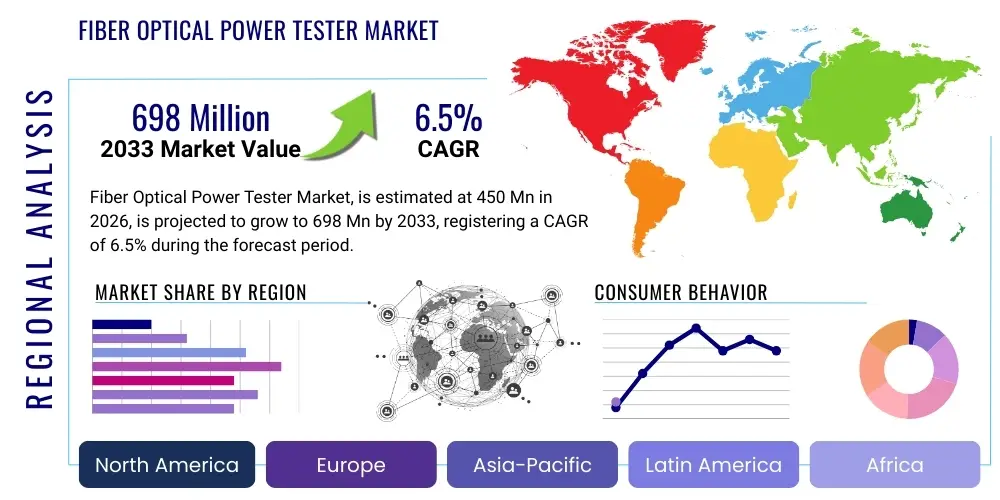

Fiber Optical Power Tester Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442041 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Fiber Optical Power Tester Market Size

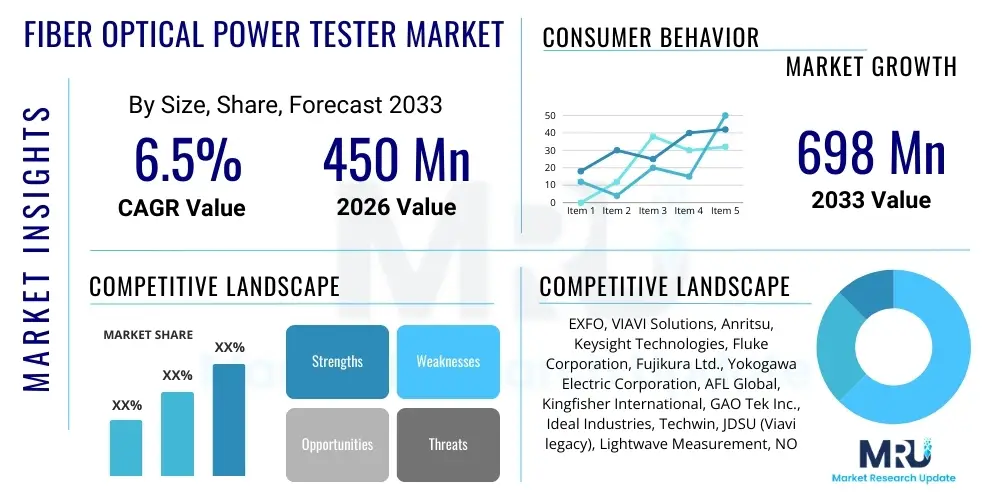

The Fiber Optical Power Tester Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 698 Million by the end of the forecast period in 2033.

Fiber Optical Power Tester Market introduction

The Fiber Optical Power Tester Market encompasses devices crucial for measuring the strength or loss of optical signals in fiber optic communication systems. These instruments are fundamental for installation, maintenance, and troubleshooting across various network infrastructures, ensuring optimal performance and compliance with industry standards like ISO/IEC and TIA/EIA. The essential components of a power tester include a calibrated optical sensor, signal processing circuitry, and a user interface for display and data logging. Given the continuous global expansion of bandwidth-intensive applications and the subsequent rollout of 5G, Fiber-to-the-Home (FTTH), and hyperscale data centers, the demand for precise and reliable testing equipment is accelerating significantly.

Major applications for fiber optical power testers span telecommunication networks, where they verify long-haul transmission integrity; data centers, for certifying high-speed interconnects; and enterprise networks, for managing internal fiber backbone integrity. The core benefits derived from using these testers include rapid identification of system faults, accurate measurement of insertion loss, and ensuring network uptime, which directly translates to reduced operational expenditure for network providers. They are indispensable for guaranteeing that the installed fiber infrastructure meets required performance parameters before activation and throughout its operational lifecycle.

Key driving factors fueling market expansion include the exponential increase in data traffic demanding higher network speeds, stimulating massive investments in optical fiber deployment worldwide, particularly in emerging economies. Furthermore, technological advancements leading to more intuitive, rugged, and feature-rich testers—such as integration with Optical Time Domain Reflectometers (OTDRs) and automated reporting capabilities—are boosting adoption rates. Regulatory requirements mandating certified installation and maintenance practices also contribute heavily to the sustained growth trajectory of the market.

Fiber Optical Power Tester Market Executive Summary

The Fiber Optical Power Tester Market demonstrates robust growth, primarily driven by expansive global investments in next-generation connectivity infrastructure, including 5G backhaul and FTTx projects. Business trends indicate a shift towards integrated testing solutions and cloud-enabled devices that facilitate real-time data analysis and remote calibration, optimizing field technician efficiency. Leading market players are focusing on developing portable, multi-functional testers capable of handling complex network architectures, such as passive optical networks (PON) and high-density multifiber push-on (MPO) connections, thereby addressing the demanding requirements of hyperscale data centers and modern telecommunications.

Regionally, the Asia Pacific (APAC) region maintains market dominance and the highest growth potential, attributed to extensive government-backed digital infrastructure initiatives in countries like China, India, and Southeast Asia, aimed at increasing broadband penetration and launching nationwide 5G networks. North America and Europe remain mature markets characterized by high technology adoption rates, focusing on upgrading existing core networks and the rapid expansion of hyperscale cloud infrastructure, driving demand for high-precision, benchtop, and advanced portable testers essential for certifying high-speed optical links.

Segment trends highlight the dominance of the handheld segment due to its versatility and ease of use in field applications, though the benchtop segment is gaining traction in manufacturing and research laboratories requiring ultimate precision. Application-wise, the telecommunications sector remains the largest consumer, but the data center segment is poised for the fastest expansion, fueled by the relentless demand for higher bandwidth and stricter certification standards for 100G, 400G, and future 800G optical links, mandating highly accurate power measurement instruments for loss budget validation.

AI Impact Analysis on Fiber Optical Power Tester Market

Common user questions regarding AI’s influence typically center on whether artificial intelligence can automate fault detection, predict network degradation, and enhance the accuracy of calibration processes without manual intervention. Users frequently inquire about the integration of machine learning algorithms to analyze vast quantities of loss measurement data collected across diverse geographical locations, seeking patterns that could optimize network planning and maintenance schedules. Key themes also revolve around leveraging AI to simplify complex testing procedures, enabling less-experienced technicians to perform advanced diagnostics accurately, and the future potential of autonomous testing systems that can self-diagnose and recalibrate, reducing reliance on specialized technical expertise.

- AI integration enables predictive maintenance by analyzing historic power loss data to anticipate fiber degradation and schedule proactive repairs, minimizing unexpected outages.

- Machine learning algorithms enhance measurement accuracy and reliability by filtering out environmental noise and compensating for minor device-related biases during calibration cycles.

- Automated diagnostics utilize AI to instantly compare measured power levels against complex threshold databases, rapidly isolating fault sources (e.g., connector contamination, excessive bends) with high confidence.

- AI supports the development of smart testing protocols that dynamically adjust measurement parameters based on the fiber type and system architecture being tested, improving efficiency in the field.

- Cloud-based AI processing facilitates centralized data governance and remote asset management, allowing power tester fleet calibration and firmware updates to be optimized based on usage patterns.

DRO & Impact Forces Of Fiber Optical Power Tester Market

The market's trajectory is primarily shaped by the compelling drivers of global fiber optic network deployment and the critical restraints posed by the high initial cost of precision instruments and the need for frequent, specialized calibration. Opportunities arise from the proliferation of specialized high-speed optical standards (e.g., 400G and 800G Ethernet) and the emergence of industrial IoT (IIoT), which mandates robust and ruggedized testing solutions. These forces collectively define the market landscape, pushing manufacturers toward innovation in portability, integration, and user accessibility to maintain competitive relevance and address the escalating technical requirements of modern optical networks.

Market Drivers include the surging demand for high-bandwidth applications, necessitating widespread FTTx and 5G network rollouts, which rely heavily on certified optical links. The expansion of hyperscale and edge data centers globally requires continuous performance validation of high-density fiber connectivity. Furthermore, evolving international standards for fiber testing push network owners to upgrade their existing fleet of power measurement equipment to ensure compliance and reliable operation. These factors create a sustained foundational demand for accurate measurement tools.

Restraints encompass the substantial initial capital investment required for high-precision, NIST-traceable power testers and the operational complexity associated with maintaining these instruments, including mandatory periodic calibration which can lead to equipment downtime. The market also faces challenges due to a shortage of highly skilled technicians capable of interpreting complex test results and operating advanced multi-functional testing equipment proficiently, particularly in developing regions, which slows the adoption of sophisticated testers. However, the opportunities presented by new technologies and underserved industrial applications are expected to significantly mitigate these restraints over the long term, favoring market penetration and expansion.

Segmentation Analysis

The Fiber Optical Power Tester market is comprehensively segmented based on product type, power measurement range, application across various industries, and geographical distribution. This segmentation provides a granular view of market dynamics, revealing that the highest growth is concentrated within the portable and handheld segment due to its utility in widespread field deployment, while the telecommunication and rapidly expanding data center applications constitute the primary revenue streams. Analyzing these segments helps stakeholders tailor their product offerings and market strategies to align with the specific needs of end-users, whether they require high-precision benchtop units for laboratory environments or rugged, battery-operated devices for outdoor installation work.

- By Type:

- Handheld

- Benchtop

- Portable (Non-handheld specialized units)

- By Application:

- Telecommunication Networks (FTTx, Long Haul)

- Data Centers and Enterprise Networks

- Military and Aerospace

- Industrial and Manufacturing (Fiber Sensors)

- Research and Development

- By Power Range:

- Low Power (Standard Networks)

- High Power (CATV and Specialized Applications)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Fiber Optical Power Tester Market

The value chain for Fiber Optical Power Testers begins with the upstream procurement of highly specialized raw materials, critically including precision photodetector components (such as Germanium or Indium Gallium Arsenide, InGaAs) necessary for accurate light measurement, high-speed microprocessors for complex signal processing, and durable, ruggedized housing materials. The quality and traceability of these components directly impact the tester's accuracy and long-term stability, making vendor relationships with specialized component manufacturers crucial. Furthermore, the development of proprietary calibration software and firmware represents a significant value-add during the early stages, defining the instrument's capabilities and compliance with international metrology standards.

The manufacturing and assembly phase involves stringent quality control, especially concerning the optical interface precision and the calibration process. Calibration is the most critical activity, requiring comparison against traceable national or international standards (e.g., NIST), ensuring the instrument delivers accurate absolute power measurements (dBm) and relative loss (dB). High-value is added through integrating complex functionalities, such as OTDR capabilities, visual fault locators, and automated test sequencing software, transforming the basic power meter into a comprehensive certification tool. This phase is characterized by intense R&D investment aimed at miniaturization and increased battery life for field usability.

Downstream analysis highlights complex distribution channels. The primary channel often involves specialized distributors or value-added resellers (VARs) who possess deep technical knowledge of fiber optic installation and maintenance procedures, offering localized support and training. Direct sales channels are frequently employed for large telecommunication providers or governmental contracts. A significant portion of the downstream market relies on essential aftermarket services, including mandatory annual or biennial calibration, repair, and ongoing software support, which contribute substantially to the product's lifetime value and maintain regulatory compliance for end-users operating critical infrastructure.

Fiber Optical Power Tester Market Potential Customers

The primary end-users and buyers of Fiber Optical Power Testers are institutions and companies deeply involved in the deployment, certification, and maintenance of high-speed optical communication infrastructure. The largest customer base is the telecommunications industry, specifically Tier 1 and Tier 2 carriers, internet service providers (ISPs), and FTTx operators responsible for nationwide backbone networks and last-mile connectivity. These entities require robust, highly accurate testers for commissioning new fiber routes, diagnosing signal loss in existing lines, and certifying installations based on stringent service level agreements (SLAs).

Another rapidly expanding customer segment includes data center operators—ranging from hyperscale cloud providers to enterprise data center managers. Due to the high-density and high-speed nature of modern data centers (e.g., 400G and above), precise measurement of connector loss (MPO/MTP interfaces) and overall link budget is mandatory to ensure interoperability and performance. Certification is often a prerequisite for warranty validation. Additionally, large enterprises with internal campus fiber networks, utility companies utilizing fiber for grid monitoring (Smart Grid), and specialized industrial sectors requiring fiber optic sensing or control systems represent crucial secondary markets for specialized ruggedized testers.

Furthermore, government and military agencies utilize power testers for secure, mission-critical fiber networks, often requiring devices certified to meet specific environmental and operational standards. Finally, independent cabling contractors, network installation firms, and maintenance service providers form a crucial indirect customer segment, as they often purchase fleets of portable power testers to execute project-based fiber deployment and troubleshooting services for their varied client base across commercial and residential markets. The increasing complexity of fiber networks drives these contractors to invest in advanced, multi-function power testing solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 698 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EXFO, VIAVI Solutions, Anritsu, Keysight Technologies, Fluke Corporation, Fujikura Ltd., Yokogawa Electric Corporation, AFL Global, Kingfisher International, GAO Tek Inc., Ideal Industries, Techwin, JDSU (Viavi legacy), Lightwave Measurement, NOYES (AFL brand), Tempo Communications, 3M, Tribrer, Deviser Instruments, Sensoray |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Optical Power Tester Market Key Technology Landscape

The technological evolution of Fiber Optical Power Testers is centered on achieving higher accuracy, enhanced portability, and advanced software integration to meet the rigorous demands of modern communication standards. Central to this landscape is the continuous improvement in photodetector technology, with InGaAs (Indium Gallium Arsenide) detectors being the standard choice for high-sensitivity measurements across typical fiber communication wavelengths (1310 nm, 1550 nm, and 1625 nm). Recent innovations focus on reducing the noise equivalent power (NEP) and broadening the dynamic range of these detectors, enabling precise measurements in low-light environments typical of long-haul and complex PON networks. Furthermore, sophisticated internal calibration circuitry utilizing thermally stabilized reference sources is critical for maintaining measurement traceability and minimizing drift caused by temperature variations in the field.

Software and connectivity represent the fastest-evolving segment of the technology landscape. Modern power testers are transitioning from standalone devices to integral components of a comprehensive network certification ecosystem. Key technologies include integrated Wi-Fi and Bluetooth capabilities for seamless data transfer to mobile devices and cloud platforms. This allows for instant test reporting, automated documentation generation, and centralized management of test results across multiple field teams, which is crucial for large-scale FTTx deployments. The embedding of standardized reporting formats (e.g., XML output) ensures compatibility with third-party asset management and project management software, streamlining the certification workflow and reducing human error associated with manual data entry.

Looking ahead, the integration of advanced features derived from other testing instruments is becoming standard. Many modern power meters are now bundled with or seamlessly integrate with Optical Loss Test Sets (OLTS) and Visual Fault Locators (VFLs), offering a unified solution for fiber inspection and loss measurement. The development of specialized power testers capable of measuring multi-fiber connections (like MPO/MTP) simultaneously is vital for data center applications, drastically cutting down certification time. Future technology development is expected to focus on autonomous calibration checks leveraging embedded reference sources and further miniaturization enabled by system-on-chip (SoC) architectures, making high-precision testing accessible in extremely rugged and constrained environments.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological adoption within the Fiber Optical Power Tester Market, reflecting varying levels of infrastructure maturity and investment priorities across the globe. The Asia Pacific (APAC) region stands out as the primary growth engine, fueled by unprecedented government and private sector investment into 5G infrastructure, national broadband plans (e.g., in India, Indonesia, and Australia), and the establishment of massive localized and regional data centers to support the booming digital economies. The sheer volume of fiber deployment in China and Southeast Asia drives high demand for robust, cost-effective handheld and portable testers for mass installation and maintenance activities. This region often prioritizes solutions that offer a balance between affordability and essential functionality.

North America holds a significant market share, characterized by high adoption rates of advanced testing technology and demanding standards set by hyperscale cloud providers and major telecom carriers undergoing network modernization. The focus here is on precision, integration, and high-speed readiness, necessitating the use of benchtop testers for laboratory R&D and high-end portable testers capable of certifying complex 400G/800G links. The maturity of the market means that replacement cycles and technology upgrades drive continuous demand, rather than just new installations. Stringent regulatory environments and high labor costs also drive the adoption of automated and cloud-connected testing solutions that maximize technician efficiency and data integrity.

Europe represents a stable and mature market, largely driven by FTTx deployment goals mandated by the European Union and the continuous upgrade of backbone networks to support growing intra-continental data traffic. Countries in Western Europe show high demand for high-quality, traceable calibration services alongside the testing equipment. Eastern Europe, currently undergoing rapid digitalization, presents substantial opportunities for new installations. Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets experiencing significant expansion in fiber deployment, primarily driven by urbanization and improved connectivity initiatives. These regions are increasingly important, shifting demand from basic testers toward more sophisticated, ruggedized equipment suitable for harsh environmental conditions and remote operation.

- North America: Focus on high-precision testing (400G+), hyperscale data center certification, and adoption of automated, cloud-integrated solutions.

- Europe: Stable growth fueled by FTTx expansion, network upgrade cycles, and strict adherence to standardized measurement practices.

- Asia Pacific (APAC): Leading market in terms of volume and growth; driven by 5G rollout, massive telecom infrastructure projects, and increasing data center construction in emerging economies.

- Latin America (LATAM): Emerging market potential driven by governmental efforts to increase broadband access and modernization of legacy telecom networks.

- Middle East and Africa (MEA): Rapid infrastructure investment, particularly in Gulf Cooperation Council (GCC) countries, focusing on establishing modern fiber backbones and smart city projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Optical Power Tester Market.- EXFO Inc.

- VIAVI Solutions Inc.

- Anritsu Corporation

- Keysight Technologies

- Fluke Corporation

- Fujikura Ltd.

- Yokogawa Electric Corporation

- AFL Global

- Kingfisher International Pty Ltd.

- GAO Tek Inc.

- Ideal Industries, Inc.

- Tempo Communications

- Deviser Instruments

- 3M Company

- Lightwave Measurement

- OpticTest Equipment

- Dimension Technology Inc.

- Precision Rated Optics (PRO)

- SENKO Advanced Components

- Diamond SA

Frequently Asked Questions

Analyze common user questions about the Fiber Optical Power Tester market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Fiber Optical Power Tester Market?

The market growth is primarily accelerated by the global proliferation of high-bandwidth services, necessitating massive investments in 5G infrastructure, Fiber-to-the-Home (FTTx) deployments, and the continuous expansion and certification requirements of hyperscale and edge data centers worldwide.

How is the adoption of AI affecting the functionality of optical power testers?

AI integration is enhancing tester functionality by enabling predictive maintenance through data analysis, automating complex diagnostic routines, improving measurement accuracy by compensating for environmental variables, and streamlining compliance reporting for field technicians.

Which geographic region demonstrates the highest growth potential in this market?

The Asia Pacific (APAC) region exhibits the highest growth potential, largely driven by large-scale government-backed digital infrastructure projects, rapid 5G network rollout, and increasing investments in telecommunication and data center expansions across key emerging economies like China, India, and Southeast Asia.

What is the key difference between handheld and benchtop fiber optical power testers?

Handheld testers prioritize portability, durability, and battery life, making them ideal for field installation and maintenance; whereas benchtop testers offer superior accuracy, higher dynamic range, and enhanced stability, making them preferred for laboratory testing, research and development, and primary calibration facilities.

Why is periodic calibration crucial for fiber optical power testers?

Periodic calibration is essential to ensure that the tester’s measurements remain accurate and traceable to national or international standards (such as NIST). Regular calibration prevents measurement drift, maintains compliance with industry regulations, and guarantees reliable network certification, thus avoiding costly system failures or misdiagnoses.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager