Field Service Management Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442368 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Field Service Management Software Market Size

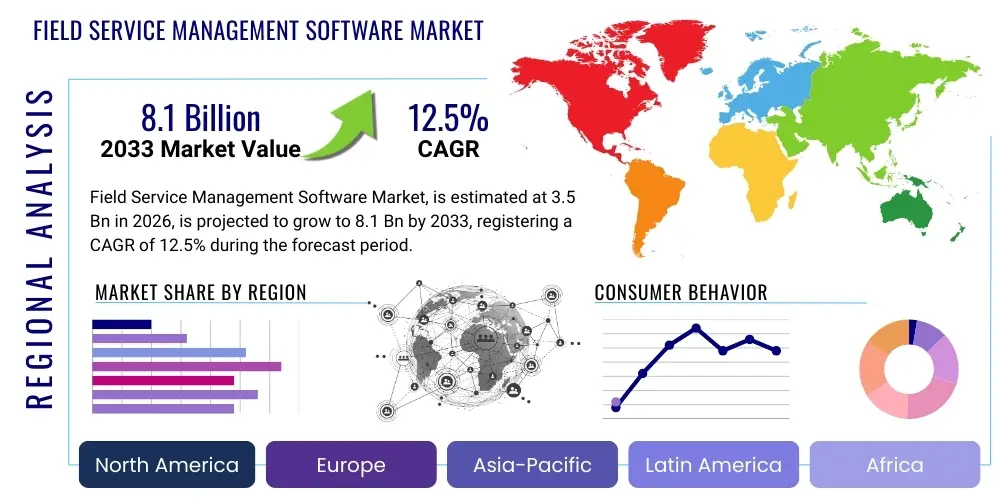

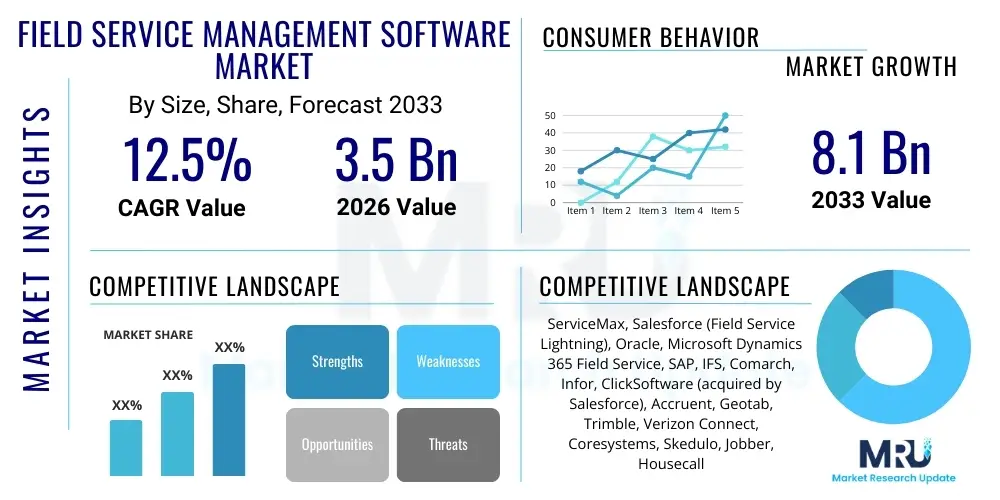

The Field Service Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $8.1 Billion by the end of the forecast period in 2033.

Field Service Management Software Market introduction

The Field Service Management (FSM) software market encompasses solutions designed to automate and streamline field operations, primarily focusing on resource scheduling, dispatching, inventory management, customer communications, and mobile workforce optimization. This robust suite of tools ensures that service requests are handled efficiently, maximizing technician productivity and enhancing customer satisfaction levels. Key components include real-time data synchronization, automated workflow generation, and predictive maintenance capabilities, which collectively transform traditional reactive service models into proactive, data-driven frameworks. The increasing complexity of equipment and the rising demand for faster, more personalized service delivery are fundamental drivers propelling the adoption of FSM solutions across diverse industries.

FSM products are critical for organizations managing a mobile workforce, such as those in telecommunications, utilities, manufacturing, and HVAC. These systems offer significant benefits, including optimized routing algorithms that reduce travel time and fuel costs, improved first-time fix rates through instant access to knowledge bases and remote diagnostics, and enhanced compliance tracking. The core application revolves around managing the entire service lifecycle, from initial request and scheduling through to job completion, invoicing, and performance analysis. Furthermore, modern FSM platforms integrate seamlessly with existing Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems, creating a unified operational ecosystem that supports holistic business decision-making.

Major driving factors fueling market expansion include the exponential proliferation of smart devices and IoT sensors, which generate vast quantities of operational data requiring management through specialized platforms. There is a persistent organizational need to minimize operational expenditure (OpEx) while simultaneously elevating the quality of service delivery in highly competitive environments. The shift towards cloud-based and Software-as-a-Service (SaaS) models provides scalable, flexible, and cost-effective deployment options, making sophisticated FSM tools accessible even to small and medium-sized enterprises (SMEs). This technological maturation, combined with relentless pressure for operational excellence, ensures sustained growth for the FSM software segment.

Field Service Management Software Market Executive Summary

The Field Service Management (FSM) software market is experiencing robust growth driven by the digital transformation mandates sweeping across asset-intensive industries and the increasing necessity for real-time operational visibility. Current business trends indicate a strong prioritization of mobile enablement, ensuring technicians can access all necessary information, complete work orders, and process payments directly from the field, which drastically improves operational throughput. Furthermore, the market is characterized by intense competition among major vendors focusing on Artificial Intelligence (AI) and Machine Learning (ML) integration to deliver predictive scheduling and maintenance capabilities. The overall trajectory suggests a migration from standalone FSM tools to comprehensive, integrated platforms that form a vital layer within the broader enterprise application architecture, emphasizing seamless data flow and process automation.

Regionally, North America maintains market dominance, attributed to high technological adoption rates, the presence of major FSM software providers, and significant investments in smart grid infrastructure and digital utility management. However, the Asia Pacific (APAC) region is poised to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization, burgeoning demand for infrastructure maintenance services in developing economies like India and China, and the increasing organizational awareness regarding the efficiency gains derived from modern FSM solutions. Europe represents a mature but steady market, driven by stringent regulatory requirements, particularly concerning environmental sustainability and safety standards in the utilities and manufacturing sectors, prompting organizations to adopt sophisticated compliance-tracking FSM tools.

Segmentation trends highlight the increasing preference for cloud-based deployment models across all organization sizes, offering scalability and reduced capital expenditure. While large enterprises continue to invest heavily in highly customized, on-premise solutions for stringent security requirements, SMEs are overwhelmingly favoring SaaS offerings. By industry vertical, the Telecommunications and IT sector remains a primary consumer, necessitating complex workforce scheduling for installations and network maintenance. Concurrently, the Energy & Utilities segment is rapidly accelerating its FSM adoption to manage distributed assets and smart meter deployments effectively. Service components, particularly consulting and managed services, are gaining prominence as organizations seek expert guidance to optimize implementation and leverage advanced platform functionalities like augmented reality (AR) guided repairs.

AI Impact Analysis on Field Service Management Software Market

User queries regarding the impact of AI on Field Service Management (FSM) software predominantly center on achieving true predictive capabilities, optimizing complex scheduling under uncertainty, and augmenting technician performance. Key themes include "How can AI reduce truck rolls?" "What is the role of Machine Learning in demand forecasting for spare parts?" and "Can AI enhance safety compliance for remote field workers?" Users are keenly interested in moving beyond rudimentary scheduling to adopting sophisticated systems that anticipate equipment failure (predictive maintenance), automatically adjust technician routes based on real-time traffic and job complexity (dynamic scheduling), and utilize natural language processing (NLP) for efficient customer service interaction and work order generation. The primary concern is often the initial complexity and data requirements needed to train effective AI models, but the expectation is that AI will fundamentally redefine service delivery efficiency and operational profitability.

AI’s influence is revolutionizing FSM software by shifting the paradigm from reactive repair to proactive intervention. Predictive maintenance, powered by machine learning algorithms analyzing IoT sensor data, allows service organizations to schedule maintenance activities before failures occur, dramatically reducing unplanned downtime and mitigating costly emergency repairs. Furthermore, AI-driven resource optimization dynamically matches the complexity of a job with the specific skill set and certification level of the closest available technician, ensuring high first-time fix rates and optimal utilization of human capital. This intelligent allocation minimizes unnecessary travel and maximizes the efficiency of the mobile workforce, directly contributing to improved profitability.

Beyond optimization and prediction, AI is crucial for enhancing the technician experience and operational decision support. Virtual assistants and conversational AI interfaces streamline the process of work order completion and documentation, reducing administrative overhead. Augmented Reality (AR) tools, often integrated with AI recognition capabilities, provide step-by-step guidance for complex repairs, effectively acting as an expert on demand. Ultimately, the integration of AI transforms FSM from a scheduling tool into a strategic business intelligence platform, generating actionable insights on performance bottlenecks, inventory consumption patterns, and customer satisfaction correlations, thereby ensuring the service organization maintains a competitive edge.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting equipment failure based on IoT data analysis.

- Dynamic Scheduling and Routing: Optimizes technician schedules in real-time, considering traffic, skill matching, and SLA requirements.

- Intelligent Knowledge Management: Uses NLP to index and retrieve technical documentation, supporting faster diagnosis and repair.

- Augmented Technician Performance: Integrates AI with AR/VR tools for guided remote assistance and complex procedural support.

- Automated Service Triage: Utilizes chatbots and virtual assistants for initial customer queries and efficient work order creation.

DRO & Impact Forces Of Field Service Management Software Market

The Field Service Management (FSM) software market is fundamentally shaped by a confluence of accelerating drivers related to digital necessity and operational complexity, balanced against inherent implementation hurdles and promising growth opportunities. Key drivers include the pervasive adoption of Internet of Things (IoT) technologies that necessitates structured data management, the imperative to elevate customer experience through rapid service delivery, and the continuous need for cost optimization in labor-intensive field operations. These forces compel organizations to invest in sophisticated FSM solutions capable of handling dynamic variables and large, geographically dispersed workforces. However, resistance to change, particularly among veteran field staff, and significant initial investment costs associated with migrating legacy systems act as major restraints. The complexity of integrating FSM systems with diverse existing enterprise platforms further complicates deployment and adoption.

Opportunities for expansion are primarily concentrated in emerging economies undergoing massive infrastructural development, particularly in APAC and Latin America, where the demand for modern utility and telecom services is surging. The shift toward subscription-based, outcome-driven service contracts (servitization) presents a substantial avenue for FSM providers, as these models require highly precise tracking, scheduling, and performance monitoring capabilities inherent in advanced software. Furthermore, the specialized FSM segment targeting niche industrial applications, such as specialized medical equipment maintenance or complex aerospace repair, offers premium monetization potential. The transition to hyper-personalized service delivery, facilitated by mobile and AI technologies, guarantees sustained market relevance and innovation.

The overall impact forces are overwhelmingly positive, driven by the irreversible trend toward enterprise digitalization and the critical role field services play in maintaining business continuity across multiple sectors. The COVID-19 pandemic significantly accelerated the reliance on remote assistance and self-service FSM capabilities, solidifying the software’s necessity rather than viewing it merely as a business improvement tool. Competitive pressure forces continuous innovation, particularly concerning mobile functionality, offline capabilities, and augmented reality integration. The market dynamics favor vendors who can offer highly scalable, industry-specific solutions that effectively leverage real-time data to transition clients from reactive maintenance models to highly proactive, predictive service delivery frameworks, directly impacting operational profitability and long-term asset value.

Segmentation Analysis

The Field Service Management (FSM) software market is segmented across several critical dimensions, primarily based on deployment type, component, organization size, and industry vertical. This stratification allows vendors to tailor their offerings to specific operational needs and technological maturity levels of different client segments. The dominance of the cloud segment reflects the global trend toward flexible, OpEx-friendly solutions, while the sustained demand for on-premise systems underscores the security and control requirements of heavily regulated large enterprises. Component segmentation highlights the increasing importance of professional services, suggesting that complex FSM deployments require substantial consulting, integration, and training support to maximize ROI.

The organization size dimension reveals distinct buying patterns; Small and Medium Enterprises (SMEs) prioritize quick deployment, user-friendliness, and affordability, often opting for highly standardized SaaS models. Conversely, Large Enterprises require extensive customization, integration capabilities with legacy systems, and robust support for geographically extensive operations. Vertically, market growth is heavily concentrated in sectors characterized by high asset complexity and widespread distribution, such as telecommunications, utilities, and high-tech manufacturing, all of which necessitate sophisticated scheduling and asset performance monitoring provided by FSM platforms.

This detailed segmentation confirms the market's maturity and specialization. Providers are increasingly developing modules tailored not just to a vertical (e.g., healthcare) but often to sub-verticals (e.g., medical device maintenance), incorporating unique regulatory compliance and reporting features. The segmentation analysis serves as a roadmap for market strategy, indicating that future competitive advantage will be gained by offering highly scalable, modular solutions that can seamlessly adapt to hybrid deployment environments and integrate AI-driven intelligence at every level of the service workflow.

- By Deployment Type:

- Cloud

- On-premise

- Hybrid

- By Component:

- Solution (Scheduling, Dispatch, Inventory Management, Work Order Management, Customer Management, Reporting & Analytics)

- Services (Implementation, Training & Support, Consulting)

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Telecommunications and IT

- Manufacturing

- Energy and Utilities

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Transportation and Logistics

- BFSI (Banking, Financial Services, and Insurance)

Value Chain Analysis For Field Service Management Software Market

The value chain for the Field Service Management (FSM) software market begins with Upstream Analysis, focusing on the core development and intellectual property creation. This stage involves software vendors investing heavily in R&D to develop sophisticated algorithms for scheduling, routing, and predictive analytics, utilizing expertise in cloud infrastructure, mobile application development, and AI/ML modeling. Key activities include sourcing advanced database management systems, developing secure mobile platforms, and establishing partnerships with hardware manufacturers for IoT integration. The quality of this upstream component directly dictates the functional depth and technological sophistication of the final FSM product, representing the critical input phase of the market.

The Midstream component centers on the distribution and implementation of the software. Distribution channels are bifurcated into Direct and Indirect channels. Direct sales involve vendors selling and servicing the software directly to large enterprises, ensuring high levels of customization and complex integration services. Indirect channels involve partnering with resellers, system integrators (SIs), and value-added resellers (VARs), which are crucial for reaching global markets and serving the SME segment. These intermediaries handle local installation, customization, and initial technical support, effectively bridging the technology gap between the core vendor and the end-user. The choice of channel significantly impacts market reach and customer relationship management.

Downstream Analysis focuses on the end-user deployment and ongoing maintenance lifecycle. Once deployed, the FSM software becomes integral to the client’s operational ecosystem, requiring continuous support, updates, and optimization services provided by the vendor or third-party service partners. This stage includes ongoing training for field technicians and dispatchers, cloud infrastructure management, and the provision of continuous feature updates, particularly related to security and compliance. The efficiency of the downstream support dictates long-term customer retention and the perceived total cost of ownership (TCO) of the FSM solution, closing the value chain loop and often driving future R&D based on operational feedback.

Field Service Management Software Market Potential Customers

The potential customers for Field Service Management (FSM) software are organizations across virtually every industry vertical that manage a significant mobile workforce or maintain geographically dispersed assets requiring regular maintenance, installation, or repair. Historically, the primary buyers were telecom operators needing to manage network infrastructure and utilities companies overseeing extensive power, water, and gas distribution networks. These sectors are characterized by mission-critical services where maximizing uptime and adhering to strict Service Level Agreements (SLAs) are paramount, making FSM software a non-negotiable operational tool for ensuring efficiency and compliance with rigorous regulatory standards.

The customer base has significantly diversified, now including large-scale manufacturers utilizing FSM for complex machinery installation and warranty services, particularly in industries like heavy equipment and industrial automation. Healthcare organizations, specifically those managing expensive medical devices in clinics and hospitals, are increasingly adopting FSM solutions to ensure calibration and regulatory adherence. Moreover, the retail sector, particularly those with numerous geographically spread point-of-sale (POS) systems or complex refrigeration units, relies on FSM for rapid maintenance responses that minimize business disruption and safeguard perishable inventory, illustrating a broad applicability across commercial services.

Crucially, the segmentation by organization size also defines customer types. Large enterprises typically seek robust, highly scalable, and customizable solutions, focusing on global deployment and integration with proprietary ERP systems. Small and Medium Enterprises (SMEs), which represent a massive, underserved segment, are ideal buyers for SaaS-based, easily implementable solutions focused on core functionality like scheduling and mobile work order management. In essence, any organization where the efficient, monitored deployment of a human resource to a specific physical location to perform a defined task is critical to revenue or operational continuity constitutes a potential customer for FSM technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $8.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ServiceMax, Salesforce (Field Service Lightning), Oracle, Microsoft Dynamics 365 Field Service, SAP, IFS, Comarch, Infor, ClickSoftware (acquired by Salesforce), Accruent, Geotab, Trimble, Verizon Connect, Coresystems, Skedulo, Jobber, Housecall Pro, Field Nation, FSM Solutions, Praxedo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Field Service Management Software Market Key Technology Landscape

The technology landscape for Field Service Management (FSM) software is characterized by a high degree of integration between core operational tools and emerging digital technologies aimed at maximizing efficiency and augmenting technician capabilities. The foundation rests on advanced cloud computing infrastructures, primarily Software-as-a-Service (SaaS) models, which provide the scalability, global accessibility, and continuous deployment capabilities necessary for managing large, distributed workforces. Core FSM platforms leverage proprietary and commercial mapping technologies and Geographic Information Systems (GIS) for optimal route planning and real-time location tracking, ensuring resource allocation is precise and responsive to dynamic conditions, thereby minimizing travel expenses and enhancing service punctuality.

Beyond the fundamental architecture, Artificial Intelligence (AI) and Machine Learning (ML) represent the most transformative technologies currently deployed in FSM. AI algorithms power sophisticated features such as predictive maintenance, analyzing vast datasets from IoT sensors to forecast equipment failures and schedule proactive intervention. ML is also instrumental in dynamic scheduling, where the system continuously learns and optimizes based on technician performance, travel times, and job complexity metrics, moving beyond static scheduling to a continuously self-improving system. Furthermore, Robotic Process Automation (RPA) is increasingly used to automate administrative tasks, such as generating reports, updating customer records, and processing routine invoices, freeing up dispatcher and technician time for higher-value activities.

The mobile technology stack remains absolutely critical, encompassing highly specialized, secure mobile applications compatible with various operating systems (iOS and Android). These apps often incorporate offline synchronization capabilities, ensuring technicians can access work orders, customer histories, and technical manuals even in remote areas without connectivity. Additionally, the increasing integration of Augmented Reality (AR) and Virtual Reality (VR) tools provides technicians with heads-up, hands-free guidance for complex repair procedures, leveraging visual overlays and remote expert support. This convergence of cloud flexibility, AI intelligence, and mobile/AR enablement defines the cutting edge of modern FSM capabilities, ensuring future systems are highly autonomous and predictive.

Regional Highlights

- North America: This region holds the largest market share, driven by rapid technological adoption, significant digital transformation efforts across utilities and telecommunications, and the robust presence of key market players (e.g., Salesforce, Microsoft, ServiceMax). High investment in smart infrastructure and the early maturation of IoT ecosystems ensure sustained demand for advanced FSM solutions, particularly those offering AI-driven predictive capabilities and complex enterprise integrations.

- Europe: Characterized by mature markets and stringent regulatory requirements, particularly regarding worker safety and data privacy (GDPR). Growth is steady, fueled by the modernization of aging infrastructure in Western Europe and strong adoption in the manufacturing and energy sectors. Emphasis is placed on FSM systems that offer sophisticated compliance tracking and localized support, ensuring adherence to regional labor laws and environmental standards.

- Asia Pacific (APAC): Projected to be the fastest-growing region, owing to rapid industrialization, massive infrastructure projects (e.g., smart cities in China and India), and burgeoning populations requiring efficient utility and telecom services. Increasing awareness among SMEs about the benefits of SaaS-based FSM, coupled with rising digital spending, is driving exponential growth. Localization and multi-language support are key competitive factors in this diverse market.

- Latin America (LATAM): This region shows promising growth potential, primarily focused on improving operational efficiency in resource-intensive sectors like mining, oil & gas, and telecommunications. Market penetration is moderate but accelerating due to the increased availability of affordable, cloud-based FSM solutions suitable for smaller operational scales, aiming to streamline logistics and reduce operational costs across dispersed field teams.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by mega-projects in construction, infrastructure, and oil & gas, which require sophisticated asset maintenance and workforce management. Demand is highly focused on robust, scalable solutions capable of managing large expatriate workforces and operating in harsh environmental conditions, often prioritizing mobile and satellite communication capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Field Service Management Software Market.- ServiceMax

- Salesforce (Field Service Lightning)

- Oracle

- Microsoft Dynamics 365 Field Service

- SAP

- IFS

- Comarch

- Infor

- ClickSoftware (acquired by Salesforce)

- Accruent

- Geotab

- Trimble

- Verizon Connect

- Coresystems

- Skedulo

- Jobber

- Housecall Pro

- Field Nation

- FSM Solutions

- Praxedo

Frequently Asked Questions

Analyze common user questions about the Field Service Management software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating from on-premise FSM to a cloud-based solution?

The primary benefit of migrating to a cloud-based FSM solution is enhanced scalability, reduced capital expenditure (OpEx over CapEx), and superior accessibility, allowing real-time data synchronization and updates for remote field teams without extensive local IT infrastructure management. Cloud FSM ensures faster deployment and continuous feature updates, improving agility.

How significantly does AI impact technician productivity in Field Service Management?

AI significantly enhances technician productivity by enabling dynamic, optimized scheduling and routing, which minimizes non-productive travel time. Furthermore, AI-powered predictive maintenance reduces emergency call-outs, and integrated AR/AI knowledge tools accelerate diagnosis and increase the first-time fix rate, transforming technician efficiency.

Which industry vertical is showing the fastest growth in FSM software adoption?

The Energy and Utilities sector, alongside the Telecommunications and IT segment, is demonstrating rapid growth in FSM adoption. This acceleration is driven by the necessity to manage large-scale smart meter deployments, complex network maintenance, and geographically extensive infrastructure, all requiring robust scheduling and asset performance monitoring.

What are the key integration points required for a successful FSM implementation?

Successful FSM implementation mandates seamless integration with core enterprise systems, primarily Customer Relationship Management (CRM) platforms for customer history and service contract validation, and Enterprise Resource Planning (ERP) systems for inventory management, asset tracking, and financial reconciliation (invoicing and payroll).

What challenges do Small and Medium Enterprises (SMEs) face when adopting FSM software?

SMEs primarily face challenges related to initial implementation cost, the complexity of migrating existing manual processes, and ensuring adequate training for a small team. They typically seek user-friendly, highly standardized, and affordable SaaS solutions with low maintenance overhead to address these concerns effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager