Fidaxomicin Market Size

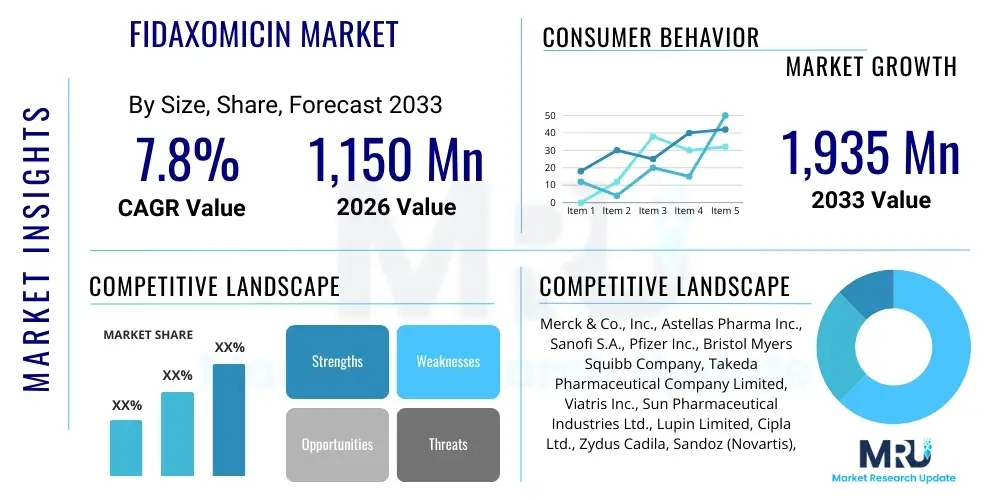

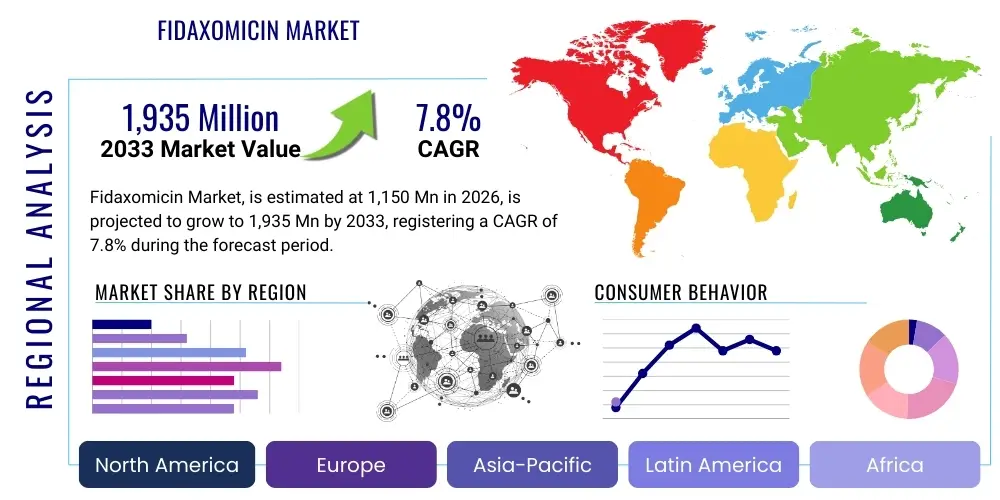

The Fidaxomicin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1,150 Million in 2026 and is projected to reach $1,935 Million by the end of the forecast period in 2033.

Fidaxomicin Market introduction

The Fidaxomicin market encompasses the therapeutic landscape dedicated to the management and treatment of Clostridium Difficile Infection (CDI), particularly focusing on reducing the risk of recurrence. Fidaxomicin, a narrow-spectrum macrocyclic antibiotic, distinguishes itself from traditional treatments like vancomycin and metronidazole by exhibiting potent bactericidal activity primarily against C. difficile, while minimally disrupting the beneficial commensal gut microbiota. This targeted mechanism of action is crucial, as the preservation of the gut microbiome is directly correlated with lower rates of CDI recurrence, a major clinical challenge. The product is predominantly available in tablet and oral suspension forms, catering to both adult and pediatric patient populations suffering from this debilitating infection.

Major applications of Fidaxomicin center exclusively on the treatment of CDI, including the initial episode and subsequent recurrent episodes. Its demonstrated clinical superiority in sustaining clinical response and minimizing reinfection risk has positioned it as a preferred, albeit premium-priced, first-line agent, especially in high-risk patients. The primary benefit driving its adoption is the substantial reduction in recurrence rates compared to older standards of care, which translates directly into improved patient outcomes and decreased overall healthcare expenditure associated with readmissions and prolonged treatment cycles. Furthermore, its minimal systemic absorption ensures high concentration levels at the site of infection within the colon, maximizing therapeutic effectiveness.

The market growth is fundamentally driven by the escalating global incidence and prevalence of healthcare-associated infections (HAIs), particularly CDI, which remains a significant cause of morbidity and mortality in hospitalized and long-term care facility patients. Increased awareness among clinicians regarding the limitations of older antibiotics concerning recurrence, coupled with robust clinical trial data supporting Fidaxomicin’s efficacy profile, further stimulates demand. Furthermore, the expansion of its indication to include pediatric patients, addressing a previously underserved segment, serves as a vital accelerator for market expansion, ensuring sustained revenue growth throughout the forecast period.

Fidaxomicin Market Executive Summary

The Fidaxomicin market demonstrates robust growth, anchored by its superior clinical profile in managing and preventing the recurrence of Clostridium Difficile Infection (CDI). Key business trends include pharmaceutical companies focusing heavily on generating real-world evidence and expanding product reach in high-recurrence settings, such as intensive care units and specialized elderly care facilities. Strategic pricing, despite the high acquisition cost, is often justified by the long-term cost savings derived from reduced hospital readmission rates, driving institutional purchasing decisions. Furthermore, patent longevity and ongoing life-cycle management efforts, including the development of new formulations or combination therapies, are central to maintaining competitive advantage in the high-value anti-infective space.

Regionally, North America maintains market dominance, primarily due to well-established healthcare infrastructure, high CDI incidence rates, and favorable reimbursement policies that support the adoption of premium therapies like Fidaxomicin. Europe follows, driven by similar clinical needs and increasing antibiotic stewardship programs promoting targeted treatments. Asia Pacific is emerging as the fastest-growing region, fueled by rising antibiotic resistance, improving diagnosis rates, and governmental initiatives aimed at combating HAIs, which are increasing the market penetration potential for novel anti-infectives. However, pricing pressures and regulatory complexities remain notable constraints in developing economies within this region.

Segment trends highlight the dominance of the tablets segment in terms of revenue, catering primarily to the vast adult population. However, the oral suspension segment is exhibiting accelerated growth, directly attributed to the expansion of the drug’s use in pediatric patients and individuals with dysphagia, necessitating liquid formulations. Regarding application, the segment focused on recurrent CDI treatment is witnessing higher growth rates, reflecting the urgent clinical need for therapies that effectively break the cycle of infection and relapse. Distribution channels are shifting slightly, with hospital pharmacies remaining the primary channel due to the acute nature of CDI, but specialty and online pharmacies are gaining traction for post-discharge or maintenance prescriptions.

AI Impact Analysis on Fidaxomicin Market

Users and stakeholders intensely question how Artificial Intelligence (AI) and Machine Learning (ML) will influence the diagnosis, prescription patterns, and development pipeline within the Fidaxomicin market. Key user concerns revolve around whether AI can precisely identify high-risk CDI recurrence patients who would most benefit from Fidaxomicin over generic alternatives, thereby optimizing resource allocation. There is also significant interest in AI's role in accelerating new formulation development and predicting antibiotic resistance patterns specific to C. difficile strains. Expectations are high that AI-driven diagnostics will improve the timeliness and accuracy of CDI detection, leading to earlier intervention with targeted therapies like Fidaxomicin, maximizing therapeutic success and potentially altering market demand forecasting by providing superior epidemiological insights.

AI is already beginning to influence clinical decision support systems (CDSS) used in large hospital networks. These systems integrate patient electronic health records (EHRs), microbiologic data, and comorbidity scores to calculate CDI recurrence probabilities. For Fidaxomicin, this means AI can potentially filter out low-risk patients, ensuring the drug is preferentially administered to those where the cost-benefit ratio is highest, thus defending its premium pricing position. Furthermore, ML algorithms are critical in analyzing vast patient outcome datasets generated globally, helping refine treatment guidelines and supporting payers in evidence-based coverage determinations, directly impacting the volume of Fidaxomicin prescriptions.

In the realm of drug discovery and manufacturing, AI models are used to optimize fermentation processes for macrocyclic antibiotics, enhancing yield and purity, which could eventually mitigate some of the high manufacturing costs associated with Fidaxomicin. Beyond production, predictive analytics are being deployed to monitor global supply chain integrity, crucial for maintaining a stable supply of this essential antibiotic. Ultimately, the integration of AI is expected to move the market towards personalized anti-infective medicine, where Fidaxomicin's prescription is guided not just by infection status, but by an individual patient's risk profile derived from sophisticated ML models.

- AI-driven Clinical Decision Support Systems (CDSS) optimize patient selection for Fidaxomicin based on recurrence risk profiling.

- Machine Learning algorithms enhance CDI outbreak surveillance and predictive epidemiology, improving supply chain responsiveness.

- AI accelerates drug discovery and formulation optimization, potentially lowering future production costs.

- Natural Language Processing (NLP) analyzes vast medical literature and electronic health records to refine Fidaxomicin's real-world efficacy profile.

- AI assists in predicting antibiotic resistance trends specific to C. difficile, ensuring continuous therapeutic relevance.

DRO & Impact Forces Of Fidaxomicin Market

The Fidaxomicin market is primarily driven by the imperative to reduce CDI recurrence rates, a major unmet clinical need, alongside the increasing global prevalence of healthcare-associated infections. However, the market faces significant restraints, chiefly stemming from the high cost of treatment and the competitive presence of generic older generation drugs. Opportunities for sustained growth lie in expanding indications, such as preventive or prophylactic use in high-risk groups, and penetrating rapidly developing healthcare markets. These forces—Drivers, Restraints, and Opportunities (DRO)—collectively define the competitive dynamics and growth trajectory of the market, influencing strategic decisions of pharmaceutical manufacturers and healthcare providers alike.

The major impact forces acting upon this market include high regulatory scrutiny common in anti-infective development, coupled with public health pressure to practice antibiotic stewardship, which favors targeted, narrow-spectrum agents like Fidaxomicin. Regulatory bodies emphasize demonstration of superior clinical efficacy, especially in comparison to existing standards, which Fidaxomicin has successfully navigated, thus creating a high barrier to entry for competitors. Moreover, the economic impact force, driven by payer organizations, focuses on the pharmacoeconomic value—justifying the high price point by proving long-term savings from reduced recurrence and hospitalizations, a critical element sustaining Fidaxomicin's market position.

The ongoing threat of antimicrobial resistance (AMR) is a subtle but powerful impact force. As resistance to broad-spectrum antibiotics increases, the clinical value and necessity of targeted drugs like Fidaxomicin escalate. This public health crisis reinforces the rationale for developing and adopting novel antibiotics with unique mechanisms of action, securing continuous investment and clinical importance for macrocyclic compounds. The collective interplay of clinical need, regulatory acceptance, and economic justification determines the ultimate market penetration and overall success of Fidaxomicin.

Segmentation Analysis

The Fidaxomicin market is systematically segmented based on Dosage Form, Application, and Distribution Channel, allowing for granular analysis of market dynamics and targeted strategic initiatives. Dosage form segmentation differentiates between tablets, which are the primary route for adults, and oral suspensions, which are critical for the pediatric patient population and those with difficulties swallowing, representing a key area of future growth. Application segmentation provides insights into the demand split between treating initial CDI episodes versus recurrent episodes, with the latter segment showing higher clinical importance due to Fidaxomicin’s superior recurrence reduction profile. Finally, the distribution channel analysis reveals the dominant role of institutional settings versus outpatient dispensing mechanisms.

- Dosage Form

- Application

- Clostridium Difficile Infection (CDI) in Adults

- CDI in Pediatrics

- Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Fidaxomicin Market

The value chain for the Fidaxomicin market commences with complex upstream activities involving the sourcing and synthesis of raw materials, primarily focusing on the fermentation and purification processes required for macrocyclic antibiotics. Given the complexity of the molecular structure, robust quality control and highly specialized manufacturing facilities are required, often leading to a limited number of specialized Contract Manufacturing Organizations (CMOs) capable of handling this production phase. These upstream activities are capital-intensive and critical to maintaining product integrity and supply consistency, setting the foundation for the drug's quality and cost profile.

Midstream activities involve formulation, packaging, and logistics. This stage includes converting the active pharmaceutical ingredient (API) into the finished dosage forms—tablets and oral suspensions—and establishing secure, temperature-controlled warehousing. Downstream analysis focuses on market access, distribution, and end-user engagement. Distribution channels are largely bifurcated into direct channels, where the manufacturer or their specialty distributor interacts directly with major hospital systems (essential for acute CDI treatment), and indirect channels, involving large wholesalers and retail pharmacy chains for outpatient or recurrent CDI management.

The distribution network relies heavily on specialty distributors due to the high-cost, controlled nature of the drug, ensuring secure and tracked dispensing. Hospital pharmacies constitute the dominant primary channel due to the acute, often inpatient, nature of CDI diagnosis and initial treatment. Sales and marketing efforts are heavily concentrated on key opinion leaders (KOLs), infectious disease specialists, and hospital formulary committees, emphasizing the drug's pharmacoeconomic benefits, particularly the reduction in recurrence, which justifies its high price point to the ultimate buyers, the healthcare systems and payers.

Fidaxomicin Market Potential Customers

The primary customers for Fidaxomicin are institutional healthcare facilities, including large tertiary hospitals, community hospitals, and specialized long-term care facilities, where the incidence of Clostridium Difficile Infection (CDI) is highest. These institutions, driven by patient safety mandates and cost-containment goals related to readmissions, are the largest volume purchasers. Infectious disease physicians, gastroenterologists, and clinical pharmacists serve as the immediate prescribers and decision-makers within these institutional settings, influencing formulary adoption based on efficacy and recurrence prevention data.

Beyond institutional buyers, the second major customer group includes patients diagnosed with CDI, particularly those with a history of recurrent episodes or those identified as high-risk (e.g., elderly, immunocompromised, or those receiving concomitant antibiotics). While the patient is the end-user, the purchase transaction is heavily intermediated by third-party payers (government programs, private insurance, managed care organizations) who determine coverage and co-pays. The growing pediatric segment also represents an important customer base, necessitating procurement by children's hospitals and specialized pediatric outpatient clinics.

The procurement process is largely driven by institutional formulary review committees, making these committees crucial potential customers who must be convinced of the drug’s long-term economic and clinical value. Drug utilization reviews often analyze the recurrence rates within a hospital population to justify the continued or expanded use of Fidaxomicin, highlighting the complex purchasing matrix involving clinical, administrative, and financial stakeholders.

| Report Attributes |

Report Details |

| Market Size in 2026 | $1,150 Million |

| Market Forecast in 2033 | $1,935 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces | - Drivers: High CDI recurrence rates, superior efficacy, rising healthcare-associated infections.

- Restraints: High cost of therapy, potential future generic competition, regulatory barriers.

- Opportunities: Pediatric indication expansion, use in high-risk prophylaxis, emerging market penetration.

|

| Segments Covered | - Dosage Form (Tablets, Oral Suspension)

- Application (CDI in Adults, CDI in Pediatrics)

- Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies)

|

| Key Companies Covered | Merck & Co., Inc., Astellas Pharma Inc., Sanofi S.A., Pfizer Inc., Bristol Myers Squibb Company, Takeda Pharmaceutical Company Limited, Viatris Inc., Sun Pharmaceutical Industries Ltd., Lupin Limited, Cipla Ltd., Zydus Cadila, Sandoz (Novartis), Teva Pharmaceutical Industries Ltd., Alfasigma S.p.A., Dr. Reddy's Laboratories Ltd., Melinta Therapeutics, Glenmark Pharmaceuticals Limited, Aurobindo Pharma, Mylan N.V. (now Viatris), Accord Healthcare. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fidaxomicin Market Key Technology Landscape

The technological landscape supporting the Fidaxomicin market is characterized primarily by advanced fermentation and purification techniques crucial for producing its complex macrocyclic structure. Unlike synthetic small molecule drugs, Fidaxomicin is derived from fermentation of Dactylosporangium aurantiacum subsp. hamdenense, requiring highly specialized bioprocessing technology to maximize yield, ensure purity, and maintain batch consistency. Continuous optimization of bioreactor systems, coupled with sophisticated chromatographic separation methods, constitutes the core technology required to manufacture the active pharmaceutical ingredient (API) cost-effectively and to meet stringent regulatory quality standards.

Beyond API manufacturing, advanced drug formulation technology is essential, especially for developing the stable and bioavailable oral suspension designed for vulnerable populations like pediatric patients. Formulation efforts focus on taste masking, stability enhancement, and ensuring accurate dosing across various age groups. Furthermore, the integration of digital health platforms and telemedicine is increasingly becoming a technological driver, facilitating remote monitoring of patients, particularly those undergoing treatment for recurrent CDI, ensuring adherence and tracking outcomes in real-world settings, which generates valuable post-marketing data.

In the near future, advancements in genomic diagnostics—specifically rapid molecular testing platforms capable of identifying C. difficile toxin genes quickly—will significantly impact the market by accelerating the identification of infection and guiding immediate, targeted treatment with Fidaxomicin. This diagnostic technology ecosystem shortens the window between suspicion and therapy, thereby improving patient prognosis and maximizing the clinical benefit derived from the drug. Furthermore, ongoing research into novel drug delivery systems, although currently minor, aims to further enhance colon-specific targeting, minimizing systemic exposure and potential side effects.

Regional Highlights

The global Fidaxomicin market exhibits significant regional variations in terms of incidence rates, treatment guidelines, reimbursement structures, and market maturity. North America, encompassing the United States and Canada, stands out as the primary revenue generator. This dominance is attributed to high CDI incidence in sophisticated healthcare environments, aggressive adoption of targeted antibiotics driven by strong stewardship programs, and favorable, albeit complex, reimbursement landscapes that support the use of high-value treatments. The U.S. market, in particular, benefits from extensive clinical trials, strong physician awareness, and the concentration of major pharmaceutical players.

Europe represents the second largest market, where adoption is strongly influenced by national health technology assessment (HTA) bodies, such as NICE in the UK and comparable agencies across Germany and France. While efficacy is recognized, pricing negotiations are often rigorous, requiring robust pharmacoeconomic data demonstrating cost-effectiveness, particularly in reducing recurrence. The Scandinavian countries and Germany often lead in adopting specialized anti-infectives due to advanced healthcare systems and focus on minimizing antimicrobial resistance (AMR). Prescription volumes are increasing steadily across the continent as guidelines shift away from broad-spectrum agents for CDI management.

Asia Pacific (APAC) is projected to be the fastest-growing region, propelled by rapidly expanding hospital infrastructure, increasing awareness of HAIs, and improving diagnostic capabilities, particularly in high-growth economies like China and India. However, challenges persist, including price sensitivity, a preference for cheaper generic alternatives, and slower regulatory approval processes in some jurisdictions. Latin America and the Middle East & Africa (MEA) currently represent smaller market shares but offer long-term potential due to increasing urbanization, better access to specialized healthcare, and governmental investments in combating infectious diseases, though market penetration remains constrained by affordability and distribution logistics.

- North America: Dominant market share driven by high CDI prevalence, established reimbursement mechanisms, and strong physician adherence to recurrence-reducing therapies.

- Europe: Significant market size, growth contingent upon positive health technology assessment (HTA) outcomes and stringent antibiotic stewardship policies favoring targeted treatment.

- Asia Pacific (APAC): Expected to demonstrate the highest CAGR, spurred by healthcare modernization, growing awareness of HAIs, and increasing focus on CDI management in emerging economies.

- Latin America: Moderate growth potential, influenced by improving hospital infrastructure and increasing private healthcare investment, but limited by affordability concerns.

- Middle East and Africa (MEA): Nascent market with future potential linked to government spending on healthcare facilities and infectious disease control programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fidaxomicin Market.

- Merck & Co., Inc.

- Astellas Pharma Inc.

- Sanofi S.A.

- Pfizer Inc.

- Bristol Myers Squibb Company

- Takeda Pharmaceutical Company Limited

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Cipla Ltd.

- Zydus Cadila

- Sandoz (Novartis)

- Teva Pharmaceutical Industries Ltd.

- Alfasigma S.p.A.

- Dr. Reddy's Laboratories Ltd.

- Melinta Therapeutics

- Glenmark Pharmaceuticals Limited

- Aurobindo Pharma

- Mylan N.V. (now Viatris)

- Accord Healthcare

Frequently Asked Questions

Analyze common user questions about the Fidaxomicin market and generate a concise list of summarized FAQs reflecting key topics and concerns.

What is the primary clinical advantage of Fidaxomicin over standard CDI treatments?

Fidaxomicin's primary advantage is its significantly reduced rate of Clostridium Difficile Infection (CDI) recurrence compared to older therapies like vancomycin. Its narrow spectrum of activity minimizes disruption to beneficial gut microbiota, preserving colonization resistance against recurrent infection.

How is the high cost of Fidaxomicin therapy justified within healthcare systems?

The high cost is justified through pharmacoeconomic studies demonstrating long-term cost savings. By substantially reducing CDI recurrence and subsequent readmissions, Fidaxomicin lowers overall healthcare expenses associated with prolonged hospital stays and complex repeat treatments.

Which patient segments are driving the most rapid growth in Fidaxomicin consumption?

The most rapid growth is observed in the pediatric patient segment, following the approval of the oral suspension formulation, and in high-risk adult patients with recurrent CDI, where the therapeutic benefit of recurrence prevention is maximized.

What are the main patent and competitive threats facing the Fidaxomicin market?

The main threat is the eventual patent expiration, which will introduce generic competition. Current competition primarily stems from established, lower-cost antibiotics and emerging alternative treatments such as fecal microbiota transplants (FMT) and novel microbiome therapeutics.

Which geographic region currently holds the largest market share for Fidaxomicin?

North America, particularly the United States, holds the largest market share due to its advanced healthcare infrastructure, high prevalence of CDI, robust reimbursement coverage, and widespread adherence to guidelines recommending targeted therapies for CDI management.