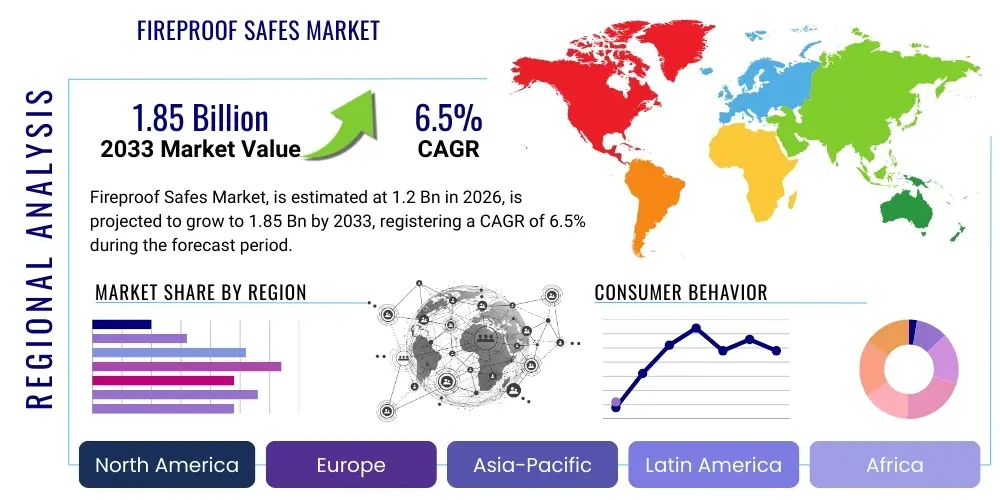

Fireproof Safes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441073 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Fireproof Safes Market Size

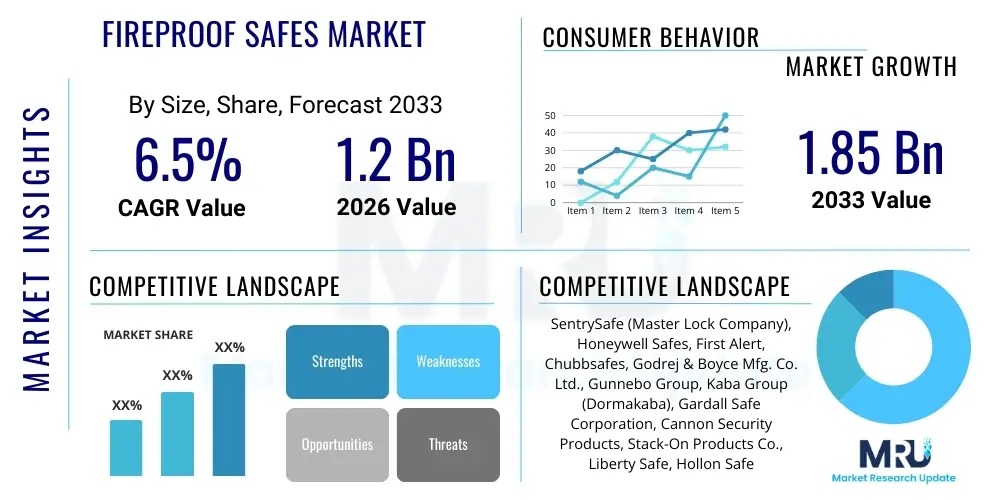

The Fireproof Safes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by increasing global awareness regarding the critical importance of protecting sensitive documents, digital media, and high-value physical assets from catastrophic damage, primarily fire. Regulatory mandates in various sectors, demanding secured storage for records, further fuel this upward trajectory. The inherent vulnerabilities associated with physical disasters necessitate robust protective measures, positioning fireproof safes as essential security components for both commercial enterprises and residential consumers worldwide.

Fireproof Safes Market introduction

The Fireproof Safes Market encompasses the manufacturing, distribution, and sale of specialized security containers designed explicitly to withstand extreme heat and protect internal contents from fire damage for a specified duration. These products are crucial for preserving currency, jewelry, critical documents, data storage devices, and firearms. Major applications span residential security, commercial offices, financial institutions, and specialized industrial environments requiring stringent safety protocols for sensitive materials. Key benefits include guaranteed asset integrity during fire incidents, compliance with insurance requirements, and enhanced peace of mind regarding irreplaceable items. The primary driving factors sustaining market growth include stricter regulatory requirements for record keeping, the increasing frequency of natural disasters globally, and technological advancements leading to superior fire-resistant composite materials and electronic locking mechanisms.

Fireproof Safes Market Executive Summary

The global Fireproof Safes Market is characterized by a strong emphasis on compliance and material innovation, driving steady growth across core geographical segments. Business trends indicate a significant shift towards smart safes incorporating biometric authentication and IoT connectivity, moving beyond traditional mechanical security solutions. Furthermore, customization and modular design are emerging trends, particularly in commercial applications where varied storage requirements exist. Regional trends highlight North America and Europe as mature markets demanding high-certification standards (e.g., UL ratings), while the Asia Pacific region exhibits the fastest growth due to rapid urbanization, increasing disposable incomes, and subsequent higher consumer investment in home security infrastructure. Segment trends show that document and media safes dominate the market volume, although the high-security, certified safes segment maintains premium pricing and strong growth, reflecting increased corporate governance standards globally.

AI Impact Analysis on Fireproof Safes Market

Analysis of common user questions related to AI's impact on the Fireproof Safes Market reveals key themes centered around operational efficiency, preemptive failure detection, and enhanced access control sophistication. Users frequently inquire if AI can predict safe integrity failures, how machine learning might improve biometric recognition accuracy, and whether smart safes utilize AI for pattern recognition in attempted break-ins or unauthorized access events. The core expectation is that AI integration will shift the market focus from purely passive physical protection to proactive, intelligent security systems capable of real-time threat assessment and remote monitoring. Concerns often revolve around data privacy when safes are connected to cloud-based AI platforms and the potential vulnerability of complex AI-driven systems to cyberattacks, balancing physical robustness with digital resilience.

- AI-driven predictive maintenance modeling for electronic lock mechanisms, preventing pre-emptive failures.

- Enhanced biometric authentication accuracy and speed using deep learning algorithms for identity verification.

- Integration of machine vision and AI within smart safes to detect and analyze unusual physical intrusion attempts in real-time.

- Optimization of manufacturing processes and material science through AI modeling to improve fire-resistance composite efficacy.

- Development of intelligent inventory management systems integrated within commercial safes, powered by AI analytics.

DRO & Impact Forces Of Fireproof Safes Market

The market dynamics for fireproof safes are shaped by a complex interplay of stringent regulatory mandates, technological leaps in material science, and fluctuating consumer purchasing power influenced by perceived risk levels. Drivers include escalating insurance industry standards requiring certified fire resistance, the proliferation of irreplaceable digital assets (e.g., cold storage for cryptocurrencies), and increasing awareness campaigns regarding disaster preparedness. Conversely, restraints involve the high initial cost associated with certified, premium-grade safes, particularly those offering extended fire endurance and water resistance, which can deter price-sensitive consumers. Counterfeit or non-certified products entering the market from unregulated sources also pose a challenge, diluting quality standards and customer confidence in the overall product category.

Opportunities in the market reside heavily in the expansion of connectivity features, merging physical security with IoT protocols to offer integrated home and business security solutions. The development of lighter, yet equally effective, fireproof materials (e.g., advanced ceramics and composite insulators) presents a strong opportunity to reduce shipping costs and increase product accessibility for residential markets. Furthermore, growth is anticipated in emerging economies, driven by rising construction standards and an increasing middle class prioritizing secure asset storage. These opportunities require substantial investment in R&D to meet the dual demands of superior physical protection and sophisticated digital functionality.

Impact forces currently shaping the competitive landscape are dominated by technological standardization, particularly concerning UL (Underwriters Laboratories) and ETL certification requirements, which act as barriers to entry for manufacturers unable to meet rigorous testing criteria. Supply chain volatility, especially concerning steel and specialized insulation materials, exerts pressure on manufacturing costs and lead times. The competitive rivalry is high, pushing key players toward continuous product innovation, particularly in integrating advanced locking systems (biometrics, RFID) and providing comprehensive warranty and after-sales service packages to maintain market share against fierce pricing competition.

Segmentation Analysis

The Fireproof Safes Market is meticulously segmented across dimensions including product type, material composition, locking mechanism, certification standard, and end-user application, allowing for a detailed understanding of consumer preferences and specific security requirements. Segmentation by product type helps differentiate between portable and fixed installations, while material segmentation highlights the use of specialized composites versus traditional concrete and steel constructions. The distinction in locking mechanisms—from traditional mechanical dials to sophisticated electronic and biometric systems—reflects the varying levels of access security demanded by different end-user groups. Analyzing these segments is critical for manufacturers to tailor their offerings, ensuring products meet the specific fire resistance duration (e.g., 30 minutes, 60 minutes, 120 minutes) and asset protection goals of commercial and residential clients.

- By Product Type:

- Document Safes

- Data/Media Safes

- Wall Safes

- Floor Safes

- Gun Safes/Vaults

- Deposit Safes

- By Fire Resistance Duration:

- 30 Minutes

- 60 Minutes

- 120 Minutes and Above

- By Locking Mechanism:

- Mechanical Locks (Dial Combination)

- Electronic/Digital Locks (Keypad)

- Biometric Locks (Fingerprint/Facial Recognition)

- By End-User:

- Residential

- Commercial (Small & Medium Enterprises, Large Corporations)

- Financial Institutions (Banks, Credit Unions)

- Government & Military

- By Material:

- Steel-Plated

- Composite Materials (Ceramic Fiber, Concrete Mixes)

Value Chain Analysis For Fireproof Safes Market

The value chain for the Fireproof Safes Market commences with the upstream activities involving the sourcing of high-grade raw materials, primarily specialized steel alloys, fire-resistant composites (such as vermiculite, cementitious fillers, or proprietary insulating compounds), and advanced electronic components for locking systems. Material sourcing and initial processing are critical due to the stringent quality requirements dictated by safety certifications (UL, ETL). Efficient supply chain management in this upstream segment is vital, as material quality directly correlates with the safe's performance during a fire, affecting the final certified rating and overall manufacturing cost. Manufacturers often engage in long-term contracts with specialized material suppliers to ensure consistency and compliance with fire-retardant standards.

The midstream involves manufacturing, assembly, and rigorous testing processes. Sophisticated processes are required for molding fire-resistant barriers and precision engineering of the safe body and doors to minimize heat transfer points. This stage includes integrating complex locking systems and adhering to specific regulatory requirements, often necessitating third-party verification and certification before mass production. Companies that achieve vertical integration, controlling both material processing and final assembly, typically enjoy better control over quality and cost structures. Certification standards heavily influence the manufacturing cost, requiring repeated testing cycles to validate temperature endurance and humidity control within the safe.

Downstream activities focus on distribution and reaching the end customer. The primary distribution channels include specialized security equipment distributors, large-scale retail hardware chains (both physical and e-commerce platforms), and direct sales channels targeting large commercial or government contracts. Direct channels often handle customized or high-security vault installations, requiring specialized technical support and installation expertise. Indirect distribution through major e-commerce retailers is rapidly growing, particularly for residential and small office safes, demanding robust logistical support and customer education on safe installation and maintenance. Effective after-sales service and warranty provision are crucial for maintaining brand reputation and customer loyalty in this security-sensitive industry.

Fireproof Safes Market Potential Customers

The potential customer base for fireproof safes is highly diversified, ranging from individual homeowners seeking basic protection for personal documents to multinational corporations requiring comprehensive, high-capacity vault solutions for critical data and physical assets. Residential users primarily purchase smaller, certified safes (e.g., 30-minute to 60-minute rating) to protect items like passports, insurance policies, digital backup drives, and jewelry, often motivated by insurance requirements or recent localized fire incidents. The increasing prevalence of high-value collectibles and firearms also drives demand in this segment, emphasizing durability and reliable fire resistance alongside burglar protection features.

Commercial clients represent a substantial and sophisticated segment, demanding larger capacity, higher fire ratings (often 120 minutes or more), and advanced locking mechanisms like multi-user biometric access. Financial institutions require highly certified, bank-grade fireproof and burglar-resistant vaults for cash reserves, safety deposit boxes, and critical server infrastructure. Healthcare providers and legal firms are major purchasers, driven by strict data privacy and regulatory mandates (e.g., HIPAA compliance) necessitating secured physical storage for sensitive client records. Government agencies and military installations often require custom-built, highly secure vaults that meet specialized, often proprietary, fire and explosive resistance specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.85 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SentrySafe (Master Lock Company), Honeywell Safes, First Alert, Chubbsafes, Godrej & Boyce Mfg. Co. Ltd., Gunnebo Group, Kaba Group (Dormakaba), Gardall Safe Corporation, Cannon Security Products, Stack-On Products Co., Liberty Safe, Hollon Safe, Amsec (American Security), Brown Safe Manufacturing, Brattonsound Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fireproof Safes Market Key Technology Landscape

The technology landscape of the Fireproof Safes Market is rapidly evolving, driven by innovations in both passive physical protection and active digital security integration. Core material technologies focus on developing advanced, lightweight composite fire barriers, often utilizing specialized inorganic fillers and ceramics that minimize thermal conductivity while maintaining structural integrity during prolonged exposure to high temperatures. This addresses the traditional drawback of safes being excessively heavy, making transport and installation challenging. Manufacturers are heavily investing in proprietary fire-resistant formulas that can achieve higher UL classification ratings (e.g., UL 72 Class 350) while reducing wall thickness, thereby increasing internal storage capacity without compromising protection efficacy.

In addition to material science, the market is undergoing a significant digital transformation centered around locking mechanisms and connectivity. The adoption of advanced biometric systems, including multi-factor authentication combining fingerprint, retinal scans, and PIN codes, enhances security significantly over traditional mechanical locks. Furthermore, the incorporation of IoT technology enables "smart safes" that can communicate their status remotely. These systems provide real-time alerts regarding unauthorized access attempts, temperature spikes, or physical relocation efforts, integrating the safe into a comprehensive, digitally managed security ecosystem. This connectivity is particularly vital for commercial and financial institutions managing multiple safe units across geographically dispersed locations.

Another crucial technological development involves integrated data protection features, specifically for media safes. Digital storage media (hard drives, flash drives) are highly susceptible to damage from heat and humidity, even within a certified fireproof safe. Technological innovations now include specialized internal cooling gels and humidity control mechanisms designed to keep the internal temperature below the critical 120°F threshold required for magnetic and optical media survival, which is a much lower requirement than that for paper documents. These dual-protection systems ensure that both physical documents and sensitive digital assets remain viable after a fire event, addressing the increasing volume of digitally stored critical information.

Regional Highlights

- North America: This region maintains the largest market share, characterized by high consumer awareness regarding asset protection, strict enforcement of UL and ETL safety standards, and high disposable incomes facilitating investment in premium security products. The strong presence of insurance mandates requiring certified fireproof storage for business records and specialized items drives consistent commercial demand. Furthermore, the large market for secure firearms storage (gun safes and vaults) significantly contributes to the regional market size. Innovation often focuses on integrating smart home technology and advanced anti-burglary features alongside fire resistance.

- Europe: The European market is highly regulated, particularly concerning data protection (GDPR) and workplace safety standards, fueling demand for certified document and media safes in commercial settings. Western European countries like Germany, the UK, and France show mature market characteristics, emphasizing sustainability in materials and adherence to regional certifications (e.g., VdS). While market growth is steady, it is focused on replacement cycles and upgrades to connected, higher-security models. Eastern Europe is emerging as a faster-growing sub-region due to increased foreign investment and subsequent infrastructure development requiring new security installations.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This accelerated growth is primarily attributed to rapid economic development, urbanization, and a burgeoning middle class in countries like China, India, and Southeast Asian nations. Increasing awareness of personal wealth security, coupled with a higher frequency of natural disasters (monsoons, earthquakes, fires), is pushing both residential and commercial sectors to adopt better asset protection strategies. The market is competitive and often price-sensitive, leading manufacturers to focus on cost-effective composite materials while gradually introducing smart safe technology to high-end customers in metropolitan areas.

- Latin America (LATAM): The LATAM market growth is steady but faces challenges related to economic volatility and reliance on imported certified products, often resulting in higher retail prices. Demand is concentrated in major commercial centers and among high-net-worth individuals, primarily driven by concerns about physical security (theft) combined with the need for fire protection. Brazil and Mexico are the dominant markets, where local manufacturers are starting to focus on meeting international fire rating standards to compete effectively against global suppliers.

- Middle East and Africa (MEA): This region presents varied growth patterns. The Gulf Cooperation Council (GCC) countries exhibit high demand for premium, large-capacity safes, particularly within the banking, energy, and government sectors, driven by significant infrastructure projects and high per-capita wealth. In contrast, the African segment is nascent, with demand predominantly focused on basic security needs and often constrained by price sensitivity, although commercial growth in South Africa and Nigeria suggests potential future expansion for mid-range fireproof safe products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fireproof Safes Market.- SentrySafe (Master Lock Company)

- Honeywell Safes

- First Alert

- Chubbsafes

- Godrej & Boyce Mfg. Co. Ltd.

- Gunnebo Group

- Kaba Group (Dormakaba)

- Gardall Safe Corporation

- Cannon Security Products

- Stack-On Products Co.

- Liberty Safe

- Hollon Safe

- Amsec (American Security)

- Brown Safe Manufacturing

- Brattonsound Engineering

- Diplomat Safe Co.

- Mesa Safe Company

- Viking Security Safes

- Steelwater Gun Safes

- Barska

Frequently Asked Questions

Analyze common user questions about the Fireproof Safes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between fire-resistant and fireproof safes?

The terms are often used interchangeably, but "fireproof" implies absolute, indefinite protection which is unrealistic. Reputable manufacturers specify their products as "fire-resistant," meaning they are tested and certified (e.g., by UL) to protect contents from specified heat levels for a defined duration (e.g., 30 minutes, 2 hours), usually at specific external temperatures (e.g., 1700°F). Consumers should focus on the certified duration and temperature rating.

Which certification standards are most important for fireproof safes?

The most crucial certification is the Underwriters Laboratories (UL) 72 standard. Specifically, UL Class 350 protects paper records by ensuring the interior temperature remains below 350°F, while UL Class 125 is required for digital media and data tapes, ensuring the internal temperature stays below 125°F and relative humidity below 80%. These certifications validate a safe's performance under standardized fire conditions.

Do fireproof safes also provide water resistance?

Not all fire-resistant safes are inherently water-resistant. In a fire event, firefighters' hoses or activated sprinkler systems can damage contents. Many modern high-end fire safes are now engineered with seals to offer dual protection—fire resistance and limited water resistance—certified often through independent testing to withstand submersion or pressurized spray for short periods, a feature critical for basement installations.

How does the integration of IoT and smart technology affect safe security?

Smart technology, including IoT connectivity and biometric locking, significantly enhances convenience and active security. IoT allows for remote monitoring, real-time alerts regarding temperature changes, and attempted intrusions, transforming the safe from a passive storage unit into an integrated security asset. While convenient, users must ensure the digital components are secured against cyber threats and unauthorized remote access.

What factors should influence the choice of a safe's fire rating duration?

The required duration rating depends primarily on the value and replaceability of the contents, and the likely fire exposure duration based on the location. For residential homes in densely populated areas with fast emergency response, a 60-minute rating may suffice. Commercial properties storing irreplaceable legal documents or data backups often require 120-minute ratings or higher, matching the potential prolonged duration of fire exposure in large structures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager