Fire Resisting Door Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441729 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Fire Resisting Door Market Size

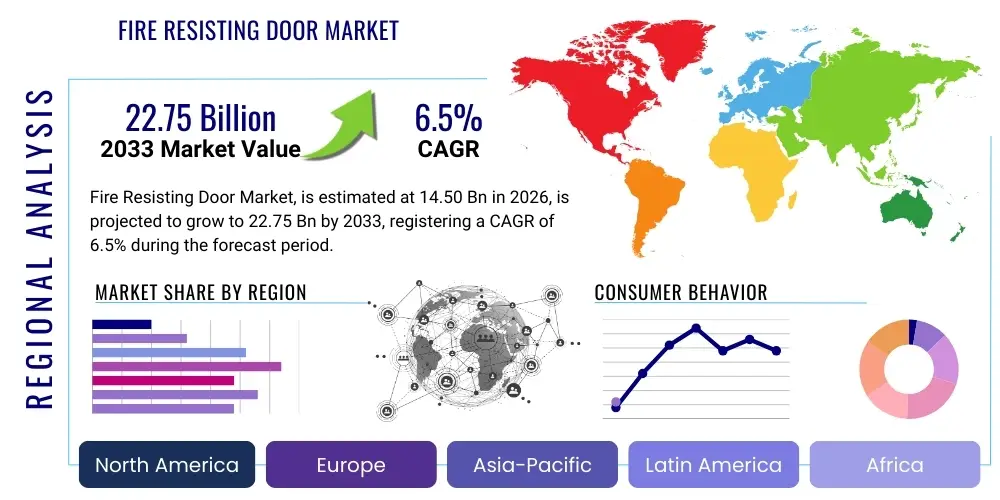

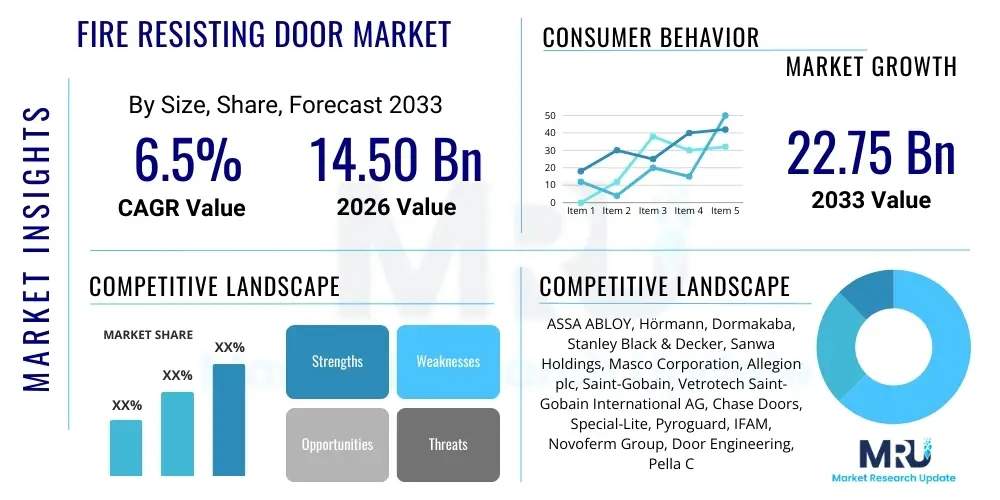

The Fire Resisting Door Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $14.50 Billion USD in 2026 and is projected to reach $22.75 Billion USD by the end of the forecast period in 2033.

Fire Resisting Door Market introduction

The Fire Resisting Door Market encompasses the manufacturing, distribution, and installation of specialized door assemblies designed and tested to resist the spread of fire and smoke for a defined period. These safety-critical components are integral to passive fire protection systems in modern infrastructure, ensuring compartmentation within buildings. The primary function of these doors is to maintain the integrity of fire-rated walls, providing safe egress routes for occupants and limiting property damage. Products range significantly based on material composition—including steel, timber, aluminum, and advanced composite cores—and fire rating, often specified in minutes (e.g., 20, 60, 120 minutes), depending on regulatory requirements dictated by building codes such as NFPA (National Fire Protection Association) and relevant European standards (EN 1634).

Major applications for fire-resisting doors span across all construction sectors, driven by increasingly stringent global safety mandates. In the commercial sector, these doors are essential in high-traffic areas like office buildings, shopping centers, and hotels, typically utilized in stairwells, corridor intersections, and service shafts. Institutional applications, particularly in healthcare facilities and educational establishments, demand highly reliable and durable fire doors, often integrated with complex access control and specialized hardware to meet both safety and operational needs. The growth trajectory is significantly underpinned by large-scale urban development projects, renovations of aging infrastructure requiring code upgrades, and the rising awareness among developers and building owners regarding life safety prioritization.

The core benefits of fire-resisting doors include enhanced life safety through compartmentalization, minimizing the rapid spread of flames and toxic smoke, and providing crucial time for evacuation and emergency response. Key driving factors stimulating market growth involve mandatory adoption driven by updated international building and fire safety codes, coupled with the exponential growth in the construction of high-rise commercial and residential structures, which inherently require sophisticated passive fire protection strategies. Furthermore, technological advancements in intumescent materials, specialized glazing (fire-rated glass), and integrated smart monitoring systems are continually enhancing product performance and reliability, making them indispensable elements in the modern built environment.

Fire Resisting Door Market Executive Summary

The global Fire Resisting Door Market is experiencing robust expansion, primarily propelled by global regulatory harmonization emphasizing occupant safety and the rapid pace of urbanization, particularly across the Asia Pacific region. Business trends are characterized by consolidation among major players, who are leveraging strategic acquisitions to expand their geographic footprint and diversify their product portfolios, focusing heavily on integrating fire doors with access control systems and IoT capabilities for proactive maintenance and compliance monitoring. Manufacturers are also heavily investing in sustainability, moving towards certified materials and processes that reduce the environmental impact of traditional manufacturing, aligning with broader green building initiatives. Furthermore, there is a distinct shift toward customizable aesthetic solutions, where fire safety components are designed to blend seamlessly with modern architectural designs without compromising protective functionality, driving demand for specialized timber and glazed options.

Regional trends clearly indicate that North America and Europe, characterized by established building codes and rigorous compliance enforcement, remain crucial markets, driven primarily by replacement cycles and retrofitting activities in older buildings. However, the highest growth rates are forecast to originate from the Asia Pacific (APAC) region, led by construction booms in China, India, and Southeast Asian nations. This growth is linked to massive infrastructure development, including metro projects, airports, and burgeoning residential complexes, where newly enforced, often European or American-standard, fire safety regulations necessitate the widespread adoption of certified fire doors. The Middle East and Africa (MEA) region also presents significant opportunities, fueled by mega-projects in commercial and hospitality sectors, demanding premium, high-specification fire resistance solutions suitable for challenging environmental conditions.

Segmentation trends highlight the increasing preference for steel fire doors in industrial and high-security commercial applications due to their superior durability and cost-effectiveness, while timber-based fire doors command a significant share in residential and premium commercial segments due to their aesthetic appeal. Within the application segment, the healthcare sector is demonstrating exceptional growth due to strict hygiene and safety requirements, often necessitating specialized doors with antibacterial properties alongside fire resistance. In terms of rating, 60-minute and 90-minute ratings are standard for internal divisions, but demand for specialized 120-minute and higher-rated doors is rising in utility rooms, server centers, and high-density storage facilities. The integration of advanced hardware, such as electromagnetic hold-open devices and concealed door closers, is defining the performance standard for the premium segment.

AI Impact Analysis on Fire Resisting Door Market

User queries regarding the intersection of AI and fire safety predominantly center on predictive maintenance, smart compliance reporting, and enhanced emergency response capabilities. Common questions analyze how AI-driven systems can monitor the integrity and operational status of installed fire doors in real-time, moving beyond traditional manual inspection cycles. Users are keen to understand the feasibility and return on investment of embedding AI sensors (e.g., computer vision for self-closing integrity checks, acoustic monitoring for hinge wear) into door assemblies. A key concern is data privacy and the integration complexity of linking thousands of sensors across a large campus or building network to a centralized AI analytics platform. Expectations are high regarding the system's ability to not only identify faults (like a door failing to latch properly) but also predict potential failures based on usage patterns and environmental stress, thereby ensuring continuous compliance and significantly reducing facility management costs related to safety checks.

The application of Artificial Intelligence within the Fire Resisting Door market is rapidly transforming the life cycle management of these critical assets, particularly through the advent of the Internet of Things (IoT) integrated smart safety systems. AI algorithms process vast amounts of data collected from embedded sensors on fire doors—monitoring opening cycles, latch engagement effectiveness, smoke seal integrity, and ambient temperature fluctuations—to create a holistic digital twin of the passive fire protection system. This proactive monitoring capability allows facility managers to shift from reactive repairs to predictive maintenance schedules, ensuring that every door assembly meets its mandated performance specifications at all times. This technological integration addresses a major traditional weakness: the common failure of fire doors due to improper use, physical damage, or maintenance neglect over time, which often goes unnoticed in manual inspections.

Beyond maintenance, AI is optimizing the design and material selection phase. Machine learning models are being utilized by manufacturers to simulate fire dynamics and structural performance of new composite materials under extreme thermal loads, reducing the time and cost associated with physical testing and certification. Furthermore, in the event of a fire, AI-powered building management systems (BMS) can dynamically analyze sensor data to confirm the operational status of critical escape route fire doors, communicate their status to emergency services, and even adjust adjacent systems (like HVAC smoke extraction) based on the door’s integrity, thus significantly improving the efficiency and success rate of coordinated emergency procedures. This integration elevates fire doors from static physical barriers to intelligent, active components within a comprehensive building safety ecosystem, justifying higher long-term investment in these advanced solutions.

- AI enables predictive maintenance by monitoring door usage, hinge integrity, and latch functionality in real-time.

- Smart sensors coupled with AI algorithms ensure continuous compliance checks, eliminating reliance on periodic manual inspections.

- Machine learning optimizes fire door design by simulating thermal performance of new materials and configurations.

- AI integrates door status data with Building Management Systems (BMS) for enhanced, dynamic emergency response planning.

- Computer vision systems use AI to verify the self-closing function and correct door alignment post-installation or heavy usage.

DRO & Impact Forces Of Fire Resisting Door Market

The Fire Resisting Door Market is fundamentally driven by stringent global building codes and fire safety regulations, which act as the primary impetus for mandatory installation in new constructions and required upgrades in existing structures. Restraints primarily involve the substantial initial cost associated with certified fire-rated assemblies, specialized hardware, and complex installation requirements compared to standard doors, potentially leading smaller developers in less regulated areas to seek non-compliant or cheaper alternatives. Significant opportunities exist in the retrofitting of aged commercial and institutional buildings globally, especially in regions adopting modern international standards, alongside continuous innovation in materials, offering aesthetically pleasing, lightweight, and higher-rated solutions. The core impact forces include regulatory pressure, technological innovation in smart safety integration, and the intrinsic need for life safety and property protection, which continuously reinforces demand regardless of economic cycles, positioning fire doors as non-negotiable building elements.

The primary driver accelerating market expansion is the increasing global emphasis on passive fire protection as a core element of sustainable and safe infrastructure development. This is coupled with demographic shifts, such as higher population density in urban centers, necessitating high-rise construction where fire compartmentation is non-negotiable. Furthermore, liability and insurance considerations compel commercial property owners and facility managers to invest in certified fire door systems to mitigate risks and secure favorable insurance premiums. Conversely, a major constraint is the global shortage of skilled labor specifically trained in the installation and routine inspection of certified fire door systems. Improper installation severely compromises the fire rating, making the entire investment ineffective. This lack of standardization in installation quality across different regions poses a systemic risk and market bottleneck. Additionally, the proliferation of counterfeit or non-certified products, particularly in emerging markets, dilutes market integrity and requires constant vigilance from governing bodies and reputable manufacturers.

Opportunities for sustained growth are manifold, focusing strongly on product diversification and regional penetration. The rising demand for integrated security and fire systems—where access control, fire resistance, and egress functions are unified—presents a major avenue for manufacturers to capture higher value. Geographically, untapped potential lies in developing economies implementing their first wave of rigorous national building standards. The development of advanced intumescent seals and fire-rated glazing that allows for greater visibility and natural light while maintaining high fire resistance ratings is catering to modern architectural demands. Impact forces such as changing climate patterns, which increase the risk of electrical fires or extreme environmental conditions, subtly influence demand for higher resilience and integrity in construction components. The overall market resilience is high because demand for fire safety is inelastic; it is driven by mandatory compliance rather than discretionary consumer spending.

Segmentation Analysis

The Fire Resisting Door Market is comprehensively segmented based on material, mechanism, fire rating, and end-use application, providing a highly granular view of demand patterns across the construction industry. Material composition, ranging from traditional steel and timber to newer composites and fully glazed solutions, dictates both the aesthetic suitability and the core fire resistance properties of the assembly, directly influencing the target application segment. The mechanism segmentation highlights operational requirements, where swing doors are standard for daily passage, while sliding and rolling fire doors are critical for large openings in industrial or institutional settings requiring automatic closure upon alarm. Crucially, the fire rating dictates the duration of resistance, ensuring compliance with specific compartmentalization requirements mandated by local authorities, which often vary significantly based on building height and occupancy risk.

In terms of application, the commercial sector, encompassing offices, retail spaces, and hospitality establishments, holds the largest market share, driven by high traffic volumes and strict public safety regulations. However, the institutional segment, particularly healthcare and education facilities, is expected to exhibit the fastest growth due to stringent standards requiring multiple layers of protection and specialized requirements like smoke control and tamper-proof hardware. The residential sector, while often utilizing lower-rated doors primarily in multi-family units and high-rise apartments, is also showing steady growth as premium residential developments increasingly adopt comprehensive passive fire protection strategies. Analyzing these segments helps stakeholders tailor product development, focusing on balancing cost, compliance, durability, and aesthetic integration necessary for success in specialized sub-markets, such as explosion-proof fire doors for chemical facilities or acoustic-rated fire doors for theaters.

The trend towards customized solutions is strongly evident across all segments. For instance, manufacturers are offering enhanced security features integrated within fire doors to meet the dual requirements of safety and protection against unauthorized access, especially in data centers and high-value industrial facilities. The increasing adoption of fire-rated glass partitions and doors in modern office environments signifies a growing balance between open-plan aesthetics and critical safety compartmentalization. This demand for sophisticated, multi-functional fire door systems ensures that the market remains dynamic, requiring continuous product innovation to meet evolving architectural and regulatory demands globally. The segmentation by rating is vital, with 60-minute and 90-minute classifications dominating standard commercial use, while 120-minute and higher ratings are reserved for critical infrastructure like plant rooms and essential services corridors.

- Material: Steel, Timber, Aluminum, Composite, Glass (Glazed Fire Doors).

- Mechanism: Swing Doors (Single/Double Acting), Sliding Doors (Manual/Automatic), Rolling Shutters, Folding Doors.

- Fire Rating (Duration): 20 Minute, 45 Minute, 60 Minute, 90 Minute, 120 Minute, Above 120 Minute.

- Application (End-Use):

- Residential (Multi-Family, High-Rise Apartments)

- Commercial (Offices, Retail, Hospitality, Data Centers)

- Industrial (Manufacturing Plants, Warehouses, Utilities)

- Institutional (Healthcare, Education, Government Buildings, Transportation Hubs)

- Operation: Manual, Automatic (Integrated with Fire Alarm Systems).

Value Chain Analysis For Fire Resisting Door Market

The value chain for the Fire Resisting Door market commences with upstream activities involving the sourcing and processing of core raw materials, predominantly specialized steel (galvanized, stainless), engineered timber (solid core, composite core), and advanced intumescent and sealing materials. Strict quality control at this stage is paramount, as the intrinsic fire resistance and integrity of the final product depend heavily on the material quality and compliance with thermal stability standards. Key suppliers in the upstream market include specialized chemical companies providing intumescent strips and sealants, steel manufacturers focused on high-gauge specifications, and timber processors certified for fire-rated wood products. Optimization in this phase focuses on reducing material weight while enhancing thermal resistance, often through proprietary core compositions, which represent a significant competitive advantage for door manufacturers.

Midstream activities involve the fabrication, assembly, and rigorous testing of the door systems. Manufacturers must adhere to complex, internationally recognized testing procedures (e.g., UL, NFPA, EN standards) to obtain certification for specific fire ratings. The manufacturing process often requires specialized machinery for cutting, welding, integrating fire-rated glazing, and installing sophisticated hardware (e.g., closers, panic bars, locks). Direct and indirect distribution channels play a pivotal role in market penetration. Direct distribution often involves large-scale contracts with major construction companies and institutional end-users, where manufacturers offer bespoke design, installation, and maintenance services. Indirect channels utilize networks of specialized contractors, architectural product distributors, and system integrators who facilitate sales to smaller projects and manage regional inventory, ensuring rapid supply and localized technical support.

Downstream activities center on installation, inspection, and aftermarket services. Because fire door performance is highly dependent on proper installation—including frame integration, gapping tolerances, and hardware configuration—specialized, certified installers are critical components of the value chain, differentiating high-quality providers. Post-installation, maintenance and inspection services, often mandated annually, generate significant recurring revenue for certified maintenance providers. Potential customers, including building owners and facility management companies, rely heavily on this final stage to maintain compliance. The flow is highly regulated; failure at any point—from certified material sourcing upstream to correct installation downstream—can compromise the entire safety system, underscoring the necessity of a tightly controlled and auditable value chain across all segments.

Fire Resisting Door Market Potential Customers

The core end-users and buyers of fire resisting door products are segmented into entities responsible for large-scale building construction, infrastructure maintenance, and public safety compliance. Commercial developers constructing new high-rise office towers, shopping malls, and hospitality complexes represent a primary customer base, demanding high volumes of certified doors tailored for aesthetic integration and heavy usage. Institutional bodies, including public works departments, hospital network administrators, and university facility managers, constitute a robust segment due to their requirement for long-life, high-integrity products that must comply with the most stringent life safety codes, often prioritizing smoke control features and durability over basic cost considerations.

A rapidly growing customer segment comprises facility management companies and property maintenance service providers. These entities are responsible for managing the compliance and operational integrity of existing building stock. Their purchasing decisions are driven by replacement cycles, fire code upgrades, and the need for standardized maintenance components. They typically seek long-term supply contracts with manufacturers or distributors offering comprehensive inspection and repair services to minimize operational downtime and avoid compliance penalties. Additionally, homeowners' associations and property managers of multi-family residential complexes (e.g., condominiums, apartments) are significant buyers, particularly in jurisdictions where fire safety codes mandate fire doors for entranceways and utility access points.

Specialized industrial clients form another high-value customer base. This includes operators of data centers, chemical processing plants, oil and gas facilities, and large-scale manufacturing operations. These end-users often require highly customized fire doors that offer supplementary resistance to hazards such as explosion, radiation, or extreme temperature fluctuations (Cryogenic storage), alongside the primary fire rating. Their procurement processes are highly technical, favoring manufacturers that can provide verifiable certification for multi-hazard protection and specialized materials suitable for harsh environments. Ultimately, the purchasing decision across all segments is non-discretionary, driven by regulatory compliance and risk mitigation rather than market choice, ensuring sustained demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.50 Billion USD |

| Market Forecast in 2033 | $22.75 Billion USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASSA ABLOY, Hörmann, Dormakaba, Stanley Black & Decker, Sanwa Holdings, Masco Corporation, Allegion plc, Saint-Gobain, Vetrotech Saint-Gobain International AG, Chase Doors, Special-Lite, Pyroguard, IFAM, Novoferm Group, Door Engineering, Pella Corporation, Marvin Windows and Doors, Anderson Windows and Doors, AlKuhaimi Metal Industries, Teckentrup, Sentry Door and Hardware. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fire Resisting Door Market Key Technology Landscape

The technology landscape for fire resisting doors is primarily characterized by advancements in material science, intumescent technology, and smart integration capabilities. Core technological improvements focus on achieving higher fire ratings (integrity and insulation) using lighter, more sustainable, and aesthetically versatile materials. For instance, the use of vermiculite and advanced mineral fiber cores in timber and composite doors allows for achieving 60- to 120-minute ratings while maintaining reduced thickness and weight compared to traditional construction methods. Intumescent technology, which uses materials that expand exponentially upon exposure to heat to seal gaps around the door edge, is continuously being refined to ensure quicker and more complete sealing, significantly improving smoke containment, a critical life safety factor often overlooked by traditional testing focusing only on fire integrity.

Another pivotal technological area is the integration of advanced mechanical and electronic hardware. Modern fire doors frequently incorporate certified electro-magnetic hold-open devices linked directly to the central fire alarm system, allowing doors to remain open for accessibility under normal conditions but automatically and reliably closing the door upon detection of smoke or fire. Furthermore, the hardware itself—including hinges, closers, and latch mechanisms—is engineered and tested for extreme durability and thermal resilience to ensure operation remains uncompromised during a fire event. Concealed closing devices and high-precision adjustable hinges are common features in premium segments, enhancing both functionality and aesthetics, addressing architectural demands for clean lines without sacrificing safety performance.

The newest technological frontier involves the convergence of fire doors with IoT and smart building technologies. Manufacturers are embedding micro-sensors that monitor the door’s operational status, including open/closed position, latch status, and the health of the door closer mechanism. This data is transmitted wirelessly to a Building Management System (BMS) or a dedicated cloud platform, facilitating AI-driven predictive maintenance and generating digital audit trails for compliance purposes. This digitalization is essential for large institutional and commercial campuses, enabling remote monitoring of thousands of fire doors simultaneously and ensuring continuous operational integrity, fundamentally shifting the responsibility from manual inspection to automated compliance verification, thereby establishing a new standard for asset management in passive fire protection.

Regional Highlights

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA) (Saudi Arabia, UAE, South Africa)

North America represents a mature yet continuously growing market segment, driven by the highly standardized and rigorously enforced building codes established by organizations such as the National Fire Protection Association (NFPA) and International Code Council (ICC). The market is characterized by a strong emphasis on certified products, with third-party verification (e.g., UL listings) being mandatory for most commercial and institutional projects. Market growth is sustained by ongoing large-scale infrastructure renewal projects, particularly in metropolitan areas, and mandatory retrofitting of existing commercial real estate to meet updated life safety codes, especially concerning smoke control and accessibility (ADA compliance). The U.S. remains the largest national market, focusing heavily on durable steel and specialized institutional doors for healthcare facilities.

Key trends in this region include the increasing adoption of automated and integrated fire door systems that interface seamlessly with access control and security protocols. There is significant demand for products offering both fire resistance and enhanced protection against environmental hazards or forced entry, particularly in government and critical infrastructure buildings. Canadian market growth mirrors the U.S., focusing on compliance with national building codes that align closely with international best practices. The emphasis on high-performance glazing and acoustical fire doors is prevalent in high-end commercial office constructions seeking LEED or similar green building certifications.

Europe is a highly fragmented but technologically advanced market, regulated by the European harmonized standards (EN 1634, EN 13501) which dictate testing procedures and classification. The UK and Germany are the leading markets, known for their rigorous enforcement and high-quality manufacturing base. The UK market has shown intensified focus on fire safety standards following high-profile incidents, driving rapid replacement cycles and demanding higher quality assurance and traceability throughout the supply chain. Germany, with its strong industrial and manufacturing sectors, drives demand for robust, specialized fire doors, particularly for industrial warehouses and automotive facilities.

The European market shows a strong preference for aesthetic timber and glazed fire doors, especially in Scandinavian countries and Central Europe, where design integration is prioritized alongside safety. Regulatory shifts, such as stricter energy efficiency mandates, also influence product design, prompting manufacturers to integrate superior insulation and airtight sealing alongside fire resistance. The ongoing renovation wave targeting energy performance improvement in older residential and public buildings necessitates the simultaneous upgrading of existing door assemblies to current fire standards, providing a long-term, stable growth opportunity for specialized European manufacturers.

The Asia Pacific (APAC) region is the fastest-growing market globally, fueled by unprecedented rates of urbanization and massive investments in commercial, residential, and transport infrastructure. China and India are the dominant drivers, characterized by a sheer volume of new construction projects. While regulatory enforcement historically varied, major metropolitan areas are rapidly adopting and enforcing international standards (or creating strict national equivalents) for high-rise building safety, catapulting demand for certified fire doors.

Market dynamics in APAC are split: high-end projects, often funded by multinational corporations or targeting luxury markets (e.g., Singapore, Hong Kong), demand products meeting stringent European or North American specifications. Conversely, volume construction in emerging cities often favors cost-effective steel and composite doors. The institutional segment—particularly the rapid construction of new hospitals and educational institutions—is a key market segment. Challenges include battling the prevalence of lower-quality, non-certified alternatives, necessitating aggressive education and certification verification from reputable global players entering the region.

The Latin American market is characterized by moderate growth, primarily concentrated in major economies like Brazil and Mexico, linked to commercial and hospitality development. Regulatory frameworks are often decentralized or subject to local interpretation, but there is a clear trend towards adopting international standards, particularly in foreign-invested commercial projects. Brazil’s construction sector provides the largest source of demand, particularly for steel fire doors in industrial and government buildings. Market penetration relies heavily on strong distributor relationships and overcoming economic volatility, which can impact large construction project timelines.

The MEA region exhibits significant demand driven by ambitious mega-projects, especially in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia, Qatar). These projects, including world-class airports, luxury hotels, and commercial hubs, typically specify the highest fire rating standards (often demanding 120 minutes or more) and premium aesthetics. Demand is highly concentrated on high-specification, bespoke steel and sophisticated glazed fire door systems. South Africa acts as the regional hub for sub-Saharan Africa, driven by industrial and mining sector safety regulations. The market growth is contingent upon sustained government investment in infrastructure development and strict adherence to international safety consultants' specifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fire Resisting Door Market.- ASSA ABLOY

- Hörmann

- Dormakaba

- Stanley Black & Decker

- Sanwa Holdings

- Masco Corporation

- Allegion plc

- Saint-Gobain

- Vetrotech Saint-Gobain International AG

- Chase Doors

- Special-Lite

- Pyroguard

- IFAM

- Novoferm Group

- Door Engineering

- Pella Corporation

- Marvin Windows and Doors

- Anderson Windows and Doors

- AlKuhaimi Metal Industries

- Teckentrup

Frequently Asked Questions

Analyze common user questions about the Fire Resisting Door market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fire doors and standard doors?

The primary difference is that fire doors are engineered and tested to maintain integrity and insulation for a specific duration (rating, e.g., 60 minutes) to prevent the passage of fire and smoke, using certified materials, intumescent seals, and specialized hardware. Standard doors offer no such tested barrier performance.

What determines the required fire rating for a building door?

The required fire rating (e.g., 20, 60, 90 minutes) is determined by mandatory local building and fire safety codes, based on factors such as the building’s occupancy type, the compartment size, the structure's height, and the door's location relative to escape routes and adjacent fire-rated walls.

Are fire doors required to automatically close, and if so, how is this ensured?

Yes, most fire doors must be self-closing (latching shut automatically) to maintain compartmentalization integrity. This is ensured through certified door closers (mechanical or hydraulic) or, in the case of hold-open requirements, through electro-magnetic devices linked directly to the building's fire detection system, which release the door immediately upon alarm activation.

How is the global growth of the Fire Resisting Door market segmented by geography?

While North America and Europe maintain large market shares driven by replacement and code enforcement, the highest growth rate is projected in the Asia Pacific (APAC) region, led by massive urbanization and infrastructure development in countries like China and India adopting stricter international fire safety standards.

What impact does IoT and AI have on the maintenance of fire resisting doors?

IoT sensors and AI facilitate predictive maintenance by monitoring real-time door usage and operational status (latch engagement, closing speed). This allows facility managers to proactively identify and address issues, ensuring continuous compliance and significantly reducing the risks associated with faulty fire door operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager