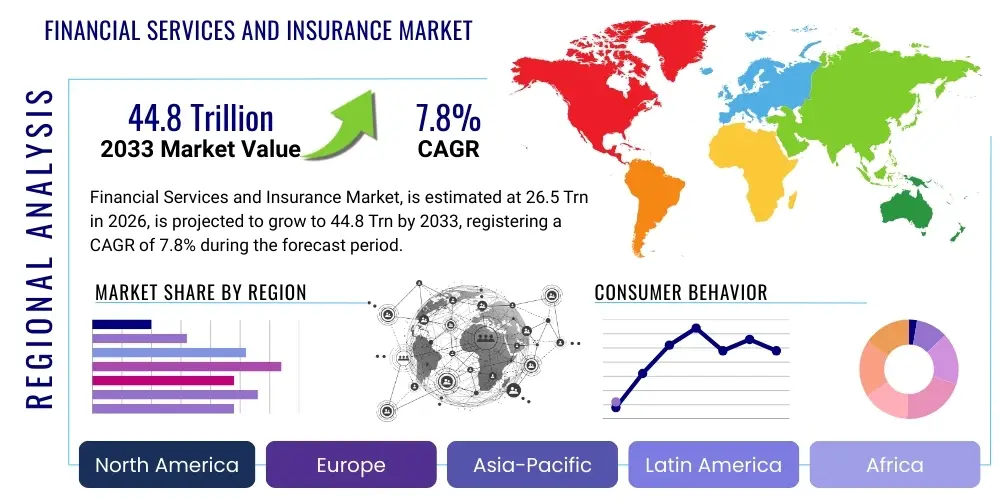

Financial Services and Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443441 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Financial Services and Insurance Market Size

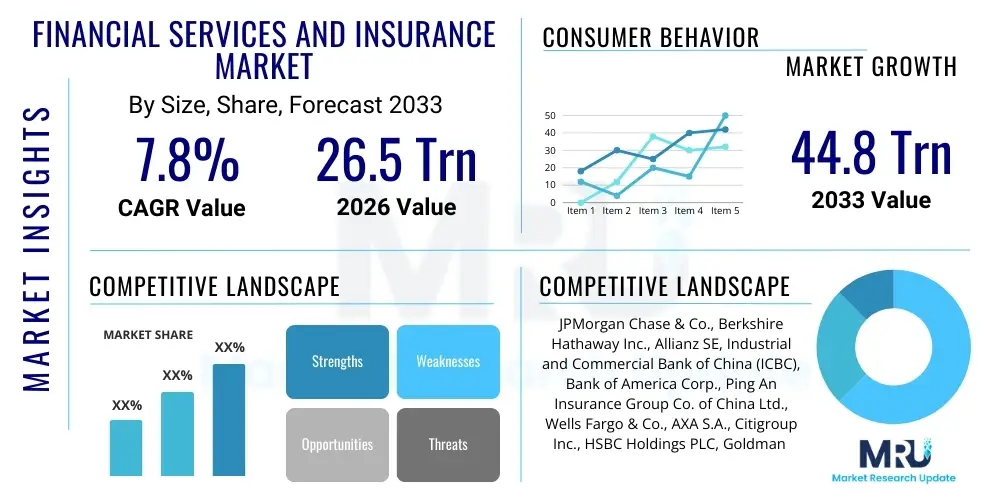

The Financial Services and Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. This robust growth trajectory is primarily fueled by accelerated digital transformation, shifting consumer expectations toward personalized services, and the increasing integration of advanced technologies such as Artificial Intelligence (AI) and blockchain across core operations. The expansion is particularly evident in emerging economies where financial inclusion initiatives and a growing middle class are driving demand for sophisticated banking, wealth management, and risk mitigation products.

The market is estimated at USD 26.5 Trillion in 2026, representing the total revenue generated from core financial intermediation, risk underwriting, and advisory services globally. This valuation reflects the foundational role these sectors play in global economic stability and capital allocation. Furthermore, the base year assessment highlights the swift recovery and adaptation strategies implemented post-global economic shifts, positioning the industry for significant forward momentum.

The total market size is projected to reach USD 44.8 Trillion by the end of the forecast period in 2033. This substantial increase is underpinned by continued structural changes, including consolidation among major players, specialization in high-yield segments like sustainable finance and InsurTech, and regulatory pressures promoting resilience and transparency. The forecasted value underscores the critical nature of these services as global economies become more complex and interconnected, necessitating robust financial infrastructure and sophisticated risk transfer mechanisms.

Financial Services and Insurance Market introduction

The Financial Services and Insurance Market encompasses a vast ecosystem of organizations providing financial intermediation, risk management, asset allocation, and payment services globally. This market includes commercial banks, investment banks, asset management firms, wealth managers, insurance carriers (life, non-life, and reinsurance), and specialized lending institutions. The core product offering spans traditional services such such as deposits, loans, mortgages, annuities, insurance policies, and investment advisory, increasingly delivered through digital-first channels.

Major applications of these services are pervasive across the economic landscape, serving retail consumers for daily transactions and long-term planning, small and medium enterprises (SMEs) for capital access and payroll solutions, and large corporations for complex trade finance, merger & acquisition (M&A) activities, and large-scale risk hedging. The integration of advanced technological platforms ensures efficiency, scale, and compliance across these diverse applications, moving away from legacy infrastructure towards scalable, cloud-native solutions.

The market's sustained growth and fundamental benefits are driven by factors such as urbanization, rising disposable income in developing nations, and the imperative for robust personal and commercial risk coverage in an unpredictable global environment. Key driving factors include the proliferation of mobile banking, regulatory support for innovation (e.g., Open Banking initiatives), and the competitive necessity for personalization and speed in service delivery, compelling incumbents to invest heavily in digital transformation and partner with innovative FinTech and InsurTech entities.

Financial Services and Insurance Market Executive Summary

The Executive Summary highlights a market defined by rapid technological assimilation and strategic consolidation, responding to evolving consumer demands for seamless digital experiences. Business trends indicate a strong move towards hyper-personalization, enabled by big data analytics and AI, allowing firms to tailor risk profiles, product recommendations, and pricing structures with unprecedented precision. Furthermore, sustainable finance, particularly Environmental, Social, and Governance (ESG) investing, has transitioned from a niche concern to a core strategic imperative, influencing capital allocation decisions and requiring new disclosure and reporting frameworks across the industry.

Regional trends demonstrate North America and Europe maintaining leadership in market maturity and technological adoption, specifically in sophisticated capital markets and complex derivative products. However, the Asia Pacific (APAC) region is poised for the most explosive growth, driven by massive unbanked or underbanked populations transitioning directly to mobile and digital financial services, bypassing traditional branch infrastructure. Latin America and the Middle East & Africa (MEA) show significant potential, focusing on addressing issues of financial inclusion and leveraging blockchain technology for enhanced payment transparency and cross-border transactions.

Segment trends underscore the rising dominance of InsurTech and digital wealth management platforms. Within insurance, parametric insurance and usage-based models are revolutionizing risk assessment and claims processing, reducing operational overheads. In banking, the shift from proprietary software to Software-as-a-Service (SaaS) and platform models is accelerating, facilitating faster deployment of new services and improving regulatory compliance capabilities. Cybersecurity services within financial institutions are experiencing exponential demand, reflecting the increased frequency and sophistication of digital threats faced by institutions holding sensitive customer and corporate data.

AI Impact Analysis on Financial Services and Insurance Market

Common user questions regarding AI’s impact on the Financial Services and Insurance Market often center on automation potential, ethical implications, and the future of human employment. Specifically, users frequently ask: "How will AI change underwriting and claims processing?", "Can AI accurately detect sophisticated financial fraud?", and "What are the regulatory risks associated with using opaque AI models (black box problem) in financial decision-making?". There is also significant interest in the competitive advantage AI offers in hyper-personalizing customer interactions and the required investment in AI infrastructure.

Based on this analysis, the key themes summarizing AI's influence are operational efficiency enhancement, advanced risk mitigation, and profound customer experience transformation. Users recognize AI’s potential to dramatically reduce manual processing errors and time-to-market for financial products, but they express concerns about algorithmic bias, data privacy, and the need for clear governance frameworks. Expectations are high for AI-driven fraud detection systems, which promise real-time anomaly identification far beyond traditional rule-based engines, fundamentally altering security protocols across banking and insurance operations.

Overall, AI is not merely viewed as a cost-cutting tool but as a catalyst for innovation, enabling the creation of entirely new products (e.g., dynamically priced insurance) and optimizing capital deployment. However, the industry acknowledges that the successful integration of AI requires significant upskilling of the workforce and continuous monitoring to ensure compliance with global data protection and anti-discrimination laws, making explainability (XAI) a critical area of focus for deployment.

- Automation of routine compliance checks, reducing manual errors and increasing speed.

- Enhanced underwriting accuracy through predictive modeling of risk factors.

- Real-time fraud detection and anomaly analysis in payment systems.

- Hyper-personalization of financial products and advisory services (robo-advisors).

- Optimization of capital allocation and portfolio management strategies.

- Streamlining of claims processing in insurance through image and natural language processing.

- Improved customer service via sophisticated AI chatbots and virtual assistants.

- Development of proprietary AI models providing competitive differentiation in pricing and risk.

DRO & Impact Forces Of Financial Services and Insurance Market

The dynamics of the Financial Services and Insurance Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces shaping its trajectory. The primary Drivers revolve around rapid technological modernization, particularly the adoption of cloud computing and API-driven architecture, enabling seamless integration between financial institutions and third-party developers (FinTech partnerships). Complementary drivers include demographic shifts, such as the generational transfer of wealth and the rising financial literacy of younger consumers demanding digitally native services, pressuring traditional institutions to innovate or risk obsolescence. The push for financial inclusion in developing markets also acts as a potent structural driver for product expansion.

Significant Restraints impeding growth often stem from the inherently conservative and highly regulated nature of the industry. Stringent global regulatory requirements (e.g., Basel III, Solvency II, GDPR, CCPA) necessitate substantial compliance costs and limit the speed of innovation, particularly for large, established banks and insurers. Furthermore, the persistent threat of sophisticated cyberattacks and data breaches poses a continuous operational and reputational risk, requiring massive, ongoing investments in cybersecurity infrastructure. Legacy IT systems, common in many established firms, also represent a major architectural restraint, hindering the efficient deployment of modern, scalable solutions.

Opportunities are abundant, particularly in leveraging untapped data for enhanced decision-making and exploring new business models. The rise of embedded finance—integrating financial products directly into non-financial retail platforms (e.g., e-commerce)—presents a vast market expansion opportunity. Additionally, the development and adoption of Decentralized Finance (DeFi) infrastructure, while nascent and risky, offers long-term potential for disintermediation and creation of highly transparent, peer-to-peer financial ecosystems. The impact forces are thus dominated by the dichotomy between regulatory caution and technological necessity, forcing institutions to adopt agile compliance strategies while aggressively pursuing digital differentiation.

Segmentation Analysis

The Financial Services and Insurance Market is structurally segmented across various dimensions, including the type of service offered, the end-user demographics, delivery channels, and the underlying technology platform. Service Type segmentation helps understand core revenue streams, dividing the market into Banking (Retail, Corporate, Investment), Insurance (Life, P&C, Health), and Specialized Finance (Asset Management, Payment Processing, Wealth Advisory). Understanding these divisions is crucial as regulatory frameworks and profitability metrics vary significantly across segments. Furthermore, geographical segmentation remains vital, distinguishing between mature, saturated markets and high-growth, digitally emergent regions.

Segmentation by delivery channel, ranging from traditional physical branches and agents to direct digital platforms and mobile applications, highlights the dramatic shift in consumer preference towards digital self-service. The B2C segment, driven by retail consumers, demands high accessibility and personalization, contrasting with the B2B segment, which requires complex, bespoke enterprise solutions like commercial lending and reinsurance. Technological segmentation, focusing on solutions like cloud migration, blockchain implementation, and the use of AI/ML, reveals where capital investments are concentrated and which providers are driving foundational infrastructure change across the industry value chain.

- By Service Type:

- Banking (Retail Banking, Corporate Banking, Investment Banking)

- Insurance (Life Insurance, Property & Casualty (P&C) Insurance, Health Insurance, Reinsurance)

- Wealth and Asset Management (Retail Investment, Institutional Asset Management, Private Wealth Management)

- Payment Services (Credit/Debit Cards, Digital Wallets, Cross-Border Payments)

- By Application/End-User:

- Retail Consumers

- Small and Medium Enterprises (SMEs)

- Large Corporations and Institutional Clients

- Government and Public Sector

- By Technology Deployment:

- Cloud-Based Solutions

- On-Premise Systems

- API and Open Banking Platforms

- Blockchain Technology

Value Chain Analysis For Financial Services and Insurance Market

The value chain in the Financial Services and Insurance Market begins with upstream activities focused heavily on data acquisition, risk modeling, and capital management. This involves sophisticated data ingestion and cleansing processes, crucial for accurate underwriting in insurance and credit scoring in banking. Upstream processes are increasingly relying on external data sources, geospatial intelligence, and advanced computational models to refine predictive capabilities and ensure regulatory compliance, often requiring strategic partnerships with specialized data providers and risk modeling firms.

Midstream activities involve core financial processes such as product development, underwriting, claims processing (for insurance), and transaction execution (for banking and capital markets). The distribution channel forms a critical part of the value delivery, transitioning rapidly from traditional direct agents and branch networks to omnichannel strategies. Direct channels, powered by mobile apps and web portals, offer speed and lower operational costs, while indirect channels leverage brokers, affinity partnerships, and embedded finance arrangements, significantly broadening market reach and accessibility, particularly for standardized products.

Downstream activities center on customer service, portfolio servicing, and regulatory reporting. Post-sale customer relationship management (CRM) and advisory services ensure customer retention and opportunities for cross-selling. The value chain is being fundamentally reshaped by digitalization, where every step—from initial data collection (upstream) to final service delivery and reporting (downstream)—is being automated and integrated through unified digital platforms, emphasizing efficiency and superior customer experience over manual intervention and fragmented legacy systems.

Financial Services and Insurance Market Potential Customers

Potential customers for the Financial Services and Insurance Market span the entire global economy, categorized primarily into retail consumers, small and medium enterprises (SMEs), and large institutional clients. Retail consumers constitute the largest volume segment, requiring essential services such as deposit accounts, personal loans, mortgages, life insurance, and basic investment products. Their demand is highly sensitive to ease of use, transparency in pricing, and the convenience of mobile and digital access. The rapid growth of digital-only banks and InsurTech platforms is specifically targeting this segment by offering superior user interfaces and highly tailored financial solutions.

The SME segment represents a high-growth opportunity, characterized by a persistent need for working capital, commercial insurance (P&C), and specialized tools for payroll management and trade financing. SMEs often lack the internal financial expertise of larger corporations, making them valuable targets for bundled financial and advisory services. Financial institutions focusing on this segment must offer flexible, scalable, and rapidly deployable products that can adapt to the cyclical nature of smaller businesses, utilizing alternative data sources for credit assessment beyond traditional historical financial statements.

Large corporations and institutional clients, including multinational companies, sovereign wealth funds, and pension funds, require complex, high-value services such as investment banking (M&A, IPOs), sophisticated risk hedging instruments (derivatives, structured products), and highly specialized corporate insurance and reinsurance solutions. These customers prioritize global reach, regulatory expertise, deep domain knowledge, and the security and stability offered by major global financial players. The focus here is on bespoke solutions and strategic partnership rather than volume processing, often involving intense relationship management and proprietary technological infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 26.5 Trillion |

| Market Forecast in 2033 | USD 44.8 Trillion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JPMorgan Chase & Co., Berkshire Hathaway Inc., Allianz SE, Industrial and Commercial Bank of China (ICBC), Bank of America Corp., Ping An Insurance Group Co. of China Ltd., Wells Fargo & Co., AXA S.A., Citigroup Inc., HSBC Holdings PLC, Goldman Sachs Group Inc., Morgan Stanley, Zurich Insurance Group AG, Travelers Companies Inc., MetLife Inc., Prudential Financial Inc., Standard Chartered PLC, China Life Insurance Company, Mitsubishi UFJ Financial Group, Credit Suisse Group AG (now UBS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Financial Services and Insurance Market Key Technology Landscape

The technological landscape of the Financial Services and Insurance Market is rapidly transitioning from monolithic, legacy core systems to a modular, API-driven architecture, enabling greater agility and interoperability. Central to this transformation is cloud computing (IaaS, PaaS, SaaS), which provides the scalability and cost efficiency necessary to handle massive transactional volumes and process complex data sets required for advanced analytics and regulatory reporting. Hybrid and multi-cloud strategies are becoming the norm, allowing institutions to balance security and regulatory residency requirements with the flexibility of public cloud services, facilitating faster product launches and system modernization across the entire enterprise.

Beyond foundational cloud migration, specialized technologies such as Artificial Intelligence (AI) and Machine Learning (ML) are becoming integrated into virtually every facet of operations. Predictive analytics models are deployed for credit risk assessment, actuarial pricing, and market forecasting, offering deeper insights than traditional statistical methods. Furthermore, the rising prominence of Distributed Ledger Technology (DLT), particularly blockchain, is gaining traction in specific use cases, notably cross-border payments, trade finance, and reinsurance processes, where it promises enhanced transparency, immutability, and reduced settlement times by eliminating multiple intermediaries.

The future technology landscape is further shaped by advanced regulatory technology (RegTech) and cybersecurity solutions. RegTech leverages AI and automation to monitor transactions in real-time, ensuring adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations, significantly reducing compliance overheads and penalty risks. Simultaneously, the focus on quantum-resistant cryptography and advanced behavioral biometric authentication highlights the industry's commitment to securing customer assets and proprietary data against increasingly sophisticated threats, solidifying technology as the primary competitive differentiator in the modern financial ecosystem.

Regional Highlights

Regional dynamics play a vital role in shaping the global Financial Services and Insurance Market, reflecting varying regulatory maturity, economic growth rates, and levels of digital penetration. North America, dominated by the United States, represents the largest and most mature market, characterized by highly sophisticated capital markets, advanced asset management practices, and significant investment in FinTech innovation. Regulatory scrutiny remains high, particularly concerning consumer protection and systemic risk management, driving demand for advanced RegTech solutions and robust data governance frameworks across banking and insurance.

Europe, while mature, is highly fragmented and governed by expansive pan-European regulations such as GDPR and PSD2 (Open Banking). The strong focus on data privacy and interoperability is accelerating the adoption of API strategies, fostering collaboration between incumbent banks and third-party payment providers. Western Europe leads in sustainable finance and ESG integration, setting global standards for responsible investment and climate risk reporting, which heavily influences the investment strategies of asset managers and insurers in the region.

The Asia Pacific (APAC) region is the fastest-growing market globally, driven by massive population growth, increasing urbanization, and expanding access to mobile internet. Countries like China and India are leapfrogging traditional banking infrastructure, moving directly to digital payment systems and mobile-first insurance products (InsurTech). The competitive landscape is intensely focused on digital innovation, often supported by government initiatives aimed at fostering national FinTech hubs and enhancing financial inclusion in rapidly developing markets across Southeast Asia.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets exhibiting significant potential, though growth is often hampered by macroeconomic instability and varying degrees of political risk. In LATAM, mobile payments and challenger banks are successfully addressing historical banking inefficiencies and low penetration rates. In MEA, particularly the Gulf Cooperation Council (GCC) nations, large governmental investment in digital infrastructure and diversification away from oil economies is fueling rapid growth in wealth management, specialized Islamic finance, and digital insurance products aimed at younger, tech-savvy demographics.

- North America: Leads in capital markets technology, high FinTech funding, and advanced regulatory compliance needs (AML, KYC).

- Europe: Driven by Open Banking (PSD2), strong ESG mandate adoption, and stringent data protection (GDPR).

- Asia Pacific (APAC): Highest growth rate globally, focused on mobile payments, micro-insurance, and financial inclusion via digital platforms in emerging economies.

- Latin America (LATAM): High adoption of challenger banks and mobile lending solutions to overcome traditional banking access hurdles.

- Middle East and Africa (MEA): Rapid digitalization fueled by government diversification efforts and focus on wealth management and specialized financial services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Financial Services and Insurance Market. These entities define industry standards, drive technological adoption, and possess substantial global market influence through extensive operational scale and capital deployment capabilities.- JPMorgan Chase & Co.

- Berkshire Hathaway Inc.

- Allianz SE

- Industrial and Commercial Bank of China (ICBC)

- Bank of America Corp.

- Ping An Insurance Group Co. of China Ltd.

- Wells Fargo & Co.

- AXA S.A.

- Citigroup Inc.

- HSBC Holdings PLC

- Goldman Sachs Group Inc.

- Morgan Stanley

- Zurich Insurance Group AG

- Travelers Companies Inc.

- MetLife Inc.

- Prudential Financial Inc.

- Standard Chartered PLC

- China Life Insurance Company

- Mitsubishi UFJ Financial Group

- UBS Group AG

Frequently Asked Questions

Analyze common user questions about the Financial Services and Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Financial Services and Insurance Market?

The primary driver is accelerated digital transformation and the necessity for incumbent firms to adopt advanced technologies like AI, cloud computing, and APIs. This migration enables personalized customer experiences, operational efficiency, and adherence to evolving Open Banking and data sharing mandates globally.

How is blockchain technology currently impacting the insurance sector?

Blockchain is primarily impacting the insurance sector by streamlining complex processes such as reinsurance settlement, subrogation, and claims verification. It provides an immutable ledger for transactional data, enhancing trust and reducing the need for costly intermediaries in multi-party agreements (smart contracts).

What are the largest risks facing financial institutions in the current market?

The two largest risks are systemic cybersecurity threats, which compromise sensitive data and operational stability, and increasing regulatory fragmentation across jurisdictions. Institutions must navigate conflicting global data residency requirements and evolving anti-money laundering (AML) protocols.

Which geographical region is showing the most potential for market growth?

The Asia Pacific (APAC) region, particularly emerging economies within Southeast Asia and India, is projected to show the most potential for growth. This is driven by high rates of financial inclusion efforts, rapid mobile technology adoption, and a vast, increasingly affluent consumer base accessing digital financial services for the first time.

What is embedded finance and why is it important?

Embedded finance refers to the integration of financial products, such as lending, payment processing, or insurance, directly into non-financial platforms at the point of need (e.g., purchasing insurance during an e-commerce checkout). It is important because it seamlessly integrates financial services into daily life, creating new distribution channels and enhancing customer convenience, potentially disintermediating traditional banks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Power Distribution Unit (Pdu) Market Size Report By Type (Metered PDU, Monitored PDU, Switched PDU, Basic PDU, Others), By Application (It & telecom, Healthcare, Government & Defense, Banking, Financial Services and Insurance (BFSI), Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Deal Tracker As A Service Dtaas Market Size Report By Type (Private Cloud, Public Cloud, Hybrid Cloud), By Application (Banking Financial Services and Insurance (BFSI), Manufacturing, Consumer Goods, Government and Defence, Automotive, Retail, Energy and Utilities, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Web 20 Data Center Market Size Report By Type (Solutions, Server, Storage, Networking, Software, Services, Consulting, Installation and deployment, Maintenance, Support), By Application (Banking, Financial Services and Insurance (BFSI), IT and Telecom, Research and Academics, Government and Defense, Retail, Manufacturing, Healthcare, Media and Entertainment, Others, Energy and utilities, Transportation and logistics), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Mobile Advertising Market Size Report By Type (Search, Display, Video, Social Media, Websites, Others), By Application (Government, Fast Moving Consumable Goods (FMCG), Healthcare, Media and Entertainment, Banking, Financial Services and Insurance (BFSI), Education), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Surveillance Sensing Infrared Led Market Size Report By Type (Cooled Infrared Imaging, Uncooled Infrared Imaging, 700nm-850nm, 850nm-940nm, 940nm-1020nm, 1020nm-1720nm), By Application (Aerospace and Defense, Automotive, Banking, Financial Services and Insurance (BFSI), Consumer Electronics, Education, Healthcare, Retail, Industrial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager