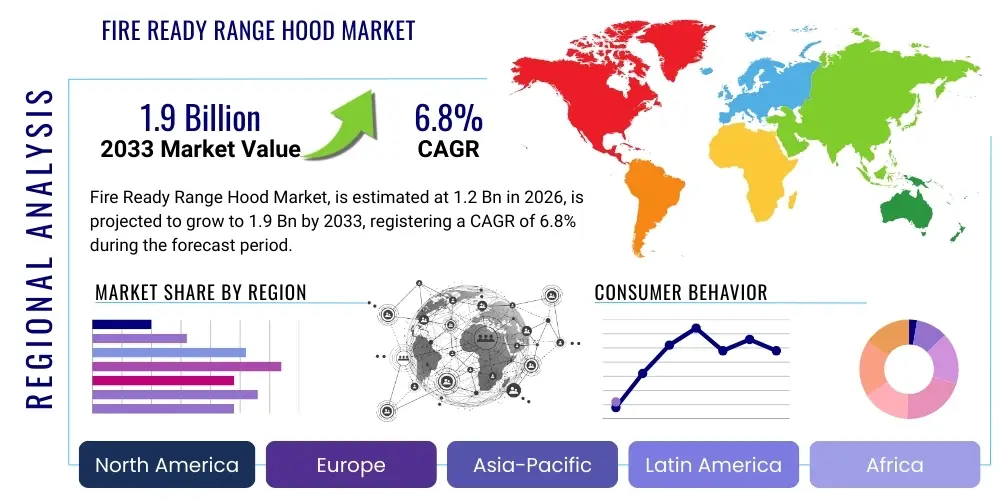

Fire Ready Range Hood Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443408 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Fire Ready Range Hood Market Size

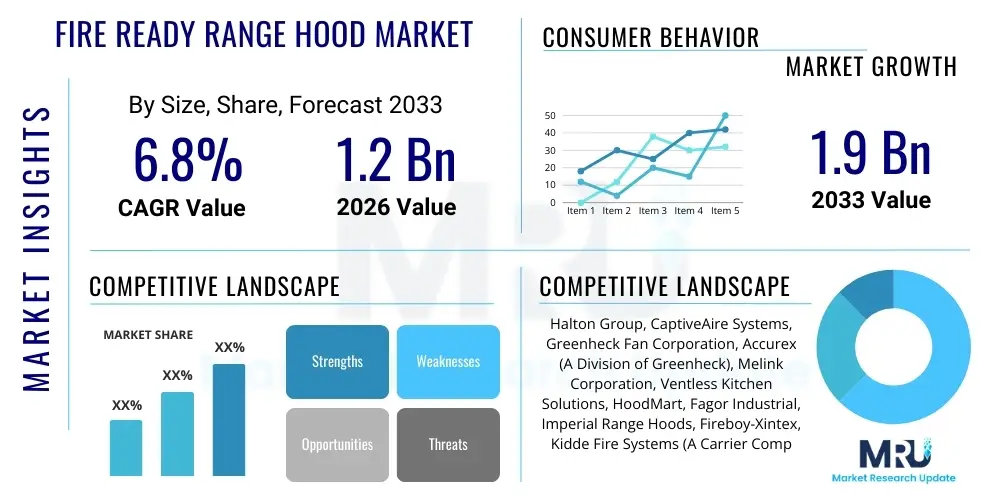

The Fire Ready Range Hood Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Fire Ready Range Hood Market introduction

The Fire Ready Range Hood Market comprises advanced kitchen ventilation systems equipped with integrated, automatic fire detection and suppression capabilities. These specialized hoods represent a critical safety evolution, moving far beyond simple smoke extraction by incorporating sophisticated thermal and optical sensors, microprocessors for rapid decision-making, and reservoirs containing certified fire suppression agents. The fundamental purpose is to immediately address incipient fires, particularly grease fires common in cooking environments, before they can spread beyond the kitchen area. This capability is increasingly demanded across residential, commercial, and institutional sectors where enhanced protection of property and life is paramount. The technology is rigorously tested to comply with international standards such as NFPA 96 (Standard for Ventilation Control and Fire Protection of Commercial Cooking Operations), making compliance a foundational driver of market demand.

Product differentiation in this segment is achieved through system responsiveness, the nature of the suppression agent used (e.g., wet chemical vs. dry chemical), and seamless aesthetic integration, particularly crucial for high-end residential applications. Major applications span high-volume environments like restaurant chains, hospitals, educational facilities, and large corporate cafeterias, which rely heavily on continuous operation and face high regulatory scrutiny regarding fire safety protocols. Additionally, the proliferation of specialized cloud kitchens and ghost restaurants—high-intensity cooking operations concentrated in small urban footprints—has created a significant niche market demanding compact, highly effective Fire Ready systems. The core benefits derived from adopting these systems include substantial reduction in fire damage risk, minimized insurance liabilities, and ensured business continuity by drastically limiting downtime following a minor incident. These intrinsic safety benefits validate the higher initial investment compared to conventional ventilation.

Market expansion is largely driven by escalating global awareness of kitchen fire statistics, which frequently cite cooking appliances as a leading cause of structural fires in both homes and businesses. This awareness translates into stricter governmental building codes globally, particularly requiring certified fire suppression in all commercial cooking installations. Furthermore, technological advancements have made these systems more reliable and user-friendly; integrated diagnostics and IoT connectivity allow property owners to monitor system health remotely and ensure compliance with inspection schedules, thereby overcoming previous resistance related to system maintenance complexity. The increasing disposable income in developed and emerging economies also contributes, enabling consumers and businesses to prioritize safety investments that were previously considered optional luxury upgrades. The driving momentum is thus a convergence of regulatory mandate, technological feasibility, and consumer readiness to invest in superior protection infrastructure.

Fire Ready Range Hood Market Executive Summary

The Fire Ready Range Hood market exhibits strong growth underpinned by sustained compliance requirements and rapid technological integration, particularly within the IoT and AI domains. Business trends highlight a significant push toward developing hybrid systems that offer flexible suppression capabilities, accommodating various cooking types, from high-temperature charbroiling to deep frying, while maintaining modularity for simplified installation. Key industry players are aggressively acquiring or partnering with sensor technology firms to enhance detection accuracy, thereby tackling the persistent issue of false alarms, which previously hampered adoption in sensitive environments. Furthermore, globalization of safety standards is creating opportunities for manufacturers to standardize products for broader international distribution, streamlining the compliance burden and facilitating cross-border market penetration, especially into Asia Pacific’s booming commercial sector.

Regional dynamics clearly place North America and Europe at the forefront in terms of market value and technological maturity, primarily due to well-established safety legislation (like NFPA in the U.S.) that dictates mandatory installations across substantial portions of the commercial and institutional kitchen landscapes. These regions are characterized by a preference for advanced, often wet chemical, systems and a strong appetite for premium features like AI-driven diagnostics and remote monitoring. Conversely, the Asia Pacific region is anticipated to demonstrate the highest growth velocity. This exponential rise is attributed to massive residential and commercial construction booms, coupled with the rapid modernization and formalization of the foodservice industry in nations such as China, India, and Southeast Asian economic hubs. Governments in these areas are increasingly adopting strict fire codes mirroring Western standards, rapidly converting potential demand into actual sales and installation volume. Latin America and MEA continue steady expansion, largely centered on international hotel and franchise developments.

Segmentation trends illustrate a pivotal shift in application focus, with the residential segment showing disproportionately high growth potential, fueled by luxury housing developments and the growing affordability of integrated safety solutions. While the commercial segment remains the dominant revenue generator due to the high cost and complexity of institutional-grade installations, the residential sector is absorbing sophisticated technology faster than anticipated. Product-wise, wet chemical suppression remains the leading segment because of its superior effectiveness against common kitchen grease fires. Distribution channels are diversifying; commercial installations are still overwhelmingly reliant on direct contracts and certified HVAC specialists, whereas the residential segment is leveraging e-commerce and specialized appliance retailers to reach a wider, geographically dispersed consumer base, requiring robust logistics and localized installation support networks. The ongoing trend is towards systems offering dual functionality: optimized ventilation and unparalleled, automated fire protection.

AI Impact Analysis on Fire Ready Range Hood Market

A comprehensive analysis of user and industry inquiries reveals a consensus that Artificial Intelligence is critical for transforming Fire Ready Range Hoods from reactive safety mechanisms into proactive, intelligent risk management systems. The most frequent user questions revolve around the reliability of AI in avoiding unwarranted system activation, often asking, "Can AI truly tell the difference between heavy wok smoke and a real fire?" There is a strong expectation that machine learning will virtually eliminate costly false alarms associated with highly sensitive multi-sensor systems. Users also express interest in how AI can optimize system maintenance, querying about predictive scheduling and component failure forecasts to ensure peak readiness, especially in busy commercial environments. Concerns generally center on data privacy for connected systems and the algorithmic transparency required for compliance auditing, particularly when AI determines the timing of a critical safety response.

Industry stakeholders anticipate AI driving a paradigm shift in detection capability by moving beyond simple threshold alerts. AI-powered diagnostics process continuous, multimodal data streams—including spectral analysis of smoke, thermal mapping of the cooking surface, ambient CO/CO2 levels, and ventilation flow rate—to construct a comprehensive model of the kitchen environment. This advanced analysis allows the system to establish a baseline of "normal" operations for specific times of day or cooking practices, enabling highly nuanced threat identification. For example, an AI system can recognize that high heat accompanied by a specific thermal signature is characteristic of searing steak and should be tolerated, whereas the same heat profile coupled with a rapid spike in optical smoke density and unusual gas emissions signals an emergency. This intellectual layer vastly enhances reliability and ultimately lowers the total cost of ownership by preventing unnecessary discharges.

Furthermore, AI is pivotal in automating compliance and optimizing energy use. By continuously logging operational data, including sensor readings and self-check results, AI generates auditable digital logs, simplifying the regulatory burden for facility managers. On the efficiency front, AI algorithms learn peak usage periods and modulate the exhaust fan speed dynamically, ensuring adequate ventilation only when required, thus substantially reducing the energy footprint associated with high-capacity motors. The future trajectory involves AI systems communicating directly with building HVAC and utility management systems, coordinating shutdown procedures, modulating air intake, and alerting external maintenance teams, making the Fire Ready Range Hood an intelligent node in a larger safety ecosystem, providing unprecedented levels of oversight and safety assurance.

- AI-Enhanced Predictive Maintenance: Algorithms analyze sensor performance and component wear (e.g., fan motor hours, filter saturation) to predict potential system failures before they occur, scheduling proactive maintenance.

- False Alarm Mitigation: Machine learning models analyze real-time data from multiple sensors (heat, smoke density, gas concentration, CO2 levels) to distinguish between non-threatening cooking vapors and dangerous incipient fire conditions, drastically improving reliability.

- Optimized Suppression Deployment: AI dictates the precise timing and pattern of chemical agent release based on fire dynamics modeling, ensuring maximum efficacy while minimizing unnecessary agent usage and cleanup.

- Energy Efficiency Optimization: AI algorithms learn occupant cooking patterns and automatically adjust ventilation speeds and durations, leading to significant reductions in household or facility energy consumption.

- Integrated System Diagnostics: AI provides continuous self-check routines for all safety components, generating detailed compliance reports automatically for regulatory and insurance purposes.

- Advanced Behavioral Monitoring: AI analyzes changes in kitchen heat signatures and human presence patterns to detect abnormal activity that might precede a safety incident, generating pre-emptive soft alerts.

- Remote System Calibration: AI facilitates remote fine-tuning and recalibration of sensor sensitivities via cloud platforms, reducing the need for costly physical technician visits.

- Automated Compliance Reporting: Systems automatically generate and timestamp operational reports required by NFPA and local fire marshals, ensuring documentation integrity.

DRO & Impact Forces Of Fire Ready Range Hood Market

The core dynamics of the Fire Ready Range Hood Market are meticulously balanced by robust regulatory drivers and compelling technological opportunities, counteracted by substantial capital investment requirements and inherent installation complexities. The central driving factor is the non-negotiable requirement for certified fire suppression systems in commercial kitchens globally, enforced through rigorous health and safety codes and often mandated by property insurance carriers; this factor alone creates a captive and essential market. Additionally, the increasing convergence of appliance technology with smart home platforms, offering integrated connectivity and remote diagnostics, enhances the product's value proposition beyond simple safety, appealing to the technologically savvy consumer base. Technological advancements, particularly in highly accurate multi-sensor arrays and sustainable suppression chemistries that minimize environmental impact and cleanup residue, further fuel demand and accelerate the replacement cycle of older, less reliable systems, promoting market refresh.

However, the market faces notable restraints, chiefly the elevated initial cost of acquisition and complex installation process. Unlike conventional hoods, Fire Ready systems require specialized venting, electrical, and plumbing connections for the suppression lines, demanding certified technicians, which significantly increases the total installed cost. This cost barrier disproportionately affects small independent restaurants and budget-conscious residential builders. Furthermore, the mandatory recurring cost and complexity of system inspection and recertification (typically semi-annually for commercial units) act as a persistent deterrent. Another structural restraint is the fragmented regulatory landscape across smaller municipalities and developing economies, where inconsistent enforcement or lack of standardization sometimes permits the use of less expensive, non-compliant alternatives, diluting market penetration for premium safety solutions.

Significant opportunities lie in the development of innovative, modular, and retrofit solutions designed for existing kitchen infrastructure, which substantially reduces installation complexity and cost, thereby unlocking vast untapped markets, especially in aging building stock across North America and Europe. Geographically, the rapidly developing Asia Pacific market presents immense long-term opportunities, particularly as regulatory bodies harmonize their standards with international best practices. Impact forces include intense rivalry centered on innovation in detection algorithms and system reliability; manufacturer reputation for zero false-discharge incidents is a powerful competitive differentiator. Substitution threat is moderate; while cheaper standard hoods exist, they lack the life-saving suppression capability, making substitution unviable in regulated settings. Overall, market growth is primarily dictated by the velocity of regulatory convergence and the industry's ability to lower the barrier to entry through cost-effective, AI-enhanced, and user-friendly products.

The political and economic environment plays a crucial role; government subsidies or tax incentives for adopting certified fire safety equipment can rapidly accelerate market adoption, especially for SMEs. Conversely, economic downturns tend to cause delays in capital expenditure, slowing down the replacement market. Social factors, such as increased media attention on fire safety incidents, heighten consumer risk perception and willingness to pay a premium for guaranteed protection. The most influential external force remains regulatory harmonization: global standardization, particularly the widespread acceptance and enforcement of comprehensive guidelines like NFPA 96 in emerging markets, promises to standardize demand, streamline production, and foster healthy international competition focused on optimizing technological safety features rather than navigating diverse compliance protocols.

Segmentation Analysis

Market segmentation provides a critical view of the diverse requirements and technological preferences driving the Fire Ready Range Hood industry, separating it by operational requirements, target environment, and the technical specifications of the suppression mechanism. This analysis clarifies that the market is not monolithic; a commercial wet chemical system for a high-volume fry line differs fundamentally in design, cost, and regulation from a sleek, integrated residential system. The commercial segment, encompassing restaurants and institutions, commands the largest revenue share due to the necessity of complex, high-capacity systems, while the residential segment is the fastest-growing volume segment, benefiting from product miniaturization and aesthetic improvements. Understanding the breakdown by suppression type (wet chemical dominance) and application environment allows manufacturers to prioritize R&D investment and tailor specific compliance and marketing strategies to the most profitable and fastest-expanding niches.

Further granularity in segmentation focuses on installation type and material composition. Island-mounted hoods, common in high-end residential and central cooking stations, typically require more powerful and complex fire suppression distribution systems than simpler wall-mounted units. Material segmentation emphasizes stainless steel for both commercial and premium residential applications due to its non-corrosive, fire-resistant, and hygienic properties, critical for food service operations. The emerging segmentation based on sensor technology (e.g., thermal vs. optical vs. AI fusion) reflects the industry’s push toward increased intelligence, separating older, purely heat-activated systems from modern, predictive units that minimize false discharges. This detailed segmentation is essential for accurate forecasting and strategic market entry, ensuring that product development aligns with specific regulatory and operational demands of distinct customer groups.

- By Product Type (Suppression System):

- Wet Chemical Systems (Dominant in Commercial Grease Fire Applications)

- Dry Chemical Systems (Used for Multi-Purpose Protection, Less Common in Modern Kitchens)

- Inert Gas/Clean Agent Systems (Niche applications requiring zero residue, e.g., high-value electronic kitchen equipment)

- Integrated Water Mist Systems (Emerging, high-pressure mist technology)

- By Application:

- Residential (Single Family, Multi-Family High-Rise)

- Commercial (Full-Service Restaurants, Quick Service Restaurants (QSR))

- Institutional (Hospitals, Schools, Corporate Cafeterias, Military Bases)

- Industrial (Food Processing Plants, Large-Scale Catering Facilities)

- By Installation Type:

- Wall-Mounted (Standard Commercial and Residential)

- Island/Ceiling-Mounted (High-End Residential and Open Commercial Concepts)

- Under-Cabinet (Space-Saving Residential Options)

- By Operation:

- Ducted (Vented to Exterior - Majority Market Share)

- Non-Ducted (Recirculating with Activated Charcoal Filters - Limited Suppression Capability, Niche Use)

- By Material:

- Stainless Steel (High Durability, Hygiene, and Heat Resistance - Predominant)

- Aluminum (Lighter Weight, Cost-Effective)

- Others (e.g., Copper Finishes, High-Durability Polymers for specific components)

- By Sensor Technology:

- Thermal Sensors (Fusible Link and Fixed Temperature)

- Optical Smoke Sensors (Photoelectric and Ionization)

- Multi-Sensor Integration (AI-Enhanced Fusion for False Alarm Reduction)

Value Chain Analysis For Fire Ready Range Hood Market

The value chain initiates with sophisticated Upstream activities focused on sourcing proprietary and safety-critical components. This involves acquiring high-grade, corrosion-resistant steel alloys suitable for commercial kitchen environments, specialized fan motors designed for continuous, high-heat operation, and, most critically, certified fire suppression chemicals. The market relies heavily on a limited number of specialized suppliers for certified wet chemical agents (such as Ansul or Kidde suppliers), giving these few component providers significant bargaining power regarding cost and formulation specifications. Additionally, the increasing reliance on advanced sensor and micro-processing chips necessitates strong, reliable sourcing relationships with leading electronics manufacturers to ensure the precision and reliability required for rapid safety response, often involving customized sensor arrays and dedicated firmware development.

The core manufacturing stage involves precision sheet metal fabrication, followed by the meticulous assembly and calibration of the suppression system components—nozzles, piping, detection lines, and actuation mechanisms—into the hood structure. This stage is dominated by stringent quality control and third-party certification (UL, ETL, NFPA) to ensure operational integrity, a bottleneck that raises manufacturing costs but guarantees compliance. Downstream logistics are bifurcated: Commercial installations (Direct Channel) typically involve the manufacturer selling directly to large general contractors, kitchen design consultants, or specialized fire safety firms. These complex sales require extensive pre-sale engineering support, detailed regulatory documentation, and on-site project management. This direct model allows for strict control over installation quality and ensures long-term service contracts.

The Indirect Channel primarily serves the residential market, moving products through national appliance distributors, wholesale retailers (e.g., Home Depot, Lowes), and e-commerce platforms. While offering broad reach, this channel presents challenges regarding standardized professional installation, often relying on non-specialized third-party contractors, which can risk system compliance if not rigorously supervised. Post-sale, the service and maintenance segment (both direct and indirect) is crucial, representing a significant recurring revenue stream. Due to mandatory inspection schedules for commercial systems, manufacturers and their certified partners retain high power in the aftermarket segment, ensuring the continuous operational readiness of the life-safety equipment. This essential service component differentiates the Fire Ready market from the standard appliance sector, necessitating highly skilled technical personnel for long-term customer engagement and system upkeep.

Fire Ready Range Hood Market Potential Customers

The market for Fire Ready Range Hoods is strongly demarcated by the requirement for regulatory compliance and enhanced asset protection, leading to two distinct customer bases. Commercial and institutional enterprises form the largest revenue generating segment; this includes high-volume foodservice operations such as Quick Service Restaurants (QSRs), large-scale hotel kitchens, university dining halls, hospitals, and corporate catering facilities. For these customers, the purchase is non-discretionary, driven entirely by mandatory fire codes (NFPA 96) and insurance liability management. Procurement decisions here are highly centralized, focused on system certification, long-term durability, minimizing maintenance downtime, and securing favorable long-term service contracts with guaranteed response times. These buyers require robust, heavy-duty systems capable of continuous operation in aggressive cooking environments, often preferring specialized, customized installations.

The second major segment, the high-end residential consumer, consists of individuals or developers focused on luxury properties, custom homes, and high-rise multi-family housing projects. While often not subject to the same strict codes as commercial kitchens, these customers prioritize safety, prestige, and seamless technological integration into smart home systems. The purchasing decision here is driven by value-added features like quiet operation, aesthetic design, sophisticated false-alarm reduction technology (AI-enhanced), and the desire for premium protection that lowers home insurance premiums and provides peace of mind. Developers of multi-family units also constitute a major client base, driven by the need to protect against catastrophic loss across numerous attached units, often selecting systems that offer centralized monitoring and compliance verification.

An emerging demographic includes smaller commercial operators, such as independent cafes, local bakeries, and rapidly growing cloud kitchen operators. These customers are highly sensitive to initial capital expenditure but still require compliance. They are increasingly targeted by manufacturers offering compact, modular, or ventless Fire Ready solutions that minimize installation complexity and space requirements while meeting fundamental safety thresholds. Furthermore, governmental and military institutions represent highly stable end-users, requiring specialized, often proprietary, certified systems for sensitive or unique cooking environments where adherence to internal and national safety protocols is absolute and often involves long-term, high-value procurement contracts. The convergence of commercial grade technology miniaturization and residential aesthetic demands is blurring the lines, expanding the total addressable market significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Halton Group, CaptiveAire Systems, Greenheck Fan Corporation, Accurex (A Division of Greenheck), Melink Corporation, Ventless Kitchen Solutions, HoodMart, Fagor Industrial, Imperial Range Hoods, Fireboy-Xintex, Kidde Fire Systems (A Carrier Company), Amerex Corporation, Johnson Controls International plc, Siemens AG, Eurotech Hoods, Faber S.p.A., Broan-NuTone LLC, Electrolux AB, Whirlpool Corporation, Panasonic Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fire Ready Range Hood Market Key Technology Landscape

The technological core of the Fire Ready Range Hood market is defined by continuous innovation in rapid fire detection and effective, environmentally conscious suppression. Modern systems are migrating away from reliance on purely mechanical fusible links toward advanced electronic thermal and optical sensors, often integrated in a multi-criteria approach. Key technology includes high-sensitivity thermal sensors capable of detecting temperature rise rates, not just fixed temperature thresholds, combined with specialized optical sensors that analyze smoke particle density and coloration. This sensor fusion, increasingly managed by dedicated AI algorithms, provides a powerful reduction in latency and greatly improves the accuracy of detecting genuine fire events while ignoring common cooking disturbances such as heavy steam or high-heat searing, which is critical for operational reliability in busy kitchens.

A central technological focus is the development and deployment of clean and highly effective fire suppression agents. The shift is decidedly toward wet chemical extinguishing agents, primarily potassium carbonate solutions, known for their ability to saponify hot grease and immediately cool the fuel source, preventing reignition—the most significant risk in commercial cooking. Manufacturers are heavily investing in proprietary nozzle designs that ensure maximum coverage and precise delivery patterns, optimizing the agent release for specific hood sizes and cooking equipment layouts. Furthermore, integrated power interruption technology ensures that upon fire detection, all electrical and gas supplies to the cooking equipment are automatically shut off instantaneously, isolating the hazard and preventing further fuel supply, a mandatory feature under most international safety standards.

The rise of Internet of Things (IoT) connectivity is transforming maintenance and compliance management. Contemporary Fire Ready systems utilize secure cloud platforms for real-time diagnostics, remote firmware updates, and automated system health reporting. Technicians can remotely monitor component lifecycles, suppression agent pressure, and battery backup status, ensuring that potential issues are identified and resolved proactively through predictive maintenance scheduling. This connectivity also enables seamless integration with overall building management and security systems, allowing for coordinated emergency response, such as automated notification to local fire services and coordinated HVAC system shutdowns. This focus on remote management and integration is driving significant value for large institutional and multi-site commercial clients seeking centralized safety oversight and minimized labor costs associated with manual compliance checks.

Regional Highlights

- North America: This region remains the most mature market, characterized by strict and deeply entrenched regulations, notably NFPA 96 compliance, which drives mandatory adoption in virtually all commercial foodservice environments. The US and Canada are significant investors in smart technology integration, leading to high penetration rates of connected, AI-enhanced systems in both commercial and high-end residential sectors. Market growth is sustained by strong renovation cycles and continuous upgrades to meet evolving safety standards, with a high preference for reliable, established brands and specialized certified installation services.

- Europe: Europe represents a sophisticated market demanding energy-efficient and highly aesthetic solutions. Driven by pan-European safety standards (e.g., EN 16282 series) and national fire codes, the market focuses strongly on reducing overall building energy consumption while ensuring maximum fire safety. Western European nations like Germany, the UK, and Scandinavia lead in the institutional adoption of advanced water mist and wet chemical systems. The replacement cycle is robust, prioritizing systems that offer superior environmental certifications and minimized chemical residue.

- Asia Pacific (APAC): APAC is the epicenter of future market growth. Driven by rapid infrastructural expansion, massive urban development, and the explosive growth of the organized foodservice sector (QSRs, international hotel chains), demand for compliant systems is surging. Countries like China, India, and Australia are rapidly updating their fire safety codes, aligning them closer to global benchmarks. While the commercial segment is currently the largest purchaser by revenue, the emerging middle-class population and increased residential high-rise construction are propelling the residential segment toward exponential volume growth, albeit with higher price sensitivity.

- Latin America: The market sees steady, localized growth concentrated in economic hubs such as Mexico City, São Paulo, and Santiago. Adoption is predominantly driven by multinational corporations and international franchise operations ensuring consistency with global safety standards, overshadowing local regulations. Infrastructure projects and hospitality sector investments are key drivers, demanding cost-effective yet reliable suppression technology. Economic instability occasionally affects large-scale, long-term investments in high-cost safety infrastructure.

- Middle East and Africa (MEA): Growth in the MEA region is high, particularly within the Gulf Cooperation Council (GCC) states (UAE, Qatar, Saudi Arabia), propelled by large-scale, high-profile construction projects (luxury resorts, mega-cities) that mandate best-in-class international safety standards. These projects require high-capacity, durable systems designed to withstand harsh operating environments. The African market is developing, with growth tied primarily to commercial and industrial foreign investment projects requiring high levels of compliance and certified equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fire Ready Range Hood Market.- Halton Group

- CaptiveAire Systems

- Greenheck Fan Corporation

- Accurex (A Division of Greenheck)

- Melink Corporation

- Ventless Kitchen Solutions

- HoodMart

- Fagor Industrial

- Imperial Range Hoods

- Fireboy-Xintex

- Kidde Fire Systems (A Carrier Company)

- Amerex Corporation

- Johnson Controls International plc

- Siemens AG

- Eurotech Hoods

- Faber S.p.A.

- Broan-NuTone LLC

- Electrolux AB

- Whirlpool Corporation

- Panasonic Corporation

Frequently Asked Questions

Analyze common user questions about the Fire Ready Range Hood market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a standard range hood and a Fire Ready Range Hood?

A Fire Ready Range Hood integrates proprietary, automatic fire detection and suppression systems (typically wet or dry chemical agents) directly into the ventilation unit. Unlike standard hoods which only ventilate, Fire Ready systems are designed to sense an incipient fire and automatically deploy suppression agents to extinguish it immediately, minimizing damage and ensuring NFPA or local code compliance.

Are Fire Ready Range Hoods mandatory for residential kitchens?

While generally not mandatory for standard residential homes, they are often required in specific high-density residential settings (like multi-family dwellings, dormitories, or assisted living facilities) by local building codes or insurance mandates. They are also highly recommended for custom, high-end kitchens as a premium safety feature, offering crucial protection against common grease fires.

How often do these suppression systems require maintenance and inspection?

Commercial Fire Ready systems typically require professional inspection and certification every six months, as mandated by fire safety regulations (like NFPA 96) and insurance providers. Residential systems, while sometimes having looser requirements, should be professionally inspected at least annually to verify sensor calibration, chemical agent pressure levels, and overall operational readiness, usually by a certified fire suppression technician.

How does AI help prevent false alarms in modern Fire Ready Range Hoods?

AI utilizes machine learning algorithms to analyze data from multiple integrated sensors (thermal, optical, gas). By learning to distinguish the spectral and temporal patterns of normal cooking activities (e.g., steam, high heat searing) from genuine combustion events, AI significantly reduces the likelihood of unwarranted and costly activation of the fire suppression system, greatly improving operational reliability and user confidence.

What are the primary factors driving the projected 6.8% CAGR in this market?

The robust CAGR is primarily driven by three factors: increasingly stringent global fire safety regulations mandating certified suppression systems in commercial kitchens; rapid technological integration, including AI and IoT, which enhances system reliability and remote management; and exponential growth in high-density residential and commercial construction, particularly across the Asia Pacific region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager