Fire Code Consulting Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441405 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Fire Code Consulting Service Market Size

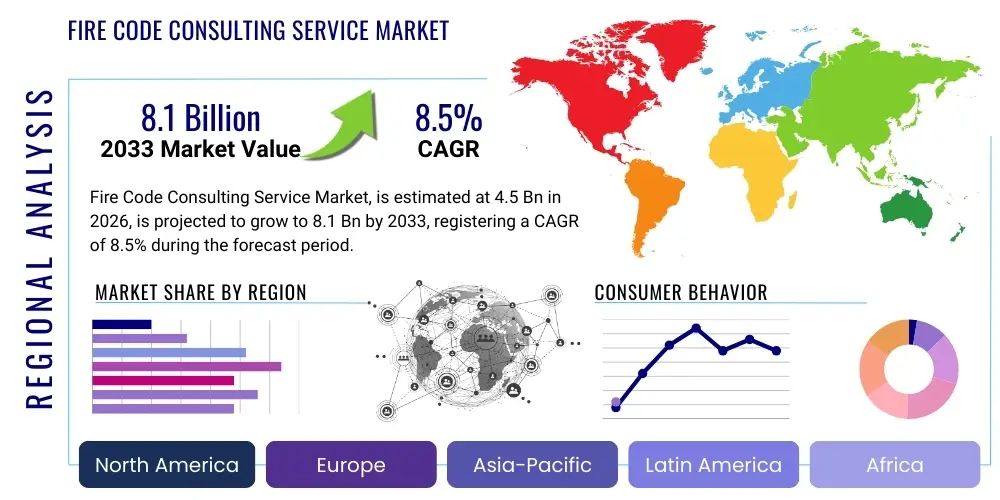

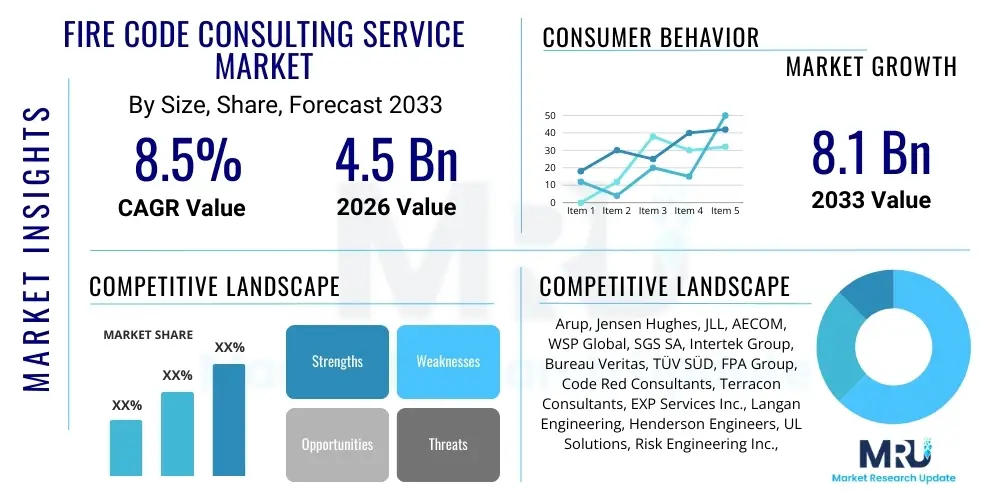

The Fire Code Consulting Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $8.1 Billion by the end of the forecast period in 2033.

Fire Code Consulting Service Market introduction

The Fire Code Consulting Service Market encompasses professional engineering and regulatory advisory services focused on ensuring that buildings, infrastructure, and operational practices adhere to local, national, and international fire safety codes, standards, and regulations. These services are crucial for minimizing fire risk, protecting human life, and safeguarding assets, covering the entire lifecycle of a structure from initial design and construction through occupancy and renovation. Consultants provide specialized expertise in interpreting complex codes, developing fire protection strategies, conducting plan reviews, performing risk assessments, and navigating the regulatory approval process. Demand is primarily driven by increasingly stringent global fire safety standards, rapid urbanization leading to complex construction projects, and the mandatory requirement for compliance across various end-use sectors.

Key services offered include detailed fire suppression system design (sprinklers, clean agent systems), fire alarm and detection system planning, egress analysis, computational fluid dynamics (CFD) modeling for smoke control, and hazardous material storage compliance. The product—the consultation—is highly customized based on the structure type (e.g., high-rise, industrial facility, healthcare environment) and the specific jurisdiction’s requirements (e.g., NFPA standards in the US, Eurocodes in Europe, or specific regional building codes). The core benefit provided by these services is mitigating legal liability and ensuring business continuity by preventing catastrophic loss. The driving factors include heightened public awareness regarding fire safety, large-scale infrastructure investments globally, and the complexity introduced by modern architectural designs utilizing novel materials and structural systems.

Major applications span commercial real estate (offices, retail centers), industrial facilities (manufacturing plants, petrochemical sites), governmental infrastructure (transportation hubs, utilities), and specialized sectors such as healthcare and data centers, where downtime is intolerable and life safety protocols are paramount. The inherent regulatory nature of construction and operation means that fire code consulting is often a mandatory requirement, not merely an optional addition, sustaining steady market growth irrespective of minor economic fluctuations. Furthermore, the trend toward sustainable and smart buildings requires consultants to integrate fire safety with high-efficiency systems, adding another layer of complexity and specialization to the services demanded by clients.

- Market Intro: Provision of specialized expertise and advisory services to ensure adherence to fire safety regulations (NFPA, ICC, ISO standards).

- Product Description: Customized consulting, risk assessment, design review, performance-based design, and compliance verification services.

- Major Applications: Commercial buildings, industrial complexes, infrastructure projects, residential high-rises, and specialized facilities (e.g., hospitals, data centers).

- Benefits: Reduced risk of loss, protection of life safety, regulatory compliance assurance, minimized legal liability, and continuity of operations.

- Driving factors: Stringent regulatory enforcement, global infrastructure development, complexity of modern architecture, and increasing public safety awareness.

Fire Code Consulting Service Market Executive Summary

The global Fire Code Consulting Service Market exhibits robust growth, primarily propelled by global regulatory convergence towards stricter safety standards and substantial investment in complex urban infrastructure projects across developed and developing economies. Business trends highlight a significant shift toward specialized consulting niches, particularly performance-based design (PBD), which allows for flexible, cost-effective, and innovative fire safety solutions beyond prescriptive codes. Consolidation among major engineering and consulting firms is a defining characteristic, as larger players acquire smaller, specialized regional firms to expand their geographical footprint and enhance their technical capabilities in areas like digital modeling (BIM integration) and forensic engineering. Furthermore, the market is capitalizing on recurring revenue streams generated by mandatory re-inspections, annual compliance audits, and retrofitting projects for aging infrastructure that must meet updated standards, thereby stabilizing demand across economic cycles.

Regional trends indicate North America and Europe retaining mature market dominance due to established regulatory frameworks and high enforcement levels, while the Asia Pacific (APAC) region is projected to register the fastest growth rate. This accelerated growth in APAC is fueled by massive urbanization, rapid commercial construction booms in countries like China and India, and the subsequent implementation of modern, western-style fire codes where they previously lacked rigor. Latin America and the Middle East also demonstrate significant potential, driven by mega-projects (e.g., smart cities, large transportation networks) requiring world-class fire safety engineering expertise, often mandated by international investors or insurance bodies. Consultant firms are increasingly establishing local partnerships in these high-growth regions to navigate diverse regulatory landscapes and local approval processes effectively, leveraging regional experts for localized knowledge application.

Segment trends reveal that the Application segment sees high demand from the Industrial and Infrastructure sectors, where the potential cost of fire damage and business interruption is exceptionally high, justifying premium consulting fees for advanced risk mitigation strategies. Within the Service Type segment, performance-based design consulting is gaining traction over prescriptive consulting, especially for unique or architecturally challenging structures, offering optimization benefits. Technology integration, specifically the use of Building Information Modeling (BIM) platforms, has emerged as a critical service differentiator, enabling precise simulation and coordinated design across multiple engineering disciplines. This digital integration improves project efficiency and reduces potential clashes between fire safety systems and other building utilities, enhancing the overall value proposition delivered by market leaders.

- Business Trends: Increased market consolidation, greater reliance on performance-based design, integration of BIM, and growth in recurring regulatory audit services.

- Regional Trends: Rapid expansion in APAC driven by urbanization; sustained maturity and high regulation in North America and Europe; growth tied to mega-projects in MEA.

- Segments trends: Industrial and infrastructure applications showing strongest demand; Performance-Based Design (PBD) segment outpacing prescriptive compliance services.

AI Impact Analysis on Fire Code Consulting Service Market

User inquiries concerning AI's impact on Fire Code Consulting frequently revolve around automation capabilities, efficiency gains in code review processes, and the potential displacement of human expertise. Key themes include questions about how machine learning (ML) models can rapidly analyze vast amounts of regulatory text and project blueprints, significantly speeding up the initial compliance checks that traditionally consume substantial consultant time. Concerns often center on the liability associated with AI-driven design recommendations and whether current regulatory bodies (like NFPA or ICC) are prepared to validate and certify systems designed or optimized predominantly by AI algorithms. Users also express strong interest in AI's role in predictive maintenance for existing fire protection systems, moving beyond passive compliance to proactive risk management and continuous monitoring.

The primary influence of Artificial Intelligence (AI) and related technologies, such as Machine Learning (ML) and computer vision, lies in enhancing the efficiency and accuracy of compliance verification and risk modeling. AI systems are being developed to instantly cross-reference architectural drawings and engineering specifications against jurisdictional codes, flagging potential non-compliance issues much earlier in the design phase. This ability to automate prescriptive code checking frees up senior fire protection engineers to focus on complex, high-value tasks such as performance-based simulations, intricate smoke control modeling, and advanced system optimization. AI significantly reduces the manual, repetitive aspects of plan review, thereby lowering project turnaround times and potentially reducing consulting costs for standardized projects, while simultaneously increasing the consistency and thoroughness of the compliance review process.

Furthermore, AI algorithms are proving invaluable in advanced risk assessment and forensic analysis. By processing large datasets of past fire incidents, building characteristics, and material performance, AI can generate highly accurate predictive models that forecast potential failure points or fire spread dynamics under various conditions, aiding in the design of highly resilient fire safety systems. For example, ML can optimize the placement and sensitivity of detection devices or fine-tune emergency egress routes based on real-time occupancy data analysis. However, the integration of AI requires significant investment in data infrastructure and expert training, and currently, the final decision-making authority and ultimate liability still rest firmly with the licensed human fire protection engineer, emphasizing that AI functions as a powerful assistive tool rather than a full replacement for specialized human judgment in complex PBD scenarios.

- Automated Code Review: AI algorithms rapidly cross-reference blueprints with regional fire codes (e.g., NFPA 101, IBC), automating the identification of prescriptive compliance deficiencies, drastically reducing initial review time.

- Performance-Based Design Optimization: Machine learning optimizes complex parameters in CFD and egress modeling, improving the efficiency and reliability of specialized fire safety systems.

- Predictive Risk Modeling: AI analyzes historical fire data and building sensor inputs (IoT) to forecast potential fire hazards, enabling proactive risk mitigation strategies beyond standard inspection cycles.

- Enhanced Digital Documentation: AI facilitates the integration of fire safety compliance data directly into Building Information Modeling (BIM) environments, ensuring seamless coordination across project disciplines.

- Forensic Analysis: AI aids in post-incident investigations by rapidly analyzing physical evidence and system logs to determine root causes and improve future code interpretations.

- Skill Shift: Consultants transition from routine code checking to managing and validating AI outputs, focusing on advanced engineering challenges and regulatory liaison.

DRO & Impact Forces Of Fire Code Consulting Service Market

The dynamics of the Fire Code Consulting Service Market are shaped by a powerful interplay of drivers, restraints, and opportunities, all underscored by significant impact forces. Key drivers include the ever-increasing complexity and stringency of global fire safety regulations, which necessitate specialized expertise for interpretation and compliance, particularly in high-risk sectors like petrochemical and healthcare. The global construction boom, especially in metropolitan areas and for complex structures (high-rises, subterranean infrastructure), continuously generates demand for advanced fire code services, often requiring performance-based design solutions that go beyond baseline standards. Furthermore, the rising awareness of legal and insurance liabilities related to fire incidents compels building owners and developers to invest proactively in comprehensive consulting services, ensuring maximum risk protection and favorable insurance premiums, cementing consulting as a mandatory expenditure rather than a discretionary cost.

Conversely, significant restraints hinder optimal market growth. The most prominent restraint is the severe shortage of highly qualified and certified fire protection engineers globally, especially those proficient in advanced modeling techniques (CFD, PBD). This talent gap drives up consulting fees and limits the capacity of firms to undertake numerous complex projects simultaneously. Economic volatility and cyclical downturns in the construction industry, particularly in non-essential commercial real estate, can temporarily suppress new project starts, impacting demand for upfront design consulting. Additionally, the fragmented and highly localized nature of fire codes across different jurisdictions creates barriers for firms seeking to standardize services and expand internationally, requiring substantial investment in local regulatory expertise and professional licensing.

Opportunities for growth are abundant, primarily through the expansion of services into specialized domains such as cybersecurity for interconnected fire systems (IoT integration), disaster resiliency planning, and retro-commissioning of older buildings to meet new energy and safety codes. The adoption of advanced digital tools like BIM and AI-assisted code review represents a major opportunity to enhance efficiency, reduce costs, and standardize project delivery, providing competitive advantages to early adopters. The most critical impact forces currently shaping the market are regulatory mandates—where governmental decisions to update or enforce codes immediately trigger demand—and technological adoption, specifically the integration of smart building sensors and data analytics, transforming traditional compliance services into ongoing, preventative risk management services, shifting the market toward recurring service contracts.

- Drivers: Mandatory updates to international fire codes (e.g., NFPA, EN standards), globalization of complex architectural designs, increasing litigation risk related to non-compliance, and major infrastructure project investments.

- Restraints: Critical shortage of licensed Fire Protection Engineers (FPEs), high costs associated with advanced consulting services, and economic uncertainty affecting construction spending.

- Opportunity: Expansion into Performance-Based Design (PBD) consulting, offering smart building integration and IoT fire safety planning, specializing in forensic engineering, and leveraging BIM platforms for greater coordination.

- Impact forces: Strict government enforcement of new safety standards (regulatory force), rapid technological evolution (AI, IoT), and climate change requiring new resilience planning for extreme weather events.

Segmentation Analysis

The Fire Code Consulting Service Market is comprehensively segmented based on Service Type, Application (End-User), and Geographic Region, providing a detailed view of key market dynamics and revenue streams. The analysis reveals distinct preferences and growth rates across these segments, driven by regulatory environments and the risk profiles of various client types. Understanding these segmentations is critical for consulting firms to tailor their offerings, allocating specialized resources to areas demonstrating the highest growth potential, such as the industrial sector's need for highly detailed hazard analyses or the push for PBD solutions in complex commercial developments. The intrinsic regulatory nature of the market ensures that no single segment experiences a complete downturn, but rather a shift in focus between new construction (design phase services) and existing building maintenance (inspection and retrofitting services).

Segmentation by Service Type highlights the divergence between traditional prescriptive consulting and modern performance-based design consulting. Prescriptive consulting, which verifies adherence to black-and-white code requirements, remains the largest segment by volume, fueled by routine projects and smaller structures. However, Performance-Based Design (PBD) is the fastest-growing segment, commanding higher fees due to its requirement for advanced computational modeling (CFD, egress analysis) and high-level engineering judgment, often employed for landmark buildings, essential infrastructure, or unique structures where standard code provisions are inadequate or impractical. This trend reflects the industry's maturation toward value-added engineering solutions.

Segmentation by Application reveals that the Commercial and Industrial segments are the primary revenue drivers. Industrial facilities, particularly those handling hazardous materials (e.g., chemical, oil & gas, manufacturing), necessitate extensive risk assessments, process safety management, and customized fire suppression systems, driving high-value contracts. The Infrastructure segment (e.g., tunnels, airports, rail stations) is experiencing accelerated growth globally, fueled by public spending on transportation modernization and resilience planning. Residential consulting, while high in volume, often focuses on basic code compliance for multi-family dwellings, commanding lower average fees compared to specialized industrial risk services. Strategic market participants are increasingly focusing on the specialized sectors like Healthcare (critical systems) and Data Centers (system redundancy and continuity planning) due to the high regulatory hurdles and critical nature of their operations.

- By Service Type:

- Prescriptive Code Consulting (Compliance Verification)

- Performance-Based Design (PBD)

- Fire Risk Assessment & Modeling (CFD Analysis)

- Plan Review and Inspection Services

- Fire Investigation and Litigation Support

- By Application (End-User):

- Commercial Real Estate (Office, Retail, Hospitality)

- Industrial & Manufacturing Facilities (Oil & Gas, Chemical, Heavy Manufacturing)

- Infrastructure & Transportation (Airports, Tunnels, Rail, Utilities)

- Healthcare & Institutional Facilities (Hospitals, Universities)

- Residential (Multi-Family High-Rise)

- By Geographical Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Fire Code Consulting Service Market

The value chain for the Fire Code Consulting Service Market is fundamentally knowledge-driven, originating with the highly skilled human capital and progressing through rigorous project execution and final client adoption. Upstream activities are concentrated on talent acquisition, continuous professional development, obtaining necessary engineering licenses (e.g., Professional Engineer registration, specialized certifications), and investing in advanced simulation software (CFD modeling tools, BIM platforms). The quality and reputation of the human capital—the fire protection engineers—are the primary determinants of service quality and differentiation. Maintaining expertise in rapidly evolving international standards (NFPA updates, ISO standards) is a continuous upstream requirement that dictates the firm's capacity to handle complex, high-value projects, making knowledge management a core competitive strategy.

Midstream processes involve the core consulting services: project initiation, hazard analysis, design conceptualization, computational modeling, preparation of compliance reports, and iterative coordination with architects and other engineering disciplines (structural, mechanical, electrical). The distribution channel in this sector is highly relationship-based, relying heavily on direct interaction (Direct Channel). Consultants typically engage directly with building owners, developers, architectural firms, general contractors, and governmental regulatory bodies. Indirect channels are less common but may involve partnering with larger, multidisciplinary engineering, procurement, and construction (EPC) firms that outsource specialized fire safety components to dedicated consulting firms. The credibility and established reputation of the consulting firm are paramount, often secured through references from regulatory authorities or previous successful collaborations with major development teams.

Downstream activities focus on project execution support, regulatory liaison, site inspections during construction, commissioning of fire safety systems, and post-occupancy services such as periodic compliance audits and emergency response planning. Successful completion of the value chain is measured by the issuance of regulatory permits and client sign-off, affirming that the structure is safe and compliant. Continuous client engagement for mandated annual inspections and system maintenance checks constitutes a vital downstream revenue stream. The trend toward digital delivery, including remote inspections and digital compliance certification, is optimizing the downstream process, improving accessibility and reducing costs, especially for international projects, further cementing the direct relationship between the consultancy and the end-user throughout the building's operational life.

Fire Code Consulting Service Market Potential Customers

The potential customer base for Fire Code Consulting Services is broad, encompassing virtually every entity involved in the design, construction, ownership, and operation of physical infrastructure. The primary End-Users/Buyers can be categorized into four major groups: Real Estate Developers, who require consultation during the conceptual and design phases of new construction; Institutional Owners (e.g., hospitals, universities, government entities), who demand high levels of safety and complex compliance protocols for specialized buildings; Industrial and Manufacturing Corporations, particularly those operating high-risk processes or storing hazardous materials; and Governmental Regulatory Agencies, which often contract consultants for third-party plan reviews and code development support. Decision-makers within these organizations are typically Risk Managers, Chief Operating Officers (COOs), Project Managers, and Facilities Directors, all focused on minimizing liability and ensuring continuous operation.

The segmentation of customers directly influences the type of consulting demanded. For example, a large-scale commercial developer requires expertise in optimizing egress and maximizing leasable space while meeting fire standards, often necessitating Performance-Based Design (PBD) to achieve architectural vision. Conversely, a pharmaceutical manufacturing client requires deep expertise in process safety management, explosion protection (NFPA 68), and precise suppression systems tailored to sensitive equipment. This diversity mandates that consulting firms maintain highly specialized teams capable of addressing the specific risk and regulatory environments unique to each industry vertical. The shift towards sustainable and 'smart' buildings is creating a new customer cohort focused on integrated fire safety with green technology, demanding consultants who understand the interaction between new materials and traditional fire suppression systems, effectively expanding the addressable market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arup, Jensen Hughes, JLL, AECOM, WSP Global, SGS SA, Intertek Group, Bureau Veritas, TÜV SÜD, FPA Group, Code Red Consultants, Terracon Consultants, EXP Services Inc., Langan Engineering, Henderson Engineers, UL Solutions, Risk Engineering Inc., SFPE, Reliance Consulting Group, Fire Safety Consultants, Inc. (FSCI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fire Code Consulting Service Market Key Technology Landscape

The technological landscape of the Fire Code Consulting Service Market is rapidly evolving, driven by the need for enhanced accuracy, speed, and cross-disciplinary collaboration in complex projects. The central technology platform currently dominating the advanced consulting space is Building Information Modeling (BIM). BIM allows fire protection engineers to integrate fire safety systems—such as sprinkler piping, ductwork, and firestopping locations—into a unified, three-dimensional model accessible by all stakeholders. This integration dramatically reduces coordination errors (clashes) between fire safety systems and other building services, improving design integrity and accelerating the regulatory approval process. BIM is transitioning from a mere visualization tool to a critical data management and compliance verification platform, capable of storing all necessary regulatory documentation and performance specifications directly within the model elements, thereby streamlining the final compliance handover and future maintenance requirements.

Complementary to BIM, Computational Fluid Dynamics (CFD) modeling remains a cornerstone technology, particularly within the fast-growing Performance-Based Design (PBD) segment. CFD software simulates the movement of smoke, heat, and toxic gases in complex architectural spaces, allowing consultants to accurately predict fire behavior and optimize smoke control systems, evacuation routes, and ventilation strategies far beyond the limits of standard prescriptive calculations. This technology is vital for large venues, tall buildings, and enclosed infrastructure (like tunnels), where empirical testing is impractical. The use of advanced algorithms and high-performance computing enables engineers to run thousands of permutations, testing system resilience under various adverse conditions, thereby providing a quantifiable basis for non-prescriptive design solutions that often result in significant cost savings or enhanced safety outcomes for the client.

Furthermore, the integration of Internet of Things (IoT) sensors and Artificial Intelligence (AI) is transforming consulting from a project-based service into a continuous, data-driven offering. IoT devices placed in existing structures collect real-time data on system health, environmental conditions, and occupancy, feeding this information into AI platforms. These platforms analyze the data against optimal fire safety parameters, providing predictive alerts before maintenance issues escalate into system failures. This shift from reactive inspection to proactive monitoring opens new recurring revenue streams (digital consulting services) for firms. Other key technologies include advanced virtual reality (VR) tools for immersive stakeholder review of design concepts, specialized fire hazard analysis software for industrial process safety, and secure cloud platforms for real-time document management and regulatory submission, all aimed at improving collaboration efficiency and regulatory transparency across geographically dispersed project teams.

Regional Highlights

Regional dynamics are critical in the Fire Code Consulting Service Market, largely dictated by local legislative frameworks, construction activity levels, and the maturity of safety standards. North America (comprising the United States and Canada) remains a dominant force, characterized by highly stringent and frequently updated national standards (NFPA, ICC). This market is mature, highly competitive, and driven by continuous regulatory enforcement and technological adoption, particularly the integration of BIM into the mandatory permitting processes. The focus here is on high-value, specialized services like PBD and sophisticated forensic investigation, alongside mandated compliance checks for existing infrastructure retrofit projects. The demand is stable, anchored by constant commercial development and regulatory liability concerns.

Europe demonstrates steady growth, driven by unified European safety directives (Eurocodes) and national implementation standards. Western European nations (Germany, UK, France) emphasize strong structural fire protection and life safety regulations, often requiring third-party verification from certification bodies. The market is propelled by sustainability mandates, requiring consultants to integrate passive fire protection with energy efficiency goals. Central and Eastern Europe are catching up, driven by foreign investment in manufacturing and infrastructure that adheres to Western European standards, creating strong demand for specialized code expertise and international compliance services.

The Asia Pacific (APAC) region is the most dynamic and fastest-growing market. Countries like China, India, Singapore, and Australia are experiencing massive construction booms, coupled with a concerted effort to modernize and standardize fire safety codes, often adopting or adapting NFPA or ISO standards. This transition from basic, often less-enforced codes to modern, prescriptive, and performance-based frameworks creates immense demand for experienced international consulting firms capable of training local professionals and navigating complex, multi-tiered regulatory approvals. Urbanization and the construction of high-density residential and commercial towers are primary market accelerators.

Latin America (LATAM) and the Middle East & Africa (MEA) represent significant emerging markets. In the MEA, demand is heavily concentrated around large-scale government-backed infrastructure and smart city projects (e.g., in the UAE and Saudi Arabia), where compliance with premium, often US or European-derived, fire safety standards is mandatory for international investor confidence. LATAM shows heterogeneous growth; markets like Brazil and Mexico are mature enough to have established local consulting firms but still rely on global experts for highly specialized industrial projects, with growth dictated by commodity prices and foreign direct investment in large-scale resource extraction and industrial processing facilities.

- North America: Dominant market share; driven by high regulatory stringency (NFPA/ICC), advanced PBD usage, and mandatory compliance for commercial and high-rise development.

- Europe: Mature market; growth influenced by Eurocodes, integration of fire safety with sustainability goals, and strong demand for third-party inspection and certification services.

- Asia Pacific (APAC): Fastest growing region; acceleration fueled by rapid urbanization, massive infrastructure development, and the modernization/adoption of international fire safety codes.

- Middle East & Africa (MEA): Growth tied to mega-projects (smart cities, tourism infrastructure) requiring adherence to high international safety benchmarks to attract foreign investment.

- Latin America (LATAM): Varied growth; demand focuses on industrial safety, resource processing facilities, and high-density urban development, often requiring international expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fire Code Consulting Service Market.- Arup

- Jensen Hughes

- JLL

- AECOM

- WSP Global

- SGS SA

- Intertek Group

- Bureau Veritas

- TÜV SÜD

- FPA Group

- Code Red Consultants

- Terracon Consultants

- EXP Services Inc.

- Langan Engineering

- Henderson Engineers

- UL Solutions

- Risk Engineering Inc.

- SFPE

- Reliance Consulting Group

- Fire Safety Consultants, Inc. (FSCI)

Frequently Asked Questions

Analyze common user questions about the Fire Code Consulting Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Prescriptive and Performance-Based Design (PBD) in fire code consulting?

Prescriptive design involves strict adherence to published code minimums (e.g., required sprinkler spacing or fire-rated assemblies). PBD utilizes advanced engineering principles and computational modeling (CFD) to achieve life safety and property protection goals, offering greater flexibility and optimization for unique or complex structures where standard code rules are impractical or insufficient.

How is digital technology impacting the efficiency of fire code plan reviews?

Digital technologies, particularly Building Information Modeling (BIM) and AI-assisted review platforms, significantly enhance efficiency by automating the cross-referencing of designs against code requirements, rapidly flagging non-compliance issues, reducing manual errors, and streamlining coordination among project stakeholders, thereby accelerating the regulatory approval timeline.

Which geographical region is expected to demonstrate the fastest growth in fire code consulting services?

The Asia Pacific (APAC) region, fueled by rapid, large-scale urbanization and substantial infrastructure investments, coupled with the ongoing modernization and stringent enforcement of fire safety standards, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) through the forecast period.

What are the greatest challenges currently facing the Fire Code Consulting Service Market?

The most significant challenge is the critical global shortage of experienced, licensed Fire Protection Engineers (FPEs) capable of undertaking complex Performance-Based Design (PBD) and advanced risk modeling, leading to increased labor costs and limiting the capacity for major international projects.

Are fire code consulting services mandatory, or primarily used for risk mitigation?

Fire code consulting services are generally mandatory for all new construction and major renovation projects to obtain required building permits and occupancy certificates, ensuring legal compliance. While providing vital risk mitigation and liability protection, the primary trigger for demand remains governmental and regulatory enforcement across commercial and institutional sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager