Ferro Nickel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443048 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Ferro Nickel Market Size

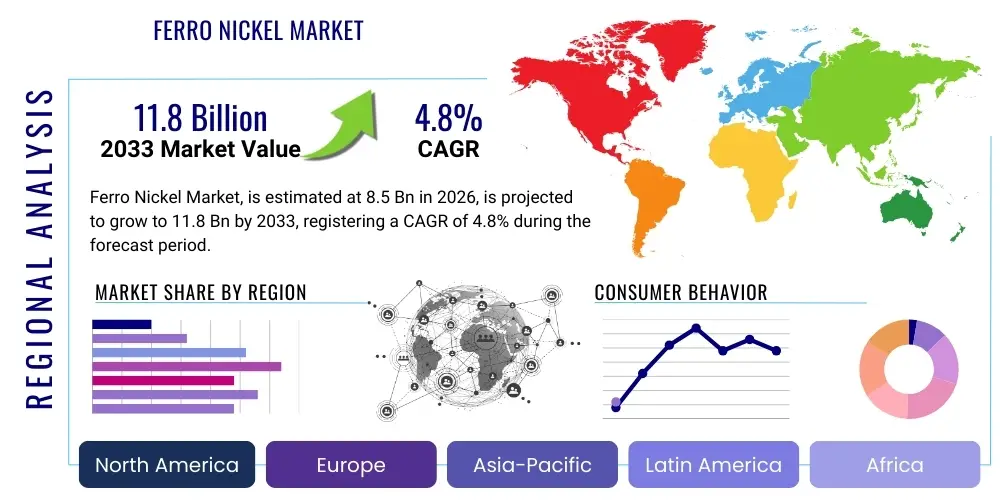

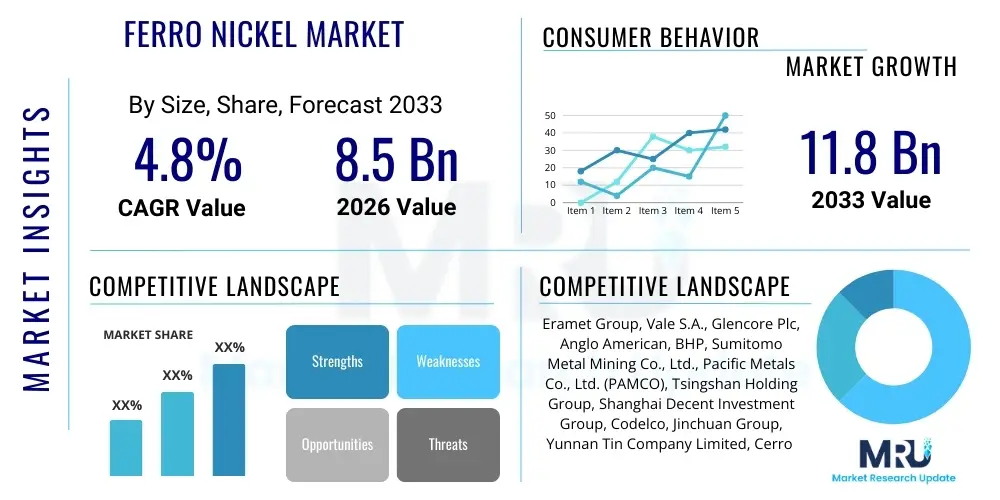

The Ferro Nickel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 11.8 Billion by the end of the forecast period in 2033.

Ferro Nickel Market introduction

Ferro Nickel (FeNi) is a primary alloy of iron and nickel, characterized by a nickel content typically ranging from 15% to 50%. It serves as an essential raw material in the global metallurgical industry, primarily utilized for the production of various grades of stainless steel and certain specialized low-alloy steels where nickel is critical for enhancing corrosion resistance, high-temperature strength, and ductility. The production process involves complex pyrometallurgical techniques, predominantly the Rotary Kiln Electric Furnace (RKEF) method, which processes lateritic nickel ores (such as limonite and saprolite) found abundantly in equatorial regions.

The product's inherent properties, specifically its ability to introduce nickel economically into steel melts, make it indispensable for the global stainless steel sector, which accounts for the vast majority of its consumption. Ferro Nickel provides a cost-effective alternative to pure nickel for specific applications, particularly in the production of 300 series stainless steels (austenitic grades). Its major applications extend into construction, automotive manufacturing, chemical processing, and infrastructure development, areas which require materials capable of resisting harsh environmental conditions and ensuring long operational lifecycles.

Market growth is predominantly driven by the surging demand for stainless steel in rapidly industrializing economies, especially across Asia Pacific, where urbanization and infrastructure investments are escalating. Furthermore, the indirect boost from the electric vehicle (EV) sector, which requires specialized stainless steels and high-performance alloys for battery casings and structural components, contributes significantly to sustaining the demand trajectory. Benefits of using Ferro Nickel include superior alloying characteristics, reliable supply chain dynamics tied to mature mining operations, and established industrial processes globally.

Ferro Nickel Market Executive Summary

The Ferro Nickel market is currently undergoing significant structural shifts characterized by increased scrutiny on sustainable sourcing and technological adaptation to lower carbon intensity. Business trends indicate a movement towards vertically integrated operations, particularly in regions like Indonesia, which possess vast laterite ore reserves and have heavily invested in Nickel Pig Iron (NPI) and subsequent FeNi production capacity. This integration helps producers manage raw material price volatility and stabilize supply chains for global steel mills. Innovation is focused on optimizing energy consumption within smelting processes, often employing pre-reduction techniques and advanced furnace designs to remain competitive amidst escalating global energy costs and stringent environmental mandates.

Regionally, the Asia Pacific (APAC) continues to dominate the Ferro Nickel landscape, driven primarily by China’s immense stainless steel production capacity and the rapid development of mining and processing facilities in Indonesia and the Philippines. This region dictates global pricing benchmarks and supply patterns. Conversely, established markets in Europe and North America maintain demand for high-grade, low-carbon Ferro Nickel suitable for specialty alloy manufacturing, often sourcing from producers who adhere to stricter environmental, social, and governance (ESG) standards. Supply chain diversification away from reliance on a single geographic source is a critical risk mitigation strategy observed among major steel producers globally.

Segment trends highlight the growing importance of high-purity, lower-carbon Ferro Nickel grades, although high-carbon Ferro Nickel (often grouped with NPI) maintains significant market share due to its cost-effectiveness, particularly in bulk stainless steel production in Asia. End-user demand is robust across the infrastructure and construction segments, spurred by post-pandemic economic recovery and large-scale public works projects in developing nations. The market structure remains moderately consolidated, with key players investing in resource expansion and efficiency enhancements to capture market share and navigate the cyclical volatility inherent in commodity markets, ensuring long-term supply stability for their captive and external customers.

AI Impact Analysis on Ferro Nickel Market

Analysis of common user questions reveals strong interest in how Artificial Intelligence (AI) can mitigate the inherent risks associated with Ferro Nickel production, including raw material variability, high energy consumption, and volatile pricing. Key themes revolve around AI's ability to enhance operational efficiency, optimize complex pyrometallurgical processes (like RKEF), and provide superior predictive capabilities for market movements and geological exploration. Users are keen to understand if AI can democratize access to high-fidelity market data, thereby reducing investment risk, and how machine learning algorithms can specifically contribute to reducing the carbon footprint of production, a major environmental concern.

The primary influence of AI in the Ferro Nickel sector is centered on optimizing upstream mining and extraction processes. Machine learning models are deployed to analyze vast datasets collected from geological surveys, enabling more accurate prediction of ore grades, moisture content, and mineral composition. This intelligence allows miners to selectively target extraction sites, minimizing waste rock and improving the consistency of feedstock entering the smelting process. Furthermore, AI-powered systems are crucial for predictive maintenance of heavy machinery, reducing unplanned downtime and substantial capital expenditure related to equipment failure, ultimately translating to higher operational uptime and lower unit costs for the Ferro Nickel produced.

Downstream, AI is being integrated into the core smelting and refining operations. Sophisticated algorithms monitor parameters such as furnace temperature, electrical input, gas flow rates, and chemical reactions in real-time. By dynamically adjusting these variables, AI ensures optimal energy utilization—a massive operational expense for FeNi producers—while guaranteeing adherence to strict quality specifications (nickel percentage and impurities). This optimization capability not only lowers production costs but also ensures consistent product quality, essential for maintaining supply agreements with demanding stainless steel manufacturers. AI’s application in market forecasting, integrating macroeconomic indicators with nickel price volatility, also offers producers and buyers advanced tools for risk management and strategic purchasing decisions.

- AI-driven optimization of ore sorting and blending improves feedstock consistency, maximizing furnace efficiency.

- Predictive maintenance analytics minimize operational downtime in resource-intensive RKEF facilities.

- Machine learning algorithms enhance energy consumption efficiency during the high-temperature smelting process.

- Advanced market forecasting tools utilize AI to predict nickel price fluctuations, aiding strategic procurement and sales.

- Computer vision and automated quality control systems ensure precise grading and purity of the final Ferro Nickel product.

DRO & Impact Forces Of Ferro Nickel Market

The market dynamics of Ferro Nickel are shaped by powerful forces emanating from global industrial demand, resource constraints, and environmental policy. The overarching Driver is the relentless global expansion of stainless steel production, intrinsically linked to urbanization, infrastructure development, and the increasing consumer preference for durable, corrosion-resistant materials across automotive, construction, and capital goods sectors. This demand pull is strong, especially in Asia. However, the primary Restraint is the extreme volatility of global LME (London Metal Exchange) nickel prices, which directly impacts the profitability of FeNi producers and creates uncertainty for buyers. Additionally, stringent environmental regulations regarding slag management and high CO2 emissions from RKEF facilities impose significant compliance costs and operational limitations.

Key Opportunities in the sector stem from technological advancements aimed at processing lower-grade nickel laterite ores, making previously uneconomical resources viable. The emergence of high-pressure acid leaching (HPAL) and other hydrometallurgical routes, while primarily targeting battery-grade nickel, indirectly affects the FeNi market by diversifying the global nickel supply base and pushing FeNi producers towards greater efficiency. Furthermore, there is a distinct opportunity in developing and marketing "green" Ferro Nickel produced using renewable energy sources or carbon capture technologies, catering to the growing demand from sustainability-focused manufacturers in mature Western markets. Strategic investments in resource exploration and vertical integration also present long-term growth avenues.

The Impact Forces shaping the competitive landscape are multifaceted. The increasing energy costs globally disproportionately affect high energy-intensive processes like Ferro Nickel smelting, placing pressure on margins and driving innovation toward energy efficiency. Simultaneously, geopolitical shifts and trade policies, particularly concerning raw material exports (e.g., Indonesia’s ore export bans), fundamentally restructure global supply chains, favoring localized processing and creating new centers of production dominance. Customer power is significant, as large stainless steel producers demand consistent quality and favorable pricing, compelling FeNi suppliers to optimize logistics and maintain operational excellence to secure long-term contracts in this highly cyclical market environment.

Segmentation Analysis

The Ferro Nickel market segmentation provides a granular view of supply and demand dynamics, categorized primarily based on the product’s nickel content, the production process, and its end-use application. Understanding these segments is crucial as the required specifications for nickel input vary widely between different grades of stainless steel and specialized alloys. Segmentation by Nickel Content (e.g., Low Carbon Ferro Nickel (LC-FeNi), Medium Carbon Ferro Nickel (MC-FeNi), High Carbon Ferro Nickel (HC-FeNi)/Nickel Pig Iron (NPI)) directly determines the suitability for specific end-user processes and dictates the prevailing market price and production complexities.

The application segment is dominated by the stainless steel industry, which further breaks down into austenitic, ferritic, and duplex grades. Austenitic stainless steel (300 series) relies heavily on FeNi due to its high nickel requirement, driving demand for medium to high-purity FeNi grades. The segmentation by process technology is also becoming increasingly relevant, distinguishing between the traditional, high-energy RKEF process and emerging hydrometallurgical techniques or upgraded NPI, reflecting shifts in environmental compliance and resource availability globally. Regional segmentation highlights distinct differences in market maturity, regulatory environments, and prevailing production costs.

The strategic value of segmentation lies in identifying high-growth niches. For instance, while high-volume production of NPI/HC-FeNi for general stainless steel dominates in APAC, there is a premium, albeit smaller, market for specialized LC-FeNi required for high-precision aerospace and medical-grade alloys in North America and Europe. This distinction allows manufacturers to tailor their production strategies—either focusing on high volume, cost-competitive production or specialized, high-margin products—optimizing resource allocation based on specific market characteristics and regional economic indicators.

- By Product Type:

- Low Carbon Ferro Nickel (LC-FeNi)

- Medium Carbon Ferro Nickel (MC-FeNi)

- High Carbon Ferro Nickel (HC-FeNi)/Nickel Pig Iron (NPI)

- By Application:

- Stainless Steel Production (Austenitic, Ferritic, Duplex)

- Alloy Steel Production (Specialty Alloys)

- Foundry and Casting

- Chemical Industry

- By End-User Industry:

- Construction and Infrastructure

- Automotive and Transportation

- Consumer Goods

- Heavy Machinery and Industrial Equipment

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Ferro Nickel Market

The Ferro Nickel value chain commences with the upstream segment involving the geological exploration, mining, and beneficiation of lateritic nickel ores, primarily saprolite and limonite. This phase is capital intensive and highly dependent on resource location, requiring substantial infrastructure development in remote mining areas. Upstream profitability is dictated by the grade of the nickel ore and the efficiency of pre-treatment processes (e.g., drying, crushing). Key risks at this stage include geopolitical instability in resource-rich nations and environmental permitting challenges, which can significantly delay project development and impact the long-term cost structure of the resulting FeNi product.

The midstream phase encompasses the complex pyrometallurgical processing, predominantly utilizing the RKEF method, which converts the refined ore into Ferro Nickel. This transformation stage is characterized by high energy consumption, making producers highly sensitive to electricity and fuel costs. Efficiency gains at this stage, achieved through technology like furnace gas utilization or process automation, are crucial for competitive pricing. The midstream operation generates the final product, Ferro Nickel, which is then sold either directly to major integrated steel mills (direct channel) or traded through established commodity exchanges and specialized metal trading houses (indirect channel). These trading houses manage logistics, hedging, and inventory, adding necessary liquidity and risk management capabilities to the global supply system.

The downstream segment is dominated by the end-user industries, primarily stainless steel manufacturers globally. Direct distribution channels involve long-term procurement contracts between major FeNi producers and large steel conglomerates, ensuring stable supply and customized quality specifications. Indirect distribution, leveraging trading houses, serves smaller mills or those needing flexibility in procurement volumes and timing. The ultimate value capture occurs when the stainless steel produced using Ferro Nickel is integrated into high-value applications across construction, automotive, and capital goods, where the properties imparted by nickel justify the premium cost. Supply chain optimization, focusing on efficient maritime logistics for bulk material movement, is a critical element connecting the production sites in Asia Pacific to manufacturing hubs in Europe and North America.

Ferro Nickel Market Potential Customers

The primary customers of the Ferro Nickel market are the global integrated stainless steel producers, who rely on FeNi as a fundamental alloying component to meet specific mechanical and corrosion resistance requirements for their finished products. These customers include massive multinational steel corporations operating blast furnaces and electric arc furnaces (EAFs), requiring bulk quantities of FeNi, often categorized by specific carbon and nickel purity levels. Their purchasing decisions are driven by cost-effectiveness, consistency in supply, and adherence to increasingly stringent quality standards necessary for certifications in critical end-use sectors like pressure vessels and chemical processing equipment. Strategic partnerships with these major mills are vital for securing long-term revenue streams for FeNi suppliers.

A secondary, yet highly critical, group of buyers comprises specialized alloy manufacturers and precision foundries. These entities produce high-performance alloys (e.g., nickel-based superalloys, specialized tool steels) for demanding applications in aerospace, defense, energy generation (turbines), and medical implants. Unlike bulk steel producers, these customers often require higher-grade, low-carbon Ferro Nickel (LC-FeNi) with minimal impurities. Their procurement strategy prioritizes product purity and reliability over marginal price differences, reflecting the high value and safety criticality of their final products. They often engage in smaller, more specialized procurement cycles, demanding certified material provenance and strict quality documentation.

In addition to the primary steel and alloy sectors, the chemical industry and casting manufacturers represent further segments of potential customers. Chemical processing plants require corrosion-resistant components, often derived from specialty stainless steels, ensuring sustained demand. Furthermore, general foundries utilize Ferro Nickel for producing various high-strength cast iron and ductile iron products where enhanced metallurgical properties are required. As global infrastructure demands continue to rise, particularly in environments exposed to extreme temperatures or chemical agents, the customer base relying on the specific benefits delivered by nickel-containing alloys is expected to broaden, supporting sustained market momentum for high-quality Ferro Nickel products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 11.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eramet Group, Vale S.A., Glencore Plc, Anglo American, BHP, Sumitomo Metal Mining Co., Ltd., Pacific Metals Co., Ltd. (PAMCO), Tsingshan Holding Group, Shanghai Decent Investment Group, Codelco, Jinchuan Group, Yunnan Tin Company Limited, Cerro Matoso, Nickel Asia Corporation, Shenghe Resources Holding Co., Ltd., Trafigura Group, South32 Limited, PT Antam Tbk, Fenix Nickel, Huayou Cobalt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ferro Nickel Market Key Technology Landscape

The technological landscape of Ferro Nickel production is fundamentally dominated by the Rotary Kiln Electric Furnace (RKEF) process, particularly when utilizing nickel laterite ores, which constitute the primary raw material source globally. RKEF is a two-stage pyrometallurgical process involving the drying and partial reduction of ore in a rotary kiln, followed by smelting in a high-power electric furnace to produce the molten Ferro Nickel alloy. Recent advancements in RKEF technology focus intensely on enhancing energy efficiency, as electricity often represents the largest variable cost. This includes optimizing furnace design for better heat recovery, integrating larger and more efficient transformers, and implementing advanced process control systems to maintain tight thermal and chemical balances throughout the reaction cycle. These improvements are crucial for maintaining profitability and complying with tightening global carbon emission standards.

A significant technological trajectory involves the continuous improvement of Nickel Pig Iron (NPI) production, which is a lower-grade, high-carbon form of Ferro Nickel predominantly produced in China and Indonesia. While technically distinct, NPI competes directly with traditional FeNi in standard stainless steel applications. Technological innovation in NPI has focused on utilizing lower-grade saprolite ores through modified rotary hearth furnaces (RHF) or smaller electric furnaces, allowing for rapid capacity expansion and lower initial capital outlay compared to full RKEF facilities. Furthermore, producers are exploring ways to upgrade NPI, such as subsequent refining or converting it into higher-grade FeNi through secondary smelting or purification steps, blurring the historical lines between NPI and traditional Ferro Nickel products and expanding the versatility of lateritic ore utilization.

Beyond traditional pyrometallurgy, the industry is closely monitoring the development and scaling of technologies related to hydrometallurgy, such as High-Pressure Acid Leaching (HPAL). While HPAL is primarily aimed at extracting nickel and cobalt for the high-purity demands of the electric vehicle battery supply chain, its success impacts the availability and pricing of nickel units across the board. The ability of HPAL to process low-grade limonite ores efficiently could potentially free up higher-grade saprolite ores, which are often preferred for RKEF operations, creating a complex interplay in the raw material supply chain. Simultaneously, process innovations in off-gas treatment and slag utilization are becoming standardized, minimizing the environmental footprint and demonstrating a commitment to circular economy principles, which is critical for accessing premium markets.

Regional Highlights

Regional dynamics play a paramount role in shaping the Ferro Nickel market, reflecting imbalances in resource distribution, processing capacity, and end-user demand. The Asia Pacific (APAC) region is indisputably the global epicenter for both production and consumption. Driven by colossal stainless steel manufacturing hubs in China and the massive investment in mining and processing capabilities in Indonesia and the Philippines, APAC controls the global supply chain narrative. Indonesia, leveraging its comprehensive nickel ore export ban and subsequent investment in downstream processing, has rapidly ascended as a major global FeNi/NPI supplier, transforming regional trade flows and exerting considerable pressure on older, high-cost operations elsewhere. This region's dominance is projected to continue due to sustained high infrastructure spending and burgeoning middle-class consumption across emerging Asian economies.

Europe represents a mature market characterized by stringent quality demands and a focus on specialty steel and high-end alloy production. European producers maintain competitive advantage not through sheer volume, but through technological sophistication, particularly in refining and recycling processes. While local primary production is limited, the region imports significant quantities of high-grade Ferro Nickel to feed its advanced manufacturing sectors, including automotive and aerospace. Market activity is heavily influenced by EU regulations regarding CO2 emissions and material sourcing ethics, leading to a strong preference for suppliers who demonstrate high ESG compliance. This creates a niche market for premium, ethically sourced FeNi, differentiating procurement strategies from the cost-driven models prevalent in Asia.

North America maintains a balanced market position, relying on a combination of domestic production (albeit limited), imports, and highly developed scrap recycling infrastructure, particularly for stainless steel. The region’s demand is stable, supported by manufacturing, construction, and specialized industrial applications. Producers and consumers here are highly sensitive to geopolitical risks and trade tariffs, driving efforts toward supply chain security and diversification. Latin America and the Middle East & Africa (MEA) offer potential growth opportunities, largely centered on resource extraction projects (e.g., Brazil, Colombia) and increasing localized stainless steel production capacity to serve growing domestic infrastructure needs, although production remains highly susceptible to regional political and economic instability.

- Asia Pacific (APAC): Dominates global production and consumption; key drivers include China's stainless steel industry and Indonesian NPI/FeNi capacity expansion. This region dictates global pricing and supply stability.

- Europe: Characterized by high-value specialty alloy production; focuses on high-grade FeNi imports and sustainable sourcing; stringent regulatory environment impacts procurement decisions.

- North America: Stable, mature demand for specialty applications; strong reliance on efficient scrap recycling; high sensitivity to supply chain security and external trade policies.

- Latin America: Emerging resource base, with potential for increased primary production (e.g., Brazil, Colombia); market subject to high domestic economic volatility.

- Middle East and Africa (MEA): Growing localized demand for infrastructure projects; limited current production capacity but increasing exploratory mining interest in key mineral-rich nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ferro Nickel Market.- Eramet Group

- Vale S.A.

- Glencore Plc

- Anglo American

- BHP

- Sumitomo Metal Mining Co., Ltd. (SMM)

- Pacific Metals Co., Ltd. (PAMCO)

- Tsingshan Holding Group

- Shanghai Decent Investment Group

- Codelco

- Jinchuan Group

- Yunnan Tin Company Limited

- Cerro Matoso (South32)

- Nickel Asia Corporation (NAC)

- Shenghe Resources Holding Co., Ltd.

- Trafigura Group

- PT Antam Tbk (Persero)

- Fenix Nickel

- RKEF Asia Pte Ltd

- Huayou Cobalt

Frequently Asked Questions

Analyze common user questions about the Ferro Nickel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of demand in the Ferro Nickel market?

The primary driver is the extensive global production of austenitic stainless steel (300 series), which utilizes Ferro Nickel as a cost-effective source of nickel to enhance corrosion resistance and mechanical strength, particularly within the construction and automotive sectors.

How does Nickel Pig Iron (NPI) relate to Ferro Nickel?

Nickel Pig Iron (NPI) is considered a lower-grade, high-carbon form of Ferro Nickel (HC-FeNi). It serves the same fundamental purpose—alloying stainless steel—but typically contains lower nickel content (4%–15%) and is primarily produced in Asia using the RKEF process from laterite ores, competing directly with traditional higher-grade FeNi.

Which geographical region dominates Ferro Nickel production capacity?

The Asia Pacific (APAC) region, specifically Indonesia and China, dominates global Ferro Nickel and NPI production capacity. Indonesia's vast laterite reserves and strategic export policies have cemented its position as the largest single source of nickel units for the ferrous metallurgical sector.

What are the key technological challenges facing Ferro Nickel producers?

Key challenges include managing the high energy intensity and associated carbon emissions of the RKEF process, effectively processing lower-grade lateritic ores, and maintaining competitive production costs amidst volatile global energy prices and stringent environmental regulations.

How does the price of pure nickel affect the Ferro Nickel market?

Ferro Nickel pricing is strongly correlated with, but generally trades at a discount to, the price of pure LME nickel. Volatility in pure nickel prices directly translates into pricing risk for FeNi producers and significantly influences the procurement strategies of stainless steel manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager