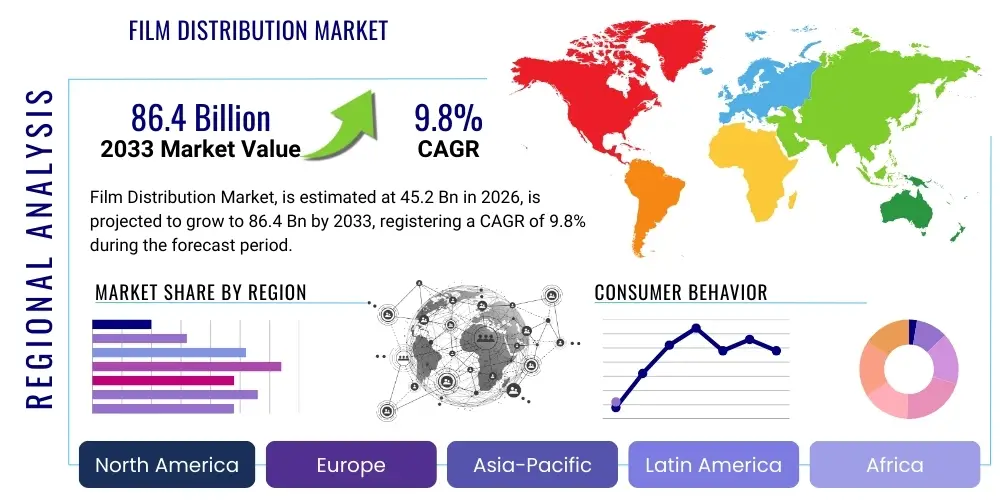

Film Distribution Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443444 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Film Distribution Market Size

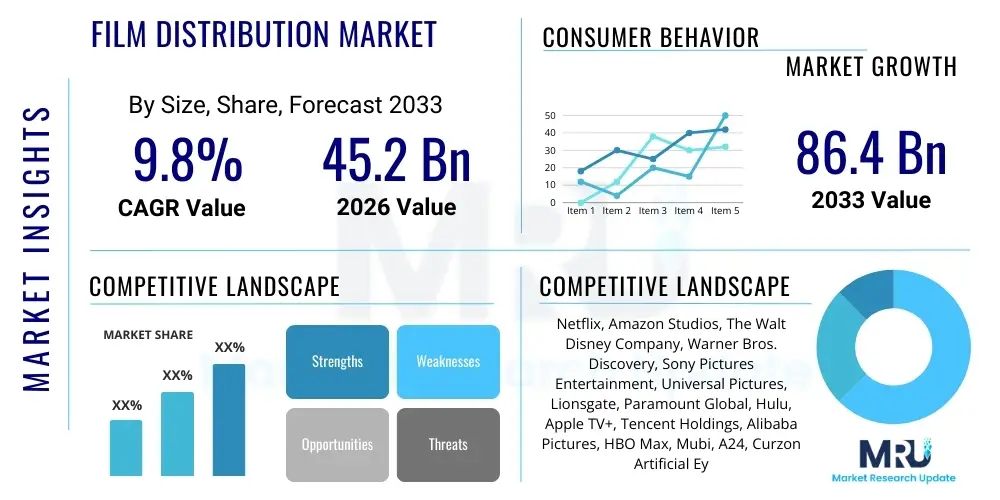

The Film Distribution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 86.4 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the accelerated penetration of digital streaming services (SVOD, AVOD, and FAST channels) across emerging economies, coupled with significant investments in original content creation by major media conglomerates. The valuation reflects the total revenue generated from licensing, theatrical exhibition, home entertainment, and television rights sales globally.

The transition from traditional theatrical windowing models to flexible release strategies, including Premium Video on Demand (PVOD), has redefined revenue streams and accelerated monetization timelines. While theatrical revenue remains crucial for blockbuster titles, the sustained growth trajectory is underpinned by the predictable, recurring subscription revenue generated by global Over-The-Top (OTT) platforms. Market expansion is also facilitated by technological advancements in anti-piracy solutions and the improved quality of digital delivery infrastructure, ensuring high-fidelity viewing experiences across diverse consumer devices globally.

Film Distribution Market introduction

The Film Distribution Market encompasses the complex processes and mechanisms by which completed motion pictures are delivered to consumers worldwide, spanning contractual negotiations, marketing execution, physical logistics, and digital delivery. Traditionally centered around the strict sequential windowing system—theatrical release, followed by home video, and then television broadcast—the market has undergone a radical transformation due to the ubiquitous adoption of high-speed internet and the proliferation of powerful digital platforms. This sector acts as the critical bridge between content creators (production studios) and global audiences, managing copyright, ensuring regulatory compliance, and maximizing revenue realization across multiple territories and formats.

The core product within this market is the licensing and exhibition rights of cinematic content. Major applications include direct-to-consumer streaming (Netflix, Disney+), theatrical exhibition (cinemas), pay-per-view (TVOD/PVOD), and broadcast licensing (cable and satellite networks). The primary benefits of an efficient distribution system include optimized content monetization through targeted audience reach, enhanced copyright protection via Digital Rights Management (DRM) technologies, and streamlined international market access. Driving factors for the current market acceleration include the fierce global competition among OTT giants requiring massive content libraries, increasing consumer demand for personalized viewing experiences, and technological infrastructure improvements facilitating 4K/HDR delivery to billions of devices globally.

Furthermore, the market's dynamics are intensely competitive, driven by the constant need for exclusive or "first window" content to attract and retain subscribers. The strategic integration of production and distribution capabilities, often seen in major studios like Disney and Warner Bros. Discovery, optimizes content flow and minimizes third-party dependency. The continuous evolution of consumer habits towards mobile and on-demand consumption necessitates agile distribution strategies that can adapt quickly to territorial restrictions and evolving regulatory landscapes, particularly concerning censorship and local content quotas.

Film Distribution Market Executive Summary

The Film Distribution Market is characterized by a significant structural shift away from legacy linear distribution models towards fragmented, non-linear digital delivery, positioning digital platforms as the dominant revenue stream generator. Business trends indicate a strong move toward vertical integration, where content creators are increasingly bypassing traditional middlemen (aggregators and sub-distributors) to launch proprietary Direct-to-Consumer (D2C) platforms, maximizing control over data and revenue capture. This consolidation is fostering 'streaming wars,' driving unprecedented investment in high-quality, exclusive intellectual property (IP), which, in turn, fuels the demand for robust global distribution networks capable of handling simultaneous worldwide releases.

Regional trends highlight the Asia Pacific (APAC) region, particularly China and India, as the primary growth engine, fueled by explosive mobile broadband adoption and a massive, underserved population rapidly embracing digital consumption habits. While North America and Europe remain high-value markets, characterized by high Average Revenue Per User (ARPU) and mature streaming ecosystems, APAC represents the highest volume opportunity for subscriber acquisition and content localization. Regulatory complexities, particularly in Europe (mandating local content investment) and in specific Asian nations (strict censorship), necessitate tailored distribution strategies for regional success.

Segmentation trends confirm the overwhelming dominance of the Digital Platform segment, specifically Subscription Video On Demand (SVOD), which commands the largest share of overall distribution revenue. Theatrical distribution, although recovering post-pandemic, has become increasingly polarized, focusing almost exclusively on high-budget tentpole films. Concurrently, the rise of free, ad-supported streaming television (FAST) channels represents a burgeoning trend, monetizing long-tail library content and offering consumers a zero-cost access point, thereby diversifying revenue beyond pure subscription models and catering to price-sensitive demographics worldwide.

AI Impact Analysis on Film Distribution Market

Common user inquiries regarding AI in film distribution center primarily on three areas: optimizing audience reach, mitigating financial risk associated with content investment, and enhancing operational efficiencies. Users frequently ask, "How can AI predict box office success or streaming viewership?", "Is AI used to fight global content piracy?", and "Can AI personalize movie marketing campaigns to individual viewers?". The prevailing concern is whether AI tools will lead to homogenization of creative content, prioritizing data-driven formulas over artistic risk. Conversely, users expect AI to solve the complex logistical challenge of distributing hundreds of thousands of hours of content globally, focusing on automated localization (subtitling, dubbing) and dynamic pricing models.

The implementation of predictive analytics, powered by sophisticated AI algorithms, is fundamentally transforming the greenlighting and distribution scheduling processes. These systems analyze historical performance data, social media sentiment, demographic viewing patterns, and competitive release calendars to forecast optimal release windows, maximizing revenue potential across various windows (theatrical, PVOD, SVOD). This data-driven approach significantly reduces the inherent financial volatility of content investments, providing studios with quantified risk assessments before committing to massive marketing spends. AI also plays a crucial role in content discovery, ensuring that platform algorithms effectively surface relevant titles to individual users, dramatically improving customer retention rates and viewing hours.

Furthermore, AI is instrumental in fortifying the content supply chain against piracy and ensuring compliance with complex rights management agreements. Machine learning models are trained to identify and automatically flag illegal uploads across global file-sharing and streaming sites, enabling rapid takedowns and protecting intellectual property integrity. Operationally, AI streamlines post-production distribution tasks, such as automated metadata generation, dynamic bitrate adjustment for various network conditions, and efficient quality control checks on localized versions, drastically reducing the time required to bring content to market simultaneously across multiple international territories.

- AI-powered Predictive Analytics: Forecasting content performance (box office, streaming views) to optimize greenlighting decisions and release timing.

- Automated Marketing Segmentation: Utilizing machine learning to target trailer promotion and digital advertising based on highly granular viewer demographics and past consumption behavior.

- Dynamic Pricing and Windowing: Implementing algorithms to adjust PVOD rental prices or subscription tiers based on regional demand elasticity and competitive positioning.

- Piracy Mitigation and DRM Enforcement: AI systems continuously scan the dark web and unauthorized platforms, facilitating automated detection and takedown of illegal copies.

- Localization and Accessibility Enhancement: Automated subtitling, quality-controlled dubbing synchronization, and creation of descriptive audio tracks, enabling faster global market entry.

DRO & Impact Forces Of Film Distribution Market

The Film Distribution Market is powerfully shaped by the synergy between technological advancements and evolving consumer behavior, summarized by key Drivers, Restraints, and Opportunities. The primary drivers revolve around the continuous expansion of high-speed global broadband infrastructure and the intense, capital-heavy competition known as the 'Streaming Wars,' forcing rapid international expansion and content acquisition. Restraints primarily include the persistent challenge of digital piracy, leading to significant revenue leakage, and the escalating cost of producing high-quality content necessary to compete in the crowded digital space. Opportunities emerge from underserved segments, such as highly localized niche content demand, the potential for decentralized Web3 distribution models, and the monetization of secondary windows through Ad-Supported Video On Demand (AVOD) and Free Ad-Supported Streaming Television (FAST).

Key drivers include the ubiquitous adoption of smart devices and the shift to mobile-first consumption patterns in emerging markets, dramatically increasing the addressable audience for digital distribution. Furthermore, the regulatory pressures in established markets like the EU and Canada, mandating local content investment and ensuring cultural diversity, force global distributors to broaden their content sourcing strategies, creating market opportunities for local producers and distributors. The technical impact force of 5G network deployment enables seamless, high-definition streaming on the go, further cementing the consumer preference for instantaneous, non-linear access, thereby reinforcing the dominance of digital platforms over scheduled broadcasting.

Conversely, significant friction points act as restraining forces. The fragmentation of content ownership, where consumers often require multiple subscriptions to access desired content, leads to subscription fatigue and encourages a return to illicit downloading (piracy). The rising regulatory scrutiny over market dominance and data privacy (GDPR, CCPA) imposes high compliance costs on global distributors. The ongoing structural shifts resulting from the COVID-19 pandemic, which permanently altered the traditional 90-day theatrical window, represent a fundamental impact force, demanding permanent flexibility and hybrid distribution strategies for major studios moving forward.

Segmentation Analysis

The Film Distribution Market is comprehensively segmented based on the mechanism through which content is delivered to the end-user, the technology utilized for delivery, the revenue model applied, and the geographic region of consumption. The most critical differentiation lies between the traditional theatrical segment, which commands high initial revenue and cultural impact, and the multifaceted digital segment, which provides long-tail monetization and reliable, recurring revenue streams. Understanding these segment dynamics is vital for studios to allocate marketing budgets and define optimal release strategies that maximize global return on investment (ROI) across the entire content lifecycle, from initial release through library monetization.

The complexity of modern film distribution necessitates granular segmentation, particularly within the digital space, where sub-segments like Transactional Video On Demand (TVOD), Premium Video On Demand (PVOD), and Advertising-Supported Video On Demand (AVOD) each serve distinct consumer needs and pricing sensitivities. PVOD, for instance, targets early adopters willing to pay a premium to bypass the theatrical window, while AVOD leverages mass market reach through free, ad-supported viewing. This intricate segmentation allows market players to optimize their content portfolios for diverse consumer demographics globally, ensuring every piece of content—from blockbuster to classic library title—has a tailored monetization path.

- By Platform:

- Theatrical Distribution (Cinemas)

- Digital Distribution (OTT Platforms, Internet)

- Television Distribution (Broadcast, Cable, Satellite)

- Ancillary Markets (Airlines, Educational Institutions, Physical Media)

- By Digital Model:

- Subscription Video On Demand (SVOD)

- Advertising Video On Demand (AVOD)

- Transactional Video On Demand (TVOD)

- Premium Video On Demand (PVOD)

- By Genre:

- Action & Adventure

- Comedy

- Drama & Romance

- Horror & Thriller

- Documentary & Educational

- Animation & Family

- By End-User:

- Individual Consumers

- Commercial Users (Airlines, Hotels)

Value Chain Analysis For Film Distribution Market

The Film Distribution Value Chain commences upstream with content creation and production, where intellectual property (IP) is generated and financed. The initial upstream phase involves securing talent, developing the script, and filming the content, often requiring massive capital outlay managed by major studios or independent production houses. Once content is completed, the critical first distribution step involves securing licensing agreements—the rights holder (studio/producer) licenses exhibition and broadcast rights to distributors for specific territories and defined time windows. Aggregators often play an intermediary role, especially for independent filmmakers, preparing content metadata, ensuring technical compliance, and delivering the finalized digital files to major downstream platforms.

The midstream phase focuses on core distribution activities: strategic planning (windowing), marketing and promotion, and content preparation (localization, subtitles, compliance checks). Distribution channels are bifurcated into direct and indirect models. Direct distribution is exemplified by vertically integrated studios (e.g., Disney+ distributing Disney content directly to consumers), offering maximum control over pricing, data, and branding. Indirect distribution involves licensing content to third-party exhibitors (cinemas) or platforms (Netflix, Amazon Prime Video), where the distributor receives licensing fees or profit splits based on performance.

The downstream segment represents the final consumption points, primarily consisting of Theatrical Exhibition (multiplexes), Digital Streaming Platforms (SVOD/AVOD), and Broadcast Networks. Revenue realization is finalized here, with complex royalty and revenue-sharing mechanisms governing the flow of funds back up the chain to the content owner. The efficiency of the downstream relies heavily on robust cloud delivery networks and reliable Digital Rights Management (DRM) systems to ensure secure, high-quality delivery to global audiences, thus completing the value loop from creation to consumption and monetization.

Film Distribution Market Potential Customers

Potential customers for film distribution services and content licensing are highly diverse, spanning both large institutional entities and direct individual consumers, dependent upon the specific distribution window and revenue model employed. The primary B2B customers are global Over-The-Top (OTT) streaming platforms, which continuously require vast libraries of licensed and original content to sustain subscriber engagement and competitive advantage. Secondly, traditional Theatrical Exhibitors, ranging from large multinational cinema chains to independent local theaters, represent the crucial initial customer base for blockbuster content, driving high initial box office revenues and setting the stage for subsequent window monetization.

Furthermore, major Telecommunications and Cable/Satellite Operators remain vital customers, particularly in regions where fixed-line broadcasting still holds significant market share, purchasing licensing rights for linear television broadcast, and often bundling OTT services with their internet packages. The ancillary market segment includes customers such as International Airlines, which license films for in-flight entertainment systems, and institutional buyers like educational bodies, which license documentaries and educational films. These customers require specialized licensing terms and often utilize complex distribution protocols optimized for their unique operating environments.

Ultimately, the largest volume of potential customers is the global base of individual consumers who engage with content through various transactional models. This includes paying subscribers (SVOD), renters/buyers (TVOD/PVOD), and ad-supported viewers (AVOD/FAST). Distribution strategies are increasingly tailored to address the micro-segments within this mass audience, utilizing localized marketing and platform customization to maximize reach and revenue capture across differing economic strata and technological access points worldwide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 86.4 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Netflix, Amazon Studios, The Walt Disney Company, Warner Bros. Discovery, Sony Pictures Entertainment, Universal Pictures, Lionsgate, Paramount Global, Hulu, Apple TV+, Tencent Holdings, Alibaba Pictures, HBO Max, Mubi, A24, Curzon Artificial Eye, Studiocanal, CJ ENM, Eros STX Global Corporation, Reliance Entertainment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Film Distribution Market Key Technology Landscape

The foundational technology driving the modern Film Distribution Market is the robust ecosystem of Cloud Computing and Content Delivery Networks (CDNs). Cloud platforms (AWS, Azure, Google Cloud) provide scalable storage solutions essential for managing petabytes of high-resolution digital masters and localized content versions, while CDNs are crucial for ensuring low-latency, high-speed delivery of streamed video to billions of global endpoints simultaneously, even during peak usage periods. These infrastructure technologies enable the core D2C streaming model, allowing platforms to scale rapidly without physical infrastructure limitations and drastically reducing the time-to-market for new releases across international boundaries.

Digital Rights Management (DRM) remains a critical technological pillar, implementing encryption and access control mechanisms to protect copyrighted content from unauthorized copying and sharing. Advanced DRM solutions are constantly evolving to counter sophisticated piracy threats, integrating features like secure hardware playback and forensic watermarking, which helps track the source of any leak. Simultaneously, the adoption of Advanced Data Analytics and Machine Learning (ML) platforms provides distributors with powerful tools to analyze complex viewer data, optimize content metadata for better discoverability, and predict consumer churn, thereby informing strategic content investment and retention strategies across various regional markets.

Emerging technologies like Blockchain are starting to gain traction, particularly in streamlining the complex process of rights management and royalty payments. By offering a transparent, immutable ledger of licensing agreements and usage metrics, blockchain technology has the potential to drastically reduce friction, disputes, and administrative costs associated with calculating residual payments to numerous creative participants across global territories. Furthermore, the shift to cloud-based post-production workflows (e.g., remote color grading and editing) enables faster finalization and distribution of content masters, minimizing logistical bottlenecks and accelerating global release synchronization.

Regional Highlights

Regional dynamics play an instrumental role in shaping distribution strategies, necessitating tailored approaches due to variations in broadband penetration, regulatory environments, local content preference, and disposable income influencing subscription rates. North America (NA) represents the most mature market, characterized by saturation in SVOD services and high consumer willingness to pay for premium content, making it a critical market for initial blockbuster revenue and high-ARPU generation. Distribution strategies here focus on managing content windows effectively and leveraging PVOD models to capture immediate high-value returns.

Europe presents a complex patchwork of national markets, heavily influenced by strict regulatory quotas requiring investment in locally produced content and rigorous enforcement of data privacy laws (GDPR). Distribution success in Europe demands meticulous localization across dozens of languages and adherence to fragmented legal frameworks, but offers a sophisticated consumer base accustomed to high-quality cinematic and serial content. The rise of strong regional players, often supported by government mandates, challenges the dominance of US giants.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by massive, untapped markets like India and Southeast Asia, where mobile-first viewing and low-cost AVOD/FAST models are gaining rapid momentum. Distribution in APAC requires extreme scalability, focusing on low-cost data consumption optimization, partnering with local telcos for bundle deals, and investing heavily in hyper-localized content that resonates deeply with diverse cultural groups within the region.

- North America (NA): Market maturity, highest ARPU, focus on hybrid windowing (theatrical/PVOD), and fierce competition among established D2C platforms.

- Europe: Highly regulated environment, demand for local language content (Quotas), segmentation challenges due to linguistic and national boundaries, strong growth in localized SVOD platforms.

- Asia Pacific (APAC): Explosive subscriber growth driven by mobile broadband, lower ARPU necessitating AVOD/FAST monetization strategies, key growth hubs include China, India, and Indonesia.

- Latin America (LATAM): High digital adoption and rising disposable income, significant piracy challenges, strong demand for US content balanced by vibrant local production industries.

- Middle East and Africa (MEA): Rapid development of digital infrastructure in the Gulf Cooperation Council (GCC) states, unique content censorship requirements, emerging opportunities for international content licensing and localized platform development in South Africa and Nigeria (Nollywood).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Film Distribution Market.- Netflix

- Amazon Studios

- The Walt Disney Company

- Warner Bros. Discovery

- Sony Pictures Entertainment

- Universal Pictures

- Lionsgate

- Paramount Global

- Hulu

- Apple TV+

- Tencent Holdings

- Alibaba Pictures

- HBO Max

- Mubi

- A24

- Curzon Artificial Eye

- Studiocanal

- CJ ENM

- Eros STX Global Corporation

- Reliance Entertainment

Frequently Asked Questions

Analyze common user questions about the Film Distribution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current standard timeline for film distribution windows?

The traditional 90-day theatrical window is now largely obsolete; major studios utilize flexible, hybrid windowing strategies. Blockbusters may see theatrical runs ranging from 17 to 45 days before transitioning to PVOD or SVOD, reflecting increased prioritization of digital monetization.

How has the rise of SVOD platforms fundamentally changed the distribution market structure?

SVOD platforms have restructured the market by prioritizing direct-to-consumer delivery, bypassing traditional distributors, and shifting the revenue model from transactional (tickets/rentals) to recurring subscription revenue, increasing demand for continuous original content supply.

What role does Digital Rights Management (DRM) play in international film distribution?

DRM is essential for securing copyrighted content across territories. It employs encryption and access control to ensure that only authorized platforms and users can view content, preventing unauthorized copying and enforcing specific licensing terms globally.

Which geographical region is expected to drive the highest growth in the film distribution market?

The Asia Pacific (APAC) region, driven by countries like India and Southeast Asia, is projected to be the fastest-growing market segment. This growth is primarily attributed to rapidly increasing smartphone penetration and expansion of low-cost mobile internet infrastructure facilitating digital consumption.

Are traditional theatrical releases still financially viable compared to digital releases?

Yes, theatrical releases remain crucial for branding and initial revenue generation, particularly for high-budget blockbusters. A successful theatrical run drives cultural impact and significantly increases the value of content in subsequent digital windows and ancillary markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager