Fiber Laser Cutting Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443235 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Fiber Laser Cutting Machines Market Size

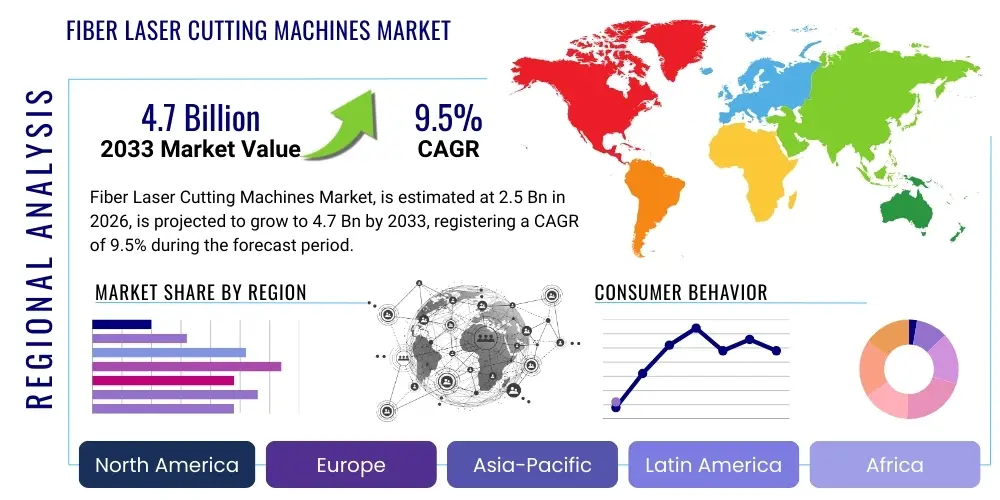

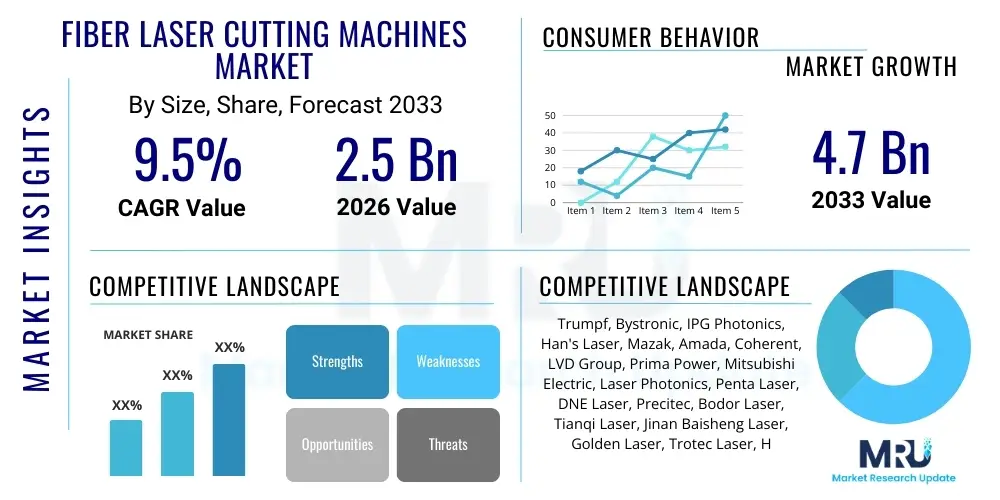

The Fiber Laser Cutting Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.7 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily fueled by the accelerating adoption of automation technologies across diverse manufacturing sectors globally, coupled with the inherent advantages of fiber lasers over traditional cutting methods, such as enhanced energy efficiency, superior cutting speed, and minimal maintenance requirements. The continuous innovation in high-power fiber laser sources, pushing output capabilities beyond 30kW, is significantly expanding the application scope into thick material processing, which was historically dominated by CO2 lasers or plasma cutting.

Fiber Laser Cutting Machines Market introduction

The Fiber Laser Cutting Machines Market encompasses specialized industrial equipment utilizing solid-state fiber lasers as the primary source for material processing, specifically cutting metal sheets, tubes, and complex components with high precision and speed. These systems function by directing a highly concentrated beam of light, amplified through rare-earth elements embedded in optical fiber, onto the material surface, causing localized melting and vaporization. The resulting cut is characterized by a narrow kerf, smooth edges, and significantly reduced heat-affected zones (HAZ), making them indispensable tools in modern precision engineering and fabrication.

Major applications span crucial industries including automotive manufacturing, where they are used for lightweighting initiatives and high-volume part production; aerospace and defense, necessitating extreme accuracy for critical components; general industrial machinery and heavy equipment fabrication; and the burgeoning electronics sector for precise cutting of delicate metal components and enclosures. The core benefits driving their adoption include exceptional operational efficiency dueability, reduced consumables reliance, and the ability to process reflective materials like copper and brass effectively, which pose challenges for CO2 laser systems. Furthermore, their solid-state design ensures a longer lifespan and lower total cost of ownership (TCO) compared to alternative cutting solutions.

Key driving factors supporting the market expansion involve the global shift toward Industry 4.0 paradigms, demanding fully automated and integrated manufacturing processes. Governments and major corporations are increasingly investing in sophisticated infrastructure and production capabilities to enhance global competitiveness, particularly in emerging economies like China, India, and Southeast Asia. The consistent evolution of laser source technology, providing higher power levels at increasingly competitive price points, democratizes access to advanced cutting capabilities, further stimulating demand across small and medium-sized enterprises (SMEs) that previously relied on less efficient mechanical or plasma cutting techniques.

Fiber Laser Cutting Machines Market Executive Summary

The Fiber Laser Cutting Machines Market is exhibiting vigorous growth, underpinned by significant global business trends focusing on operational optimization, supply chain resilience, and digital transformation in manufacturing. Businesses are prioritizing investments in flexible and high-speed fabrication equipment to handle fluctuating production volumes and complex material requirements. The prevailing trend toward lightweighting materials, particularly in the automotive and aerospace industries using advanced high-strength steels and aluminum alloys, fundamentally necessitates the precision and speed offered by fiber laser systems, solidifying their market dominance over older technologies. Furthermore, competitive pressures are driving continuous price reduction and feature enhancement in laser sources, making high-power machines accessible to a broader user base, accelerating replacement cycles.

Regionally, the Asia Pacific (APAC) continues to lead the market, driven by massive manufacturing output in China, Korea, and Japan, coupled with rapid industrialization in Southeast Asian countries. The APAC region benefits from substantial government support for domestic machine tool industries and high levels of foreign direct investment (FDI) into manufacturing hubs. North America and Europe demonstrate mature market characteristics, emphasizing technological sophistication, integration with robotics and automation cells, and a strong focus on high-power, high-precision applications, especially in aerospace and medical device fabrication. Investment intensity in these regions is skewed toward advanced features such as automatic nozzle change, adaptive optics, and seamless integration with Manufacturing Execution Systems (MES).

In terms of segmentation, the High-Power segment (above 6kW) is experiencing the fastest growth rate, reflecting the increased requirement for rapid processing of thick plate materials. Application-wise, the Automotive and General Fabrication sectors remain the largest consumers, though the Electronics industry is emerging as a significant high-growth area due to the need for precise micro-cutting capabilities. Furthermore, the market for 3D fiber laser cutting machines, capable of processing complex geometric shapes and pre-formed parts, is expanding rapidly as manufacturers seek solutions for hydroformed parts and advanced structural components, driving product diversification and technological rivalry among key machine builders.

AI Impact Analysis on Fiber Laser Cutting Machines Market

Common user questions regarding AI’s impact on the Fiber Laser Cutting Machines Market center primarily on enhanced autonomy, optimization of cutting parameters, predictive maintenance capabilities, and the potential for lights-out manufacturing operations. Users frequently inquire about how AI algorithms can dynamically adjust power, feed rates, and gas pressure based on real-time material feedback (such as surface roughness, temperature variations, and material inconsistencies), minimizing scrap rates and maximizing throughput. There is also significant interest in AI-driven diagnostics that predict component failure (especially costly optical components or laser sources) long before critical malfunction occurs, thereby improving operational uptime and reducing maintenance costs. Overall, users expect AI integration to transform laser cutting from a skilled operation requiring constant human oversight into a highly intelligent, self-optimizing industrial process.

- AI-Driven Parameter Optimization: Machine learning algorithms dynamically adjust cutting parameters (power, speed, focal position) based on material type, thickness, and real-time sensor data, ensuring optimal cut quality and speed autonomously.

- Predictive Maintenance (PdM): AI models analyze vibration, temperature, and performance data from critical components (e.g., cooling systems, optics) to forecast failures, significantly reducing unplanned downtime and optimizing maintenance schedules.

- Defect Recognition and Quality Control: Vision systems integrated with deep learning identify microscopic defects, thermal deviations, or inconsistent kerf width in real-time, enabling immediate process correction and ensuring zero-defect output.

- Process Automation and Scheduling: AI-powered software optimizes nesting patterns and job scheduling across multiple machines, maximizing material utilization (minimizing waste) and improving overall factory efficiency.

- Operator Assistance and Training: AI systems provide real-time guidance and troubleshooting advice to operators, accelerating training for complex tasks and standardizing best practices across the facility.

- Energy Consumption Optimization: Algorithms analyze energy usage patterns across different job types and shifts, suggesting or implementing operational changes to minimize energy expenditure without compromising productivity.

DRO & Impact Forces Of Fiber Laser Cutting Machines Market

The Fiber Laser Cutting Machines Market is strongly influenced by a robust set of driving forces centered on industrial modernization and technological maturity, counterbalanced by significant restraints related to capital expenditure and specialized workforce requirements, while substantial opportunities exist in emerging applications and global economic shifts. The primary driver is the unparalleled efficiency and speed offered by fiber lasers, which dramatically reduces per-part cost in high-volume production environments. This efficiency is coupled with the global push for sustainability, as fiber lasers offer superior energy conversion efficiency compared to CO2 lasers. The increasing availability of high-power fiber sources (12kW+) at competitive prices is rapidly displacing older technologies across the board. However, the high initial investment cost, particularly for large-format, high-power systems, poses a barrier, especially for smaller market participants. Furthermore, specialized technical expertise is required for maintenance and advanced programming, which can be challenging to source and retain in many industrial regions.

Opportunity generation is primarily tied to the convergence of fiber laser technology with ancillary advancements such as advanced robotics, real-time monitoring via IIoT, and additive manufacturing integration. The expanding demand for specialized cutting in emerging sectors like battery manufacturing (for EVs) and advanced medical devices presents niche, high-value opportunities. Geopolitical factors, specifically the desire for localized production and resilient supply chains (reshoring manufacturing), further stimulate capital expenditure in advanced machine tools in North America and Europe. The competitive landscape continues to be shaped by pricing pressure from Asian manufacturers who offer highly functional machines at lower costs, forcing established Western OEMs to focus intensely on software integration, service contracts, and unparalleled precision.

The impact forces currently shaping the market are substantial. Technological obsolescence is a continuous pressure, where constant power increases and software advancements push manufacturers to regularly upgrade or replace existing fleets to maintain competitive operational costs. Regulatory impact forces, particularly those related to safety standards and environmental mandates, push manufacturers toward closed-loop, highly controlled cutting environments. Economic impact forces, such as global steel prices and automotive production volumes, directly correlate with demand for cutting systems. These forces collectively dictate the pace of adoption, investment strategies of manufacturers, and the rate of displacement of conventional cutting technologies across diverse industrial fabrication markets worldwide.

Segmentation Analysis

The Fiber Laser Cutting Machines Market is broadly segmented based on laser power (a critical determinant of capability and cost), machine type (defining dimensionality of movement), application industry (the end-user base), and end-user organization size (influencing machine complexity and volume needs). Understanding these segmentations is vital for stakeholders to tailor product offerings and marketing strategies effectively. For instance, high-power systems are primarily aimed at large-scale industrial machinery and heavy fabrication, while low-power systems are dominant in detailed electronics and custom job shops. The market structure reflects the diversity of material processing requirements globally, ranging from ultra-high-speed thin sheet cutting to intricate 3D profiling of pre-formed tubes and hydroformed automotive components, driving specialization in machine design and software integration.

- By Power (kW):

- Low Power (1kW – 3kW): Focus on thin sheets, precision cutting, and entry-level operations.

- Medium Power (3kW – 6kW): Balanced performance for speed and medium-thickness processing.

- High Power (Above 6kW, including 10kW to 30kW+): Designed for rapid cutting of thick plates, high-throughput manufacturing, and demanding industrial applications.

- By Machine Type:

- 2D Fiber Laser Cutting Machines (Flat Sheet Cutting): Dominant segment for standard metal fabrication.

- 3D Fiber Laser Cutting Machines (Multi-Axis Cutting): Specialized for complex geometries, tubes, and pre-formed parts (e.g., automotive structural components).

- By Application Industry:

- Automotive and Transportation (Chassis, Body Panels, Components)

- Aerospace and Defense (Turbine Blades, Structural Components, Exotic Alloys)

- Heavy Machinery and Industrial Fabrication (Construction Equipment, Agricultural Machinery)

- Electronics and Electrical Devices (Enclosures, Housings, Precision Components)

- Others (Medical Devices, HVAC, Energy Sector)

- By End-User Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises (Tier 1 Suppliers, OEMs)

Value Chain Analysis For Fiber Laser Cutting Machines Market

The value chain for the Fiber Laser Cutting Machines Market is complex, beginning with upstream raw material suppliers and laser source manufacturers, extending through the original equipment manufacturers (OEMs) who assemble the final machines, and culminating in downstream distribution, installation, and essential after-sales services. Upstream analysis focuses heavily on the procurement of critical components, notably the optical fibers, diodes, resonators, and high-precision motion control systems. The quality and cost of the core fiber laser source, often supplied by specialized firms like IPG Photonics, Coherent, or Han's Laser, dictate the machine's ultimate performance and profitability. Strategic partnerships between OEMs and component suppliers are crucial for securing competitive pricing and integrating the latest laser source innovations rapidly into new machine models.

The midstream stage involves the OEMs (e.g., Trumpf, Bystronic, Amada) who focus on machine design, software development (including HMI, nesting algorithms, and process control), and final assembly. This stage is highly competitive, emphasizing integration capabilities, machine footprint optimization, and proprietary cutting head technologies designed for enhanced precision and speed. Significant value addition occurs through the development of intuitive user interfaces and software solutions that improve operational efficiency and simplify complex job setups. Direct distribution channels are often favored by large OEMs for high-value machines to maintain control over installation, training, and long-term service relationships with key accounts, especially in technically demanding markets like aerospace.

Downstream analysis covers distribution and end-user utilization. Distribution channels are bifurcated into direct sales (for large, sophisticated systems sold to major industrial enterprises) and indirect channels utilizing regional distributors or agents (common for selling entry-to-mid-level machines to SMEs). The post-sales phase, including maintenance, software updates, spare parts supply, and technical support, is a crucial profit center and a major factor in customer retention and satisfaction. The success in the downstream market hinges on establishing robust global service networks capable of quick response times, given the high throughput and criticality of these machines in modern manufacturing lines. Efficient spare parts logistics and localized technical expertise are therefore paramount for long-term success.

Fiber Laser Cutting Machines Market Potential Customers

Potential customers for Fiber Laser Cutting Machines are generally identified as organizations engaged in high-precision, high-volume material shaping and fabrication across various capital goods sectors. These entities are characterized by the requirement to process metals (steel, stainless steel, aluminum, copper, brass) efficiently, often needing strict tolerances and minimal secondary finishing operations. The automotive sector, including large Original Equipment Manufacturers (OEMs) and their extensive network of Tier 1 and Tier 2 suppliers, constitutes a massive customer base, demanding machines capable of processing high-strength low-alloy (HSLA) steels and complex aluminum structures for electric vehicle (EV) manufacturing. Their purchase decisions are driven by speed, reliability, and the ability to integrate machines into existing or planned automated production lines.

The second major group includes general sheet metal fabrication job shops and heavy industrial equipment manufacturers. These customers prioritize flexibility, machine size (large format capabilities), and the ability to handle a wide range of material thicknesses, from thin sheets for ductwork to thick plates for construction machinery and agricultural equipment frames. Their purchasing criteria often revolve around the total cost of ownership (TCO), machine footprint efficiency, and availability of robust local service. Finally, high-tech sectors such as aerospace and medical device manufacturing represent smaller volume but extremely high-value customers. These buyers demand absolute precision, rigorous process documentation, and machines specialized for processing high-performance alloys (e.g., titanium, Inconel), with purchasing decisions heavily influenced by certification, repeatability, and sophisticated quality control integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.7 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trumpf, Bystronic, IPG Photonics, Han's Laser, Mazak, Amada, Coherent, LVD Group, Prima Power, Mitsubishi Electric, Laser Photonics, Penta Laser, DNE Laser, Precitec, Bodor Laser, Tianqi Laser, Jinan Baisheng Laser, Golden Laser, Trotec Laser, HGTECH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Laser Cutting Machines Market Key Technology Landscape

The technology landscape of the Fiber Laser Cutting Machines Market is characterized by intense innovation in three core areas: the laser source itself, the cutting head and optics, and the machine control software and system integration. In laser source technology, the relentless pursuit of higher power continues to dominate, with commercially available systems now exceeding 30kW, enabling faster and cleaner cuts on increasingly thick materials (up to 50mm mild steel). These advanced sources leverage highly efficient diode pumping and optimized fiber designs to improve beam quality and energy conversion efficiency (wall-plug efficiency), which directly translates to lower operational costs for the end-user. Furthermore, the development of adjustable spot size technology allows the laser beam characteristics to be dynamically optimized for various material types and thicknesses within a single cutting job, significantly increasing machine versatility.

The cutting head assembly represents another critical technological battlefield. Modern cutting heads feature sophisticated non-contact sensing, automated focusing, and rapid nozzle changing capabilities (Auto Nozzle Changer, ANC). Adaptive optics systems are becoming standard, continuously compensating for thermal lens effects and maintaining optimal focus position regardless of process fluctuations or component heating, thereby ensuring consistent cut quality over long production runs. Protection of the crucial internal optics from back reflection, particularly when processing highly reflective materials like aluminum and copper, is managed through advanced protection modules and specialized coatings, significantly enhancing the durability and reducing the maintenance burden of the cutting head.

Finally, the integration of advanced software and control systems is paramount to achieving Industry 4.0 readiness. Key features include intuitive Human-Machine Interfaces (HMI), sophisticated nesting software utilizing AI algorithms for maximum material yield, and seamless integration with MES and ERP systems for centralized production planning and data logging. Remote diagnostics and monitoring capabilities, leveraging IIoT connectivity, allow OEMs to provide proactive service and performance optimization recommendations. The adoption of linear drives in high-end machines, replacing traditional rack and pinion systems, ensures ultra-high acceleration and cutting speeds with superior positional accuracy, critical for high-throughput applications in sectors like automotive stamping and electronics fabrication, solidifying the technological advantage of modern fiber laser cutters over legacy machinery.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, technological adoption rates, and competitive environment of the Fiber Laser Cutting Machines Market. Each region exhibits unique characteristics driven by industrial composition, regulatory environments, and investment priorities. Asia Pacific (APAC), particularly China, holds the largest market share globally due to its massive manufacturing base, high rate of industrial automation implementation, and the presence of numerous domestic low-cost, high-volume laser machine builders. The governmental emphasis on developing advanced manufacturing capabilities through initiatives like 'Made in China 2025' ensures continued strong investment in laser processing technology across automotive, general fabrication, and increasingly, battery production sectors. South Korea, Japan, and India are also significant markets focusing on high-precision applications and technological advancement.

North America is characterized by high demand for advanced, high-power fiber laser systems, particularly driven by the stringent requirements of the aerospace, defense, and high-tech automotive sectors. Manufacturers in this region prioritize quality, integration with robotics, and comprehensive service contracts, often favoring machines from established Western OEMs that provide robust support and advanced software capabilities for managing complex supply chains. The trend of manufacturing reshoring, fueled by supply chain security concerns and governmental incentives, is providing a significant impetus for capital expenditure in new machine tools, focusing on maximizing efficiency and minimizing reliance on manual labor.

Europe represents a mature but highly sophisticated market, demonstrating strong uptake in Germany, Italy, and Scandinavia. European manufacturers exhibit a strong preference for fully automated, integrated manufacturing cells, often integrating fiber lasers with automated storage systems (AS/RS) and bending machines to create end-to-end fabrication solutions. The market is highly focused on sustainability and energy efficiency, further favoring fiber lasers over CO2 alternatives. Western European companies are at the forefront of 3D laser cutting technology and advanced software integration, catering to complex parts required by the continent's dominant automotive and heavy machinery industries. Latin America and the Middle East & Africa (MEA) are emerging markets experiencing growing adoption, primarily focusing on general fabrication and infrastructure projects, driven by expanding energy and construction sectors, though adoption is often reliant on favorable capital investment policies and local distribution networks.

- North America: Focus on aerospace, defense, and high-precision automation. Strong emphasis on integration and service quality. Key markets include the United States and Canada.

- Europe: Leading adoption of fully automated systems (lights-out manufacturing) and 3D cutting. Driven by automotive, heavy machinery, and strict environmental regulations. Key countries: Germany, Italy, UK.

- Asia Pacific (APAC): Largest market globally, characterized by high volume, competitive pricing, and rapid industrialization. Dominant manufacturing hub for automotive, electronics, and construction. Key markets: China, Japan, South Korea, India.

- Latin America (LATAM): Emerging growth potential, driven by infrastructure development and increasing domestic manufacturing capacity, primarily in Brazil and Mexico.

- Middle East and Africa (MEA): Growth linked to oil and gas infrastructure, construction projects, and diversification efforts away from resource dependence. Key focus on general fabrication and heavy equipment maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Laser Cutting Machines Market.- Trumpf: A global leader known for high-power, high-precision laser systems and advanced automation solutions, focusing heavily on software integration and Industry 4.0 features.

- Bystronic: Renowned for user-friendly interfaces, automated sheet metal processing solutions, and a strong presence in the medium-to-high power segments globally.

- IPG Photonics: The world's largest manufacturer of high-performance fiber lasers, acting as a crucial upstream supplier to many machine builders, driving technological advancements in source power and efficiency.

- Han's Laser: A prominent Chinese manufacturer and global player known for competitive pricing, high production volume, and extensive product range across low to ultra-high power machines.

- Mazak: Integrated machine tool manufacturer offering hybrid fabrication solutions combining laser cutting with conventional machining, targeting precision manufacturing environments.

- Amada: A key player specializing in sheet metal processing machinery, providing comprehensive, integrated fabrication systems including laser cutting, bending, and punching solutions.

- Coherent (formerly Rofin-Sinar): A diversified photonics company supplying high-quality fiber laser sources and specialized cutting optics, particularly strong in demanding industrial applications.

- LVD Group: Known for intelligent machine features and software integration, offering synchronized laser cutting and bending systems for optimal workflow.

- Prima Power: Specializes in systems for sheet metal fabrication, including 2D and 3D laser cutting machines, often integrating automated loading and unloading systems.

- Mitsubishi Electric: Offers highly reliable laser cutting systems, leveraging its expertise in industrial controls and motion systems for precision performance.

- Laser Photonics: Focuses on industrial laser solutions, including specialized fiber laser systems for niche cleaning and cutting applications.

- Penta Laser: A major Chinese manufacturer providing a broad range of fiber laser cutting equipment with a focus on cost-effectiveness and high-speed processing capabilities.

- DNE Laser: Emerging high-volume manufacturer focusing on high-speed, cost-effective fiber laser cutting solutions for the general fabrication market.

- Precitec: A leading supplier of high-quality laser cutting heads, optics, and sensors, essential components determining the performance of high-power fiber laser systems.

- Bodor Laser: Known for aggressively marketed, aesthetically designed machines with high levels of automation aimed at expanding its global footprint among SMEs.

- Tianqi Laser: Focuses on mid-to-high power fiber laser cutters, often catering to the automotive and heavy machinery industries within the Chinese market and expanding internationally.

- Jinan Baisheng Laser: Supplier of economical fiber laser systems, targeting small and medium-sized job shops with standard cutting requirements.

- Golden Laser: Specializes in specialized laser processing solutions, including systems designed for tube and profile cutting and integrated automation features.

- Trotec Laser: Although prominent in smaller format lasers, their industrial systems offer high precision for specialized material processing needs.

- HGTECH: Major diversified laser equipment manufacturer in China, offering solutions across cutting, welding, and marking, leveraging strong domestic R&D support.

Frequently Asked Questions

Analyze common user questions about the Fiber Laser Cutting Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of fiber laser cutting over traditional CO2 laser cutting?

Fiber laser cutting offers significantly higher energy efficiency, superior cutting speeds (especially on thin to medium materials), lower maintenance requirements due to the solid-state design, and the ability to process highly reflective materials like copper and brass effectively.

How does the integration of Industry 4.0 principles affect fiber laser cutting machines?

Industry 4.0 integration enables features such as real-time performance monitoring, remote diagnostics, AI-driven process optimization, and seamless connectivity with Manufacturing Execution Systems (MES), leading to autonomous operations and predictive maintenance protocols.

Which power segment is currently driving the highest market growth, and why?

The High Power segment (above 6kW) is experiencing the fastest growth because increased wattage allows manufacturers to cut thicker materials faster than ever before, significantly boosting throughput and displacing traditional technologies like plasma cutting in heavy fabrication.

What are the main factors contributing to the high initial investment cost of fiber laser systems?

The high initial cost is primarily driven by the expense of the core fiber laser source (diodes and optics), the precision motion control systems (especially linear drives), and the sophisticated proprietary software required for optimal machine operation and automation integration.

Which geographical region holds the largest market share for fiber laser cutting machines?

Asia Pacific (APAC), particularly driven by China, holds the largest market share due to its vast, rapidly automating manufacturing sector, strong government support for industrial modernization, and the presence of numerous domestic high-volume machine suppliers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager