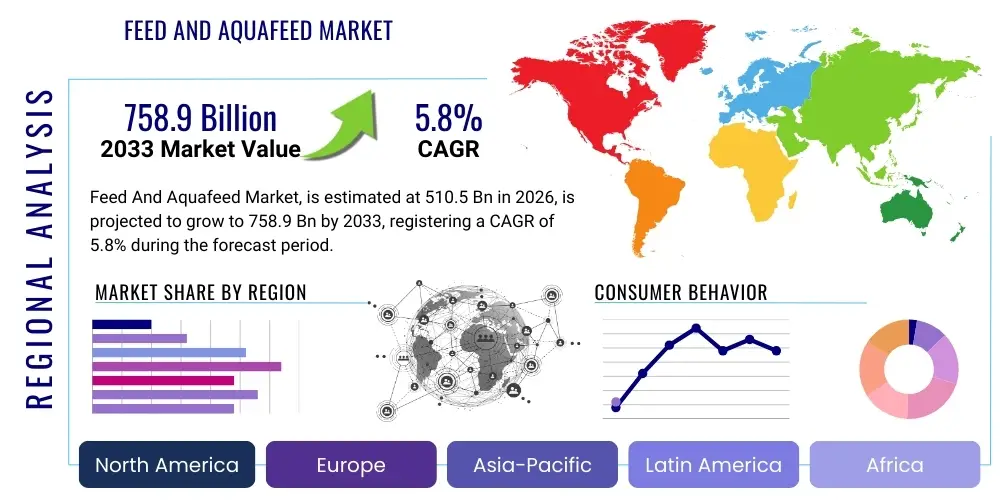

Feed And Aquafeed Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441751 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Feed And Aquafeed Market Size

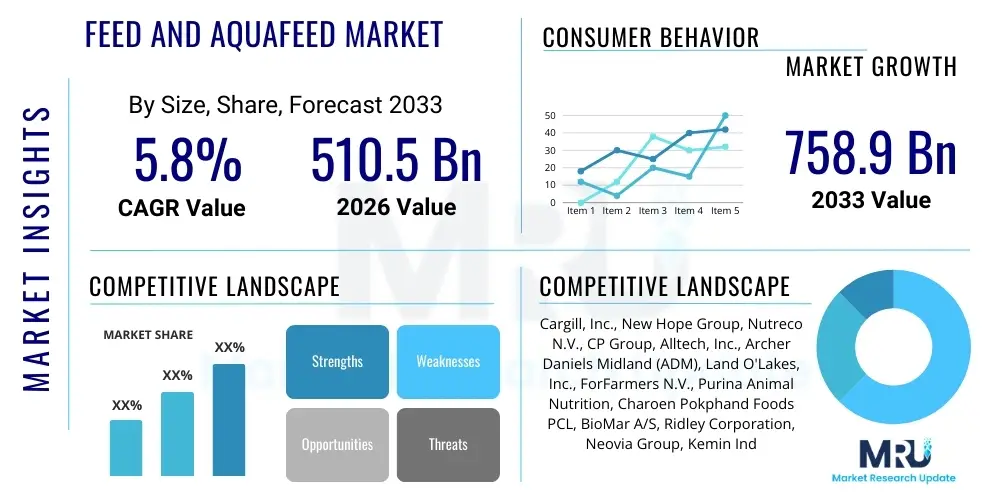

The Feed And Aquafeed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $510.5 Billion USD in 2026 and is projected to reach $758.9 Billion USD by the end of the forecast period in 2033.

The substantial expansion of the global population, coupled with shifting dietary preferences toward high-quality protein sources, fundamentally drives the robust growth observed in the Feed and Aquafeed market. This market segment is crucial for maintaining efficient and sustainable livestock and aquaculture production systems worldwide. Increased demand for specialized, performance-enhancing feed, particularly in emerging economies like China, India, and Brazil, contributes significantly to the escalating market valuation. Furthermore, advancements in nutritional science, focusing on gut health optimization and disease prevention through functional ingredients, are creating premium market opportunities.

Market dynamics are also heavily influenced by stringent regulatory frameworks concerning animal welfare, antibiotic usage, and environmental sustainability. Producers are increasingly investing in sustainable sourcing of raw materials, including utilizing novel proteins such as insect meal and algae, which not only address supply chain constraints but also align with consumer demands for eco-friendly protein production. The integration of precision nutrition techniques and digital farming technologies is enhancing feed efficiency, thereby supporting the overall trajectory of market valuation toward the forecasted high-value figure by 2033.

Feed And Aquafeed Market introduction

The Feed and Aquafeed Market encompasses the production and distribution of formulated diets designed to meet the specific nutritional requirements of livestock (poultry, swine, ruminants) and aquatic species (fish, shrimp, crustaceans). Key products include complete feeds, supplements, premixes, and specialized functional feeds (e.g., medicated or growth-promoting feeds). Major applications span commercial farming operations aiming for improved growth rate, feed conversion ratios (FCR), and overall animal health. The primary benefits include maximizing production efficiency, ensuring consistent meat/seafood quality, and reducing the environmental footprint of protein production. Driving factors include globalization of meat and seafood trade, rising disposable incomes leading to increased protein consumption, technological advancements in feed formulation, and the necessity for sustainable intensification of animal agriculture to meet global food security demands, alongside the critical shift toward antibiotic-free and sustainable feeding practices.

Feed And Aquafeed Market Executive Summary

The Feed and Aquafeed Market demonstrates strong resilience, characterized by rapid technological assimilation and a focus on sustainability and efficiency. Business trends highlight strategic mergers and acquisitions (M&A) among major ingredient suppliers and feed millers, aimed at consolidating raw material sourcing and expanding geographical reach, particularly into high-growth Asia Pacific markets. The regional trends indicate that Asia Pacific remains the dominant consumption hub due to expansive aquaculture development and intensive livestock farming practices, while North America and Europe lead in implementing precision feeding and utilizing alternative protein sources. Segment trends show accelerated growth in the aquafeed sector, driven by increasing global seafood consumption and the necessity for high-quality, sustainable fishmeal alternatives. Additionally, the functional feed additives segment, focusing on probiotics, prebiotics, and enzymes, is experiencing substantial investment due to its ability to enhance gut health and mitigate the reliance on conventional antibiotics, directly impacting farm profitability and animal welfare standards across all livestock segments.

AI Impact Analysis on Feed And Aquafeed Market

Analysis of common user questions reveals a central interest in how Artificial Intelligence (AI) and Machine Learning (ML) can optimize complex feed formulation processes, predict supply chain disruptions, and enhance animal health monitoring in real-time. Users frequently inquire about AI's role in mitigating the volatile costs of raw materials, specifically soybean and corn, and how predictive analytics can personalize nutrition plans for individual animals or specific farm conditions. There is significant anticipation regarding AI's capability to improve Feed Conversion Ratios (FCRs) through micro-adjustments in diet composition based on behavioral data, environmental parameters, and genomic information, effectively pushing the boundaries of precision livestock farming. Concerns often center on data privacy, the initial high cost of AI implementation, and the need for standardized data collection across diverse farm settings, emphasizing the requirement for robust, verifiable algorithms that deliver clear Return on Investment (ROI) for farmers.

AI’s influence is rapidly transforming the operational efficiency of feed mills and large-scale farming enterprises. Through advanced algorithms, AI systems analyze vast datasets—including ingredient nutrient composition, animal performance records, weather patterns, and market prices—to generate optimal least-cost formulations far quicker and more accurately than traditional linear programming methods. This optimization minimizes waste, ensures regulatory compliance regarding nutrient limits, and allows for rapid reformulation in response to sudden raw material price spikes or quality variations, thereby stabilizing profit margins for feed manufacturers amidst global market volatility.

Furthermore, AI is pivotal in moving the industry toward preventative health management rather than reactive treatment. In aquaculture, image recognition and machine vision powered by AI monitor fish behavior, feeding efficiency, and early signs of disease outbreak with unparalleled accuracy. Similarly, in swine and poultry, AI analyzes audio patterns (e.g., coughing analysis) and movement data to preemptively identify stress or illness in flocks and herds. This proactive intervention reduces mortality rates, minimizes the use of antibiotics, and contributes significantly to the sustainability and ethical profile of modern animal protein production, confirming AI as a critical component in future market competitiveness.

- AI-driven optimization of feed formulation using predictive nutrient modeling.

- Real-time monitoring of animal health, behavior, and environment via machine vision and sensors.

- Enhanced supply chain resilience through predictive logistics and inventory management.

- Precision feeding strategies based on individual animal genomics and growth stage data.

- Automated quality control and ingredient safety checks in feed manufacturing.

- Forecasting raw material price volatility to inform procurement strategies.

- Development of personalized functional feed additives based on analyzed microbiome data.

DRO & Impact Forces Of Feed And Aquafeed Market

The market is primarily driven by the escalating global demand for animal protein, particularly in developing regions, compelling intensive farming systems to utilize specialized, high-performance feeds to maximize yields and efficiency. Opportunities arise from the necessity to innovate sustainable raw materials, such as single-cell proteins, insect derivatives, and novel oilseeds, which mitigate environmental impact and reduce reliance on volatile resources like fishmeal and soy. Restraints include the significant volatility in commodity prices (corn, soybean meal), which directly impacts production costs, coupled with increasing regulatory pressure regarding sustainability mandates, environmental pollution, and strict controls on medicated feeds. These forces exert a significant, dynamic impact, compelling stakeholders to prioritize technological investments in feed efficiency, sustainable sourcing, and regulatory compliance to maintain competitive advantage and manage operational risks effectively in the global marketplace.

Segmentation Analysis

The Feed and Aquafeed market is intricately segmented across various dimensions, including the type of ingredient, the target animal species, the product form, and the geography of consumption. Understanding these segments is crucial as different species demand specific nutritional profiles and processing techniques, leading to varied market growth rates. For instance, the aquafeed segment necessitates high-protein, highly digestible formulas, often driving innovation in alternative marine ingredient sourcing. Conversely, the poultry segment focuses heavily on cost-efficiency and Feed Conversion Ratio (FCR) optimization due to its high volume and rapid production cycles. The rise of pet food and specialty supplements, categorized under product type, also represents a premium growth avenue distinct from commodity livestock feed.

- Animal Type:

- Poultry Feed (Broilers, Layers, Turkeys)

- Swine Feed (Starters, Growers, Finishers)

- Ruminant Feed (Cattle, Dairy, Sheep)

- Aquafeed (Fish, Shrimp, Mollusks)

- Pet Food

- Others (Equine, Specialty Animals)

- Ingredient Type:

- Cereals (Corn, Wheat, Barley)

- Oilseed Meals (Soybean Meal, Rapeseed Meal)

- Fish Meal and Fish Oil

- Additives (Vitamins, Minerals, Enzymes, Amino Acids, Probiotics, Prebiotics)

- Alternative Proteins (Insect Meal, Algae, Single-Cell Proteins)

- Product Form:

- Pellets

- Mash

- Crumbles

- Extruded

- Liquid Feed

- Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Feed And Aquafeed Market

The value chain for the Feed and Aquafeed Market is complex, beginning with upstream analysis focused on the procurement of raw materials, primarily agricultural commodities such as corn, soy, wheat, and marine resources. Upstream efficiency relies heavily on global commodity market stability, effective hedging strategies, and the negotiation power with large-scale agricultural traders. The core manufacturing stage involves formulation, milling, blending, and quality assurance, where technology and process optimization drive cost efficiency. Downstream analysis encompasses the distribution network, which is critical for delivering bulk feed efficiently to commercial farms, processing plants, and retail outlets. Distribution channels include direct sales from large manufacturers to integrated farming operations, indirect sales through local distributors and cooperatives, and specialized logistics for highly perishable or sensitive ingredients, emphasizing cold chain requirements for certain functional additives or ingredients like fish oil.

Feed And Aquafeed Market Potential Customers

The primary consumers and end-users of the Feed and Aquafeed Market are highly diversified, ranging from integrated livestock producers and large commercial aquaculture farms to small-scale independent farmers and household pet owners. Large-scale customers, such as multinational poultry integrators and major dairy corporations, demand high-volume, standardized feeds designed for maximum FCR and output consistency. Aquaculture farms, particularly those specializing in high-value species like shrimp and salmon, constitute a rapidly expanding customer base seeking specialized, sustainable feeds with minimal environmental impact. Additionally, smaller farms, often served by local feed millers, require balanced nutrition solutions, while the growing pet industry serves as a crucial segment for specialized, premium, and functional companion animal nutrition products, characterized by higher price points and greater focus on ingredient traceability and natural sourcing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $510.5 Billion USD |

| Market Forecast in 2033 | $758.9 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Inc., New Hope Group, Nutreco N.V., CP Group, Alltech, Inc., Archer Daniels Midland (ADM), Land O'Lakes, Inc., ForFarmers N.V., Purina Animal Nutrition, Charoen Pokphand Foods PCL, BioMar A/S, Ridley Corporation, Neovia Group, Kemin Industries, Novozymes, Evonik Industries, DSM, ADM Animal Nutrition, Lallemand Inc., De Heus Animal Nutrition |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Feed And Aquafeed Market Key Technology Landscape

The technological landscape of the Feed and Aquafeed market is undergoing a fundamental transformation, moving toward digitalization, automation, and precise nutritional delivery. Key technologies center on enhancing efficiency and sustainability across the entire production cycle, from raw material analysis to feed processing and farm delivery. High-throughput sequencing and advanced ingredient analysis (e.g., Near-Infrared Spectroscopy or NIR) are widely adopted to provide rapid and accurate nutrient composition data, which is essential for dynamic formulation. Precision feeding technologies utilize IoT sensors, AI, and cloud computing to monitor animal intake and environmental factors, allowing for instantaneous adjustments to feed ratios, drastically improving Feed Conversion Ratios (FCRs) and reducing input costs. Furthermore, innovations in feed processing, particularly extrusion technology for aquafeed, ensure optimal digestibility and palatability, while the use of encapsulated additives guarantees effective delivery of functional ingredients, such as enzymes and probiotics, to the targeted digestive tract segments, promoting better gut health and reducing the need for prophylactic medication.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, driven by expansive growth in aquaculture (particularly in China, Vietnam, and India) and large-scale, intensive swine and poultry farming. This region faces immense pressure to utilize sustainable ingredients and mitigate disease risks, driving demand for functional feeds and antibiotic-free solutions. China remains the single largest consumer and producer of livestock and aquafeed globally.

- North America: Characterized by highly mature and vertically integrated agricultural systems. Growth is concentrated in specialized feeds, pet nutrition, and the adoption of cutting-edge precision livestock technology and advanced data analytics (AI/ML) to optimize large-scale operations and ensure traceability and regulatory compliance.

- Europe: Leads in sustainable and ethical feed production, driven by strict regulatory mandates (e.g., prohibition of antibiotic growth promoters). The market emphasizes novel protein sources (insect farming, algae), reduction of environmental pollution (nitrogen/phosphorous excretion), and sophisticated functional feed additives tailored for organic and high-welfare farming systems.

- Latin America (LATAM): A major production hub, particularly for poultry and beef, relying heavily on local soybean and corn production. Brazil and Argentina are critical players. The region focuses on improving logistics efficiency and integrating local raw materials into high-quality feed formulations for export markets.

- Middle East and Africa (MEA): Represents an emerging growth market, particularly in the Gulf Cooperation Council (GCC) states due to increasing local aquaculture projects and a push for food self-sufficiency. Challenges include reliance on imported raw materials and harsh climatic conditions, necessitating specialized feed resilience solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Feed And Aquafeed Market.- Cargill, Incorporated

- Nutreco N.V. (a SHV company)

- Archer Daniels Midland Company (ADM)

- Charoen Pokphand Foods PCL (CP Group)

- New Hope Group

- Alltech, Inc.

- Land O'Lakes, Inc.

- ForFarmers N.V.

- Purina Animal Nutrition (Land O'Lakes subsidiary)

- BioMar A/S

- Ridley Corporation Limited

- De Heus Animal Nutrition

- Evonik Industries AG

- Royal DSM N.V.

- Kemin Industries, Inc.

- Novozymes A/S

- Lallemand Inc.

- Vilofoss

- Faccenda Group (A Boparan company)

- InVivo Group (Neovia)

Frequently Asked Questions

Analyze common user questions about the Feed And Aquafeed market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the long-term growth of the global aquafeed sector?

The aquafeed sector's growth is predominantly driven by increasing global demand for healthy, sustainable seafood, coupled with the necessity of replacing volatile and unsustainable marine ingredients (fishmeal and fish oil) with high-performance, novel protein sources such as insect meal, algae, and fermented proteins, ensuring production scalability.

How is the volatility of raw material prices affecting the Feed and Aquafeed industry?

Raw material price volatility significantly impacts operational costs and profit margins. Companies mitigate this by adopting advanced risk management strategies, utilizing flexible formulation software (often AI-driven), and investing in diversified, locally sourced ingredients to reduce reliance on globally traded commodities like soy and corn.

What is the significance of functional feed additives in modern animal nutrition?

Functional feed additives, including probiotics, prebiotics, enzymes, and essential oils, are crucial for enhancing animal gut health, improving nutrient absorption efficiency, and supporting immune function. They play a vital role in reducing the dependency on prophylactic antibiotics, aligning with global regulatory trends toward sustainable and antibiotic-free animal protein production.

Which geographical region represents the most significant market opportunity for specialized feed producers?

Asia Pacific (APAC) represents the most significant market opportunity, driven by its vast population, rapidly expanding middle class, and the consolidation of livestock and aquaculture farming into large, professional operations requiring high-quality, scientifically formulated feeds to maximize high-volume production efficiency.

How does precision nutrition technology benefit commercial livestock operations?

Precision nutrition utilizes sensors, data analytics, and real-time monitoring to tailor the exact nutrient requirements to individual animals or small groups based on genetics, environment, and growth phase. This practice minimizes feed waste, optimizes Feed Conversion Ratio (FCR), reduces environmental nitrogen/phosphorus excretion, and maximizes profitability.

The Feed and Aquafeed market report provides an extensive examination of the key dynamics, technological transformations, and strategic landscape shaping the industry through the forecast period 2026-2033. The continuous integration of digital technologies, particularly AI and IoT, is fundamentally altering traditional feed manufacturing and livestock management, moving the sector toward hyper-efficient, sustainable, and transparent production models. Investment in R&D remains high, focusing on microbial protein synthesis, personalized animal health solutions, and advanced supply chain traceability, all of which are essential components for addressing global food security challenges while adhering to increasingly stringent environmental and animal welfare regulations. The dominance of Asia Pacific in volume, contrasted with North America and Europe’s leadership in technological adoption and specialized high-value products, creates a dynamically competitive global structure. Stakeholders must strategically position themselves by embracing alternative ingredients and leveraging data-driven decision-making to secure long-term market competitiveness and growth.

The trend towards vertical integration, where large corporations control genetics, feed production, and processing, continues to concentrate market power and standardize production protocols globally. This integration mandates high consistency and quality in feed products, further favoring large, technologically advanced feed millers who can guarantee supply chain stability and compliance across multiple regulatory jurisdictions. Moreover, the environmental footprint associated with traditional feed ingredients, such as deforestation linked to soybean production, is driving legislative and consumer demand for verifiable sustainability credentials. Consequently, feed producers are increasingly required to demonstrate carbon footprint reduction and responsible sourcing practices, transforming sustainability from a niche consideration into a core operational mandate.

Future growth will be significantly shaped by breakthroughs in biotechnology and genomics. Nutrigenomics—the study of how nutrients affect gene expression—is enabling the creation of ultra-specific diets that enhance disease resistance and genetic potential in animals, leading to superior production outcomes and reduced reliance on pharmaceutical interventions. Furthermore, the development of sophisticated fermentation processes to produce essential amino acids and single-cell proteins locally reduces reliance on global supply chains and offers a circular economy approach to ingredient sourcing. These technological shifts not only ensure market stability against geopolitical disruptions but also unlock entirely new market segments centered on performance, health, and ethical sourcing, propelling the market valuation towards the upper end of the forecasted range.

Regional analysis further underscores the diversification of market challenges and opportunities. While Europe focuses on premium, sustainable, and Non-GMO feeds, driven by consumer demand for transparency and high welfare standards, Latin America continues to focus on optimizing the output efficiency of commodity feeds for massive export markets. North America’s strength lies in integrating digital platforms for data-driven farming, offering integrated solutions that combine nutritional consulting with farm management software. In contrast, emerging markets in Africa are beginning to develop localized feed production capabilities to reduce import dependency, focusing on utilizing regional co-products and strengthening indigenous animal agriculture sectors. These differentiated regional strategies collectively contribute to the overall resilience and complexity of the global Feed and Aquafeed market structure.

Addressing the critical constraint of high-quality protein sourcing, particularly for aquafeed, remains a pivotal concern influencing strategic investments. The innovation surrounding Black Soldier Fly (BSF) larvae production, specifically, has transitioned from pilot projects to industrial-scale operations, offering a viable, highly sustainable, and cost-effective alternative to fishmeal in poultry and aquaculture diets. This transition is supported by regulatory approvals in major economic blocs and increased venture capital funding into bio-conversion technologies. Similarly, the scaling up of microalgae and macroalgae cultivation is addressing the omega-3 fatty acid shortage, offering a plant-based alternative to fish oil, which is crucial for maintaining the nutritional value of farmed seafood without depleting wild fish stocks. These material science advancements are key to decoupling market growth from finite natural resources.

The regulatory environment across various jurisdictions is becoming stricter, particularly concerning Maximum Residue Limits (MRLs) for veterinary drugs and contaminants, and traceability requirements for feed ingredients, especially those sourced from high-risk regions. Compliance necessitates significant investment in advanced testing facilities and robust quality management systems throughout the feed production lifecycle. Failure to comply can result in large-scale recalls, severe financial penalties, and irreversible damage to brand reputation. Consequently, market leaders are increasingly differentiating themselves not just through product efficacy, but through demonstrated commitment to environmental integrity, ingredient transparency, and adherence to global feed safety standards, positioning compliance as a competitive differentiator rather than merely a cost center.

Finally, the long-term profitability of the market hinges on the ability of manufacturers to transition toward customized, species-specific, and life-stage-appropriate nutritional solutions. Generic feeds are rapidly being replaced by highly specialized products formulated using knowledge derived from animal genetics and microbiome research. This shift supports better health outcomes, reduces overall animal treatment costs, and enhances the final product quality for human consumption. This increasing customization, facilitated by data analytics and automated blending systems, drives greater value creation across the entire value chain, solidifying the market's trajectory towards its forecasted valuation by 2033, centered around optimization, health, and sustainability mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager