Fire Alarm And Detection Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441904 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Fire Alarm And Detection Systems Market Size

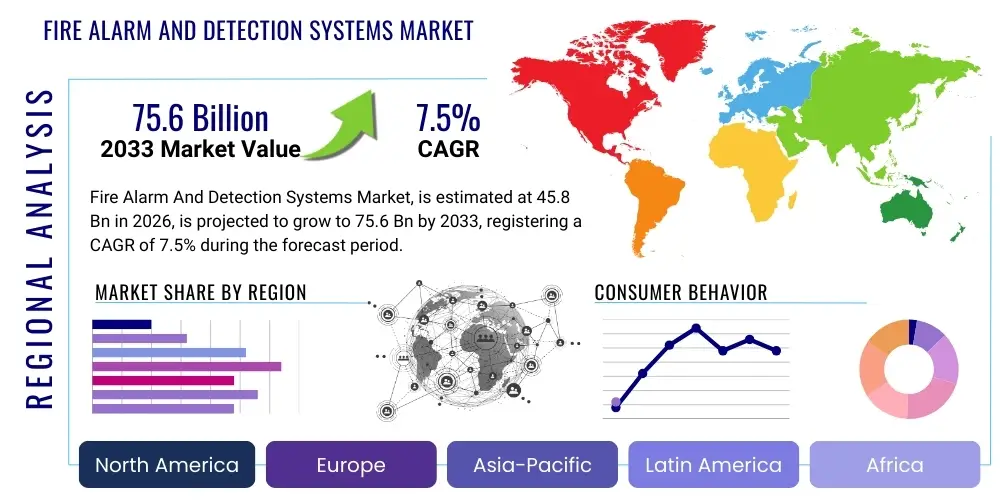

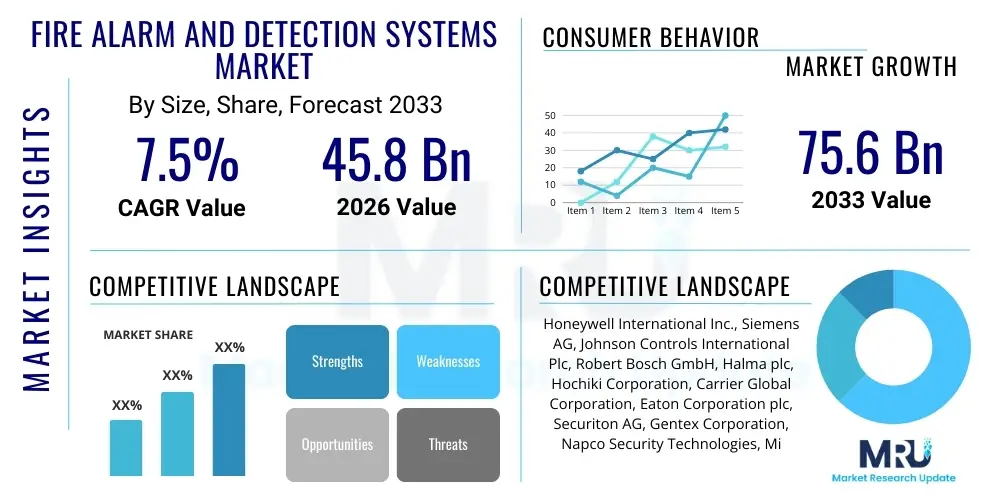

The Fire Alarm And Detection Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 75.6 Billion by the end of the forecast period in 2033.

Fire Alarm And Detection Systems Market introduction

The Fire Alarm And Detection Systems Market encompasses a comprehensive range of electronic devices and infrastructure designed to sense the presence of fire, smoke, heat, or carbon monoxide and notify occupants and emergency services. These systems are crucial components of modern building safety infrastructure, mandated by stringent regulatory codes globally. Key product offerings include smoke detectors, heat detectors, flame detectors, control panels, notification appliances (horns, strobes), and manual call points. The fundamental purpose is to minimize property damage and, critically, save lives by providing early warnings, enabling rapid evacuation and prompt suppression efforts. The efficacy of these systems is continually enhanced by integration with building management systems (BMS) and advanced network connectivity, moving traditional systems towards smart, interconnected safety networks.

Major applications of fire alarm and detection systems span across residential, commercial, industrial, and government sectors. Commercial buildings, including offices, retail spaces, and hotels, rely heavily on addressable systems for precise fire location identification. Industrial complexes, such as manufacturing plants and chemical processing facilities, require robust detection systems, often utilizing specialized flame and gas detection technologies tailored to volatile environments. Furthermore, the rising construction of smart cities and high-rise structures globally necessitates sophisticated, reliable, and standards-compliant fire safety solutions. The market is driven by increasing awareness regarding fire safety, coupled with massive investments in infrastructure development, particularly in emerging economies where regulatory compliance is tightening.

The primary benefits derived from investing in advanced fire alarm and detection systems include enhanced safety compliance, reduced insurance premiums, and unparalleled protection of critical assets and personnel. Driving factors for market expansion include escalating urbanization, resulting in densely populated areas requiring centralized safety mechanisms, and the modernization of existing infrastructures to comply with international safety standards like NFPA and EN standards. Moreover, technological advancements, such as the incorporation of wireless networking and IoT capabilities, are making installation simpler, monitoring more effective, and overall system maintenance less invasive, fostering greater adoption across diverse end-user sectors.

Fire Alarm And Detection Systems Market Executive Summary

The Fire Alarm And Detection Systems Market is experiencing robust expansion driven by mandatory regulatory environments and rapid technological integration, notably IoT and AI. Business trends indicate a strong shift towards hybrid and wireless systems, which offer flexibility and cost-efficiency in installation and retrofitting projects. Key industry players are focusing on mergers and acquisitions to consolidate market share and invest heavily in developing sophisticated, sensor-based technologies capable of differentiating between true fire threats and nuisance alarms, thereby reducing operational false alarms. Furthermore, the demand for integrated security solutions that combine fire detection, intrusion detection, and video surveillance under a unified platform is a significant commercial trend defining market growth and vendor strategies globally.

Regionally, North America and Europe maintain dominant market positions due to established regulatory frameworks and high spending on modern infrastructure safety updates. However, the Asia Pacific (APAC) region is forecasted to exhibit the fastest growth, fueled by massive construction booms in commercial and residential sectors, rapid industrialization, and the increasing adoption of Western safety standards, particularly in countries like China and India. Government initiatives promoting smart infrastructure and public safety projects in the Middle East are also contributing significantly to localized market demand, focusing on advanced, high-reliability systems for large-scale urban development.

Segmentation trends highlight the rapid proliferation of Addressable Fire Alarm Systems over conventional systems, attributed to their capacity for precise localization and simplified troubleshooting in complex structures. By end-user, the commercial and industrial segments remain the largest revenue generators, requiring high-specification detectors (e.g., beam detectors, flame detectors). However, the residential segment is projected to witness accelerated growth, largely due to the mandatory installation of interconnected smoke alarms in new residential construction and stricter codes compelling upgrades in existing residential properties, solidifying the market's foundational stability and future growth trajectory.

AI Impact Analysis on Fire Alarm And Detection Systems Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Fire Alarm And Detection Systems Market center on three key themes: False Alarm Reduction, Predictive Maintenance Capabilities, and Enhanced Threat Detection Accuracy. Users frequently inquire about how AI-driven analytics can filter environmental noise, such as steam or dust, to minimize costly and disruptive false alarms, a pervasive industry challenge. There is significant interest in AI's role in performing predictive maintenance, allowing system administrators to identify component failures or degradation before they cause operational issues. Furthermore, users seek clarity on how machine learning algorithms improve the speed and accuracy of identifying genuine fire signatures across varied environmental conditions, moving beyond traditional threshold-based alarms to contextual and behavioral pattern recognition.

- AI algorithms significantly reduce false alarms by analyzing contextual data (e.g., time of day, air flow, ambient temperature) to validate alarm signals.

- Machine learning facilitates predictive maintenance by monitoring sensor health and performance metrics, proactively scheduling component replacement.

- AI-enabled video analytics systems are integrated with detection infrastructure to visually confirm fire or smoke events, speeding up response times.

- Natural Language Processing (NLP) within monitoring systems improves communication efficiency during emergencies and integrates seamlessly with city-wide emergency services protocols.

- Deep learning models enable sophisticated early warning capabilities by recognizing subtle behavioral patterns indicative of a developing hazard, such as unusual heat buildup or localized air quality changes.

DRO & Impact Forces Of Fire Alarm And Detection Systems Market

The Fire Alarm And Detection Systems Market is primarily driven by rigorous enforcement of global fire safety codes and regulations, making installation mandatory in commercial and public infrastructure. Key drivers include increasing infrastructural development worldwide, particularly the growth of smart cities and high-rise commercial buildings, coupled with heightened public awareness regarding fire safety following major catastrophic events. Technological drivers involve the continuous integration of IoT, wireless connectivity, and intelligent sensor technologies, improving system reliability and installation ease. These forces collectively push the market forward by creating consistent, non-discretionary demand for compliant and effective safety equipment across all sectors globally.

Restraints, however, pose certain challenges to market expansion. The high initial installation cost of sophisticated addressable and hybrid systems often limits adoption in budget-constrained small and medium enterprises (SMEs) or existing residential structures. Another significant restraint is the prevalence of operational and maintenance issues, including false alarms which lead to 'alarm fatigue' and distrust in the system's reliability, requiring frequent and costly service calls. Moreover, regulatory inconsistencies across different jurisdictions, particularly in developing countries, sometimes complicate the standardization and rapid deployment of international products and technologies.

Opportunities for growth are abundant, focusing primarily on the lucrative retrofit and replacement market, where older conventional systems in established markets are upgraded to modern, intelligent, and network-enabled versions. Significant opportunity exists in expanding market penetration for wireless fire alarm systems, which minimize wiring complexity and offer ideal solutions for historically significant buildings or temporary structures. Furthermore, the integration of fire detection systems with cybersecurity measures, protecting network integrity from malicious attacks, presents a specialized, high-value growth area, especially in critical infrastructure installations. The impact forces indicate that regulatory compulsion and technological innovation are overwhelmingly positive, ensuring sustained market growth despite cost-related restraints.

Segmentation Analysis

The Fire Alarm And Detection Systems Market is comprehensively segmented based on technology, component type, service model, and end-user application, allowing for a detailed understanding of market dynamics and targeted deployment strategies. This segmentation highlights the shift from hardware-centric sales to integrated solutions and value-added services. Component segmentation differentiates between detection hardware (sensors, detectors), control panels (conventional vs. addressable), and notification appliances (horns, strobes). Service segmentation is gaining prominence, reflecting the industry's focus on recurring revenue streams generated through installation, maintenance, and managed monitoring services. Understanding these segments is crucial for stakeholders to align product development and marketing efforts with specific market needs and regulatory requirements across diverse geographies.

- By Product Type:

- Detectors (Smoke, Heat, Flame, Gas)

- Control Panels (Conventional, Addressable, Hybrid)

- Notification Appliances (Horns, Strobes, Speakers)

- Ancillary Devices (Manual Pull Stations, Isolators)

- By Technology:

- Conventional Systems

- Addressable Systems

- Wireless Systems

- By Service:

- Installation & Design

- Maintenance & Support Services

- Managed Monitoring Services

- Inspection Services

- By End-User:

- Commercial (Offices, Retail, Hospitality)

- Industrial (Manufacturing, Energy & Power, Oil & Gas)

- Residential

- Government & Institutional (Healthcare, Education, Military)

Value Chain Analysis For Fire Alarm And Detection Systems Market

The value chain for the Fire Alarm And Detection Systems Market commences with upstream raw material suppliers providing components like specialized sensors, semiconductors, plastics, and metals required for detector manufacturing and panel construction. The subsequent stage involves core manufacturing and assembly, dominated by established original equipment manufacturers (OEMs) who focus on R&D, compliance certification (UL, FM, EN), and scalable production. This manufacturing segment is highly competitive and capital-intensive, prioritizing quality assurance and regulatory adherence. Effective inventory management and robust supply chain resilience, especially concerning microchip availability, are critical success factors at this stage.

The midstream of the value chain is characterized by complex distribution channels. Direct channels involve large-scale contracts with government entities or major construction companies for flagship projects, often handled directly by the OEM or its certified subsidiaries. Indirect channels are more pervasive, utilizing specialized electrical distributors, security system integrators, and value-added resellers (VARs) who manage sales, customization, and local installation services. System integrators play a vital role, bridging the gap between hardware manufacturers and diverse end-user requirements by integrating fire systems with other safety and building management protocols, thus adding significant customer value.

Downstream analysis focuses on end-users and post-sale services. End-users span commercial, residential, and industrial sectors, each requiring unique system specifications and regulatory adherence. The service sector—installation, maintenance, and monitoring—forms a crucial part of the downstream value capture. Recurring revenue streams from inspection and maintenance contracts are essential for long-term profitability. The trend toward cloud-based monitoring and remote diagnostics, often provided through third-party monitoring stations or directly by manufacturers, is optimizing the efficiency of the downstream operations and solidifying customer loyalty.

Fire Alarm And Detection Systems Market Potential Customers

Potential customers for Fire Alarm And Detection Systems are extremely diverse, reflecting the mandatory nature of fire safety across virtually all organized human environments. The largest and most lucrative customer segment remains the commercial sector, encompassing new construction and retrofitting projects for high-traffic areas such as shopping malls, corporate headquarters, data centers, and hospitals, which demand high-end, networked addressable systems. The industrial sector, including petrochemical plants, utility companies, and logistics warehouses, represents another critical customer base, requiring specialized, ruggedized detection systems like flame detectors and gas sensors tailored for harsh operating conditions and volatile materials.

The governmental and institutional segment, covering educational facilities, public transport hubs, military bases, and municipal buildings, serves as a consistent customer base, driven strictly by public safety mandates and large, multi-year budgetary cycles. These customers often prioritize robust reliability and long system lifespans. Furthermore, the residential market, segmented into multi-family dwellings and single-family homes, is rapidly becoming a high-growth area. This growth is propelled by stricter building codes demanding interconnected, smart smoke alarms and CO detection devices in new residential developments, creating a high volume, though often lower-margin, opportunity for basic to mid-range systems. System integrators and electrical contractors act as crucial intermediaries in reaching these varied end-user groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 75.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Siemens AG, Johnson Controls International Plc, Robert Bosch GmbH, Halma plc, Hochiki Corporation, Carrier Global Corporation, Eaton Corporation plc, Securiton AG, Gentex Corporation, Napco Security Technologies, Mircom Group of Companies, Viking SupplyNet, Fike Corporation, Nittan Company, Ltd., Minimax Viking GmbH, Advanced Fire Systems, Notifier by Honeywell, FirePro Systems, C-TEC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fire Alarm And Detection Systems Market Key Technology Landscape

The technological landscape of the Fire Alarm And Detection Systems Market is rapidly evolving, moving away from simple, centralized conventional systems towards intelligent, distributed, and highly networked platforms. A crucial technological shift involves the dominance of Addressable Fire Alarm Systems, which use complex protocols to communicate the precise location and status of individual devices to the main control panel. This granular level of data minimizes response time and simplifies maintenance, making them standard for large commercial and industrial applications. Furthermore, the development of multi-sensor detectors, combining input from smoke, heat, and carbon monoxide sensors, utilizes sophisticated algorithms to enhance accuracy and significantly reduce nuisance alarms, representing a major advancement in early detection capabilities.

The integration of Information and Communication Technologies (ICT) is defining the next generation of fire safety. Internet of Things (IoT) connectivity enables detectors to communicate wirelessly, facilitating deployment in complex or remote locations and allowing real-time remote monitoring via cloud platforms. This not only improves system management but also supports predictive maintenance schedules. Another prominent technology is the utilization of advanced detection methods, specifically high-sensitivity detectors like Aspirating Smoke Detection (ASD) systems for critical environments such as data centers, where even minor combustion particles must be detected instantly. This focus on speed and sensitivity in specialized environments expands the market for high-margin, technically complex solutions.

Artificial Intelligence (AI) and machine learning are increasingly integrated, primarily for advanced analytics. AI algorithms are trained on vast datasets of environmental disturbances and real fire signatures to dramatically improve the discrimination capabilities of sensors, ensuring higher reliability. Furthermore, Power over Ethernet (PoE) technology is gaining traction, simplifying installation and wiring by allowing control panels and notification appliances to receive both power and data through a single network cable, significantly lowering infrastructure costs for new installations and modernizing existing network backbones. This confluence of wireless, networked, and intelligent systems is reshaping product design and setting new benchmarks for system performance and reliability.

Regional Highlights

- North America: This region holds a significant market share due to highly mature safety regulations enforced by bodies like NFPA (National Fire Protection Association) and strict building codes across the US and Canada. High spending power, early adoption of advanced technologies like AI-enabled sensors and wireless systems, and a large retrofit market continually drive stable growth. Key focus areas include cybersecurity protection for networked systems in critical infrastructure and the integration of fire safety into smart building management systems (BMS).

- Europe: Europe is characterized by stringent adherence to European Standards (EN) and significant government investment in public building safety upgrades. Countries like Germany, the UK, and France are leaders in adopting sophisticated addressable systems. The region is witnessing robust demand for fire suppression and detection solutions in the industrial manufacturing sector, particularly in compliance with complex industrial safety directives.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily driven by rapid urbanization, massive infrastructure development (e.g., smart cities, mega-high rises), and increasing awareness spurred by recent catastrophic fire events. Governments in China, India, and Southeast Asia are actively updating outdated fire codes to align with international safety benchmarks, creating immense opportunities for both established global players and local manufacturers offering cost-effective, compliant solutions.

- Latin America (LATAM): The LATAM market growth is steady but highly dependent on regulatory enforcement consistency. Brazil and Mexico are the primary markets, driven by commercial construction and industrial expansion, especially in mining and energy sectors. Market penetration of advanced systems is lower compared to North America and Europe, suggesting significant long-term potential as economies stabilize and safety standards consolidate.

- Middle East and Africa (MEA): Growth in the MEA region is propelled by large-scale, visionary construction projects, particularly in the UAE and Saudi Arabia, demanding the highest level of certified fire safety and detection technology. The focus is on large, complex systems for critical assets, government buildings, and luxury high-rise residential towers, often incorporating aspirating and video-based detection systems due to the high value of protected assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fire Alarm And Detection Systems Market.- Honeywell International Inc.

- Siemens AG

- Johnson Controls International Plc

- Robert Bosch GmbH

- Halma plc

- Hochiki Corporation

- Carrier Global Corporation

- Eaton Corporation plc

- Securiton AG

- Gentex Corporation

- Napco Security Technologies

- Mircom Group of Companies

- Viking SupplyNet

- Fike Corporation

- Nittan Company, Ltd.

- Minimax Viking GmbH

- Advanced Fire Systems

- Notifier by Honeywell

- FirePro Systems

- C-TEC

Frequently Asked Questions

Analyze common user questions about the Fire Alarm And Detection Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Fire Alarm And Detection Systems Market?

The primary factor driving market growth is the global adherence to increasingly stringent government regulations and mandatory safety codes (such as NFPA and EN standards) requiring certified fire detection systems in all commercial, institutional, and high-density residential structures. This regulatory environment creates non-discretionary demand across all major geographies.

How do Addressable Fire Alarm Systems differ from Conventional Systems?

Addressable systems assign a unique digital address to every single device, enabling the control panel to pinpoint the exact location and status of the alarming device. Conventional systems only identify the general zone or circuit where the alarm originated, making troubleshooting and rapid response much less efficient in large, complex buildings.

What role does IoT technology play in modern Fire Alarm Systems?

IoT enables modern fire alarm systems to connect wirelessly to central monitoring platforms, offering real-time data transmission, remote diagnostics, and status monitoring. This connectivity facilitates efficient maintenance scheduling, reduces system downtime, and allows integration with broader building management and emergency response networks.

Which end-user segment contributes the most revenue to the market?

The commercial end-user segment, including corporate offices, retail spaces, and hospitality sectors, contributes the highest revenue share. This is due to the mandatory requirement for sophisticated, networked detection and alarm systems to protect large occupancy areas and high-value commercial assets.

What is the biggest technological challenge facing the Fire Alarm Detection Market?

The most significant technological challenge is reducing the incidence of false alarms. High rates of nuisance alarms lead to operational costs, disruption, and user apathy, which can compromise overall safety. Manufacturers are addressing this through the integration of AI and multi-criteria sensor fusion to differentiate real threats from environmental anomalies.

The relentless pursuit of safety standards, mandated by global legislative frameworks, establishes a resilient foundation for the Fire Alarm And Detection Systems Market. Market growth is structurally guaranteed by the continuous evolution of building codes and the mandatory requirement for periodic system upgrades, ensuring a steady stream of revenue from both new construction and retrofitting activities. The shift towards smarter, networked fire safety infrastructures is transforming operational efficiency. These intelligent systems leverage Internet of Things (IoT) connectivity to provide continuous real-time monitoring and advanced remote diagnostics, significantly lowering the total cost of ownership (TCO) over the system's lifecycle and improving reliability. Manufacturers are increasingly focused on developing highly integrated platforms that unify fire detection with other security functions, such as access control and video surveillance, catering to the growing demand for holistic building safety management solutions across commercial and institutional sectors. The need for comprehensive solutions that offer both life safety and asset protection drives premium product adoption and technological sophistication in competitive regions.

Furthermore, the market's trajectory is strongly influenced by demographic shifts and global urbanization trends. As populations concentrate in dense urban centers, the construction of multi-story residential buildings and vast commercial complexes necessitates more sophisticated, addressable, and reliable fire safety infrastructure. This demand dynamic is particularly pronounced in the Asia Pacific (APAC) region, where rapid infrastructure expansion is coupled with the adoption of global best practices in safety engineering. The challenge remains the standardization of installation and maintenance practices across diverse regional regulatory landscapes. To mitigate this, leading global manufacturers are expanding their certification and training programs to ensure compliance and reliable system performance, thereby supporting sustained expansion into emerging markets where technical expertise is rapidly developing.

Innovation in detection hardware, specifically in sensor technology, remains critical to maintaining market vitality. The development of advanced optical and photo-electric detectors capable of discerning between various smoke types (e.g., pyrolysis smoke, smoldering fires, flaming fires) significantly enhances alarm accuracy. This technological focus directly addresses the long-standing industry restraint related to false alarms. Moreover, the increasing integration of Artificial Intelligence (AI) for predictive analysis and contextual data validation marks a pivotal trend. AI allows control panels not only to react to fixed thresholds but to analyze complex patterns, thereby forecasting potential fire risks based on subtle environmental changes. These capabilities position fire detection systems as proactive risk management tools rather than purely reactive devices, solidifying their value proposition in mission-critical environments like data centers, hospitals, and high-tech manufacturing facilities.

The Service segment, covering installation, maintenance, and managed monitoring, is increasingly becoming a critical differentiator and a high-margin business area. Customers are shifting from outright purchase models to long-term service contracts that guarantee compliance, operational reliability, and rapid technical support. This shift favors large manufacturers and specialized service providers who can offer 24/7 monitoring capabilities and comprehensive technical certifications. Maintenance services often include mandatory periodic inspections and testing, mandated by codes such as NFPA 72, generating highly stable and predictable recurring revenue streams. The adoption of cloud-based monitoring services allows system providers to remotely diagnose potential issues, reducing on-site service costs and maximizing system uptime, thereby enhancing customer satisfaction and reinforcing market stability.

Within the technology segmentation, Wireless Fire Alarm Systems are emerging as a disruptive force, particularly in the retrofit market and in facilities where running extensive wiring is impractical or cost-prohibitive, such as historical buildings or modular constructions. These systems utilize secure, supervised radio frequencies to ensure reliable communication between detectors and the control panel, meeting stringent safety standards without compromising integrity. While initially facing regulatory hurdles and cost concerns, advancements in battery life, mesh networking reliability, and communication security have made wireless systems a viable and highly attractive alternative. This flexibility allows for faster deployment and minimal disruption to ongoing operations, addressing the need for efficiency in the installation process across both commercial and educational institutions.

The industrial sector remains highly valuable due to its demand for specialized and robust detection equipment. Facilities such as oil refineries, chemical plants, and power generation stations require advanced flame detectors (UV, IR, and Multi-Spectrum IR) and toxic or combustible gas detection systems integrated into the fire alarm network. These complex industrial environments necessitate systems with high resistance to vibration, temperature extremes, and corrosive atmospheres. The adherence to strict Process Safety Management (PSM) standards further mandates continuous system operation and high reliability, driving demand for premium, certified detection instruments and specialized engineering services. The capital investment in these systems is significant, reflecting the high catastrophic risk associated with industrial incidents, and this segment consistently drives innovation in detection physics and resilience.

Geographically, while North America and Europe remain the key centers of technological advancement and regulatory stability, the future momentum of the market is unequivocally shifting toward the Asia Pacific (APAC) region. Countries within APAC are undergoing unprecedented structural transformation, characterized by rapid infrastructural growth and increasing regulatory harmonization towards international safety standards. This dynamic convergence of new construction activity and a strengthening legislative framework positions APAC as the dominant growth engine for the next decade. Manufacturers are strategically relocating production facilities and establishing regional sales and service hubs in key APAC countries to capitalize on this exponential demand and mitigate complex supply chain logistics, adapting products to local certification requirements and installation preferences.

The competitive landscape of the market is characterized by the presence of large, multinational conglomerates like Honeywell International Inc. and Siemens AG, who offer comprehensive, end-to-end fire safety and building automation solutions, leveraging their global distribution networks and extensive R&D budgets. These industry leaders often dictate technology standards and market pricing strategies. However, the market also supports niche specialization, with companies focusing exclusively on specific high-performance detectors (e.g., flame detection specialists) or tailored solutions for particular end-user verticals, such as healthcare or marine applications. Strategic partnerships between hardware manufacturers and software developers, particularly those specializing in AI and cloud security, are becoming commonplace, enabling the development of integrated, smart-enabled products that provide a competitive edge in the evolving digital safety ecosystem.

Looking ahead, the market for Fire Alarm And Detection Systems is expected to benefit significantly from the widespread adoption of Aspirating Smoke Detection (ASD) systems outside of traditional high-value environments like data centers. As costs decrease and awareness of ASD’s high sensitivity increases, it is being utilized in environments requiring very early warning, such as cold storage, museums, and high-end residential complexes. Furthermore, the convergence of fire safety with broader building cybersecurity concerns is paramount. Since modern fire systems are network-connected, they represent potential entry points for malicious cyber actors. Consequently, manufacturers must embed robust security protocols and encryption methods directly into their control panels and networked devices, adding a necessary layer of complexity and value to new product development and ensuring system integrity against external threats.

The long-term market opportunity lies in achieving truly autonomous fire safety management. This involves integrating AI not just for false alarm filtering, but for taking preliminary, safe actions autonomously, such as initiating localized suppression, closing fire doors, or isolating specific ventilation zones immediately upon confirmed detection, without waiting for human intervention. These integrated capabilities, combined with mandatory adherence to global life safety standards, ensure that the Fire Alarm And Detection Systems Market maintains a stable, upward growth trajectory well beyond the forecast period, driven by both regulatory compliance and continuous technological advancement aiming for zero fatalities and minimized property loss. The emphasis on lifecycle management, including sustainable and easily upgradeable components, is also driving purchasing decisions among environmentally conscious corporations and government agencies seeking long-term value.

The sustained success of market participants hinges on their ability to manage complex supply chains, particularly concerning specialized electronic components and sensing elements, many of which are subject to global supply fluctuations. Resilient supply chain strategies and vertical integration, where feasible, are essential for maintaining competitive pricing and reliable product delivery schedules. Furthermore, the technical expertise required for system design, installation, and commissioning demands continuous workforce training and certification. Companies investing heavily in specialized training programs for their distributors and service partners are better positioned to guarantee high-quality installations and reliable system performance, crucial determinants of customer loyalty and long-term contract retention, especially in high-compliance sectors like healthcare and critical infrastructure where performance failure is unacceptable.

Market segmentation based on technology is increasingly nuanced. While addressable systems dominate the high-end market, the growth of Hybrid Systems is providing flexible solutions, allowing users to integrate conventional components with addressable panels. This capability is highly beneficial for phased upgrade projects where replacing an entire existing system simultaneously is not financially viable. Hybrid systems allow end-users to incrementally modernize their infrastructure while benefiting from the superior monitoring and reporting capabilities of addressable technology in critical areas. This flexibility broadens the market appeal, enabling budget-sensitive organizations to transition towards advanced safety standards without requiring prohibitive initial capital outlay, thereby stimulating demand in the mid-market segment. This adaptation to varying budget cycles is a key strategy for unlocking latent demand in the substantial retrofit sector globally.

Finally, the growing environmental consciousness is introducing green technology standards into the fire safety domain. This includes the development of detectors and control panels that consume less standby power and the use of sustainable or recyclable materials in manufacturing. While fire safety remains the paramount concern, efficiency and environmental impact are becoming secondary purchasing criteria, particularly among European and North American institutional buyers. Manufacturers are responding by achieving certifications related to energy efficiency and environmental management, reinforcing their commitment to corporate social responsibility while adhering to all core safety performance requirements. This dual focus on high performance and environmental stewardship is likely to define new product development cycles over the latter half of the forecast period, especially as smart city initiatives increasingly demand sustainable building solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager