Fireproofing Hydraulic Fluid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442592 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Fireproofing Hydraulic Fluid Market Size

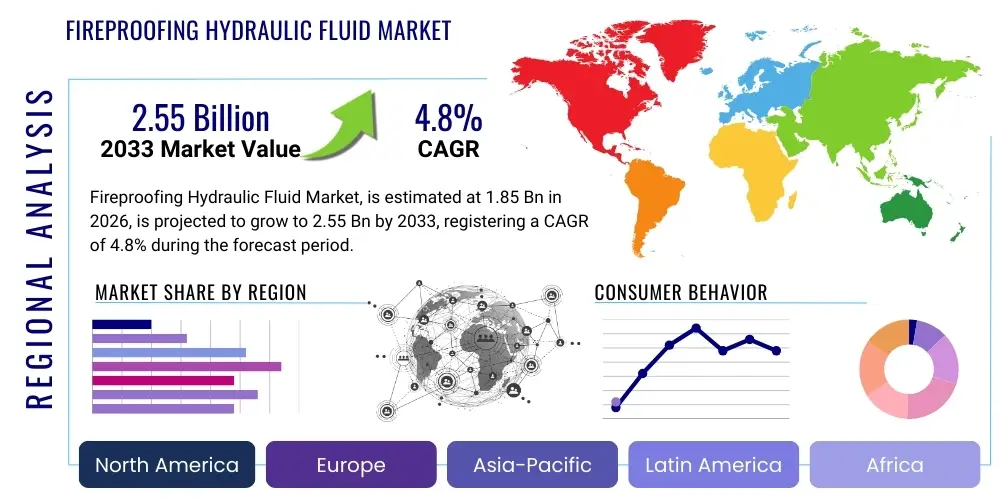

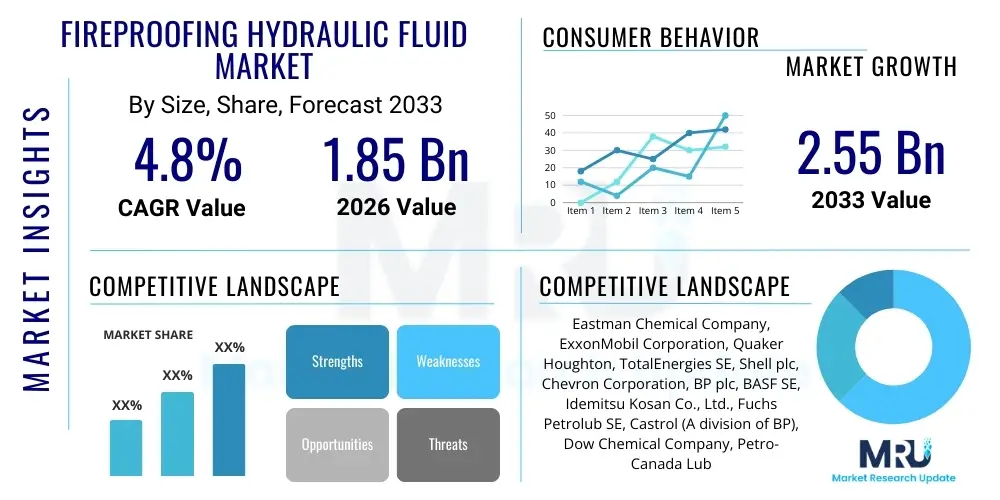

The Fireproofing Hydraulic Fluid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Fireproofing Hydraulic Fluid Market introduction

Fireproofing hydraulic fluids, often referred to as fire-resistant hydraulic fluids, are specialized liquids designed to transmit power within hydraulic systems while significantly reducing the risk of ignition and fire propagation in high-temperature or hazardous environments. These fluids are critical components in industries where hydraulic lines operate near intense heat sources, open flames, or electrically conductive materials, such as steel mills, mining operations, aerospace, and die-casting facilities. Unlike traditional mineral oil-based hydraulic fluids, fire-resistant variants are formulated using various chemistries, including water-glycol mixtures, phosphate esters, and polyol esters, to meet stringent safety and operational standards.

The primary application areas for these fluids encompass heavy machinery and equipment utilized in sectors where operational safety is non-negotiable. For instance, in the mining industry, continuous operation in confined spaces necessitates fluids that mitigate catastrophic risk should a hydraulic line burst onto hot surfaces. Similarly, in aviation, phosphate ester-based fluids are extensively used due to their stable fire-resistant properties at varying altitudes and temperatures. The market growth is inherently tied to increasing global industrial safety regulations, mandating the replacement of conventional, highly flammable petroleum-based fluids with safer alternatives to protect personnel and assets.

The core benefits driving the adoption of these specialized fluids include enhanced worker safety, reduced insurance premiums, minimized downtime associated with fire incidents, and compliance with international standards such as ISO 6743-4 (categorizing fluids like HFA, HFB, HFC, and HFD). Furthermore, advancements in synthetic fluid technology are addressing historical drawbacks, such as reduced lubricity or environmental concerns associated with certain chemical compositions, leading to high-performance, environmentally conscious, and fire-resistant products that maintain system efficiency while providing superior safety margins.

Fireproofing Hydraulic Fluid Market Executive Summary

The Fireproofing Hydraulic Fluid Market is experiencing robust expansion driven by stringent industrial safety mandates across mature and emerging economies, particularly within the manufacturing, metal processing, and energy sectors. Business trends indicate a significant shift towards environmentally acceptable lubricants (EALs) within the fire-resistant category, pushing manufacturers to innovate beyond traditional phosphate esters toward synthetic polyol esters and water-based solutions (HFA/HFC). Strategic mergers, acquisitions, and technological licensing agreements focused on expanding product portfolios in niche applications, such as high-pressure machinery in offshore drilling, characterize the competitive landscape. Supply chain resilience, ensuring the consistent availability of specialized base stocks and additives, remains a key focus for market leaders seeking sustained competitive advantage amid fluctuating raw material costs.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive infrastructure development, rapid industrialization in countries like China and India, and the subsequent implementation of enhanced occupational health and safety (OHS) standards in heavy industries like mining and construction. North America and Europe, while being mature markets, continue to contribute substantial revenue, driven by rigorous regulatory enforcement (e.g., OSHA, REACH) and the systematic replacement of older, non-compliant equipment. The Middle East and Africa (MEA) are also showing promising growth, particularly in the oil and gas extraction and refining segments, where high-temperature operations mandate the use of HFD-type synthetic fluids for enhanced thermal stability and non-flammability.

Segmentation trends highlight the dominance of Water-Glycol (HFC) and Synthetic Ester (HFD-U) fluids due to their superior balance of fire resistance, lubricity, and cost-effectiveness across general industrial applications. The Phosphate Ester segment, although facing environmental scrutiny, maintains critical importance in specialized, high-performance areas such as aerospace and turbine control systems where uncompromising thermal stability is required. Furthermore, the End-User segment shows that the Metal Processing and Mining industries collectively hold the largest market share, requiring large volumes of non-flammable fluids to operate hydraulic presses, forging equipment, and underground excavation machinery safely.

AI Impact Analysis on Fireproofing Hydraulic Fluid Market

Common user questions regarding AI's influence on the fireproofing hydraulic fluid market revolve primarily around predictive maintenance capabilities, optimizing fluid lifespan, and the role of AI in new product development and safety compliance monitoring. Users frequently ask: "Can AI predict when hydraulic fluid fire resistance degrades?", "How can machine learning reduce fluid consumption and waste?", and "Will AI integration into hydraulic systems mandate new fluid performance metrics?" The collective interest centers on leveraging AI and IoT sensors to move from reactive fluid management to proactive, condition-based monitoring, ensuring fluids are replaced or conditioned precisely when their critical fireproofing or lubricating properties begin to decline, thus maximizing safety and minimizing operational waste.

The consensus suggests that AI integration will not directly alter the chemical composition of fire-resistant fluids but will revolutionize their utilization and maintenance. By deploying machine learning models trained on sensor data (temperature, pressure, particle count, viscosity, and chemical composition), operators can gain unprecedented insights into the real-time health of the fluid. This predictive capability significantly enhances the safety profile, as fluids nearing the regulatory threshold for fire resistance can be flagged for immediate attention, thereby preventing potential hazards long before traditional, time-based sampling methods would detect the issue. This data-driven approach also promises substantial operational expenditure (OpEx) savings by extending fluid change intervals safely.

Beyond predictive maintenance, AI also plays a burgeoning role in R&D and quality control. Specialized AI algorithms are being deployed to analyze vast material science databases to accelerate the formulation of next-generation, environmentally benign fire-resistant fluids, particularly focusing on improving the thermal stability and hydrolytic resistance of synthetic esters. Furthermore, in manufacturing facilities, AI-powered vision systems are used to monitor hydraulic component integrity and detect micro-leaks or equipment wear that could lead to dangerous spray fires, effectively creating a closed-loop system of continuous safety improvement for hydraulic infrastructure utilizing fireproofing fluids.

- AI-driven Predictive Maintenance: Optimizes fluid change intervals based on real-time degradation data, enhancing safety and reducing operational waste.

- Enhanced Safety Monitoring: IoT sensors coupled with machine learning detect early signs of fluid contamination or system leaks, mitigating fire risk proactively.

- Formulation Acceleration: AI models analyze material properties to expedite the development of superior, environmentally acceptable fire-resistant fluid chemistries.

- Operational Efficiency Gains: Reduces unnecessary fluid changes and optimizes inventory management through accurate consumption forecasting.

- Compliance Automation: Automated data logging and analysis ensure continuous regulatory adherence regarding fluid performance and safety standards.

DRO & Impact Forces Of Fireproofing Hydraulic Fluid Market

The market is predominantly driven by increasing regulatory scrutiny and the implementation of stringent safety standards worldwide, particularly in high-risk industrial environments such as offshore oil platforms, aerospace, and heavy manufacturing. These regulations, often mandated by bodies like OSHA, MSHA, and various European agencies, compel industries to adopt fluids with superior fire-resistant properties, directly translating into demand for HFC and HFD fluids. Coupled with this regulatory push, the continuous technological upgrade cycle within industrial machinery, necessitating higher operating pressures and temperatures, further validates the need for advanced, thermally stable fireproofing fluids. The opportunity lies significantly in the convergence of safety requirements with sustainability goals, prompting widespread innovation in developing non-toxic, readily biodegradable fire-resistant fluids (EALs) that meet demanding performance metrics while adhering to environmental directives such as the European Union’s Eco-label criteria.

However, the market faces significant restraints, primarily related to the higher acquisition cost of fire-resistant fluids compared to conventional mineral oils, which can deter adoption among small and medium-sized enterprises (SMEs) operating under tight budgetary constraints. Furthermore, certain high-performance fire-resistant chemistries, specifically phosphate esters, pose challenges related to compatibility with standard seal materials, paint coatings, and filtration media, necessitating costly system upgrades or modifications. Environmental concerns surrounding the bioaccumulation and toxicity of specific chemical classes within fire-resistant fluids also restrain adoption in environmentally sensitive applications, driving the need for continuous, costly reformulation efforts and challenging widespread acceptance.

The key impact forces shaping this market include the growing focus on spray-fire hazards, which emphasizes the need for fluids that prevent ignition even when atomized under high pressure onto hot surfaces. This force is pushing the industry away from less stable fluid types. Another major impact force is the volatile pricing and supply chain instability of specialized raw materials, such as specific base stocks and performance additives (e.g., anti-wear and corrosion inhibitors required to compensate for the lower lubricity of water-based or synthetic fluids), directly affecting the final product pricing and market accessibility. The technological imperative to deliver fluids that maintain lubricity and thermal stability over extended periods without compromising fire resistance dictates R&D spending, thereby influencing competitive differentiation and market leadership.

Segmentation Analysis

The Fireproofing Hydraulic Fluid market is systematically segmented based on four primary factors: Fluid Type, End-User Industry, Application, and Geographic Region. Analyzing these segments provides a nuanced understanding of current market dynamics and future growth trajectories. The Fluid Type segmentation, which includes Water-Based Fluids (HFA, HFB, HFC) and Synthetic Fluids (HFD, primarily Phosphate Esters and Polyol Esters), is crucial as it reflects the varying performance requirements and regulatory compliance levels across different applications, with HFC dominating volume due to its favorable balance of cost and performance. The End-User Industry segmentation illustrates demand concentration, highlighting the dominance of high-risk sectors like Metal Processing (die casting, steel production) and Mining, which necessitate mandatory use of fire-resistant solutions to protect critical infrastructure and personnel.

Further segmentation by Application focuses on specific machinery where the fluid is utilized, such as injection molding, furnace controls, material handling, and power generation turbines, demonstrating distinct needs for temperature resilience and pressure stability across different equipment types. The geographical segmentation, categorized into North America, Europe, Asia Pacific, Latin America, and MEA, underscores the influence of regional industrial activity and safety legislation on market penetration. The combination of these segmentation approaches allows stakeholders to identify specific market niches—for example, the high-growth niche of eco-friendly HFD-U fluids being adopted rapidly in European manufacturing to meet both stringent fire safety and environmental compliance standards.

- By Fluid Type:

- Water-Based Fluids

- HFA (Oil-in-Water Emulsions)

- HFB (Water-in-Oil Emulsions)

- HFC (Water-Glycol Solutions)

- Synthetic Fluids

- HFD-R (Phosphate Esters)

- HFD-S (Chlorinated Hydrocarbons)

- HFD-T (Mixture of PEs and others)

- HFD-U (Polyol Esters/Anhydrous Synthetics)

- Water-Based Fluids

- By End-User Industry:

- Metal Processing (Steel Mills, Die Casting)

- Mining (Underground and Surface Equipment)

- Aerospace and Defense

- Marine and Offshore Drilling

- Energy & Power Generation (Turbine Controls)

- Construction and Heavy Equipment

- Automotive Manufacturing (Injection Molding)

- By Application:

- Hydraulic Presses

- Furnace Controls and Foundries

- Casting Machinery

- Material Handling Equipment

- Power Steering Systems

Value Chain Analysis For Fireproofing Hydraulic Fluid Market

The value chain for the Fireproofing Hydraulic Fluid market commences with the Upstream Analysis, which focuses primarily on the sourcing and processing of raw materials. This segment involves major chemical manufacturers supplying specialized components such as mineral oils (for HFB), glycols, water-soluble polymers (for HFC), and key synthetic base stocks like phosphoric acid derivatives (for Phosphate Esters) and natural/synthetic fatty acids (for Polyol Esters). The high purity and specific performance requirements of these chemical components mean that this upstream segment is characterized by relatively few specialized suppliers, leading to concentrated bargaining power and vulnerability to geopolitical disruptions and volatile commodity pricing. Key manufacturers must manage long-term contracts with these specialized chemical providers to ensure feedstock consistency and quality, which is paramount for maintaining the fire-resistant integrity of the final product.

The core of the value chain is the formulation and manufacturing process, where base stocks are blended with complex additive packages, including anti-wear agents, corrosion inhibitors, antioxidants, and viscosity index improvers. Manufacturers, such as global chemical and lubricant specialists, invest heavily in R&D and sophisticated blending facilities to ensure strict quality control and regulatory compliance for fire point, flash point, and auto-ignition temperature across various fluid categories (HFC, HFD). This phase adds significant value through proprietary formulation expertise and adherence to industrial standards (e.g., Factory Mutual approval). The Distribution Channel analysis shows a duality: Direct distribution is common for high-volume sales to major industrial end-users (e.g., large steel mills or aerospace manufacturers) requiring technical support and customized specifications, allowing for better margin control and technical service provisioning.

Conversely, Indirect distribution involves global and regional distributors and specialized industrial supply houses (MRO providers) that cater to fragmented markets, smaller operators, and localized demand for standard HFC and HFD fluids. These indirect channels provide necessary geographic coverage and inventory management, especially in regions with rapidly developing industrial bases. The Downstream Analysis focuses on end-user utilization across industries like Metal Processing, Mining, and Power Generation, where the fluid's performance and maintenance lifecycle become critical. Value is realized downstream through efficient predictive maintenance services, fluid analysis programs, and responsible disposal or recycling services, often provided either by the fluid manufacturer or specialized service firms, thereby closing the loop and contributing to sustainable operational practices.

Fireproofing Hydraulic Fluid Market Potential Customers

The primary potential customers for fireproofing hydraulic fluids are industrial entities operating machinery in environments classified as high-risk, where standard mineral oil usage is either prohibited by regulation or deemed excessively dangerous due to proximity to ignition sources. These end-users prioritize safety, regulatory compliance, and system longevity, viewing the higher cost of fire-resistant fluids as a necessary insurance premium against catastrophic loss. The largest volume consumers include steel manufacturing plants and foundries, where hydraulic systems (presses, furnace tilts, casters) operate close to molten metal and extremely hot surfaces, making HFC and specialized HFD fluids indispensable for preventing spray fires following a line failure. The continuous operational nature of these facilities means they require reliable supply and sophisticated technical support for fluid conditioning and monitoring.

Another major category of potential customers includes the global Mining industry, particularly subterranean operations, where enclosed spaces amplify the risks associated with fluid flammability. Underground hydraulic equipment—such as roof supports, continuous miners, and shuttle cars—must utilize fluids that meet strict underground safety certifications. This segment typically leans heavily on HFC water-glycol fluids for its fire suppression properties and robustness. Furthermore, the Aerospace and Defense sector represents a high-value customer base, demanding fluids like Phosphate Esters (HFD-R) for aircraft hydraulic systems and naval applications, driven by exceptionally strict performance specifications regarding thermal stability, wide operating temperature ranges, and non-flammability crucial for mission-critical functions.

Lastly, the Power Generation sector, especially those utilizing steam or gas turbines (including nuclear facilities), represents crucial clientele. These facilities rely on fire-resistant fluids for electro-hydraulic control (EHC) systems, where controlling large valves requires precise, stable, and highly non-flammable fluids to prevent turbine overspeed incidents and fires that could result from high-pressure fluid leaks near hot steam lines or electrical components. The focus for these customers is on fluids with excellent thermal stability and hydrolytic resistance to ensure operational reliability over multi-year cycles without degradation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Chemical Company, ExxonMobil Corporation, Quaker Houghton, TotalEnergies SE, Shell plc, Chevron Corporation, BP plc, BASF SE, Idemitsu Kosan Co., Ltd., Fuchs Petrolub SE, Castrol (A division of BP), Dow Chemical Company, Petro-Canada Lubricants Inc., Rocol (ITW), Klüber Lubrication (Freudenberg Group), Houghton International Inc., Lanxess AG, Sinopec Corp., Afton Chemical Corporation, Schaeffer Manufacturing Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fireproofing Hydraulic Fluid Market Key Technology Landscape

The technological landscape of the fireproofing hydraulic fluid market is defined by a continuous push towards optimizing the balance between fire resistance, lubricity, and environmental compatibility. A key technology involves the advancement of water-glycol (HFC) formulations, utilizing complex polymer thickeners and innovative additive packages to improve shear stability and high-temperature performance, thereby extending fluid life and applicability in more demanding machinery. Current R&D focuses heavily on minimizing the evaporation rate of the water content in HFC fluids to maintain consistent fire resistance, often through specialized closed-loop system designs and advanced moisture monitoring technologies. This continuous refinement ensures HFC fluids remain the most cost-effective and widely accepted solution for general industrial hydraulic power systems, even as operating pressures rise.

Another dominant technological trend is the expansion of advanced synthetic HFD fluids, particularly the development of high-performance Polyol Esters (HFD-U). These fluids are valued for their exceptional fire resistance without containing water, offering superior thermal stability and lubricity compared to water-based fluids or traditional phosphate esters. Manufacturers are investing in catalyst technology and purification processes to produce high-purity synthetic esters that are readily biodegradable and less toxic, effectively addressing the environmental drawbacks associated with older HFD-R formulations. This technological shift is critical for penetrating environmentally stringent markets like Western Europe and North America, where regulatory bodies increasingly favor EAL compliance alongside fire safety.

Furthermore, technology integration within the hydraulic system itself is paramount. This involves sophisticated sensor technologies (IoT) being deployed to monitor the fluid’s condition in real-time, checking for parameters like acid number, particle count, and water content (especially critical for HFC fluids). These sensors feed data into predictive maintenance systems, ensuring the fluid’s fireproofing integrity is always within specification. Innovation is also evident in filtration technology, including micro-filtration units and varnish removal systems specifically designed to manage the unique chemical properties and contamination pathways of fire-resistant fluids (e.g., controlling hydrolytic degradation in phosphate esters) to extend their service life and maximize operational safety.

Regional Highlights

The dynamics of the Fireproofing Hydraulic Fluid Market are highly dependent on regional industrialization levels, regulatory frameworks, and sector-specific applications. North America and Europe, as technologically mature regions, exhibit steady demand driven primarily by stringent regulatory compliance (e.g., NFPA standards in the US, ATEX directives in Europe) and the necessity to maintain aging, but critical, high-value infrastructure in aerospace, power generation, and specialized manufacturing. These regions are leaders in the adoption of premium synthetic esters (HFD-U) due to a strong emphasis on sustainability and superior performance, often driving innovation towards non-phosphate ester chemistries.

Asia Pacific (APAC) represents the primary growth engine for the global market, fueled by explosive growth in manufacturing, heavy infrastructure projects, and rapidly industrializing sectors in China, India, and Southeast Asia. While cost sensitivity often dictates a higher consumption of HFC water-glycol fluids, the concurrent implementation of formalized safety standards in critical industries (like mining in Australia and Indonesia, and metal processing in China) is accelerating the transition away from cheaper, flammable mineral oils. The APAC market is characterized by increasing foreign direct investment in manufacturing, which often imports Western safety standards, thereby increasing demand for certified fire-resistant fluids.

Latin America and the Middle East & Africa (MEA) are emerging markets showing significant potential, particularly tied to the Oil & Gas, Mining, and Metals industries. In MEA, the petrochemical and energy sectors, characterized by high-temperature operations, drive robust demand for thermally stable HFD fluids. Latin America’s substantial mining and construction sectors are steadily increasing their use of HFC fluids to comply with localized safety mandates. Growth in these regions is often linked to major new industrial projects, necessitating bulk procurement of certified fire-resistant hydraulic solutions from global suppliers.

- North America: Mature market characterized by strict OSHA regulations and high penetration of specialized Phosphate Esters (aerospace, power control) and HFD-U fluids; strong focus on R&D for next-generation, eco-friendly fire resistance.

- Europe: High focus on EALs (Environmentally Acceptable Lubricants) and REACH compliance; dominant market for HFC fluids in general industry, strongly driven by ISO 6743-4 standards and the systematic replacement of flammable fluids across the EU manufacturing base.

- Asia Pacific (APAC): Fastest-growing region; demand volume driven by China and India’s rapid industrial expansion and infrastructure investment; rising adoption of fire-resistant fluids in mining and metal processing despite initial cost resistance.

- Latin America (LATAM): Growth linked to mining and construction sectors; increasing regulatory enforcement necessitates conversion to HFC and HFD solutions in heavy machinery operations.

- Middle East and Africa (MEA): Significant demand originating from the Oil & Gas, Petrochemical, and Energy sectors, where high ambient and operational temperatures require high-specification, thermally stable HFD fluids for safety and longevity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fireproofing Hydraulic Fluid Market.- Eastman Chemical Company

- ExxonMobil Corporation

- Quaker Houghton

- TotalEnergies SE

- Shell plc

- Chevron Corporation

- BP plc

- BASF SE

- Idemitsu Kosan Co., Ltd.

- Fuchs Petrolub SE

- Castrol (A division of BP)

- Dow Chemical Company

- Petro-Canada Lubricants Inc.

- Rocol (ITW)

- Klüber Lubrication (Freudenberg Group)

- Houghton International Inc.

- Lanxess AG

- Sinopec Corp.

- Afton Chemical Corporation

- Schaeffer Manufacturing Co.

Frequently Asked Questions

Analyze common user questions about the Fireproofing Hydraulic Fluid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between HFC and HFD fireproofing fluids?

HFC fluids are Water-Glycol solutions, offering fire resistance primarily through their high water content, which generates cooling steam upon contact with a heat source. HFD fluids are anhydrous synthetic fluids (like Phosphate Esters or Polyol Esters) which achieve fire resistance through chemical composition and high auto-ignition temperatures, providing superior thermal stability and lubricity compared to water-based fluids.

Which industries are mandated to use fire-resistant hydraulic fluids?

Key industries mandated to use fire-resistant fluids include Metal Processing (especially die casting and steel mills near hot surfaces), Underground Mining, Aerospace and Defense, and Power Generation (specifically turbine governing systems). Regulations typically enforce their use where fluid leaks could create dangerous spray fires or pool fires near ignition sources.

Are fire-resistant hydraulic fluids considered environmentally acceptable lubricants (EALs)?

Not all fire-resistant fluids are EALs. Traditional phosphate esters (HFD-R) often pose environmental concerns. However, modern Polyol Esters (HFD-U) and certain specialized HFC formulations are increasingly designed to be readily biodegradable and non-toxic, qualifying them for EAL status and enabling their use in environmentally sensitive applications like marine and offshore operations.

What are the main drawbacks of using fireproofing hydraulic fluids compared to mineral oil?

The primary drawbacks include significantly higher initial purchase costs, potential incompatibility with standard system components (seals, paints), the necessity for specialized filtration and maintenance (especially for HFC water content monitoring), and potential lower lubricity in certain water-based formulations, requiring robust anti-wear additives.

How does predictive maintenance affect the lifecycle of fire-resistant fluids?

Predictive maintenance systems, often utilizing AI and IoT sensors, monitor the real-time condition of the fluid (e.g., water content, acid number). This allows operators to accurately determine the functional end-of-life of the fluid's fire resistance and lubrication properties, safely extending service intervals, minimizing unnecessary replacements, and ensuring continuous regulatory compliance and safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager