Filament Dryer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442788 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Filament Dryer Market Size

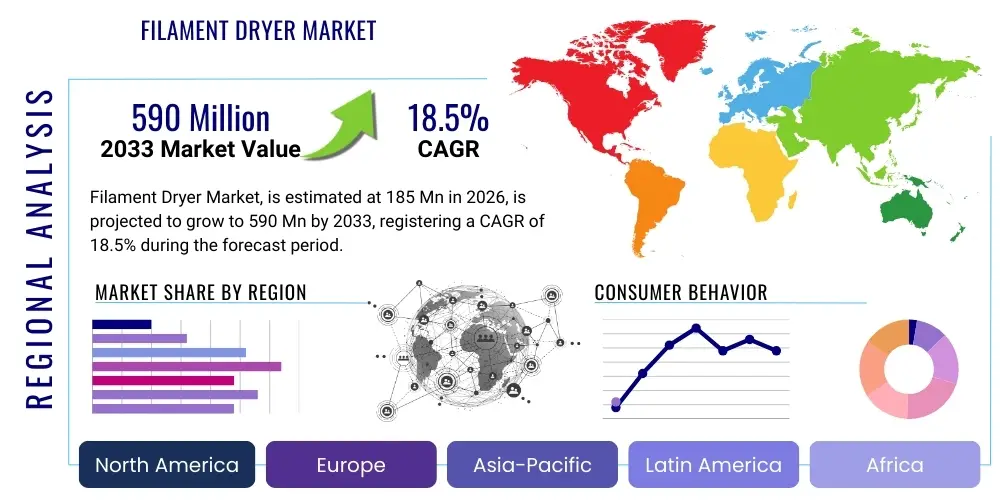

The Filament Dryer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 185 Million in 2026 and is projected to reach USD 590 Million by the end of the forecast period in 2033. This substantial expansion is primarily driven by the escalating adoption of Fused Deposition Modeling (FDM) and other additive manufacturing technologies across industrial and consumer sectors, which inherently require rigorously moisture-controlled materials for successful and dimensionally accurate printing results.

The imperative for high-quality 3D printing results, especially in performance-critical applications like aerospace, automotive, and medical device manufacturing, necessitates advanced filament drying solutions. Moisture contamination in hygroscopic filaments, such as PLA, PETG, Nylon, and ABS, leads to defects like stringing, warping, brittleness, and nozzle clogging, resulting in material wastage and prolonged print times. Consequently, industrial users and professional hobbyists are increasingly investing in sophisticated drying systems that offer precise temperature and humidity control, justifying the robust market valuation predicted for the end of the forecast period.

Filament Dryer Market introduction

The Filament Dryer Market encompasses equipment designed to remove moisture content from thermoplastic filaments used in additive manufacturing processes, predominantly Fused Filament Fabrication (FFF) and Fused Deposition Modeling (FDM). These devices utilize controlled heating and dehumidification technologies, often incorporating desiccant materials or forced air circulation, to bring the filament moisture level down to acceptable standards prior to printing. Major applications span industrial prototyping, end-use parts manufacturing, educational research, and professional desktop 3D printing, ensuring the structural integrity and aesthetic quality of printed objects.

The primary benefits of utilizing filament dryers include significantly enhanced print quality, reduction in costly print failures due optimization of material properties, and extension of filament shelf life. Driving factors for market growth include the global expansion of the 3D printing industry, the increasing complexity and size of printed parts demanding higher material quality, and the introduction of advanced, highly hygroscopic engineering-grade filaments (e.g., Nylon, PC, TPU) that require mandatory drying protocols. The transition from basic passive storage solutions to active, smart drying systems is defining the current market trajectory, emphasizing efficiency and repeatability.

Filament dryers range from small, single-spool desktop units targeted at hobbyists and small businesses to large, industrial-grade drying cabinets capable of handling multiple spools simultaneously or integrated into automated material handling systems. The underlying technology often involves Positive Temperature Coefficient (PTC) heating elements coupled with hygrometer monitoring and specialized desiccant regeneration capabilities, addressing the critical need for precise atmospheric control throughout the printing workflow. This technological sophistication aids in standardizing material preparation, a key requirement for regulated industries adopting additive manufacturing at scale.

Filament Dryer Market Executive Summary

The Filament Dryer Market is experiencing rapid maturation, characterized by strong business trends centered on automation, integration, and specialized material handling. Key business trends include the shift towards integrated drying solutions embedded within 3D printers or material stations, the development of smart dryers offering app connectivity and environmental monitoring, and increased focus on energy efficiency in industrial units. Segment trends highlight robust growth in the industrial segment, driven by manufacturers utilizing large-format FDM printers, and a significant surge in demand for multi-spool capacity dryers to support continuous, high-volume production cycles. Technological innovation focusing on faster drying times and automated desiccant regeneration cycles is a major theme.

Regionally, Asia Pacific (APAC) is emerging as a dominant force, propelled by extensive manufacturing activity, high adoption rates of 3D printing in China and South Korea, and supportive government initiatives for industrial digitalization. North America and Europe maintain strong market shares, primarily due to the high concentration of advanced aerospace, automotive, and medical R&D centers that demand stringent material quality standards, driving the adoption of premium, high-capacity drying units. The competitive landscape is becoming increasingly fractured, with established 3D printing hardware manufacturers entering the accessories market, alongside specialized peripheral companies focusing purely on moisture control solutions. Strategic partnerships between printer OEMs and drying system providers are key to market penetration and product differentiation.

The executive outlook confirms that the market's sustained growth trajectory is insulated by the fundamental material science requirement for dry filaments, making filament dryers an essential, non-negotiable accessory for professional additive manufacturing. Future growth will be significantly influenced by the introduction of new, highly sensitive engineering-grade polymers and the continued decentralization of manufacturing, necessitating reliable, localized moisture management solutions. The market is consolidating around quality, data reporting capabilities, and seamless integration into existing digital manufacturing ecosystems, transforming dryers from simple accessories into critical components of the production workflow.

AI Impact Analysis on Filament Dryer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Filament Dryer Market predominantly revolve around how AI can enhance process control, predictive maintenance, and overall workflow optimization within the 3D printing environment. Users seek to understand if AI can automate the drying parameters (temperature, time) based on real-time filament moisture levels and atmospheric conditions, thereby eliminating human error and maximizing material preparation efficiency. Key themes include the implementation of AI-driven sensor fusion for hyper-accurate moisture monitoring, predictive algorithms to forecast drying requirements based on material history and environment, and integration into broader manufacturing execution systems (MES) for quality assurance reporting. The core concern is realizing a truly autonomous, closed-loop material management system that guarantees optimal filament dryness without manual intervention.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze heating element performance, desiccant saturation rates, and motor usage, predicting potential failure points before they impact production schedules.

- Automated Parameter Optimization: AI models adjusting drying temperature and duration dynamically based on input parameters (filament type, initial measured moisture content, ambient humidity) to minimize drying time while preventing material degradation (e.g., glass transition temperature overshoot).

- Quality Assurance Reporting: Implementing AI to correlate environmental data (temperature, humidity within the dryer) with final print quality metrics, generating immutable quality assurance logs essential for regulated industries like aerospace and medical devices.

- Smart Inventory Management: AI integrated into networked drying cabinets tracks material usage, remaining moisture content, and optimal re-drying cycles, automatically alerting operators or ordering replacement desiccant.

- Energy Efficiency Optimization: AI algorithms determining the minimum required energy input to achieve target moisture levels based on real-time environmental thermal inertia, significantly reducing operational costs for large industrial installations.

- Closed-Loop Drying Systems: AI facilitating communication between the dryer and the 3D printer, ensuring the printer only commences operation when the filament dryness standard is met and maintaining dryness throughout the print via integrated heated chambers.

DRO & Impact Forces Of Filament Dryer Market

The Filament Dryer Market's trajectory is primarily driven by the escalating demand for high-performance engineering plastics in additive manufacturing and the absolute necessity of moisture control to ensure successful utilization of these materials. Restraints include the perception among entry-level users that drying is optional, the initial capital expenditure associated with high-capacity industrial units, and the energy consumption overheads of continuous drying operations. Opportunities are vast, focusing on developing integrated solutions that eliminate manual handling and leverage smart technology for superior material conditioning. These impact forces collectively dictate the adoption rate, moving the dryer from an optional accessory to a critical component of the professional AM workflow, particularly as material costs rise and quality expectations become more stringent.

Drivers: The dominant driver is the expansion of 3D printing into mass customization and high-volume industrial applications where material consistency is paramount. As manufacturers utilize advanced polymers like PEEK, PEI, and carbon fiber composites, which are highly sensitive to moisture, mandatory pre-processing becomes standard. Furthermore, increasing filament costs mean minimizing material waste due to moisture-induced defects provides a clear Return on Investment (ROI) for dryer implementation. The proliferation of desktop FDM printers has also broadened the consumer base, creating a large volume market for smaller, affordable drying units.

Restraints: Significant restraints include market fragmentation regarding product quality and specification clarity, leading to consumer confusion about effective drying methods. For industrial clients, the integration challenge—fitting bulk drying and storage units into existing factory layouts—can be a hurdle. Additionally, less experienced users sometimes attempt rudimentary, ineffective drying methods (e.g., conventional ovens), underestimating the precise temperature and dehumidification control required for effective conditioning, thus delaying the adoption of professional equipment. Price sensitivity in the large hobbyist sector also restricts the uptake of premium, feature-rich smart dryers.

Opportunities: Key opportunities lie in the development of seamlessly integrated material handling systems where drying, storage, and feeding are unified and automated (dry-to-print solutions). The market is poised for growth in specialized dryers tailored for extremely temperature-sensitive or high-performance filaments, offering precise, certified drying profiles. Furthermore, leveraging IoT capabilities to provide real-time material condition monitoring and regulatory compliance reporting (e.g., validating dryness for critical applications) presents a significant value-add opportunity for market leaders.

Segmentation Analysis

The Filament Dryer Market is comprehensively segmented based on technology utilized, capacity capabilities (spool handling), end-user applications, and the type of material compatibility. This segmentation allows for precise market targeting, reflecting the diverse needs spanning from small-scale hobbyist workshops to large industrial additive manufacturing facilities. The primary segmentation dimensions reveal a strong correlation between capacity/technology sophistication and target end-user application, with industrial sectors demanding high-throughput, integrated dehumidification systems, contrasting with the desktop market's preference for cost-effective, smaller footprint solutions focusing on ease of use. Understanding these distinctions is crucial for market participants tailoring their product development and distribution strategies.

The segmentation by Technology highlights the difference between basic heating-only units and advanced active dehumidification dryers. Heating-only dryers rely primarily on elevating temperature to drive moisture out, suitable for less hygroscopic materials or quick maintenance cycles. In contrast, active dehumidification dryers, often using molecular sieves or desiccant regeneration systems, provide a lower dew point and controlled atmosphere, essential for highly sensitive polymers like Nylon or Polycarbonate. The industrial segment overwhelmingly favors active dehumidification due to its efficacy and ability to maintain consistent, low-humidity environments over extended periods required for production reliability.

Furthermore, segmentation by Capacity (Single Spool, Multi-Spool/Industrial Cabinet) illustrates the transition from individual user needs to production requirements. Multi-spool dryers (typically 4+ spools) are critical for industrial users running large or continuous prints requiring material changes without interruption, ensuring a constant supply of conditioned filament. The increasing adoption of automated material handling and robotic integration in 3D printing factories is further driving demand specifically for modular, high-capacity industrial drying cabinets that can integrate seamlessly with automated guided vehicles (AGVs) and central material repositories.

- By Type of Technology:

- Active Dehumidification Dryers (Desiccant-Based)

- Heating-Only Dryers (Convection/Forced Air)

- Vacuum Drying Systems (Niche Industrial Applications)

- By Capacity:

- Single Spool Dryers

- Dual Spool Dryers

- Multi-Spool Cabinet Dryers (4+ Spools)

- By End-User:

- Industrial and Manufacturing

- Desktop/Professional Hobbyists

- Education and Research Institutions

- Service Bureaus and Print Farms

- By Material Compatibility:

- Standard Polymers (PLA, ABS, PETG)

- Engineering Polymers (Nylon, PC, TPU)

- High-Performance Polymers (PEEK, PEI, PSU)

Value Chain Analysis For Filament Dryer Market

The value chain for the Filament Dryer Market begins with upstream suppliers providing critical components such as heating elements (PTC ceramics or specialized resistance wire), humidity sensors (hygrometers), desiccant materials (e.g., molecular sieve, silica gel), and microcontrollers/PCB components for smart functionality. Key upstream risks involve securing a stable supply of high-precision sensors and ensuring the long-term efficacy and regeneration capability of desiccant materials. Efficiency gains at this stage often revolve around developing more energy-efficient heating and dehumidification modules, which directly influence the final product’s operational cost and market appeal. Collaboration with specialized sensor manufacturers is crucial for achieving the necessary measurement accuracy required for high-end applications.

Midstream activities involve the design, assembly, and integration of these components into the final dryer unit. Manufacturing processes range from small-scale electronics assembly for desktop units to complex sheet metal fabrication and thermal engineering for large industrial cabinets. Differentiation at this stage is achieved through proprietary thermal management systems, advanced firmware for smart monitoring, and ergonomic design suitable for industrial environments. The manufacturing segment requires rigorous quality control, particularly for thermal stability and internal atmosphere consistency, which directly impacts the filament quality delivered to the 3D printer.

Downstream activities include distribution, sales, and post-sale support. Distribution channels are bifurcated: Direct channels are common for high-value industrial cabinets sold through specialized additive manufacturing solutions providers, offering installation and integration services. Indirect channels, primarily e-commerce platforms, dedicated 3D printing retailers, and global distributors, handle the high-volume sales of desktop and dual-spool units. Potential customers, ranging from individual engineers to large OEMs, prioritize reliability, validated performance data, and comprehensive warranty support, making effective technical support a critical link in the value chain. The influence of digital marketing and direct-to-consumer sales for smaller units is substantial, necessitating optimized digital distribution networks.

Filament Dryer Market Potential Customers

Potential customers for filament dryers span the entire spectrum of additive manufacturing users, unified by the requirement for high-quality, defect-free 3D prints. The largest segment of end-users are industrial manufacturers, particularly those in the aerospace, automotive, and consumer electronics sectors, who utilize 3D printing for tooling, jigs, fixtures, and increasingly, end-use parts. These buyers require multi-spool capacity, continuous operation capability, and data logging for regulatory compliance, viewing the dryer as an essential part of their material preparation and quality assurance protocol. Investment decisions are driven by minimizing material waste and maximizing machine uptime.

A rapidly growing customer base includes professional hobbyists, small and medium-sized enterprises (SMEs), and educational institutions. Professional hobbyists and SMEs often use desktop FDM printers to produce prototypes or small batches and demand compact, easy-to-use dual-spool dryers that maintain filament integrity over periods of intermittent use. Educational and research facilities require reliable drying solutions for handling a wide variety of specialized and experimental materials, valuing flexibility and precise temperature control for repeatable scientific experimentation. These segments are more price-sensitive than industrial users but prioritize features like transparent lids for monitoring and intuitive digital controls.

Service bureaus and print farms represent another crucial customer segment. Operating 24/7 with diverse material portfolios, these businesses require modular, high-throughput drying cabinets that can be integrated into automated material handling systems. Their purchasing criteria are centered on maximum uptime, energy efficiency, and the ability to rapidly swap materials while maintaining optimal humidity levels across dozens of printers simultaneously. For these large-scale operations, the filament dryer is a mission-critical infrastructure component, where failure can halt significant portions of the production line.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185 Million |

| Market Forecast in 2033 | USD 590 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Creality, EIBOS, Sunlu, PrintDry, Polymaker, FilaDry, MatterHackers, Ultimaker, Flashforge, MakerBot, Stratasys (through specialized material stations), FilamentSafe, Spool3D, XVICO, Raise3D, BCN3D, Prusa Research, Zortrax, Wanhao, XYZprinting |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Filament Dryer Market Key Technology Landscape

The technology landscape of the Filament Dryer Market is characterized by the convergence of precision heating, advanced humidity sensing, and smart control systems. The predominant technology involves active dehumidification using desiccant wheels or regenerative desiccant beds, typically constructed from materials like molecular sieves or specialized silica gel. These systems operate by continuously cycling the air through a drying agent to achieve extremely low dew points (often below 10% Relative Humidity), which is crucial for effectively extracting bound moisture from highly hygroscopic materials. Recent advancements focus on optimizing the desiccant regeneration process, allowing for continuous, high-efficiency operation without the need for manual desiccant replacement or prolonged downtime, thereby enhancing industrial viability.

Smart technology integration is a major disruptive force. Modern filament dryers incorporate sophisticated microcontrollers, Wi-Fi connectivity, and high-precision temperature and humidity sensors (hygrometers) that provide real-time data monitoring and historical logging. This digital integration facilitates features such as automated drying schedules based on material profiles, remote monitoring via mobile applications, and integration with cloud-based material management platforms. The implementation of Positive Temperature Coefficient (PTC) heating elements is becoming standard due to their self-regulating temperature capabilities, providing a safer and more stable heating environment compared to traditional resistive elements, minimizing the risk of overheating and degrading sensitive filaments.

A burgeoning technological segment involves vacuum drying systems, particularly for ultra-high-performance polymers and high-volume industrial applications. By reducing the ambient pressure, these systems lower the boiling point of water, allowing moisture to be removed efficiently at lower temperatures, preserving the mechanical properties and coloration of sensitive filaments. Although currently niche due to higher cost and complexity, vacuum technology promises the fastest drying times and superior moisture removal efficiency. Future research and development are concentrating on incorporating multi-sensor arrays (e.g., integrating weight sensing with humidity and temperature monitoring) to create truly adaptive, closed-loop drying protocols that guarantee material readiness and significantly improve overall manufacturing consistency.

Regional Highlights

Asia Pacific (APAC) Dominance: The APAC region is poised to dominate the Filament Dryer Market both in terms of volume and growth rate. This accelerated expansion is fundamentally fueled by the region's massive manufacturing ecosystem, particularly in China, South Korea, and Japan, which are rapidly integrating additive manufacturing into their production workflows across automotive, consumer goods, and electronics sectors. The vast number of new professional and desktop 3D printer installations annually creates an immediate and continuous demand for filament management solutions. Furthermore, local manufacturers are aggressively innovating in the low-to-mid capacity dryer segment, making high-quality drying technology more accessible and cost-effective for a broad range of users, thereby driving high adoption rates.

North America (NA) Focus on High-Performance Systems: North America maintains a strong position, characterized by high average selling prices (ASPs) for drying units due to a concentration on advanced industrial applications. The aerospace, defense, and medical device industries in the US and Canada demand highly reliable, validated drying systems compatible with high-performance polymers (e.g., PEEK, Ultem). This drives demand for multi-spool, highly regulated industrial cabinets featuring advanced data logging and regulatory compliance features. Investment here is driven by quality assurance and supply chain resilience rather than purely volume maximization, leading to robust adoption of premium, integrated material handling solutions offered by market leaders.

Europe’s Emphasis on Automation and R&D: Europe represents a mature market characterized by a strong commitment to industry 4.0 principles, driving demand for fully automated, integrated dry-to-print solutions. Countries such as Germany, the UK, and Scandinavia are significant consumers, driven by advanced automotive, engineering, and academic research institutions. European manufacturers prioritize energy efficiency and seamless integration with existing robotic and MES infrastructure. The focus on sustainable manufacturing also encourages the adoption of highly efficient desiccant regeneration systems, minimizing the operational environmental footprint. This region acts as a key innovation hub, often pioneering the standardization of material preparation protocols.

Latin America (LATAM) and Middle East & Africa (MEA) Emerging Markets: While currently smaller in market share, LATAM and MEA present high potential growth areas. LATAM's growth is driven by increasing industrialization and adoption of 3D printing in educational and small manufacturing sectors in countries like Brazil and Mexico, leading to demand for mid-range, affordable drying solutions. The MEA region, particularly the UAE and Saudi Arabia, is investing heavily in digitalization and technology infrastructure, spurring the creation of specialized additive manufacturing hubs. This investment activity is creating targeted demand for robust, high-capacity dryers capable of operating reliably in high-ambient temperature and humidity environments, requiring tailored thermal engineering solutions.

- North America: Leads in adoption of high-performance, validated drying systems for aerospace and medical applications; high ASPs.

- Asia Pacific (APAC): Highest growth rate and volume; driven by mass manufacturing and accessibility of consumer-grade units (China, South Korea).

- Europe: Strong emphasis on Industry 4.0 integration, automation, and energy efficiency across advanced engineering sectors.

- Latin America and MEA: Emerging markets characterized by increasing educational and localized industrial adoption, focused on essential, reliable drying technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Filament Dryer Market.- Creality

- EIBOS

- Sunlu

- PrintDry

- Polymaker

- FilaDry

- MatterHackers

- Ultimaker

- Flashforge

- MakerBot

- Stratasys (Material Stations division)

- FilamentSafe

- Spool3D

- XVICO

- Raise3D

- BCN3D

- Prusa Research

- Zortrax

- Wanhao

- XYZprinting

Frequently Asked Questions

Analyze common user questions about the Filament Dryer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most crucial benefit of using a filament dryer in FDM 3D printing?

The most crucial benefit is the prevention of print defects such as stringing, bubbling, and weak layer adhesion caused by moisture absorption in hygroscopic filaments (e.g., Nylon, PETG, PLA), thereby ensuring high-quality, mechanically sound final parts and significantly reducing material waste.

How do active dehumidification dryers differ from basic heating-only models?

Active dehumidification dryers utilize desiccant materials (often regenerative) to actively maintain a low dew point environment (low relative humidity), effectively drawing moisture out of the filament, which is essential for engineering-grade materials. Heating-only models rely solely on heat and ambient air circulation, offering less precise moisture control.

Which filament materials absolutely require pre-drying before use?

Highly hygroscopic engineering-grade filaments require mandatory drying, including Nylon (PA), Polycarbonate (PC), Polyurethane (TPU/TPE), PETG, and high-performance materials like PEEK and PEI. Even PLA and ABS benefit significantly from drying, especially when stored for extended periods.

What technological advancements are driving the growth of the industrial dryer segment?

Industrial growth is driven by the integration of IoT and smart monitoring, which allows for automated drying profiles, real-time data logging for quality assurance, automated desiccant regeneration, and seamless integration into automated material handling systems (dry-to-print workflow).

Is it more cost-effective for an industrial print farm to invest in bulk drying cabinets or individual spool dryers?

For industrial print farms, bulk, multi-spool drying cabinets or integrated material management systems are significantly more cost-effective due to higher throughput, better energy efficiency per spool, centralized control, and reduced manual handling, optimizing operational efficiency and material logistics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager