transport. Regional trends also show a bifurcation in demand: established European markets prioritize high-end, durable, and highly engineered models, while emerging markets show higher demand for moderately priced, robust, and often non-electric variants suitable for mixed terrain and utility purposes.

Segmentation trends highlight the dominance of the Electric-Assist segment (E-Cargo) in terms of revenue growth, reflecting consumer preference for power assistance when carrying heavy loads, particularly multiple children. Within the Type segmentation, the Long John (front-loading, two-wheeled) format is gaining prominence over three-wheeled tricycles in mature markets due to its superior handling, speed, and maneuverability, although tricycles maintain a strong foothold where stability is prioritized for very heavy loads or multiple young passengers. Application analysis underscores the Child Transportation segment as the primary revenue driver, establishing the family freight bike as a critical asset for modern parental logistics. Furthermore, there is a measurable shift towards integrating smart features, such as GPS tracking and anti-theft systems, enhancing the overall security and utility proposition of high-value freight bicycles, thereby driving premiumization within specific segments of the market.

AI Impact Analysis on Family Freight Bicycle Market

Analysis of common user questions reveals a collective curiosity focused primarily on how Artificial Intelligence can enhance the safety, efficiency, and maintenance of family freight bicycles, rather than replacing the physical product itself. Users frequently inquire about AI-powered safety features, such as collision detection, predictive maintenance schedules based on riding habits, and optimizing route planning for cargo loads and family safety (e.g., avoiding high-traffic areas or poorly lit roads). Key concerns revolve around data privacy related to usage tracking and the cost implications of integrating sophisticated AI hardware and software into already expensive e-cargo bikes. Expectations center on AI contributing to a seamless, safer riding experience, particularly for novice riders transporting precious cargo—children. The overall sentiment suggests AI will act as an augmenting technology, significantly improving rider assistance, security protocols, and operational diagnostics, rather than fundamentally altering the core mechanism of the bicycle.

The integration of AI into the Family Freight Bicycle Market is poised to revolutionize the user experience by moving beyond simple electric assistance toward intelligent mobility systems. AI algorithms can be deployed to analyze rider inputs, terrain data, and current battery charge to dynamically optimize power delivery from the electric motor, maximizing range and ensuring smoother ascents under heavy loads. This smart power management extends battery life and reduces wear on mechanical components, addressing major ownership concerns. Furthermore, AI-driven diagnostics will allow bikes to communicate preemptively about potential mechanical failures, prompting the user for necessary maintenance before minor issues escalate, significantly enhancing reliability and safety, which is paramount for a vehicle transporting children.

Beyond the functional aspects, AI also offers significant advancements in security and user interface. For instance, integrated AI systems can employ facial recognition or behavioral biometrics for enhanced anti-theft protection, making the bike unusable to unauthorized individuals. In terms of user interaction, AI can personalize the riding profile, adjusting suspension stiffness, braking sensitivity, and even integrated lighting based on time of day, weather conditions, and load weight. This level of personalized, proactive assistance transforms the freight bicycle from a utility vehicle into a highly sophisticated, secure, and personalized mode of transport, justifying the premium price points associated with high-end e-cargo models and driving competitive differentiation among manufacturers.

- AI-Enhanced Safety Systems: Predictive collision warnings and blind spot detection optimized for carrying large cargo boxes.

- Predictive Maintenance: Algorithms analyzing usage patterns (load weight, mileage, terrain) to recommend optimized maintenance schedules for batteries, brakes, and drivetrain components.

- Smart Power Management: Dynamic adjustment of electric assist level based on real-time load, gradient, and battery health to maximize efficiency and range.

- Optimized Route Planning: Utilizing AI to suggest routes prioritizing low traffic, enhanced cycle infrastructure, and minimal gradient changes for heavy cargo loads.

- Advanced Anti-Theft Features: AI-powered GPS tracking, geo-fencing, and authentication methods (biometric/behavioral) for high-value cargo bikes.

- Personalized Riding Profiles: Automatic adjustment of bike settings (e.g., suspension, lighting intensity) based on rider and environmental conditions.

DRO & Impact Forces Of Family Freight Bicycle Market

The Family Freight Bicycle Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to various internal and external impact forces. Key drivers center on the strong global push toward sustainable urban mobility, governmental subsidies that make e-cargo bikes financially accessible, and the growing consumer recognition of these bikes as effective car replacements, particularly for second vehicles in dense urban settings. However, the market faces significant restraints, primarily the high initial purchase price, which often rivals that of a used small car, and limited standardized infrastructure in many emerging urban centers, creating safety concerns for riders sharing roads with faster motorized traffic. Opportunities lie in expanding into fleet services (e.g., corporate campus transport, localized rental schemes) and developing specialized, affordable non-electric variants for developing economies, alongside continuous innovation in lightweight materials and battery technology.

Impact forces on the market are multifaceted. The environmental force, driven by climate change mitigation efforts and stricter city-level emission zones, exerts a consistently positive pressure on cargo bike adoption. Economic forces, particularly fluctuating consumer disposable income and rising fuel costs, favor the lower operational expenses of cargo bikes over automobiles, acting as a strong driver. Conversely, high manufacturing costs for specialized components (robust frames, high-capacity batteries) act as a significant restraint, limiting mass market penetration outside of affluent regions. Regulatory forces, manifested through favorable city planning (building protected cycle lanes) and purchase incentives, provide the most direct positive impact, correlating strongly with high market growth in specific countries.

The convergence of urbanization trends and technological advancement dictates the future trajectory. As cities become denser, the premium placed on space efficiency and quick transit increases, inherently favoring the compact nature of freight bikes. The continuous advancements in battery energy density and motor power output are steadily eroding the performance gap between e-cargo bikes and small cars in city environments. Overcoming the initial investment barrier through innovative financing, leasing models, and expanded government support is critical for maximizing the market's opportunity space, particularly as geopolitical instability impacts global supply chains, requiring manufacturers to localize production and diversify sourcing to maintain price competitiveness and consistent availability.

Segmentation Analysis

The Family Freight Bicycle Market is comprehensively segmented based on Type, Application, and Component, allowing for targeted analysis of consumer preferences and technological trends. The Type segmentation distinguishes between two-wheeled and three-wheeled configurations, where two-wheeled models (Long Johns) are valued for speed and agility, while three-wheeled tricycles offer superior stability, especially crucial for transporting multiple young children or very heavy, bulky loads. Application segmentation clearly delineates the primary use cases, with Child Transportation consistently representing the most lucrative segment, validating the product's function as a family logistical tool. Component segmentation separates the market into electric-assist (E-Cargo) and non-electric categories, reflecting the critical role of battery and motor technology in overcoming geographic and physical barriers to adoption, making E-Cargo the dominant segment in terms of value generation and future growth potential.

Detailed analysis of the Type segment reveals a growing sophistication in frame geometry and suspension systems, especially for two-wheeled models, aiming to mimic the ride comfort and safety of standard city bikes while managing substantial front-loaded weight. Manufacturers are investing heavily in reducing the learning curve associated with riding front-loading cargo bikes to appeal to a broader consumer base. Within the Application segment, while child transport remains central, there is an observable upward trend in the 'Grocery Shopping and Utility’ category, driven by consumers seeking to minimize reliance on cars for routine household errands. This trend is further supported by the availability of specialized accessories like rain covers, weather-proof storage boxes, and secure locking mechanisms tailored for diverse utility applications.

The Component segmentation is pivotal, as the performance and price of the electric drive system (motor, battery, control unit) largely dictate the overall market value and consumer purchasing decision. Premiumization is evident in the E-Cargo segment, with consumers often willing to pay more for proven, high-quality systems from established suppliers (e.g., Bosch, Shimano) known for reliability, widespread service networks, and long warranties. This focus on component quality underlines the consumer perception of these bicycles as long-term investments in family mobility. The sustained growth of the E-Cargo category directly correlates with improvements in battery energy density, which allows for greater range and facilitates multi-modal urban commuting without frequent recharging, solidifying its dominant position in the market structure.

- By Type:

- Two-Wheeled Cargo Bikes (Long John/Bakfiets)

- Three-Wheeled Cargo Bikes (Tricycles)

- Compact/Mini Cargo Bikes

- By Application:

- Child Transportation

- Grocery Shopping & Utility

- Pet Transportation

- Local Personal Deliveries

- Leisure & Recreation

- By Component:

- Electric Assist (E-Cargo)

- Non-Electric (Traditional)

Value Chain Analysis For Family Freight Bicycle Market

The Value Chain for the Family Freight Bicycle Market begins with Upstream Analysis, focusing on raw material sourcing and specialized component manufacturing. This stage involves the procurement of high-strength, lightweight materials such as aluminum alloys and reinforced steel tubing for robust frame construction, alongside sophisticated components like specialized hub gear systems, hydraulic brakes designed for heavy loads, and, crucially, proprietary electric drive systems (motors, batteries, controllers) sourced primarily from leading automotive or e-mobility technology firms (e.g., Bosch, Shimano, Bafang). The upstream segment is characterized by high levels of specialized intellectual property and stringent quality control, as the safety and performance of the final product depend heavily on these inputs. Manufacturers must manage complex global supply chains, often facing geopolitical risks and volatility in rare earth metals critical for battery production, necessitating strong vendor relationship management and supply diversification strategies to ensure consistent production flow and cost efficiency.

The midstream section involves the manufacturing, assembly, and quality assurance processes. Due to the high-value, low-volume nature of family freight bikes compared to standard bicycles, assembly is often less automated and requires specialized technical skill. This stage focuses on precision welding, frame treatment, integration of electric systems (wiring, sensor placement), and thorough final testing under simulated load conditions to meet demanding safety standards, particularly in the European market (e.g., EN standards). The design and engineering phase within the midstream is critical for innovation, focusing on ergonomic improvements, stability enhancement (especially for three-wheeled variants), and modularity to allow easy accessory attachment. Manufacturing hubs are geographically concentrated in regions with strong engineering capabilities and established cycling traditions, notably the Netherlands, Germany, and key production centers in Asia, although there is a growing trend toward localized assembly in consumption markets to mitigate shipping costs and tariffs associated with bulky finished goods.

The Downstream Analysis addresses distribution channels and sales mechanisms. The market relies heavily on specialized, authorized bicycle dealers who provide crucial pre-sales consultation, fitting services, and essential post-sales support and maintenance for these complex, high-investment products. Direct sales channels (online portals run by manufacturers) are increasingly utilized, particularly for established brands with strong recognition, offering enhanced customization options and direct consumer engagement, though this necessitates investment in robust logistics for handling large, assembled products. Indirect channels, including select high-end outdoor retailers and, increasingly, partnership with specialized urban mobility leasing or subscription services, are broadening market access. Effective marketing emphasizes the sustainable, health, and logistical benefits, positioning the product not merely as a bike, but as a lifestyle investment and a practical car replacement, targeting affluent, environmentally conscious urban families.

Family Freight Bicycle Market Potential Customers

The primary segment of potential customers for the Family Freight Bicycle Market comprises affluent, environmentally conscious families residing in dense urban and suburban areas, typically possessing two or more young children. These consumers value sustainable living, prioritize health and physical activity, and are often seeking to reduce their reliance on second cars due to high operating costs, parking difficulty, and the environmental impact of short-distance vehicular travel. These buyers are willing to absorb the high initial investment cost because they view the freight bicycle as a high-utility replacement for a family vehicle, expecting superior durability, advanced safety features, and a high level of engineering quality. Their purchasing decisions are heavily influenced by the availability of supportive cycling infrastructure (protected lanes, dedicated parking) and favorable government incentives, making Northern European and specific North American metropolitan populations the core demographic.

A secondary, rapidly growing customer segment includes small and medium-sized local businesses requiring efficient, low-cost solutions for last-mile delivery and localized services. This includes independent grocery stores, florists, bakeries, coffee shops, and specialized maintenance and repair services (e.g., plumbers, handymen) operating within constrained city centers where vehicle access is restricted or prohibitively expensive. For these commercial users, the family freight bike chassis is adapted into a utility cargo bike, offering significant advantages in speed, parking flexibility, and access to pedestrian zones, contributing to enhanced operational efficiency. The appeal here is driven by economic viability—lower fuel, insurance, and maintenance costs—and enhanced corporate social responsibility (CSR) visibility through zero-emission delivery methods, attracting companies dedicated to local, sustainable commerce.

Furthermore, mobility service providers and corporate campuses represent an emerging institutional customer base. Universities, large technology parks, and urban planning entities are increasingly adopting fleets of family and utility freight bicycles for internal logistics, employee transport, and short-term rental programs. This institutional demand focuses on robust, low-maintenance designs, often prioritizing standardized electric components and sophisticated fleet management software. These customers often procure bikes in bulk, creating a distinct sales channel requiring specialized B2B service and support structures. The decision criteria for this segment are based on total cost of ownership (TCO), scalability, and integration capabilities with existing smart city infrastructure, further diversifying the customer profile beyond the traditional household consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,800 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Riese & Müller, Urban Arrow, Larry vs Harry (Bullitt), Babboe, Douze Cycles, Tern Bicycles, Yuba Bicycles, Kona Bicycles, Surly Bikes, Xtracycle, Gazelle, Butchers & Bicycles, Nihola, XYZ Cargo, Rad Power Bikes (Cargo models), Blix Bike, Pedego, Cube, Canyon, Muli Cycles |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Family Freight Bicycle Market Key Technology Landscape

The technology landscape of the Family Freight Bicycle Market is defined by the critical integration of sophisticated electric powertrain systems with enhanced mechanical and structural innovations focused on safety and payload capacity. The core technological advancement is the Electric Assist system (E-Cargo), predominantly utilizing mid-drive motors (e.g., Bosch Cargo Line, Shimano Steps EP8) which provide high torque necessary for moving heavy loads up inclines and from a standstill. Battery technology continues to evolve rapidly, featuring higher energy density lithium-ion packs that offer extended range (often exceeding 50 miles per charge under load) and are designed for quick swapping or integrated chassis protection. Control systems utilize advanced torque sensors and smart algorithms to modulate power delivery smoothly and safely, preventing sudden acceleration that could endanger passengers, marking a significant leap from rudimentary electric bikes.

Beyond the electric components, structural engineering innovation is crucial. Frames are designed with low centers of gravity and exceptional stiffness to maintain stability and predictable handling, even when fully loaded with children or heavy goods. Material science contributes through the use of hydroformed aluminum tubing and specialized alloys that maximize strength-to-weight ratios, ensuring durability without excessive bulk. Furthermore, dedicated cargo bike braking systems, primarily hydraulic disc brakes with oversized rotors, are standard, engineered to deliver reliable stopping power and resistance to fade under continuous high-stress use. Many high-end models incorporate advanced suspension systems (front and sometimes rear) specifically tuned for cargo weight distribution, significantly improving rider and passenger comfort over varied urban road surfaces and enhancing overall safety and control.

In terms of digital integration, the market is leveraging smart technology to improve user experience and security. GPS tracking and integrated IoT connectivity are becoming standard features, enabling real-time location tracking for theft recovery and remote diagnostics. Connectivity features include seamless smartphone integration for ride data logging, navigation tailored for cycling infrastructure, and anti-theft immobilization features accessible via a mobile app. The increasing focus on modularity also represents a technological push, with standardized quick-release mounting systems allowing families to swiftly interchange between dedicated passenger seats, weather protection canopies, and specialized commercial cargo boxes, maximizing the bike's utility and appeal across multiple applications throughout the ownership lifecycle.

Regional Highlights

- Europe: Market Dominance and Innovation Hub

Europe, spearheaded by the Netherlands, Germany, Denmark, and the UK, constitutes the largest and most mature market for family freight bicycles. This dominance stems from historical cycling culture, early and sustained investment in premium cycling infrastructure, and proactive government subsidies (e.g., tax exemptions, purchase bonuses) that significantly offset the high initial cost of e-cargo bikes. Germany and the Netherlands, in particular, serve as the global innovation hubs, hosting key manufacturing centers (e.g., Riese & Müller, Urban Arrow) and boasting the highest per capita ownership rates. The European market demands high-quality, long-lasting products with sophisticated safety features and seamless integration of high-end electric components, reflecting the consumer's view of these bikes as genuine, long-term car substitutes. The trend here is moving towards fully enclosed cargo boxes and highly customized modular systems.

Regulations across the EU, particularly those enforcing low-emission zones (LEZs) and encouraging micromobility, solidify the position of the family freight bicycle as an indispensable tool for urban logistics and family transport. Furthermore, robust aftermarket service networks and high consumer confidence in local brands ensure sustained growth. The competitive landscape is intense, focusing on incremental improvements in handling characteristics, battery range, and integration of smart features. The adoption rate remains highest in cities with effective municipal policies that restrict car use and prioritize cycle traffic flow, creating a self-reinforcing ecosystem where bike use is both convenient and efficient.

- North America: Rapid Growth and Infrastructure Development

The North American market, though smaller than Europe's, is experiencing the fastest growth, largely concentrated in dense, progressive urban corridors like the Pacific Northwest, the Northeast U.S., and major Canadian cities (e.g., Vancouver, Montreal). Growth is spurred by increased awareness of environmental issues, lifestyle shifts prioritizing outdoor activity, and substantial local government efforts to build protected cycling infrastructure that makes riding feel safer and more feasible, especially for families with young children. The market is primarily driven by the electric-assist segment, as North American distances and terrain variations often necessitate additional power.

Consumer behavior in North America shows a preference for rugged, powerful models capable of handling both heavy loads and varied terrain, often incorporating aesthetic elements similar to high-end mountain bikes or utility vehicles. Pricing sensitivity remains a challenge, necessitating innovative financing and leasing models to facilitate adoption. The expansion of localized direct-to-consumer brands (e.g., Rad Power Bikes) offering competitive pricing and robust online support is democratizing access. Future growth hinges critically on continued public and private sector investment in safe and integrated urban cycling networks that connect residential areas to commercial and educational centers, transforming the bike from a leisure item into a primary utility vehicle.

- Asia Pacific (APAC): Emerging Potential and Diversified Needs

The APAC region presents a highly fragmented market landscape. Developed economies like Australia, New Zealand, Japan, and Singapore show strong potential, mirroring North American and European growth drivers—sustainability, traffic congestion, and a focus on high-quality family logistics. In Australia, for instance, subsidies and strong outdoor culture are fueling adoption, particularly among suburban families seeking versatile transport. However, developing Asian markets face unique challenges, including existing reliance on low-cost motorized two-wheelers (scooters/mopeds) and often insufficient or hazardous cycling infrastructure.

In high-density metropolises like Tokyo or Seoul, the focus is on compact cargo bikes that can navigate tight spaces and fit into small apartment storage. For widespread adoption across the rest of the region, the market requires more affordable, highly durable, and perhaps simpler mechanical (non-electric) solutions suitable for diverse climates and road conditions. The opportunity lies in integrating family freight bikes into the burgeoning gig economy and last-mile delivery sector, creating visibility and demonstrating utility to the general public. Governmental policies supporting e-mobility and tackling extreme air pollution could serve as significant long-term catalysts for mass market penetration, shifting reliance away from fuel-dependent transport options.

- Latin America, Middle East, and Africa (LAMEA): Nascent Adoption

The LAMEA region represents a nascent market segment, where adoption is currently limited to small, specialized niches within capital cities or eco-focused communities. High import duties, lack of dedicated infrastructure, and the prioritization of lower-cost motorbikes pose significant barriers. However, rising fuel costs and environmental pressure in rapidly growing urban centers offer long-term opportunities. Initial adoption is typically concentrated among expatriate communities, high-income locals, or specific localized B2B applications (e.g., internal transport within large industrial complexes or resorts).

Market entry strategies in LAMEA often focus on non-electric, robust utility cargo models designed for longevity and easy local repair, bypassing the complexity and high cost of advanced E-Cargo systems. Educational initiatives highlighting the long-term cost savings and health benefits are essential for consumer adoption. Any substantial growth will be contingent upon municipal investments in basic, protected cycle paths and the implementation of financial incentives or fleet leasing programs targeting micro-entrepreneurs and local family businesses, rather than immediate widespread consumer uptake.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Family Freight Bicycle Market.- Riese & Müller

- Urban Arrow

- Larry vs Harry (Bullitt)

- Babboe

- Douze Cycles

- Tern Bicycles

- Yuba Bicycles

- Kona Bicycles

- Surly Bikes

- Xtracycle

- Gazelle

- Butchers & Bicycles

- Nihola

- XYZ Cargo

- Rad Power Bikes (Cargo models)

- Blix Bike

- Pedego

- Cube

- Canyon

- Muli Cycles

Frequently Asked Questions

Analyze common user questions about the Family Freight Bicycle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate of the Family Freight Bicycle Market?

The Family Freight Bicycle Market is anticipated to exhibit a robust Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033, driven largely by the high adoption rate of electric-assist cargo models in urban areas.

Which application segment drives the highest demand in this market?

The Child Transportation segment is the primary revenue driver, establishing family freight bicycles as essential mobility solutions for parents seeking safe, sustainable, and convenient alternatives to automotive transport for daily routines like school runs and errands.

Why is Europe the leading region for Family Freight Bicycle sales?

Europe dominates the market due to its mature cycling infrastructure, supportive governmental subsidies and tax incentives, deep-rooted cycling culture, and high density of major manufacturers focusing on premium e-cargo bike innovation.

What is the most significant restraint impacting market growth?

The high initial purchase price of high-quality, electric-assist family freight bicycles is the most significant restraint, often requiring innovative financing or substantial government subsidies to overcome this economic barrier for mass consumer adoption.

How is AI expected to influence the future of family freight bicycles?

AI integration will enhance safety through predictive maintenance and collision avoidance systems, optimize electric power usage for maximum range under load, and improve security via advanced anti-theft and GPS tracking features.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager