Fiberglass Insulating Sleeving Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441793 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Fiberglass Insulating Sleeving Market Size

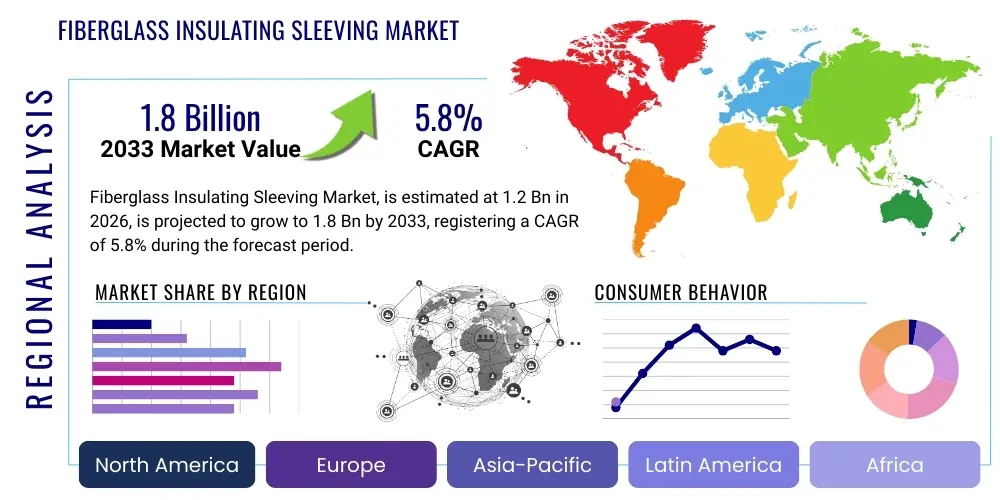

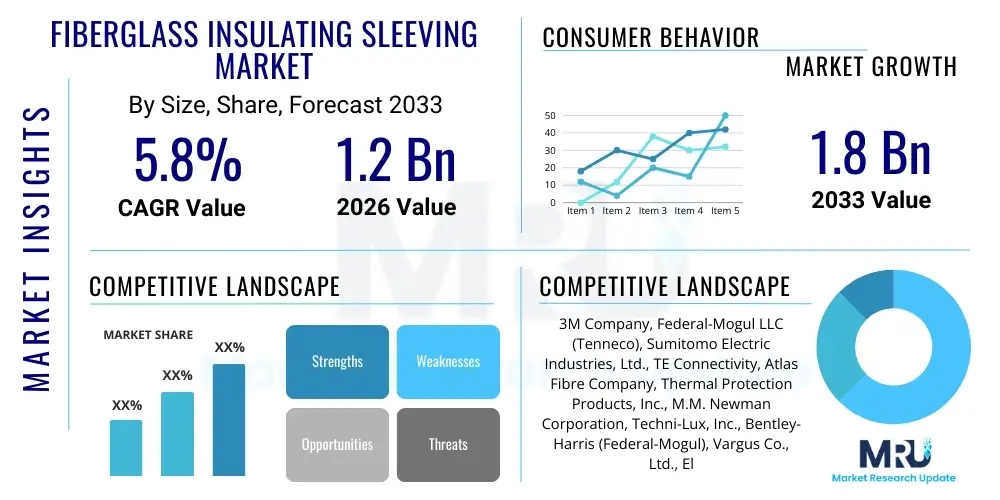

The Fiberglass Insulating Sleeving Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Fiberglass Insulating Sleeving Market introduction

The Fiberglass Insulating Sleeving Market encompasses the production and distribution of woven or braided glass fiber tubes utilized primarily for thermal and electrical insulation and mechanical protection of wires, cables, hoses, and electronic components. These sleeving products are essential safety components designed to withstand harsh operating conditions, including extremely high temperatures, chemical exposure, and mechanical abrasion, thus ensuring the reliability and longevity of electrical and thermal systems across diverse industries. The inherent properties of fiberglass, such as its excellent dielectric strength, non-combustible nature, and dimensional stability, make it the material of choice for demanding applications where polymer-based insulation materials fail.

Products within this market range significantly in composition and performance, often incorporating specialized coatings such as silicone, acrylic, polyurethane, or fluoropolymers (PTFE/FEP) to enhance specific characteristics, including abrasion resistance, fluid repellency, or expanded temperature limits. Major applications span critical sectors, most notably the automotive industry (especially electric vehicles, where high-voltage and thermal management are paramount), aerospace and defense (for shielding complex wiring harnesses), and heavy industrial machinery (motors, transformers, generators, and heating elements). The continuous drive towards miniaturization and higher power density in electrical devices necessitates superior insulating performance, directly stimulating demand for advanced fiberglass sleeving solutions.

The primary benefit driving the market expansion is the unparalleled thermal resistance offered by these products, often capable of continuous operation above 200°C and short excursions up to 600°C or more, depending on the coating used. This high-performance profile is crucial for regulatory compliance and operational safety in high-stress environments. Furthermore, key driving factors include the rapid electrification across transportation sectors, the modernization of power grid infrastructure requiring enhanced electrical protection, and increasingly stringent international safety and flammability standards, particularly UL (Underwriters Laboratories) and IEC (International Electrotechnical Commission) certifications, which mandate the use of highly reliable insulating materials.

Fiberglass Insulating Sleeving Market Executive Summary

The Fiberglass Insulating Sleeving Market is poised for sustained growth, fundamentally driven by pervasive business trends toward enhanced electrical safety and the widespread adoption of high-performance materials in critical infrastructure. Current business trends indicate a strong shift toward highly customized sleeving solutions tailored to specific operating conditions, such as high-frequency noise suppression and specific chemical resistance requirements in specialized industrial automation settings. Manufacturers are focusing heavily on integrating advanced coating technologies, particularly silicone rubber and high-temperature polyurethanes, to offer superior flexibility and improved resistance to fluids like lubricants and hydraulic oils, meeting the rigorous standards of modern manufacturing and mobility sectors.

Regional trends highlight the Asia Pacific (APAC) as the undisputed leader in both consumption and production, spearheaded by massive investment in manufacturing infrastructure, rapid expansion of the consumer electronics and automotive sectors in countries like China, India, and South Korea, and the burgeoning establishment of electric vehicle gigafactories. North America and Europe, while growing at a steadier pace, are characterized by a strong demand for premium, highly certified sleeving products used in aerospace, medical devices, and high-end industrial automation, emphasizing regulatory compliance (e.g., REACH, RoHS) and zero-defect quality control. Strategic mergers and acquisitions are observed, enabling key players to expand geographic footprint and acquire specialized coating expertise.

Segment trends reveal that the silicone-coated fiberglass sleeving segment maintains significant dominance due to its exceptional flexibility, robust electrical properties, and wide-ranging temperature capability, making it ideal for standard industrial motors and transformers. However, the uncoated and plain fiberglass segment is experiencing robust growth in extremely high-temperature applications (e.g., thermal barriers, furnace applications) where electrical insulation is secondary to thermal protection. Application-wise, the automotive sector, specifically the propulsion and battery wiring harnesses of electric and hybrid vehicles, represents the fastest-growing segment, requiring sleeving capable of handling high voltages (400V to 800V) and severe thermal cycling within compact designs, thereby pushing the boundaries of material science in insulation technology.

AI Impact Analysis on Fiberglass Insulating Sleeving Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fiberglass Insulating Sleeving Market predominantly center on three core themes: optimization of manufacturing processes, predictive quality control, and accelerated material discovery for next-generation coatings. Users frequently question how AI algorithms can minimize defects during the braiding and coating stages, asking about the feasibility of real-time machine vision systems integrated with neural networks to identify microscopic inconsistencies in the weave or premature wear of manufacturing machinery. Another common concern relates to supply chain resilience, focusing on how AI-driven predictive analytics can manage the volatile pricing and availability of raw materials, such as specific grades of fiberglass yarn and specialized chemical coatings, ensuring cost stability and timely delivery for large-scale industrial projects.

Furthermore, there is considerable user interest in leveraging AI and Machine Learning (ML) for advanced material science—specifically, how these technologies can model and predict the performance characteristics (dielectric strength degradation, thermal stability under prolonged stress) of novel coating formulations before extensive physical prototyping. This reduces the time-to-market for high-performance sleeving products required by emerging technologies like 800V EV architectures and solid-state battery systems. The consensus from user interactions suggests an expectation that AI will transition fiberglass sleeving production from traditional quality assurance (post-production inspection) to proactive quality control and design optimization, thereby significantly improving throughput and reducing operational waste, contributing to greener manufacturing practices.

The implementation of AI is anticipated to transform labor dynamics, shifting focus from manual operation and inspection to data interpretation and system management. AI-powered tools will likely enable more precise control over the coating thickness and curing processes, which are critical determinants of the final product's performance profile. This adoption is expected to enhance market competitiveness by allowing manufacturers to produce highly specialized, small-batch orders economically, catering to niche applications in medical electronics and high-frequency communication systems where material integrity is paramount and standard sleeving products are inadequate.

- AI-driven Predictive Maintenance: Minimizes machine downtime of braiding and coating equipment, ensuring consistent product quality and higher operational efficiency.

- Automated Visual Inspection: Utilizes deep learning and computer vision to identify micro-defects in braiding patterns and coating uniformity in real-time, drastically reducing scrap rates.

- Supply Chain Optimization: ML algorithms forecast raw material price fluctuations (e.g., specialty silica, curing agents) and manage inventory levels for critical components.

- Accelerated Material R&D: AI models simulate the aging and performance of new high-temperature coatings (e.g., specialized elastomers) under various environmental stresses, speeding up innovation cycles.

- Enhanced Customization: Enables manufacturers to rapidly calibrate production lines for highly specific, low-volume orders based on end-user electrical and thermal specifications.

DRO & Impact Forces Of Fiberglass Insulating Sleeving Market

The Fiberglass Insulating Sleeving Market dynamics are shaped by a complex interplay of internal and external forces. Drivers predominantly include the rigorous global adoption of high-voltage systems across the renewable energy and electric vehicle sectors, where the requirement for reliable, fire-resistant insulation is non-negotiable. Government mandates enforcing strict electrical safety and fire protection standards in industrial, commercial, and residential construction further solidify demand, especially in public transit and confined spaces. These regulatory pressures compel OEMs to upgrade their wiring insulation systems, favoring fiberglass due to its inherent non-flammability and superior thermal performance compared to conventional polymers. Additionally, the increasing complexity and density of wiring harnesses in modern electronics demand mechanical protection against abrasion and physical stress, a core strength of braided fiberglass sleeving.

However, the market faces significant Restraints, primarily centered on the volatility of raw material costs. Fluctuations in the price of specialty glass fiber yarn (E-glass, S-glass) and petroleum-derived specialty chemical coatings (silicone, acrylics) can compress profit margins for manufacturers and lead to price instability for end-users. Furthermore, competition from alternative high-performance insulating materials, such as sophisticated engineering plastics (e.g., PEEK, high-temperature PTFE variants) and certain ceramic fiber products, poses a continuous challenge, particularly in ultra-high-temperature or chemical-intensive niche applications where fiberglass performance may be marginally surpassed. The labor-intensive nature of some braiding and coating processes in regions with high labor costs also presents an operational restraint.

Opportunities for market growth are vast, particularly in the domain of smart grid infrastructure development, which requires millions of miles of protected wiring in transformers, switchgear, and control systems demanding high dielectric and thermal reliability. The continuous innovation in specialized coatings represents a major opportunity, allowing fiberglass sleeving to penetrate new markets, such as medical imaging devices and laser equipment, requiring specialized electrical shielding and chemical inertness. The impact forces analysis, utilizing Porter's Five Forces, reveals that the bargaining power of buyers is moderate to high due to the standardized nature of some products, while the threat of substitutes is present but managed through continuous performance enhancement of the core fiberglass product. Barriers to entry remain moderate, requiring substantial capital investment in braiding and coating machinery, along with stringent quality certifications (e.g., ISO, UL, VDE), which favors established, quality-focused manufacturers.

Segmentation Analysis

The Fiberglass Insulating Sleeving Market is highly differentiated based on material composition, thermal capabilities, and target applications, allowing manufacturers to cater precisely to specific industry needs ranging from general electrical protection to mission-critical thermal management in high-stress environments. Primary segmentation revolves around the Coating Material, which fundamentally dictates the thermal class, dielectric strength, and resistance to environmental factors such as moisture and chemicals. Silicone-coated sleeving dominates volume sales due to its balance of high flexibility, exceptional heat tolerance (up to 200°C continuous), and robust electrical properties, making it the workhorse in motors and appliance wiring. In contrast, acrylic and polyurethane coatings offer cost-effective solutions for lower-temperature applications requiring good abrasion resistance, while specialized coatings like fluoropolymer (FEP/PTFE) are reserved for highly corrosive or extremely fluid-rich environments.

Segmentation by Temperature Rating is also crucial, categorizing products into standard classes (e.g., Class F, Class H, Class C) relevant to motor and transformer insulation standards. This classification directly influences the raw material selection and coating formulation, ensuring compliance with established industrial longevity and safety metrics. The Type segment distinguishes between Coated (treated with elastomers or resins for enhanced protection) and Uncoated/Plain (used predominantly for pure thermal buffering or secondary containment at very high temperatures). The shift toward high-efficiency motors and compact electronic assemblies is increasing demand for sleeving capable of withstanding Class H (180°C) and Class C (above 200°C) ratings, pushing technological boundaries for silicone and specialized PTFE coatings.

Application-wise, the market is broadly segmented into Automotive, Aerospace & Defense, Industrial Equipment (including motors, pumps, and machinery), Power Generation & Distribution, and Consumer Electronics. The Automotive sector is the most dynamic growth area, driven by the shift to electric vehicle architectures which utilize extensive, protected high-voltage cabling throughout the chassis. Sleeving in this segment must provide high dielectric strength, exceptional flexibility to navigate tight bends, and resistance to common automotive fluids and vibration. Conversely, the Power Generation segment demands large-diameter, highly robust sleeving for busbar insulation and transformer winding protection, prioritizing long-term durability and resistance to thermal aging in massive, static installations.

- By Coating Material:

- Silicone Coated

- Acrylic Coated

- Polyurethane Coated

- Fluoropolymer Coated (PTFE, FEP)

- Vinyl Coated

- Uncoated/Plain

- By Temperature Rating:

- Class F (155°C)

- Class H (180°C)

- Class C (Above 200°C)

- By Type:

- Coated Fiberglass Sleeving

- Uncoated Fiberglass Sleeving

- By Application:

- Automotive (EV/HEV, Engine Compartment)

- Aerospace and Defense

- Industrial Equipment and Machinery (Motors, Generators)

- Power Generation and Distribution (Transformers, Switchgear)

- Consumer Appliances and Electronics

- Medical Devices

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Fiberglass Insulating Sleeving Market

The value chain for the Fiberglass Insulating Sleeving Market begins with upstream suppliers, primarily focused on the extraction and processing of high-purity silica sand necessary to manufacture specialized E-glass and S-glass fibers, which serve as the foundational reinforcement material. This initial stage is crucial as the quality and grade of the glass fiber directly impact the thermal and mechanical strength of the final sleeving product. Following fiber manufacturing, the next stage involves textile processing, encompassing the intricate processes of yarn spinning, braiding, and weaving of the raw fiberglass into tubular structures of varying diameters and wall thicknesses. Precision and consistency in the braiding angle are paramount here, as they define the sleeving's flexibility and coverage capacity. Manufacturers must maintain high standards to avoid gaps or uneven density, which could compromise electrical integrity.

The midstream of the value chain is characterized by the crucial coating and curing stage, where the plain fiberglass sleeves are treated with specialized polymer solutions, such as high-grade silicone elastomers, acrylic resins, or fluoropolymers. This coating process, often done through dipping or continuous extrusion, imparts the final performance characteristics, including enhanced dielectric strength, fluid resistance, and abrasion protection. Manufacturers differentiate themselves significantly through proprietary coating formulations and efficient, waste-reducing curing techniques. Quality control and certification (e.g., UL testing, thermal classification) are intensively applied at this stage, adding substantial value and ensuring product compliance for highly regulated end-use sectors like aerospace and medical devices.

The downstream segment involves distribution channels, which are segmented into direct sales to large Original Equipment Manufacturers (OEMs)—especially in the automotive and heavy electrical machinery sectors—and indirect distribution via specialized industrial distributors and wholesalers serving the Maintenance, Repair, and Operations (MRO) market. Direct channels facilitate deep integration and customization, whereas indirect channels ensure broad market access for standardized products used in general electronics and appliance repair. Final customers (potential customers) are typically electrical system designers, automotive engineers, and procurement managers in industrial facilities who prioritize performance specifications (temperature class, voltage rating) over simple price metrics. The overall value chain emphasizes vertical expertise, from specialized textile manufacturing to high-performance chemical coating, ensuring a highly reliable safety product reaches the end-user.

Fiberglass Insulating Sleeving Market Potential Customers

The potential customers for Fiberglass Insulating Sleeving are diverse, spanning virtually every industrial sector where electrical safety, thermal stability, and mechanical protection of wiring or fluid-carrying conduits are critical operational requirements. The largest purchasing segment comprises manufacturers within the high-voltage electrical apparatus domain, including producers of transformers, electric motors, and generators, who utilize sleeving to insulate internal windings and connections against heat and electrical discharge, ensuring apparatus longevity and preventing catastrophic failure. These customers often procure large volumes of certified, high-temperature (Class H and above) silicone-coated sleeving, driven by standards such as IEC 60085 and NEMA MG 1, necessitating suppliers with consistent quality control and bulk production capabilities.

Another major customer segment is the global automotive industry, particularly manufacturers focused on Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). With vehicle architectures rapidly shifting to high-voltage battery packs (400V and 800V systems), fiberglass sleeving is indispensable for insulating battery interconnects, motor wiring, and high-current power cables that operate under extreme thermal cycling and intense vibration within confined engine bays and battery enclosures. EV OEMs require highly flexible, abrasion-resistant, and flame-retardant products that meet stringent automotive standards like ISO 6722 and USCAR, driving demand for specialized coated products designed for flexibility and chemical resistance to fluids like coolants and transmission oils.

Finally, aerospace and defense contractors represent a highly valuable, albeit smaller, customer base, purchasing ultra-premium, zero-defect sleeving used in avionics, sensor wiring, and critical control systems where failure is unacceptable. These customers prioritize lightweight construction, radiation resistance, and the highest thermal ratings, often requiring specialized, thin-walled PTFE-coated fiberglass sleeves. Additionally, major appliance manufacturers (white goods) and large-scale industrial machinery producers for sectors such as metallurgy and petrochemicals consistently procure fiberglass sleeving to manage thermal loads around heating elements, boilers, and high-heat processing equipment, emphasizing the product's role as a vital safety and performance component across the entire industrial ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Federal-Mogul LLC (Tenneco), Sumitomo Electric Industries, Ltd., TE Connectivity, Atlas Fibre Company, Thermal Protection Products, Inc., M.M. Newman Corporation, Techni-Lux, Inc., Bentley-Harris (Federal-Mogul), Vargus Co., Ltd., Elkem Silicones, Shenzhen Haiwo Technology Co., Ltd., Electrolab, Zeus Industrial Products, Inc., Alpha Wire, Insulating Materials, Inc., Hi-Temp Products Inc., Cable Management Solutions, Therm-x, Newtex Industries, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiberglass Insulating Sleeving Market Key Technology Landscape

The technological landscape of the Fiberglass Insulating Sleeving Market is primarily defined by advancements in braiding techniques, specialized coating chemistries, and quality assurance methodologies. Modern braiding technology utilizes high-speed, multi-spindle automated systems capable of producing densely woven, highly uniform sleeving structures. Key innovations focus on achieving varying wall thicknesses and diameters with extreme precision, which is critical for meeting the tight tolerances required by miniaturized electronic assemblies. Furthermore, manufacturers are increasingly employing complex braiding patterns, such as biaxial or triaxial weaves, to enhance mechanical durability and resistance to physical cut-through, especially in harsh industrial or military applications. Continuous process monitoring using laser measurement systems ensures consistent dimensional stability and minimizes product variability across long production runs.

The most significant technological differentiation occurs in the coating processes, where proprietary chemical formulations are applied to the raw fiberglass braid. Silicone-based coatings have evolved significantly, now incorporating advanced fire retardants and heat stabilizers that allow for higher continuous operating temperatures while maintaining exceptional flexibility and low smoke generation upon combustion. Fluoropolymer coatings, particularly based on high-performance materials like PFA and specialized PTFE, represent a niche technology aimed at providing unparalleled chemical inertness and non-stick surfaces, crucial for applications involving harsh solvents or high-purity environments, such as semiconductor manufacturing equipment. The technology challenge lies in achieving perfect adherence of the coating to the glass substrate without compromising the flexibility of the sleeve, often requiring plasma treatment or specialized primers before the curing stage.

Furthermore, digital transformation is impacting the manufacturing landscape through the integration of Industry 4.0 principles. This involves deploying sophisticated IoT sensors on braiding and coating lines to collect real-time data on tension, temperature profiles, and coating viscosity. This data is fed into control systems to dynamically adjust machine parameters, resulting in higher product consistency and reduced material waste. Non-destructive testing techniques, such including advanced dielectric breakdown analysis and thermal shock testing protocols, are continuously being refined to validate the performance of high-end sleeving products, ensuring that they meet the increasingly demanding lifespan requirements of electric vehicle battery systems and long-life industrial motors.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Momentum

The Asia Pacific region currently holds the largest market share and is anticipated to exhibit the fastest growth rate throughout the forecast period. This dominance is primarily attributed to the region's massive industrial base, particularly in China, India, and South Korea, which are leading global manufacturing hubs for electrical equipment, consumer electronics, and automotive components. The rapid scaling of Electric Vehicle (EV) production in China, coupled with extensive governmental investment in power transmission and distribution infrastructure modernization, creates an insatiable demand for high-performance insulating sleeving. Local manufacturers benefit from integrated supply chains, allowing for cost-effective mass production. However, quality standards are rapidly increasing, driven by demand from international OEMs requiring compliance with global certifications like UL and VDE, leading to increased adoption of advanced silicone and acrylic coated products across the region.

India and Southeast Asian countries are significantly contributing to the regional growth due to burgeoning industrialization and urbanization, which necessitate vast electrical installations and motor manufacturing. The focus in these emerging economies is often on balancing cost-effectiveness with safety compliance, driving demand for both standard and mid-range performance sleeving. The competitive environment is fierce, marked by local players competing heavily on price, but premium product suppliers from Japan and the West maintain strong market positions in critical high-reliability applications, such as high-speed trains and precision machinery. The strategic movement of key global electronics assembly operations into Vietnam and Malaysia also spurs localized demand for electrical protection components.

- North America Market Maturity and High-Value Application Focus

The North American market, comprising the U.S. and Canada, is characterized by high maturity, strict regulatory oversight, and a strong focus on high-reliability, high-value applications. Growth here is primarily driven by the aerospace and defense sectors, which mandate the use of the highest thermal and electrical insulation classes for mission-critical wiring harnesses and fluid conveyance systems. The ongoing transition of the conventional automotive industry toward electrification is a major growth catalyst, demanding specialized sleeving materials for complex battery wiring and charging infrastructure. Manufacturers operating in this region must adhere to exceptionally rigorous quality control protocols and often require military-grade (e.g., MIL-I-3190) or aviation-specific certifications.

Demand is also bolstered by substantial maintenance and retrofitting activities in the established power grid, industrial plant, and commercial HVAC sectors, which seek durable, long-life insulating solutions to reduce operational expenditures and enhance safety compliance. Price sensitivity is generally lower compared to APAC, with end-users placing a higher premium on documented performance history, technical support, and rapid customization capabilities. The market favors established global suppliers with strong brand recognition and robust distribution networks capable of delivering certified products across diverse industrial landscapes, including oil and gas and medical technology manufacturing.

- European Emphasis on Environmental Standards and Advanced Engineering

Europe represents a stable and technologically advanced market, distinguished by its stringent environmental regulations, such as REACH and RoHS directives, which heavily influence material selection and coating chemistries. The region shows strong demand for eco-friendly, halogen-free, and low-smoke sleeving solutions, particularly in public infrastructure, rolling stock (railroad), and building automation systems. The core drivers include the European Union's ambitious renewable energy targets, leading to significant investment in wind power, solar installations, and associated high-voltage interconnect systems requiring superior fiberglass insulation.

Germany, France, and the UK are key markets, focusing on precision industrial automation, high-end motor manufacturing, and the rapidly growing electric mobility sector. European OEMs often demand highly specialized, customized sleeving solutions tailored to unique design specifications and thermal requirements, pushing regional suppliers toward technological leadership in advanced coating polymers like high-temperature polyurethane and specialized vulcanized silicone. The emphasis remains firmly on verifiable quality, long-term operational reliability, and compliance with EU safety directives, ensuring the market remains highly competitive based on technical specification rather than purely on volume or price.

- Latin America, Middle East, and Africa (LAMEA) Emerging Growth Pockets

The LAMEA region represents a nascent but rapidly developing market, characterized by localized demand fueled by infrastructure expansion, resource exploration (oil, gas, mining), and increasing urbanization. In Latin America, countries like Brazil and Mexico are seeing growth driven by expanding automotive manufacturing and general electrical power upgrades, stimulating demand for standard industrial-grade coated sleeving. Market penetration is often challenging due to economic volatility and reliance on imported materials, leading to high price sensitivity and a greater prevalence of basic or mid-range products.

The Middle East and Africa demonstrate high demand in specific sectors: the oil and gas industry requires sleeving that withstands extreme heat and harsh chemical exposure in exploration and refining activities, while massive construction projects in the GCC nations drive temporary, high-volume demand for standard electrical insulation products. Future growth in MEA is highly contingent upon diversification away from hydrocarbon economies and continued investment in local manufacturing and renewable energy projects, which will gradually increase the technical requirements and standardization needs for insulating materials across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiberglass Insulating Sleeving Market.- 3M Company

- Federal-Mogul LLC (Tenneco)

- Sumitomo Electric Industries, Ltd.

- TE Connectivity

- Atlas Fibre Company

- Thermal Protection Products, Inc.

- M.M. Newman Corporation

- Techni-Lux, Inc.

- Bentley-Harris (Federal-Mogul)

- Vargus Co., Ltd.

- Elkem Silicones

- Shenzhen Haiwo Technology Co., Ltd.

- Electrolab

- Zeus Industrial Products, Inc.

- Alpha Wire

- Insulating Materials, Inc.

- Hi-Temp Products Inc.

- Cable Management Solutions

- Therm-x

- Newtex Industries, Inc.

Frequently Asked Questions

Analyze common user questions about the Fiberglass Insulating Sleeving market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between silicone-coated and acrylic-coated fiberglass sleeving?

Silicone-coated fiberglass sleeving offers superior temperature resistance (typically Class H/180°C and higher), excellent flexibility, and robust dielectric strength, making it ideal for high-heat environments like electrical motors and transformers. Acrylic-coated sleeving, conversely, is more cost-effective, provides better resistance to abrasion and cutting in standard industrial conditions, but is limited to lower temperature classes (typically Class F/155°C or lower). The choice depends entirely on the required thermal performance and mechanical stress levels of the application, with silicone favored for extreme heat and high-voltage critical systems, while acrylic suffices for general-purpose wiring protection.

How is the growth of Electric Vehicles (EVs) specifically impacting the demand for fiberglass sleeving?

The proliferation of EVs is generating massive demand for specialized fiberglass sleeving, primarily due to the stringent requirements of high-voltage (400V to 800V) battery systems and associated power electronics. EV applications require sleeving that is halogen-free, flame-retardant, and highly resistant to thermal runaway conditions, often demanding high-performance silicone-coated sleeves capable of resisting battery coolants and mechanical vibration. This segment is driving innovation towards higher dielectric withstand voltage capabilities and compact, lightweight designs necessary for modern automotive architecture, making it the most significant growth area for premium sleeving products.

Which geographical region leads the global Fiberglass Insulating Sleeving Market and why is it dominant?

The Asia Pacific (APAC) region, particularly driven by China, holds the leading market share globally. This dominance is attributable to the region's immense industrial capacity, leading global production of consumer electronics, high-volume manufacturing of electric motors, and extensive governmental investment in developing modern power transmission infrastructure. The high concentration of original equipment manufacturers (OEMs) and robust demand from the rapidly expanding automotive and electronics assembly sectors solidify APAC as the primary hub for both fiberglass sleeving consumption and cost-competitive manufacturing.

What is the role of technical certifications (e.g., UL, VDE) in purchasing decisions within this market?

Technical certifications such as UL (Underwriters Laboratories) and VDE (Association for Electrical, Electronic & Information Technologies) are absolutely critical, serving as non-negotiable prerequisites in most industrial and commercial purchasing decisions. These certifications validate the product's fire resistance, temperature rating, and dielectric performance according to international safety standards, mitigating legal liability and ensuring operational safety for the end-user. In sectors like aerospace, medical, and high-end automotive, failure to possess specific, documented certifications can immediately disqualify a potential supplier, placing regulatory compliance at the forefront of the supplier selection process.

What technological trends are expected to shape the future of fiberglass sleeving materials?

Future technological trends are focused on enhancing sustainability, performance under extreme conditions, and integration with digital manufacturing. Key advancements include the development of specialized, environmentally friendly (halogen-free) coating chemistries to comply with stricter global environmental regulations (e.g., REACH). Furthermore, innovation focuses on ultra-high-temperature coatings capable of continuous operation above 250°C for specialized industrial furnaces and aerospace applications. The increased use of AI in manufacturing is leading to tighter quality control and precision during the braiding and coating processes, facilitating the production of highly customized, technically superior products with minimal dimensional variation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager