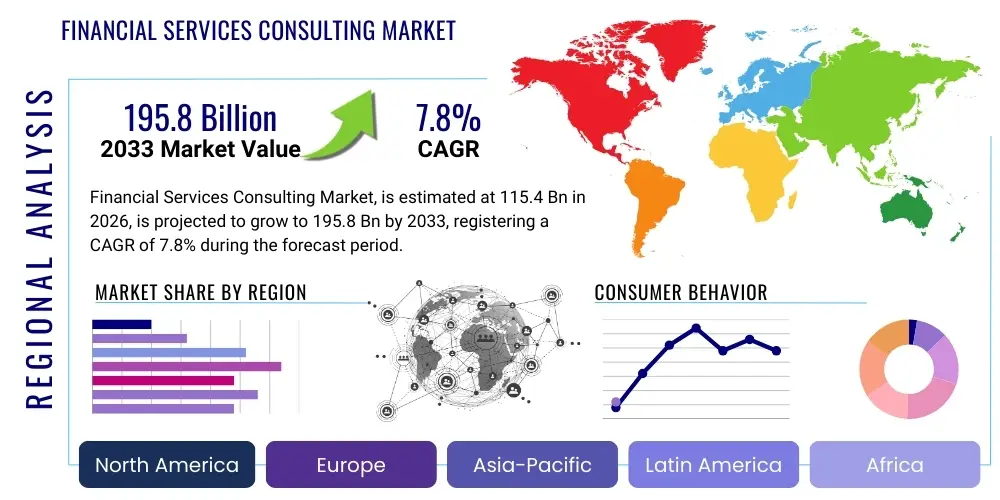

Financial Services Consulting Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442533 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Financial Services Consulting Market Size

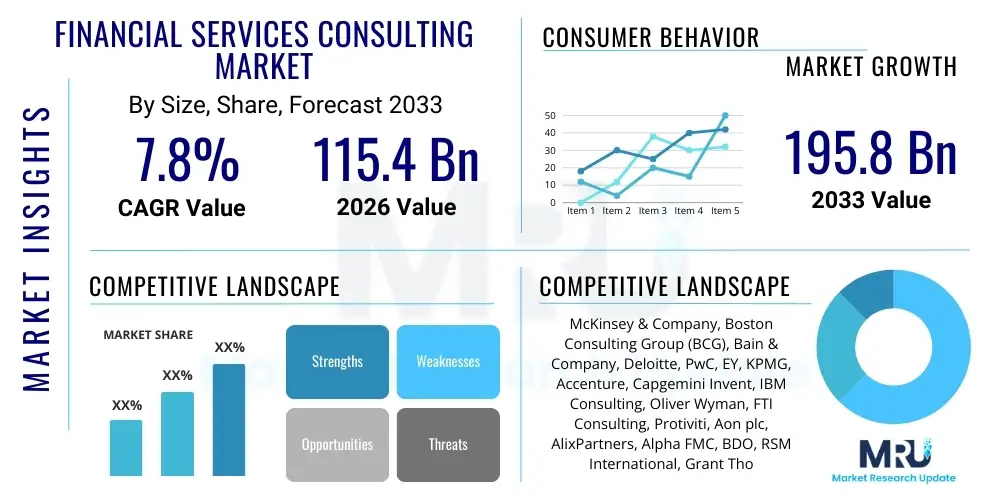

The Financial Services Consulting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 115.4 Billion in 2026 and is projected to reach USD 195.8 Billion by the end of the forecast period in 2033.

The steady expansion of this market is fundamentally driven by the relentless pace of digital transformation across banking, insurance, and capital markets sectors. Financial institutions are increasingly reliant on external expertise to navigate complex technology integrations, optimize operational efficiencies, and ensure compliance with rapidly evolving global regulatory frameworks. This demand for specialized knowledge, particularly in areas like cloud computing, cybersecurity, and data analytics implementation, positions consulting firms as indispensable partners in strategic development and execution.

Furthermore, heightened competition from agile FinTech companies necessitates that traditional financial players adopt innovative business models, driving substantial investment in consulting services aimed at competitive differentiation. The focus extends beyond basic technology adoption to include profound organizational restructuring, talent management consulting tailored for the digital age, and strategic advisory on emerging opportunities such as Decentralized Finance (DeFi) and Environmental, Social, and Governance (ESG) investing mandates. The market growth reflects a strategic shift from reactive problem-solving to proactive, holistic transformation guided by expert consultancy.

Financial Services Consulting Market introduction

The Financial Services Consulting Market encompasses specialized advisory services provided to institutions across the entire financial spectrum, including commercial banks, investment banks, insurance companies, wealth and asset managers, and FinTech organizations. These services range broadly from high-level strategic planning and mergers and acquisitions (M&A) advisory to tactical operational improvements, risk management, regulatory compliance, and technology implementation (such as core banking modernization and cloud migration). The product delivered is intellectual capital, tailored solutions, and change management expertise designed to improve efficiency, enhance profitability, mitigate risks, and ensure adherence to jurisdictional requirements. Major applications include regulatory adherence (e.g., Basel IV, MiFID II), enhancing customer experience through digital channels, and deploying advanced analytical tools for predictive modeling and fraud detection. The core benefits derived by clients include reduced operational costs, improved speed-to-market for new products, robust enterprise risk frameworks, and the ability to scale globally while maintaining local compliance. Key driving factors include mandatory regulatory reforms, explosive growth in FinTech innovation, the necessity for end-to-end digital transformation, and the persistent need to manage sophisticated global cybersecurity threats.

The market environment is characterized by intense specialization, where large global consultancies compete alongside highly niche boutique firms offering deep domain expertise in specific areas like actuarial science or specific geographic regulatory landscapes. The demand profile is shifting toward consulting engagements that deliver measurable, sustained business outcomes rather than just reports or recommendations. This necessitates consulting firms to embed themselves within client operations, often providing implementation support and managed services alongside traditional advisory roles. The shift towards outcome-based pricing models and strategic partnerships further defines the evolution of the competitive landscape.

Technological disruption acts as both a challenge and a primary catalyst for growth in this sector. Financial institutions recognize that legacy systems are impeding innovation and regulatory agility, thus fueling massive technology consulting projects. Furthermore, the increasing integration of data science and proprietary intellectual property (IP) within the consulting firms themselves—such as pre-built accelerators, proprietary models, and industry benchmarks—allows for faster, more predictable deployment of solutions. This emphasis on tech-enabled consulting ensures that services remain relevant and high-value in an environment where internal data science capabilities are also expanding within client organizations.

Financial Services Consulting Market Executive Summary

The Financial Services Consulting Market is undergoing a rapid transformation, characterized by significant business model innovation driven by macroeconomic uncertainty and technological acceleration. Business trends highlight a strong shift toward operational resilience, cost optimization through hyper-automation, and increased focus on cybersecurity and data privacy consulting across all sub-sectors. Consultancies are capitalizing on the integration of cutting-edge technologies like Generative AI and Quantum Computing readiness planning, positioning these services as crucial differentiators. Regional trends demonstrate North America maintaining market dominance, propelled by aggressive FinTech adoption and substantial investment in big data analytics, while Europe's growth is heavily influenced by mandatory sustainability reporting (e.g., EU Taxonomy) and complex cross-border regulatory harmonization efforts. The Asia Pacific region emerges as the fastest-growing market, fueled by rapid digitalization in emerging economies like India and Southeast Asia, alongside burgeoning wealth management needs in China. Segment trends indicate the Risk & Compliance segment holding the largest market share due to continuous global regulatory scrutiny, while the Technology Consulting segment is projected to experience the highest growth rate, reflecting the industry's pivot toward cloud-native architecture and AI-powered customer engagement platforms. Furthermore, the specialized insurance and asset management sub-sectors show robust demand for bespoke consulting related to investment strategy optimization and product innovation tailored for long-term demographic shifts.

A critical element defining the current market structure is the necessity for consulting firms to demonstrate tangible returns on investment (ROI) from digital transformation initiatives. This performance pressure is shifting consulting engagements away from pure strategy formulation towards execution-focused partnerships, often involving joint ventures or co-creation models with clients. This necessitates that consultancies maintain robust, up-to-date industry benchmarks and proprietary data assets to validate their strategic recommendations. The market also observes an increasing number of non-traditional competitors, including technology vendors and specialized data providers, who are blurring the lines between software implementation and advisory services, compelling traditional consulting players to enhance their platform and integration capabilities.

In terms of human capital, the executive summary must highlight the war for talent, particularly in specialized fields like quantum cryptography or ethical AI governance. Consulting firms are heavily investing in internal training and upskilling programs, alongside strategic acquisitions of boutique firms that possess niche technological expertise. The trend towards sustainable finance has also catalyzed a new segment of consulting focused exclusively on helping financial institutions integrate ESG criteria across their lending portfolios, disclosure practices, and investment decision-making processes, thereby introducing a significant ethical and sustainability dimension to the strategic consulting landscape.

AI Impact Analysis on Financial Services Consulting Market

Users frequently inquire about how AI will automate core financial functions, specifically asking whether machine learning will reduce the need for human consultants in areas like risk modeling and operational audit. Common concerns revolve around data security and algorithmic bias when deploying AI solutions provided by external consultants, prompting questions about governance frameworks and ethical guidelines. Furthermore, users often seek clarity on the practical implementation timeline for generative AI in client-facing services, such as personalized wealth management advice or automated compliance checks, and which consulting firms are leading in developing proprietary AI tools that accelerate client outcomes. The overarching expectation is that AI will necessitate a shift in consulting focus from transactional efficiency to strategic high-value transformation and system integration complexity, demanding consultants with dual expertise in finance and advanced data science.

The impact of Artificial Intelligence (AI) and Machine Learning (ML) on the financial services consulting market is transformative, fundamentally changing both the services offered and the delivery mechanism. AI tools are increasingly being utilized by consulting firms to accelerate due diligence, perform predictive regulatory impact assessments, and automate vast segments of repetitive data analysis tasks that traditionally consumed significant consultant time. This internal efficiency allows consulting teams to allocate more time to high-level strategic advisory, complex problem-solving, and human-centric aspects of organizational change management, effectively elevating the value proposition of the consulting engagement. Furthermore, AI acts as a product differentiator, as consultancies develop proprietary, industry-specific AI models (e.g., advanced credit scoring algorithms, hyper-personalized insurance pricing tools) that they license or integrate into client systems, turning advisory expertise into reusable, scalable technological assets.

For clients, AI consulting focuses primarily on three areas: optimizing front-office customer interactions (e.g., intelligent chatbots, dynamic personalization), enhancing middle-office risk management (e.g., real-time fraud detection, scenario planning), and drastically improving back-office efficiency through intelligent automation (e.g., robotic process automation combined with cognitive services for handling unstructured data). However, the complexity of integrating AI solutions into legacy IT infrastructure, ensuring model explainability (XAI), and navigating the patchwork of global AI governance laws creates a robust demand for expert consulting on implementation, risk validation, and ethical compliance. Consultants specializing in data governance, data pipeline engineering, and regulatory technology (RegTech) are therefore witnessing peak demand.

- AI enables rapid predictive risk modeling, replacing traditional statistical methods.

- Generative AI accelerates content creation for compliance documentation and client reporting.

- Automation of data collection and reconciliation streamlines audit and operational efficiency projects.

- Need for specialized consulting in ethical AI deployment and bias mitigation.

- Proprietary AI platforms developed by consulting firms become critical accelerators for client transformation.

- AI drives demand for cloud migration consulting essential for high-performance computing needs.

- Increased scrutiny on AI governance mandates expert advice on regulatory adherence (e.g., EU AI Act).

- Personalized financial product recommendations powered by ML enhance wealth management consulting services.

DRO & Impact Forces Of Financial Services Consulting Market

The dynamics of the Financial Services Consulting Market are shaped by powerful Drivers, inherent Restraints, and significant Opportunities, which collectively determine the Impact Forces influencing market direction. Key drivers include the mandatory acceleration of digital transformation across global financial ecosystems, coupled with the persistent need for complex regulatory compliance related to anti-money laundering (AML), Know Your Customer (KYC), and data privacy regimes (GDPR, CCPA). These mandatory changes compel institutions to seek specialized external support for system overhaul and operational redesign. Restraints primarily involve the high cost associated with top-tier consulting services, the scarcity of talent possessing combined financial and advanced technological expertise (e.g., quantum computing readiness), and increasing client fatigue regarding long, expensive projects that fail to deliver expected ROI. Opportunities are centered around the rise of sustainable finance (ESG integration), the necessity to advise on emerging technologies like DeFi and blockchain, and the expansion into high-growth regional markets (APAC, LATAM) that are building out modern financial infrastructure. The collective impact forces push the market toward extreme specialization, technological integration, and a focus on delivering quantifiable, sustained results through strategic partnerships rather than purely advisory relationships.

Drivers: The most significant driver remains the perpetual wave of disruptive technology, which necessitates continuous system upgrades and strategic reorientation for financial institutions. Cloud adoption is non-negotiable for scale and cost efficiency, creating massive consulting projects focused on infrastructure migration and securing cloud-native environments. Furthermore, the volatility inherent in global capital markets and geopolitical tensions increases the demand for sophisticated risk modeling and macroeconomic advisory services, helping clients stress-test portfolios and operational resilience. The push toward consumer-centric banking models, demanding seamless omni-channel experiences, mandates consulting services focused on customer journey mapping, behavioral economics, and the implementation of advanced CRM and CX platforms. Regulatory change, particularly in cross-border payments and capital adequacy requirements (like Basel IV), acts as a non-discretionary spending catalyst, ensuring a steady revenue stream for specialized compliance consultants.

Restraints: The market faces considerable resistance from internal client capabilities. Many large financial institutions are building robust internal consulting and data science teams, potentially reducing dependency on external firms for routine tasks. Cybersecurity risks and high-profile data breaches associated with third-party vendors also heighten client caution regarding the sharing of sensitive institutional data with external consultants. Moreover, the perceived commoditization of basic consulting services, especially in areas like IT maintenance and low-level process optimization, puts downward pressure on pricing, forcing consulting firms to constantly innovate and prove their value through proprietary data and specialized IP. Addressing regulatory fragmentation across different geographies adds substantial complexity and operational drag, impacting project speed and cost effectiveness.

Opportunities: Major opportunities reside in the burgeoning segment of ESG and sustainability consulting, which is rapidly moving from a niche concern to a central strategic imperative requiring standardized reporting, risk quantification, and portfolio decarbonization strategies. The emerging potential of Decentralized Finance (DeFi) and digital assets presents an opportunity for consultancies to advise on market entry, operational setup for crypto custody, and regulatory navigation in this nascent space. Furthermore, the need for robust operational resilience—covering everything from natural disasters to cyber warfare—offers a chance for consultancies to provide integrated, end-to-end resilience frameworks. Lastly, M&A activity within the financial sector, driven by consolidation and the pursuit of technological capabilities, generates substantial, high-margin strategic advisory and post-merger integration work.

Impact Forces Summary: These forces collectively accelerate the specialization trend. Consulting firms are abandoning generalized service models in favor of deep domain expertise (e.g., payment infrastructure consulting, actuarial AI). The focus on demonstrable return on investment (ROI) means that pure strategy advice is increasingly paired with long-term, managed services contracts. High fixed costs for advanced technological talent, required to stay ahead of client needs in AI and cybersecurity, solidify the market position of global leaders while simultaneously creating high barriers to entry for new generalist competitors. The regulatory pressure serves as a constant baseline demand, ensuring resilience against broader economic downturns, positioning risk and compliance consulting as a recession-proof segment.

Segmentation Analysis

The Financial Services Consulting Market is comprehensively segmented based on the service type offered, the size of the client organization, and the specific end-user within the financial sector. Service segmentation typically includes Strategy Consulting, Operations Consulting, Technology Consulting, Risk & Compliance Consulting, and Human Resources Consulting, reflecting the holistic nature of client transformation needs. Organization size differentiates between large enterprises, which require broad, multi-year transformation contracts, and small and medium-sized enterprises (SMEs), which often seek niche, cost-effective, and rapid deployment solutions, particularly for technology adoption. End-user categorization clearly delineates specialized needs across Banking and Capital Markets, Insurance, and Wealth and Asset Management, acknowledging the distinct regulatory environments and core business models of each sub-sector. This multi-dimensional segmentation allows consulting providers to tailor their value proposition, pricing models, and talent deployment strategy for maximal market penetration and relevance.

The segmentation by Service Type provides the clearest view of current market demand shifts. While Strategy consulting remains vital for setting long-term direction, Technology Consulting has rapidly become the highest-growth area, driven by cloud migration, data warehousing projects, and the implementation of AI/ML frameworks. Risk & Compliance maintains its market size dominance due to the continuous and expensive cycle of global regulatory updates, particularly concerning financial crime and systemic risk management. Operations Consulting focuses intensely on efficiency gains, often through process automation and redesign, directly addressing client pressure to reduce operational expenditure (OpEx). The intersection of these segments—for instance, technology consulting applied specifically to regulatory reporting (RegTech)—is where the highest growth premiums are observed, signifying the market's movement toward integrated, cross-functional solutions rather than siloed advice.

End-user specialization is crucial because the challenges faced by an investment bank are vastly different from those of a retail insurer. Insurance consulting is heavily focused on actuarial modernization, shifting towards usage-based insurance models (UBI), and managing generational transfer of wealth. Banking consulting centers on core system replacement, digital branch strategy, and optimizing lending portfolios. Asset management consulting is largely concerned with alpha generation through sophisticated data analytics, passive investment strategy design, and adherence to global fiduciary standards. Consulting firms must thus build deep expertise specific to these verticals, often acquiring specialized talent or firms to maintain credibility and offer high-value services.

- By Service Type:

- Strategy Consulting

- Operations Consulting

- Technology Consulting

- Risk & Compliance Consulting

- Human Resources Consulting/Change Management

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End-User:

- Banking and Capital Markets (B&CM)

- Insurance

- Wealth and Asset Management

- FinTech and Payment Processors

- Regulatory Bodies and Government Agencies

- By Delivery Model:

- Advisory Services

- Implementation and Integration Services

- Managed Services

Value Chain Analysis For Financial Services Consulting Market

The value chain for the Financial Services Consulting Market starts with the Upstream Analysis involving the acquisition and development of specialized knowledge capital, proprietary technologies, and expert talent. This phase includes continuous investment in R&D, data assets, global industry benchmarking, and advanced training in areas like Generative AI and quantum algorithms. The middle stage encompasses the core consulting process: problem definition, data collection and analysis, solution development (including model building and technology design), and presentation of recommendations. Key elements in this stage are the rigorous quality assurance of advice and the strategic use of proprietary tools to accelerate project delivery. Downstream Analysis focuses on implementation, change management, systems integration, and post-engagement evaluation, ensuring that the strategic advice translates into measurable business outcomes. The value chain is differentiated by the consulting firm’s ability to leverage technology at every step, moving from purely human capital advisory to technology-enabled consulting assets.

The upstream segment is highly competitive and centered around intellectual property (IP) creation and talent sourcing. Consulting firms must differentiate themselves not just by brand reputation, but by their demonstrable expertise in niche, high-value areas. This requires strategic alliances with technology providers (e.g., hyper-scalers like AWS, Microsoft Azure, Google Cloud) and the active recruitment of senior professionals with deep operational experience in banking or regulatory bodies. The acquisition of FinTech startups or specialized data analytics firms is a common strategy to rapidly infuse the necessary advanced capabilities into the upstream knowledge base. The cost structure here is dominated by high fixed labor costs and the substantial investment required to maintain advanced data infrastructure and security protocols necessary for handling sensitive client information globally.

The downstream distribution channel defines how services reach the end-user. Direct channels—where consulting firms engage clients through long-term relationships, strategic partnerships, and large framework agreements—dominate the market, especially for strategic and transformation projects. Indirect channels, while less common for full-scale strategic consulting, include partnerships with systems integrators (SIs), specialized software vendors, or through joint venture models where the consulting firm provides the high-level strategy and IP, and the partner handles localized deployment. The trend is moving towards integrated delivery, where the distinction between direct advisory and outsourced managed services blurs, leading to hybrid contracts that cover both the strategic overhaul and the subsequent operational management of the new systems. Successful firms optimize their distribution by offering flexible engagement models that align pricing with client success metrics and long-term value delivery.

Financial Services Consulting Market Potential Customers

The potential customers for the Financial Services Consulting Market span the entire spectrum of global financial institutions, encompassing highly regulated entities and agile new market entrants. The primary end-users or buyers of these services are the C-suite (CEOs, CFOs, CIOs, CROs) and senior departmental heads (e.g., Head of Digital Banking, Head of Compliance) within large institutional financial entities. These customers are driven by mandates to enhance shareholder value, achieve competitive advantage through digitalization, manage systemic risk, and comply with evolving geopolitical and financial regulations. The largest volume of spending originates from global systemically important banks (G-SIBs) and multinational insurance carriers due to the sheer complexity and scale of their operations and regulatory exposure. However, the fastest-growing customer base includes mid-sized regional banks and specialized asset managers who require highly targeted, scalable solutions to meet modernization and growth objectives without the internal capacity for large-scale transformation.

Within the banking sector, customers range from retail banks seeking improved customer loyalty and branch network rationalization to investment banks requiring sophisticated advisory on capital markets technology, trading infrastructure resilience, and derivative valuation modeling. The insurance industry clientele, including life, property & casualty (P&C), and reinsurance firms, are focused buyers of consulting services related to product innovation (parametric insurance), risk aggregation models, and operational efficiency improvements in claims processing, often powered by AI. Furthermore, sovereign wealth funds, pension funds, and major endowments constitute a key customer segment in wealth and asset management, primarily seeking advice on investment strategy, risk governance, and increasingly, integration of complex ESG metrics into their portfolio management structures.

A rapidly expanding segment of potential customers includes the ecosystem of FinTech companies, payment processors, and specialized regulatory technology (RegTech) firms. While these entities are themselves disruptors, they often lack the expertise in scaling operations, navigating multi-jurisdictional regulatory hurdles, or establishing formalized enterprise risk frameworks necessary for institutional partnerships or expansion. They hire consultants for strategic guidance on scaling technology infrastructure, M&A strategy, and attaining necessary financial licenses (e.g., banking charters, e-money licenses). Government regulatory bodies and central banks also represent key customers, engaging consultants for large-scale projects related to financial stability assessment, the modernization of national payment infrastructures, and the feasibility studies for introducing central bank digital currencies (CBDCs).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.4 Billion |

| Market Forecast in 2033 | USD 195.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte, PwC, EY, KPMG, Accenture, Capgemini Invent, IBM Consulting, Oliver Wyman, FTI Consulting, Protiviti, Aon plc, AlixPartners, Alpha FMC, BDO, RSM International, Grant Thornton, Roland Berger |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Financial Services Consulting Market Key Technology Landscape

The technology landscape underpinning the Financial Services Consulting Market is defined by intense innovation across several critical domains, moving far beyond basic IT integration into sophisticated data science and distributed ledger technologies. Cloud computing (hybrid and multi-cloud strategies) remains the foundational technology, enabling scalable operations and the deployment of advanced analytics. High-performance computing, often delivered through consulting-led cloud solutions, is essential for complex tasks like real-time risk calculations, quantitative trading strategies, and managing vast datasets for regulatory reporting. Advanced technologies like Generative AI and Machine Learning are paramount, utilized both internally by consulting firms for operational efficiency and externally as core client solutions for personalized customer engagement, fraud detection, and automated underwriting processes. Furthermore, the increasing relevance of Distributed Ledger Technology (DLT) and blockchain is driving consulting in areas such as digital asset custody, tokenization of assets, and optimization of cross-border payment rails, necessitating a deep understanding of cryptography and smart contract auditing. The integration of RegTech solutions, automating compliance monitoring and reporting, is also a critical technology focus area.

Cybersecurity consulting has evolved dramatically, moving beyond perimeter defense to encompass advanced threat intelligence, operational resilience planning, and zero-trust architecture implementation. The increasing sophistication of state-sponsored cyber threats and financial crime groups compels financial institutions to invest heavily in consulting focused on security posture assessment, incident response planning, and securing complex, multi-cloud environments. Furthermore, specialized consulting is emerging around Quantum Computing Readiness. While commercial quantum applications are still nascent, leading financial firms are seeking advice on post-quantum cryptography strategies and exploring quantum machine learning for optimization problems, establishing this as a high-value, forward-looking technology segment within the consulting domain. The successful deployment of these technologies requires highly skilled integration experts who can bridge the gap between theoretical models and practical, secure financial systems.

Finally, data management technology forms the backbone of all modern financial services consulting engagements. This includes consulting on building scalable data lakes and data warehouses, implementing robust data governance frameworks (essential for AI deployment), and ensuring data quality. The reliance on Application Programming Interfaces (APIs) and microservices architecture is critical for Open Banking initiatives and enables rapid integration of FinTech partnerships, driving demand for consulting specializing in API strategy and platform modernization. Consulting firms that possess proprietary technology accelerators—pre-built modules or platforms for rapid KYC onboarding or regulatory reporting—are demonstrating a competitive edge by significantly reducing implementation timelines and associated client costs, thus capitalizing on the blend of technology product and expert service delivery.

Regional Highlights

- North America (Dominance through Innovation and Scale): North America, particularly the United States, represents the largest and most technologically mature market for financial services consulting. Growth is driven by the rapid deployment of AI, aggressive cloud migration strategies across major banking institutions, and the robust venture capital ecosystem fueling FinTech disruption, which in turn necessitates strategic M&A and scaling consulting. High demand exists for complex regulatory consulting (e.g., OCC, SEC rules), cybersecurity risk management, and specialized wealth management advisory focused on generational wealth transfer and tax optimization. The market here is defined by large-scale, multi-year transformation projects and fierce competition among global consulting giants and highly specialized boutique firms, all competing based on proprietary data and predictive analytical capabilities.

- Europe (Regulatory Complexity and ESG Focus): Europe is a highly regulated market, with growth primarily fueled by non-discretionary regulatory spend, including implementation of stringent data privacy laws (GDPR), capital adequacy requirements (Basel IV), and massive projects related to the harmonization of financial markets (MiFID II). The region is a global leader in ESG and sustainable finance, generating significant consulting opportunities related to the EU Taxonomy, climate-related risk reporting, and portfolio greening strategies. The fragmentation of the banking sector and disparate national regulations create persistent demand for cross-border operational and compliance consulting. UK, Germany, and France remain the largest markets, characterized by a preference for specialist knowledge in areas like anti-financial crime technology and operational resilience.

- Asia Pacific (APAC) (Fastest Growth Driven by Digitalization): APAC is projected to be the fastest-growing region, driven by the massive scale of digitalization across emerging economies like India, Indonesia, and Vietnam, where financial inclusion and mobile banking infrastructure are rapidly expanding. China remains a distinct, large market with intense consulting demand focused on market access, local regulatory adherence, and massive payment processing systems. Key drivers include wealth creation among a burgeoning middle class, requiring sophisticated asset management consulting, and the necessity for cross-border banking modernization to handle growing international trade flows. The lack of legacy infrastructure in many APAC countries allows for leapfrogging directly to cloud-native and mobile-first financial solutions, creating substantial technology consulting opportunities in core banking replacement and digital identity management.

- Latin America (LATAM) (Infrastructure Modernization and Financial Inclusion): Growth in LATAM is driven by critical infrastructure modernization projects, particularly in Brazil and Mexico, focusing on modernizing outdated payment systems and combating financial instability through advanced risk modeling. Financial inclusion remains a central theme, necessitating consulting for mobile banking platforms and microfinance solutions. Regulatory convergence and the adoption of Open Banking frameworks across key economies are fueling demand for technology integration and data governance consulting. Political and economic volatility, however, maintains strong demand for sophisticated macroeconomic and strategic risk advisory services.

- Middle East and Africa (MEA) (Sovereign Wealth and Economic Diversification): The MEA region is characterized by substantial investment in financial infrastructure modernization, particularly in the UAE and Saudi Arabia, driven by national economic diversification visions (e.g., Saudi Vision 2030). Consulting demand is high in areas related to establishing FinTech hubs, managing large sovereign wealth funds, and developing Islamic finance structures. Africa sees growth driven by mobile money penetration and the development of new banking standards, creating opportunities for consulting on digital identity, localized payment systems, and robust governance frameworks necessary to attract foreign investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Financial Services Consulting Market.- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Deloitte

- PwC

- EY

- KPMG

- Accenture

- Capgemini Invent

- IBM Consulting

- Oliver Wyman

- FTI Consulting

- Protiviti

- Aon plc

- AlixPartners

- Alpha FMC

- BDO

- RSM International

- Grant Thornton

- Roland Berger

- CGI Inc.

- Wipro Consulting

- TCS Consulting

- Slalom Consulting

Frequently Asked Questions

Analyze common user questions about the Financial Services Consulting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Financial Services Consulting Market?

The primary growth drivers are accelerated digital transformation (especially cloud migration and AI adoption), mandatory regulatory changes (e.g., Basel IV, ESG reporting), and the increasing need for advanced cybersecurity and operational resilience planning against systemic threats.

How is technology consulting changing the market?

Technology consulting is shifting from simple IT integration to complex systems transformation, focusing on implementing proprietary AI/ML models, building scalable data governance frameworks, and transitioning core banking systems to microservices architecture, demanding hybrid finance and tech expertise.

Which geographical region holds the largest market share, and why?

North America currently holds the largest market share due to its massive financial ecosystem, high early adoption rates of disruptive technologies (FinTech and AI), and significant capital expenditure on sophisticated risk management and compliance infrastructure.

What role does ESG play in financial services consulting?

ESG (Environmental, Social, and Governance) has become a major service segment, driving demand for consulting on portfolio decarbonization, mandatory sustainability reporting (e.g., EU Taxonomy), climate risk stress testing, and the integration of sustainable metrics into lending and investment decision-making processes.

What are the main restraints impacting market growth?

Key restraints include the high costs associated with premium specialized consulting services, the scarcity of integrated talent (finance + advanced data science), and internal competition from client organizations developing their own in-house advisory and data capabilities.

What is the significance of the Value Chain’s upstream segment?

The upstream segment is critical as it involves the strategic acquisition and development of Intellectual Property (IP), proprietary data assets, and high-level specialized talent. This segment defines the firm’s ability to offer differentiated, scalable, and high-value solutions beyond generic advice.

How are consulting firms utilizing Generative AI internally?

Consulting firms use Generative AI internally to automate tedious tasks such as synthesizing regulatory documents, drafting initial reports, accelerating data analysis during due diligence, and creating proprietary code accelerators, significantly improving project delivery speed and consultant utilization rates.

Which end-user segment is driving the highest specialized demand?

The Wealth and Asset Management segment is driving high specialized demand, particularly for consulting focused on advanced quantitative strategy, portfolio optimization using ML, navigating complex global tax regimes, and developing digital platforms tailored for high-net-worth clients.

What is the current trend regarding the consulting delivery model?

The current trend leans toward hybrid delivery models, moving away from purely advisory roles towards outcome-based partnerships that include integrated technology implementation, managed services, and long-term co-creation agreements, linking consultancy fees directly to realized client success metrics.

What is the role of RegTech consulting?

RegTech consulting focuses on implementing automated, technology-driven solutions for compliance. This includes deploying AI for anti-money laundering (AML) monitoring, automating regulatory reporting (e.g., MiFID II data submission), and ensuring real-time adherence to global KYC standards, reducing manual intervention and compliance risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager