Fashion and Apparels Print Label Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442241 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Fashion and Apparels Print Label Market Size

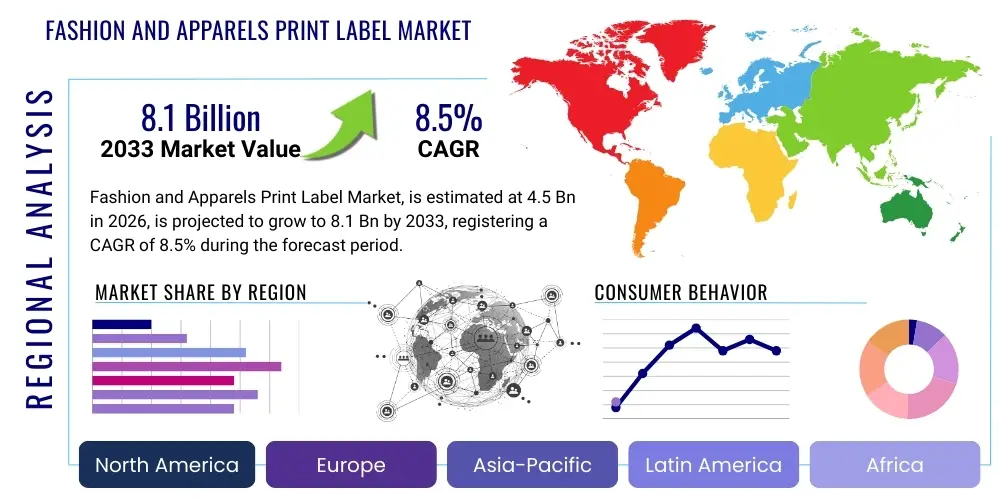

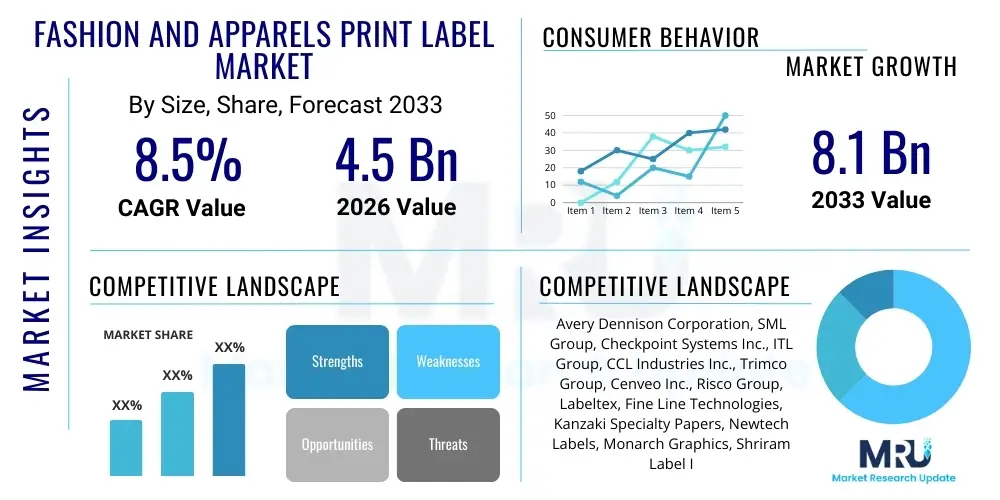

The Fashion and Apparels Print Label Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Fashion and Apparels Print Label Market introduction

The Fashion and Apparels Print Label Market encompasses the production and utilization of various types of printed labels applied directly to garments and textile products. These labels serve critical functions, including brand identification, care instructions, sizing information, material composition, and regulatory compliance data. The core products range from thermal transfer labels and digitally printed tags to specialized satin and woven labels, catering to diverse segments of the apparel industry, from high-end luxury wear to mass-market fast fashion.

The major applications of these print labels span the entire garment lifecycle, ensuring traceability and providing essential information to the consumer. Key benefits driving market expansion include enhanced brand visibility, improved supply chain efficiency through track-and-trace capabilities, and adherence to complex international labeling standards. Furthermore, the shift towards sustainable and eco-friendly labeling materials is fundamentally altering product specifications, positioning labels as integral components of the sustainability narrative within the fashion supply chain.

Driving factors for this market include the global expansion of the fast fashion and e-commerce sectors, which necessitates high-volume, rapidly deployable labeling solutions. Increasing consumer demand for transparency regarding garment origins and material sourcing, alongside stringent governmental regulations concerning consumer safety and disclosure (such as Proposition 65 requirements and EU textile rules), further mandate sophisticated and durable print labeling solutions. Technological advancements in digital printing and automation are also playing a crucial role in enabling faster turnaround times and greater customization, thereby accelerating market growth across all regional spheres.

Fashion and Apparels Print Label Market Executive Summary

The global Fashion and Apparels Print Label Market is experiencing significant upward momentum driven by evolving retail dynamics, increased global trade in textiles, and continuous technological innovation in printing processes. Business trends highlight a strong industry focus on personalization, anti-counterfeiting measures integrated into label designs (such as RFID and NFC tags), and the transition toward sustainable material substrates, including recycled polyester and organic cotton fabrics, reflecting corporate social responsibility initiatives across the apparel value chain. Consolidation among major label manufacturers is also a prevalent business trend, aiming to achieve economies of scale and offer integrated labeling solutions globally.

Regionally, the Asia Pacific (APAC) continues to dominate the market, primarily due to its position as the world's leading manufacturing hub for apparel and textiles, driving massive demand for labels used in export-oriented production. North America and Europe, while representing mature markets, exhibit higher demand for premium, technologically advanced, and sustainable labeling solutions, capitalizing on regulatory compliance and the demand for high-end branding. Growth in emerging markets across Latin America and the Middle East & Africa (MEA) is accelerating, stimulated by rising domestic consumption of branded apparel and increasing foreign direct investment in local textile manufacturing capabilities.

Segment trends indicate a robust shift towards Digital Printing technology, favored for its flexibility, speed, and capability for short-run, variable data printing, which is essential for customized branding and serialized labels. In terms of product type, Care Labels remain the highest volume segment due to mandatory regulatory requirements, while Brand Identification Labels are showing the fastest growth rate, fueled by aggressive brand marketing and the need for sophisticated aesthetic solutions that complement garment design. The increasing popularity of specialized materials like satin and nylon labels for intimate wear and specialized sportswear further diversifies segmentation growth within the sector.

AI Impact Analysis on Fashion and Apparels Print Label Market

Common user questions regarding AI's impact on the print label market generally revolve around supply chain optimization, design automation, predictive maintenance, and anti-counterfeiting efficacy. Users are seeking to understand how AI algorithms can streamline label inventory management, forecast material demand based on fluctuating fashion cycles, and enhance the digital traceability embedded within labels. A significant theme is the expectation that AI will dramatically reduce human error in compliance checks and improve the speed of design iteration. There is also specific interest in how AI, coupled with visual recognition technologies, can be used to authenticate branded goods by analyzing label anomalies, addressing major concerns related to global product counterfeiting.

The consensus suggests that AI integration will shift the label manufacturing process from a reactive system to a highly predictive and automated workflow. AI-driven predictive maintenance will significantly reduce machinery downtime, optimizing the efficiency of high-speed printing presses. Furthermore, in the context of personalized fashion, AI tools will manage the complexity of variable data printing (VDP), ensuring that thousands of unique labels—each carrying specific serialized or personalized data—are produced accurately and efficiently, matching specific production runs without manual intervention.

This integration of AI extends beyond the production floor and into the final application, where intelligent systems can analyze complex international regulatory databases, automatically generating compliant care and content labels based on the garment's destination market and material composition. This automation not only minimizes compliance risk but also accelerates time-to-market for global apparel brands, establishing AI as a core strategic tool for mitigating regulatory and logistical hurdles inherent in global fashion supply chains.

- AI optimizes supply chain logistics by predicting raw material needs (inks, substrates) based on seasonality and order forecasts.

- Predictive maintenance algorithms reduce printing press downtime, increasing overall equipment effectiveness (OEE).

- AI-powered visual inspection systems enhance quality control, immediately identifying print defects or misalignments at high speeds.

- Integration with regulatory databases allows AI to automatically generate legally compliant labels across diverse geographic markets.

- Machine learning facilitates personalized variable data printing (VDP) for serialized or individualized branding initiatives.

- AI-enabled anti-counterfeiting involves analyzing label metadata and patterns for instant authentication verification in retail and secondary markets.

- Automated design assistance accelerates the labeling artwork approval process, optimizing layouts for material usage and printability.

DRO & Impact Forces Of Fashion and Apparels Print Label Market

The Fashion and Apparels Print Label Market is dynamically shaped by powerful drivers, necessitating rapid technological adjustments, while simultaneously being constrained by environmental pressures and logistical complexities. Opportunities arise predominantly from technological innovation and the increasing global focus on ethical and transparent sourcing practices. These forces collectively dictate the strategic trajectory of label manufacturers and their suppliers within the broader apparel ecosystem, influencing material choices, printing technologies, and geographical operational strategies.

Primary drivers include the massive growth in global apparel consumption, especially through e-commerce platforms which require highly durable and trackable labels for logistics. Regulatory mandates for product transparency, safety standards (e.g., restricted substances), and material disclosure are non-negotiable forces boosting demand for compliance labels. Key restraints center on the rising cost of raw materials, particularly specialized inks and sustainable substrates, alongside stringent environmental regulations concerning waste generated during the printing process. The highly competitive nature of the market, particularly in Asia, often leads to price compression, limiting profit margins for non-specialized producers.

Opportunities are abundant in the integration of smart label technologies, such as passive RFID and NFC tags, transforming labels into active information carriers essential for inventory management and consumer engagement. The surging consumer preference for sustainable and circular fashion opens significant avenues for innovative, biodegradable, or recyclable labeling materials. Impact forces manifest as the accelerating rate of digital transformation across the fashion industry, pushing label manufacturers to invest heavily in advanced digital printing capabilities and automated workflow solutions to maintain competitive relevance and meet rapid market turnaround demands.

Segmentation Analysis

The Fashion and Apparels Print Label Market is segmented based on the function of the label, the underlying printing technology utilized, the material substrate, and the specific application within different garment categories. This structural breakdown helps in understanding the varying demands placed on label manufacturers concerning durability, aesthetic quality, regulatory compliance, and cost efficiency. The segmentation reflects the diverse requirements of the global apparel industry, from highly resilient labels needed for industrial washing processes to visually sophisticated labels that enhance brand perception.

Analyzing the market by printing technology reveals a significant shift towards digital methods, which facilitate variable data printing and on-demand manufacturing, contrasting with traditional high-volume methods like flexography and thermal transfer. The material segmentation underscores the industry's response to sustainability initiatives, with increasing adoption of materials derived from recycled content or natural fibers. Application-wise, segments such as intimate wear and performance sportswear demand specialized labels (e.g., heat transfers or non-irritating materials) that differ fundamentally from the needs of general T-shirts or heavy outerwear, leading to specialized market niches.

Understanding these segments is crucial for strategic market positioning. Manufacturers focusing on the luxury segment prioritize high-definition printing and premium materials (like satin and woven edges), whereas those serving the mass market focus on cost-effective, high-speed thermal transfer or care labels. This nuanced segmentation framework allows for targeted development of innovative solutions that address specific functional requirements, regulatory challenges, and emerging aesthetic trends within distinct sectors of the global fashion market.

- By Type:

- Care Labels

- Brand Identification Labels

- Variable Information Labels (VILs)

- Security/Anti-Counterfeiting Labels

- Size and Composition Labels

- By Printing Technology:

- Digital Printing

- Thermal Transfer Printing

- Flexography

- Screen Printing

- Letterpress

- By Material:

- Cotton

- Polyester/Nylon

- Satin/Taffeta

- Adhesive Paper/Film

- Recycled and Sustainable Substrates

- By Application (End-Use Garment):

- T-shirts & Tops

- Dresses and Skirts

- Outerwear (Jackets, Coats)

- Denim and Bottoms

- Intimate Wear and Swimwear

- Sports and Activewear

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Fashion and Apparels Print Label Market

The value chain for the Fashion and Apparels Print Label Market begins with upstream activities focused on raw material procurement, encompassing the sourcing of specialized substrates like textile tapes (satin, cotton, nylon), specialized inks (dyes, pigments, metallic inks), and advanced adhesive systems. Key upstream suppliers include chemical companies, textile weavers, and paper/film producers, who must adhere to rigorous quality standards and, increasingly, sustainable sourcing mandates to ensure the final label complies with restricted substance lists (RSLs). The quality and composition of these raw inputs directly influence the durability, wash-fastness, and eco-friendliness of the final printed product, making supplier qualification a critical element in this stage.

Midstream activities involve the conversion and manufacturing processes, primarily dominated by specialized label printing companies. This stage involves the selection of appropriate printing technology (digital, thermal transfer, flexographic), pre-press preparation, printing, finishing (cutting, folding, adding features like RFID), and quality control. Investments in high-speed, multi-color printing equipment and advanced software for variable data management define the competitive advantage at this level. Efficient operational procedures, waste minimization, and compliance with stringent quality metrics specific to the apparel industry are paramount for label converters to optimize production costs and meet the demanding delivery schedules of apparel manufacturers.

Downstream activities center on distribution, sales, and final application. Labels are distributed either directly to large apparel brands with in-house labeling capabilities or, more commonly, indirectly through third-party packaging and trim distributors, who manage complex inventories for multiple apparel manufacturers. The end-users—apparel manufacturers and contract garment assemblers—apply the labels via sewing, heat-transfer, or adhesive attachment, ensuring correct placement and compliance before distribution to retail channels. The shift toward faster production cycles has increased reliance on indirect distribution models that offer rapid local supply and specialized logistics services, connecting label producers efficiently with global garment factories located primarily in the APAC region.

Fashion and Apparels Print Label Market Potential Customers

The primary potential customers and end-users of the Fashion and Apparels Print Label Market are multifaceted, extending beyond traditional garment manufacturers to encompass specialized textile processors and regulatory bodies. The largest consumer base comprises global and regional apparel brands, ranging from luxury fashion houses that demand high-quality, aesthetically pleasing labels for branding and exclusivity, to mass-market retailers and fast-fashion giants requiring high-volume, cost-effective care and size labels for rapid production cycles. These customers require suppliers to handle complex international specifications and provide just-in-time delivery services.

A second significant customer segment involves large-scale contract manufacturing organizations (CMOs) and textile processing facilities that handle production for multiple brands. These entities require a comprehensive suite of labeling solutions, often procuring generic or semi-finished labels in bulk, which are then printed or customized on-site using thermal transfer technology to meet immediate order specifications. The demand here is driven by efficiency, standardization, and integration with automated garment assembly lines.

Furthermore, specialized segments such as manufacturers of performance sportswear, protective wear, and intimate apparel constitute growing niche markets. These customers require advanced, non-irritating, durable labeling solutions, such as seamless heat transfer labels or printed labels using soft materials like satin or nylon, designed to withstand rigorous washing, excessive stretching, or specific industrial cleaning procedures. The burgeoning market for recycled and upcycled clothing also represents a unique customer segment focused on leveraging labels to communicate sustainability narratives and material composition transparency to environmentally conscious consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Avery Dennison Corporation, SML Group, Checkpoint Systems Inc., ITL Group, CCL Industries Inc., Trimco Group, Cenveo Inc., Risco Group, Labeltex, Fine Line Technologies, Kanzaki Specialty Papers, Newtech Labels, Monarch Graphics, Shriram Label Industries, Hangzhou Sainty. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fashion and Apparels Print Label Market Key Technology Landscape

The technology landscape of the Fashion and Apparels Print Label Market is characterized by a dual trend: the optimization of conventional printing methods for scale and cost-efficiency, and the rapid adoption of digital technologies for flexibility and sophistication. Digital inkjet and toner printing technologies represent a significant disruptive force, allowing manufacturers to handle short-run orders, achieve high-resolution graphics, and facilitate variable data printing (VDP) crucial for serialization, personalization, and complex compliance information. This shift reduces lead times and inventory waste, aligning closely with the demands of fast-fashion production cycles and customizable product lines.

Thermal transfer printing remains a dominant, foundational technology, particularly for care and variable information labels, due to its durability, low cost per label, and robustness in high-volume, monochromatic applications. However, modern thermal transfer systems are being enhanced with improved ribbon formulations and printhead technologies to achieve higher resistance to industrial washing and abrasion. Flexography and screen printing continue to hold relevance for extremely high-volume, standardized production runs and for specialized applications requiring thick ink deposition or specific material compatibility, though they face increasing competitive pressure from the superior agility of digital processes.

Beyond the core printing techniques, the technological landscape is increasingly defined by "smart label" integration. This includes the incorporation of radio-frequency identification (RFID) tags and near-field communication (NFC) chips directly into the label substrate, transforming a static identifier into an active data carrier. This technological integration is vital for advanced inventory management, anti-theft measures, and providing enhanced interactive consumer experiences (e.g., wash instructions via smartphone scan), establishing these embedded technologies as critical differentiators in the premium and logistics-intensive segments of the market.

Regional Highlights

The global market for fashion and apparels print labels exhibits significant regional disparity driven primarily by manufacturing concentration and consumer spending habits.

- Asia Pacific (APAC): APAC holds the undisputed leadership position in the market due to its status as the world's primary apparel and textile manufacturing hub, especially countries like China, India, Vietnam, and Bangladesh. The immense volume of garment production, both for export and domestic consumption, drives high demand for all types of labels. The region is characterized by high-volume, cost-competitive manufacturing, but is rapidly adopting digital printing technologies to meet the complex VDP demands of international brands and comply with diverse export regulations.

- North America: This region is a mature, high-value market characterized by robust consumer spending and stringent regulatory requirements regarding material content, safety, and import disclosure. Demand is high for advanced, integrated labeling solutions, including smart labels (RFID) for sophisticated retail inventory management and premium, high-definition labels that enhance brand aesthetics. Sustainability certifications and compliance with complex standards are key purchase drivers here.

- Europe: Similar to North America, the European market focuses heavily on premium quality, sustainability, and adherence to demanding EU regulations, particularly REACH and strict waste directives. There is a strong preference for labels made from recycled or eco-certified materials. The market is also heavily influenced by luxury fashion houses that prioritize customized, sophisticated woven and printed labels that contribute significantly to the perceived value of the garment.

- Latin America (LATAM): This region shows promising growth, fueled by increasing domestic production capabilities in countries like Brazil and Mexico, coupled with rising brand consciousness among local consumers. The market is transitioning from basic thermal labels to higher-quality flexographic and digital solutions to support growing domestic apparel brands and regional exports.

- Middle East and Africa (MEA): Growth in MEA is moderate but accelerating, spurred by expansion in local textile industries, particularly in Turkey and parts of North Africa. Demand is concentrated in care labels and mandatory information tags required for export, alongside growing internal consumption of fast fashion, necessitating efficient and cost-effective labeling solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fashion and Apparels Print Label Market.- Avery Dennison Corporation

- SML Group

- Checkpoint Systems Inc.

- ITL Group (Information Technology Labels)

- CCL Industries Inc.

- Trimco Group

- Cenveo Inc.

- Risco Group

- Labeltex

- Fine Line Technologies

- Kanzaki Specialty Papers

- Newtech Labels

- Monarch Graphics

- Shriram Label Industries

- Hangzhou Sainty

- Guangzhou Liabel Packaging

- Shandong Sinotex Co., Ltd.

- Polylabel Group

- Paxar Corporation (part of Avery Dennison)

- Dai Nippon Printing Co., Ltd. (DNP)

Frequently Asked Questions

Analyze common user questions about the Fashion and Apparels Print Label market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards sustainable print labels in apparel?

The primary driver is escalating consumer demand for supply chain transparency and environmentally friendly products, coupled with stringent regulatory pressure (e.g., EU Green Deal mandates) requiring brands to reduce textile waste. This pushes manufacturers toward using recycled, organic, and biodegradable label substrates, minimizing the environmental footprint of garment trims.

How is Digital Printing technology impacting traditional label manufacturing?

Digital printing provides unparalleled flexibility, enabling rapid, short-run production and efficient variable data printing (VDP) essential for customized and serialized products. It reduces minimum order quantities and accelerates design iteration, fundamentally challenging the scale and setup limitations associated with traditional flexographic and screen printing methods.

What role do smart labels (RFID/NFC) play in anti-counterfeiting efforts?

Smart labels embedded with RFID or NFC chips serve as secure, digital identifiers that enable real-time authentication throughout the supply chain and at the point of sale. By linking the physical label to a secured digital ledger, they provide immutable proof of origin and prevent unauthorized duplication, significantly bolstering brand protection measures.

Which geographical region holds the largest market share for apparel print labels?

The Asia Pacific (APAC) region dominates the global market share, primarily driven by the massive concentration of high-volume apparel manufacturing operations in countries like China, India, and Southeast Asian nations. This regional strength is due to both large-scale export production and rapidly expanding domestic consumption markets.

What are the key differences between Care Labels and Brand Identification Labels?

Care Labels are mandatory tags detailing washing, drying, and ironing instructions necessary for regulatory compliance and garment longevity. In contrast, Brand Identification Labels (e.g., logos, hang tags) are non-mandatory, focusing primarily on aesthetic appeal, brand messaging, and enhancing the perceived value and premium quality of the clothing item.

What challenges does the adoption of AI pose for small label manufacturers?

Small manufacturers face significant barriers primarily related to the high initial capital investment required for AI implementation, including specialized software, sensor technology, and data infrastructure. They also struggle with acquiring specialized talent needed to develop and maintain complex AI algorithms for quality control and predictive maintenance.

How do heat transfer labels compare to woven labels in performance wear?

Heat transfer labels are favored in performance and intimate wear because they are seamless, non-irritating to the skin, and remain highly durable through stretching and repeated washing. Woven labels, while aesthetically superior for branding, often lack the softness and flexibility required for close-fitting athletic or sensitive apparel.

What is the impact of fast fashion cycles on label production lead times?

Fast fashion demands extremely reduced lead times, forcing label manufacturers to adopt 'on-demand' production models, often utilizing digital printing to minimize inventory and enable rapid design changes. The speed requirement necessitates highly integrated supply chains and localized printing facilities near garment factories.

Are biodegradable polyester labels gaining traction, and why?

Yes, biodegradable and recycled polyester labels are gaining significant traction as brands prioritize circular economy initiatives. These materials allow garments to be labeled with durable synthetic materials while addressing environmental concerns regarding plastic waste, offering a balance between functionality and sustainability goals.

What regulations primarily govern the content of care labels globally?

Key global regulatory frameworks include the Federal Trade Commission (FTC) rules in the US, the European Union's Textile Regulation (EU) No 1007/2011 on textile fiber names, and local standards set by textile and garment manufacturing associations in major producing countries, all mandating clear and accurate information on fiber content and care instructions.

How is mass customization affecting the demand for variable information labels?

Mass customization requires VILs to accommodate unique data points, such as serial numbers, consumer names, or specialized QR codes, for every single product. This drives the demand for sophisticated digital printing capabilities that can handle immense data variability without compromising production speed or quality, shifting volume from static to dynamic labeling solutions.

What are the common substrate materials used for sustainable apparel labels?

Common sustainable substrates include recycled post-consumer waste polyester (rPET), organic cotton, natural linen, and innovative materials like stone paper or bio-plastic films derived from corn starch (PLA). These materials aim to minimize reliance on virgin petrochemical resources and reduce end-of-life environmental impact.

Why is flexography still relevant despite the rise of digital printing?

Flexography remains relevant primarily for its capacity to handle extremely large, high-volume production runs of simple, standardized care labels at a significantly lower cost per unit than digital methods. It offers excellent ink opacity and durability on fabric tapes, making it ideal for essential utility labeling.

How does the quality of adhesive systems affect the print label market for tags?

High-quality adhesive systems are crucial for maintaining the integrity of temporary labels (like swing tickets and price tags) through transit and handling, and for ensuring permanent adhesive labels (used in certain apparel sectors) remain fixed without damaging the garment, addressing critical consumer satisfaction and logistic requirements.

What technological advancements are enhancing print label durability?

Advancements include specialized high-performance resins and durable inks (e.g., UV-cured inks) that resist fading, abrasion, and industrial washing chemicals. Furthermore, optimized thermal transfer ribbons and integrated polymer coatings are extending the lifespan and readability of essential care information over the garment's usage lifetime.

In what ways do print labels contribute to supply chain traceability?

Print labels, especially those integrated with technologies like barcodes, QR codes, and RFID, act as primary data points linking the physical garment to digital tracking systems. They facilitate efficient inventory counting, logistics management, product authentication, and track-and-trace capabilities from the factory floor to the consumer.

How has e-commerce accelerated the demand for variable information labels (VILs)?

E-commerce necessitates detailed and unique labeling for every shipped item, including specialized logistics barcodes, return authorization codes, and specific shipping data printed directly onto the garment label or swing tag. This increased complexity and serialization mandate a reliance on VILs produced using flexible digital technology.

What is the primary restraint facing the European print label market?

The primary restraint in Europe is the confluence of high labor costs and very strict environmental regulations concerning ink disposal, substrate sourcing, and manufacturing waste. These factors significantly increase the operational complexity and production cost for label manufacturers operating within the continent.

How does AI contribute to reducing human error in label compliance?

AI systems integrate complex, frequently updated regulatory texts into the design software. They automatically cross-reference the garment material composition and destination market, flagging potential non-compliance issues and ensuring the generated label text adheres perfectly to mandatory legal standards, drastically reducing human-induced compliance errors.

Which application segment requires the most specialized, non-irritating label materials?

The Intimate Wear and Sports/Activewear segments require the most specialized labels. These garments are in close contact with the skin, necessitating the use of smooth, soft materials like heat transfer decals or extremely soft, cut-and-folded satin/nylon labels to prevent irritation and maintain comfort during wear and movement.

What is the expected long-term impact of 3D printing technology on this market?

While not mainstream, 3D printing holds potential for highly customized, unique brand badges or structural elements integrated into the label. Its long-term impact is anticipated to be in creating specialized, low-volume, high-value embellishments and complex aesthetic brand identifiers rather than replacing mass-produced informational print labels.

What is the role of specialized finishing processes in the premium label market?

Specialized finishing processes, such as laser cutting, ultrasonic welding of edges, and high-definition folding, are crucial in the premium market to achieve a clean, luxurious, and non-fraying product. These processes enhance the aesthetic quality and tactile feel, reinforcing the garment's overall branding strategy and perceived value.

Why are cotton labels gaining popularity despite the cost?

Cotton labels, particularly organic cotton, are favored for babywear, sustainable fashion lines, and luxury casual wear because of their soft texture, hypoallergenic properties, and perception of being environmentally sound and natural. This material choice aligns with ethical sourcing and consumer preference for natural fibers, overriding their higher cost structure.

How do global trade tensions influence regional label production strategies?

Trade tensions incentivize apparel brands to diversify their manufacturing away from single-country dependence (like China), leading to increased label production decentralization. This creates opportunities for label manufacturers in alternate production hubs (e.g., Vietnam, Indonesia, Mexico) to establish localized supply chains capable of meeting rapid regional demand.

What is the typical lifespan expected for a standard printed care label?

A standard printed care label is expected to remain legible and intact for the entire life cycle of the garment, typically requiring durability to withstand 30 to 50 cycles of domestic washing and drying, often using high-temperature water or bleach, depending on the material composition and specified care instructions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager