Family or Indoor Entertainment Centers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441748 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Family or Indoor Entertainment Centers Market Size

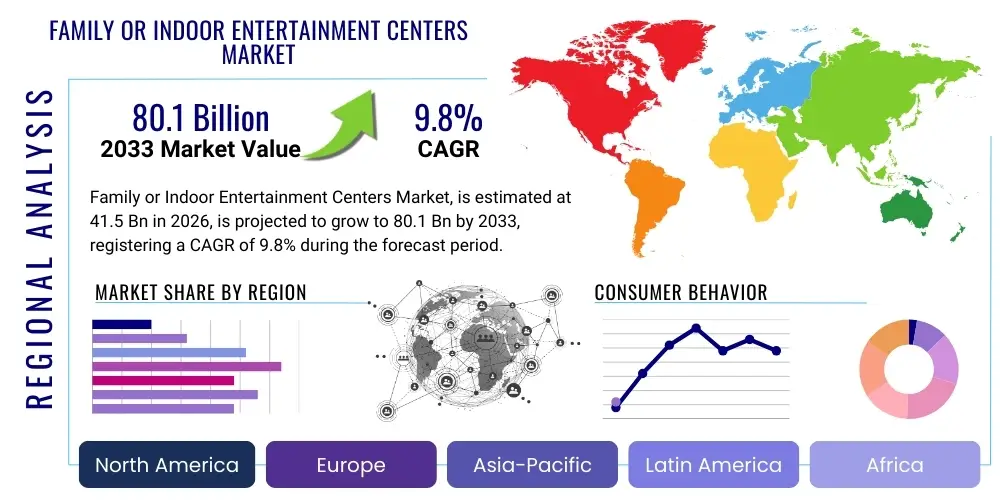

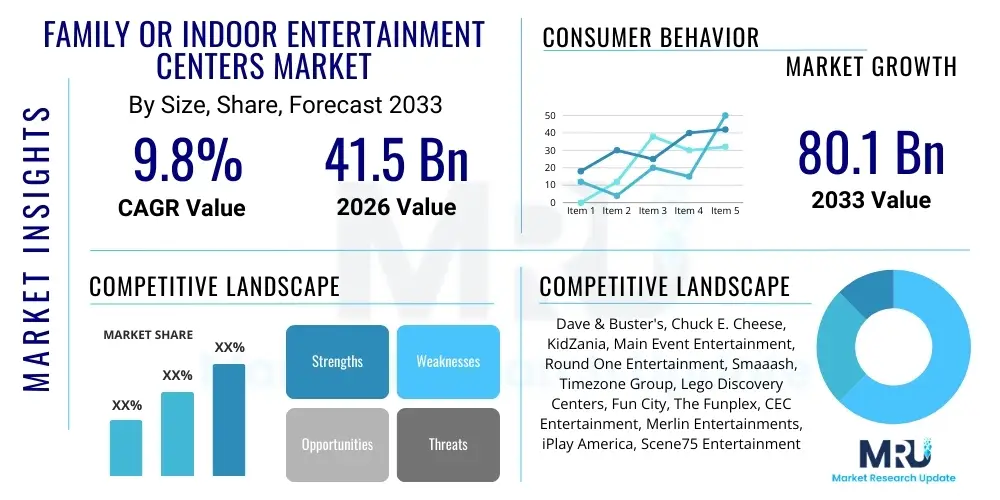

The Family or Indoor Entertainment Centers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 41.5 Billion in 2026 and is projected to reach USD 80.1 Billion by the end of the forecast period in 2033.

Family or Indoor Entertainment Centers Market introduction

The Family or Indoor Entertainment Centers (FEC) Market encompasses a diverse and increasingly sophisticated portfolio of dedicated venues that offer structured leisure, recreation, and edutainment activities within climate-controlled, safe indoor environments. These centers serve as crucial social hubs, moving beyond simple arcade offerings to integrate high-tech attractions, elaborate dining experiences, and personalized customer journeys. The fundamental market drivers include the persistent, post-global pandemic emphasis on shared family experiences, the necessity for weather-independent entertainment alternatives, and the critical social trend of prioritizing experiential consumption over the acquisition of material goods. This shift positions FECs as integral providers of vital recreational infrastructure, especially in dense urban landscapes where private recreational space is limited.

The core product offering of modern FECs is the delivery of immersive, curated entertainment modules designed to appeal to multiple age groups simultaneously. Major applications span routine weekend outings, specialized party hosting (particularly birthdays and celebrations), structured corporate team-building events, and increasingly, specialized edutainment programs aligned with school curricula. Key user benefits derived from these venues extend beyond simple amusement; they include fostering essential social skills, encouraging physical activity in a controlled setting, stimulating cognitive development through complex interactive games, and strengthening familial bonds. The integration of robust safety protocols and professional staffing provides parents with confidence, enhancing the overall perceived value of the outing and contributing significantly to the market's favorable positioning relative to home-based digital entertainment.

The driving forces sustaining the market’s projected high CAGR are deeply rooted in technological acceleration and demographic changes. Rapid urbanization globally concentrates large populations requiring localized entertainment solutions. Furthermore, the quick cycle of innovation in gaming technology—particularly in virtual reality (VR), augmented reality (AR), and simulation engineering—provides FEC operators with novel and high-throughput attractions that justify premium pricing and encourage frequent, repeat visitation. Strategic business alignments, such as the co-location of FECs within large commercial real estate developments (malls, lifestyle centers), generate mutual foot traffic benefits. This convergence of technology, convenience, and the fundamental human desire for social, structured play solidifies the FEC market as a robust and expanding sector within the broader leisure industry globally.

Family or Indoor Entertainment Centers Market Executive Summary

The Family or Indoor Entertainment Centers Market is currently defined by two simultaneous forces: aggressive digital modernization and strategic expansion into high-revenue-per-square-foot models, particularly the 'Eatertainment' concept. Business trends show a distinct movement away from low-fidelity, low-margin arcade games towards sophisticated, proprietary Location-Based Entertainment (LBE) experiences, notably high-end VR simulations and technologically augmented physical challenges. This trend necessitates significantly higher initial capital investment but promises enhanced operational efficiency and higher customer lifetime value (CLV) due to superior engagement. Major international chains are pursuing aggressive M&A strategies to achieve economies of scale, standardizing operations, and leveraging centralized procurement power, driving market consolidation across several key geographies.

Regionally, the market dynamics reflect a clear delineation between mature markets focused on renewal and emerging markets driven by foundational growth. North America and Europe, saturated with traditional centers, are seeing investment focused on integrating food and beverage excellence and implementing advanced data analytics for personalized marketing and yield management. Conversely, the Asia Pacific (APAC) region continues its dominance as the epicenter of market growth, fueled by vast infrastructure investment in entertainment zones and the sheer volume of middle-class households prioritizing discretionary spending on children’s activities. Latin America and the Middle East and Africa (MEA) are characterized by the rapid development of large, thematic destination centers often supported by government-backed tourism initiatives, positioning them as significant future growth vectors.

Segment trends underscore the supremacy of high-tech and experiential offerings. The Virtual Reality and Augmented Reality (VR/AR) component segment commands the fastest growth, capitalizing on its ability to offer high-replay value within a constrained physical footprint. End-user segmentation reveals a crucial shift: while families with young children remain the foundational revenue source, the fastest-growing segment is teenagers and young adults, attracted by high-stakes competitive gaming (eSports integration) and complex, non-linear narrative attractions like premium escape rooms. Operators are strategically adapting facility sizes, with growth evident both in large-scale anchor centers offering comprehensive experiences and small, niche micro-FECs specializing in a single high-demand activity like bowling or specific edutainment modules, maximizing flexibility and targeting hyper-local demand efficiently.

AI Impact Analysis on Family or Indoor Entertainment Centers Market

Analyzing common user discourse reveals a strong focus on how Artificial Intelligence (AI) can transcend basic automation and create genuinely adaptive and secure entertainment ecosystems within Family or Indoor Entertainment Centers. Users frequently question the mechanisms by which AI can personalize dynamic storytelling in attractions, ensuring that game scenarios or ride experiences feel unique during every visit, thereby solving the problem of attraction fatigue. Operational efficiency is a major theme, particularly concerning predictive staffing models that use AI to forecast localized demand fluctuations based on variables like school holidays, public events, and real-time weather data. Additionally, security and safety are paramount concerns, with users keen to understand how AI-powered computer vision systems can instantaneously detect safety hazards or inappropriate behavior in play areas without relying solely on human monitoring, ensuring a proactive approach to risk management and minimizing liability exposure. Integration challenges and return on investment (ROI) for these high-cost AI systems are also central to user inquiries.

- AI-driven Personalization Engines: Utilizing machine learning algorithms to dynamically adjust the difficulty, narrative paths, content theming, and duration of interactive attractions based on individual visitor skill levels and past engagement data captured through RFID wristbands. This enhances engagement and ensures high replayability.

- Predictive Maintenance Protocols: Implementing IoT sensors and AI diagnostics on complex mechanical rides and digital simulators to predict component failure proactively, scheduling maintenance during off-peak hours, which drastically reduces unexpected downtime and preserves the quality of the visitor experience.

- Optimized Operational Workflow: Deploying AI to manage human resources by creating dynamic staffing schedules that align with hourly foot traffic forecasts, optimizing cashier allocation, attraction supervision, and F&B preparation efficiency, resulting in significant labor cost savings.

- Advanced Crowd and Safety Management: Leveraging computer vision systems integrated with existing CCTV networks to continuously monitor crowd density, identifying potential bottlenecks or overcapacity issues, and automatically alerting staff to safety violations, such as unauthorized climbing or distress signals, allowing for swift incident response.

- Targeted Marketing and Loyalty Programs: Using AI to analyze complex transactional and behavioral data, enabling operators to construct highly precise customer segments and deliver automated, timely promotions (e.g., F&B discounts, package upgrades) via digital channels, boosting conversion rates and loyalty program enrollment.

- Content Curation and Testing: Applying generative AI tools to rapidly prototype, iterate, and test new digital assets, soundscapes, and themed environments for VR and AR attractions, drastically shortening the time-to-market for novel entertainment content and keeping the center's offerings fresh and competitive.

DRO & Impact Forces Of Family or Indoor Entertainment Centers Market

The momentum of the Family or Indoor Entertainment Centers Market is dictated by robust Drivers centered around societal behavior and technological integration. The predominant driver is the escalating preference for experiences over material goods, particularly among Millennials and Gen Z parents, who seek high-quality, memorable shared activities for their families. This behavioral trend is strongly supported by technological drivers, chiefly the continuous advancement and cost reduction of LBE VR/AR platforms which deliver compelling, differentiated experiences that home systems cannot replicate. Furthermore, global demographic shifts, specifically the rapid expansion of urban centers and the associated rise in disposable incomes in emerging economies, create readily available, concentrated customer bases, justifying large-scale capital investments into new facility construction and comprehensive infrastructure development.

However, significant Restraints impede unbridled market expansion and pose substantial operational risks. The most acute challenge is the inherently high barrier to entry due to massive initial capital expenditure required for acquiring specialized, high-capacity mechanical rides, advanced digital infrastructure, and securing suitable commercial real estate. Moreover, the technological lifecycle within the FEC sector is extremely short; equipment depreciation is rapid, and operators must contend with constant pressure to refresh or upgrade attractions every 3-5 years to maintain novelty, leading to high operating expenses. Regulatory burdens, particularly stringent local and international standards pertaining to child safety, fire codes, and electrical systems, add complexity and continuous compliance costs, severely impacting profitability for smaller independent operators who lack the scale to absorb these overheads.

Opportunities for strategic growth are concentrated in market niche identification and synergistic partnerships. The Edutainment segment, combining interactive play with curriculum-aligned learning (STEM fields), offers high growth potential due to institutional demand and government interest in innovative education methods. Strategic licensing of well-known Intellectual Property (IP)—ranging from movie franchises to popular video games—allows operators to leverage established brand recognition, ensuring strong initial visitor turnout and merchandising potential. Impact forces revolve around the sector’s high sensitivity to economic downturns, which immediately curb discretionary spending, and the intense competitive pressure from alternative leisure activities (e.g., cinemas, theme parks, home streaming). Success is therefore contingent upon achieving scalable, multi-site operational excellence and continuous technological adaptation to maintain a compelling value proposition that surpasses home-based entertainment alternatives.

Segmentation Analysis

The comprehensive segmentation of the Family or Indoor Entertainment Centers Market is pivotal for both strategic planning and targeted investment, allowing operators to optimize their attraction mix based on local demographic characteristics and competitive landscape analysis. Segmentation by component is critical, distinguishing between capital-intensive physical attractions (e.g., bowling, soft play) and high-throughput digital systems (e.g., arcades, VR simulators). The mix between these components directly influences the center's revenue generation model, with digital attractions typically requiring lower physical space but high technology maintenance, while physical attractions demand more safety oversight and cleaning resources but offer high perceived social value.

Segmentation by Facility Size dictates the operational scale and market reach. Small (micro-FECs) focus on convenience and hyper-local communities, specializing in single high-demand activities like escape rooms or laser tag, offering attractive lease terms in high-traffic urban areas. Conversely, Large (destination FECs) require major anchor locations, typically near transport hubs or large retail complexes, offering a holistic, all-day entertainment package including diverse F&B outlets, multiple high-end attractions, and event hosting facilities, aiming for maximum dwell time and high spend-per-visitor metrics. The choice of facility size is inherently linked to real estate availability and the scale of required capital deployment.

The analysis based on End User and Application is fundamental to content curation and revenue management. Centres targeting Young Children (Ages 3-12) emphasize safety, educational themes, and redemption games, generating revenue primarily through party packages and food sales directed at accompanying parents. Centers focused on Teenagers and Young Adults rely heavily on cutting-edge VR, competitive eSports infrastructure, and adult-oriented dining concepts (Eatertainment), maximizing revenue through higher ticket prices per experience and higher F&B margins. Successful market players strategically blend these applications to ensure year-round traffic, using off-peak times to cater to niche markets like corporate events or structured edutainment programs, effectively smoothing out seasonal and weekly demand volatility.

- Component:

- Arcade Gaming Systems: Includes classic coin-op, redemption games, and sophisticated motion simulators, often tied to card-swipe/RFID systems for streamlined revenue collection.

- Virtual Reality (VR) & Augmented Reality (AR) Simulators: High-fidelity, multi-user platforms and proprietary LBVR systems that offer highly immersive, short-cycle experiences.

- Soft Play Equipment & Toddler Zones: Essential non-digital infrastructure focusing on physical activity and safety for the youngest demographic, requiring frequent sanitization.

- Physical Activity Attractions: Includes high-adrenaline experiences like indoor skydiving, multi-level climbing walls, extensive ropes courses, and specialized sports facilities like indoor mini-golf and karting.

- Skill-Based Games: Core attractions such as professional bowling alleys, laser tag arenas, and tactical paintball fields, often serving as anchor tenants in large centers.

- Food & Beverage (F&B) and Merchandising Systems: Revenue-critical ancillary services ranging from quick-service concessions to full-service restaurants and licensed merchandise retail.

- Facility Size:

- Small (Under 5,000 sq. ft.): Micro-FECs focusing on high-density activities like dedicated escape rooms or localized laser tag, maximizing revenue per square foot in urban settings.

- Medium (5,000 to 20,000 sq. ft.): Standard community centers offering a balanced mix of soft play, arcade, and core attractions like mini-bowling or climbing features, serving localized family markets.

- Large (Above 20,000 sq. ft.): Destination mega-centers incorporating extensive F&B, multiple anchor attractions (e.g., karting, full bowling), and large event spaces, drawing regional foot traffic.

- End User:

- Families with Young Children (Ages 3-12): Primary demographic, sensitive to safety features, pricing of party packages, and availability of healthy F&B options.

- Teenagers and Young Adults (Ages 13-25): Driven by technology, competitive social gaming, novelty factor, and sophisticated dining/hangout environments.

- Adults and Corporate Groups: Primarily utilize facilities during off-peak hours for team building, social events, requiring private space and high-end catering packages.

- Application:

- Arcade & Video Gaming: Traditional and modern digital entertainment revenue stream.

- Physical Play & Sports Simulation: Focuses on kinetic activities and fitness-based fun, including interactive sports screens and fitness tracking.

- Edutainment & Structured Learning: Customized programs blending entertainment with STEM education, often targeting school groups and utilizing interactive museum-style exhibits.

- Themed Entertainment: High-investment, IP-driven immersive experiences, including highly stylized LBE VR and narrative-driven walk-through attractions.

Value Chain Analysis For Family or Indoor Entertainment Centers Market

The Value Chain Analysis commences with the Upstream segment, which involves the critical processes of Research & Development, content creation, and highly specialized manufacturing. This stage includes securing intellectual property rights for new games and themed environments, manufacturing robust arcade cabinets, highly engineered mechanical ride systems, and specialized VR/AR hardware (e.g., motion simulators, haptic vests). Key upstream suppliers are global leaders in gaming hardware, industrial engineering firms, and specialized food and beverage (F&B) sourcing partners. Strategic supplier relationships are essential for quality control, predictable supply chain logistics, and ensuring rapid access to the latest, high-margin entertainment technologies while mitigating potential supply disruptions associated with proprietary hardware components.

The central activity of the value chain is the Inbound Logistics and Operations of the FEC facility itself. This includes strategic site selection, facility design and construction (often integrating complex mechanical and digital infrastructure), installation of attractions, and the continuous management of operations—encompassing staffing, maintenance, and rigorous safety compliance. Distribution channels are predominantly direct-to-consumer, relying on the physical presence of the center to deliver the service. However, indirect channels play a crucial role in customer acquisition and aggregation: online booking systems, affiliate marketing partnerships with local tourism operators, and licensing arrangements with major commercial real estate developers (e.g., mall operators) to secure prime locations and mutual traffic benefits. The operational stage dictates the customer’s immediate experience and drives key performance indicators like throughput and attraction uptime.

The Downstream segment focuses on customer interface, revenue generation, and retention. Core activities involve highly organized ticketing and access control (often managed via integrated RFID technology), effective sales of F&B and merchandise (which contribute significantly to overall profitability), and proactive customer relationship management (CRM) via loyalty programs and post-visit feedback loops. Effective downstream management requires highly trained staff focused on safety, hospitality, and upselling opportunities, maximizing the average transaction value per visitor. The success of the direct channel is amplified by utilizing advanced analytics to understand visitor flow and purchasing behavior, allowing for iterative improvements to the attraction mix and pricing strategies, ensuring that the total customer experience is compelling enough to generate high positive word-of-mouth marketing and sustainable repeat visitation, thereby completing and reinforcing the value cycle.

Family or Indoor Entertainment Centers Market Potential Customers

The segmentation of potential customers in the Family or Indoor Entertainment Centers Market is multi-layered, reflecting the diverse range of services offered. The primary customer group remains the nuclear family unit, typically composed of middle-to-affluent socioeconomic status parents (age 30–50) with children between the ages of 4 and 14. These consumers prioritize convenience, safety certifications, cleanliness, and the availability of packaged deals, making decisions heavily influenced by the center's reputation for security and suitability for various age ranges. For this core segment, specialized event hosting, such as premium birthday party packages that alleviate parental planning stress, represents a significant, high-margin revenue stream, particularly during weekend hours and school holidays.

A rapidly expanding secondary customer base includes teenagers and young adults (15–29), often seeking social interaction and high-intensity, competitive experiences. This demographic is less focused on passive leisure and more interested in competitive eSports arenas, highly themed escape rooms, and high-fidelity racing or flight simulators that offer social bragging rights. Marketing efforts targeting this group leverage social media, emphasize technological novelty, and promote specialized late-night or adult-only event programming, often integrated with sophisticated dining concepts and specialized non-alcoholic or alcoholic beverages (depending on the jurisdiction and license). Attracting this segment is vital for utilizing facility capacity during evening hours when family traffic typically decreases.

Institutional and corporate customers represent high-value, predictable revenue outside of peak consumer hours. Potential institutional buyers include local schools, daycare centers, and community organizations utilizing edutainment facilities for educational field trips, favoring centers that provide curriculum-aligned learning experiences in STEM or creative arts. Corporate clients, conversely, book facilities for large-scale employee team-building, product launches, or client entertainment. These buyers demand custom catering, private event spaces, dedicated staff support, and integrated team-competition activities (e.g., specialized laser tag or bowling leagues), making them crucial partners for improving facility utilization and generating consistent mid-week revenue streams, thereby stabilizing overall cash flow management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 41.5 Billion |

| Market Forecast in 2033 | USD 80.1 Billion |

| Growth Rate | CAGR 9.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dave & Buster's, Chuck E. Cheese, KidZania, Main Event Entertainment, Round One Entertainment, Smaaash, Timezone Group, Lego Discovery Centers, Fun City, The Funplex, CEC Entertainment, Merlin Entertainments, iPlay America, Scene75 Entertainment Center, Playtime LLC, Bowlero Corporation, Cineplex Entertainment, Al-Othman Group, Pinstripes, and Autobahn Indoor Speedway. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Family or Indoor Entertainment Centers Market Key Technology Landscape

The technological evolution of the Family or Indoor Entertainment Centers Market is defined by the critical adoption of digital integration, moving beyond traditional mechanics to highly connected, data-rich environments. The foundational shift involves sophisticated Point-of-Sale (POS) and Enterprise Resource Planning (ERP) systems that manage all operational facets, from inventory management (especially F&B logistics) to labor scheduling and customer throughput analysis. Crucially, the ubiquitous use of Radio Frequency Identification (RFID) wristbands or Near Field Communication (NFC) cards has replaced cash transactions, providing seamless payment across all attractions and allowing operators to capture granular data on visitor behavior, dwell time, preferred attractions, and average spend-per-visitor, which is essential for maximizing revenue per guest and dynamically adjusting attraction maintenance cycles.

In terms of entertainment offerings, the technological focus is squarely on Location-Based Entertainment (LBE) systems that offer high-immersion, group-based experiences. This includes advanced Virtual Reality (VR) platforms that utilize wireless, untethered headsets, high-precision inside-out tracking, and powerful GPU processing that runs complex, proprietary content designed specifically for high-throughput commercial use. Coupled with this are sophisticated simulation technologies, such as full-motion hydraulic platforms, 4D seating systems that incorporate wind, scent, and temperature effects, and projection mapping that transforms physical spaces into dynamic interactive environments. These technologies differentiate the out-of-home experience from consumer-grade products, justifying the admission fee and driving strong consumer value perception.

Furthermore, technology is indispensable for safety and sustainability. Modern FECs deploy advanced computer vision and IoT systems—often managed through centralized cloud architectures—for continuous, automated monitoring of soft play structures, high-altitude attractions, and exit points, instantly flagging any potential safety breaches to staff. Energy efficiency is also a rising technological consideration; next-generation attractions are engineered with optimized power consumption profiles and modular components to facilitate quick upgrades rather than full replacements, improving the return on technology investment (ROTI). This convergence of robust operational software, cutting-edge immersive hardware, and AI-enhanced security and analytics forms the technological backbone supporting the market’s sustained profitability and scalability across international markets.

Regional Highlights

Global growth in the FEC market is distinctly uneven, with mature regions focused on innovation and optimization, and emerging markets prioritizing aggressive, foundational facility build-out.

- North America: Representing a significant revenue share, the North American market is highly competitive and characterized by the dominance of 'Eatertainment' chains (e.g., Dave & Buster’s, Main Event). Growth is driven not by the opening of simple centers, but by the strategic refresh and expansion of existing properties, integrating high-margin F&B, professional eSports lounges, and the newest generation of high-fidelity LBVR attractions, targeting older Gen Z and Millennial consumers alongside families.

- Europe: The European market displays heterogeneity, with strong pockets of growth in Western Europe (UK, Germany) focused on niche segments like dedicated trampoline parks and themed escape rooms that align with localized leisure preferences. Regulatory compliance is stringent, particularly regarding safety standards. The market is slowly consolidating, with operators leveraging data analytics to optimize facility layouts and pricing structures across diverse national markets.

- Asia Pacific (APAC): The undeniable market leader in terms of growth trajectory, APAC benefits from favorable demographics—a large youth population and rapidly growing middle class with increased discretionary income. Investment is massive, particularly in China, India, and Southeast Asia, focusing on large-scale, anchor FECs integrated within vast mixed-use commercial developments. Edutainment concepts based on international and local IP are highly successful due to strong parental focus on supplementary education.

- Latin America: Characterized by economic volatility but high potential, growth in Latin America is concentrated in major metropolitan areas, utilizing FECs as anchor tenants in modern shopping centers. Operators typically prioritize durable, high-throughput attractions like bowling and traditional arcade games to mitigate technology obsolescence risks, gradually introducing high-end VR as economic conditions stabilize.

- Middle East and Africa (MEA): Driven by ambitious national visions (e.g., Saudi Vision 2030), the GCC countries are seeing unparalleled investment in leisure infrastructure, resulting in the creation of ultra-luxurious, destination-style indoor entertainment complexes that must provide world-class, heat-independent recreation options. These facilities often feature premium F&B, massive thematic zones, and advanced technology integration, catering to both domestic and international high-spending tourists.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Family or Indoor Entertainment Centers Market.- Dave & Buster's Entertainment, Inc. - A leader in the 'Eatertainment' segment, known for blending casual dining with extensive arcade and social gaming facilities.

- Chuck E. Cheese (CEC Entertainment, Inc.) - A historic market anchor focused primarily on families and birthday party hosting with specialized pizza and redemption games.

- KidZania Operations S.A. de C.V. - Global leader specializing in edutainment, offering role-playing cities for children to simulate adult professions.

- Main Event Entertainment, Inc. - A major US operator offering a diverse mix including bowling, laser tag, and high-end dining.

- Round One Entertainment, Inc. - Japanese-based international operator known for extensive bowling, karaoke, and niche Japanese arcade gaming selections.

- Smaaash Entertainment Pvt. Ltd. - Prominent player in India, focusing on advanced VR experiences, sports simulation, and immersive dining concepts.

- Timezone Group (The Entertainment and Education Group) - Leading Asian operator with a vast network of arcades and FECs across Australia, India, and Southeast Asia.

- Merlin Entertainments Ltd. (Operates Lego Discovery Centers) - Focuses on IP-driven experiential learning and play, leveraging the global Lego brand.

- Fun City (Landmark Leisure) - Major GCC region operator providing a range of attractions suitable for diverse family demographics across the Middle East.

- The Funplex - Regional US chain focusing on a wide range of indoor and outdoor attractions for year-round fun.

- iPlay America - Large New Jersey-based venue integrating indoor theme park rides, dining, and event spaces.

- Scene75 Entertainment Center - Large-format operator known for wide variety, including multiple anchor attractions like go-karts and bowling.

- Playtime LLC - A key equipment and solutions provider often involved in the design and operation of various branded indoor playgrounds.

- Bowlero Corporation - Largest operator of bowling centers globally, increasingly integrating supplementary FEC attractions into their venues.

- Cineplex Entertainment LP - Canadian operator expanding beyond cinema into LBE with sophisticated gaming and dining hubs.

- Al-Othman Group - Significant regional player in the Middle East, investing heavily in large, themed entertainment projects.

- Pinstripes, Inc. - Premium Eatertainment provider blending upscale Italian-American dining, bowling, and bocce.

- Autobahn Indoor Speedway - Specialized operator focusing on high-speed electric indoor karting and related competitive racing simulations.

- Viking Bungee Trampoline Co. - Niche equipment supplier reflecting the growing physical activity segment.

- Aeromax Entertainment - Focuses on providing flight simulators and immersive aerial experiences.

Frequently Asked Questions

Analyze common user questions about the Family or Indoor Entertainment Centers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Family or Indoor Entertainment Centers Market?

The Family or Indoor Entertainment Centers Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 9.8% from 2026 to 2033, primarily driven by rapid technological adoption, especially in LBE VR/AR, and sustained consumer demand for high-quality, out-of-home experiential leisure activities.

Which geographical region is currently leading the growth in the FEC market?

The Asia Pacific (APAC) region is spearheading global market growth, underpinned by aggressive investment in large-scale entertainment complexes, rapid urbanization, and a burgeoning middle class in countries like China and India with increasing discretionary spending capacity.

What are the primary technological innovations influencing the design of modern FECs?

Key technological shifts include the integration of high-fidelity, untethered Location-Based Virtual Reality (LBVR), sophisticated RFID/NFC cashless payment systems for data capture, and AI-enhanced operational management systems for predictive maintenance and dynamic pricing optimization.

What is the biggest operational challenge faced by Family or Indoor Entertainment Center operators?

The most significant operational challenge is managing the high capital expenditure required for sophisticated, large-scale attractions and navigating the industry’s rapid technological obsolescence cycle, which demands frequent, costly equipment upgrades to maintain competitive novelty and appeal.

How are FECs adapting their business models to appeal to older demographics?

FECs are successfully appealing to older segments (teenagers, young adults, and corporate groups) by adopting the high-margin 'Eatertainment' model, offering premium dining and beverages, integrating eSports infrastructure, and providing complex, high-engagement activities like themed escape rooms and competitive laser tag leagues.

Why is the Edutainment segment considered a significant future opportunity?

The Edutainment segment offers high growth potential because it caters to the dual parental demand for entertainment and educational value. By integrating interactive STEM-focused exhibits and educational programming, FECs can attract reliable institutional revenue through school field trips and benefit from lower operating hours during off-peak times.

How do high-cost restraints impact smaller, independent FEC operators?

High capital expenditure for advanced technology and the recurring costs of safety compliance create significant barriers for smaller independent operators, forcing them to focus on niche markets or leverage older, lower-cost equipment, making consolidation by larger chains a frequent market dynamic.

What role does Intellectual Property (IP) licensing play in the FEC market value chain?

IP licensing is critical downstream, allowing FEC operators to immediately leverage established brand recognition from popular films or video games. This strategy reduces marketing costs, generates strong initial foot traffic, and provides high-margin revenue opportunities through exclusive merchandise sales and themed F&B offerings.

How are environmental factors impacting FEC design and technology?

Modern FEC design is increasingly incorporating modular components and energy-efficient technologies to address sustainability concerns. This includes optimized HVAC systems for large enclosed spaces, water-saving technologies in F&B areas, and attractions designed for easy refurbishment rather than complete disposal, enhancing operational lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager