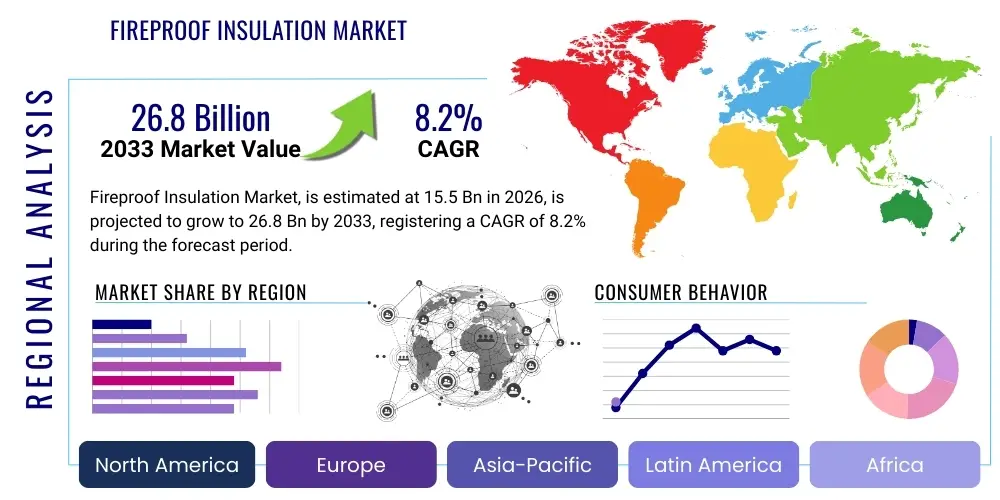

Fireproof Insulation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443001 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Fireproof Insulation Market Size

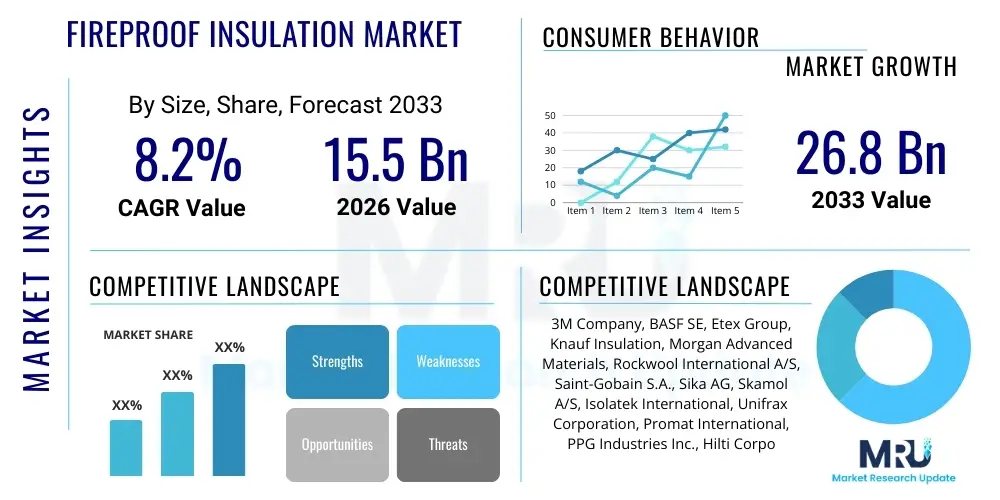

The Fireproof Insulation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $26.8 Billion by the end of the forecast period in 2033.

Fireproof Insulation Market introduction

The Fireproof Insulation Market encompasses a diverse range of materials designed to resist high temperatures and prevent or significantly slow the spread of fire. These specialized products, including mineral wool, ceramic fiber, calcium silicate, and intumescent coatings, are crucial components in modern building and industrial infrastructure, providing essential passive fire protection. The primary function is to maintain structural integrity during a fire event, thereby protecting human life, valuable assets, and ensuring operational continuity. Fireproof insulation achieves this by offering superior thermal resistance and stability when exposed to extreme heat, effectively compartmentalizing fires and extending the time available for evacuation and emergency response. This capability is paramount across high-risk environments.

Major applications for fireproof insulation span multiple high-growth sectors, particularly commercial and residential construction, oil and gas, petrochemicals, aerospace, and marine industries. In construction, it is widely utilized in walls, ceilings, ductwork, and structural steel elements to meet stringent building codes that mandate specific fire ratings. The proliferation of complex, high-rise urban structures and industrial facilities handling combustible materials directly correlates with increased demand for advanced insulation solutions. Furthermore, the market benefits immensely from continuous innovation in material science, focusing on producing lightweight, durable, and environmentally sustainable fire-resistant products that do not compromise performance. Key drivers fueling market expansion include rapid urbanization in developing economies, coupled with stricter global safety regulations and increased awareness regarding fire hazard mitigation.

The benefits derived from high-quality fireproof insulation are multifaceted, extending beyond immediate fire containment to include energy efficiency and long-term asset preservation. By offering excellent thermal performance, these materials contribute significantly to reducing energy consumption in buildings, aligning with global sustainability targets. From a regulatory perspective, global bodies continually update fire safety standards, compelling end-users to adopt materials that meet or exceed these elevated performance thresholds. This regulatory push, combined with insurance mandates for superior fire protection, solidifies the market's trajectory toward sustained growth. The transition towards smart buildings and advanced industrial safety systems further integrates fireproof materials as foundational elements of resilient infrastructure.

Fireproof Insulation Market Executive Summary

The global Fireproof Insulation Market is characterized by robust growth driven primarily by escalating urbanization and increasingly stringent international fire safety mandates. Key business trends indicate a significant shift towards high-performance, non-combustible materials such as mineral wool and advanced ceramic fibers, favored for their excellent thermal stability and environmental profiles. There is a noticeable investment surge in R&D aimed at developing bio-based or recyclable insulation products, reflecting a broader industry commitment to sustainability and Circular Economy principles. Furthermore, strategic alliances, mergers, and acquisitions focused on vertical integration and technological licensing are defining the competitive landscape, enabling key players to enhance production efficiency and expand geographic reach into fast-growing markets, particularly in Asia Pacific.

Regionally, the market exhibits divergent growth patterns. Asia Pacific (APAC) stands out as the primary growth engine, propelled by massive infrastructure projects, rapid industrialization, and subsequent adoption of Western safety standards in commercial and residential construction sectors. North America and Europe, representing mature markets, maintain stability, driven by renovation and retrofitting activities targeting older structures to comply with updated, rigorous energy and fire safety codes, such as the EU's Energy Performance of Buildings Directive (EPBD). The Middle East and Africa (MEA) are emerging rapidly, fueled by large-scale oil and gas investments and ambitious construction megaprojects requiring premium fire protection for complex facilities.

Segment trends reveal that the Mineral Wool segment (including glass wool and rock wool) continues to dominate the market share due to its cost-effectiveness, superior thermal and acoustic properties, and inherent fire resistance. However, the Intumescent Coatings segment is projected to experience the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to their ease of application, aesthetic benefits, and effectiveness in protecting structural steel elements without adding significant weight or bulk, making them ideal for architectural applications. Within end-use applications, the construction sector remains the largest consumer, while the industrial and transportation sectors, demanding highly specialized, high-temperature resistance products, show strong incremental growth opportunities for ceramic fiber and specialty foam materials.

AI Impact Analysis on Fireproof Insulation Market

User inquiries regarding the intersection of AI and fireproof insulation frequently center on how machine learning can enhance material development, optimize manufacturing processes, and improve the efficiency of fire risk assessment in built environments. Key concerns revolve around the integration of AI-driven predictive maintenance systems with existing fire safety infrastructure, the potential for AI to simulate complex fire scenarios for better product testing, and the ethical implications of using automated systems for fire safety compliance checks. Users are keen to understand if AI can accelerate the transition to sustainable, high-performance insulation materials by rapidly screening new compound formulations and predicting long-term material degradation under various environmental stresses. The overarching theme is the expectation that AI will deliver superior, safer, and more cost-effective passive fire protection solutions through data-driven insights.

The influence of Artificial Intelligence (AI) and machine learning models on the Fireproof Insulation Market is transformative, primarily through predictive analytics and optimized material design. AI algorithms can analyze vast datasets concerning raw material performance, environmental conditions, and real-world fire incident statistics to predict the exact specifications required for insulation in novel building designs. This capability significantly reduces the traditional lengthy and expensive cycles of laboratory testing and physical prototyping, leading to faster deployment of materials tailored for specific fire load scenarios. Furthermore, AI is utilized to fine-tune manufacturing processes, ensuring high consistency and quality control in producing fibrous materials and chemical coatings, optimizing energy consumption during the curing or firing phases, thereby reducing operational costs and carbon footprint.

Beyond material science and production, AI plays a critical role in the deployment and maintenance phases of fireproof insulation. Computer Vision and AI-powered drones can perform automated inspections of large industrial facilities or complex architectural structures, rapidly identifying defects, gaps, or damage in installed insulation that could compromise fire resistance. This capability drastically improves the reliability of passive fire protection systems over their lifespan, shifting maintenance from reactive to proactive. Additionally, integrating AI tools with Building Information Modeling (BIM) platforms allows engineers to simulate the performance of fireproof insulation within the context of the entire building system, providing critical insights into fire spread dynamics and optimizing the placement and quantity of insulation required for maximal safety compliance, which drives demand for higher-specification products.

- AI-driven optimization of material formulation using predictive chemical modeling, accelerating R&D cycles.

- Machine learning algorithms enhancing manufacturing quality control and reducing waste in production lines.

- Integration of AI with BIM for predictive fire behavior simulation and optimized insulation specification.

- Automated inspection (using drones and computer vision) for proactive identification of compromised fireproofing.

- Predictive maintenance schedules for intumescent coatings based on environmental exposure data analysis.

DRO & Impact Forces Of Fireproof Insulation Market

The Fireproof Insulation Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities (DRO), which collectively shape its growth trajectory and competitive dynamics. Key drivers include the global push for stricter building and safety codes, mandated by governmental and international organizations following high-profile fire incidents. This regulatory environment necessitates the integration of high-performance passive fire protection measures in all new commercial and infrastructure projects. Simultaneously, rapid industrial expansion, particularly in energy-intensive sectors like petrochemicals, power generation, and specialized manufacturing, creates sustained demand for durable, high-temperature insulation solutions capable of protecting critical assets under extreme conditions. Furthermore, the increasing complexity and density of urban environments amplify the risk associated with fire, reinforcing the necessity for advanced compartmentalization strategies provided by fireproof materials. These fundamental factors provide a resilient foundation for consistent market expansion across diverse geographic regions.

Conversely, several restraints present headwinds to immediate market acceleration. The primary challenge revolves around the volatile pricing and supply chain complexities associated with key raw materials, such as specific mineral fibers, specialized chemicals for intumescents, and high-purity ceramic precursors. Fluctuations in energy costs, necessary for the high-temperature manufacturing processes (e.g., smelting rock into wool), directly impact the final product cost, sometimes making compliance-grade materials prohibitively expensive for budget-conscious projects. Another significant restraint involves the technical skills required for installation. Incorrect application, particularly for spray-applied fire resistive materials (SFRMs) and intumescent coatings, can severely compromise the material's fire rating, leading to potential structural failure during a fire, thereby necessitating rigorous training and certification which adds to project complexity and expense.

Despite these challenges, substantial opportunities exist, driven by technological innovation and shifting market preferences. The development of sustainable and bio-based fireproof materials, such as treated cellulose or mineral-wool derivatives with lower embodied energy, presents a major opportunity, aligning with global green building standards and environmental compliance goals. There is also a burgeoning opportunity in the integration of fireproof insulation with smart building technology, where embedded sensors monitor temperature and integrity, providing real-time data on the fire resistance status of the structure. The rapid growth of retrofit and renovation markets in developed economies, aimed at upgrading older buildings to current fire safety and energy efficiency standards, constitutes a lucrative niche. The impact forces are generally positive, driven by high societal demands for safety, stringent regulatory enforcement, and continuous innovation in material science aimed at reducing cost and improving performance.

Segmentation Analysis

The Fireproof Insulation Market segmentation is categorized based on product type, application, and end-use, providing a granular view of market dynamics and adoption trends across different industries. Product type segmentation distinguishes between traditional fibrous materials like mineral wool and newer chemical solutions such as intumescent coatings, reflecting the diverse requirements for structural protection versus surface application. Application segmentation focuses on where the insulation is primarily used, such as pipes, ducts, or entire structural elements, guiding manufacturers in developing tailored product forms. The end-use segment identifies the primary purchasing sectors, highlighting the critical role of construction, specialized industrial facilities, and transportation infrastructure in driving demand.

Understanding these segments is essential for strategic market positioning. The construction sector remains the largest consumer, driven by mandated safety standards for commercial and residential complexes. However, high-growth segments are emerging in areas demanding extreme temperature resistance and specific physical properties, such as the aerospace and marine industries, which rely heavily on lightweight ceramic fiber and specialty mineral products. Geographic segmentation further reveals market maturity and growth potential, with developed regions focusing on high-specification, sustainable products, while developing regions prioritize large-volume, cost-effective traditional insulation materials to meet immediate infrastructure needs.

The market analysis indicates a clear trend towards hybrid solutions, where different insulation types are combined to optimize fire resistance, thermal performance, and acoustic dampening within a single structure. For instance, the combination of mineral wool for core structural protection and intumescent paint for aesthetic steel beams provides comprehensive, multi-layered passive fire protection. This shift towards integrated safety solutions necessitates a comprehensive understanding of how different segments interact and complement each other, guiding future product development and marketing strategies for key industry players navigating a complex regulatory landscape.

- By Product Type:

- Mineral Wool (Rock Wool, Glass Wool)

- Ceramic Fiber

- Calcium Silicate

- Intumescent Coatings

- Fireproofing Sprays/Cementitious Materials

- Specialty Foams

- By Application:

- Structural Protection

- Pipe Insulation

- Ductwork Insulation

- Sealants and Firestops

- Cable and Conduit Protection

- By End-Use Industry:

- Building and Construction (Commercial, Residential, Infrastructure)

- Industrial (Oil and Gas, Petrochemicals, Power Generation)

- Transportation (Marine, Automotive, Aerospace)

- Specialty Applications

Value Chain Analysis For Fireproof Insulation Market

The value chain of the Fireproof Insulation Market begins with the upstream sourcing of crucial raw materials, which are categorized by the final product type. For mineral wool, this involves quarrying basalt rock or glass cullet, and for ceramic fibers, high-purity alumina and silica are essential. The volatility and purity of these raw materials directly impact manufacturing costs and product performance characteristics. Manufacturers must manage complex global procurement networks to ensure consistent supply and quality, especially given the high energy consumption involved in processing these materials into usable fibers or chemical precursors. Strategic partnerships with key mining and chemical suppliers are critical to maintaining competitive pricing and ensuring the sustainability credentials of the final product.

The midstream phase involves manufacturing and formulation, where raw materials are processed into finished insulation products. This stage is capital-intensive, requiring specialized high-temperature furnaces, spinning equipment for fibers, and advanced chemical blending facilities for intumescent coatings and cementitious sprays. Quality control is paramount here, as products must adhere to rigorous international fire testing standards (e.g., ASTM, ISO, EN). Innovation is focused on optimizing energy efficiency in manufacturing and developing proprietary formulations that enhance fire resistance, durability, and ease of installation. The choice between producing board, blanket, loose-fill, or sprayable formats dictates the necessary technological investment and operational complexity.

The downstream component encompasses distribution, sales, and installation. Distribution channels are varied, including direct sales to large construction firms or industrial clients, indirect sales through specialized distributors focusing on HVAC and fire protection supplies, and large retail hardware chains for smaller contractors. Direct sales are common for highly specialized products like ceramic fiber used in furnaces, while mineral wool often moves through large construction material supply networks. Installation typically requires certified contractors, especially for structural fireproofing applications, emphasizing the importance of training programs provided by manufacturers. The market's complexity demands efficient logistics to manage the transportation of bulky insulation materials, minimizing shipping costs while ensuring timely delivery to vast project sites.

Fireproof Insulation Market Potential Customers

The primary customer base for fireproof insulation products is the construction and engineering sector, encompassing general contractors, specialized fireproofing subcontractors, architects, and engineering procurement and construction (EPC) firms. These entities are mandated by regulatory bodies to incorporate specific fire-rated systems in new developments and major renovations, making them continuous, high-volume buyers of materials such as structural mineral wool boards, fire-rated sealants, and spray-applied cementitious compounds. Their procurement decisions are driven equally by product performance specifications (fire rating, thermal conductivity) and logistical considerations (supply reliability, installation speed, and cost efficiency) crucial for maintaining project schedules and budgets.

Another critical segment includes operators of heavy industrial facilities, particularly in the oil and gas, petrochemical, and power generation industries. These customers require highly specialized, durable fireproof insulation to protect high-value assets, critical piping, vessels, and control rooms from catastrophic failure due to hydrocarbon pool fires or jet fires. Products used here, often high-density ceramic fiber blankets or specialized passive fire protection (PFP) coatings, must withstand extremely harsh environmental conditions, including chemical corrosion and high thermal stress. Procurement in this sector is heavily influenced by stringent insurance requirements, asset integrity management protocols, and regulatory compliance related to hazardous material handling, prioritizing reliability and longevity over initial cost.

The third major group of potential customers comprises the marine and transportation sectors, including shipbuilders, aerospace manufacturers, and high-speed rail operators. These environments demand lightweight fireproof materials to minimize fuel consumption while ensuring the highest level of passenger and crew safety. Customized solutions, such as lightweight fire-rated panels and specialized thermal acoustic insulation systems, are essential. Government defense departments and naval constructors also represent a key customer segment, demanding materials that meet extremely rigorous military specifications for fire, shock, and sound dampening. Purchasing decisions here are predominantly driven by weight reduction targets, regulatory certification (e.g., IMO standards for marine use), and proven performance under extreme stress conditions, creating a high-margin market for innovative specialty products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $26.8 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, BASF SE, Etex Group, Knauf Insulation, Morgan Advanced Materials, Rockwool International A/S, Saint-Gobain S.A., Sika AG, Skamol A/S, Isolatek International, Unifrax Corporation, Promat International, PPG Industries Inc., Hilti Corporation, Tenmat Ltd., Firestone Building Products, Aspen Aerogels Inc., Armacell International S.A., CertainTeed Corporation, Thermal Ceramics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fireproof Insulation Market Key Technology Landscape

The technological landscape of the Fireproof Insulation Market is rapidly evolving, driven by the dual needs of enhanced fire resistance performance and improved environmental sustainability. One key area of innovation is in nanotechnology, where materials engineers are incorporating nanoparticles (such as carbon nanotubes or nano-clays) into polymer matrices and intumescent formulations. These additions significantly enhance the barrier formation process during pyrolysis, leading to thinner, lighter, and more effective intumescent coatings that provide superior insulation characteristics compared to traditional bulk applications. Furthermore, research into high-performance aerogels and phase-change materials (PCMs) is expanding the boundaries of thermal management, offering ultra-low density, non-combustible insulation for critical applications like aerospace and high-temperature industrial equipment, allowing for exceptional performance in confined spaces.

Another crucial technological development focuses on the manufacturing efficiency and properties of traditional mineral wool products. Companies are adopting advanced fiber spinning techniques and binder chemistries that result in higher compression strength, improved water repellency, and reduced dust emission during installation, addressing long-standing contractor concerns regarding handling and durability. The sustainability imperative is driving research into bio-based fire retardants derived from natural sources, aiming to replace halogenated chemicals commonly used in specialized foams and sealants. This shift requires sophisticated chemical engineering to ensure that the natural components maintain adequate fire resistance properties without compromising other mechanical characteristics, balancing ecological goals with uncompromising safety standards.

The integration of advanced testing and monitoring technologies is also transforming the market. Manufacturers are increasingly relying on sophisticated computational fluid dynamics (CFD) modeling to simulate fire spread and heat transfer within structural elements, allowing for precise optimization of insulation products before physical testing. Furthermore, the incorporation of passive sensing elements—such as fiber optic cables or micro-sensors—directly into the insulation material allows for continuous, real-time health monitoring of the fire protection system throughout a building’s life cycle. This technological advancement provides unprecedented data on material degradation, moisture ingress, or potential vulnerabilities, ensuring that passive fire protection remains robust and compliant with evolving safety requirements, moving the industry toward data-driven safety management.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, largely due to unprecedented infrastructure spending and rapid urbanization across China, India, and Southeast Asia. The region’s aggressive adoption of international safety and energy standards, particularly in high-rise commercial construction and industrial zones (like petrochemical clusters and data centers), fuels immense demand. Manufacturers are establishing local production hubs to mitigate logistical costs and cater directly to large-scale, ongoing governmental projects.

- North America: North America represents a mature, high-value market driven by rigorous safety regulations (e.g., NFPA codes) and a strong emphasis on energy efficiency retrofits in older commercial and institutional buildings. Innovation centers here focus on developing high-specification, sustainable products like formaldehyde-free mineral wool and advanced intumescent systems tailored for structural steel and specific seismic requirements. The oil and gas sector remains a stable, demanding client for PFP materials.

- Europe: Europe is characterized by stringent environmental and energy efficiency directives (such as the EPBD and REACH regulations), which mandate the use of insulation materials with low thermal conductivity and minimal environmental impact. The region shows strong demand for Rock Wool, benefiting from its recycled content and superior fire rating. Growth is steady, focused heavily on renovation projects and specialized industrial applications conforming to harmonized EU standards for fire resistance.

- Latin America (LATAM): LATAM is an emerging market with significant potential, spurred by increasing foreign direct investment in manufacturing and the slow but steady adoption of international building codes, particularly in major economies like Brazil and Mexico. The market is highly price-sensitive but shows growing interest in localized production solutions for basic mineral wool and cementitious sprays, targeting large public housing and commercial development projects.

- Middle East and Africa (MEA): The MEA market is defined by large-scale, specialized construction megaprojects, especially in the UAE, Saudi Arabia, and Qatar, requiring premium fireproof insulation for complex architectural structures, airports, and energy facilities. The extreme climate conditions necessitate products that combine fire resistance with superior thermal performance. Demand is heavily concentrated in the industrial sector for protection against severe jet and hydrocarbon fires.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fireproof Insulation Market.- 3M Company

- BASF SE

- Etex Group

- Knauf Insulation

- Morgan Advanced Materials

- Rockwool International A/S

- Saint-Gobain S.A.

- Sika AG

- Skamol A/S

- Isolatek International

- Unifrax Corporation

- Promat International

- PPG Industries Inc.

- Hilti Corporation

- Tenmat Ltd.

- Firestone Building Products

- Aspen Aerogels Inc.

- Armacell International S.A.

- CertainTeed Corporation

- Thermal Ceramics

Frequently Asked Questions

Analyze common user questions about the Fireproof Insulation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between passive and active fire protection systems?

Passive fire protection (PFP), which includes fireproof insulation, focuses on limiting fire spread through structural elements and compartmentation using fire-resistant materials that inherently slow heat transfer. Active fire protection (AFP), such as sprinklers and alarms, requires mechanical or electrical activation to suppress or detect a fire. PFP is foundational, requiring no intervention, while AFP provides immediate response upon detection.

How do intumescent coatings provide fire protection, and where are they most commonly used?

Intumescent coatings protect substrates, primarily structural steel, by chemically reacting to heat. Upon reaching a critical temperature (around 200°C), the coating rapidly swells into a thick, char-like foam layer. This foam acts as a highly effective insulator, keeping the underlying steel below its critical failure temperature for a specified period. They are commonly used in commercial buildings and visible architectural steelwork due to their aesthetic finish and low applied thickness.

Which product type dominates the fireproof insulation market, and why is its use so prevalent?

Mineral wool (including rock wool and glass wool) currently dominates the market share. Its prevalence stems from its inherent non-combustibility, excellent thermal and acoustic insulation properties, cost-effectiveness, and ease of mass production. Mineral wool is versatile, available in boards, blankets, and loose fill, making it suitable for a wide range of applications from residential wall cavities to high-temperature industrial equipment.

What impact are stricter global building codes having on the demand for fireproof insulation materials?

Stricter global building codes, particularly those requiring longer fire-resistance ratings and focusing on life safety, are significantly driving demand. These codes necessitate the use of higher-performance, third-party certified fireproof materials in more areas of a structure. This pushes the market towards specialty products like high-density ceramic fibers and advanced calcium silicate boards, ensuring compliance and superior asset protection in high-occupancy or critical infrastructure.

What emerging technologies are expected to revolutionize the fireproof insulation sector?

Key emerging technologies include the integration of nanotechnology in intumescent coatings for enhanced thermal shielding and the use of sustainable, bio-based fire retardants to meet green building standards. Furthermore, the adoption of Artificial Intelligence for predictive material design and automated, real-time monitoring of installed insulation via embedded sensors is enhancing product quality, predictive maintenance, and overall fire safety reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager