Fin Pipes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442300 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Fin Pipes Market Size

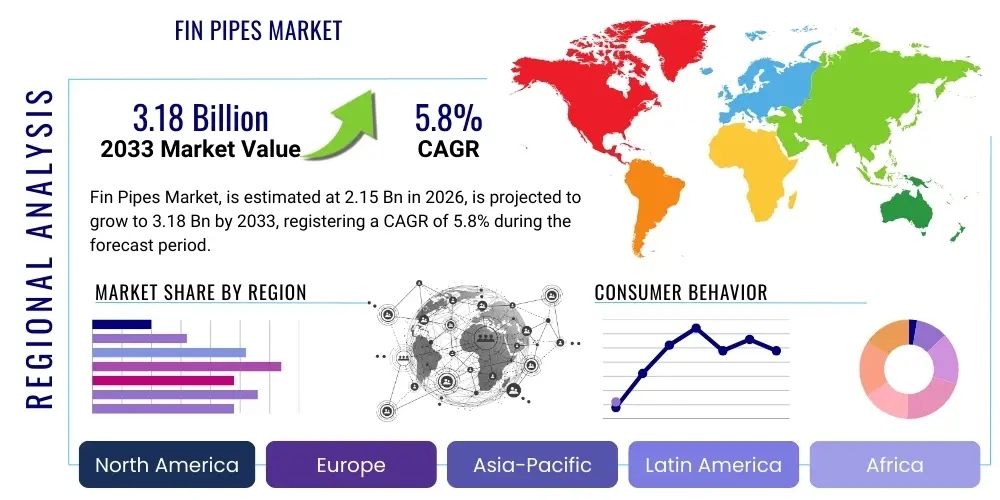

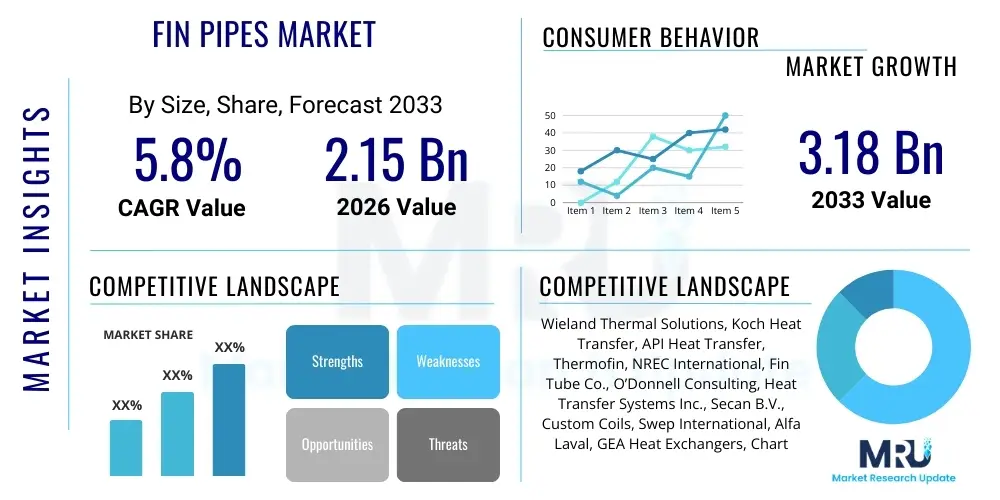

The Fin Pipes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.18 Billion by the end of the forecast period in 2033.

Fin Pipes Market introduction

The Fin Pipes Market encompasses the manufacturing, distribution, and utilization of heat exchanger components characterized by external extensions, known as fins, which significantly increase the surface area available for heat transfer between two fluids. These specialized tubes are integral components in various industrial applications where efficient thermal exchange is paramount, ranging from large-scale power generation facilities to precision HVAC systems and complex petrochemical processing units. The fundamental purpose of fin pipes is to maximize thermal efficiency, thereby reducing energy consumption and operational costs associated with heating or cooling processes. Advances in metallurgy and manufacturing techniques, particularly high-frequency resistance welding and extrusion methods, have led to enhanced durability and performance characteristics, making fin pipes indispensable across critical infrastructure sectors.

Product descriptions vary widely based on the fin type, material composition, and application requirements. Extruded fin tubes offer superior resistance to atmospheric corrosion and mechanical handling, frequently utilized in air-cooled heat exchangers (ACHEs) within oil and gas operations. Alternatively, L-footed, G-embedded, and helically wound fin pipes cater to specific operational environments, providing tailored solutions for high-pressure or high-temperature applications. Major applications include process heaters, economizers, fluid coolers, condensers, and evaporators. The continuous need for efficiency improvements and regulatory pressures demanding lower carbon footprints are cementing the role of advanced fin pipe designs in achieving sustainable industrial operations globally. This robust demand is underpinned by the increasing complexity of industrial heat recovery systems and the need to manage thermal processes optimally across different climatic zones.

The core benefits derived from employing fin pipes involve significant space saving due to their compactness, substantial improvement in overall heat transfer coefficients compared to bare tubes, and extended operational lifespans when constructed from corrosion-resistant materials like stainless steel and specialized alloys. Driving factors include the ongoing global expansion of the petrochemical and refining industries, which require high-capacity heat exchangers; the necessity for waste heat recovery systems in industrial processes to meet energy efficiency standards; and the surging demand for reliable cooling solutions in modern power plants, particularly combined cycle gas turbines (CCGT). Furthermore, technological innovations in material science allowing for thinner fins and higher fin density without compromising structural integrity are continually enhancing the market's growth trajectory and product adoption rates worldwide.

Fin Pipes Market Executive Summary

The Fin Pipes Market is currently experiencing robust growth driven primarily by surging infrastructure investments in developing economies and the mandated replacement of aging industrial equipment in mature markets. Key business trends indicate a definitive shift toward modular and customized heat exchange solutions, particularly high-density fin configurations and advanced alloy materials designed to withstand harsh operating conditions such as fouling and high temperature differentials prevalent in chemical and power sectors. Manufacturers are focusing heavily on integrating automation into finning processes to improve yield rates and precision, ensuring tighter tolerances are met for critical applications. Furthermore, the trend of outsourcing complex heat exchanger fabrication is bolstering growth for specialized fin pipe suppliers who can guarantee material traceability and compliance with stringent international standards like ASME and TEMA, positioning compliance and certification as critical competitive advantages within the sector.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure projects, rapid industrialization, and substantial investments in new refinery and power generation capacity, notably in China, India, and Southeast Asian nations. North America and Europe, while being mature markets, are maintaining stable demand driven by maintenance, repair, and overhaul (MRO) activities and the implementation of energy transition projects, focusing on highly efficient waste heat recovery systems and thermal management for renewable energy auxiliary equipment. Regulatory frameworks favoring energy efficiency in the EU and emission reduction mandates in North America are forcing industrial operators to upgrade legacy heat exchangers, thereby creating consistent replacement demand for high-performance fin pipes. Latin America and the Middle East & Africa (MEA) are also emerging as significant markets due to expansion in oil and gas infrastructure and large-scale desalination projects requiring robust cooling and heating elements.

Segment trends reveal that the Extruded Fin Pipe segment dominates the market due to its superior mechanical bond and durability, making it preferred in environments subject to thermal cycling and external corrosion. However, the Welded Fin Pipe segment, particularly high-frequency welded spiral fins, is gaining rapid traction across high-temperature applications like waste heat boilers and incinerators due to its excellent thermal conductivity and structural integrity at extreme pressures. Application-wise, the Power Generation segment remains the largest consumer, necessitated by the global reliance on thermal power plants and the concurrent shift towards maximizing efficiency in these facilities. Material trends show a growing preference for specialty alloys over traditional carbon steel in corrosive chemical and marine environments, reflecting industry efforts to extend equipment life and minimize downtime associated with material failure.

AI Impact Analysis on Fin Pipes Market

User queries regarding the intersection of AI and the Fin Pipes Market predominantly revolve around optimizing manufacturing processes, predictive maintenance of heat exchange units, and enhancing the design phase for thermal efficiency. Common questions address how AI can reduce material waste in fin extrusion, whether machine learning models can accurately predict fouling rates in high-density fin packs, and the feasibility of autonomous quality control systems detecting microscopic flaws in fin-to-tube bonds. The overarching themes reflect industry expectations for AI to deliver quantifiable improvements in operational efficiency (OEE), minimize unexpected failures in critical applications, and accelerate the development cycle for next-generation, high-performance finned tube heat exchangers. Concerns often center on the initial cost of integrating AI infrastructure and the need for specialized data scientists capable of translating complex thermal data into actionable manufacturing insights.

AI is already beginning to influence the fin pipe sector by enabling predictive maintenance routines far superior to traditional scheduled checks. By processing real-time sensor data—including vibration analysis, flow rates, and temperature distribution across heat exchanger bundles—machine learning algorithms can precisely anticipate the onset of degradation phenomena such as fouling, scaling, or erosion on the fin surface. This proactive capability allows industrial operators to schedule cleaning or replacement only when necessary, maximizing operational uptime and significantly extending the effective lifespan of the fin pipe assets. Furthermore, AI-driven computational fluid dynamics (CFD) modeling is dramatically reducing the iteration time for fin geometry optimization, allowing engineers to simulate thousands of design variations to identify the perfect balance between pressure drop minimization and heat transfer maximization for specific fluid characteristics and operational pressures, resulting in energy savings.

- AI optimizes fin manufacturing by reducing material trim waste and calibrating machinery based on real-time quality metrics.

- Machine learning algorithms predict fin fouling and corrosion rates, enabling precise, condition-based maintenance schedules.

- AI-enhanced visual inspection systems automate quality control, detecting micro-cracks and imperfections in fin welds with high accuracy.

- Generative design AI explores novel fin geometries (e.g., wavy, segmented) that surpass traditional designs in thermal efficiency.

- Predictive analytics supports supply chain resilience by forecasting demand for specific fin tube materials and configurations.

DRO & Impact Forces Of Fin Pipes Market

The dynamics of the Fin Pipes Market are heavily influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the critical Impact Forces shaping its trajectory. Key drivers include the global imperative for energy efficiency across all industrial processes, pushing operators toward highly efficient heat transfer solutions. This is significantly compounded by continuous expansion and modernization within the power generation, petrochemical, and HVAC sectors, which are foundational consumers of finned tube products. Restraints primarily involve the inherent vulnerability of finned surfaces to fouling and corrosion, which diminishes thermal performance over time and necessitates costly maintenance, alongside the high initial capital expenditure associated with high-grade materials and specialized manufacturing equipment. However, burgeoning opportunities lie in the development of anti-fouling coatings, the adoption of advanced manufacturing techniques like additive manufacturing for complex fin geometries, and the burgeoning use of fin pipes in niche applications such as thermal energy storage and concentrated solar power (CSP) facilities.

One primary driver stems from the rigorous enforcement of environmental regulations worldwide, particularly concerning industrial emissions and waste heat utilization. Industries are mandated to improve energy recovery rates, leading to increased adoption of economizers and heat recovery steam generators (HRSGs) that heavily rely on advanced fin pipe technologies. The sustained increase in global energy consumption, coupled with aging infrastructure in established markets like North America and Europe, necessitates continuous replacement and upgrade cycles for heat exchangers, providing a stable stream of demand. Furthermore, the structural resilience and inherent thermal advantage of fins, which allow for compact designs, are critical factors in industrial settings where footprint reduction is often a major design criterion. The integration of advanced diagnostics and smart sensor technology into heat exchangers is also driving demand for pipes compatible with these systems, pushing manufacturers to innovate materials and connectivity.

Conversely, the major restraint facing the market is the technical challenge of maintaining peak thermal performance throughout the equipment lifecycle. Fouling—the accumulation of undesirable deposits on the fin surfaces—is a persistent issue, leading to decreased heat transfer efficiency and increased pressure drop, which directly translates to higher operating costs. Furthermore, the market faces significant material price volatility, particularly for specialty metals like copper and nickel alloys, impacting production costs and ultimately the final product price. The stringent quality control required for fin pipe fabrication, especially ensuring a robust and conductive fin-to-tube bond, acts as an entry barrier for new manufacturers. Nevertheless, opportunities abound in emerging regions where rapid industrialization requires foundational thermal equipment, and in the development of specialized fin tubes designed for extremely corrosive media or ultra-high-temperature service, effectively segmenting and diversifying the market away from purely commodity offerings. These forces collectively necessitate continuous innovation in material science and surface engineering to overcome performance limitations and sustain market expansion.

Drivers

- Strict global energy efficiency regulations promoting waste heat recovery systems.

- Continuous capacity expansion and modernization across the petrochemical and power generation industries.

- Technological advancements allowing for higher fin densities and improved thermal performance.

- Increasing demand for compact and lightweight heat exchangers in HVAC and refrigeration systems.

Restraints

- High susceptibility of fin surfaces to fouling and scaling, reducing long-term efficiency.

- Significant initial capital investment required for high-performance fin pipe manufacturing equipment.

- Volatility in the prices of key raw materials, including specialized steel and non-ferrous alloys.

- Complex quality assurance requirements for critical applications (e.g., nuclear, aerospace).

Opportunities

- Development and adoption of advanced anti-fouling coatings and surface treatments.

- Growing market for fin pipes in niche applications like concentrated solar power (CSP) and geothermal energy.

- Expansion of modular and standardized heat exchanger solutions facilitating faster deployment.

- Integration of IoT and sensor technologies for real-time performance monitoring and predictive maintenance.

Segmentation Analysis

The Fin Pipes Market is meticulously segmented based on Type, Material, and Application, providing a detailed view of demand patterns and technological preferences across various industrial ecosystems. Analyzing these segments is crucial for stakeholders to identify high-growth areas and tailor product strategies effectively. Segmentation by Type distinguishes between manufacturing methods and resulting thermal/mechanical properties, with extruded fins leading in durability and welded fins excelling in high-temperature performance. Material segmentation reflects the operational environment, dictating corrosion resistance and thermal conductivity requirements, ranging from common carbon steel for general industrial use to high-performance alloys for specialized chemical processing. The application segment drives volume and complexity, encompassing massive requirements from power generation down to smaller, critical needs in specialized processes.

The Extruded Fin Pipe segment maintains market dominance due to its robust mechanical bond, which ensures minimal thermal contact resistance and superior resilience against thermal cycling and harsh external environments, making it the standard choice for offshore and refinery air coolers. However, the High-Frequency Welded (HFW) Fin Pipe segment is exhibiting the fastest growth rate, specifically driven by applications requiring operation above 300°C, such as boiler economizers and fired heater convection sections where a metallurgical bond is indispensable for safety and efficiency. Material segmentation highlights the shift toward Stainless Steel and Alloy Fin Pipes (e.g., Copper-Nickel, Inconel) as industries move towards extending operational life in highly corrosive environments (e.g., flue gas desulfurization, marine heat exchangers), despite the associated higher initial cost. Carbon Steel remains fundamental for large-volume, moderate-temperature applications. This granular analysis demonstrates that technological maturity and application-specific demands are the primary factors determining segmental market performance.

- By Type:

- Extruded Fin Pipes (Solid Fins)

- Welded Fin Pipes (High-Frequency Welded Spiral Fins, Studded Tubes)

- Embedded/G-Fin Pipes

- L/LL/KL-Footed Tension Wound Fin Pipes

- By Material:

- Carbon Steel

- Stainless Steel (300 series, 400 series)

- Alloy Steel (e.g., Chrome-Moly)

- Non-Ferrous Alloys (Copper, Aluminum, Nickel Alloys)

- By Application:

- Power Generation (HRSGs, Condensers, Economizers)

- Oil & Gas (Air Cooled Heat Exchangers, Process Heaters)

- HVAC & Refrigeration (Coils, Cooling Towers)

- Chemical & Petrochemical Processing

- Metallurgical & Mining Industries

- Others (Desalination, Marine, Food Processing)

Value Chain Analysis For Fin Pipes Market

The value chain of the Fin Pipes Market begins with upstream activities focused on securing and processing high-quality raw materials. This includes the sourcing of seamless or welded base tubes and the specialized metals (steel strips, aluminum sheets) required for fin creation. Key upstream players are metallurgical processing companies and large steel mills. Price fluctuations in these raw materials directly impact the profitability of midstream manufacturers. Efficiency and quality control at this stage—ensuring material traceability and adherence to specifications like surface finish and chemical composition—are paramount, as any defect in the base tube or fin material will compromise the final heat transfer performance and structural integrity of the finished fin pipe.

Midstream activities involve the highly specialized manufacturing processes of finning, including extrusion, welding (such as high-frequency resistance welding), rolling, or embedding techniques. Fin pipe manufacturers use sophisticated machinery to bond the fins onto the base tubes, requiring precise thermal and mechanical control to minimize contact resistance. Following finning, rigorous quality checks, including ultrasonic testing and dye penetrant inspection, are performed. Downstream activities involve the integration of these fin pipes into final heat exchange equipment, such as air coolers, shell and tube exchangers, and process heaters, typically executed by engineering, procurement, and construction (EPC) firms or Original Equipment Manufacturers (OEMs) specializing in thermal systems. This phase also includes logistics, ensuring safe and damage-free transportation of sensitive pipe bundles to remote industrial sites.

The distribution channel is multifaceted, relying heavily on both direct and indirect routes. Direct sales are common for large, highly customized projects (e.g., new power plants or refinery expansions) where fin pipe manufacturers engage directly with EPC contractors or end-users to meet precise specifications. Indirect distribution involves working through specialized technical distributors, representatives, and agents who maintain local inventories and provide after-sales support and installation services, particularly for MRO activities and smaller industrial applications. The effectiveness of the channel relies on technical competency, inventory management capabilities, and the ability to provide rapid, localized response, which is particularly critical in the demanding Oil & Gas sector.

Fin Pipes Market Potential Customers

The primary consumers of fin pipes span a broad spectrum of heavy industrial sectors that rely critically on controlled and efficient thermal processes. The most significant potential customer base resides within the Power Generation industry, specifically thermal power plants (coal, gas, nuclear) utilizing fin pipes in critical components such as boiler economizers, superheaters, and air preheaters, and heat recovery steam generators (HRSGs) in combined cycle plants. These end-users demand high-reliability, corrosion-resistant fin pipes capable of handling high pressures and extreme temperatures. Their purchasing decisions are driven by total cost of ownership, regulatory compliance, and proven long-term performance under continuous load. The need for periodic maintenance and replacement in these large-scale facilities ensures sustained, long-term demand for quality fin pipes.

The Oil & Gas and Petrochemical sectors represent another substantial segment of potential customers. Refineries and chemical processing plants utilize finned tubes extensively in air-cooled heat exchangers (ACHEs), furnaces, and various process fluid coolers. In upstream operations, finned tubes are crucial for gas processing and compression stations where heat rejection is vital. These environments often expose fin pipes to corrosive media (e.g., H₂S, chlorides) and mechanical stresses, driving demand for specialized materials like galvanized carbon steel or stainless steel fin tubes. Purchasers in this sector prioritize robust design (like extruded or high-frequency welded fins) that minimizes downtime due to fouling and maximizes operational availability in remote or harsh climates, making durability a key purchasing criterion.

Furthermore, the HVAC (Heating, Ventilation, and Air Conditioning) and Refrigeration sectors, encompassing both commercial and industrial applications, constitute a rapidly expanding customer base. Fin pipes, particularly those made with copper or aluminum fins for high thermal conductivity and lower weight, are central to large cooling coils, industrial chillers, and precision climate control systems used in data centers and pharmaceuticals. These customers prioritize energy efficiency (Seasonal Energy Efficiency Ratio or SEER) and compactness. Secondary, but growing, potential customers include manufacturers in the food and beverage industry for sterilization and cooling processes, the marine industry for shipborne heat exchangers, and the nascent renewable energy sector, specifically thermal storage and geothermal installations, indicating diversification in the end-user landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.18 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wieland Thermal Solutions, Koch Heat Transfer, API Heat Transfer, Thermofin, NREC International, Fin Tube Co., O’Donnell Consulting, Heat Transfer Systems Inc., Secan B.V., Custom Coils, Swep International, Alfa Laval, GEA Heat Exchangers, Chart Industries, Hamon & Cie, Airco Fin, Finned Tube Products, TK Heatech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fin Pipes Market Key Technology Landscape

The technological landscape of the Fin Pipes Market is characterized by continuous refinement aimed at enhancing the thermal bond between the fin and the base tube, which is the singular most critical factor determining heat transfer efficiency. High-Frequency Resistance Welding (HFRW) remains the predominant method for manufacturing high-integrity fin pipes, particularly those used in demanding applications like fired heaters and waste heat recovery units. HFRW technology creates a true metallurgical bond, ensuring zero thermal contact resistance and mechanical stability under severe thermal cycling and high internal pressure. Current innovations in this area focus on optimizing the welding parameters using real-time monitoring systems to ensure uniform weld quality across varying materials and dimensions, thereby increasing manufacturing throughput while maintaining stringent quality standards required by international codes like TEMA R and ASME.

Another crucial technology is the extrusion process, which is favored for aluminum and copper fins on bimetallic tubes. Extrusion involves mechanically working an outer aluminum sleeve over a steel or copper base tube, resulting in a solid, corrosion-resistant outer fin layer with superior mechanical protection. Recent advancements focus on cold-working processes and material combinations that enhance the pressure fit and resistance to atmospheric deterioration, making these tubes ideal for air-cooled exchangers in petrochemical complexes and coastal environments. Furthermore, the development of specialized coating technologies, including ceramic, polymer, and metallic composite coatings, is gaining traction. These coatings are applied to fin surfaces to minimize the adherence of foulants (such as dust, soot, or biological deposits) and offer passive protection against chemical corrosion, thereby sustaining high thermal performance for longer durations without requiring frequent mechanical cleaning.

The manufacturing ecosystem is increasingly adopting Industry 4.0 principles, integrating automation, robotics, and advanced non-destructive testing (NDT) methodologies. Robotic welding systems are utilized to ensure dimensional consistency and speed in producing complex fin geometries, while laser scanning and ultrasonic testing equipment are deployed inline to verify the structural integrity of the fin-to-tube bond and detect subsurface defects immediately. The utilization of sophisticated Computer-Aided Engineering (CAE) tools and Computational Fluid Dynamics (CFD) is fundamental in the design phase, allowing engineers to simulate various operational scenarios, optimize fluid flow patterns around the fins, and accurately predict thermal performance before commencing physical production. This technological integration not only enhances product quality and efficiency but also significantly reduces the time-to-market for custom heat exchange solutions required by the energy transition and decarbonization efforts.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to lead the global market growth, driven by massive investments in infrastructure development, including new power plants (both conventional and nuclear), expanded refinery capacity in China, India, and Southeast Asia, and burgeoning industrialization. Favorable governmental policies supporting manufacturing and energy self-sufficiency are catalyzing demand for efficient heat transfer solutions. The region's hot and humid climate further necessitates robust fin pipe solutions for high-capacity cooling in HVAC systems and industrial processes.

- North America: This region is characterized by high replacement demand and technological upgrades in the mature Oil & Gas and Power Generation sectors. Strict environmental regulations, particularly concerning flare gas reduction and waste heat utilization, are driving the adoption of high-efficiency fin pipe economizers and air coolers. Investments in liquefied natural gas (LNG) infrastructure and associated thermal management systems contribute significantly to market stability and growth, focusing on high-quality, long-life, and customized solutions compliant with ASME standards.

- Europe: Growth in Europe is primarily centered around the energy transition and the drive towards net-zero emissions. The market is supported by robust MRO (Maintenance, Repair, and Overhaul) activities and significant investments in industrial decarbonization, particularly in the chemical and manufacturing sectors. Demand is strong for specialized, high-alloy fin pipes used in demanding environments like biomass energy conversion and specialized high-temperature reactors, reflecting a focus on advanced materials and energy recovery technologies.

- Middle East & Africa (MEA): This region is witnessing substantial market growth tied directly to massive capital projects in the oil and gas sector (both upstream and downstream expansion) and large-scale desalination plants. The extreme heat of the climate necessitates enormous air-cooled heat exchanger installations, driving robust demand for extruded fin tubes offering mechanical durability and corrosion resistance against desert dust and high ambient temperatures. Government initiatives aimed at economic diversification are also fueling industrial development outside of the traditional energy sector.

- Latin America (LATAM): Market expansion in LATAM is driven by renewed focus on oil and gas exploration and production, particularly in Brazil, Mexico, and Argentina, requiring significant investment in process heat exchangers and cooling systems. The mining industry is also a substantial consumer of finned tubes for cooling large machinery and process fluids. Economic stability and regulatory environments remain key determinants of investment pace, with demand focusing on cost-effective yet reliable fin pipe solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fin Pipes Market.- Wieland Thermal Solutions

- Koch Heat Transfer

- API Heat Transfer

- Thermofin

- NREC International

- Fin Tube Co.

- O’Donnell Consulting

- Heat Transfer Systems Inc.

- Secan B.V.

- Custom Coils

- Swep International

- Alfa Laval

- GEA Heat Exchangers

- Chart Industries

- Hamon & Cie

- Airco Fin

- Finned Tube Products

- TK Heatech

Frequently Asked Questions

Analyze common user questions about the Fin Pipes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for High-Frequency Welded (HFW) Fin Pipes?

The demand for HFW fin pipes is primarily driven by their superior thermal bond and mechanical strength, making them essential for high-temperature and high-pressure applications in the power generation (HRSGs, Economizers) and petrochemical industries where structural integrity and minimal thermal contact resistance are paramount for safe and efficient operation.

How does fouling impact the Fin Pipes Market and what are the countermeasures?

Fouling severely reduces the overall heat transfer coefficient and increases pressure drop in finned exchangers, leading to decreased efficiency and higher operational costs. Countermeasures driving market innovation include developing specialized anti-fouling coatings (e.g., polymer or ceramic) and implementing intelligent cleaning systems and predictive maintenance powered by AI analysis.

Which geographical region exhibits the highest growth potential for Fin Pipes?

Asia Pacific (APAC), particularly driven by industrial expansion in China, India, and Southeast Asia, exhibits the highest growth potential. This growth is fueled by massive infrastructure projects, increasing energy demands, and the continuous construction of new refineries and power generation facilities requiring high volumes of finned heat exchange components.

What are the key material trends observed in fin pipe manufacturing?

While carbon steel remains the foundation, there is an accelerating trend toward utilizing Stainless Steel and specialized Nickel-based Alloys (e.g., Inconel) to enhance resistance to corrosion and oxidation in highly aggressive chemical processing and marine environments, thereby maximizing the equipment's operational lifespan and reducing maintenance frequency.

How is digital technology influencing the design and performance of finned tubes?

Digital technology, including Computational Fluid Dynamics (CFD) and Generative Design AI, is critically influencing finned tube design by enabling the rapid optimization of fin geometry for maximum thermal efficiency and minimized pressure drop. Furthermore, IoT integration provides real-time performance monitoring, supporting highly accurate predictive maintenance schedules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager