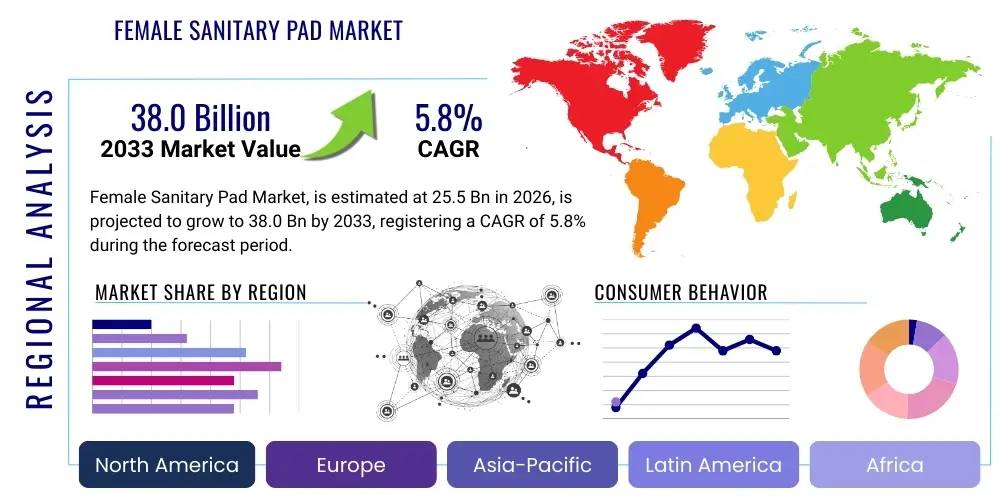

Female Sanitary Pad Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443579 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Female Sanitary Pad Market Size

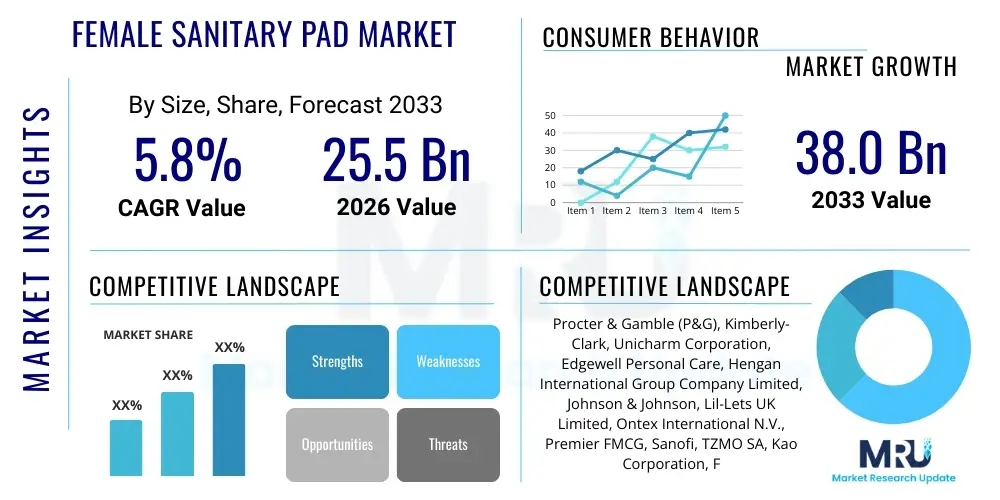

The Female Sanitary Pad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $25.5 Billion in 2026 and is projected to reach $38.0 Billion by the end of the forecast period in 2033.

Female Sanitary Pad Market introduction

The Female Sanitary Pad Market encompasses the global production, distribution, and consumption of absorbent products primarily designed for menstrual hygiene management, representing a critical segment within the Fast-Moving Consumer Goods (FMCG) healthcare sector. Product offerings are diverse, ranging from traditional thick pads utilizing cellulose fluff pulp cores to advanced, ultra-thin variants incorporating high-performance Super Absorbent Polymers (SAPs). A key feature of modern sanitary pads is the multi-layered construction designed for rapid fluid intake, secure retention, and comfortable wearability. Major applications include routine menstrual care, post-partum bleeding management, and increasingly, as a comfortable alternative for minor urinary leakage, positioning them as essential items for female health and wellness globally. The inherent, non-discretionary nature of demand ensures market resilience against macroeconomic fluctuations, driving consistent investment in supply chain stability and localized manufacturing capabilities across key geographic regions.

The core benefits derived from widespread sanitary pad usage extend beyond mere containment; they significantly contribute to public health outcomes by reducing the prevalence of reproductive tract infections associated with unhygienic traditional methods. Furthermore, the availability and affordability of quality sanitary products are inextricably linked to social empowerment, enabling women and adolescents to participate fully in education and economic activities without disruption. Driving factors include aggressive public health campaigns, such as those promoting Menstrual Hygiene Education (MHE) in South Asia and Africa, which actively dismantle cultural taboos surrounding menstruation. Concurrently, technological advancements permit manufacturers to integrate features like better adhesion, superior breathability, and antibacterial properties, enhancing user confidence and pushing consumers toward branded, higher-performing products. The overall market trajectory is further bolstered by sustained demographic growth and increasing longevity, expanding the consumer base globally.

Product innovation now heavily emphasizes ecological sustainability as a critical differentiator. Consumers, particularly in North America and Western Europe, are actively seeking alternatives to plastic-heavy conventional pads, leading to a surge in demand for products made from 100% organic cotton, bamboo, and biodegradable plant-based materials. This environmental imperative is driving significant capital expenditure into R&D focused on bio-based SAP substitutes and compostable outer layers. The competitive landscape is characterized by established multinational giants leveraging extensive distribution networks and strong brand recognition, while concurrently, innovative startups capitalize on direct-to-consumer (D2C) models, specializing in ethical sourcing and transparent ingredient lists. The sustained pressure for both affordability in emerging markets and sustainability in mature markets defines the strategic direction for manufacturers aiming to secure future growth and enhance brand equity among ethically conscious consumers.

Female Sanitary Pad Market Executive Summary

The Female Sanitary Pad Market exhibits robust growth dynamics, strategically shifting toward a dual-focus model emphasizing both mass accessibility and high-end personalization. Business trends indicate accelerated digital transformation, with e-commerce platforms and mobile applications serving as vital conduits for consumer engagement, market intelligence gathering, and distribution of specialized products, especially subscription boxes tailored to individual cycle lengths and flow needs. Financial strategies center on supply chain diversification to mitigate raw material price volatility, particularly for petroleum-derived polymers, necessitating substantial investments in resilient sourcing of bio-based alternatives. Furthermore, mergers and acquisitions activity is focused on integrating smaller, sustainability-focused brands into larger corporate portfolios, rapidly acquiring specialized technology and environmental credibility without protracted internal development cycles. This consolidation reflects the imperative to meet the rapidly changing ethical demands of the modern consumer base.

Regionally, the market presents a segmented growth profile. The Asia Pacific (APAC) region stands out as the primary engine of volume growth, driven by China and India, where improved economic access and government mandates regarding school hygiene are translating into massive scale-up opportunities. In contrast, North America and Europe, representing saturated markets, demonstrate value growth fueled by premiumization. European regulations, particularly concerning single-use plastics and packaging waste, are setting global standards for material innovation, influencing the product portfolios of global players. The Middle East and Africa (MEA) region, while hampered by historical infrastructural deficits and lower per capita income, shows strong emerging potential, particularly within high-growth urban centers in the UAE and South Africa, necessitating localized product formats and highly cost-efficient production models to capture market share effectively.

Segmentation trends underscore the rising preference for Ultra-Thin and Winged pads, favored for superior comfort and leak protection, which dominate the high-volume category. However, the most significant growth rate is recorded in the Material segment, specifically for pads utilizing organic cotton and certified biodegradable components, reflecting the consumer prioritization of health and planetary impact. Distribution channel analysis confirms that while physical retail (supermarkets and pharmacies) maintains volumetric leadership, the disproportionately fast growth of online retail is redefining brand exposure, allowing smaller, digitally native vertical brands (DNVBs) to bypass traditional gatekeepers and build strong, direct relationships with highly targeted consumer niches. Strategic success in the coming decade hinges on balancing mass production economies of scale with the agility required to pivot rapidly toward specialized, ethical, and customized product offerings across these critical segment matrices.

AI Impact Analysis on Female Sanitary Pad Market

Analysis of public discourse and professional inquiries concerning AI integration reveals a deep user interest in optimizing the product lifecycle, from personalized manufacturing to discreet consumer outreach. Common user questions probe the feasibility of using machine learning (ML) to analyze menstrual cycle tracking data (often collected via companion apps or smart wearables) to predict precise individualized demand, thereby enabling highly customized subscription delivery schedules that eliminate consumer stockouts. Users also express curiosity about AI's capacity to streamline quality assurance processes, querying if AI vision systems can guarantee flawless product assembly at ultra-high manufacturing speeds, ensuring zero defect rates across billions of units annually. A parallel stream of inquiry focuses on how AI can ethically handle and anonymize sensitive health data used for these personalized services, addressing potential privacy vulnerabilities and algorithmic biases in targeted advertisements, reflecting growing consumer demand for data sovereignty and transparent AI utilization.

The transformative impact of Artificial Intelligence is already evident in the operational efficiency domain of the sanitary pad industry. AI and ML algorithms are deployed extensively in sophisticated demand forecasting models, which integrate historical sales data, promotional campaigns, seasonal variations, and external macroeconomic indicators to predict future demand with unprecedented accuracy. This predictive capability directly translates into optimized inventory levels across regional distribution centers, minimizing capital tied up in inventory and dramatically reducing the risks associated with product expiration or obsolescence. On the manufacturing floor, AI-powered systems monitor hundreds of parameters in real-time—including temperature, humidity, and material tension—to adjust machinery dynamically, ensuring peak performance and adherence to precise specifications, which is paramount for achieving the ultra-thin, highly absorbent structure of modern pads.

Furthermore, AI is rapidly reshaping consumer interaction and product development. Natural Language Processing (NLP) tools analyze vast quantities of customer feedback, social media sentiment, and direct inquiries to rapidly identify emerging consumer pain points (e.g., irritation, leakage issues with new designs, desire for specific materials). This data-driven product iteration cycle drastically shortens the time-to-market for new formulations and design improvements. In the sales environment, AI-driven recommendation engines optimize the cross-selling and upselling of complementary products, such as specialty panty liners or feminine washes, within e-commerce platforms. This level of personalized marketing engagement enhances customer lifetime value and solidifies brand loyalty by making the purchasing experience feel curated and hyper-relevant to the individual user’s needs, a core tenet of modern digital commerce strategy.

- AI optimizes global supply chain resilience and inventory forecasting, minimizing stockouts across diverse retail channels.

- Machine learning algorithms enhance personalized product recommendations and subscription models based on cycle tracking data and demographic profiles.

- AI-powered vision systems improve quality control in high-speed manufacturing, identifying minute defects like misplaced adhesives or material tears, reducing rejects and maintaining hygiene standards.

- Predictive analytics enables proactive maintenance of high-speed converting machinery, maximizing production uptime and minimizing costly unplanned stoppages.

- AI facilitates dynamic pricing strategies and hyper-localized promotional targeting based on real-time geographical demand signals and competitive analysis.

- Generative AI supports rapid product design iteration and simulation of new core material structures to enhance absorbency and user comfort prior to physical prototyping.

- Natural Language Processing (NLP) analyzes consumer feedback at scale, accelerating the identification of user preferences and pain points to inform R&D priorities.

DRO & Impact Forces Of Female Sanitary Pad Market

The trajectory of the Female Sanitary Pad Market is a result of interacting Drivers, Restraints, and Opportunities (DRO), collectively forming crucial impact forces that dictate strategic decision-making. Significant drivers include the relentless demographic growth, particularly the expanding population of women entering reproductive age in high-growth regions like APAC and LATAM, guaranteeing an expanding baseline demand. Secondly, enhanced Menstrual Hygiene Education (MHE) campaigns, often spearheaded by public-private partnerships, effectively shatter cultural stigma and increase product adoption rates in traditionally underserved communities. The third powerful driver is continuous product innovation, particularly the successful introduction of thinner, more comfortable, and highly discreet pads that cater to modern lifestyle requirements, sustaining replacement demand even in mature markets. These drivers are high-impact forces that contribute significantly to market expansion and stabilization.

Restraints, however, pose significant challenges to market homogeneity and access. The foremost restraint is the affordability barrier, especially the premium pricing associated with sustainable and organic products, which limits their accessibility in low-income settings, forcing reliance on conventional, less environmentally sound options. A second critical restraint involves persistent cultural and religious taboos surrounding menstruation in various parts of the globe, which restricts open discussion, limits retail visibility, and negatively impacts marketing effectiveness. Thirdly, the lack of adequate waste management and sanitation infrastructure in many emerging economies hinders the adoption of disposable products, raising serious environmental concerns and acting as a friction point against full market penetration. These restraints exert moderate to high negative impact, often requiring extensive localized regulatory or infrastructural solutions to mitigate their effects effectively.

Opportunities for exponential growth are concentrated in the rapid development and scalable deployment of biodegradable and compostable menstrual solutions, aligning with global climate change mitigation goals and appealing directly to environmentally conscious consumers. Secondly, the expansion of e-commerce and m-commerce channels provides a crucial opportunity to bypass traditional retail limitations, offering discreet purchasing options and direct logistical access to remote consumers, lowering the overall cost of market entry for specialized brands. Finally, governmental interventions, such as the removal of value-added taxes (VAT) on sanitary products—aimed at combating period poverty—represent a powerful positive impact force, potentially unlocking billions in consumer spending power and fundamentally changing the economics of product accessibility, particularly in previously price-sensitive regions.

Segmentation Analysis

The Female Sanitary Pad Market’s comprehensive segmentation is vital for understanding granular consumer preferences and optimizing product portfolio strategies. Segmentation by Product Type is foundational, separating high-volume, standard pads from high-value, specialty items. The Ultra-Thin segment, characterized by superior comfort and discretion achieved through highly concentrated SAP cores, holds significant market volume and value share due to universal consumer preference. Conversely, Maxi/Super Absorbent pads maintain relevance by catering to specific needs such as night use, heavy flow days, and postpartum recovery, proving essential for specialized consumer groups. This detailed product breakdown allows manufacturers to invest R&D resources effectively based on projected consumer migration patterns towards advanced, thin-core technologies.

Segmentation by Material Composition is increasingly dynamic and critical, reflecting the shift toward ethical and sustainable consumption. Conventional synthetic materials (polymers, standard non-wovens) still dominate volume due to cost effectiveness and proven performance, particularly in mass markets. However, the fastest growth is observed in the Organic Cotton and Biodegradable Materials segments, including bamboo and sustainable wood pulp alternatives. These materials appeal directly to consumers concerned about skin health (reducing exposure to pesticides and bleaching agents) and environmental waste. Manufacturers leveraging verifiable certifications (e.g., GOTS for organic cotton) gain a substantial competitive advantage in mature markets where transparency and ethical sourcing are non-negotiable consumer criteria. This material pivot requires substantial upstream investment in sustainable sourcing infrastructure.

Distribution Channel segmentation analyzes consumer access points and logistical efficiency. Supermarkets and Hypermarkets collectively retain the largest market share globally, acting as primary high-volume outlets that benefit from strong consumer traffic and purchasing regularity. Pharmacies and Drug Stores, while smaller in volume, are crucial for specialty and premium medical-grade products, emphasizing a focus on health and expert advice. Critically, Online Retail, including company-specific D2C sites and third-party marketplaces, is demonstrating exponential growth, driven by the desire for discreet purchasing, convenience, and subscription models. Strategic investment in optimizing last-mile delivery and leveraging digital marketing campaigns tailored to these varied distribution channels determines market success and brand penetration across diverse socio-economic landscapes.

- By Product Type: Ultra-Thin Pads, Regular Pads, Maxi Pads/Super Absorbent Pads, Panty Liners, Specialty Pads (e.g., Maternity Pads, Extended Length).

- By Material: Non-Woven Synthetic (Polyethylene/Polypropylene), Organic Cotton, Biodegradable Pulp (Wood/Bamboo based), Other Natural Fibers.

- By Distribution Channel: Supermarkets and Hypermarkets, Pharmacies and Drug Stores, Online Retail (E-commerce), Convenience Stores.

- By End-User: Adults (18-45 years), Adolescents (10-17 years), Institutional/Medical Use.

Value Chain Analysis For Female Sanitary Pad Market

The value chain of the Female Sanitary Pad Market begins with intensive upstream activities focused on securing raw materials, which significantly impact both final product cost and environmental footprint. Critical inputs include fluff pulp, Super Absorbent Polymers (SAPs), back sheets (usually polyethylene film), top sheets (non-woven fabric), release paper, and adhesives. The shift towards sustainable sourcing necessitates rigorous supply chain audits to guarantee certified organic cotton and bio-based polymer availability, often leading to vertical integration or long-term strategic partnerships with specialized suppliers. Manufacturing is a high-capital intensity process involving highly automated converting lines designed for rapid, continuous production. Efficiency in this stage—optimizing material utilization and minimizing trim waste—is crucial for maintaining competitive pricing and achieving economies of scale across global production hubs.

Midstream activities encompass sophisticated quality control, packaging, and inventory management. Quality assurance is non-negotiable due to the intimate nature of the product, requiring advanced vision systems and sterile environments. Packaging, moving beyond basic functionality, now serves as a key marketing tool, demanding sustainable, resealable, and aesthetically pleasing solutions. The subsequent downstream process involves navigating complex distribution channels. Distribution is split between indirect channels, which utilize wholesalers, distributors, and logistics partners to supply mass retail (supermarkets, hypermarkets), ensuring wide geographical reach; and direct channels, primarily through e-commerce and subscription box models, which offer enhanced margin control and direct consumer data access. Effective cold chain management is generally not required, but strict inventory rotation is necessary to manage material integrity and product shelf life.

The final element involves marketing, sales, and post-sale consumer engagement. Brand building focuses heavily on digital media, leveraging social platforms to overcome cultural taboos and educate consumers on product benefits, materials transparency, and usage instructions. Direct communication, often facilitated by AI-powered chatbots and customer relationship management (CRM) systems, addresses sensitive consumer inquiries efficiently. The efficiency of the entire chain relies on seamless integration through Enterprise Resource Planning (ERP) systems, allowing manufacturers to respond rapidly to shifting global demand trends—such as localized panic buying or seasonal sales spikes—while adhering to stringent quality and sustainability benchmarks demanded by various regional regulatory bodies.

Female Sanitary Pad Market Potential Customers

The core consumer demographic for the Female Sanitary Pad Market is exceptionally broad, encompassing virtually all women and menstruating individuals globally, approximately aged 10 to 50 years. This massive audience can be segmented based on lifestyle, economic status, and hygiene awareness levels. Developed market consumers (e.g., US, Germany) represent high-value customers who prioritize performance, comfort, ethical sourcing, and are willing to pay a significant premium for specialized features like organic certification, hypoallergenic materials, and sleek, environmentally friendly packaging designs. They are highly active in the digital space, often opting for flexible, tailored subscription services that guarantee timely, discreet delivery, minimizing the need for physical store visits.

Conversely, potential customers in emerging and developing markets (e.g., India, Nigeria, Brazil) are primarily characterized by their high price sensitivity and the need for basic, reliable functionality and pervasive availability. For these consumer segments, the critical decision factor remains affordability and the convenience of purchasing in small, accessible formats from local convenience stores or neighborhood kiosks. Market growth here is intrinsically linked to rising disposable incomes, aggressive educational outreach programs that normalize product usage, and governmental initiatives that improve sanitation access. Successfully converting this segment requires manufacturers to focus on economies of scale, localized production, and low-cost packaging to achieve necessary price points without compromising essential hygiene standards.

A rapidly expanding segment of institutional customers includes hospitals, especially maternity wards and gynecological clinics, which purchase specific medical-grade sanitary products in bulk, often requiring enhanced absorbency and sterility. Furthermore, NGOs and charitable organizations dedicated to combating period poverty constitute significant buyers, purchasing large volumes of cost-effective, basic pads for distribution in vulnerable communities and disaster relief scenarios. Targeting future potential customers involves identifying the next generation of consumers—adolescents—through school-based programs and educational digital content that establishes early brand loyalty based on trust, comfort, and positive representation, ensuring sustained demand for the forecast period.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $38.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (P&G), Kimberly-Clark, Unicharm Corporation, Edgewell Personal Care, Hengan International Group Company Limited, Johnson & Johnson, Lil-Lets UK Limited, Ontex International N.V., Premier FMCG, Sanofi, TZMO SA, Kao Corporation, First Quality Enterprises, Diva International, Rael Inc., The Honest Company, Saathi, Sustain Natural, Bodywise (UK) Ltd., Lola. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Female Sanitary Pad Market Key Technology Landscape

The technology underpinning the Female Sanitary Pad Market is dominated by advancements in material science aimed at maximizing absorbency efficiency and minimizing the product's environmental footprint. The cornerstone technology is the Super Absorbent Polymer (SAP), which allows thin, flexible pads to manage heavy flow effectively. Ongoing innovation focuses on developing bio-based SAPs derived from renewable sources (e.g., starch, cellulose) to replace conventional petroleum-derived polyacrylate polymers. Similarly, the top sheet technology uses sophisticated non-woven fabrics that ensure rapid fluid transmission to the core while maintaining a dry, comfortable surface against the skin, often incorporating micro-perforations or embossed patterns optimized for liquid channeling and reducing skin friction, a significant technological challenge.

Manufacturing technology relies on extremely high-speed rotary converting machines, capable of assembling multi-layered products at rates often exceeding 1,000 pieces per minute. Key technological processes include ultrasonic bonding, which provides secure material joining without harsh chemical adhesives or excessive heat, improving product safety and sustainability. Robotics and sensor technology are integrated extensively throughout the production line to ensure precise placement of adhesives, wing folds, and packaging components, minimizing human contact and maximizing hygiene. Automation also extends to sophisticated defect detection systems utilizing high-resolution cameras and AI to scan for flaws in material integrity or structural misalignment in real-time, instantly rejecting substandard products before packaging.

Emerging technology focuses on smart integration and advanced functionality. While commercialization is still limited, research is progressing on smart pads embedded with passive RFID tags or microscopic sensors. These systems aim to track usage frequency and potential infection markers (e.g., pH levels or specific chemical indicators) to provide personalized health insights, seamlessly connecting menstrual hygiene management with broader female health monitoring via mobile platforms. Additionally, biodegradable packaging films utilizing polylactic acid (PLA) and other compostable polymers represent critical technological breakthroughs in addressing the end-of-life disposal challenges, positioning technological innovation as a central pillar of corporate sustainability strategy.

Regional Highlights

- Asia Pacific (APAC): Dominating the market by volume and exhibiting the highest CAGR, APAC is characterized by rapid market penetration in historically underserved rural areas. China and India are the gravitational centers, driven by huge populations and improving sanitation infrastructure. Localized manufacturing is key to lowering logistical costs and offering competitive pricing. The consumer transition from traditional cloth methods to affordable, branded disposable pads is the primary growth mechanism, supplemented by emerging premium demand in tier-one cities for Korean and Japanese-style ultra-thin, high-tech pads.

- North America: A highly mature yet highly profitable market, growth is derived from continuous premiumization and niche segmentation. Consumers demand ethical sourcing, full ingredient transparency, and biodegradable options. Subscription models and D2C brands focusing on organic cotton and customized delivery schedules hold a strong influence. Regulatory standards are high, particularly concerning material safety and chemical disclosure, forcing manufacturers to innovate rapidly in hypoallergenic formulations.

- Europe: The market is defined by leading-edge sustainability mandates and strong political initiatives to reduce product taxes. Scandinavia and Western Europe lead the global charge toward reusable and fully compostable menstrual products. Consumer behavior reflects a deep commitment to environmental stewardship, often favoring local European brands that demonstrate verified circular economy practices. Regulatory pressure on plastic reduction in packaging and product composition is the central market dynamic.

- Latin America (LATAM): Showing strong development potential, particularly in Brazil, Mexico, and Argentina, driven by increased urbanization and female economic participation. Market characteristics include a high preference for winged and specialized flow protection pads. Localized branding and marketing that respects regional cultural nuances are crucial for building trust. Economic stability often dictates purchasing power, leading to strong performance in the value segment, although premium brands are gaining traction in major metropolitan areas.

- Middle East and Africa (MEA): This region presents varied growth patterns. The GCC countries exhibit high per capita consumption of premium products due to high disposable income, favoring international brands. Sub-Saharan Africa is a high-potential volume market, where the primary challenge is tackling period poverty. Market expansion here relies heavily on partnerships with NGOs and governments to distribute affordable, basic, high-quality sanitary pads and integrate MHE into educational curricula effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Female Sanitary Pad Market.- Procter & Gamble (P&G)

- Kimberly-Clark Corporation

- Unicharm Corporation

- Edgewell Personal Care Company

- Hengan International Group Company Limited

- Kao Corporation

- Johnson & Johnson (J&J)

- Ontex International N.V.

- TZMO SA

- Premier FMCG

- Lil-Lets UK Limited

- The Honest Company

- First Quality Enterprises

- Diva International Inc.

- Rael Inc.

- Sanofi

- Saathi

- Sustain Natural

- Bodywise (UK) Ltd.

- Lola

Frequently Asked Questions

Analyze common user questions about the Female Sanitary Pad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Female Sanitary Pad Market?

The primary factor driving growth is the increasing global awareness and education regarding menstrual hygiene (MHE), particularly supported by governmental and non-governmental initiatives, alongside continuous innovation in product comfort and sustainability features, leading to higher adoption rates globally.

How is sustainability influencing sanitary pad product innovation?

Sustainability is influencing innovation by accelerating the shift toward materials like organic cotton, bamboo fibers, and bio-plastics, reducing reliance on conventional plastics, and driving demand for fully biodegradable and compostable pads, which in turn commands a higher average selling price (ASP) and growth in the premium segment.

Which distribution channel is experiencing the fastest growth in sanitary pad sales?

Online retail (e-commerce) is the fastest-growing distribution channel, driven by consumer demand for discretion, convenience through automated subscription services, and greater accessibility to specialized niche and environmentally conscious brands that often bypass traditional brick-and-mortar limitations.

What role does AI technology play in the manufacturing of sanitary pads?

AI technology primarily optimizes manufacturing through sophisticated quality control systems (AI vision inspection) and predictive maintenance of high-speed converting lines, ensuring high production efficiency, minimizing defects, and optimizing raw material usage in complex, multi-layered product assembly processes.

Why is the Asia Pacific region the largest market for female sanitary pads?

APAC holds the largest market share due to its vast female population base, rapidly increasing urbanization, rising disposable incomes, improving product penetration rates in formerly underserved rural and semi-urban areas, especially in key economic hubs such as China and India, making it the highest volume market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager