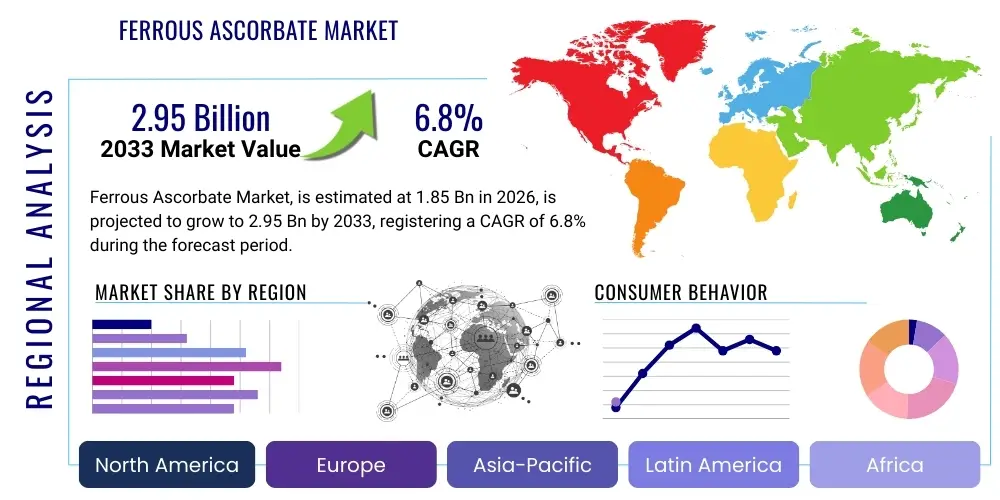

Ferrous Ascorbate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440927 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Ferrous Ascorbate Market Size

The Ferrous Ascorbate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 740.8 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the escalating global prevalence of iron deficiency anemia, particularly in developing economies, coupled with increasing consumer preference for highly bioavailable and gentle iron supplements that minimize gastrointestinal distress associated with traditional iron salts.

Ferrous Ascorbate Market introduction

The Ferrous Ascorbate market encompasses the production, distribution, and utilization of this crucial chemical compound, which is a chelated form of iron complexed with ascorbic acid (Vitamin C). This specific formulation offers significantly enhanced bioavailability compared to conventional ferrous salts, as ascorbic acid aids in the reduction and absorption of iron. It is widely recognized in the medical community as a superior oral iron supplement due to its efficacy in rapidly elevating hemoglobin levels and minimizing adverse side effects such as constipation and nausea, which often lead to poor patient compliance with standard iron therapies. Its chemical stability and superior absorption profile make it a preferred ingredient across various end-user industries.

Major applications for ferrous ascorbate span the pharmaceutical, nutraceutical, and food fortification sectors. In pharmaceuticals, it is the active ingredient in prescription and over-the-counter medications specifically designed for treating iron deficiency anemia (IDA) across demographics, including pregnant women, children, and geriatric patients. The nutraceutical segment utilizes ferrous ascorbate in dietary supplements targeting general wellness and specific deficiencies, capitalizing on the clean label trend and demand for high-performance ingredients. Furthermore, its application in food fortification programs, especially in regions battling widespread malnutrition, highlights its societal significance and expansion potential.

Market growth is predominantly driven by global initiatives aimed at addressing nutritional deficiencies, supportive regulatory frameworks promoting fortification, and continuous advancements in formulation science leading to new, consumer-friendly dosage forms like chewable tablets and liquid syrups. The synergistic action of iron and Vitamin C in this compound ensures high therapeutic value, making it indispensable in modern health management strategies. Increasing healthcare expenditure and rising awareness regarding the long-term consequences of untreated iron deficiency further contribute substantially to market expansion.

Ferrous Ascorbate Market Executive Summary

The Ferrous Ascorbate market is experiencing significant dynamism driven by favorable business trends focused on superior drug delivery and preventive healthcare. Pharmaceutical manufacturers are investing heavily in research and development to create novel formulations, such as liposomal iron preparations utilizing ferrous ascorbate, to further enhance stability and reduce dosing frequency. Business trends also indicate a vertical integration strategy among key players, securing reliable supply chains for both elemental iron sources and high-pgrade ascorbic acid, thereby mitigating volatility in raw material pricing and ensuring product quality consistency across global markets. The shift toward specialized iron products that cater to patient comfort is a dominating commercial theme.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market segment, attributed to high population density, high incidence of maternal and child anemia, and large-scale government-backed nutritional programs, particularly in India and China. North America and Europe, characterized by sophisticated healthcare infrastructures and high consumer spending on nutraceuticals, maintain significant market share, focusing on premium, scientifically backed supplement brands. Regulatory harmonization efforts in key regions are also streamlining the approval process for new ferrous ascorbate products, facilitating quicker market entry and expansion into untapped geographical areas.

Segment trends underscore the dominance of the oral solids segment (tablets and capsules) due to manufacturing ease and cost-effectiveness, although the liquid syrup segment is rapidly gaining traction, particularly for pediatric and geriatric patient groups requiring easily swallowed formulations. Application-wise, the pharmaceutical segment remains the largest revenue contributor, driven by established prescription protocols for anemia treatment. However, the nutraceutical segment exhibits the highest growth potential, capitalizing on the preventive health movement and self-medication trends where consumers actively seek highly absorbable vitamins and minerals for proactive health maintenance.

AI Impact Analysis on Ferrous Ascorbate Market

User inquiries regarding AI's influence on the Ferrous Ascorbate market frequently center on three core areas: how AI can optimize manufacturing processes, its role in drug discovery and formulation, and its potential impact on personalized nutrition and dosing strategies. Common concerns revolve around the cost of implementing sophisticated AI systems in traditional chemical manufacturing plants and the regulatory clearance needed for AI-designed pharmaceutical formulations. Users are actively seeking information on how machine learning algorithms can predict patient compliance rates based on formulation properties and recommend optimal iron intake strategies tailored to genetic and lifestyle factors, moving beyond conventional one-size-fits-all dosing.

In the domain of chemical synthesis and manufacturing, AI and machine learning algorithms are increasingly utilized for process optimization, predictive maintenance of reaction equipment, and quality control. By analyzing vast datasets related to temperature, pressure, reaction time, and purity profiles, AI systems can pinpoint optimal synthesis pathways for ferrous ascorbate, minimizing impurity formation, reducing waste, and improving batch consistency. This enhances production efficiency and lowers the overall cost of goods, making this superior iron salt more economically viable for large-scale public health programs.

Furthermore, AI plays a critical role in drug discovery and formulation development. Algorithms can screen millions of potential co-formulation agents to identify those that further enhance the stability and bioavailability of ferrous ascorbate or identify novel delivery systems, such as microencapsulation techniques. In clinical settings, AI assists in analyzing patient-specific parameters, including inflammatory markers and genetic predispositions, to personalize the required dosage of ferrous ascorbate, ensuring maximum therapeutic benefit while mitigating the risk of side effects, thus elevating patient safety and adherence.

- Optimized synthesis prediction leading to reduced manufacturing costs.

- AI-driven formulation design for enhanced stability and shelf life.

- Predictive analytics for clinical trial efficacy and side effect monitoring.

- Personalized dosage recommendations based on patient biomarkers and genetics.

- Supply chain optimization and demand forecasting through machine learning models.

DRO & Impact Forces Of Ferrous Ascorbate Market

The dynamics of the Ferrous Ascorbate market are shaped by several interconnected forces: strong clinical endorsement (Drivers), complex regulatory hurdles and high manufacturing costs (Restraints), and the vast potential of public health interventions (Opportunities). The impact forces, encompassing competitive intensity, supplier power, buyer leverage, and threat of substitutes, dictate the strategic positioning of market participants. The overall market momentum is highly positive, driven primarily by recognized clinical superiority over older generation iron supplements, translating directly into enhanced patient outcomes and higher prescriber confidence, which acts as a powerful market catalyst.

Key drivers include the persistently high global prevalence of anemia, coupled with rising healthcare expenditures and government mandates for iron supplementation, especially for vulnerable populations such as pregnant women and infants. Restraints principally involve the relatively high production cost of chelated iron compounds compared to inexpensive alternatives like ferrous sulfate, which limits adoption in extremely price-sensitive markets. Additionally, the complex intellectual property landscape surrounding specific chelation and stabilization techniques requires significant investment in research and legal compliance, slowing down generic entry and widespread availability.

Opportunities are abundant in emerging markets, where rapid economic development is increasing access to healthcare and introducing iron deficiency screening programs. The expanding nutraceutical market offers a lucrative channel for non-prescription, premium ferrous ascorbate products focused on general wellness. The increasing global focus on food fortification programs, utilizing ferrous ascorbate due to its minimal impact on food taste and color, represents a major long-term growth avenue. These opportunities, coupled with favorable clinical data promoting the product, suggest sustained upward trajectory for the market, provided restraints related to cost and complexity can be effectively managed through scale and technological innovation.

Segmentation Analysis

The Ferrous Ascorbate market is broadly segmented based on its form, application, and distribution channel, reflecting the diverse requirements of the pharmaceutical, nutraceutical, and food industries. Analyzing these segments provides strategic insights into consumer behavior and industry investment priorities. The form of the product, whether liquid or solid, dictates target patient groups and ease of administration, profoundly influencing market penetration. The application segmentation, spanning from primary pharmaceutical use to prophylactic supplementation, highlights the breadth of the compound's therapeutic utility. Furthermore, the distribution channel analysis distinguishes between high-volume retail sales and institutional procurement, impacting pricing strategies and geographical reach.

The segmentation by form is crucial, as the choice between oral solids (tablets, capsules) and liquid syrups often depends on patient adherence and demographic factors. While oral solids are cost-efficient and stable, liquids cater specifically to pediatrics, geriatrics, and individuals with dysphagia, presenting a premium segment with higher growth rates. Analyzing applications reveals the sheer volume generated by prescribed pharmaceutical treatments for acute anemia, contrasting with the high-margin, consistent growth observed in the nutraceutical sector, driven by preventative health trends and direct-to-consumer marketing.

Ultimately, a detailed segmentation analysis aids market players in refining their product portfolios, tailoring marketing efforts, and optimizing supply chain logistics to maximize profitability. For instance, focusing research on innovative slow-release matrices for tablets could capture a significant share of the adult pharmaceutical market, whereas developing palatable flavored liquid suspensions would be critical for success in pediatric care and over-the-counter supplements. Understanding these granular trends is key to navigating the competitive landscape and addressing specific market needs efficiently.

- By Form:

- Tablets

- Capsules

- Syrups/Liquids

- Injectables (Niche/Emerging)

- By Application:

- Pharmaceuticals (Treatment of IDA)

- Nutraceuticals (Dietary Supplements)

- Food Fortification

- By End-User:

- Hospitals and Clinics

- Retail Pharmacies

- E-commerce Platforms

- Government & Public Health Agencies

- By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Ferrous Ascorbate Market

The value chain for Ferrous Ascorbate begins with the upstream process, which involves sourcing raw materials: highly pure elemental iron compounds and pharmaceutical-grade L-Ascorbic Acid (Vitamin C). The complexity here lies in ensuring the purity and standardized quality of these precursors, as variations directly impact the chelation process and the final product's stability and bioavailability. Manufacturing involves complex chemical synthesis and purification steps, requiring specialized reactors and stringent quality control protocols to produce the stable, high-yield ferrous ascorbate salt. Key activities in the upstream segment include intensive supplier qualification, inventory management, and maximizing yield optimization during synthesis.

The midstream activities focus on the formulation and manufacturing of finished products. This involves transforming the bulk active pharmaceutical ingredient (API) into various dosage forms—tablets, capsules, or syrups—a phase dominated by contract manufacturing organizations (CMOs) or integrated pharmaceutical facilities. Quality assurance and regulatory compliance are paramount at this stage, particularly meeting Good Manufacturing Practices (GMP) and specific regulatory requirements for pharmaceutical versus nutraceutical products. Efficient packaging, labeling, and storage, often requiring climate control to maintain product integrity, also fall under this critical phase of the value chain.

Downstream analysis highlights the intricate distribution channel network. Direct channels involve sales to large institutional buyers such as government health agencies managing public nutrition programs and major hospital groups. Indirect channels, which dominate the retail segment, utilize wholesalers, distributors, retail pharmacies, and increasingly, specialized e-commerce platforms. The success of the downstream phase relies heavily on effective marketing, medical detailing to influence physician prescribing habits, and ensuring cold chain integrity where applicable. The fragmented nature of retail distribution, contrasted with the highly consolidated nature of pharmaceutical distribution, presents distinct challenges and opportunities for market participants seeking optimal reach.

Ferrous Ascorbate Market Potential Customers

The primary customer base for Ferrous Ascorbate is highly diverse, centered around organizations and individuals concerned with managing or preventing iron deficiency anemia. End-users span the clinical setting, encompassing hospitals, specialized hematology clinics, and general practitioners who rely on the product for treating diagnosed anemia cases, particularly in patients who exhibit poor tolerance to less bioavailable iron salts. These professional customers require robust clinical data, reliable supply, and compliance with stringent pharmacological standards, making product efficacy and purity non-negotiable purchasing criteria.

A significant and rapidly growing customer segment comprises the retail consumers purchasing over-the-counter (OTC) nutraceuticals. These buyers are typically health-conscious individuals seeking preventative supplements, pregnant women needing enhanced iron intake, or individuals with dietary restrictions (e.g., vegetarians) susceptible to mild deficiencies. This segment is highly influenced by brand reputation, perceived product bioavailability, ease of use (e.g., liquid vs. tablet), and targeted marketing emphasizing the gentle nature of ferrous ascorbate on the digestive system, a crucial selling point over traditional iron supplements.

Furthermore, government health agencies and non-governmental organizations (NGOs) focused on public health and nutritional interventions represent large-scale, institutional buyers. These entities procure vast quantities of ferrous ascorbate for national fortification programs or large-scale distribution to vulnerable populations, such as refugees or those in low-income regions. For this customer group, procurement decisions are heavily weighted by cost-effectiveness, large-scale supply capacity, and compliance with World Health Organization (WHO) and regional regulatory guidelines, emphasizing the societal rather than just the clinical application of the product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 740.8 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer Inc., Bayer AG, Sanofi S.A., GlaxoSmithKline plc (GSK), Teva Pharmaceutical Industries Ltd., Abbott Laboratories, Aurobindo Pharma Ltd., Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Torrent Pharmaceuticals Ltd., Zydus Lifesciences Ltd., Cipla Ltd., Merck KGaA, Akums Drugs & Pharmaceuticals Ltd., Alkem Laboratories Ltd., Macleods Pharmaceuticals Ltd., Mankind Pharma Ltd., Emcure Pharmaceuticals Ltd., Hetero Drugs Ltd., Indoco Remedies Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ferrous Ascorbate Market Key Technology Landscape

The technological landscape for the Ferrous Ascorbate market is centered on advanced chemical synthesis, formulation science, and specialized drug delivery systems designed to maximize absorption and minimize side effects. Current synthesis technologies focus on chelation processes that ensure high yield and high purity of the stable ferrous ascorbate complex, often employing proprietary techniques to optimize the molar ratio between iron and ascorbic acid. Innovations in crystallization and drying technologies are critical for ensuring the bulk API is highly stable and resistant to oxidation, which is a common challenge with iron salts. Furthermore, continuous flow chemistry methods are being explored to enhance scalability and reduce batch-to-batch variability, providing manufacturers with efficient, high-throughput production capabilities.

In terms of dosage form development, the market is characterized by advancements in controlled-release and delayed-release technologies. These specialized matrices, often polymer-based, are designed to release the ferrous ascorbate gradually in the gastrointestinal tract, bypassing the stomach environment where iron can cause severe irritation, and targeting the duodenum for optimal absorption. This technological focus directly addresses patient compliance issues associated with older iron supplements. Microencapsulation and nanotechnology are also emerging as crucial tools, allowing for the embedding of the ferrous ascorbate within protective shells to mask metallic taste, enhance stability in liquid formulations, and further regulate the release profile, thereby significantly improving the patient experience.

The manufacturing technology for liquid formulations is also evolving rapidly, emphasizing stabilization techniques that prevent precipitation and degradation over extended periods, particularly in high-concentration syrups targeted at pediatric populations. Bioavailability enhancement techniques, often involving the use of specific excipients and penetration enhancers, are continuously researched to ensure that even minimal doses deliver maximum therapeutic effect. The integration of advanced analytics and quality control technologies, such as High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS), throughout the production process ensures adherence to stringent global pharmaceutical standards, solidifying the technological basis for market superiority.

Regional Highlights

The global distribution and growth trajectory of the Ferrous Ascorbate market exhibit distinct regional characteristics influenced by demographic factors, healthcare policies, and economic development levels.

- Asia Pacific (APAC): This region is poised to be the fastest-growing market globally, driven by the massive patient base suffering from high rates of nutritional anemia, especially in South Asia and Southeast Asia. Government initiatives, such as mandated iron supplementation programs for pregnant women and large-scale public food fortification efforts in countries like India and Indonesia, are primary demand generators. The increasing affordability and accessibility of healthcare, coupled with the rapid expansion of domestic pharmaceutical manufacturing capabilities in China and India, ensure robust volume growth.

- North America: Characterized by mature healthcare spending and high consumer awareness, North America commands a significant market share, primarily driven by the high demand for premium nutraceuticals and dietary supplements. Consumers are willing to pay a premium for high-bioavailability forms like ferrous ascorbate to avoid gastrointestinal side effects. Strict regulatory oversight ensures product quality, fostering confidence in both pharmaceutical and OTC products. Emphasis on preventive health and a growing senior population contribute to sustained demand.

- Europe: Similar to North America, the European market benefits from established health systems and a strong focus on clinical efficacy. Growth is steady, fueled by standardized healthcare protocols for anemia management and a robust nutraceutical industry, particularly in Western Europe (Germany, UK, France). The adoption of ferrous ascorbate is favored in clinical guidelines over older salts due to superior patient tolerance and lower non-compliance rates.

- Latin America (LATAM): This region presents substantial growth opportunities, spurred by improving economic conditions and increased government investment in public health infrastructure and maternal care programs. Brazil and Mexico are key contributors, implementing programs to combat endemic nutritional deficiencies. Market penetration is accelerating as healthcare systems evolve, promoting the use of newer, more effective iron formulations.

- Middle East and Africa (MEA): The MEA region is a diverse market where growth is uneven but significant, driven largely by high birth rates and pervasive nutritional deficiencies in sub-Saharan Africa. Gulf Cooperation Council (GCC) countries offer lucrative markets for high-value imported pharmaceuticals. Challenges include distribution complexities and varying regulatory environments, but large-scale NGO and government aid programs focused on maternal and child health provide a foundational demand stream for essential supplements like ferrous ascorbate.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ferrous Ascorbate Market.- Pfizer Inc.

- Bayer AG

- Sanofi S.A.

- GlaxoSmithKline plc (GSK)

- Teva Pharmaceutical Industries Ltd.

- Abbott Laboratories

- Aurobindo Pharma Ltd.

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Torrent Pharmaceuticals Ltd.

- Zydus Lifesciences Ltd.

- Cipla Ltd.

- Merck KGaA

- Akums Drugs & Pharmaceuticals Ltd.

- Alkem Laboratories Ltd.

- Macleods Pharmaceuticals Ltd.

- Mankind Pharma Ltd.

- Emcure Pharmaceuticals Ltd.

- Hetero Drugs Ltd.

- Indoco Remedies Ltd.

Frequently Asked Questions

Analyze common user questions about the Ferrous Ascorbate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Ferrous Ascorbate over traditional iron supplements?

The primary advantage is its significantly enhanced bioavailability and superior gastrointestinal tolerability. Being a chelate complex, the iron is more readily absorbed, requiring lower doses for efficacy and drastically reducing common side effects like constipation and gastric irritation, thereby improving patient adherence to treatment regimens.

Which application segment drives the highest revenue in the Ferrous Ascorbate Market?

The Pharmaceutical segment, specifically the prescription and over-the-counter treatment of iron deficiency anemia (IDA), generates the highest current revenue due to established clinical protocols and high therapeutic dosing requirements. However, the Nutraceutical segment is projected to show the highest growth rate moving forward.

How is Ferrous Ascorbate used in public health initiatives?

Ferrous Ascorbate is crucial in public health initiatives, especially maternal and child health programs. It is used extensively in large-scale government-backed distribution programs and food fortification efforts across developing nations because of its high stability, efficacy, and minimal impact on the sensory properties of fortified foods.

What are the key technological trends influencing the formulation of Ferrous Ascorbate?

Key technological trends include the development of controlled-release dosage forms to optimize intestinal absorption and minimize gastric irritation. Advanced microencapsulation techniques are also utilized to improve the stability of liquid formulations and mask the metallic taste associated with iron salts, enhancing overall patient acceptance.

Which geographical region exhibits the fastest growth rate for Ferrous Ascorbate?

The Asia Pacific (APAC) region is expected to demonstrate the fastest growth rate, driven by the exceptionally high prevalence of anemia across populous nations like India and China, coupled with increasing government focus on addressing widespread nutritional deficiencies through supportive health policies and programs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager