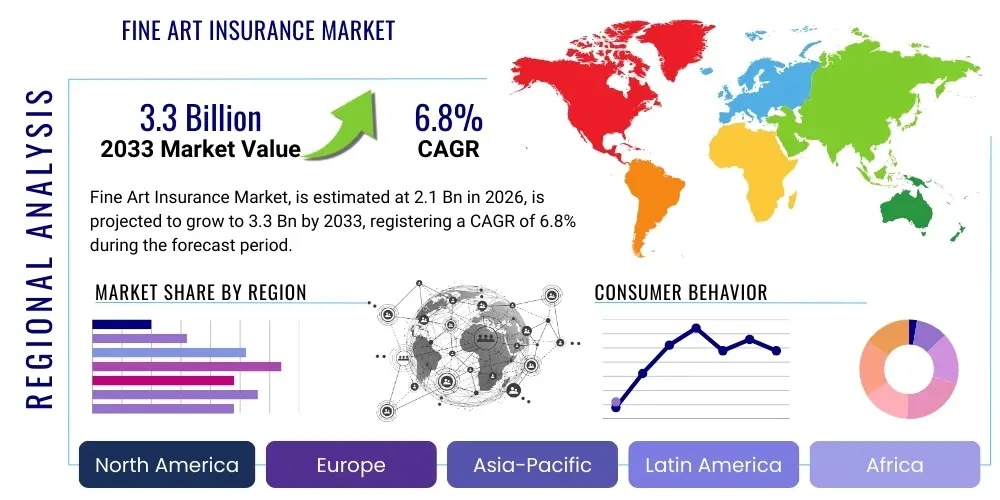

Fine Art Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441707 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Fine Art Insurance Market Size

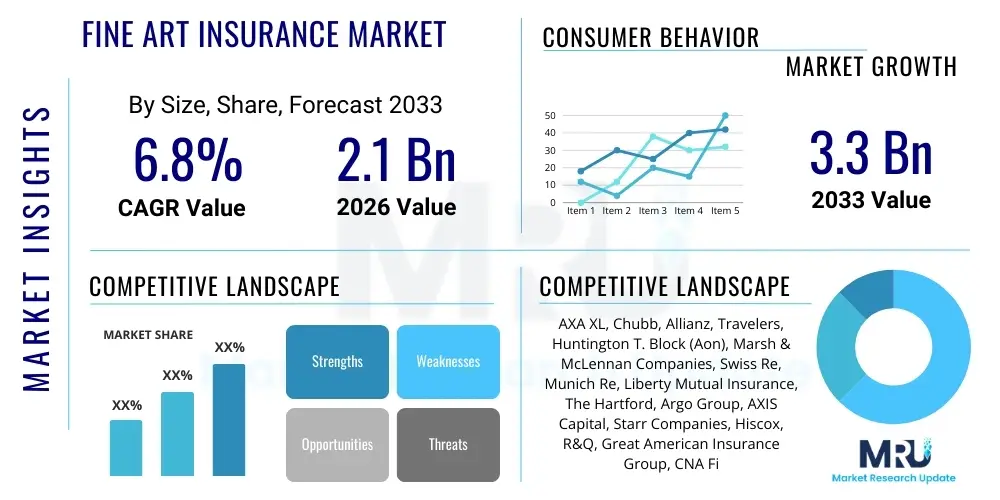

The Fine Art Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.3 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the escalating value of global art assets, coupled with the increasing professionalization of collections management across high-net-worth individuals (HNWIs) and institutional entities. The market demonstrates resilience, reflecting the non-correlated investment nature of fine art and the necessity for specialized risk mitigation products.

Fine Art Insurance Market introduction

The Fine Art Insurance Market encompasses specialized insurance products designed to protect high-value assets such as paintings, sculptures, antiques, jewelry, and rare collectibles against a wide range of risks, including physical damage, theft, and loss during transit or exhibition. This product category extends beyond standard property coverage, often including expert valuation services and coverage for 'mysterious disappearance' or 'inherent vice,' recognizing the unique vulnerability and subjective value inherent in artistic assets. The primary applications for this insurance span large public museums, private collectors with significant portfolios, commercial galleries, auction houses, and corporate collections.

The core benefit of fine art insurance is the transfer of substantial financial risk associated with loss or damage, ensuring the continuity and integrity of cultural heritage and investment portfolios. These policies often include 'agreed value' clauses, simplifying the claims process by pre-determining the asset's payout value, which is crucial given the fluctuating and often subjective nature of art valuation. Furthermore, insurers frequently provide essential risk mitigation advice regarding environmental controls, security protocols, and secure transportation logistics, acting as partners in collection stewardship rather than mere risk bearers.

Key driving factors propelling market growth include the globalization of the art market, leading to more frequent international movement and exhibition of valuable pieces, thereby increasing transit-related exposures. Simultaneously, the persistent rise in global wealth, particularly in emerging economies, has resulted in a burgeoning class of HNWIs aggressively investing in fine art as a stable, appreciating asset class. The heightened awareness of risks such as sophisticated theft, natural catastrophes exacerbated by climate change, and geopolitical instability further solidifies the need for robust specialized coverage, ensuring market momentum throughout the forecast period.

Fine Art Insurance Market Executive Summary

The Fine Art Insurance Market is characterized by robust growth, propelled by strong underlying business trends emphasizing risk management innovation and geopolitical sensitivity. A significant trend involves the adoption of sophisticated inventory management systems, often integrating blockchain technology to enhance provenance verification, which in turn improves insurer confidence and reduces underwriting risk. Additionally, the shift towards personalized and modular insurance products, allowing collectors to tailor coverage for specific risks—such as political unrest or cyber threats targeting digital provenance records—is reshaping service delivery. Business models are increasingly focusing on preventive measures, leveraging data analytics to advise clients on enhanced security and conservation practices, thereby transitioning from claims settlement to proactive risk partnership.

Regional trends highlight the dynamic expansion within the Asia Pacific (APAC) market, driven by rapidly accumulating wealth in countries like China and Singapore, which are establishing themselves as major global art trading hubs and collection centers. While North America and Europe remain dominant in terms of market share due to established institutional infrastructure and high concentrations of historical wealth, APAC is registering the highest growth rate, creating strong opportunities for international insurers. Furthermore, Latin America and the Middle East are experiencing moderate growth, spurred by governmental initiatives to develop cultural tourism and local art markets, necessitating adequate insurance infrastructure to protect national collections and attract international exhibitions.

Segmentation trends indicate that the Private Collectors segment maintains the largest market share, reflecting the sheer volume and value of assets held privately by HNWIs and UHNWIs (Ultra-High-Net-Worth Individuals). However, the Museums and Exhibitions segment is growing significantly due to the increasing frequency of high-value loan agreements and cross-border displays, demanding highly specialized transit and wall-to-wall coverage. In terms of coverage type, 'All Risks' policies continue to be the preference, offering comprehensive protection against unforeseen perils, though named perils policies are utilized for specific high-risk, high-volume, or less valuable institutional holdings where cost optimization is critical.

AI Impact Analysis on Fine Art Insurance Market

User inquiries regarding the impact of Artificial Intelligence on fine art insurance frequently center on the potential for AI to standardize the highly subjective art valuation process, combat sophisticated art fraud, and revolutionize claims processing. Key themes involve user expectations for AI-driven predictive modeling of loss events, particularly those related to environmental degradation or political instability affecting art movement. Concerns often relate to the ethical implications of using machine learning algorithms for valuation, potential algorithmic bias, and data privacy when aggregating global collection data. Users anticipate AI will significantly reduce underwriting lead times and improve pricing accuracy by integrating diverse datasets, moving the industry toward a more data-centric, rather than solely expertise-driven, operational model.

- AI-Powered Valuation: Utilization of machine learning algorithms trained on auction results, provenance history, condition reports, and market indices to generate objective, real-time valuations, significantly enhancing underwriting accuracy and reducing disputes during claims.

- Fraud Detection and Provenance Verification: Application of AI and computer vision to analyze artwork images and metadata, assisting in the detection of sophisticated forgery and verifying the authenticity and chain of custody, thereby mitigating insurer exposure to fraudulent claims.

- Predictive Risk Modeling: Employing AI to analyze large volumes of data—including weather patterns, crime statistics, geopolitical risk indicators, and exhibition schedules—to predict potential loss events and dynamically adjust premium pricing based on real-time risk exposure.

- Automated Claims Processing: Implementation of natural language processing (NLP) and machine learning to rapidly analyze loss reports, policy details, and valuation evidence, streamlining the claims adjustment process and accelerating payout times for simple, unambiguous losses.

- Enhanced Security and Environmental Monitoring: Integration of AI with IoT sensors deployed in storage facilities and museums to provide predictive alerts regarding deviations in temperature, humidity, or security breaches, promoting proactive intervention and reducing preventable damage.

DRO & Impact Forces Of Fine Art Insurance Market

The Fine Art Insurance Market is significantly shaped by a confluence of accelerating drivers, structural restraints, and transformative opportunities, creating a dynamic impact force environment. A primary driver is the ongoing proliferation of global wealth and the subsequent allocation of capital into tangible, high-value assets like art, which acts as a hedge against inflation and market volatility, directly increasing the insurable value pool. Coupled with this is the increasing institutionalization of the art market, where professional advisors, conservators, and wealth managers universally mandate robust insurance coverage, standardizing risk management practices across the collector base. The market benefits from cultural shifts promoting greater access and display of art, requiring transit and temporary exhibition coverage, further amplifying demand for specialized insurance products.

Conversely, the market faces several structural restraints that impede seamless growth and standardization. The inherent subjectivity and volatility of art valuation remain a critical challenge; disagreements over fair market value, especially for contemporary pieces lacking extensive auction history, complicate underwriting and claims resolution. High premium costs, particularly for unique or high-risk pieces, can discourage smaller collectors or public institutions operating under tight budgets from obtaining comprehensive coverage. Furthermore, regulatory fragmentation across global jurisdictions complicates multinational coverage, while the limited pool of specialized fine art insurance underwriters with deep expertise creates bottlenecks in capacity and innovation, especially for niche segments like digital art.

Opportunities for market expansion are largely centered on technological integration and addressing emerging asset classes. The ability to leverage blockchain for immutable provenance records presents a significant opportunity to de-risk policies and streamline verification processes, making coverage cheaper and more accessible. The burgeoning market for Non-Fungible Tokens (NFTs) and digital art necessitates the development of entirely new insurance frameworks covering risks like smart contract failures, custodial wallet compromise, and platform hacking, potentially unlocking a vast, untapped market segment. The overarching impact forces thus involve a mandatory technological pivot towards digitalization and predictive analytics, demanding that insurers evolve their assessment capabilities to match the complexity and global reach of modern art commerce, while simultaneously managing increasing exposures from climate-related perils and political instability.

Segmentation Analysis

The Fine Art Insurance market is segmented primarily based on the type of coverage provided, the end-user base, and the distribution channel employed. This segmentation reflects the varied needs of stakeholders, ranging from large, publicly funded museums requiring complex blanket policies to individual collectors needing tailored coverage for specific, highly valued pieces. Understanding these distinct segments is crucial for insurers to develop differentiated product offerings, optimize pricing models, and target distribution efforts effectively. The dynamics within these segments are influenced by factors such as regulatory requirements, the average value of assets held, and the frequency of art movement or exhibition activity, which dictate the necessary policy structure and risk premium.

The segmentation by Coverage Type—All Risks versus Named Perils—highlights the industry’s preference for comprehensive, expansive protection, particularly among high-net-worth clients who prioritize minimizing the administrative burden during a loss event. All Risks coverage, though typically more expensive, offers peace of mind by covering nearly all potential causes of loss unless specifically excluded (e.g., wear and tear, war, nuclear hazard). Named Perils policies are often favored by institutional clients or those focusing solely on core risks like fire, theft, or flood, managing cost while meeting minimum insurance requirements.

Analysis of the End-User segmentation reveals that private collectors represent the largest revenue contributor, yet institutions like museums and corporate collections often demand policies with higher face values and complex endorsements covering liabilities and long-term conservation issues. The Galleries and Dealers segment is particularly sensitive to speed and flexibility, requiring coverage that adapts rapidly to frequent sales, transit, and inventory turnover. Distribution channel analysis underscores the persistent dominance of specialized brokers and agents, whose expertise in fine art valuation and global risk placement remains critical for complex, high-stakes policies, overshadowing the nascent but growing trend of direct digital sales platforms.

- By Coverage Type:

- All Risks Coverage

- Named Perils Coverage

- By End User:

- Private Collectors

- Museums and Public Institutions

- Galleries and Art Dealers

- Auction Houses

- Corporate Collections

- By Sales Channel:

- Brokers and Agents

- Direct Sales/Direct Writers

- Bancassurance

- By Art Type:

- Paintings and Drawings

- Sculptures and Installations

- Antiquities and Artifacts

- Jewelry and Watches

- Collectibles (Stamps, Coins, Memorabilia)

- Digital Art (NFTs)

Value Chain Analysis For Fine Art Insurance Market

The value chain for the Fine Art Insurance Market is highly specialized, beginning with upstream activities focused on expert knowledge generation and risk assessment, extending through policy creation and culminating in the delivery of claims and risk mitigation services downstream. Upstream activities are dominated by specialized art appraisers, restorers, and security consultants who provide the critical data necessary for accurate risk evaluation and policy underwriting. The quality and reliability of these upstream services directly determine the insurer's exposure and pricing strategy. Insurers rely heavily on proprietary databases of art market values and historical loss data, often collaborating with specialized data providers to inform their actuarial models, ensuring premiums are commensurate with the unique risks associated with specific assets and locations.

The central manufacturing stage of the value chain involves policy underwriting, which is characterized by the high involvement of specialized underwriters who assess unique collections, negotiate tailored terms, and manage catastrophic risk aggregation. This stage often requires reinsurance involvement, particularly for mega-collections or high-profile global exhibitions, where capacity needs exceed the primary insurer's retention limits. Distribution channels represent a critical link in the middle of the chain. Specialized fine art insurance brokers act as intermediaries, leveraging their deep client relationships and technical expertise to match complex risks with appropriate coverage solutions, dominating market access due to the bespoke nature of the product.

Downstream activities focus on claims management, loss adjustment, and ongoing risk consultancy. Direct interaction with the insured during a loss event is managed by expert loss adjusters, often art conservators or legal specialists, who assess damage and determine the necessary restoration or payout. The importance of direct and indirect channels is pronounced; direct writers handle standardized or smaller policies, offering increased efficiency, but the majority of high-value, complex risks flow through indirect channels—brokers and agents—who offer personalized service and specialized risk placement capabilities. Effective downstream service delivery, particularly efficient claims settlement and expert advisory services, is paramount for maintaining client loyalty and brand reputation in this high-trust market.

Fine Art Insurance Market Potential Customers

The core customer base for the Fine Art Insurance Market is segmented into three primary groups: institutional bodies, high-net-worth individuals, and commercial entities involved in the art trade. Institutional buyers, such as national museums, private foundations, and university collections, are characterized by their need for comprehensive, long-term blanket policies covering large, diverse inventories, often subject to strict regulatory requirements and public scrutiny. These customers prioritize risk management continuity, disaster recovery planning, and specialized coverage for temporary loans and international exhibitions, requiring policies with extensive general liability and conservation endorsements. They are sophisticated buyers, typically engaging in multi-year contracts negotiated through specialized brokers.

High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) constitute the largest and fastest-growing segment of end-users. These collectors treat art as a significant asset class, demanding highly discreet, personalized service, and 'all risks' coverage with minimal deductible thresholds. Their purchasing decisions are often influenced by private wealth managers and family offices, integrating art insurance into a broader portfolio risk strategy. They require specialized services like valuation updates, security consulting for multiple residences, and worldwide coverage for frequent personal transport of pieces. The shift in this segment is towards policies that seamlessly integrate digital assets, such as NFTs, alongside traditional physical collections.

Commercial entities, including international auction houses, established commercial galleries, and specialized art logistics companies, form the third major customer group. Their primary need revolves around high turnover and high-exposure transit risks. Auction houses require comprehensive indemnity against damage or theft during the consignment period, transport, and auction exhibition. Galleries need flexible, adjustable policies that reflect rapid inventory changes and frequent movement to art fairs globally. These customers often seek integrated risk solutions that cover both physical assets and professional liability exposures inherent in the art trade, placing a high premium on insurer flexibility, capacity, and swift underwriting turnaround times to facilitate transactions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AXA XL, Chubb, Allianz, Travelers, Huntington T. Block (Aon), Marsh & McLennan Companies, Swiss Re, Munich Re, Liberty Mutual Insurance, The Hartford, Argo Group, AXIS Capital, Starr Companies, Hiscox, R&Q, Great American Insurance Group, CNA Financial, Generali, Willis Towers Watson, Zuerich Insurance Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fine Art Insurance Market Key Technology Landscape

The Fine Art Insurance market is increasingly adopting sophisticated technologies to enhance risk assessment, combat fraud, and improve the client experience, moving beyond traditional paper-based underwriting. A pivotal technology is the use of Internet of Things (IoT) sensors for continuous, real-time environmental monitoring within storage facilities, museums, and private homes. These sensors track vital parameters such as temperature, humidity, light exposure, and vibration, providing underwriters with actionable data that mitigates conservation risks and can justify favorable premium adjustments. Integrating these data streams with cloud-based platforms allows for predictive alerts, ensuring timely intervention and significantly reducing the incidence of preventable loss or degradation, thus shifting the focus from indemnification to proactive loss prevention.

The emergence of Distributed Ledger Technology (DLT), particularly blockchain, is fundamentally altering the documentation of provenance and authenticity. Blockchain provides an immutable, transparent record of an artwork's ownership history, condition reports, and transactional data. This transparency drastically reduces the risk of insuring fraudulent pieces or pieces with disputed ownership, streamlining the Know Your Customer (KYC) and Anti-Money Laundering (AML) processes for insurers. For the rapidly evolving Digital Art (NFT) segment, blockchain is not just an ancillary technology but the core infrastructure, necessitating insurers to develop smart contract validation and custodial verification technologies to secure these digital assets against hacking or platform failure.

Furthermore, insurers are heavily investing in Artificial Intelligence (AI) and Machine Learning (ML) capabilities, primarily for dynamic risk pricing and fraud detection. ML models analyze vast datasets of past losses, market movements, and geopolitical data to generate highly accurate risk profiles for specific regions or art types, enabling more granular and competitive pricing strategies. Advanced image recognition and computer vision techniques are being deployed to authenticate works, cross-reference inventory lists, and detect anomalies in condition reports, which enhances operational efficiency and significantly strengthens the insurer's ability to underwrite highly complex, international policies quickly and accurately, defining the future technological roadmap for the market.

Regional Highlights

- North America: Dominates the global market share, driven by the presence of the world's largest concentration of HNWIs, extensive institutional collections (e.g., in New York and Los Angeles), and a highly developed, specialized insurance brokerage infrastructure. The region exhibits high adoption rates of advanced risk mitigation technologies and demands comprehensive, high-capacity policies, particularly for major auction house activities and private wealth collections.

- Europe: Holds the second-largest market share, benefiting from centuries of art heritage, numerous world-renowned museums, and a strong regulatory framework (especially in the UK and Switzerland) supporting the art trade. Key trends involve increased cross-border exhibition activity and the growing necessity for coverage against political and terrorism risks, leading to high demand for specialized reinsurance capacity.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by rapid wealth creation, particularly in mainland China, Hong Kong, and Singapore, which are emerging as global art transaction hubs. Market growth is spurred by new collectors entering the market and government investment in cultural infrastructure, requiring insurers to develop culturally specific valuation expertise and flexible policy structures suitable for rapidly accumulating, diverse collections.

- Latin America: Characterized by a developing market structure with significant potential, though often constrained by higher geopolitical risks and economic instability. Demand is concentrated among major private collectors and national museums, requiring specialized coverage solutions that address unique exposures such as high security risks during transit and fluctuating local currency valuations impacting agreed value clauses.

- Middle East and Africa (MEA): Represents a niche, high-potential market, particularly within the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to massive government investment in cultural projects (e.g., Louvre Abu Dhabi) and the establishment of global art fairs. Growth is driven by these institutional projects, demanding international-standard coverage and sophisticated risk engineering services, often leveraging global reinsurers for capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fine Art Insurance Market.- AXA XL

- Chubb

- Allianz

- Travelers

- Huntington T. Block (Aon)

- Marsh & McLennan Companies

- Swiss Re

- Munich Re

- Liberty Mutual Insurance

- The Hartford

- Argo Group

- AXIS Capital

- Starr Companies

- Hiscox

- R&Q

- Great American Insurance Group

- CNA Financial

- Generali

- Willis Towers Watson

- Zuerich Insurance Group

Frequently Asked Questions

Analyze common user questions about the Fine Art Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between Fine Art Insurance and standard homeowners insurance?

Fine Art Insurance is specialized, offering 'Agreed Value' coverage, meaning the payout amount is pre-determined at the policy inception, avoiding depreciation claims common in standard property policies. It also covers unique risks like mysterious disappearance, transit damage, and often inherent vice, which are typically excluded or severely limited under general home contents coverage. Fine art policies are underwritten based on expert valuation and conservation needs, not just replacement cost.

How is the value of fine art determined for insurance purposes?

Value is typically determined through a professional appraisal conducted by an accredited expert, reflecting the current fair market value, usually based on recent auction sales and comparable art pieces. Insurers require updated appraisals every three to five years to ensure the Agreed Value remains current, especially for works by artists whose market values are rapidly appreciating, safeguarding against underinsurance in case of a total loss.

Does Fine Art Insurance cover digital assets like NFTs?

Coverage for Non-Fungible Tokens (NFTs) and digital art is an emerging segment. Specialized policies are being developed to cover specific digital risks, including the loss of the private cryptographic key (custodial risk), platform failure, or losses resulting from smart contract execution errors. Traditional policies generally only cover physical art; digital asset coverage requires specialized endorsements focused on cyber and blockchain risks, reflecting the intangible nature of the asset.

What are the major risk mitigation techniques recommended by art insurers?

Major risk mitigation techniques include implementing museum-grade environmental controls (temperature and humidity regulation), employing multi-layered security systems (alarm systems, secure storage, access control), and ensuring professional handling and transportation using accredited fine art logistics providers. Insurers often mandate detailed condition reports and high-resolution digital imaging prior to policy issuance to establish a baseline for loss assessment.

How does geopolitical instability affect the Fine Art Insurance market?

Geopolitical instability increases underwriting complexity, particularly for international exhibitions and pieces stored in or transiting through high-risk territories. Insurers face higher exposures related to war, civil commotion, confiscation, and terrorism. This instability drives up the cost of Political Risk Insurance endorsements and may lead to outright exclusion of coverage for certain high-risk locations, requiring specialized placement through the reinsurance market to maintain capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager