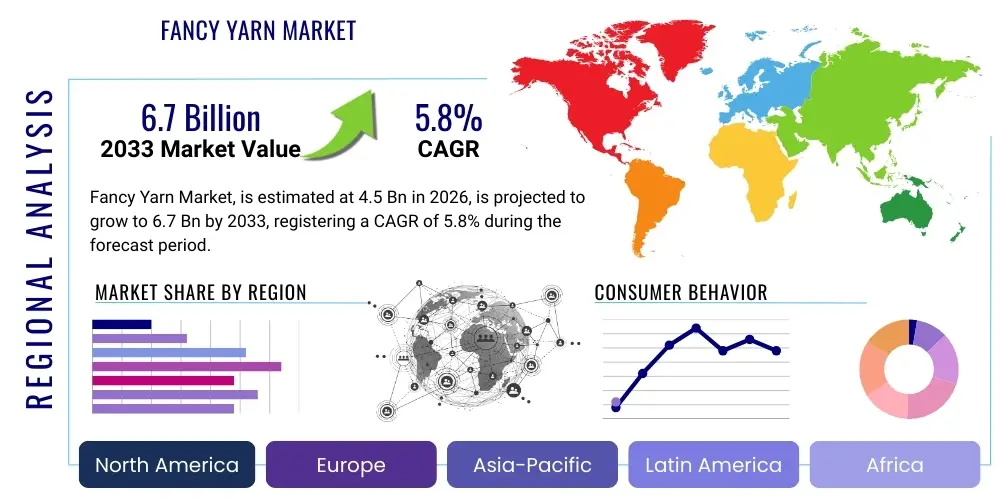

Fancy Yarn Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442567 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Fancy Yarn Market Size

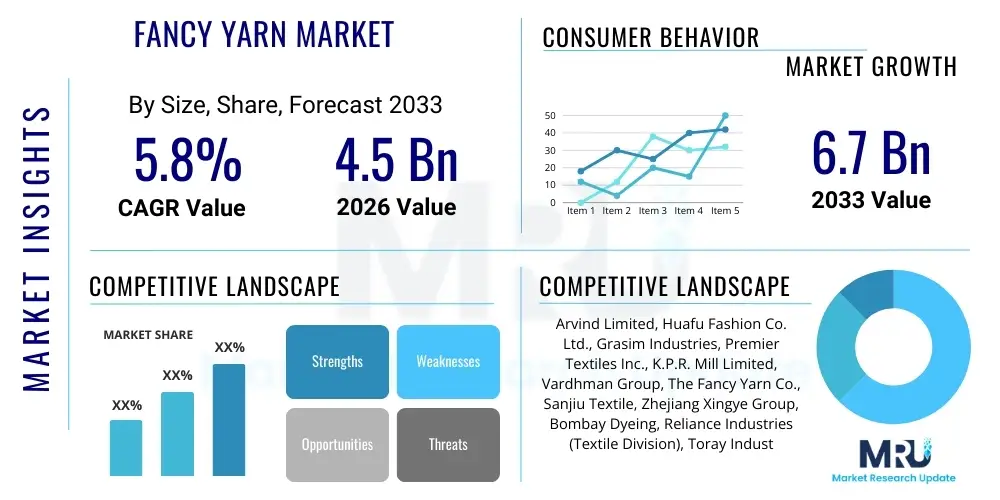

The Fancy Yarn Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Fancy Yarn Market introduction

Fancy yarn encompasses a broad and sophisticated category within the textile industry, characterized by intentional structural and visual irregularities that bestow unique aesthetic and tactile properties on the resulting fabric. Unlike conventional smooth yarns, fancy yarns are engineered through specialized mechanical processes—such as irregular drafting, twisting, or plying—to introduce features like thick and thin sections (slubs), loops, knots, spirals, or metallic effects. This deliberate manipulation transforms the material input into a high-value commodity, positioning fancy yarns as indispensable raw materials for product differentiation across various high-end applications. The continuous evolution of consumer tastes towards individuality and texture-rich apparel and home furnishings ensures sustained demand for creative yarn solutions. The distinction between commodity yarns and fancy yarns lies precisely in this complexity and the resultant visual artistry they facilitate in woven, knitted, and non-woven textiles.

The primary scope of application for fancy yarns extends deeply into sectors demanding strong visual impact. In apparel, they are vital for high-end knitwear, sophisticated outerwear, and specialized garments where fabric texture defines the garment's character. Examples include boucle jackets, chenille sweaters, and metallic-threaded evening wear. Simultaneously, the home textiles segment—covering upholstery, decorative drapes, premium carpets, and artisanal bedding—is a rapidly expanding consumer base, valuing the enhanced three-dimensional texture and luxurious hand-feel provided by fancy yarns. The use of fancy yarns in upholstery, for instance, dramatically improves light reflection and resistance to compression, contributing significantly to the lifespan and aesthetic quality of furniture items. This broad utility means market growth is decoupled somewhat from narrow fashion cycles and anchored in durable goods production, ensuring sustained profitability for specialized manufacturers.

The fundamental driving factors propelling the market include global urbanization and the resultant surge in middle-class disposable income, allowing greater expenditure on premium decorative goods and designer clothing. Concurrently, innovation in textile machinery is crucial; modern computer-controlled spinning frames are now capable of producing intricate and previously labor-intensive fancy yarn structures with high precision and speed, thereby reducing unit costs and improving market accessibility. The quantifiable benefits for textile manufacturers using fancy yarns include the ability to command higher profit margins, establish unique brand identities through proprietary textures, and respond swiftly to micro-trends, leveraging these specialized yarns as a key competitive advantage in a highly commoditized global textile trade environment. The synergy between material science and mechanical engineering continues to unlock new possibilities for novel textural effects, sustaining market vitality and pushing the boundaries of textile aesthetics.

Fancy Yarn Market Executive Summary

The global Fancy Yarn Market is experiencing an acceleration in business trends centered around sustainability, vertical integration, and rapid response manufacturing, underpinned by increasing demand for premium, textured products. Major textile manufacturers are increasingly incorporating recycled synthetic fibers and prioritizing ethical sourcing of natural fibers to meet stringent global regulatory standards, particularly within European and North American markets. Furthermore, business strategies are focusing on agility, utilizing advanced manufacturing technologies to shorten lead times for custom fancy yarn orders, crucial for serving the fast-paced nature of high-end fashion cycles. Investment in research and development is aimed at creating hybrid fancy yarns that offer superior performance characteristics, such as moisture-wicking properties combined with unique visual effects, broadening the application scope beyond traditional apparel and décor.

Regionally, the market exhibits a clear division between production powerhouses and high-value consumption centers. The Asia Pacific (APAC) region solidifies its dominance in volume manufacturing, driven by sustained investment in textile infrastructure in China and India, and the rising prominence of South Asian nations as key export hubs. Conversely, North America and Europe continue to dictate design trends and consume the majority of premium fancy yarns, particularly those incorporating natural fibers or complex metallic components. An emerging trend is the decentralization of some manufacturing capacity from established Asian centers to smaller economies to manage geopolitical trade risks and optimize logistics, alongside the robust growth in domestic consumption within Latin America fueled by increasing discretionary income and local textile modernization initiatives.

Segment analysis highlights the enduring popularity of classic fancy yarn types, such as Chenille and Slub yarns, which offer an excellent balance of cost-effectiveness and aesthetic appeal suitable for both garments and furniture upholstery. However, the Metallic Yarn segment is projected to show accelerated growth, spurred by increased use in decorative and high-visibility textiles, including specialized technical applications. Material segmentation underscores the increasing prevalence of Blended Fibers, which strategically combine the luxury feel of materials like silk and wool with the resilience and cost benefits of acrylic and polyester. This strategic blending enables manufacturers to offer durable, fancy yarns that meet consumer expectations regarding washability and longevity, while retaining the desired textural complexity essential for market success.

AI Impact Analysis on Fancy Yarn Market

User inquiries regarding the profound impact of Artificial Intelligence (AI) on the Fancy Yarn Market predominantly revolve around three critical themes: automation of design and pattern generation, optimization of complex manufacturing parameters, and enhanced supply chain predictability. Users frequently question how AI can expedite the creation of novel fancy yarn textures that meet fleeting fashion trends, moving beyond traditional CAD/CAM limitations by generating thousands of viable design alternatives based on real-time market sentiment. There is also significant interest in using predictive AI models to manage the intricate quality control processes essential for maintaining consistency in fancy yarn effects—such as uniform slub density or precise loop placement—and minimizing material waste during complex, multi-component spinning operations that require extreme precision.

The integration of AI is fundamentally transforming the conceptualization and production phases of fancy yarns. In design, AI algorithms analyze vast datasets of consumer preferences, social media trends, and historical sales patterns across geographies to predict successful color palettes, textures, and material combinations. This capability drastically accelerates the product development lifecycle from idea to sample, allowing manufacturers to offer highly personalized and trend-relevant fancy yarn options almost instantaneously, addressing the highly demanding and rapid turnover of seasonal fashion requirements. Furthermore, AI is crucial for optimizing machine settings on complex fancy yarn spinning frames, learning the optimal parameters for fiber blend ratios, twisting speeds, and tension controls to consistently reproduce delicate textures while maximizing machinery throughput and energy efficiency, a previously manual and empirical process now refined through machine learning.

In the operational domain, AI-driven predictive maintenance systems ensure high uptime for specialized spinning equipment, reducing costly unplanned downtime associated with intricate fancy yarn machinery that requires highly specialized calibration. Simultaneously, computer vision systems powered by AI are deployed for real-time quality inspection, instantly identifying even minor structural defects or irregularities in the yarn—which are particularly common in fancy yarn production—that human inspectors might overlook. This enhanced precision is vital for high-value fancy yarns, ensuring compliance with the stringent quality specifications required by luxury brands and minimizing expensive returns. The ability of AI to model complex, non-linear relationships between raw material variations and final yarn effects provides a powerful competitive advantage for manufacturers seeking superior quality, reduced operational expenditure, and sustained consistency in niche product lines.

- AI-driven trend forecasting for instantaneous texture and color adaptation in product design and material selection.

- Optimization of complex spinning parameters (tension, twist rates, fiber input) through machine learning for superior fancy effect consistency.

- Real-time, high-precision quality control using computer vision for automated defect detection in patterned yarns.

- Predictive maintenance schedules for minimizing downtime of specialized electronic fancy yarn textile machinery.

- Enhanced inventory management and waste reduction based on AI-modeled demand patterns for niche, high-value fancy yarns.

DRO & Impact Forces Of Fancy Yarn Market

The market dynamics of fancy yarns are shaped by a complex, high-pressure environment resulting from the interplay of robust Drivers, significant Restraints, and transformative Opportunities, collectively manifesting measurable Impact Forces on strategic planning. A primary driver is the accelerating global demand for differentiated and personalized textile products, particularly in the premium apparel and decorative home furnishing sectors where textural complexity and unique visual appeal are highly valued differentiators. This consumer inclination towards bespoke aesthetics compels designers to continuously seek novel fancy yarn structures. Additionally, the continuous technological innovation in textile machinery, facilitating the creation of novel, complex yarn structures economically and at industrial scale, further fuels expansion, making previously artisan-level products commercially viable and reproducible globally.

However, the market expansion is significantly constrained by several factors. The inherent complexity of fancy yarn production processes leads to substantially higher manufacturing costs compared to standard yarns, resulting in increased final product prices which can limit adoption in price-sensitive mass-market segments. Furthermore, achieving consistent quality and structural uniformity across large production batches remains a persistent technical and operational challenge, especially for highly intricate fancy effects (e.g., precise spacing of knots or loops), leading to potential waste generation and strict quality compliance issues that increase operational complexity. The market is also highly susceptible to extreme volatility in raw material prices, particularly for high-quality natural fibers like silk and fine wool, which directly impacts profitability and long-term procurement planning for specialized fancy yarn producers.

Opportunities abound in leveraging the global push for sustainability, specifically through the development and mass production of sustainable fancy yarns utilizing recycled materials (e.g., recycled cotton or PET) or bio-based synthetics, thereby addressing the growing consumer and regulatory pressure for eco-friendly textiles. The strategic expansion of e-commerce platforms and sophisticated digital design tools allows niche fancy yarn manufacturers to directly access global designer markets, bypassing traditional, lengthy distribution complexities and democratizing access to specialized inputs. Leveraging automation and AI to overcome quality consistency challenges and dramatically reduce production cycle times represents the most critical strategic opportunity for long-term competitive advantage. The resultant impact forces indicate a trend towards premiumization and technical specialization, where manufacturers who can deliver unique textures with verifiable quality and strong sustainability credentials will capture significant market share, forcing competitors relying solely on low-cost volume to rapidly innovate or exit high-value segments.

Segmentation Analysis

The Fancy Yarn Market segmentation provides a critical, granular view of market dynamics based on yarn type, material composition, and end-use application, enabling precise identification of high-growth segments and competitive positioning. Analyzing these segments is essential for strategic planning, allowing manufacturers and suppliers to tailor product development, resource allocation, and targeted marketing efforts towards specific, profitable niches defined by material performance and aesthetic demands. The segmentation structure reflects the diverse range of functional and aesthetic requirements present across the global textile value chain, highlighting specific technical areas where continuous innovation in yarn structure and material blends offers the highest potential for competitive advantage and enhanced profitability margins.

The yarn type segmentation, encompassing categories from practical Slub and Chenille yarns to highly decorative Metallic and Feather yarns, dictates the resulting fabric's texture, weight, and visual drape, directly influencing its suitability for various product categories, from lightweight apparel to heavy-duty upholstery. Material segmentation is increasingly critical, heavily influenced by evolving consumer preference for the comfort and feel of natural fibers combined with the durability and cost-effectiveness of synthetic components. This dynamic is leading to a surge in the development of sophisticated, high-performance blended fancy yarns that offer the best attributes of both fiber classes, such as combining the softness of bamboo rayon with the resilience of acrylic for luxurious, washable knitwear.

The application segment clearly illustrates the market’s reliance on two distinct demand streams: the highly cyclical and trend-dependent apparel industry, and the more stable, long-term growth driven by investment in housing, commercial construction, and interior design (home textiles). This intricate, multi-dimensional segmentation structure underscores the fact that fancy yarns are far from a homogenous product; rather, they represent a collection of specialized inputs, each engineered to serve distinct functional, tactile, and aesthetic needs across a broad, interconnected spectrum of modern textile manufacturing. Identifying the fastest-growing intersection (e.g., sustainable blended slub yarns for high-end upholstery) is key to maximizing return on investment.

- By Type: Slub Yarn, Loop Yarn, Knot Yarn, Chenille Yarn, Flock Yarn, Metallic Yarn, Spiral Yarn, Feather Yarn, Boucle Yarn.

- By Material: Natural Fibers (Cotton, Wool, Silk, Linen, Cashmere), Synthetic Fibers (Polyester, Nylon, Acrylic, Rayon, Polypropylene), Blended Fibers (Natural/Synthetic Mixes, Recycled Fiber Blends).

- By Application: Apparel (Knitwear, Outerwear, Dresses, Accessories), Home Textiles (Upholstery Fabrics, Carpets and Rugs, Drapes and Curtains, Bedding), Industrial Textiles, Technical Textiles (Automotive Interiors, Protective Wear).

- By Distribution Channel: Direct Sales (B2B Contracts with Mills), Distributors/Wholesalers (Regional Trading Houses), Online Retail/E-commerce Platforms.

Value Chain Analysis For Fancy Yarn Market

The value chain for the Fancy Yarn Market initiates with the crucial upstream stage of raw material sourcing and preparation. This phase involves procuring diverse fibers—ranging from high-grade natural fibers like Pima cotton and Merino wool sourced from specialized agriculture, to complex synthetic filaments derived from advanced petrochemical or bio-polymer processes. The preparation, including sophisticated blending, carding, and combing, is significantly more complex than for standard yarns, as the foundation for the final fancy effect is laid here. Suppliers of specialty fibers, especially those offering unique colors or functional attributes, command a high bargaining power. Maintaining strict quality control at this initial stage is non-negotiable, as inconsistencies directly compromise the final yarn effect.

The core transformative stage is specialized manufacturing, involving the application of proprietary technology. This stage utilizes advanced spinning processes, often employing computer-controlled electronic drafting systems, specialized hollow spindles, or two-for-one twisters, specifically designed to incorporate the intentional irregularities characteristic of fancy yarns (e.g., controlled frequency of slubs, wrapping of a core thread). This phase adds the highest incremental value and requires significant capital expenditure in high-precision, customized machinery, along with highly trained technical expertise in process engineering. Post-spinning, the yarn undergoes critical finishing processes, including specialized high-fastness dyeing, texturing (if necessary), and quality inspection before being wound onto bobbins or cones, ready for sale.

Downstream distribution channels are bifurcated between direct sales to large, vertically integrated textile mills and indirect sales through specialized global wholesalers or agents who possess deep knowledge of niche design houses and regional textile clusters. The ultimate customers are diverse, comprising high-end apparel manufacturers, boutique knitwear designers, luxury home textile producers, and specialized industrial fabric makers. Strong, long-term relationships established between yarn producers and downstream luxury segments are vital, as designers often require exclusivity and guaranteed consistency for their seasonal collections. Effective logistics management and rapid fulfillment capability are key performance indicators in this sophisticated downstream environment.

Fancy Yarn Market Potential Customers

Potential customers for the Fancy Yarn Market are sophisticated buyers primarily situated within the textile and garment industry's value-added segments, including high-end fashion brands, specialized atelier knitwear producers, and major commercial and residential interior design firms. These buyers regard fancy yarns not as mere functional inputs but as primary tools for achieving product differentiation, innovation in texture, and distinct market positioning. Luxury fashion houses represent a critical customer segment, often requiring customized, low-volume batches of highly specialized fancy yarns (such as metallic-wrapped or bespoke slub configurations) to anchor their seasonal collections, using these unique textures to justify premium pricing and brand exclusivity.

In the expansive home textiles sector, large manufacturers of premium upholstery fabric, residential carpets, and decorative accessories are crucial and high-volume purchasers. They utilize a range of fancy yarns, including durable Chenille, voluminous Boucle, and varied thickness Slub yarns, to create visually rich, multi-dimensional fabrics that meet stringent durability standards required for furniture and flooring. This segment’s demand is driven by global construction and renovation trends, seeking textured fabrics that enhance aesthetic appeal and perceived quality, demonstrating a stable, long-term growth trajectory distinct from fashion cycles.

Furthermore, specialized technical textile manufacturers who require performance combined with specific aesthetic properties constitute a growing segment of potential customers. This includes producers of advanced automotive interiors, where textured yarns are used for aesthetic appeal and noise reduction, or makers of specialized safety apparel where high-visibility or reflective fancy yarns are necessary. These industrial customers prioritize both the fancy visual effect and strict compliance with functional specifications like fire resistance, abrasion durability, and color fastness, positioning them as highly discerning buyers who value technical reliability alongside aesthetic versatility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arvind Limited, Huafu Fashion Co. Ltd., Grasim Industries, Premier Textiles Inc., K.P.R. Mill Limited, Vardhman Group, The Fancy Yarn Co., Sanjiu Textile, Zhejiang Xingye Group, Bombay Dyeing, Reliance Industries (Textile Division), Toray Industries, Teijin Limited, Lenzing AG, Indorama Ventures, Sinopec Yizheng Chemical Fibre, Jiangsu Dashang Group, China Resources Textiles Holdings, Jilin Chemical Fibre Group, A. T. E. Enterprises Private Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fancy Yarn Market Key Technology Landscape

The technological landscape of the Fancy Yarn Market is fundamentally defined by highly sophisticated machinery and specialized processing techniques meticulously engineered to intentionally manipulate yarn structure, surface profile, and overall appearance. Central to this landscape are advanced ring spinning, rotor spinning, and air-jet spinning frames, which are increasingly equipped with integrated electronic controls (Electronic Drafting Systems, or EDS) that allow for programmed irregularity creation. This sophistication enables precise control over variables such as drafting speed variations to produce highly consistent slubs, or sudden changes in fiber feed to generate precise knots and loops. The revolutionary transition from older mechanical linkages to these high-speed electronic controls has dramatically enhanced operational flexibility, enabling rapid pattern switching and exceptional repeatability across diverse production batch sizes, a necessity for managing the high variability of modern client orders.

A critical technological area involves specialized texturing and twisting machinery, particularly advanced two-for-one (TFO) twisters and customized covering machines utilized to efficiently produce complex composite fancy yarns, such as covered, spiral, or core-spun varieties. These machines are engineered to manage significant, delicate tension differences between multiple fed yarn components (e.g., core and effect yarns) simultaneously to achieve the desired fancy effect without fiber breakage or undesirable structural distortion. Furthermore, sophisticated computer-aided design (CAD) and manufacturing (CAM) software suites are essential for the modern fancy yarn producer, allowing for rapid simulation of new fancy yarn structures and accurate prediction of their behavior when integrated into weaving or knitting processes, significantly reducing the expensive need for extensive physical prototyping and accelerating time-to-market for novel designs.

Recent technological emphasis has strongly shifted towards comprehensive automation and deep integration with tenets of Industry 4.0. Advanced sensor technologies—including sophisticated laser scanners and high-definition cameras—are now routinely embedded directly within spinning equipment to continuously monitor vibration, temperature, and crucial yarn tension parameters in real-time. This massive data stream fuels AI-driven quality assurance systems and predictive maintenance protocols, which are vital for maintaining the complex and delicate structural integrity of high-value fancy yarns and ensuring maximum machine uptime. Additionally, significant advancements are being adopted in sustainable finishing techniques, such as digital color printing directly onto yarn and the implementation of water-efficient, low-liquor dyeing processes, which are crucial for enhancing the environmental profile and aesthetic depth of these highly texture- and color-driven products.

Regional Highlights

The global Fancy Yarn Market exhibits pronounced regional disparities in terms of core manufacturing capabilities, scale of consumption volume, and prevailing local design trends, mandating highly tailored strategic planning for manufacturers seeking global market penetration. These regional characteristics shape trade flows, influence investment decisions, and determine the specific types of fancy yarns that achieve commercial success within each major geography.

Asia Pacific (APAC)

The APAC region stands as the undisputed global hub for fancy yarn volume manufacturing and export, largely driven by massive, cost-competitive production capabilities centered in countries like China, India, and Vietnam. China remains the dominant global producer, leveraging substantial government investment in textile modernization and possessing the vertical integration necessary to control the entire process from fiber production to final yarn packaging. India, capitalizing on its abundant raw material supply (especially unique natural fibers) and a rapidly expanding domestic consumption base, is significantly scaling up its capacity for high-value fancy yarns, blending traditional artistry with modern electronic machinery. The primary regional strength lies in its ability to quickly scale production volumes and its responsiveness to bulk orders, positioning it as the primary supplier for global fast-fashion and mass-market home textile producers. Key growth drivers include rising regional affluence stimulating domestic demand for sophisticated textiles and continuous investment in advanced fancy twisting and texturing machinery to enhance product differentiation amid increasing internal competition.

Europe

Europe represents a critical market for premium consumption, design innovation, and technical specialization in fancy yarns, especially within established fashion centers like Italy, France, and Germany. The European textile industry places a predominant focus on quality, advanced aesthetics, and specialized functional requirements, often integrating fancy yarns into bespoke luxury knitwear, sophisticated tailored outerwear, and high-specification architectural textiles. Demand is heavily skewed toward niche, highly complex yarn types such such as ultra-fine Metallic yarns, advanced Spiral structures, and innovative Boucle compositions, which reliably command the highest price points globally. This region is pioneering the adoption of Industry 4.0 technologies for highly flexible, small-batch fancy yarn production, catering directly to designer houses that require minimal volume but guaranteed quality exclusivity. Furthermore, the stringent regulatory environment (e.g., REACH compliance) significantly influences the market, fostering intense consumer and designer preference for fancy yarns manufactured using certified non-toxic dyes and verifiable sustainable, traceable fibers, often overriding cost considerations.

North America

North America operates primarily as a high-value consumption market for specialized fancy yarns, fueled by the demanding and often trend-setting luxury fashion and robust home décor industries in the United States and Canada. While domestic manufacturing capacity exists, it tends to focus on highly niche, rapid-turnaround, or technical fancy yarns that require stringent, domestic quality control standards, such as specialized flame-retardant upholstery yarns. The market is characterized by a strong consumer preference for luxury textural items, often featuring natural fiber blends (high-grade wools, organic cotton) combined strategically with synthetic elements for enhanced durability and performance. The demand is closely linked to the strong cyclical performance of the housing market, which drives consumption of luxury, textured fabrics for furniture and premium carpets. A crucial regional trend is the growing insistence on verifiable supply chain traceability and eco-certification, leading North American buyers to favor fancy yarn suppliers who can demonstrate ethical sourcing and sustainable manufacturing practices, influencing global sourcing strategies.

Latin America (LATAM)

The LATAM fancy yarn market is demonstrating steady, moderate growth, strongly supported by rapid urbanization, improving regional economic stability, and the subsequent emergence of sophisticated domestic fashion and textile cultures, notably in economic powerhouses like Brazil, Mexico, and Argentina. The current market composition often favors more cost-effective, durable fancy yarns—typically utilizing synthetic bases like polyester or acrylic blends—which are predominantly used in expanding mid-range apparel segments and lower-to-mid-range home furnishings production. Local manufacturing capabilities are expanding, frequently focusing on fully vertically integrated operations to efficiently supply burgeoning domestic brand requirements. The primary opportunity in this region centers on the introduction and popularization of more advanced, high-end fancy yarn types and promoting their utilization in higher-value, export-oriented textile products as consumer spending power and sophistication continue to escalate. However, market development remains dependent on stable political economies and mitigating import dependence for specialized spinning machinery from overseas.

Middle East and Africa (MEA)

The MEA region presents a highly bifurcated market landscape for fancy yarns. The Middle East, particularly the Gulf Cooperation Council (GCC) states, acts as a major importer of ultra-high-end fancy yarns used exclusively in luxury traditional attire, highly decorative ceremonial fabrics, and sophisticated architectural textile installations, often showing a preference for pure silk blends and intricate metallic yarns sourced primarily from Europe and specialized Asian suppliers. Manufacturing is minimal in the GCC, relying almost entirely on premium imports. Conversely, regions in North Africa (such as Egypt and Tunisia) and Turkey possess large, established, and modernizing textile manufacturing bases that are increasingly adopting advanced fancy yarn techniques. These producers aim to cater to both their growing domestic markets and, crucially, to serve lucrative European export markets. The overarching trend across MEA involves aggressive modernization of processing equipment to improve quality consistency, reduce reliance on imports, and successfully enter more valuable, quality-conscious international supply chains for textured and specialized textiles.

- Asia Pacific: Dominates global manufacturing volume and export; characterized by rapid modernization, significant capacity expansion, and high vertical integration (China, India, Vietnam).

- Europe: Premier market for design innovation, high-end apparel, and advanced sustainable fancy yarns; defined by stringent quality demands and environmental compliance (Italy, Germany, France).

- North America: Major high-value consumption market, driven by luxury fashion and expansive upholstery needs; strong strategic focus on supply chain transparency and eco-certification for imported goods.

- Latin America: Emerging growth center driven by urbanization and rising domestic consumption; characterized by increasing demand for durable, blended, and cost-effective fancy yarns.

- MEA: Diverse structure featuring high-end luxury imports in the GCC and rapidly modernizing regional manufacturing bases in North Africa/Turkey targeting European export standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fancy Yarn Market.- Arvind Limited

- Huafu Fashion Co. Ltd.

- Grasim Industries

- Premier Textiles Inc.

- K.P.R. Mill Limited

- Vardhman Group

- The Fancy Yarn Co.

- Sanjiu Textile

- Zhejiang Xingye Group

- Bombay Dyeing

- Reliance Industries (Textile Division)

- Toray Industries

- Teijin Limited

- Lenzing AG

- Indorama Ventures

- Sinopec Yizheng Chemical Fibre

- Jiangsu Dashang Group

- China Resources Textiles Holdings

- Jilin Chemical Fibre Group

- A. T. E. Enterprises Private Limited.

Frequently Asked Questions

What are the primary factors driving the growth of the Fancy Yarn Market?

Market growth is primarily driven by the increasing consumer demand for personalized and unique textile products, rapid fashion cycles necessitating sophisticated product differentiation, and continuous technological advancements in specialized electronic spinning machinery that make complex fancy yarn production more efficient, scalable, and cost-effective.

Which type of fancy yarn holds the largest market share and why?

Slub Yarn and Chenille Yarn typically hold the largest market shares due to their exceptional versatile application across both major segments—apparel (knitwear, sweaters) and home textiles (upholstery, carpets). Their production process offers an optimal balance between aesthetic impact and industrial scalability, ensuring high volume adoption globally.

How is sustainability impacting fancy yarn manufacturing and material choices?

Sustainability is profoundly impacting the market, forcing manufacturers to integrate recycled fibers (e.g., recycled polyester or cotton), utilize bio-based raw materials, and implement eco-friendly, low-impact dyeing processes to meet strict regulatory requirements and growing consumer preference for traceable, environmentally responsible textile inputs and materials.

What key role does AI play in optimizing fancy yarn production and reducing waste?

AI is crucial for optimizing the intricate production process by providing real-time quality control through integrated computer vision, predicting optimal machine parameters (such as tension and twist rates) for complex textures, and enabling faster, data-driven design adjustments based on predictive trend analysis, thereby significantly reducing material waste and accelerating time-to-market.

Which geographical region is projected to exhibit the fastest market expansion for high-value fancy yarns?

The Asia Pacific (APAC) region is projected to show the fastest overall market expansion, driven by continuous infrastructure investment, expanding domestic textile industries in countries like India and Vietnam, and the strategic shift from low-value commodity production to high-value, specialized fancy yarn exports targeting global design centers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager