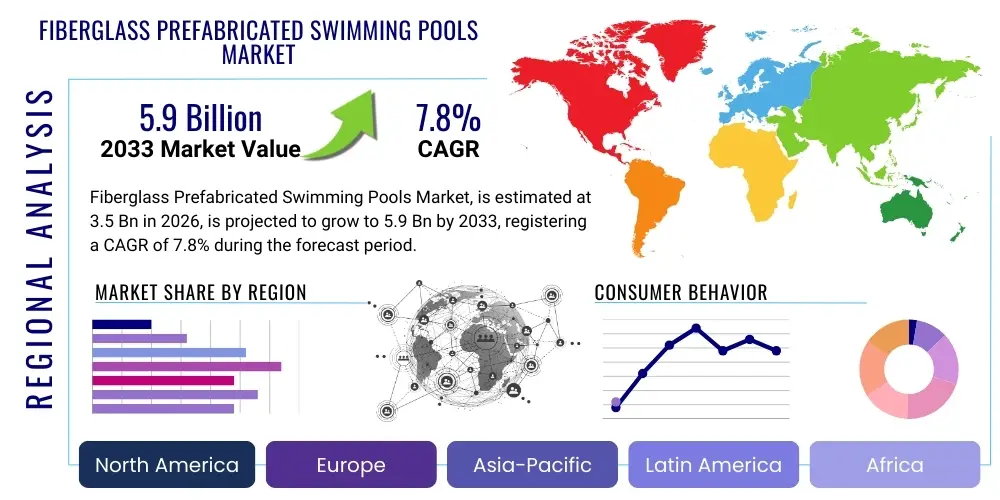

Fiberglass Prefabricated Swimming Pools Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442791 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Fiberglass Prefabricated Swimming Pools Market Size

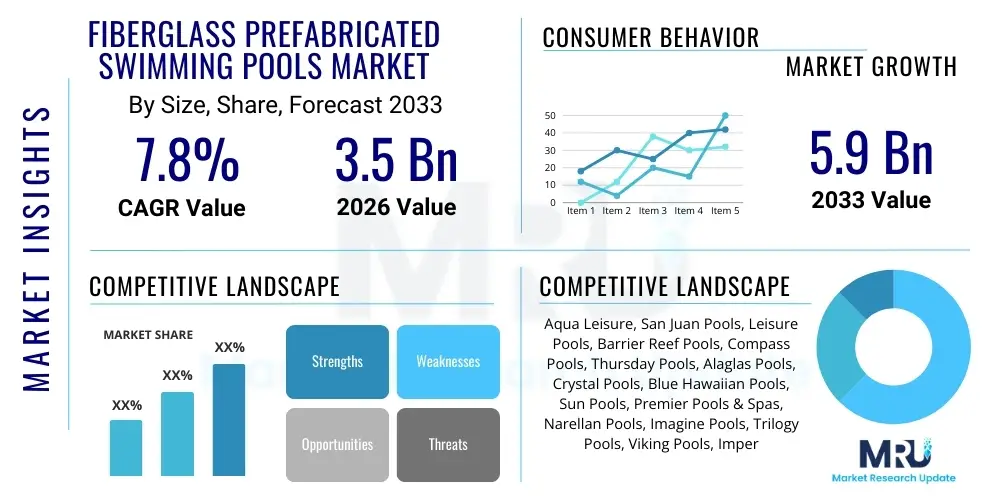

The Fiberglass Prefabricated Swimming Pools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing consumer preference for low-maintenance, quick-installation, and durable swimming solutions, particularly within the affluent residential sector and the burgeoning resort and hospitality industries globally. The cost-effectiveness over the product lifecycle, compared to traditional concrete pools, positions fiberglass as a primary choice for modern aquatic infrastructure development.

Market expansion is further supported by technological advancements in composite materials, leading to stronger, more UV-resistant, and aesthetically pleasing pool shells. Innovations in mold design allow manufacturers to offer a greater variety of shapes, sizes, and integrated features such as tanning ledges and spa sections, catering to diverse consumer needs and architectural styles. Furthermore, the global shift towards sustainable construction practices benefits fiberglass pools, as the material requires fewer resources for installation and often integrates well with energy-efficient heating and filtration systems, appealing to environmentally conscious buyers.

Fiberglass Prefabricated Swimming Pools Market introduction

The Fiberglass Prefabricated Swimming Pools Market encompasses the manufacturing, distribution, and installation of factory-made pool shells constructed from fiberglass-reinforced polymer (FRP) composites. These pools are molded into a single, monolithic structure under controlled factory conditions, offering superior strength, smoothness, and resistance to chemical corrosion compared to traditional concrete or vinyl liner pools. The product's main appeal lies in its rapid installation process—often completed in a matter of days—and its highly durable, non-porous gel coat finish, which drastically reduces maintenance requirements and eliminates the need for frequent resurfacing or liner replacement.

Major applications for fiberglass pools span both the Residential and Commercial sectors. In the residential market, they are favored for new home construction and backyard renovations due to their aesthetic appeal, safety features (non-slip surfaces), and long lifespan. Commercial applications include installations in hotels, resorts, fitness centers, community centers, and upscale housing developments, where durability and minimal operational downtime are critical. The inherent flexibility of fiberglass also makes these pools resilient to ground movement and frost, expanding their viability across varied climatic regions.

Key driving factors accelerating market adoption include rising disposable incomes in emerging economies, increased global focus on health and wellness promoting active lifestyles, and significant improvements in manufacturing efficiency which reduce overall production costs. The intrinsic benefits—low maintenance, high durability, quick installation, and excellent chemical resistance—firmly establish fiberglass prefabricated pools as a premium yet practical alternative in the global swimming pool industry, fueling sustained market growth throughout the forecast period.

Fiberglass Prefabricated Swimming Pools Market Executive Summary

The Fiberglass Prefabricated Swimming Pools Market is characterized by robust growth stemming from favorable consumer trends leaning towards convenience and longevity in home recreation infrastructure. Business trends indicate a movement towards vertically integrated supply chains, where manufacturers control both production and installation to ensure quality control and rapid deployment. Key players are increasingly investing in advanced composite materials research, particularly focused on enhancing UV resistance and developing specialized protective coatings to minimize fading and degradation over time. Furthermore, there is a distinct trend towards offering highly customizable design options, utilizing advanced CAD/CAM technology to produce pools that seamlessly integrate into complex landscape architectures. Strategic mergers and acquisitions among regional manufacturers are also shaping the competitive landscape, aiming to consolidate market share and expand geographic reach.

Regionally, North America and Europe remain the dominant markets, characterized by high consumer spending power and established infrastructures for pool installation and maintenance. However, the Asia Pacific region, led by rapidly urbanizing nations like China and India, is registering the highest Compound Annual Growth Rate (CAGR). This acceleration in APAC is fueled by expanding middle-class populations, increased investments in luxury tourism, and a rising demand for Western-style amenities in private residences and commercial developments. Latin America and the Middle East and Africa (MEA) are also showing promising growth, particularly in resort development projects, capitalizing on long swimming seasons and increasing expatriate communities.

Segment trends highlight the Residential segment as the primary revenue generator, specifically within the new construction and renovation sub-segments, driven by homeowners prioritizing lifestyle upgrades. By Type, larger, standard-sized pools (over 30 feet) maintain significant demand, though the market is seeing a notable rise in demand for smaller, compact solutions such as 'plunge pools' and 'spas' due to shrinking lot sizes in densely populated urban areas and the desire for eco-friendly, low-water-volume options. Distribution channels are evolving, with traditional dealer networks remaining strong, but direct-to-consumer sales models gaining traction through sophisticated online configurators and virtual reality visualization tools, improving customer engagement and streamlining the purchase process.

AI Impact Analysis on Fiberglass Prefabricated Swimming Pools Market

User inquiries regarding AI's influence in the fiberglass pool market primarily revolve around three key areas: optimizing manufacturing processes, improving customer experience through smart pool design and maintenance, and enhancing supply chain efficiency. Users frequently ask if AI can reduce the variability in the lamination process, a crucial quality factor in fiberglass manufacturing. There is also significant consumer interest in "smart pools" managed by AI algorithms that predict chemical needs, monitor structural integrity, and automate maintenance schedules. Furthermore, businesses are keen on understanding how AI-driven predictive analytics can improve inventory management for specialized resin composites and accessories, minimizing waste and optimizing delivery timelines for customized pool shells.

The key themes emerging from this analysis center on operational excellence and predictive maintenance. Manufacturers expect AI to drive down costs through defect detection in real-time during the molding process, thereby increasing yield and reducing material wastage—a significant concern given the high cost of raw fiberglass and specialized resins. Consumers anticipate AI integration leading to truly autonomous pool operation, where monitoring systems, integrated into the pool shell itself, use machine learning to understand usage patterns, environmental factors, and immediately flag potential issues, transitioning pool ownership from a chore to a seamless recreational activity.

Ultimately, AI is viewed as a transformative element that will bridge the gap between traditional composite manufacturing and modern smart home infrastructure. It is expected to enable highly personalized pool designs based on geophysical data and usage predictions, enhance worker safety through automated monitoring of factory environments, and revolutionize after-sales service by providing precise, preemptive diagnostics. This technological integration is crucial for maintaining the competitive edge of fiberglass pools against other materials by maximizing efficiency and durability.

- AI-driven optimization of resin application and curing cycles, ensuring structural integrity and minimizing voids.

- Predictive maintenance analytics for integrated smart pool sensors, alerting users to mechanical or chemical imbalances before failures occur.

- Machine learning algorithms enhancing demand forecasting for custom pool molds and reducing lead times for niche designs.

- Automated quality inspection using computer vision systems to detect surface imperfections in the gel coat finish during production.

- Generative design tools assisting architects and homeowners in creating optimal pool shapes tailored to specific geographical and aesthetic requirements.

- AI-powered chatbots and virtual assistants providing 24/7 technical support and installation guidance, improving dealer efficiency.

DRO & Impact Forces Of Fiberglass Prefabricated Swimming Pools Market

The market dynamics are governed by a complex interplay of forces. Drivers primarily include the rapid installation time and inherent durability of fiberglass pools, appealing directly to time-constrained and value-conscious consumers. The increasing popularity of home-based leisure and "staycations" following global shifts also bolsters demand. Restraints predominantly involve the limitations on size and shape imposed by transportation logistics, as the pool shell is a single, large unit, coupled with the initial higher capital investment compared to some basic vinyl liner options. Opportunities lie in expanding into emerging markets with rapidly growing construction sectors and leveraging advancements in material science to create hybrid composites that further enhance flexibility and longevity. The impact forces indicate that economic stability and housing market strength globally exert significant influence over market performance, classifying economic factors as high impact.

Key drivers center on the superior structural attributes of fiberglass pools. Their non-porous surface dramatically reduces the proliferation of algae, resulting in lower chemical usage and minimal cleaning effort, a substantial maintenance advantage over concrete surfaces. Furthermore, the standardization of manufacturing processes ensures consistent quality, reliability, and faster turnaround times from order placement to final installation. This efficiency appeals strongly to builders and commercial developers who need reliable, scalable pool solutions without prolonged construction delays, pushing fiberglass demand across high-density housing projects and commercial tourism infrastructure.

Conversely, significant restraints are related to logistical challenges and market perception. Due to highway regulations, the width of prefabricated fiberglass shells is restricted, limiting the maximum size of the pool a consumer can purchase, which can deter clients seeking very large or unusually shaped aquatic features. Additionally, while the lifecycle cost is favorable, the initial outlay is higher than alternatives, which can act as a financial barrier for lower-income demographics. These restraints necessitate innovative logistical solutions, such as sectional pool designs or specialized transportation fleets, to expand the addressable market globally, particularly in areas with challenging road infrastructure.

Segmentation Analysis

The Fiberglass Prefabricated Swimming Pools Market is comprehensively segmented based on Type, Application, and Distribution Channel, reflecting the diverse range of consumer needs and market delivery mechanisms. Analysis of these segments is crucial for understanding specific growth pockets and tailoring marketing strategies. The 'Type' segmentation captures the evolving preferences for pool dimensions and design, ranging from functional standards to luxurious custom shapes and specialized therapeutic pools. This diversity allows manufacturers to address varied spatial constraints, from expansive suburban properties to compact urban backyards, driving specialization in production techniques and mold design.

The segmentation by 'Application' clearly delineates the market's reliance on both private and public spending, with the Residential segment being highly sensitive to interest rates and housing market health, while the Commercial segment is tethered to global trends in hospitality, fitness, and infrastructure development. The residential market is further maturing, with homeowners increasingly prioritizing aesthetic integration and smart technology, contrasting with the commercial sector's focus on regulatory compliance, operational durability, and minimizing public liability risk. Understanding these differential demands allows for optimized product feature prioritization, such as enhancing non-slip surfaces for commercial installations or emphasizing custom color options for residential clients.

Finally, the segmentation by 'Distribution Channel' reveals the power dynamics within the supply chain. The strong presence of specialized dealers and certified installers (Indirect Sales) is essential for maintaining installation quality, crucial for the long-term performance of the fiberglass shell. However, the emerging trend of Direct Sales, often facilitated by online platforms and sophisticated virtual showroom experiences, offers manufacturers higher margin potential and closer relationships with end-users, potentially disrupting traditional intermediary roles and accelerating market penetration in regions where established dealer networks are sparse or non-existent.

- By Type:

- Standard Sizes (e.g., 20 ft - 35 ft)

- Custom Sizes (Over 35 ft or specialized dimensions)

- Plunge Pools (Small footprint, deep water)

- Lap Pools (Narrow, elongated for exercise)

- By Application:

- Residential (New Construction)

- Residential (Renovation and Replacement)

- Commercial (Hotels, Resorts, Spas)

- Commercial (Fitness Centers and Public Facilities)

- By Distribution Channel:

- Direct Sales (Manufacturer to Consumer)

- Indirect Sales (Dealers, Distributors, Certified Installers)

Value Chain Analysis For Fiberglass Prefabricated Swimming Pools Market

The value chain for fiberglass prefabricated swimming pools begins with upstream activities, centered on the procurement and processing of critical raw materials, primarily high-quality resins (e.g., vinyl ester or polyester), fiberglass reinforcement, and specialized gel coats. The quality of these inputs is paramount, directly influencing the pool's structural integrity, UV resistance, and aesthetic finish. Key upstream risks include volatility in petrochemical pricing, which affects resin costs, and ensuring consistent supply chain compliance regarding environmental standards for composite materials. Manufacturers typically maintain strong relationships with specialized chemical suppliers to guarantee the consistency and quality required for the demanding molding process, often involving rigorous internal testing protocols before material acceptance.

Midstream activities involve the highly technical manufacturing process, including mold preparation, lamination, curing, and finishing. This stage represents the highest value addition, utilizing skilled labor and capital-intensive machinery. Efficiency here is driven by advanced robotic application systems and climate-controlled curing environments to minimize defects. Downstream activities focus on logistics, distribution, and installation. Due to the size of the product, specialized transportation is required, leading to high transportation costs which influence pricing strategies. Installation involves excavation, placement of the shell, plumbing, electrical connections, and backfilling, requiring certified, skilled contractors. The successful execution of the installation phase is crucial for customer satisfaction and long-term product performance.

Distribution channels vary significantly. Direct channels allow manufacturers to maximize profit margins and maintain direct control over branding and customer service, often through in-house sales teams and installation crews. Indirect channels, relying on extensive networks of authorized dealers and independent installers, are vital for market penetration across diverse geographical areas. Dealers provide localized sales expertise, manage regional permits, and handle the complete installation lifecycle. The choice of channel strategy is often dictated by regional market maturity; established markets favor indirect models due to entrenched dealer networks, while emerging markets may see initial success through direct sales models to establish brand presence rapidly and control quality standards.

Fiberglass Prefabricated Swimming Pools Market Potential Customers

Potential customers for fiberglass prefabricated swimming pools primarily fall into two distinct groups: high-net-worth individuals and middle-to-upper-income families seeking durable, low-maintenance residential pools, and commercial developers focused on hospitality, leisure, and multi-family residential projects. For residential buyers, the appeal centers on the combination of rapid installation (reducing construction disruption), the smooth, non-abrasive surface texture, and the lower operational maintenance costs over the pool’s lifetime compared to alternative materials. These customers often prioritize family safety, aesthetic appeal, and the desire for customized features such as integrated spas, water features, and color matching to complement existing home architecture.

The second major customer segment, commercial enterprises, includes luxury hotels, private resorts, cruise lines, fitness centers, and large-scale residential community developers. These buyers prioritize operational efficiency, regulatory compliance, and structural longevity under heavy usage conditions. Fiberglass pools minimize facility downtime for repairs or refinishing, a critical factor for revenue-generating commercial properties. Furthermore, the material’s resistance to harsh chemicals and rapid installation schedule allow developers to meet aggressive construction timelines, making it a highly attractive, reliable solution for large-volume projects requiring multiple aquatic features.

A burgeoning segment of potential customers includes specialized institutional and therapeutic facilities, such as rehabilitation centers, specialized schools, and medical facilities, which utilize pools for hydrotherapy and aquatic exercise. For this segment, the smooth, non-slip surface, consistent water temperature retention capabilities of the fiberglass shell, and ease of cleaning are paramount. Targeting these niche markets requires manufacturers to offer specialized designs, potentially including features for accessibility such as built-in ramps or hydraulic lift accommodations, expanding the product’s application beyond traditional recreational use and into critical institutional infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aqua Leisure, San Juan Pools, Leisure Pools, Barrier Reef Pools, Compass Pools, Thursday Pools, Alaglas Pools, Crystal Pools, Blue Hawaiian Pools, Sun Pools, Premier Pools & Spas, Narellan Pools, Imagine Pools, Trilogy Pools, Viking Pools, Imperial Pools, River Pools, Blue Lagoon Pools, Aviva Pools, EcoPools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiberglass Prefabricated Swimming Pools Market Key Technology Landscape

The technology landscape of the Fiberglass Prefabricated Swimming Pools Market is dominated by advancements in composite material engineering and precision manufacturing processes. Key technologies include the utilization of proprietary Vinyl Ester resins, which offer superior osmotic blistering resistance compared to standard polyester resins, significantly extending the lifespan and performance guarantee of the pool shell. Sophisticated gel coat technology, often involving multiple layers and specialized protective pigments, ensures high UV stability and color fastness, maintaining the pool's aesthetic quality despite prolonged exposure to sunlight and harsh chemicals. Manufacturers leverage computer numerical control (CNC) routing and robotic spray application systems to achieve extremely precise lamination thicknesses and uniform resin distribution, eliminating human error and ensuring consistent structural integrity across every unit produced.

Beyond material composition, digital design and manufacturing technologies play a critical role in market innovation. Computer-Aided Design (CAD) and advanced Finite Element Analysis (FEA) software are employed extensively to model structural stresses and optimize the shell shape for maximum strength and minimal material usage, particularly in large custom designs. This iterative design process allows manufacturers to create pools that withstand varied backfill conditions and hydrostatic pressures, ensuring compliance with stringent building codes globally. The rapid prototyping of new molds using advanced manufacturing techniques allows companies to respond quickly to evolving consumer demands for new shapes, integrated features like infinity edges, and complex structural supports.

Furthermore, technology integration extends into the post-installation phase through the adoption of smart pool systems. These systems utilize IoT sensors and wireless communication to monitor water chemistry, temperature, filtration efficiency, and potentially, early signs of structural shifts. Integration with home automation platforms allows customers to control pool features remotely, enhancing convenience and reducing energy consumption through optimized equipment scheduling. This merging of composite manufacturing with digital smart technology is essential for future differentiation and appeals strongly to the modern, tech-savvy consumer base looking for seamless, automated home management solutions.

Regional Highlights

The Fiberglass Prefabricated Swimming Pools Market exhibits significant regional variation in growth drivers, consumer preferences, and market maturity. North America, encompassing the United States and Canada, represents the largest and most mature market segment globally. This dominance is attributed to high rates of home ownership, robust consumer spending power, and a well-established infrastructure of dealers, installers, and material suppliers. Demand in North America is driven by the residential renovation sector, where homeowners are upgrading existing aquatic features or replacing older, high-maintenance concrete or vinyl pools with durable, efficient fiberglass alternatives. The market here focuses heavily on premium features, sophisticated automation, and extended warranties, appealing to a customer base seeking convenience and long-term value.

Europe constitutes the second major market, with strong demand particularly visible in France, Germany, Spain, and the UK. While traditionally favoring concrete in some southern European regions, fiberglass adoption is accelerating due to environmental regulations favoring faster, less invasive installation methods, and the inherent water-saving properties of the non-porous shells. Regulatory frameworks regarding pool safety and energy efficiency are stringent in Europe, pushing manufacturers towards innovative solutions like integrated insulation systems and compact designs suitable for smaller urban gardens. The market is also heavily influenced by the high demand for spa and wellness facilities, leading to increased installation of fiberglass plunge pools and swim spas in urban areas.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market throughout the forecast period. This rapid expansion is primarily driven by accelerating urbanization, rising disposable incomes in countries like China, India, and Australia, and significant investment in the hospitality sector, including luxury resorts and high-end residential towers. While manufacturing bases are rapidly expanding within APAC, logistical challenges and varying construction standards across diverse nations present complexity. However, the quick installation time of fiberglass pools is a significant advantage in rapidly developing areas where construction schedules are tight, making them an optimal choice for mass development projects.

- North America: Dominant market share; driven by replacement cycles, strong housing starts, and high consumer affinity for low-maintenance solutions.

- Europe: High growth in Southern and Western Europe; focus on compact designs, energy efficiency, and compliance with stringent environmental regulations.

- Asia Pacific (APAC): Fastest CAGR; fueled by urbanization, luxury tourism development, and rising middle-class disposable income, particularly in Australia and Southeast Asia.

- Latin America (LATAM): Emerging market characterized by strong demand in coastal tourist destinations and increasing residential construction in urban centers like Mexico and Brazil.

- Middle East and Africa (MEA): Growth tied to resort development and climate factors; demand for highly durable, heat-resistant pools that minimize water evaporation and withstand extreme sun exposure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiberglass Prefabricated Swimming Pools Market, assessing their financial performance, product portfolios, strategic initiatives, and geographical presence.- Aqua Leisure

- San Juan Pools

- Leisure Pools

- Barrier Reef Pools

- Compass Pools

- Thursday Pools

- Alaglas Pools

- Crystal Pools

- Blue Hawaiian Pools

- Sun Pools

- Premier Pools & Spas

- Narellan Pools

- Imagine Pools

- Trilogy Pools

- Viking Pools

- Imperial Pools

- River Pools

- Blue Lagoon Pools

- Aviva Pools

- EcoPools

Frequently Asked Questions

Analyze common user questions about the Fiberglass Prefabricated Swimming Pools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the average lifespan of a fiberglass prefabricated swimming pool?

Fiberglass pools have an excellent lifespan, typically ranging from 30 to 50 years or more, largely due to the structural integrity of the composite shell and the longevity of the non-porous gel coat finish. Unlike concrete pools, they do not typically require expensive resurfacing every decade.

How quickly can a fiberglass pool be installed compared to a concrete pool?

Fiberglass pools offer rapid installation, often completed and ready for use in three to seven days, depending on site conditions and excavation requirements. This contrasts sharply with concrete pools, which typically require several weeks or even months due to curing times for the gunite/shotcrete material.

Are fiberglass pools prone to shifting or cracking due to ground movement?

Fiberglass is inherently flexible and is designed to withstand typical ground movement, seismic activity, and frost heave better than rigid concrete structures. This flexibility is a significant advantage, reducing the likelihood of cracking, provided the installation, particularly the backfilling process, adheres strictly to manufacturer specifications.

What are the key maintenance differences between fiberglass and vinyl or concrete pools?

Fiberglass pools require significantly less maintenance; the smooth, non-porous gel coat surface resists algae growth, demanding less chemical treatment and brushing. Concrete requires frequent brushing and higher chemical volumes, while vinyl liners require careful handling to avoid punctures and periodic replacement.

What is the role of the gel coat in a fiberglass swimming pool?

The gel coat is the outermost layer of the fiberglass shell, providing the pool's smooth, non-porous, and aesthetic finish. It is critical for chemical resistance, UV protection, algae prevention, and overall durability, acting as the primary barrier between the water and the composite structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager