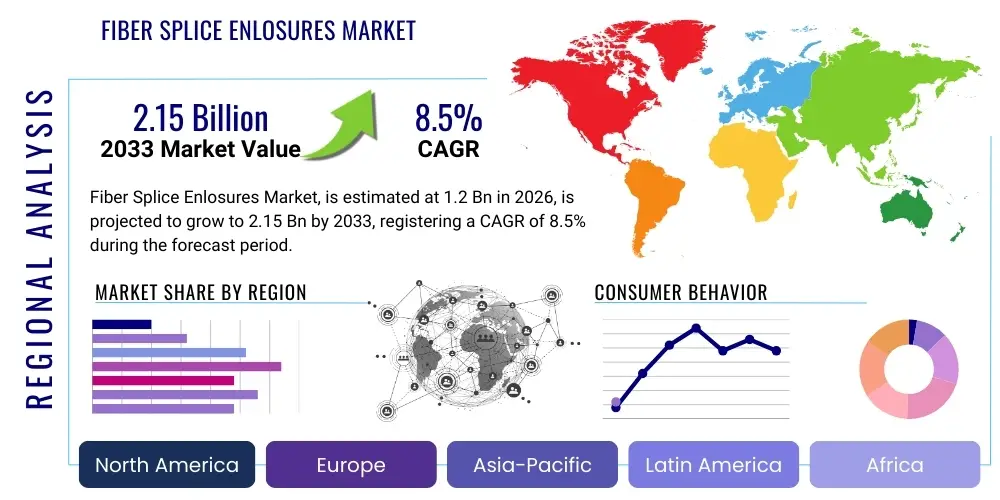

Fiber Splice Enlosures Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442561 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Fiber Splice Enlosures Market Size

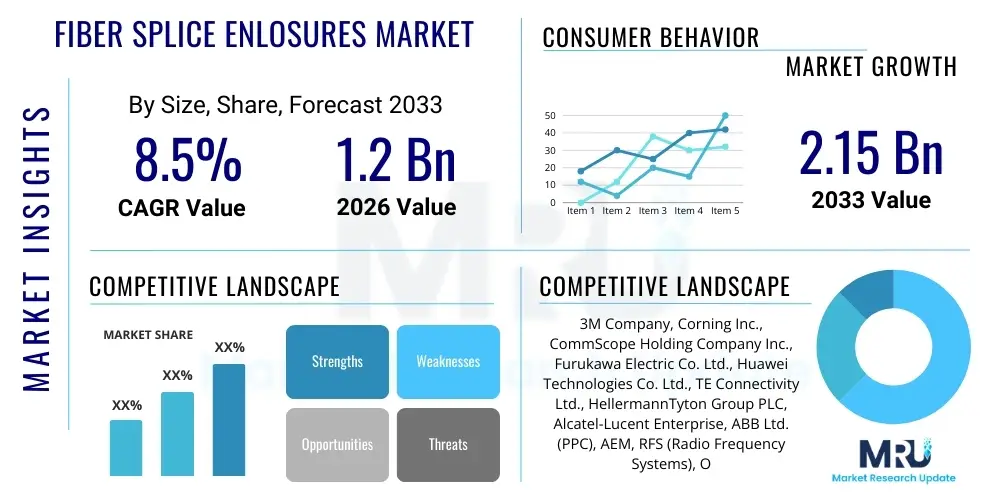

The Fiber Splice Enlosures Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

This projected growth is primarily underpinned by the global proliferation of high-speed internet infrastructure and the aggressive rollout of 5G networks, which necessitate extensive fiber optic cabling. Fiber splice enclosures are critical components that protect optical fiber splices from environmental hazards such as moisture, dust, and mechanical stress, ensuring the long-term reliability and performance of optical networks. The continuous demand for higher bandwidth in both residential and commercial sectors drives network operators to expand and upgrade their fiber backbone, directly fueling the adoption of high-quality, durable splice enclosures across diverse geographical areas.

Furthermore, advancements in enclosure technology, including improved sealing mechanisms (such as mechanical seals replacing traditional heat-shrink), enhanced durability, and modular designs that facilitate easier installation and maintenance, contribute significantly to market expansion. The shift towards Fiber-to-the-Home (FTTH) and Fiber-to-the-Curb (FTTC) architectures, particularly in developing economies, mandates a robust infrastructure for protecting fiber junctions, cementing the enclosure market's upward trajectory. Regulatory pushes for digital connectivity and smart city initiatives also contribute to the accelerated deployment of fiber infrastructure, making splice enclosures indispensable elements in modern telecommunication networks.

Fiber Splice Enlosures Market introduction

The Fiber Splice Enclosures Market is characterized by robust growth driven by global fiber deployment, 5G rollout, and rising demand for reliable bandwidth, offering essential protection for delicate fiber optic splices in diverse environments like aerial, underground, and direct-buried applications, thus ensuring network longevity and performance.

Fiber Splice Enclosures, often referred to as splice closures, are passive network components designed specifically to house and protect the junction point of two or more optical fibers that have been permanently joined (spliced). These enclosures provide a controlled environment, shielding the critical splice interface from severe environmental factors, including temperature fluctuations, humidity, UV radiation, and physical impact. The construction materials typically involve high-strength, UV-stabilized polymer compounds or sometimes metal alloys, engineered for long-term outdoor exposure. Products vary significantly based on capacity (number of fibers/splices they can accommodate), closure type (inline or dome), and sealing technology (heat-shrink or mechanical), catering to diverse application requirements ranging from trunk lines to feeder cables and distribution points.

Major applications for fiber splice enclosures span the entire telecommunication infrastructure, including long-haul backbone networks, metropolitan area networks (MANs), and increasingly, the access network (FTTH/FTTx). Beyond traditional telecom, these components are vital in utility networks, military communications, and industrial control systems where fiber optic cables are used for high-speed, interference-free data transmission. The primary benefit of employing robust enclosures is network reliability; they drastically reduce downtime caused by physical damage or environmental degradation of splices, which are the most vulnerable points in a fiber optic link. This reliability translates directly into lower operational expenditure (OpEx) for network operators and improved service quality for end-users.

Driving factors for this market include monumental investment in broadband infrastructure worldwide, spurred by government incentives and competitive pressures among telecom providers to deliver gigabit speeds. The rapid global adoption of bandwidth-intensive applications such as 4K/8K video streaming, cloud computing, and advanced IoT solutions continuously pushes the requirement for deep fiber penetration. Furthermore, the advent of 5G technology, which relies heavily on dense fiber backhaul and fronthaul networks to connect small cells, is perhaps the single largest catalyst for the demand for high-density, reliable fiber splice enclosures suitable for rugged, outdoor deployment scenarios.

Fiber Splice Enlosures Market Executive Summary

The Fiber Splice Enclosures market exhibits strong business trends marked by consolidation among key manufacturers and a focus on modular, high-capacity product designs catering to 5G and FTTH deployments. Regionally, Asia Pacific leads due to aggressive governmental mandates for digital infrastructure expansion, while segment trends show mechanical sealing enclosures gaining traction over heat-shrink methods due to faster installation times and increased re-entry capabilities, crucial for maintenance in dense urban fiber grids.

From a business trend perspective, the market is shifting towards integrated solutions. Leading vendors are not just offering standalone enclosures but comprehensive connectivity systems that include pre-terminated cables, sophisticated fiber management trays, and integrated monitoring capabilities. This integration reduces installation complexity and ensures compatibility across the network ecosystem. Furthermore, sustainability is becoming a key business differentiator; manufacturers are increasingly focusing on developing enclosures using recycled or easily recyclable materials and optimizing product weight and size to reduce carbon footprint associated with shipping and deployment. Competitive dynamics are intensifying, particularly in emerging markets, leading to innovation in cost-effective, high-performance product lines designed for varying environmental resilience levels.

Regional trends reveal significant variances in market maturity and growth rates. While North America and Europe demonstrate steady, predictable growth driven by ongoing network upgrades (e.g., copper retirement and fiber densification for fixed and mobile networks), the Asia Pacific region, particularly China, India, and Southeast Asian nations, represents the primary volume driver. This dominance is attributed to greenfield FTTH deployments and massive government-backed digital initiatives. In contrast, the Middle East and Africa (MEA) are emerging rapidly, fueled by large-scale smart city projects and international data corridor expansions, presenting lucrative opportunities for vendors specializing in rugged, high-temperature resilient enclosures.

Segment trends underscore a technological transition. High-density enclosures (capable of managing hundreds of fibers) are now standard requirements for central office and major distribution points, driven by the need to support mass fiber count cables. Additionally, the increasing complexity of network maintenance is driving demand for mechanical splice closures. These closures offer superior re-entry performance compared to traditional heat-shrink solutions, allowing technicians quick, repeatable access for necessary repairs or network modifications without compromising the environmental integrity of the splice point. This technological preference highlights the market's emphasis on efficiency and long-term serviceability.

AI Impact Analysis on Fiber Splice Enlosures Market

User inquiries regarding AI's influence typically revolve around how artificial intelligence can streamline network planning, automate fiber monitoring within enclosures, and predict infrastructure failures. Key themes center on optimizing fiber routes to reduce splice points (thereby lowering enclosure requirements), using AI-driven image recognition during installation to verify splice quality inside the enclosure, and implementing predictive maintenance models that leverage real-time data collected from sensors integrated into advanced closure systems. Concerns often include the initial cost of integrating AI-compatible hardware and the security implications of transmitting sensitive network health data.

- AI-driven Network Planning: Optimizing fiber layouts to minimize cable length and the total number of required splice points and enclosures.

- Predictive Maintenance: AI algorithms analyze environmental sensor data (temperature, humidity, vibration) within smart enclosures to predict potential seal failures or fiber damage before network degradation occurs.

- Automated Inspection: Integrating AI-enabled cameras or sensors into high-end enclosures for automated quality checks of fiber splicing and routing during installation, ensuring adherence to specifications.

- Inventory and Supply Chain Optimization: Utilizing AI to forecast demand for specific enclosure types based on regional deployment rates and network technology shifts (e.g., 5G densification).

- Fault Localization Efficiency: AI assisting in pinpointing the exact geographical location of a network fault (often near a splice enclosure) by correlating real-time network performance data, significantly speeding up repair times.

- Enhanced Security Monitoring: AI systems monitoring access control and tamper detection features in advanced enclosures to flag unauthorized physical entry attempts.

DRO & Impact Forces Of Fiber Splice Enlosures Market

The market is primarily driven by relentless global fiber deployment and 5G network expansion, counterbalanced by restraints such as the complexity of deployment in challenging urban and underground environments, high initial investment in fiber infrastructure, and intense price competition. Opportunities lie in developing smart enclosures with integrated sensing capabilities and penetrating underserved rural and remote areas, with the impact forces favoring market expansion due to technological necessity and governmental digital initiatives.

Drivers: The foundational driver remains the escalating global data consumption, necessitating massive investment in fiber optic networks. Government mandates worldwide, such as the US Broadband Equity, Access, and Deployment (BEAD) program and similar initiatives in the EU and Asia, are allocating billions to close the digital divide, requiring countless splice enclosures for network extension. Furthermore, the mandatory requirements of 5G for dense fiber connectivity to every small cell site are creating a continuous, high-volume demand, especially for compact, environmentally resilient, and high-fiber count closures suitable for street furniture and aerial deployment.

Restraints: Significant restraints include the highly competitive pricing environment, especially in standard enclosure types, which compresses profit margins for manufacturers. Technical challenges related to deploying enclosures in existing complex urban duct systems (requiring specialized, compact, and highly sealed designs) and the scarcity of skilled labor for precise fiber splicing and enclosure installation also slow down deployment timelines. Moreover, geopolitical trade tensions can disrupt the supply chain for critical materials, affecting manufacturing costs and lead times.

Opportunities: Key opportunities are present in developing specialized products, particularly "smart closures" that incorporate IoT sensors for remote monitoring of temperature, humidity, vibration, and unauthorized access. This feature addresses the growing need for proactive network management. Moreover, the massive fiber infrastructure build-out in rural and previously unconnected regions (often facilitated by public-private partnerships) presents a long-term, stable growth opportunity for manufacturers capable of supplying rugged, highly reliable enclosures designed for extreme weather conditions and remote accessibility.

Segmentation Analysis

The Fiber Splice Enclosures Market is extensively segmented by Product Type (Dome, Inline), Sealing Type (Heat Shrink, Mechanical), Cable Type (Loose Tube, Ribbon), Fiber Count (Low, Medium, High), and Application (FTTH, Trunk/Backbone Networks, Mobile Backhaul). The dominance of the FTTH application segment reflects the global trend toward direct fiber connectivity to residential and commercial premises, while the growing preference for mechanical sealing highlights the focus on installation efficiency and maintainability in high-density environments. Analysis across these dimensions provides a granular view of specific market needs and technological adoption rates.

Analyzing the segmentation by Product Type, Dome closures typically dominate the market volume, particularly in distribution and branch points where cables need to be stored and managed extensively, offering greater capacity for slack storage and splicing trays. Inline closures, conversely, are preferred for mid-span access and straight-through cable joining, especially in trunk and long-haul applications where minimal profile is desired to facilitate easier deployment in ducts or trenches. The trend towards miniaturization is evident across both types, as space constraints increase, particularly in urban infrastructure.

The Sealing Type segmentation is undergoing a noticeable shift. While Heat Shrink closures remain economical and highly reliable for permanent, undisturbed installations, Mechanical Sealing closures are rapidly gaining market share. Mechanical closures utilize durable rubber gaskets and clamping mechanisms, allowing for repeated, non-destructive re-entry into the enclosure. This characteristic is invaluable in modern, dynamic networks, such as those supporting 5G small cells, where maintenance or service upgrades are frequent, justifying their higher initial cost through significant savings in operational time and material replacement.

- By Product Type: Dome, Inline

- By Sealing Type: Heat Shrink, Mechanical

- By Fiber Count: Low (Under 24), Medium (24-96), High (Over 96)

- By Application: FTTx (FTTH, FTTB, FTTC), Trunk/Backbone Networks, Mobile Networks (5G/4G Backhaul/Fronthaul), Enterprise Networks

- By Installation Environment: Aerial, Underground (Direct Buried, Duct), Wall/Pole Mount

Value Chain Analysis For Fiber Splice Enlosures Market

The value chain for the Fiber Splice Enclosures market starts with raw material suppliers (polymers, plastics, metallic components), moves through specialized manufacturers who design and assemble the final closure units, and concludes with extensive distribution channels reaching system integrators, telecom operators, and construction contractors. The primary value addition occurs at the manufacturing stage through proprietary sealing technology and advanced fiber management tray design, ensuring the product meets stringent international durability and environmental standards.

The upstream segment is characterized by key suppliers of specialized engineered plastics (e.g., UV-stabilized polycarbonate or specialized composite polymers) that dictate the long-term durability and environmental resistance of the enclosures. Cost control and supply chain stability in this segment are crucial. Manufacturers must manage complex injection molding processes and ensure high precision in component fabrication, as the integrity of the seal is paramount. Research and development investments focus on improving sealing techniques (mechanical vs. heat-shrink) and maximizing fiber density within compact footprints, which are critical differentiators in the market.

The downstream segment involves multiple distribution channels. Direct sales are common for very large projects involving Tier 1 telecom operators (e.g., Verizon, China Mobile) who often require customized high-volume solutions. Indirect channels, involving specialized telecom equipment distributors, value-added resellers (VARs), and regional system integrators, handle sales to smaller carriers, utilities, and enterprise clients. System integrators play a vital role by combining enclosures with fiber optic cables, splice machines, and other connectivity hardware to deliver complete, ready-to-deploy network solutions. The efficiency and technical expertise of the distribution channel are critical for prompt delivery and technical support during complex network rollouts.

Fiber Splice Enlosures Market Potential Customers

Potential customers, or end-users, for fiber splice enclosures are predominantly entities involved in building, maintaining, or operating large-scale communication infrastructure. These include major Tier 1 and Tier 2 telecommunication operators implementing core network upgrades and fixed access rollouts (FTTH), mobile network operators deploying 5G infrastructure, and utility companies utilizing fiber for smart grid management. Furthermore, governmental and defense agencies represent stable, high-reliability demanding customer bases, requiring robust enclosures for secure, dedicated communication links.

Telecommunication operators constitute the largest segment of buyers, driven by the continuous need for high-capacity, reliable connections. Their procurement decisions are based on total cost of ownership (TCO), product lifespan, ease of installation, and compliance with specific network standards. For FTTH deployments, carriers prioritize high-density closures that can manage multiple distribution points and withstand harsh aerial or underground environments. The shift towards open-access networks in some regions also generates demand from smaller, competitive local exchange carriers (CLECs) and specialized fiber infrastructure providers.

Another rapidly expanding customer base is composed of system integrators and specialized network deployment contractors. These entities purchase enclosures in bulk for client projects (often municipalities, data centers, or large industrial complexes). They value vendor relationships that offer standardized, easy-to-use products with reliable technical support and prompt logistics. As 5G density increases, tower companies and infrastructure builders are also becoming significant customers, requiring compact, environmentally rugged closures suitable for co-location sites and street-level installations where space and accessibility are major limiting factors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Corning Inc., CommScope Holding Company Inc., Furukawa Electric Co. Ltd., Huawei Technologies Co. Ltd., TE Connectivity Ltd., HellermannTyton Group PLC, Alcatel-Lucent Enterprise, ABB Ltd. (PPC), AEM, RFS (Radio Frequency Systems), Optictelecom, Zhongtian Technology Group (ZTT), Cable & Wireless Optronics, AFL Telecommunications (Fujikura Ltd. Group), Clearfield, Inc., Prysmian Group, Huber+Suhner, Emtelle, Duraline. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Splice Enlosures Market Key Technology Landscape

The core technology landscape revolves around enhanced sealing methods, sophisticated fiber management, and the integration of smart monitoring features. Manufacturers are heavily investing in mechanical sealing mechanisms, moving away from heat-shrink, which enhances re-entry capability and speeds up installation, thereby reducing operational expenditure for telecom operators. Advanced polymer compounds with improved UV resistance and fire-retardant properties are continuously being developed to extend product lifespan in harsh environments, meeting stricter regulatory requirements for public infrastructure safety and durability.

A major technological advancement is the focus on high-density fiber management within compact closures. This involves the design of modular splice trays that offer superior bend radius control and slack management for high-fiber count ribbon and loose tube cables. Specialized gel-sealing technology, which provides a flexible, self-healing environmental barrier, is also emerging as an alternative to traditional rubber gaskets in mechanical closures, simplifying installation while maintaining high ingress protection (IP) ratings. These technological improvements are crucial for deployments in congested areas where space for large infrastructure components is limited.

Furthermore, the integration of IoT and smart technology represents a significant leap forward. "Smart" enclosures are equipped with micro-sensors that monitor internal conditions (temperature, humidity, pressure) and external integrity (shock, vibration, unauthorized access). This data is transmitted back to Network Operations Centers (NOCs), allowing for real-time diagnostics and predictive maintenance. While currently adopted mainly by Tier 1 carriers in high-value network segments, the trend is moving towards standardization, as these features significantly enhance network uptime and security, especially critical in remote or high-vulnerability deployment sites.

Regional Highlights

The global Fiber Splice Enclosures Market exhibits distinct growth patterns across key regions, fundamentally driven by differing levels of fiber penetration, government investment, and 5G maturity. Asia Pacific stands as the undisputed leader in market size and growth trajectory, fueled by large-scale greenfield FTTH projects in China and India and accelerated 5G deployments across Japan and South Korea. North America and Europe maintain stable, high-value markets focused on network densification, copper network retirement, and advanced infrastructure upgrades leveraging high-performance, mechanical closures.

Asia Pacific (APAC) Dominance: This region accounts for the highest volume consumption due to the sheer scale of ongoing fiber deployment programs. Governments in countries like China and India have prioritized digital connectivity, leading to unprecedented FTTH expansion. Furthermore, APAC nations are pioneering 5G technology, which requires an extremely dense fiber backhaul network. This requires large volumes of affordable, yet reliable, high-fiber count closures. The competitive manufacturing environment in this region also means APAC is a major global supplier of these components.

North America (NA) Maturity and Densification: The North American market is characterized by high-cost, high-reliability requirements, driven by major carriers investing heavily in retiring legacy copper infrastructure and extensive 5G mid-band and millimeter-wave build-outs. Demand here focuses on advanced, mechanically sealed closures that simplify maintenance and support ribbon fiber technology. Federal funding initiatives, particularly those aimed at expanding rural broadband access, ensure sustained, robust demand throughout the forecast period, emphasizing ruggedized products for challenging climates.

Europe’s Digital Agenda Focus: European market growth is driven by the EU’s Digital Agenda, pushing for gigabit connectivity across member states. The market sees strong demand for compact, aesthetically acceptable closures suitable for highly dense urban environments and for specific regional standards regarding environmental protection and safety. Countries like Germany, the UK, and France are undergoing significant fiberization efforts, although deployment pace varies by nation due to differing regulatory landscapes and utility access challenges.

Emerging Markets (LATAM and MEA): Latin America and the Middle East & Africa are emerging as high-growth potential regions. In the Middle East, smart city development (e.g., NEOM in Saudi Arabia, initiatives in UAE) mandates state-of-the-art fiber infrastructure, preferring high-specification, reliable closures. LATAM is seeing acceleration due to deregulation and increased private sector investment in fiber backbones, requiring cost-effective, durable products suitable for diverse geographical and infrastructural challenges.

- Asia Pacific (APAC): Primary growth engine; driven by FTTH volume and aggressive 5G rollout in China, India, and Southeast Asia.

- North America: Focus on network upgrade (copper retirement), 5G densification, and federal broadband initiatives; preference for mechanical seals.

- Europe: Driven by EU digital targets; strong demand for compact urban closures and specialized products compliant with varied national standards.

- Latin America (LATAM): High potential due to deregulation and increased private investment in fixed networks and mobile backhaul.

- Middle East and Africa (MEA): Growth fueled by smart city projects and essential backbone connectivity expansion, requiring ruggedized solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Splice Enlosures Market.- Corning Inc.

- CommScope Holding Company Inc.

- 3M Company

- Furukawa Electric Co. Ltd.

- TE Connectivity Ltd.

- Huawei Technologies Co. Ltd.

- Prysmian Group

- Huber+Suhner

- AFL Telecommunications (Fujikura Ltd. Group)

- Clearfield, Inc.

- Zhongtian Technology Group (ZTT)

- Nokia Corporation (via acquired assets)

- Ericsson AB

- HellermannTyton Group PLC

- Sumitomo Electric Lightwave (SEI)

- Emerson Electric Co.

- Duraline

- ABB Ltd. (PPC)

- OFS (Furukawa Company)

- Preformed Line Products (PLP)

Frequently Asked Questions

Analyze common user questions about the Fiber Splice Enlosures market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Fiber Splice Enclosures Market?

The primary factor driving market growth is the global acceleration of 5G network infrastructure deployment, which necessitates extensive fiber optic backhaul and fronthaul, coupled with massive government and private sector investments in Fiber-to-the-Home (FTTH) broadband expansion worldwide.

What are the key differences between Dome and Inline fiber splice closures?

Dome closures are typically utilized for distribution and branching points, offering greater capacity for fiber count, splice trays, and cable slack storage. Inline closures are used for splicing two main cables together in a straight-through route, minimizing the profile needed in ducts or aerial installations.

How is the adoption of mechanical sealing technology impacting the market?

Mechanical sealing is gaining significant traction because it allows technicians to repeatedly re-enter the enclosure for maintenance or upgrades without compromising the environmental seal, significantly speeding up operational tasks and reducing the total cost of ownership (TCO) compared to traditional heat-shrink methods.

Which geographical region holds the largest market share for fiber splice enclosures?

The Asia Pacific (APAC) region currently holds the largest market share due to unparalleled scale in greenfield fiber optic deployments, particularly driven by large FTTH projects in China and India, alongside rapid technological adoption for 5G connectivity.

What role does smart technology play in the future of fiber splice enclosures?

Smart technology involves integrating IoT sensors into enclosures to monitor environmental conditions, detect tampering, and relay real-time operational data. This transition is essential for enabling predictive maintenance and enhancing the security and overall reliability of complex modern fiber networks.

What are the typical environmental challenges that fiber splice enclosures must address?

Fiber splice enclosures must provide robust protection against moisture penetration, extreme temperature fluctuations, high levels of UV radiation exposure (for aerial installations), dust and debris ingress, and physical stress or vibration, necessitating high IP ratings and durable polymer construction.

How do high-fiber count cables influence demand for new enclosure designs?

The shift towards ultra-high-fiber count trunk cables (e.g., 288, 576, or more fibers) requires enclosures with highly optimized internal fiber management systems, demanding sophisticated modular splice trays and compact designs that maintain optimal fiber bend radius while maximizing splice density.

What regulations or standards affect the design and production of these enclosures?

Enclosures must comply with international ingress protection (IP) standards (e.g., IP68) for environmental sealing, relevant telecom standards (e.g., Telcordia GR-771-CORE) for reliability and performance, and often national fire safety and utility specifications, ensuring operational safety and long-term durability in diverse deployment scenarios.

In the Value Chain, where is the highest value addition achieved for this product?

The highest value addition occurs during the manufacturing stage, specifically through proprietary research and development related to sealing technology, the design of efficient fiber management trays, and the use of specialized, long-life, UV-resistant polymer materials necessary to meet stringent carrier requirements.

Beyond telecom, what emerging application areas are driving enclosure demand?

Emerging demand is noted in the utility sector for smart grid management, military and defense communications requiring highly secure and ruggedized enclosures, and large-scale industrial control systems where fiber optic cables are essential for reliable, high-speed data transmission in harsh industrial environments.

What impact does cable type (ribbon vs. loose tube) have on enclosure design?

Ribbon cables, due to their flat configuration, require specialized, high-capacity ribbon splicing machines and corresponding enclosure splice trays designed for mass fusion splicing, enabling quicker installation and managing a very high fiber count within a compact physical space compared to traditional loose tube cable management systems.

How is the market addressing the need for faster installation times?

The market is addressing faster installation through the standardization of mechanical sealing closures, modular internal designs, and the increasing use of factory-pre-terminated components that simplify field work and reduce the reliance on highly skilled splicing technicians at every installation point.

What are the key challenges faced by vendors targeting rural broadband deployment?

Vendors targeting rural broadband face challenges related to logistics, requiring ruggedized enclosures capable of withstanding extreme environmental conditions (e.g., wide temperature swings), and the need for cost-effective solutions tailored to lower subscriber density and long geographical distances.

Are sustainability practices influencing product development in this market?

Yes, sustainability is influencing product development, with manufacturers focusing on using recyclable or environmentally friendly polymer compounds, optimizing closure dimensions and weight to reduce transportation emissions, and designing products with extended lifecycles to minimize replacement frequency.

How do competitive dynamics in the APAC region differ from those in North America?

APAC competitive dynamics are characterized by high volume, aggressive price competition, and strong presence of local manufacturers, focusing on meeting massive FTTH deployment targets. North America focuses on high reliability, specific carrier standards, technological innovation (e.g., mechanical sealing, smart features), and total lifecycle performance.

What is the current adoption rate of AI in fiber splice enclosure management?

The current adoption rate of AI is nascent but rapidly increasing, primarily utilized by Tier 1 carriers for predictive network analysis and operational efficiency improvements, particularly when integrated with advanced "smart" enclosures that provide the necessary telemetry data for AI algorithms to process.

What risks are associated with using low-quality or non-compliant splice enclosures?

Using low-quality enclosures significantly increases the risk of premature network failure, high signal loss due to environmental ingress (moisture, dust), increased maintenance costs, and potential regulatory non-compliance, severely compromising the lifespan and reliability of the entire fiber optic infrastructure.

How does the increasing density of 5G small cells affect enclosure requirements?

The proliferation of 5G small cells necessitates ultra-compact, aesthetically discrete enclosures suitable for pole or street furniture mounting, requiring high fiber count capacity in a minimal footprint, and superior resistance to urban environmental factors and vandalism.

What role do system integrators play in the distribution of fiber splice enclosures?

System integrators are crucial distributors, often purchasing enclosures along with cable and connectivity hardware to deliver end-to-end, customized network solutions to clients, providing technical expertise on installation and ensuring component compatibility across diverse project requirements.

What is the typical expected lifespan for a high-quality fiber splice enclosure?

High-quality, carrier-grade fiber splice enclosures, particularly those used in permanent underground or aerial installations, are typically engineered and expected to provide reliable protection for a minimum lifespan of 20 to 25 years under specified environmental operating conditions.

What is a key technological challenge in maintaining splice integrity in harsh environments?

A key technological challenge is ensuring the long-term, repeatable integrity of the sealing system against continuous thermal cycling and hydrostatic pressure, which requires advanced material science for the polymer housing and sophisticated engineering of the mechanical clamping or heat-shrink mechanisms.

How are labor shortages impacting the demand for specific enclosure features?

Labor shortages are increasing the demand for enclosures that feature tool-less entry mechanisms, highly intuitive fiber routing, and robust mechanical seals, all of which reduce the time and specialized skill required for successful installation and maintenance activities in the field.

What is the significance of the IP rating for fiber splice enclosures?

The IP (Ingress Protection) rating signifies the enclosure's resistance to dust and moisture. A high rating, such as IP68, is critical for underground and direct-buried applications, ensuring that water and fine particles cannot reach and damage the sensitive fiber splices, maintaining signal quality.

Are refurbished or recycled enclosures common in the market?

Refurbished enclosures are rare due to the critical nature of the seal integrity; however, the use of highly recyclable materials in new manufacturing is becoming common, aligning with environmental regulations and corporate sustainability goals of telecom operators.

How does fiber ribbon splicing impact the overall cost of network deployment?

While ribbon fiber and mass fusion splicing require specialized equipment and enclosures, they significantly reduce the labor time needed to splice hundreds of fibers, offering considerable savings in deployment costs and accelerating the overall network build-out schedule compared to single fiber splicing methods.

What is the market outlook for fiber splice enclosures used in data center connectivity?

The market outlook for data center applications is strong, focusing on ultra-high-density, rack-mountable or street-side enclosures designed for connecting metro and long-haul transport fibers to the data center facility, prioritizing modularity and easy accessibility within contained environments.

Why are UV resistance properties important for aerial fiber splice enclosures?

UV resistance is crucial for aerial enclosures because prolonged exposure to sunlight can degrade standard plastic materials, leading to cracking, brittleness, and eventual failure of the enclosure seal, which would expose the fiber splices to environmental damage and cause network outages.

How is competition driving innovation in closure design?

Intense competition forces manufacturers to innovate by offering products that are smaller, lighter, easier to install (modular designs), capable of managing higher fiber counts, and integrating advanced monitoring features (smart closures) to differentiate themselves and capture market share.

What percentage of the market relies on Heat Shrink versus Mechanical sealing?

While historical data shows Heat Shrink sealing dominating, the market is rapidly moving toward a near 50/50 split in terms of newly installed capacity globally, with mechanical seals expected to exceed Heat Shrink in value market share due to their higher price point and preference in high-value, maintenance-intensive network segments.

What impact do government infrastructure programs have on enclosure pricing?

Large-scale government infrastructure programs, which mandate high-volume standardized product purchases, typically drive competitive pricing downward in the short term, but also stabilize long-term demand, encouraging manufacturers to invest in efficient, high-volume production facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager