Fat Mimetics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442878 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Fat Mimetics Market Size

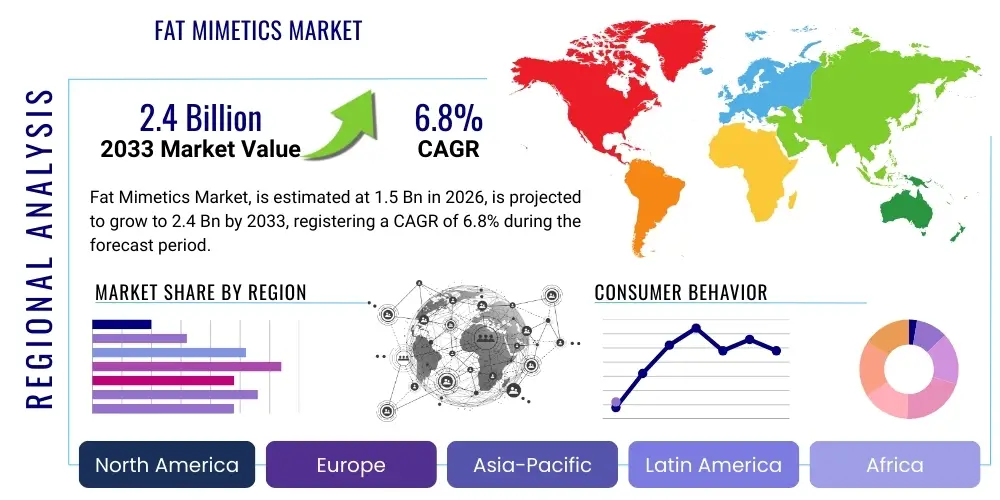

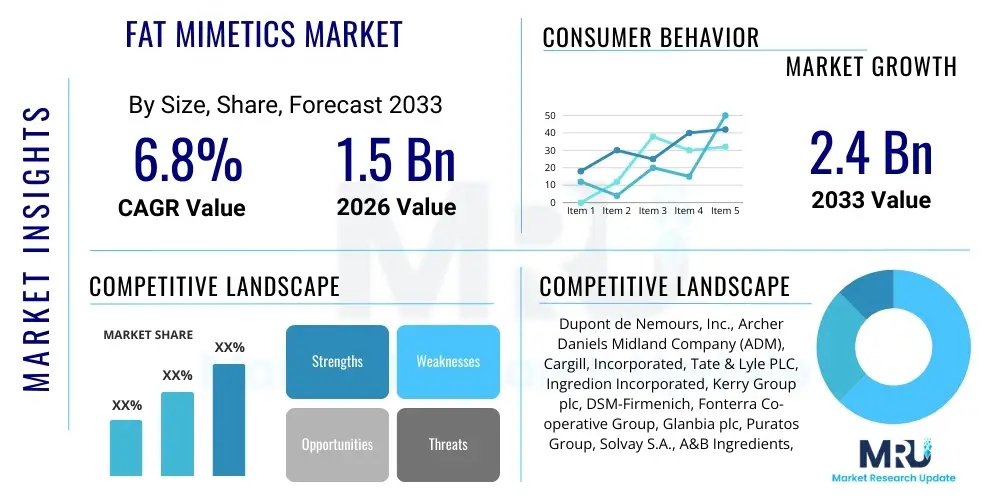

The Fat Mimetics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Fat Mimetics Market introduction

The Fat Mimetics Market encompasses ingredients designed to replicate the textural, sensory, and functional properties of traditional fats (lipids) in food products while significantly reducing calorie content. These substitutes, often derived from carbohydrates, proteins, or modified fats, are critical in meeting growing consumer demand for reduced-fat, healthier food alternatives without sacrificing palatability or mouthfeel. The primary objective of fat mimetics is to provide the lubricity, creaminess, and richness associated with full-fat products, thereby enabling manufacturers to comply with evolving public health guidelines and dietary trends focused on obesity and cardiovascular disease prevention. The market landscape is characterized by continuous innovation in ingredient technology, aiming to enhance thermal stability and compatibility across diverse food matrices, including baked goods, dairy substitutes, dressings, and processed meats. This introductory phase sets the stage for a detailed analysis of how sophisticated ingredient science is mitigating the sensory gap between traditional high-fat foods and their healthier counterparts, securing consumer acceptance crucial for market vitality. The complexity of replacing fat is not merely caloric but structural; fat mimetics must handle moisture retention, emulsion stability, and the subtle release of flavor compounds, making their development a high-value technological endeavor.

Product descriptions within this market vary widely, ranging from starch-based ingredients like maltodextrins and modified starches to protein-based systems such as microparticulated proteins (e.g., whey and milk proteins) and lipid-based products like structured triglycerides and specialized emulsifiers. Major applications span the entirety of the food and beverage industry, prominently featuring low-fat dairy products (yogurts, ice cream), confectionery, sauces, and baked goods, where maintaining moisture and structure is paramount. The increasing prevalence of clean label demands further pressures manufacturers to utilize natural and recognizable sources for these mimetics, such as plant fibers and tailored hydrocolloids, complicating formulation but expanding the market's technological breadth. The selection of a specific fat mimetic is highly dependent on the target application’s specific requirements; for instance, high-shear applications like dressings often necessitate highly stable protein or emulsifier systems, whereas high-temperature applications like baking rely heavily on resilient modified starches. The versatility demonstrated by these ingredients across multiple food categories underscores their indispensable role in the modern food formulation process and highlights the depth of research dedicated to improving their functional performance and sensory equivalence to native fats.

The core benefits of incorporating fat mimetics include significant calorie reduction, improved nutritional profiles (e.g., reduced saturated fat), and enhanced product stability during processing and storage. Driving factors for market expansion are fundamentally rooted in global health concerns, regulatory support for fat reduction, and sophisticated consumer preferences favoring indulgence without guilt. Furthermore, the functional versatility of modern fat mimetics allows for optimization of texture and flavor release in complex food systems, making them indispensable tools for food scientists developing the next generation of healthy packaged goods. Economic factors also contribute significantly; fluctuating prices of commodities like butterfat or high-quality specialty oils occasionally make technologically advanced mimetics a more stable, long-term input cost alternative for mass-market food production. The cumulative effect of these health, regulatory, and economic stimuli ensures a strong, sustained demand for novel and improved fat replacement solutions across all geographic and socioeconomic boundaries, positioning the fat mimetics sector as a high-growth segment within the broader specialty ingredients market.

Fat Mimetics Market Executive Summary

The global Fat Mimetics Market is poised for substantial growth, primarily driven by persistent worldwide concerns regarding rising obesity rates and associated non-communicable diseases, prompting consumers and regulators alike to prioritize low-fat dietary solutions. Business trends indicate a strong shift towards incorporating natural and plant-derived fat mimetics, such as specific hydrocolloids and oat-based ingredients, aligning with the clean label movement and the surge in vegan and flexitarian diets. Key market players are heavily investing in R&D to develop novel microencapsulation techniques and specialized starches that offer superior heat stability and a mouthfeel indistinguishable from actual fat, securing competitive advantage through enhanced functional performance. Strategic initiatives such as partnerships between large ingredient manufacturers and specialized biotechnology firms are becoming commonplace, aimed at accessing proprietary technologies for fermentation-derived fat mimetics that promise unparalleled sustainability and functional benefits. Furthermore, the push for customized ingredient systems, rather than generic replacements, is shaping the competitive landscape, rewarding companies capable of delivering application-specific formulation solutions tailored to client needs and high-throughput production requirements. This strategic alignment towards innovation and functional superiority is a defining characteristic of the current market trajectory, emphasizing quality over simple cost reduction.

Regional trends highlight the dominance of North America and Europe, attributed to stringent governmental health policies, high consumer awareness regarding caloric intake, and well-established industrial infrastructure for food ingredient manufacturing. North American consumers, in particular, readily adopt products boasting “low fat” or “reduced calorie” claims, supported by robust marketing campaigns and readily available specialized ingredient supplies. Conversely, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth trajectory, fueled by rapid urbanization, increasing disposable incomes, and the Westernization of diets, leading to greater consumption of processed foods that require fat reduction solutions. Investment in manufacturing capacity expansion across developing economies within APAC is crucial for capitalizing on this accelerating demand, particularly in countries like China and India. The need for temperature-stable mimetics is particularly acute in APAC due to challenging climate conditions, pushing local research towards hydrocolloid and modified starch solutions that maintain integrity throughout high heat and prolonged ambient storage, presenting a unique technological opportunity for regional suppliers.

Segment trends reveal that the Carbohydrate-based segment (including maltodextrin and starches) currently holds the largest market share due to its cost-effectiveness, wide availability, and established use in numerous applications, serving as the foundational volume driver for the market. These ingredients offer excellent water-binding properties essential for moisture retention in baked goods and structure enhancement in sauces. Nevertheless, the Protein-based fat mimetics segment is expected to register the fastest growth, propelled by the high demand for protein fortification in foods and the superior textural and emulsifying properties offered by microparticulated proteins, which closely mimic the characteristics of animal fats and dairy cream. Application-wise, the bakery and confectionery segment remains the primary consumer, although the burgeoning market for low-fat dairy and non-dairy alternatives is rapidly becoming a significant growth engine. This shift is driven by dairy manufacturers seeking high-performance ingredients that can successfully replace butterfat in products like low-fat cheese and spreadable dairy creams while maintaining the premium quality expected by consumers in mature markets.

AI Impact Analysis on Fat Mimetics Market

User inquiries regarding AI's influence on the Fat Mimetics Market predominantly revolve around optimizing ingredient formulation, predicting sensory outcomes, and enhancing supply chain efficiency for specialized raw materials. Users seek assurance that AI can accelerate the discovery and synthesis of next-generation fat mimetics that address complex issues like off-flavor generation and thermal instability, which plague current ingredients. Key themes emerging from common questions include the application of machine learning for personalized nutrition, where AI models analyze individual metabolic responses to various fat substitutes, and the automation of quality control processes to ensure the consistency of microparticulated systems. The complexity of modeling the exact rheology (flow and deformation) that distinguishes an acceptable mouthfeel from a failed formulation makes AI a critical tool. Specifically, food scientists are leveraging AI to predict the interaction matrix between fat mimetics, flavor compounds, and other bulk ingredients, a task too complex for traditional empirical testing, thus offering a predictive leap in product development cycles and minimizing expensive laboratory iterations.

There is also significant interest in how AI can streamline R&D pipelines, reducing the time and cost associated with iterative laboratory testing and scaling up production of novel, sustainable fat alternatives. For instance, generative AI models are being utilized to design molecular structures for novel hydrocolloids that exhibit specific, tunable viscoelastic properties tailored for unique applications, such as shelf-stable salad dressings or specific non-dairy cheese analogs. Furthermore, AI-driven logistics platforms are optimizing the procurement of plant-based raw materials, factoring in climate variables, yield predictions, and geopolitical risks to ensure a stable supply of high-purity inputs required for specialized fat mimetic production. This strategic application of AI moves beyond simple data processing into active material design and predictive operational management, positioning AI as a core competitive differentiator for leading ingredient suppliers seeking to rapidly commercialize breakthrough solutions that meet increasingly stringent consumer expectations regarding texture and purity.

- Accelerated Formulation Discovery: AI algorithms analyze vast chemical databases to rapidly identify and screen potential compounds that exhibit desired fat-mimicking properties, drastically shortening the R&D cycle for novel ingredients, often predicting stability and sensory attributes before costly synthesis.

- Sensory Prediction Modeling: Machine learning models predict how various fat mimetic combinations will impact texture, mouthfeel, and flavor release in specific food matrices, utilizing complex rheological data and consumer preference scores to optimize acceptance prior to large-scale sensory panels.

- Personalized Nutrition Integration: AI platforms tailor the use of fat mimetics in customized food products based on individual dietary requirements, genetic predispositions, and health goals, utilizing biomarker data to recommend optimal low-fat compositions for metabolic health.

- Supply Chain Optimization: Predictive analytics manage the sourcing and logistics of carbohydrate, protein, and specialty lipid raw materials, ensuring traceability, forecasting demand fluctuations with higher accuracy, and minimizing waste in the complex ingredient supply chain.

- Quality Control Automation: Computer vision and advanced data processing systems monitor the consistency and particle size distribution of microparticulated proteins and starches during manufacturing, guaranteeing product integrity, batch-to-batch homogeneity, and functional performance with minimal human intervention.

- Sustainable Sourcing Enhancement: AI helps identify and optimize processes for utilizing sustainable or upcycled agricultural byproducts (e.g., starch residues, spent grains) as sources for new fat mimetics, improving resource efficiency and supporting the industry’s net-zero operational goals through optimized biorefinery processes.

- Regulatory Compliance Tracking: AI tools continuously monitor and flag potential compliance issues related to novel ingredients across different jurisdictions (e.g., EU Novel Food regulations vs. FDA Generally Recognized As Safe (GRAS) status), expediting market entry processes for new fat replacers.

DRO & Impact Forces Of Fat Mimetics Market

The Fat Mimetics Market is principally propelled by the macroeconomic trend of preventive healthcare and widespread public education campaigns emphasizing the reduction of dietary saturated and trans fats. This driver is further solidified by official dietary recommendations from global health organizations and the widespread implementation of front-of-pack labeling systems that highlight high-fat content. This driver is counterbalanced by significant restraints, primarily the technical challenge of consistently replicating the sensory attributes of full-fat products, as many current mimetics fall short in providing the characteristic creaminess and richness, often leading to consumer rejection of the reformulated product. Opportunities abound in the development of hybrid systems that combine different types of mimetics (e.g., protein-lipid combinations) to achieve synergistic effects, as well as exploiting niche markets focused on specific dietary requirements, such as gluten-free or low-glycemic products. These dynamics create powerful impact forces centered around regulatory pressures, technological feasibility, and shifting consumer perceptions regarding ingredient lists and nutritional transparency, forcing manufacturers into a continuous cycle of innovation to maintain market relevance.

Key drivers include supportive regulatory environments in major economies that mandate or incentivize fat reduction, alongside the increasing cost volatility of traditional animal and vegetable fats, making mimetics a potentially more stable and cost-effective ingredient solution in the long run, particularly when factoring in long-term health externalities. The growing functional food trend, where consumers seek added benefits beyond basic nutrition (e.g., fiber fortification through carbohydrate-based mimetics), further amplifies market momentum. The development of mimetics that not only reduce fat but also offer enhanced shelf stability, antimicrobial properties, or texture modification benefits provides a significant competitive edge. Conversely, the high cost of advanced processing technologies, such as high-pressure homogenization required for microparticulation, acts as a barrier to entry for smaller manufacturers, constraining rapid market expansion. Additionally, consumer skepticism regarding the processing level and safety of chemically modified ingredients, despite regulatory approval, poses a perceptual restraint that the industry must actively manage through transparency and the development of recognizable, minimally processed alternatives.

The impact forces operate through several channels: Technological innovation determines the success of new product launches and consumer acceptance, as the market strongly favors mimetics that deliver functional parity with natural fats. Economic forces dictate pricing and raw material accessibility, with global commodity price swings influencing the relative cost-effectiveness of switching from traditional fats to specialized mimetics. Social forces, particularly the intense demand for clean labels and plant-based sourcing, reshape formulation strategies, pushing companies away from highly modified starches toward naturally derived hydrocolloids and fermentation products. The continuous cycle of research driven by the need to overcome flavor masking and instability issues ensures that technological advancements remain the most influential impact force, constantly redefining the capabilities and potential applications of fat mimetics across the food industry spectrum, rewarding those who invest heavily in R&D to solve these complex functional challenges and achieve sensory acceptance.

Segmentation Analysis

The Fat Mimetics Market is meticulously segmented based on ingredient type, source, application, and form, reflecting the diversity and specialization required to function across the vast spectrum of food manufacturing processes. This granular segmentation allows manufacturers to target specific functional requirements, such as viscosity enhancement in beverages or moisture retention in baked goods, thereby maximizing formulation efficacy. The fundamental segments define the market's structure, ranging from high-volume, cost-effective carbohydrate substitutes that leverage water-binding capacity to high-value, specialized protein-based mimetics tailored for premium food products that demand complex emulsification and heat stability. Understanding these segments is crucial for strategic market entry and anticipating shifts in raw material sourcing influenced by clean label and sustainability mandates, as sourcing strategies often dictate the final price and market positioning of the derived fat mimetic.

The segmentation by ingredient type, specifically the distinction between carbohydrate, protein, and lipid mimetics, highlights the functional trade-offs inherent in fat replacement. Carbohydrate-based options are valued for their bulking and structural properties, effectively replacing the volume of fat and retaining water, but they often lack the richness or melting profile of natural fats. Protein-based mimetics, conversely, excel in creating microparticulated systems that mimic the texture and melt of fat globules, offering a superior sensory experience, albeit at a higher cost due to specialized processing. The segmentation by source further reflects the contemporary market shift: plant-based mimetics (e.g., derived from corn, potato, or oat fiber) are seeing massive investment spurred by the vegan trend and clean label demand, gradually eroding the market share of traditional animal-based counterparts, though dairy-derived proteins remain dominant in specific high-end applications like premium ice cream and creamers.

Application segmentation reveals the areas of highest economic value and technological challenge. The dairy and frozen desserts sector demands mimetics that perform flawlessly under freezing and thawing conditions while maintaining a creamy, smooth texture, making it a high-value segment. The bakery sector, the volume leader, requires mimetics capable of surviving high heat and contributing structure and browning characteristics. This intricate classification underscores that the market is not homogenous; success depends on delivering application-specific solutions that address unique processing constraints and sensory benchmarks within each vertical. The dry vs. liquid form segmentation is essential for logistical planning, as dry powders offer ease of transport and extended shelf life, dominating the global trade of these ingredients, while liquid emulsions are often preferred by large manufacturers for seamless integration into high-volume liquid processing lines.

- By Ingredient Type:

- Carbohydrate-based: Modified Starches (Waxy Maize, Potato Starch), Maltodextrins, Gums (Xanthan, Guar, Carob), Celluloses (Microcrystalline Cellulose), Dextrins, Oat Fiber.

- Protein-based: Microparticulated Whey Protein, Caseinate, Egg Albumen, Soy Protein Isolates, Pea Protein Hydrolysates.

- Lipid-based: Structured Lipids (Medium-Chain Triglycerides (MCTs) blends), Specialized Emulsifiers (Lecithin, Mono- and Diglycerides), Diacylglycerols (DAGs).

- By Source:

- Plant-based: Potato, Corn, Wheat, Oat, Rice, Pea, Soy, Citrus Fiber, various Botanical Gums.

- Animal-based: Dairy Protein (Whey, Casein), Egg Protein.

- Microbial/Synthetic: Cultured Ingredients (Fermentation-derived Hydrocolloids), Specific Chemical Synthesis (limited due to clean label pressures).

- By Application:

- Bakery & Confectionery: Cakes, Cookies, Bread, Low-fat Chocolates, Fillings, Glazes (Largest volume segment).

- Dairy & Frozen Desserts: Low-fat Yogurt, Reduced-fat Cheese Spreads, Ice Cream, Non-dairy Alternatives (Highest value growth segment).

- Sauces, Dressings, & Spreads: Mayonnaise, Salad Dressings, Margarines, Nut Butters (focus on emulsion stability).

- Meat & Seafood Products: Processed Meats, Low-fat Sausages, Meat Analogues (focus on moisture and binding).

- Beverages & Others: Nutritional Drinks, Meal Replacements, Smoothies, Specialized Medical Foods.

- By Form:

- Dry (Powders, Granules)

- Liquid (Emulsions, Suspensions, Gels)

Value Chain Analysis For Fat Mimetics Market

The value chain for the Fat Mimetics Market begins with the upstream sourcing and processing of raw materials, which primarily include agricultural commodities such as corn, potato, wheat, oats, and dairy inputs. Upstream analysis focuses on securing stable, high-quality, and cost-effective raw material supplies, a critical challenge given the global volatility in commodity markets and the increasing requirement for non-GMO and organic sources. The initial transformation stage often involves sophisticated fractionation and purification—separating starches from proteins, or purifying hydrocolloids from plant extracts—setting the baseline quality for the final ingredient. Specialized chemical modification processes, enzymatic treatment, or physical processing (like high-pressure homogenization and membrane separation for protein microparticulation) convert these raw commodities into functional fat mimetic ingredients, representing the core manufacturing stage where technological expertise dictates the final product performance, functionality, and crucial attributes like water-holding capacity and thermal resilience. The strategic importance of vertical integration in managing raw material volatility and ensuring purity standards is growing among key market players.

The midstream involves the intricate formulation and blending of these specialized ingredients into tailored solutions for specific food applications. Ingredient manufacturers often act as solution providers, collaborating closely with food processors to ensure the fat mimetic functions optimally within complex recipes, compensating for heat, shear stress, and pH variations, a process often referred to as "application support." Distribution channels are generally robust, leveraging a combination of direct sales and specialized indirect distribution networks. Direct channels involve large ingredient suppliers providing tailored batches and technical expertise directly to major food and beverage multinationals (e.g., global dairy processors or large bakery chains), enabling highly customized application support and troubleshooting. Indirect channels utilize specialized regional food ingredient distributors that maintain inventories, handle smaller order volumes, and provide essential technical support to small and medium-sized food processors globally, acting as crucial conduits for market penetration in fragmented geographies.

Downstream analysis centers on the application manufacturers, including bakeries, dairy producers, confectionery firms, and processed food companies, who integrate the fat mimetics into their final consumer products. This stage is highly influenced by regulatory compliance regarding labeling, nutritional claims, and the consumer perception of the final product’s ingredient list. The efficiency and success of the value chain rely heavily on transparent collaboration between R&D teams of the ingredient suppliers and the product development teams of the food manufacturers to ensure seamless integration and satisfactory sensory results for the end consumer. Effective downstream marketing emphasizes the health benefits (reduced fat, reduced calories) enabled by these advanced ingredients, often linking them explicitly to specific lifestyle trends (e.g., keto-friendly, high-fiber, plant-based). The continuous feedback loop from the downstream market concerning sensory failures or successes dictates the research priorities in the upstream manufacturing stage, completing the cycle of technological refinement necessary for competitive success in the fat mimetics space.

Fat Mimetics Market Potential Customers

Potential customers for the Fat Mimetics Market are primarily large-scale and mid-tier manufacturers within the fast-moving consumer goods (FMCG) sector, specifically those operating in categories where fat reduction is a paramount consumer concern or regulatory necessity. The largest segment of end-users includes the dairy and processed food industry, seeking to formulate low-fat versions of classic products like ice cream, yogurt, cheese spreads, and ready meals without compromising consumer expectations of taste and texture. Specifically, companies focusing on dairy alternatives (e.g., oat milk, almond milk yogurt) are emerging high-growth customers, utilizing mimetics to achieve the desired creaminess often lacking in plant-based beverages. Furthermore, the bakery industry is a vital customer base, utilizing mimetics to maintain the desired moisture, crumb structure, and shelf life of reduced-fat breads, cakes, and cookies, often relying on modified starches and specific fiber systems to replace the moisturizing and structure-building roles of fat in baked goods.

Beyond traditional food manufacturing, the beverage industry, particularly companies specializing in nutritional drinks, weight management shakes, and meal replacements, constitutes a growing customer segment. These companies employ fat mimetics to improve the mouthfeel and emulsion stability of their protein and fiber-rich liquid formulations, preventing sedimentation and separation while enhancing palatability. The growing emphasis on health and wellness also brings pharmaceutical and nutraceutical companies into the customer fold, as they integrate tailored fat substitutes into medical foods and specialized dietary supplements intended for weight management or managing chronic conditions such as diabetes or hypercholesterolemia, where precise caloric control is necessary. This segment demands extremely high purity and consistent performance, often utilizing advanced lipid-based mimetics or microencapsulated systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dupont de Nemours, Inc., Archer Daniels Midland Company (ADM), Cargill, Incorporated, Tate & Lyle PLC, Ingredion Incorporated, Kerry Group plc, DSM-Firmenich, Fonterra Co-operative Group, Glanbia plc, Puratos Group, Solvay S.A., A&B Ingredients, J. Rettenmaier & Söhne GmbH & Co. KG (JRS), Gelita AG, Novozymes A/S, Associated British Foods plc (ABF), Wacker Chemie AG, AVEBE U.A., Döhler GmbH, Sensus B.V., CP Kelco U.S., Inc., The Agrana Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fat Mimetics Market Key Technology Landscape

The technological landscape of the Fat Mimetics Market is characterized by continuous refinement of physical, chemical, and biological modification techniques designed to alter raw materials into ingredients that provide fat-like rheological and textural properties. A major focus is on particle engineering, specifically microparticulation, which transforms soluble proteins (like whey) or certain starches into spherical particles ranging from 0.1 to 10 micrometers. These particles mimic the globular structure of fat cells, offering excellent lubricity, opacity, and sensory perception of richness, particularly in low-fat dairy. This high-shear process, often utilizing high-pressure homogenization or advanced membrane filtration, is crucial for developing premium, high-functionality fat replacers that are highly valued in the dairy and dessert segments for their ability to deliver a genuine mouthfeel without the high caloric load. The control over particle size distribution is paramount, as slight variations can drastically alter the creaminess and stability of the final food matrix, driving investment in highly precise and scalable processing equipment.

Another pivotal technological area involves the advanced modification of carbohydrates, primarily starches and fibers. Techniques such as cross-linking, etherification, esterification, and enzymatic hydrolysis are employed to dramatically enhance the water-binding capacity, shear resistance, and gel-forming properties of starches and fibers, creating stable, viscous matrices that entrap moisture and contribute structural integrity—essential functions in baked goods and sauces. Novel technologies also include the development of structured lipids—modified triglycerides designed to reduce caloric density (e.g., by incorporating non-digestible fatty acids) or alter absorption kinetics—and complex hydrocolloid systems that utilize synergistic gelling agents (like combinations of pectin, gums, and carrageenan) to create viscoelastic structures similar to solid fat networks. These complex hydrocolloid systems are often optimized through computational modeling to ensure stability across diverse processing conditions, such as high heat during baking or rapid freezing during dessert production, ensuring their robustness against real-world manufacturing variables.

Furthermore, enzymatic technology plays an increasing role, particularly in tailoring the molecular structure of proteins and specific polysaccharides to enhance functionality and digestibility, often resulting in cleaner label claims compared to chemical modification. Precision fermentation is also emerging as a high-potential technology, allowing for the sustainable, clean-label production of novel hydrocolloids, specialized single-cell proteins, or unique lipid components that mimic complex fat functionalities, thereby significantly reducing reliance on conventional, land-intensive agricultural sourcing. The integration of AI and high-throughput screening in R&D laboratories is indispensable for rapidly testing and optimizing these complex ingredient formulations, enabling manufacturers to minimize the impact on product flavor while maximizing textural equivalence to full-fat products, fundamentally accelerating the time-to-market for next-generation fat mimetics and solidifying the market's reliance on cutting-edge ingredient science.

Regional Highlights

- North America: Dominates the market share due to stringent governmental regulations regarding trans fats and saturated fat labeling (e.g., robust FDA guidelines), coupled with high consumer expenditure on health and wellness products and a culture that values convenience foods. The region is a hub for technological innovation in premium mimetics like microparticulated proteins and specialized clean-label starches. Key drivers include the large-scale industrial use of mimetics in quick-service restaurants and processed food manufacturers addressing the escalating demand for "better-for-you" snack options. The strong presence of leading ingredient suppliers and research institutions further cements North America’s leading position in terms of both consumption value and technological advancement.

- Europe: Exhibits high maturity, driven by proactive public health initiatives, high regulatory standards (EFSA), and a strong consumer focus on sustainable and natural ingredients, particularly within Western European nations like Germany, the UK, and the Benelux countries. The European market places a premium on clean label and non-GMO sourcing, driving the adoption of fiber-based mimetics and natural hydrocolloids. Dairy applications are particularly strong, with significant demand for mimetics that can replace traditional butterfat in high-quality cheese, spreads, and yogurt without impacting flavor integrity. The push toward carbon neutrality also favors locally sourced, plant-derived fat replacement systems.

- Asia Pacific (APAC): Projected as the fastest-growing region globally, driven by demographic shifts, rapid economic expansion, and a foundational change in consumer habits favoring processed and packaged Western-style foods. This has necessitated immediate fat reduction solutions to address emerging health epidemics linked to urbanization. Countries like China, India, Japan, and Australia are seeing massive increases in demand, primarily for cost-effective carbohydrate-based mimetics (modified starches, gums) that are scalable for mass-market food production. The key challenge and opportunity lie in developing functional mimetics that are stable under tropical climates and culturally acceptable in local culinary applications, necessitating tailored R&D efforts in local innovation centers.

- Latin America: Represents a moderately growing market, characterized by increasing health awareness and governmental efforts to combat endemic obesity and chronic disease, particularly in major economies such as Mexico, Brazil, and Argentina. Market growth is slightly hampered by economic volatility and high price sensitivity among broad consumer segments, which often necessitates the use of more cost-effective, high-volume carbohydrate-based mimetics (e.g., readily available modified starches) over more expensive imported protein systems. The regulatory landscape is evolving, with many nations adopting sugar and fat reduction policies inspired by international best practices, providing a strong long-term structural driver for market expansion in the region.

- Middle East and Africa (MEA): A nascent but rapidly developing market primarily focused on high-end imported ingredients in the GCC nations, serving high-income consumer segments and the large expatriate population seeking premium low-fat products. Growth across broader Africa is accelerating due to investment in modern food processing plants. Demand is highest for temperature-tolerant fat mimetics suitable for the region’s high heat and prolonged ambient storage conditions, focusing on stabilization and texture in confectionery and packaged dairy products. Key constraints include complex logistics and the high dependency on imported finished ingredients rather than local manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fat Mimetics Market.- Dupont de Nemours, Inc.

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Tate & Lyle PLC

- Ingredion Incorporated

- Kerry Group plc

- DSM-Firmenich

- Fonterra Co-operative Group

- Glanbia plc

- Puratos Group

- Solvay S.A.

- A&B Ingredients

- J. Rettenmaier & Söhne GmbH & Co. KG (JRS)

- Gelita AG

- Novozymes A/S

- Associated British Foods plc (ABF)

- Wacker Chemie AG

- AVEBE U.A.

- Döhler GmbH

- Sensus B.V.

- CP Kelco U.S., Inc.

- The Agrana Group

- Nexira SAS

- Fuji Oil Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fat Mimetics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are fat mimetics and how do they reduce calories?

Fat mimetics, also known as fat replacers, are specialized food ingredients, typically derived from processed carbohydrates (e.g., starches, fibers, maltodextrins) or proteins (e.g., microparticulated whey), engineered to replicate the textural, structural, and mouthfeel properties of high-caloric fat. They achieve calorie reduction by replacing the volume of fat, which yields 9 kcal/g, with ingredients that are either non-digestible or provide significantly fewer calories (often 1-4 kcal/g) due to their high water-binding capacity and modified chemical structure, effectively bulking the product while cutting caloric density.

Which segment of fat mimetics is growing the fastest, and why?

The Protein-based fat mimetics segment, particularly microparticulated proteins derived from whey, casein, or plant sources, is projected to exhibit the fastest growth. This acceleration is driven by their superior ability to mimic the sensory properties of real fat, providing excellent lubricity and creaminess. Furthermore, they align perfectly with the prevailing consumer demand for protein fortification and cleaner labels, offering highly functional and texturally robust solutions for premium low-fat dairy and non-dairy applications.

What are the primary challenges in formulating food products using fat mimetics?

The main challenges center on sensory fidelity: replicating the complex melt profile, lubricity, and rich flavor release of natural fats without leaving a characteristic 'thin' or 'gummy' mouthfeel. Technical hurdles include maintaining the structural stability of the mimetic under aggressive processing conditions (e.g., high heat during baking, high shear during homogenization) and preventing potential off-flavors that can arise from interactions between the mimetics and other flavor components in the food matrix.

How does the clean label and sustainability movement influence the Fat Mimetics Market?

The clean label movement is a critical driver, necessitating a major shift in R&D focus toward natural, recognizable, and sustainably sourced ingredients. Consumers increasingly reject chemically modified or synthetic mimetics. This has fueled high demand and investment in plant-based, non-GMO solutions, such as specialized citrus fibers, oat beta-glucans, and ingredients produced via precision fermentation, ensuring ingredients meet both functional performance and transparency expectations.

Which food application holds the largest consumption volume for fat mimetics?

The Bakery and Confectionery sector holds the largest consumption volume for fat mimetics globally. In this application, carbohydrate-based mimetics (modified starches and specialty fibers) are heavily utilized to retain moisture, improve shelf life, contribute to the structure of reduced-fat goods, and provide bulking, thereby maintaining the desired weight and consistency of breads, cakes, and cookies while minimizing caloric content.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager