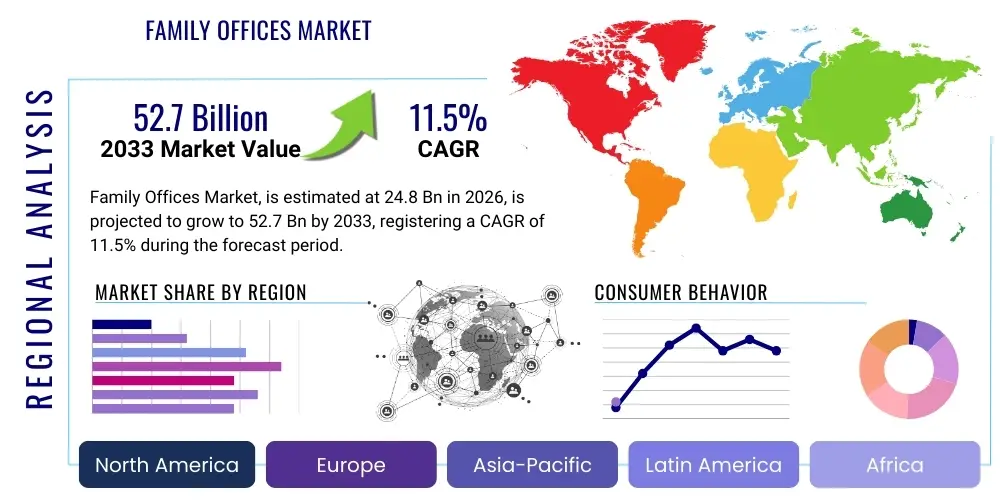

Family Offices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440940 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Family Offices Market Size

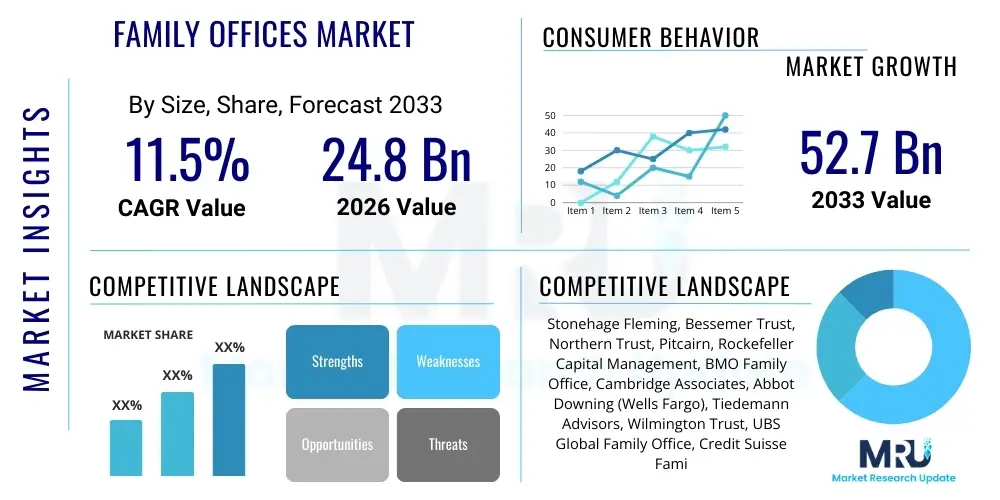

The Family Offices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $24.8 Billion (USD) in 2026 and is projected to reach $52.7 Billion (USD) by the end of the forecast period in 2033.

Family Offices Market introduction

The Family Offices Market encompasses specialized private wealth management advisory firms that serve ultra-high-net-worth (UHNW) individuals and families, providing comprehensive services that extend beyond traditional investment management to include governance, philanthropy, succession planning, risk management, and lifestyle coordination. The increasing complexity of global regulatory environments, coupled with the rising number of generational wealth transfers, has significantly amplified the demand for integrated and discreet financial solutions offered by family offices. These entities act as the central nervous system for complex family finances, managing assets across diverse classes such as private equity, real estate, hedge funds, and traditional securities, ensuring long-term wealth preservation and growth across generations. The product description emphasizes tailored, holistic services delivered through a highly personalized model, distinguishing them from standard private banking offerings.

Major applications of family offices services revolve around strategic asset allocation, sophisticated tax planning, and the execution of complex legal structures designed to protect assets from litigation and facilitate smooth intergenerational transfers. Furthermore, family offices are increasingly involved in direct investments and co-investments, particularly in venture capital and growth equity, allowing families to exert greater control and alignment with their specific values and strategic objectives. The shift towards impact investing and environmental, social, and governance (ESG) considerations is another prominent application, reflecting the evolving priorities of younger generations of wealth holders who seek to align capital deployment with societal outcomes. This comprehensive approach mandates specialized expertise across various disciplines, consolidating fragmented advisory services under one fiduciary umbrella.

The primary benefits of utilizing family office structures include enhanced transparency, reduced conflicts of interest compared to large financial institutions, and the ability to establish customized governance frameworks that cater specifically to the family’s unique dynamics and charitable goals. Driving factors for market growth include the exponential creation of wealth globally, particularly in emerging markets, the complexity introduced by cross-border wealth, and the demographic trend of retiring entrepreneurs seeking structured methods for managing and distributing their business proceeds. Additionally, the proliferation of digital wealth management tools and sophisticated data analytics is enabling family offices to deliver more efficient and insightful services, further boosting their value proposition and market penetration, especially among single-family offices (SFOs) that require institutional-grade back-office support.

Family Offices Market Executive Summary

The Family Offices Market is experiencing robust expansion, driven by significant global wealth creation and the necessity for sophisticated structuring solutions, favoring multi-family offices (MFOs) for scalability and single-family offices (SFOs) for exclusivity. Business trends indicate a strong focus on professionalization, with family offices adopting institutional investment processes, embracing advanced technology platforms, and recruiting high-caliber, non-family executive talent, moving away from purely administrative functions towards highly strategic capital deployment units. Regional trends highlight North America and Europe as mature markets, characterized by high asset values and demanding regulatory compliance, while the Asia Pacific (APAC) region, specifically countries like China and India, represents the fastest-growing segment, fueled by first-generation wealth transfer events and rapid entrepreneurial success requiring urgent wealth structuring solutions. Segment trends show substantial growth in technology adoption services (e.g., reporting, risk modeling), specialized investment services (e.g., private credit, hedge fund due diligence), and non-financial services such as philanthropic management and next-generation education, underscoring a holistic service demand profile.

AI Impact Analysis on Family Offices Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Family Offices Market predominantly revolve around three critical themes: efficiency gains in reporting and compliance, enhancing investment performance through advanced data analytics, and the ethical/security implications of delegating sensitive tasks to algorithms. Users are concerned about whether AI will replace human advisors or augment their capabilities, with a clear preference for augmentation in highly personalized and sensitive areas like succession planning and governance. Expectations center on AI standardizing back-office operations—such as portfolio reconciliation, tax document processing, and regulatory filing—thereby freeing up highly compensated human capital to focus on complex, bespoke client relationship management and strategic asset allocation decisions. A significant volume of questions addresses data privacy and cybersecurity robustness necessary for implementing AI tools, given the extremely sensitive nature of UHNW financial data. Furthermore, family offices are keenly interested in using predictive analytics powered by AI to identify novel investment opportunities, perform faster due diligence on private market assets, and model complex risk scenarios in real-time, demanding solutions that integrate seamlessly with existing legacy systems.

The adoption of AI is fundamentally changing the competitive landscape by democratizing institutional-grade analytical capabilities previously exclusive to the largest financial institutions. For smaller multi-family offices (MFOs), AI-driven automation provides a crucial mechanism to scale operations without commensurate increases in headcount, allowing them to compete effectively against larger players by offering cost-efficient yet sophisticated reporting and risk management services. This technological integration transforms the value proposition from merely administering assets to providing highly predictive and personalized advice rooted in deep quantitative analysis. AI's ability to process vast, unstructured data sets—ranging from geopolitical news feeds to obscure regulatory changes—enables portfolio managers to identify alpha generation opportunities and preemptively mitigate regulatory and market risks far faster than manual processes allow. The implementation trajectory involves an initial focus on low-risk operational areas like robotic process automation (RPA) for routine tasks, gradually moving towards machine learning for complex tasks such as customized portfolio construction based on granular behavioral finance data and multi-dimensional scenario testing relevant to generational objectives.

However, the ethical deployment and transparency of AI remain significant points of contention and concern among principals of family wealth. The 'black box' nature of some advanced ML algorithms poses a governance challenge, especially in fiduciary roles where clear justification for investment decisions is paramount. Consequently, family offices are favoring explainable AI (XAI) models that provide auditable pathways for decision-making. The transition also requires substantial investment in talent acquisition and re-skilling, as existing staff must evolve from traditional financial analysts to sophisticated data interpreters capable of leveraging AI outputs effectively. Ultimately, AI is viewed less as a threat and more as an indispensable tool for maintaining the high standards of accuracy, customization, and discretion demanded by UHNW clients, ensuring that family offices remain relevant and structurally sound in a data-intensive global financial ecosystem while preserving the crucial human element in client engagement and critical judgment.

- Enhanced predictive modeling for bespoke investment strategies and complex risk simulations.

- Automated compliance checks and regulatory reporting via Robotic Process Automation (RPA).

- Streamlined back-office operations, including reconciliation, transaction processing, and general ledger management.

- Personalized client reporting and dynamic visualization dashboards powered by AI-driven data aggregation.

- Improved due diligence processes for private market investments, accelerating deal flow analysis.

- Advanced cybersecurity protocols and fraud detection through machine learning algorithms protecting sensitive data.

- Tailored philanthropic optimization and impact measurement based on sophisticated demographic and market data.

DRO & Impact Forces Of Family Offices Market

The Family Offices Market is significantly shaped by a confluence of accelerating drivers (D), persistent restraints (R), emergent opportunities (O), and influential impact forces. A primary driver is the accelerating transfer of wealth from Baby Boomers to succeeding generations (Millennials and Gen Z), demanding customized structures focused on sustainability and impact. Restraints predominantly center on the acute shortage of highly specialized, multi-disciplinary talent capable of managing the breadth of family office functions, coupled with the ever-increasing complexity and fragmentation of global tax and regulatory mandates, which significantly raise operational compliance costs. Opportunities abound in the burgeoning demand for specialized digital services, particularly in cybersecurity, integrated reporting platforms, and the burgeoning field of private credit investment strategies. These factors converge to create a market environment where technological integration and specialized human expertise are the twin engines of success, profoundly influencing market structure, competitive dynamics, and service delivery models.

Key drivers include the global exponential increase in UHNW individuals, especially in the Asia Pacific region, who require sophisticated cross-border wealth planning. Furthermore, the persistent low interest rate environment in many developed economies pushes family offices away from traditional fixed income, driving them towards complex, higher-return, illiquid alternatives such as private equity, venture capital, and real estate, necessitating expert sourcing and management capabilities. The demand for generational governance structures—mechanisms ensuring family unity, clarity on wealth distribution, and effective communication—also acts as a strong driver, moving family offices beyond pure financial management into sophisticated relational and educational support roles. However, the market faces structural restraints, notably the lack of standardization in services and fee structures, which creates opacity for clients, alongside significant cybersecurity threats that place immense pressure on family offices to invest heavily in resilient data protection infrastructure. The personalized, high-touch nature of the service delivery inherently limits scalability for boutique operations, posing a challenge to efficient growth.

The core opportunities lie in leveraging technological advancements to create scalable, modular service offerings, allowing clients to select specific back-office and reporting functionalities without subscribing to the full suite of services, thus lowering entry barriers for smaller wealth pools. Specific investment opportunities include direct investing in disruptive technologies (FinTech, BioTech) and specializing in ESG and impact investing mandates, aligning capital with family values, which is a key priority for the next generation of wealth owners. Impact forces include the shifting geopolitical landscape, which necessitates dynamic tax planning and asset relocation strategies, and the institutionalization force, compelling SFOs to adopt the rigorous operational and governance standards typically associated with MFOs or large asset managers. These combined forces mandate continuous adaptation, strategic partnerships for expertise augmentation, and proactive engagement with regulatory bodies to mitigate emerging risks and capitalize on complex wealth creation trends.

Segmentation Analysis

The Family Offices Market is highly differentiated and traditionally segmented by the operational structure (Single vs. Multi-Family Office), the nature of services offered (Financial vs. Non-Financial), and the asset class focus. This segmentation is crucial as it reflects varying client needs, fee structures, and required organizational capabilities. The operational segmentation helps in understanding the economies of scale and the level of customization provided, with SFOs offering maximum exclusivity and control, while MFOs offer greater diversification of expertise and cost-sharing benefits. Service segmentation highlights the market's evolution from purely investment-focused advice to comprehensive lifestyle, governance, and administrative support. Analyzing these segments provides strategic insights into which service modules are experiencing the highest growth rates and where technological investment yields the greatest operational efficiency gains, particularly in areas like integrated reporting and risk aggregation, allowing vendors to tailor sophisticated solutions to distinct client organizational models.

- Type:

- Single-Family Office (SFO)

- Multi-Family Office (MFO)

- Virtual Family Office (VFO)

- Service Type:

- Financial Services (Investment Management, Tax & Accounting, Risk Management, Wealth Structuring)

- Non-Financial Services (Philanthropy Management, Concierge & Lifestyle, Governance & Succession Planning, Next-Gen Education)

- Asset Class Focus:

- Public Markets (Equities, Fixed Income)

- Private Markets (Private Equity, Venture Capital, Real Estate, Private Credit)

- Alternative Assets (Hedge Funds, Commodities)

- Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Family Offices Market

The value chain for the Family Offices Market is intricate, starting with upstream activities related to data acquisition, specialized financial research, and talent sourcing, flowing through the core service delivery, and concluding with downstream processes centered on reporting, governance assurance, and ongoing client feedback integration. Upstream analysis involves sourcing proprietary deal flow, conducting intensive macroeconomic research, and ensuring compliance with initial regulatory hurdles. The quality of the upstream research and the integrity of the data inputs (e.g., custodian feeds, third-party valuations) directly determine the robustness of subsequent investment advice and reporting accuracy. Highly capable technology vendors specializing in wealth management software and data aggregation platforms form a critical upstream component, supplying the essential infrastructure for modern family office operations. Talent sourcing in the upstream environment is highly competitive, focusing on acquiring specialists in complex fields like cross-border tax law, alternative investment due diligence, and generational planning psychology.

Downstream analysis focuses heavily on the client experience and the assurance of long-term fiduciary adherence. Distribution channels are predominantly direct, characterized by high-touch, personalized advisory relationships, where trust and discretion are paramount. Direct interaction allows for the precise customization of services, which is the defining competitive advantage of family offices. Indirect distribution plays a smaller role but is growing, primarily through strategic partnerships with specialized third-party providers such as niche legal firms, specialized cybersecurity consultants, and sophisticated software-as-a-service (SaaS) providers offering specific modules (e.g., philanthropic tracking or governance software). The final stage of the downstream process involves iterative reporting, performance attribution analysis, and continuous adaptation of the wealth strategy based on family needs and evolving global economic conditions. This ensures that the family office remains deeply integrated into the family's long-term objectives.

The core value creation lies in the central service delivery phase, where disparate information is synthesized, bespoke strategies are formulated, and critical decisions regarding investment allocation, risk mitigation, and generational transfer are executed. Effective management of this centralized hub requires robust internal controls and sophisticated management information systems. The distribution channel, whether direct through internal relationship managers or indirectly through affiliated professional networks, must emphasize security and confidentiality above all else. Success in the family office value chain is ultimately measured by the ability to maintain long-term relationships, demonstrate measurable value creation (both financial and non-financial), and seamlessly integrate complex multi-jurisdictional requirements into a cohesive, manageable structure, validating the substantial fees charged for these personalized, high-stakes services.

Family Offices Market Potential Customers

The primary potential customers and end-users of Family Office services are ultra-high-net-worth (UHNW) individuals and their immediate and extended families, typically defined as those with liquid assets exceeding $30 million, though increasingly the services are being utilized by high-net-worth (HNW) individuals seeking formalized structure. This core demographic includes successful entrepreneurs who have recently liquidated business assets through mergers and acquisitions or initial public offerings, inheriting families facing significant generational wealth transitions, and high-earning executives requiring sophisticated tax and investment structuring for complex compensation packages. The common denominator among these potential customers is the need for integrated, centralized management of intricate financial affairs that transcend simple asset management, demanding comprehensive solutions for risk, governance, and legacy planning.

Beyond individual and familial entities, certain institutional wealth pools and foundations also serve as potential customers, often utilizing Multi-Family Offices (MFOs) for outsourced operational efficiency, particularly in areas like middle- and back-office functions and specialized alternative investment due diligence. Furthermore, the market is expanding to include newly wealthy families in emerging economies who lack established financial infrastructure and require accelerated institutionalization of their wealth management practices to safeguard newly created capital. These new customers are particularly receptive to turnkey MFO solutions that offer immediate access to global expertise and compliance mechanisms. The increasing global mobility of UHNW individuals also creates demand for family offices capable of navigating multiple tax jurisdictions and regulatory environments seamlessly.

The characteristics of an ideal customer profile include a strong mandate for privacy, a willingness to delegate complex tasks to trusted advisors, and a long-term perspective on wealth preservation and growth, often spanning multiple generations. They seek a cohesive strategy that aligns investment decisions with deeply held family values, corporate governance principles, and philanthropic goals. The rising importance of social impact means that next-generation buyers are actively seeking family offices that are proficient in sustainable investing (ESG) reporting and execution. This evolution implies that potential customers are not merely seeking financial performance; they are purchasing highly customized solutions for risk transfer, complex coordination, and the preservation of family harmony across financial and non-financial domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.8 Billion (USD) |

| Market Forecast in 2033 | $52.7 Billion (USD) |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stonehage Fleming, Bessemer Trust, Northern Trust, Pitcairn, Rockefeller Capital Management, BMO Family Office, Cambridge Associates, Abbot Downing (Wells Fargo), Tiedemann Advisors, Wilmington Trust, UBS Global Family Office, Credit Suisse Family Office, Citi Private Bank, Silvercrest Asset Management, Glenmede, Fidelity Family Office Services, Hawthorn (PNC), Iconiq Capital, Key Private Bank, Merrill Lynch Private Wealth Management |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Family Offices Market Key Technology Landscape

The technology landscape for the Family Offices market is centered on achieving holistic data aggregation, enhancing security, and facilitating sophisticated scenario planning, moving rapidly beyond traditional spreadsheet-based management. Core technology utilized includes integrated Portfolio Management Systems (PMS) and Wealth Reporting Platforms (WRPs) that offer a unified view of highly fragmented assets—ranging from traditional securities held across multiple custodians to illiquid assets like private equity stakes and fine art. Furthermore, Customer Relationship Management (CRM) systems tailored for UHNW client interactions are essential, often integrated with governance software that tracks family policies, meeting minutes, and succession planning progress. The trend is shifting towards cloud-native, modular platforms that offer application programming interface (API) connectivity, enabling seamless integration with specialized third-party solutions for tasks like advanced tax modeling or regulatory filing, ensuring scalability and reducing reliance on costly, monolithic legacy enterprise systems.

Critical technological innovation is particularly concentrated in the areas of cybersecurity and risk analytics. Given the high-profile nature and sensitive data managed by family offices, robust multi-layer security protocols, including advanced encryption, biometrics, and dedicated managed security service providers (MSSPs), are non-negotiable. For investment management, the adoption of sophisticated financial modeling tools leveraging AI/ML is becoming standard, allowing analysts to perform instant stress testing, calculate complex performance attribution across diverse jurisdictions, and utilize predictive analytics to guide opportunistic direct investments. This technology migration allows family offices to professionalize their investment operations to institutional standards, closing the performance gap between SFOs and large asset management firms, while maintaining the required level of privacy and personalization expected by the principals.

The future technology trajectory involves deeper integration of blockchain technology for secure asset tokenization and streamlined legal documentation, potentially reducing reliance on intermediaries for certain transactions. The increasing prevalence of Virtual Family Offices (VFOs) is wholly dependent on resilient, secure digital infrastructure, including robust video conferencing, secure document vaults, and collaboration tools that maintain absolute confidentiality. Technology implementation is often driven by the need to manage complexity: compliance software that automatically updates with changes in global tax laws (e.g., OECD regulations) and wealth transfer planning tools that model multi-jurisdictional inheritance scenarios are highly valued. These technologies collectively enable family offices to transition from administrative back-offices to highly agile, digitally-enabled strategic advisory hubs, supporting globalized wealth structures efficiently and effectively.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for family offices globally, characterized by high wealth concentration, sophisticated financial markets, and a deeply embedded culture of entrepreneurial wealth creation. The demand is heavily driven by generational transitions and the complexity introduced by managing substantial private market allocations, necessitating high-level expertise in regulatory compliance (e.g., SEC registration, anti-money laundering protocols) and intricate tax planning. The region is a leader in adopting specialized technology solutions, hosting many of the world's largest MFOs, and showing strong growth in both traditional investment advisory and specialized non-financial services like cybersecurity consulting and next-generation financial literacy programs. The competitive landscape is dense, compelling family offices to continuously innovate their value proposition, focusing heavily on transparent fee structures and customized reporting capabilities designed to navigate a highly litigious environment, ensuring long-term asset protection and optimized capital deployment.

- Europe: Europe represents a highly fragmented yet significant market, driven by diverse national regulatory environments, long-established aristocratic wealth, and a recent surge in tech entrepreneurship, particularly in the UK, Switzerland, and Germany. Switzerland remains the premier hub for cross-border wealth management due to its long history of financial stability and privacy laws, attracting SFOs and MFOs focused on international regulatory arbitrage and complex residency issues. A key regional trend is the rapid adoption of Environmental, Social, and Governance (ESG) investing mandates, particularly among Western European family offices, often driven by government policies and younger generations' pressure. The main challenge is harmonizing service delivery across numerous legal and tax jurisdictions, making expertise in multi-domiciliary planning a crucial differentiator. The market requires localized expertise combined with global reach, favoring large MFOs with extensive global network capabilities and specialized legal advisory services.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by unprecedented wealth creation in mainland China, India, Southeast Asia, and Hong Kong/Singapore serving as major regional financial centers. Unlike the multi-generational wealth of the West, the APAC market is dominated by first-generation entrepreneurial wealth, requiring immediate, centralized, and robust wealth preservation structures. The primary drivers are succession planning for founders preparing to transition their operational businesses and the urgent need for professional governance frameworks to handle rapidly appreciating assets. The APAC market is characterized by a strong preference for direct real estate investment and involvement in domestic venture capital ecosystems. Challenges include a scarcity of experienced local talent, cultural nuances surrounding wealth disclosure, and rapidly evolving, often opaque, regulatory environments. Singapore and Hong Kong are actively competing to attract family offices through favorable tax incentives and regulatory stability, positioning themselves as leading regional hubs for wealth aggregation and strategic regional deployment.

- Latin America (LATAM): The LATAM family office market is driven primarily by the need for capital protection against economic instability, high inflation, and political volatility in home countries. Family offices often focus heavily on establishing offshore structures, managing currency risk, and diversifying assets globally, primarily in stable North American and European markets. Key countries include Brazil, Mexico, and Chile. The regional demand emphasizes sophisticated estate planning and robust fiduciary services aimed at preserving capital across political cycles. Many UHNW families from LATAM establish Virtual or Multi-Family Offices in Miami or New York to gain access to global institutional investments and secure regulatory frameworks while maintaining operational ties to their domestic businesses. Technology adoption is critical for providing real-time, consolidated reporting across multi-currency, multi-jurisdictional portfolios, essential for monitoring high-risk domestic exposures.

- Middle East & Africa (MEA): The MEA market, concentrated largely in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia, Qatar), is dominated by large SFOs established by ruling families and prominent merchant families whose wealth is often tied to natural resources or large infrastructure projects. These family offices operate with a highly institutional structure, often employing internal private equity teams for direct local and international investments. The market is increasingly professionalized, driven by national visions for economic diversification away from oil dependence, leading to large-scale investment in technology, tourism, and renewable energy sectors. The UAE, particularly Dubai and Abu Dhabi, is actively fostering an ecosystem to attract international family offices through specialized free zones and appealing regulatory frameworks. Key demands include complex governance modeling, private aviation management, and sourcing high-quality international co-investment opportunities, alongside sophisticated philanthropic strategies aligned with national development goals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Family Offices Market.- Stonehage Fleming

- Bessemer Trust

- Northern Trust

- Pitcairn

- Rockefeller Capital Management

- BMO Family Office

- Cambridge Associates

- Abbot Downing (Wells Fargo)

- Tiedemann Advisors

- Wilmington Trust

- UBS Global Family Office

- Credit Suisse Family Office

- Citi Private Bank

- Silvercrest Asset Management

- Glenmede

- Fidelity Family Office Services

- Hawthorn (PNC)

- Iconiq Capital

- Key Private Bank

- Merrill Lynch Private Wealth Management

Frequently Asked Questions

Analyze common user questions about the Family Offices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Single-Family Office (SFO) and a Multi-Family Office (MFO)?

An SFO serves one ultra-high-net-worth family, offering maximum privacy, control, and customization, typically managing assets above $100 million. Conversely, an MFO serves multiple non-related families, providing cost efficiencies, shared expertise, and institutional infrastructure through economies of scale, making it suitable for families with asset levels often starting lower than SFO thresholds.

How is technology, specifically AI, reshaping the core functions of Family Offices?

AI is primarily driving operational efficiency by automating middle- and back-office functions like regulatory reporting, data reconciliation, and compliance checks. This augmentation allows human advisors to concentrate on complex, high-value client relationship management, sophisticated strategic asset allocation, and personalized generational planning, enhancing service speed and reducing operational risks substantially.

What are the key drivers of market growth in the Asia Pacific (APAC) region for Family Offices?

Growth in APAC is predominantly driven by the significant creation of first-generation entrepreneurial wealth, requiring urgent, formalized succession planning and structuring to manage highly appreciated business assets. Favorable regulatory environments and tax incentives offered by major regional hubs like Singapore and Hong Kong also attract significant cross-border wealth consolidation.

What minimum asset level is generally required for utilizing comprehensive Family Office services?

While the exact threshold varies widely, Single-Family Offices (SFOs) are generally established by families with investable assets exceeding $100 million to justify the high fixed operating costs. Multi-Family Offices (MFOs) often lower this threshold, with entry points typically ranging from $20 million to $50 million, offering scaled, professional services to a broader UHNW and high-end HNW base.

Beyond investment management, what non-financial services do Family Offices commonly provide?

Non-financial services are critical differentiators, including comprehensive governance structure creation, family constitution drafting, philanthropic management and impact investing strategy, next-generation financial education, complex lifestyle management (e.g., travel, security), and strategic succession planning across business and wealth holdings to ensure family unity and generational continuity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager