FinTech Regulatory Sandbox Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440724 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

FinTech Regulatory Sandbox Market Size

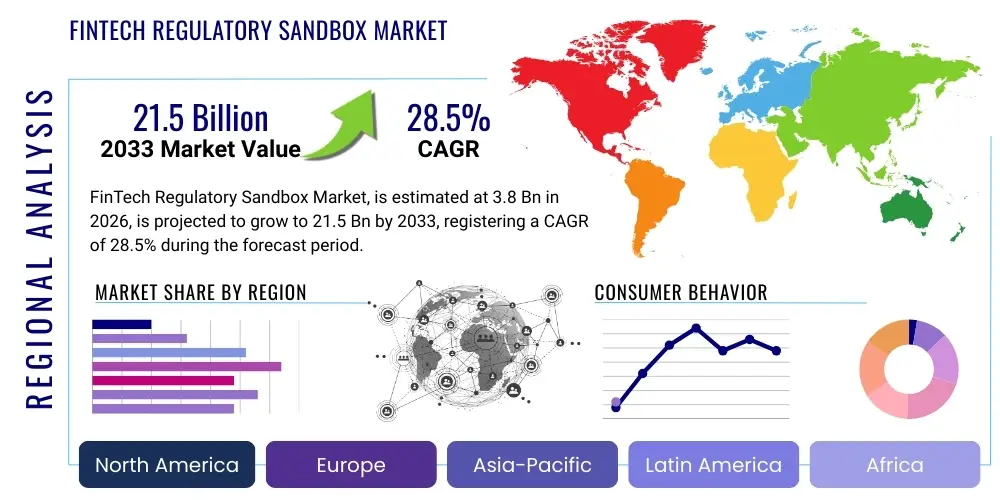

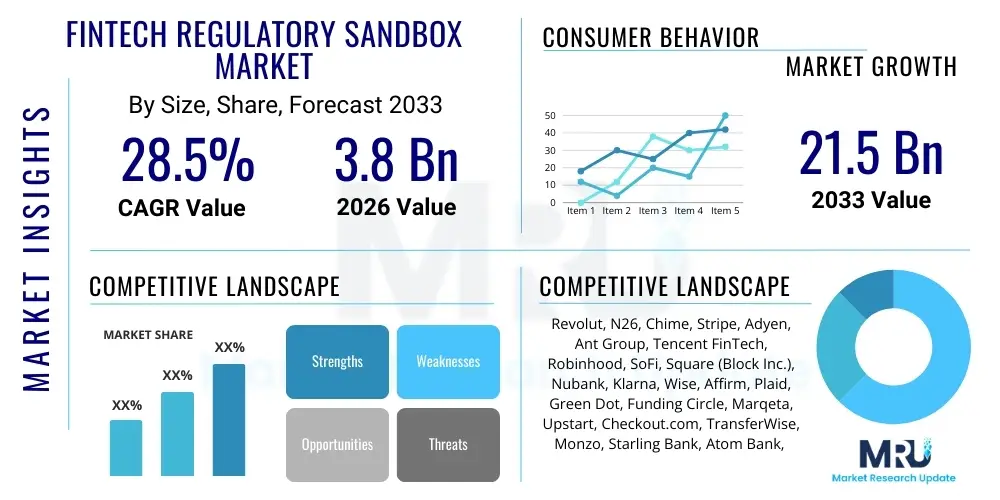

The FinTech Regulatory Sandbox Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 21.5 Billion by the end of the forecast period in 2033. This substantial growth is driven by the increasing demand for regulatory agility, innovation, and risk mitigation strategies within the rapidly evolving financial technology sector. As governments and financial authorities worldwide increasingly embrace sandboxes to foster controlled experimentation and promote responsible innovation, the market for advisory, technology, and compliance solutions enabling participation and management of these sandboxes is experiencing significant expansion.

FinTech Regulatory Sandbox Market introduction

The FinTech Regulatory Sandbox Market is characterized by platforms and frameworks established by regulatory authorities to allow financial technology (FinTech) firms, including nascent startups and established financial institutions, to test innovative products, services, and business models in a live yet controlled environment, under relaxed regulatory requirements. These sandboxes are crucial for fostering innovation while mitigating systemic risks, enabling companies to gather real-world data, refine their offerings, and receive direct feedback from regulators before full-scale market deployment. The primary goal is to strike a balance between promoting financial innovation and ensuring consumer protection, market integrity, and financial stability. Major applications span across digital payments, blockchain and cryptocurrency solutions, artificial intelligence in finance, InsurTech, Open Banking, lending, and wealth management. The benefits derived from these sandboxes are multifaceted, encompassing accelerated time-to-market for novel solutions, enhanced regulatory clarity, reduced compliance costs for early-stage innovations, and valuable opportunities for regulators to adapt their frameworks to emerging technologies. Key driving factors include the rapid pace of technological advancements, increasing global competition among financial hubs to attract FinTech investment, evolving consumer expectations for seamless digital financial services, and a proactive stance by regulators to engage with and understand disruptive innovations, thereby shaping a future-proof regulatory landscape.

FinTech Regulatory Sandbox Market Executive Summary

The FinTech Regulatory Sandbox Market is currently experiencing robust growth, propelled by a confluence of technological innovation, evolving regulatory philosophies, and increasing global connectivity in the financial services sector. Business trends indicate a shift towards more specialized and thematic sandboxes, often focusing on areas like distributed ledger technology (DLT), AI-driven financial services, or sustainable finance (Green FinTech), reflecting the industry's deepening specialization. Furthermore, there is a growing trend of "sandbox-as-a-service" offerings from private sector consultancies and technology providers, supporting FinTechs navigating the often-complex application and testing phases. Regional trends highlight Asia Pacific and Europe as frontrunners in sandbox adoption and maturity, with countries like Singapore, the UK, and Australia pioneering innovative models, while North America and emerging markets in Latin America and MEA are rapidly scaling up their initiatives to foster local innovation ecosystems. Segment trends showcase strong demand from both early-stage startups seeking pathways to market and established financial institutions leveraging sandboxes to pilot digital transformation initiatives without immediate full regulatory burden. Moreover, the integration of RegTech solutions within sandboxes is gaining traction, automating compliance processes and data reporting, thereby enhancing efficiency and reducing operational overhead for participants. The market is also witnessing a surge in cross-border sandbox collaborations, addressing the inherent global nature of many FinTech solutions and aiming to harmonize regulatory approaches across jurisdictions to facilitate international expansion.

AI Impact Analysis on FinTech Regulatory Sandbox Market

Common user questions regarding AI's impact on the FinTech Regulatory Sandbox Market frequently revolve around how artificial intelligence (AI) can both enhance the efficiency and scope of sandbox operations, as well as introduce new regulatory challenges that sandboxes are uniquely positioned to address. Users are keen to understand if AI can automate parts of the regulatory review process, improve data analytics for identifying risks and benefits of tested innovations, and personalize the sandbox experience for diverse FinTech applicants. Conversely, significant concerns are often raised about the ethical implications of AI, particularly in areas like algorithmic bias, data privacy, explainability (XAI) in complex financial models, and the potential for AI-driven fraud or systemic instability. Expectations are high for sandboxes to become critical testing grounds for AI-powered financial solutions, helping regulators develop appropriate guidelines and policy frameworks for responsible AI deployment, especially in high-stakes areas such as credit scoring, automated investment advice, and anti-money laundering (AML) operations. The market anticipates a surge in demand for sandbox environments that can effectively manage and assess the unique risks and transformative potential of machine learning, natural language processing, and deep learning applications within the financial sector.

- AI can significantly enhance the efficiency of sandbox operations by automating initial application screening, compliance monitoring, and data analysis of test results, reducing manual effort and accelerating regulatory feedback cycles.

- The deployment of AI-powered RegTech tools within sandboxes enables real-time risk assessment and proactive identification of potential regulatory breaches or market integrity issues during the testing phase.

- Sandboxes serve as vital testing grounds for AI-driven FinTech innovations, including algorithmic trading, AI-powered credit scoring, personalized financial advice, and advanced fraud detection systems, allowing for controlled experimentation.

- AI's role in creating sophisticated synthetic data environments within sandboxes can enable more robust testing of FinTech solutions, especially those requiring large datasets for training and validation, without compromising real customer data privacy.

- Ethical AI considerations, such as bias detection in algorithms, transparency (explainable AI), and data governance, are increasingly being integrated into sandbox frameworks, helping regulators develop guidelines for responsible AI deployment in finance.

- AI analytics can provide deeper insights into the performance and market impact of innovations tested in the sandbox, offering regulators a clearer picture of potential systemic risks or consumer benefits before broader market release.

- The FinTech Regulatory Sandbox Market will see an increased demand for specialized AI expertise and infrastructure within sandbox programs to effectively evaluate, monitor, and regulate complex AI-driven financial services.

DRO & Impact Forces Of FinTech Regulatory Sandbox Market

The FinTech Regulatory Sandbox Market is shaped by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the relentless pace of digital transformation across the financial sector, necessitating agile regulatory responses to emerging technologies like blockchain, AI, and cloud computing. The increasing global competition among financial centers to attract FinTech investment and talent also fuels sandbox adoption, as these frameworks signal a proactive and innovation-friendly regulatory environment. Furthermore, escalating consumer demand for seamless, personalized, and efficient digital financial services pressures incumbents and new entrants alike to innovate rapidly, often leveraging sandboxes to bring new offerings to market faster and with greater regulatory certainty. Counteracting these drivers are significant restraints, notably the inherent regulatory complexity and fragmentation across jurisdictions, which can limit the scalability of FinTech solutions and the effectiveness of cross-border sandbox initiatives. High compliance costs and the resource intensity of participating in a sandbox, particularly for smaller startups, can also be prohibitive, demanding significant investment in legal, technical, and operational expertise. Moreover, data security concerns and the challenge of maintaining consumer trust in novel, untested financial products represent ongoing hurdles that sandboxes must address through robust oversight and clear guidelines. Despite these challenges, substantial opportunities exist, particularly in fostering cross-border regulatory collaboration to create harmonized testing environments and pathways for international market entry. The integration of advanced technologies like AI and blockchain into sandbox design can further enhance their analytical capabilities and operational efficiency. Additionally, the growing focus on Environmental, Social, and Governance (ESG) principles presents an opportunity for sandboxes to facilitate the development and testing of sustainable FinTech solutions, while the expansion of open finance ecosystems provides a fertile ground for API-driven innovations to be tested in a controlled, collaborative setting. Broader impact forces, such as rapid technological advancements continuously redefine the landscape of financial services, demanding perpetual regulatory adaptation. Regulatory convergence efforts, albeit slow, are gradually shaping a more interconnected global FinTech ecosystem. Geopolitical shifts and economic volatility can influence policy priorities and investment flows into FinTech, thereby impacting sandbox activity. Finally, the evolving social acceptance of digital finance and the imperative for financial inclusion will continue to drive the strategic direction and focus of regulatory sandbox initiatives globally.

Segmentation Analysis

The FinTech Regulatory Sandbox Market is meticulously segmented to provide a granular view of its structure and dynamics, reflecting the diverse approaches adopted by regulatory bodies and the varied needs of FinTech innovators. This segmentation enables a deeper understanding of market trends, stakeholder engagement, and strategic opportunities across different dimensions. From the perspective of how sandboxes are structured and operated, to the specific technological applications they cater to, and the types of entities that primarily benefit from these frameworks, each segment contributes uniquely to the overall market landscape. Analyzing these segments is critical for identifying key growth areas, understanding competitive forces, and informing policy development that supports the evolution of a balanced and innovative financial ecosystem. The market's segmentation highlights the specialized nature of FinTech development and the bespoke regulatory approaches required to effectively manage its associated risks and opportunities, ensuring the sandbox mechanisms remain relevant and impactful as the industry matures and diversifies.

- By Type

- Standard Sandbox: Traditional regulatory sandbox models offering a broad framework for various FinTech innovations, typically with defined application windows and testing periods, focusing on a wide array of financial services.

- Thematic Sandbox: Specialized sandboxes concentrating on specific technological areas (e.g., DLT, AI/ML, Quantum Computing) or policy objectives (e.g., green finance, financial inclusion, Open Finance), enabling focused regulatory experimentation and policy development.

- Cross-border Sandbox: Initiatives that facilitate testing across multiple jurisdictions, often through bilateral or multilateral agreements between regulators, designed to support FinTech firms with international expansion strategies and harmonize regulatory perspectives.

- Regulatory Accelerators: Programs that provide FinTechs with faster access to regulatory guidance, mentorship, and streamlined authorization processes, often without the full regulatory relief of a traditional sandbox, emphasizing speed and collaborative engagement.

- By Application

- Digital Payments: Solutions involving electronic fund transfers, mobile payments, digital wallets, cross-border remittances, and instant payment systems, utilizing sandboxes to ensure security, interoperability, and consumer protection.

- Lending & Credit: Innovations in peer-to-peer lending, alternative credit scoring, embedded finance, microfinance, and digital mortgage platforms, testing new models for credit assessment and delivery.

- Wealth Management: Robo-advisors, personalized investment platforms, fractional ownership, and digital asset management tools, leveraging sandboxes to validate algorithmic integrity and client suitability.

- InsurTech: Technologies transforming the insurance sector, including AI-driven underwriting, telematics, parametric insurance, and blockchain-based claims processing, exploring new product designs and distribution channels.

- Blockchain & Crypto: Applications involving distributed ledger technology, cryptocurrencies, stablecoins, NFTs, tokenized assets, and central bank digital currencies (CBDCs), testing their regulatory implications, security, and market infrastructure.

- RegTech: Solutions employing AI, machine learning, and automation to enhance regulatory compliance, risk management, and reporting for financial institutions, often tested within sandboxes to demonstrate efficacy and interoperability with existing systems.

- Open Banking: Innovations built on open APIs for data sharing and third-party financial service integration, using sandboxes to assess data security, consent management, and competitive impacts.

- By End-User

- Startups & SMEs: Emerging FinTech companies and small to medium-sized enterprises that require regulatory guidance and a controlled environment to validate their novel products and services before full market entry.

- Established Financial Institutions: Large banks, insurance companies, and investment firms utilizing sandboxes to pilot internal innovation projects, test new technologies, or integrate FinTech solutions without disrupting core operations.

- Technology Providers: Companies offering underlying technology solutions (e.g., cloud services, API platforms, cybersecurity tools) that support FinTech innovation, leveraging sandboxes to demonstrate compliance and compatibility with financial regulations.

- Government & Regulatory Bodies: Entities that establish and operate sandboxes, often collaborating to refine regulatory frameworks, gain insights into emerging technologies, and foster a dynamic innovation ecosystem.

Value Chain Analysis For FinTech Regulatory Sandbox Market

The value chain within the FinTech Regulatory Sandbox Market encompasses a series of interconnected activities, beginning from the upstream development of innovative financial technologies to the downstream delivery of regulated financial products and services. Upstream analysis focuses on the ideation and initial development phases where FinTech firms conceptualize new products, often leveraging advanced technologies like AI, blockchain, and cloud computing. This stage involves significant research and development, initial proof-of-concept creation, and strategic planning for regulatory engagement. Key upstream participants include technology innovators, venture capitalists funding these innovations, and academic institutions contributing to foundational research. As these innovations mature, the FinTech firms enter the sandbox phase, which involves preparing detailed applications, engaging with regulatory bodies for testing protocols, and deploying their solutions in a controlled environment. Midstream activities are dominated by the sandbox operators – primarily regulatory authorities – who provide the framework, oversight, and feedback mechanisms. This phase also heavily involves advisory firms and RegTech providers who assist FinTechs with compliance, risk management, and technology integration. Downstream analysis considers the outcomes of successful sandbox participation, leading to commercialization and broader market adoption. This includes securing full regulatory licenses, scaling operations, and integrating with distribution channels. Direct distribution channels involve FinTechs offering their services directly to end-users through digital platforms and applications. Indirect distribution channels include partnerships with incumbent financial institutions, white-label solutions, or integration into broader financial ecosystems, where the tested FinTech solution becomes part of a larger offering. The entire value chain is underpinned by a continuous feedback loop between innovators, regulators, and end-users, ensuring that the regulatory framework remains adaptive and supportive of responsible innovation while safeguarding market integrity and consumer interests.

FinTech Regulatory Sandbox Market Potential Customers

The FinTech Regulatory Sandbox Market serves a diverse range of potential customers, each with unique needs and objectives in leveraging these innovation-friendly environments. Primarily, the market targets emerging FinTech startups and small to medium-sized enterprises (SMEs) that are developing groundbreaking financial products and services. These entities often lack the extensive resources and regulatory expertise of larger institutions, making sandboxes an invaluable pathway to navigate complex compliance landscapes, gain regulatory insights, and validate their business models in a live, albeit controlled, setting. For these startups, the sandbox reduces time-to-market, lowers the initial cost of regulatory compliance, and provides direct access to regulatory feedback, which is critical for refining their offerings and building investor confidence. Another significant customer segment comprises established financial institutions, including large banks, insurance companies, and asset management firms. These incumbents utilize sandboxes to pilot their digital transformation initiatives, test disruptive technologies without impacting their core legacy systems, and explore new revenue streams. By engaging with sandboxes, established players can de-risk innovation, foster a culture of experimentation, and stay competitive against agile FinTech challengers. Furthermore, technology providers and solution integrators, offering services like cloud infrastructure, API platforms, cybersecurity tools, and RegTech solutions, also represent potential customers. They may use sandboxes to demonstrate the regulatory compliance and interoperability of their foundational technologies, proving their suitability for the financial sector and enhancing their market credibility. Ultimately, the end-users of the product are the consumers and businesses who benefit from the innovative, secure, and regulated financial products and services that successfully emerge from these sandbox environments, driving financial inclusion, efficiency, and enhanced customer experiences across the globe.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 21.5 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Revolut, N26, Chime, Stripe, Adyen, Ant Group, Tencent FinTech, Robinhood, SoFi, Square (Block Inc.), Nubank, Klarna, Wise, Affirm, Plaid, Green Dot, Funding Circle, Marqeta, Upstart, Checkout.com, TransferWise, Monzo, Starling Bank, Atom Bank, Avant |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FinTech Regulatory Sandbox Market Key Technology Landscape

The FinTech Regulatory Sandbox Market is intricately linked to a dynamic and rapidly evolving technology landscape, with several key technological advancements forming the backbone of both the innovations being tested and the mechanisms for regulatory oversight. Distributed Ledger Technology (DLT), including blockchain, is a foundational technology driving numerous FinTech solutions related to cryptocurrencies, tokenized assets, smart contracts, and cross-border payments. Sandboxes provide controlled environments to assess the regulatory implications of DLT's decentralization, immutability, and consensus mechanisms, crucial for developing appropriate legal and operational frameworks. Artificial Intelligence (AI) and Machine Learning (ML) are pervasive, powering applications in algorithmic trading, fraud detection, credit scoring, personalized financial advice (robo-advisors), and automated compliance (RegTech). The sandbox helps regulators understand AI's ethical considerations, explainability, data bias, and its potential impact on market stability and consumer protection. Cloud computing platforms offer scalable and flexible infrastructure, enabling FinTechs to rapidly deploy and test their solutions without significant upfront hardware investment. Sandboxes often leverage cloud environments to create isolated testing zones, addressing concerns related to data sovereignty, security, and resilience. Application Programming Interfaces (APIs) are central to the Open Banking and Open Finance movements, facilitating secure data sharing and interoperability between financial institutions and third-party providers. Sandboxes are critical for testing API security, consent management frameworks, and the competitive implications of interconnected financial ecosystems. Cybersecurity technologies, including advanced encryption, biometric authentication, and threat intelligence, are paramount within the sandbox, ensuring the integrity and confidentiality of data during testing. RegTech (Regulatory Technology) solutions, often utilizing AI and big data analytics, automate and streamline compliance processes, risk management, and regulatory reporting, which are increasingly integrated into sandbox operations to enhance efficiency for both regulators and participants. Finally, big data analytics provides the tools to process vast amounts of transaction and behavioral data generated during sandbox testing, offering valuable insights for regulators to assess the performance, risks, and benefits of new FinTech solutions, thereby informing future policy decisions. This technological confluence makes the FinTech Regulatory Sandbox Market a crucial nexus for understanding and shaping the future of regulated financial innovation.

Regional Highlights

- North America: The North American FinTech Regulatory Sandbox Market is experiencing significant growth, driven primarily by the United States and Canada. In the U.S., while there isn't a unified federal sandbox, individual states (like Arizona and Wyoming) have launched initiatives, and federal agencies such as the OCC and CFPB have innovation offices that offer tailored guidance and no-action letters. Canada's provincial regulators, like the Ontario Securities Commission (OSC), have established sandboxes to foster innovation in capital markets. This region focuses heavily on blockchain, AI, and payments innovation, with a strong emphasis on consumer protection and financial stability, and is characterized by a dynamic startup ecosystem and significant venture capital investment in FinTech.

- Europe: Europe stands as a pioneering region in FinTech regulatory sandboxes, with the UK's Financial Conduct Authority (FCA) being a globally recognized leader. The European Union's broader efforts towards a digital single market and the Payment Services Directive 2 (PSD2) have spurred open banking and API-driven innovation, which are frequently tested in sandboxes. Countries like the Netherlands, Switzerland, and various Nordic nations have also implemented robust sandbox frameworks, focusing on cross-border collaboration, data privacy (GDPR considerations), and sustainable finance. The emphasis here is on harmonizing regulatory approaches across member states while encouraging competitive innovation.

- Asia Pacific (APAC): The APAC region is a global hotbed for FinTech regulatory sandboxes, led by exemplary initiatives from the Monetary Authority of Singapore (MAS), the Australian Securities and Investments Commission (ASIC), and the Hong Kong Monetary Authority (HKMA). This region showcases a diverse range of sandbox models, often adapting to unique market conditions, including a strong focus on financial inclusion for large unbanked populations and rapid adoption of mobile payments. Countries like Malaysia, Thailand, and India are also actively developing their sandbox capabilities, prioritizing innovations in digital payments, DLT, and InsurTech, aiming to become regional FinTech hubs and leverage technology for economic development.

- Latin America: The FinTech Regulatory Sandbox Market in Latin America is rapidly emerging, propelled by a growing unbanked population, increasing smartphone penetration, and a demand for more accessible financial services. Brazil and Mexico have been at the forefront, establishing comprehensive FinTech laws that include provisions for regulatory sandboxes, particularly for payments, lending, and crowdfunding. Other countries like Colombia and Chile are following suit, creating frameworks to support local innovation ecosystems. The region's sandboxes often prioritize financial inclusion, consumer protection in nascent digital markets, and the development of robust digital infrastructure, attracting significant local and international investment.

- Middle East and Africa (MEA): The MEA region is witnessing substantial growth in its FinTech Regulatory Sandbox Market, driven by ambitious national digital transformation agendas and efforts to diversify economies away from traditional sectors. Hubs like the United Arab Emirates (specifically Dubai Financial Services Authority and Abu Dhabi Global Market) and Bahrain have established advanced sandboxes that attract global FinTech players, with a strong focus on blockchain, digital assets, and Islamic finance. In Africa, countries such as Kenya, South Africa, and Nigeria are developing sandboxes to address local challenges like financial inclusion, cross-border remittances, and mobile money innovations, leveraging technology to bridge service gaps and foster economic growth across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FinTech Regulatory Sandbox Market.- Revolut

- N26

- Chime

- Stripe

- Adyen

- Ant Group

- Tencent FinTech

- Robinhood

- SoFi

- Square (Block Inc.)

- Nubank

- Klarna

- Wise

- Affirm

- Plaid

- Green Dot

- Funding Circle

- Marqeta

- Upstart

- Checkout.com

- Monzo

- Starling Bank

- Atom Bank

- Avant

- Thought Machine

Frequently Asked Questions

Analyze common user questions about the FinTech Regulatory Sandbox market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a FinTech Regulatory Sandbox?

A FinTech Regulatory Sandbox is a controlled testing environment established by financial regulators, allowing FinTech firms to test innovative products, services, or business models on a limited scale with real customers, under specific safeguards and relaxed regulatory requirements. It provides a safe space for innovation to flourish while regulators gain insights and refine their frameworks, balancing progress with consumer protection and financial stability.

Why are FinTech Regulatory Sandboxes important?

FinTech Regulatory Sandboxes are crucial because they accelerate innovation by providing a clearer, faster, and less costly pathway for novel financial solutions to reach the market. They help reduce regulatory uncertainty for innovators, foster collaboration between regulators and industry, and enable regulators to adapt their policies to keep pace with rapid technological advancements, ultimately benefiting consumers through more innovative and secure financial services.

Who can participate in a FinTech Regulatory Sandbox?

Participation in a FinTech Regulatory Sandbox typically extends to a wide range of entities, including FinTech startups, technology companies developing financial solutions, and even established financial institutions (banks, insurers) that wish to test new products or business models. The specific eligibility criteria vary by jurisdiction, but generally, applicants must demonstrate genuine innovation, clear consumer benefits, and a robust testing plan.

What are the benefits of participating in a regulatory sandbox for FinTech companies?

For FinTech companies, the benefits of sandbox participation are substantial. They include reduced time-to-market for innovative products, direct access to regulatory guidance and feedback, a lower initial cost of compliance compared to full authorization, the ability to test with real users in a controlled environment, enhanced credibility with investors, and a clearer path towards obtaining full regulatory licensing upon successful completion of the testing phase.

What challenges do FinTech Regulatory Sandboxes aim to address?

FinTech Regulatory Sandboxes primarily address the challenges arising from the rapid pace of technological innovation outstripping traditional regulatory cycles. They help overcome regulatory uncertainty, reduce high compliance burdens for novel solutions, mitigate the risk of market failures due to untested innovations, and prevent regulatory arbitrage. By providing a structured testing ground, sandboxes ensure that new financial products are safe, secure, and beneficial for consumers before widespread adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager