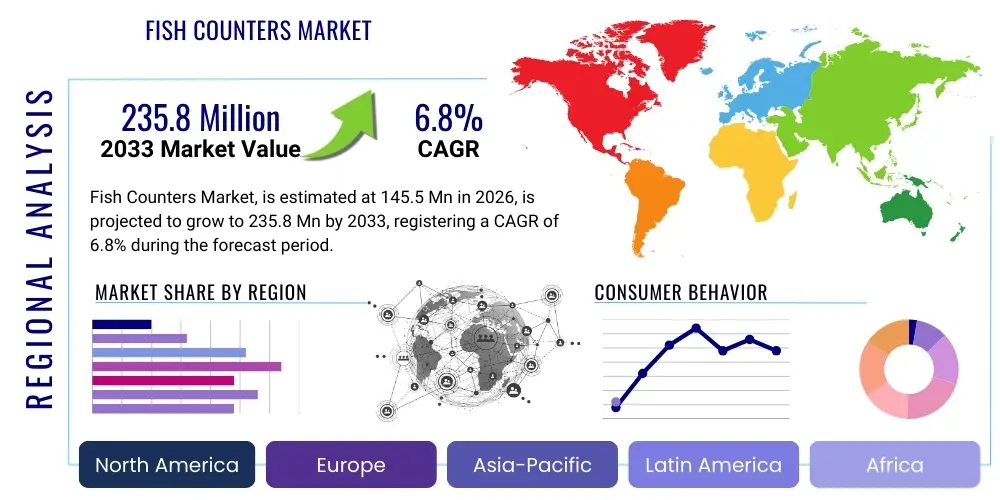

Fish Counters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442950 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Fish Counters Market Size

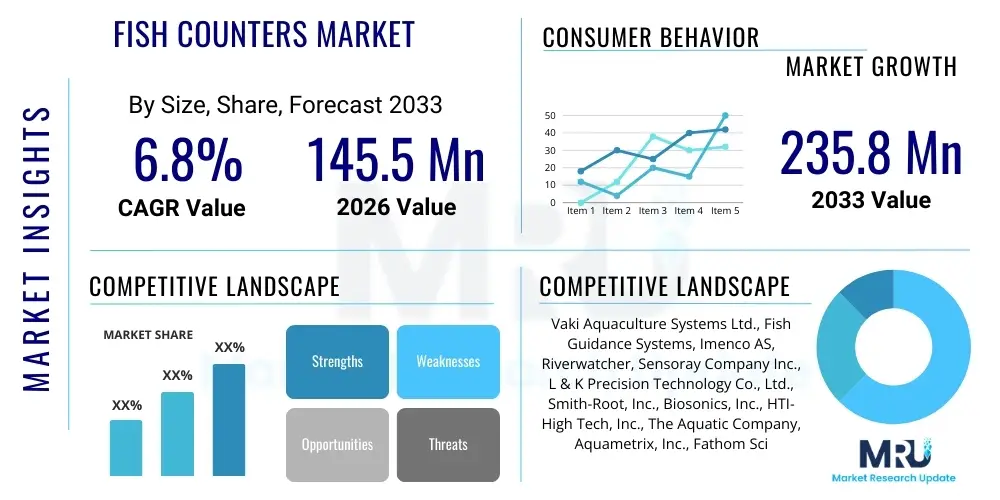

The Fish Counters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 145.5 million in 2026 and is projected to reach USD 235.8 million by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing regulatory mandates for fishery management, conservation efforts, and the advancement of non-invasive sensing technologies such as computer vision and hydroacoustics.

Fish Counters Market introduction

The Fish Counters Market encompasses specialized equipment and integrated systems designed to accurately count fish populations passing through specific points, such as fishways, aquaculture facilities, or research monitoring sites. These devices are critical tools for effective aquatic resource management, providing essential data on migration patterns, spawning success, and overall stock assessment. Product offerings range from simple mechanical counters to highly sophisticated electronic systems utilizing advanced imaging and AI-driven recognition algorithms.

Major applications of fish counters include monitoring wild salmonid populations in river systems, optimizing stocking densities in commercial fish farms, and supporting environmental impact assessments for hydroelectric projects. The inherent benefits of these systems are high accuracy, reduced need for manual labor, and the provision of continuous, long-term datasets crucial for sustainable management practices. Driving factors accelerating market adoption include global efforts toward biodiversity conservation, the imperative for precision aquaculture, and mandatory reporting requirements imposed by international fisheries organizations aimed at preventing overfishing and ensuring species viability across global waterways.

Fish Counters Market Executive Summary

The global Fish Counters Market is experiencing significant momentum driven by technological maturation and expanding regulatory oversight in both established and emerging economies. Business trends highlight a pronounced shift towards integrated digital solutions, where counting hardware is paired with cloud-based data analytics platforms, offering real-time monitoring and advanced predictive capabilities to end-users. This integration enhances operational efficiency for commercial aquaculture operators and provides robust, verifiable data for governmental research agencies.

Regional trends indicate that North America and Europe currently dominate the market due to stringent environmental protection laws and extensive investment in salmon and trout habitat restoration, necessitating precise population monitoring. However, the Asia Pacific region is anticipated to demonstrate the fastest growth rate, fueled by the rapid expansion and intensification of the aquaculture sector in countries like China, Vietnam, and India, alongside increasing governmental focus on sustainable marine and freshwater resource management. Segment trends show that electronic counters, particularly those utilizing advanced computer vision and stereoscopic imaging, are replacing traditional mechanical and manual methods, reflecting a premium placed on data accuracy and non-invasive monitoring capabilities across all major application segments.

AI Impact Analysis on Fish Counters Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Fish Counters Market typically revolve around accuracy improvement, real-time species identification, and the automation of data analysis. Users are keenly interested in how deep learning models can differentiate between species, estimate biomass, and handle complex environmental conditions (e.g., varying water clarity, high flow rates) that traditionally challenge optical systems. Key expectations include the seamless integration of AI for predictive modeling of fish movements and the reduction of false positives, which are common issues in high-volume counting scenarios. The central theme is the transition from mere counting devices to intelligent monitoring platforms that provide actionable ecological insights rather than just raw numerical data, ensuring greater efficiency and reliability in resource management decisions.

- AI-driven species classification: Utilizing convolutional neural networks (CNNs) to achieve near-perfect accuracy in differentiating between various fish species, life stages, and sizes, even under challenging visual conditions.

- Automated biomass estimation: Employing machine learning algorithms to accurately estimate the total weight and size distribution of fish populations passing through a counting zone, critical for aquaculture stock management.

- Real-time anomaly detection: AI systems analyze data streams instantaneously to identify equipment malfunctions, unusual migratory patterns, or potential poaching activities, enabling rapid operational responses.

- Data processing optimization: Integrating AI tools to filter noise, correct distortions caused by turbulence, and optimize data storage and retrieval processes for long-term ecological studies.

- Predictive modeling capabilities: Utilizing historical counting data and environmental parameters (temperature, flow rate) processed by AI to predict future migration timings and population health trends.

DRO & Impact Forces Of Fish Counters Market

The Fish Counters Market is driven by the confluence of strict environmental regulations mandating precise population assessments and the global expansion of precision aquaculture practices seeking optimized yields. However, adoption is constrained by the significant capital investment required for installing and maintaining sophisticated acoustic and optical systems, particularly in remote or harsh environments, coupled with the need for specialized technical expertise. Opportunities abound in developing portable, cost-effective, and fully autonomous monitoring units suitable for developing economies and expanding applications into marine research and offshore wind farm environmental mitigation monitoring. The primary impact force accelerating market growth is the regulatory environment, where governments globally are intensifying efforts to meet international biodiversity and sustainable fisheries targets, making accurate fish counting data indispensable for compliance and conservation accountability.

Specific market drivers include technological breakthroughs in low-power sensor technology and wireless data transmission, allowing for deployment in previously inaccessible locations. Furthermore, the rising consumer demand for sustainably sourced seafood places pressure on both wild capture fisheries and aquaculture firms to document responsible stock management, increasing the reliance on verifiable counting methods. Restraints largely center on standardization challenges across different water bodies and habitats, as a system optimized for clear riverine environments may perform poorly in turbid estuarine zones, requiring costly site-specific calibration and modification.

Segmentation Analysis

The Fish Counters Market is intricately segmented based on technology utilized, the specific environment of deployment, and the end-user application, providing a nuanced view of demand patterns across the ecosystem. Technology segmentation differentiates between physical, optical, and acoustic methodologies, reflecting varying levels of accuracy and invasiveness. Environmental segmentation highlights the distinct requirements of freshwater versus marine applications, driven by differences in water salinity, depth, and clarity. End-user segmentation defines market consumption across governmental agencies, commercial aquaculture farms, and private research institutions, each possessing unique purchasing motivations and operational scale requirements, thereby influencing the choice of counting technology deployed.

The increasing prominence of integrated systems—combining hardware counters with proprietary data management software—is fundamentally reshaping segmentation. These integrated offerings provide holistic solutions that address not only the quantitative counting function but also the qualitative analysis of species, size, and health indicators, moving beyond basic enumeration toward comprehensive biological assessment tools. This shift towards smart monitoring platforms necessitates detailed segmentation by specific software capabilities (e.g., cloud integration, AI modules, GIS mapping compatibility) in addition to the traditional hardware divisions, reflecting the high value placed on data interpretability and real-time connectivity in modern resource management.

- By Technology Type:

- Optical/Visual Counters (e.g., Computer Vision, Stereoscopic Imaging, Infrared Systems)

- Acoustic Counters (e.g., Hydroacoustic Sonar, Dual-beam/Split-beam Systems)

- Mechanical/Manual Counters (e.g., Weir Gates, Physical Traps with Manual Recording)

- Resistance/Electronic Counters (Utilizing electrical conductivity changes for detection)

- By Application:

- Fishery Management & Conservation (Wild stock monitoring, migration assessment)

- Aquaculture & Fish Farming (Stock density control, inventory management, harvest planning)

- Hydropower & Environmental Mitigation (Monitoring passage through fish ladders and bypass systems)

- Research & Education (Population dynamics studies, ecological surveys)

- By Environment:

- Freshwater Systems (Rivers, Lakes, Hatcheries)

- Marine & Estuarine Systems (Coastal zones, Offshore aquaculture sites, Migration routes)

- By End User:

- Governmental & Regulatory Bodies (Fisheries departments, Environmental Protection Agencies)

- Commercial Enterprises (Aquaculture facilities, Commercial fisheries)

- Non-Governmental Organizations (NGOs) and Academic Institutions

Value Chain Analysis For Fish Counters Market

The value chain for the Fish Counters Market begins with the upstream suppliers responsible for high-precision components, including specialized hydroacoustic sensors, high-resolution cameras, robust enclosures, and sophisticated microprocessors required for environmental resilience and accurate data acquisition. Manufacturers then integrate these components, often developing proprietary recognition software and calibration protocols, focusing heavily on ruggedization and ease of field deployment. Research and development is a critical upstream activity, driving innovation in AI-powered object recognition and data communication protocols, ensuring the reliability of counts in varied and often challenging aquatic environments.

Distribution channels for fish counters are typically specialized, involving direct sales to large governmental agencies and major aquaculture corporations, alongside partnerships with system integrators and environmental consulting firms who deploy and maintain the technology. Downstream activities are dominated by end-user operations, which involve system installation, calibration, data retrieval, and complex analysis. The service component, including maintenance contracts, software updates, and training for specialized field staff, represents a significant and growing revenue stream within the downstream market. Effective feedback loops between end-users (fishery biologists, farm managers) and manufacturers are essential to refine product accuracy and ensure regulatory compliance.

The flow often involves indirect distribution through localized environmental technology distributors, particularly in regions where manufacturers lack a direct physical presence. These partners provide regional support and specialized integration services tailored to local aquatic conditions and regulatory frameworks. Direct sales, however, are preferred for high-value governmental projects or large-scale commercial aquaculture operations that require customized system architecture and proprietary data security guarantees, emphasizing the strategic importance of technical support and long-term maintenance agreements throughout the product lifecycle.

Fish Counters Market Potential Customers

Potential customers and primary buyers of fish counters span a wide spectrum of organizations heavily invested in aquatic health and resource utilization. The largest segment comprises governmental and regulatory bodies, including national fishery management organizations (e.g., NOAA in the US, DEFRA in the UK), who purchase systems for mandated stock assessment, compliance monitoring, and environmental impact mitigation, particularly concerning hydropower generation projects and river restoration efforts. These entities prioritize data verifiability, long-term durability, and seamless integration with existing federal or regional data standards.

Commercial aquaculture companies represent the fastest-growing segment of end-users. These buyers require fish counters primarily for inventory management, optimizing feeding schedules, calculating feed conversion ratios (FCR), and ensuring compliance with sustainable certification standards. Their purchasing decisions are heavily influenced by the system's ability to operate accurately in dense, turbulent tank environments and provide real-time biomass estimates that directly impact profitability and operational efficiency. Furthermore, academic research institutions and environmental NGOs constitute a steady customer base, utilizing advanced counting technology for focused ecological studies and habitat monitoring projects, emphasizing portability and high precision in specialized, short-term deployment scenarios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 145.5 Million |

| Market Forecast in 2033 | USD 235.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vaki Aquaculture Systems Ltd., Fish Guidance Systems, Imenco AS, Riverwatcher, Sensoray Company Inc., L & K Precision Technology Co., Ltd., Smith-Root, Inc., Biosonics, Inc., HTI-High Tech, Inc., The Aquatic Company, Aquametrix, Inc., Fathom Scientific, Aqualife, Meros S.r.l., Advanced Telemetry Systems, Inc., Precision Aquaculture Ltd., Innovasea, Hydroacoustic Technology, Inc., Faivre Group, and Blue Robotics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fish Counters Market Key Technology Landscape

The technological landscape of the Fish Counters Market is rapidly evolving, moving away from simple pressure plates and light interruption sensors towards sophisticated, integrated digital systems. The current technological forefront is dominated by Computer Vision systems, which use high-resolution, often stereoscopic, cameras to capture 3D images of fish. This visual data is then processed using advanced deep learning algorithms (specifically Convolutional Neural Networks, CNNs) to achieve high accuracy in counting, species identification, length measurement, and biomass calculation. These optical systems require robust housing and sophisticated lighting (such as infrared illumination) to perform effectively across varying water clarities and light conditions, making them particularly effective in controlled environments like fish farms and clear-water fishways.

Hydroacoustic technology remains critically important, especially for large-scale monitoring in deep or highly turbid rivers, lakes, and marine environments where optical clarity is insufficient. Modern acoustic counters utilize split-beam or dual-beam sonar to track individual fish targets, providing information on range, size (target strength), and trajectory. Recent innovations focus on reducing noise interference, improving the ability of algorithms to discriminate between fish and acoustic clutter (e.g., debris, air bubbles), and integrating portable, low-power transducers suitable for remote, battery-operated deployments. Furthermore, the convergence of hydroacoustics and machine learning is improving automated species identification based on characteristic swim bladder size and swimming patterns detected by the sonar returns, significantly enhancing the utility of these systems.

A key trend across all major technologies is the development of autonomous and networked counting solutions. This involves utilizing robust IoT platforms and satellite or cellular communication modules to transmit data in real-time to centralized databases or cloud environments. Data management systems are increasingly incorporating Geographical Information Systems (GIS) mapping capabilities, allowing researchers and managers to visualize migration routes and population density shifts dynamically. Power management remains a significant technological challenge, driving innovation in efficient sensor design and the use of renewable power sources (solar, hydro) for long-term, continuous monitoring in remote sites, ensuring uninterrupted data acquisition crucial for mandated reporting cycles and complex ecological research.

Regional Highlights

- North America: This region is a mature market leader, primarily driven by stringent conservation efforts focused on salmonid restoration in the Pacific Northwest and Great Lakes regions. Governmental agencies, including the US Geological Survey (USGS) and Canadian Department of Fisheries and Oceans (DFO), are major purchasers, investing heavily in permanent, high-accuracy counting stations utilizing sophisticated acoustic and visual counting technologies integrated into hydropower bypasses and fish passage structures. The regulatory framework necessitates reliable, audited data, sustaining demand for continuous technological upgrades and advanced data processing services, making it a key hub for innovation and commercial deployment.

- Europe: Europe represents a robust market, spurred by the implementation of the EU Water Framework Directive and national conservation programs focused on improving river connectivity and fish migration. Countries like Norway, Iceland, and Scotland, home to major wild salmon populations and leading aquaculture industries, are key consumers. The market features high adoption of advanced optical counters in aquaculture for precise stock management and wide use of hydroacoustic systems for monitoring wild fish returns in key rivers, supported by substantial public funding for ecological research and sustainable management initiatives across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to the massive scale and modernization of its aquaculture sector, particularly in China, Japan, Vietnam, and India. The demand is shifting from traditional manual counting methods to electronic counters for improving stocking density control and reducing operational losses in commercial farms. Furthermore, rapid industrialization and corresponding environmental mitigation requirements in large river systems are creating new governmental demand for reliable, large-scale wild fish monitoring solutions, though challenges related to highly turbid waters often necessitate specialized acoustic solutions.

- Latin America: This region offers significant potential, particularly in countries with burgeoning trout and salmon aquaculture industries (e.g., Chile) and extensive river networks requiring monitoring for environmental impact studies related to large infrastructure projects. Market growth is currently hampered by varying regulatory enforcement and budgetary constraints, but targeted adoption is increasing, often relying on imported technology and systems tailored for highly variable climatic and hydrological conditions, focusing initially on cost-effective optical and resistance-based counting solutions for smaller facilities.

- Middle East and Africa (MEA): MEA currently holds the smallest market share, but niche growth is observed in regions investing in controlled environment aquaculture (CEA) and sustainable water resource management projects. The primary drivers are high-value seafood production (e.g., finfish in the UAE and Saudi Arabia) and international development aid projects focused on regional food security and environmental assessments, which require basic monitoring tools for project validation and long-term sustainability planning.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fish Counters Market.- Vaki Aquaculture Systems Ltd.

- Fish Guidance Systems

- Imenco AS

- Riverwatcher (A division of Vaki)

- Sensoray Company Inc.

- L & K Precision Technology Co., Ltd.

- Smith-Root, Inc.

- Biosonics, Inc.

- HTI-High Tech, Inc.

- The Aquatic Company

- Aquametrix, Inc.

- Fathom Scientific

- Aqualife

- Meros S.r.l.

- Advanced Telemetry Systems, Inc.

- Precision Aquaculture Ltd.

- Innovasea

- Hydroacoustic Technology, Inc.

- Faivre Group

- Blue Robotics

Frequently Asked Questions

Analyze common user questions about the Fish Counters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the Fish Counters Market?

The primary market driver is the proliferation of stringent global regulatory mandates requiring accurate, verifiable data for sustainable fisheries management and environmental impact assessment, particularly concerning migrating fish populations and aquaculture stock verification.

How do optical and acoustic fish counters differ in application?

Optical counters (using cameras and computer vision) are highly accurate in clear, controlled environments such as fish farms and shallow, clear rivers. Acoustic counters (using sonar) are preferred for turbid, deep, or high-flow environments, providing accurate data where visibility is compromised.

Which geographical region exhibits the highest growth potential for fish counter adoption?

The Asia Pacific (APAC) region is projected to register the highest growth rate due to the exponential expansion and modernization of its commercial aquaculture sector and increasing governmental investment in hydrological infrastructure monitoring.

What role does Artificial Intelligence (AI) play in modern fish counting systems?

AI, specifically deep learning algorithms, enhances counting accuracy, enables real-time species identification, automatically estimates biomass and size distribution, and filters out environmental noise, transforming raw data into actionable ecological intelligence.

What challenges restrain the widespread adoption of advanced fish counting technology?

Key challenges include the high initial capital investment required for sophisticated acoustic and optical hardware, coupled with the necessity for specialized technical expertise for system installation, calibration, and long-term maintenance in remote aquatic habitats.

***

The strategic overview of the Fish Counters Market highlights a critical transition period, marked by the rapid integration of digital and AI technologies. This shift is redefining how ecological data is captured, analyzed, and applied across governmental, academic, and commercial sectors. The imperative for sustainable global resource management, coupled with the economic pressures on the aquaculture industry to maximize efficiency and minimize environmental footprint, ensures sustained demand across all identified market segments. The technological evolution promises increasingly reliable, non-invasive, and cost-effective monitoring solutions, thereby expanding the potential application scope globally, particularly in environments previously considered too challenging for accurate enumeration.

Furthermore, the detailed segmentation analysis underscores the complexity of the procurement landscape, where the choice of counting technology is highly conditional on the specific environment, required data parameters (count, size, species), and the end-user’s operational scale. For instance, large hydropower operators will prioritize permanent, rugged acoustic systems, whereas high-density salmon farms will favor precise optical or resistance counters integrated into water flow channels. This market structure necessitates that vendors offer highly tailored and modular solutions, emphasizing flexibility and robust post-sales support, including cloud connectivity and data analysis subscriptions, which are increasingly becoming standard requirements across the entire value chain.

The projected CAGR of 6.8% reflects this positive feedback loop: regulatory pressure creates demand for accurate data; technology advances meet this need with better precision and automation; and this improved capability, in turn, facilitates more effective regulation and sustainable business practices. As environmental challenges intensify and the global population increases its reliance on aquatic resources, the fish counter market is positioned as an indispensable element of the global blue economy infrastructure, moving well beyond basic inventory control to become a core tool for biodiversity conservation and climate change adaptation strategy formulation. Continuous investment in sensor technology and data science will be key to unlocking further growth potential in emerging markets and optimizing resource utilization in established regions.

The influence of AI, specifically detailed in the impact analysis, is fundamentally altering the competitive dynamics of the market. Manufacturers who successfully leverage deep learning to provide instant, verified identification and biomass data are gaining a significant competitive advantage over those relying on legacy counting methodologies. This transition pushes the market towards subscription-based software services and integrated platforms, providing recurring revenue streams and deeper engagement with end-users. Future market expansion will heavily depend on overcoming current restraints related to cost and deployment complexity, potentially through the standardization of communication protocols and the introduction of ruggedized, highly energy-efficient sensors capable of decades-long field operation with minimal intervention. These factors collectively establish the Fish Counters Market as a high-value, strategically important segment within the broader environmental technology domain, contributing substantially to global ecological accountability.

The detailed regional analysis confirms that while North America and Europe lead in terms of technological adoption and stringent regulatory adherence, the most significant volumetric growth opportunities reside in the Asia Pacific region, driven by sheer industrial scale. Strategies for market entry in APAC must account for varying governmental policies, localized environmental challenges such as extreme turbidity, and the need for scalable, affordable solutions suitable for both small-scale and massive commercial operations. Conversely, success in mature markets hinges on offering superior data analytics, reliable long-term service contracts, and proprietary technology that offers measurable improvements in accuracy and data integrity over existing installations, reflecting the maturity and highly specialized nature of demand in these developed economies. The interplay between conservation demands and commercial efficiency requirements remains the central axis of market evolution.

***

The comprehensive analysis presented herein underscores the pivotal role of fish counters as essential infrastructure for achieving global sustainability objectives. The market's resilience, demonstrated by a solid growth trajectory, is intrinsically tied to external pressures, including climate change effects on fish migration patterns and the increasing scrutiny of aquaculture practices. Technological advancements, particularly in acoustic and optical sensing combined with machine learning, are not merely incremental improvements but represent a fundamental transformation in monitoring capabilities, allowing for higher fidelity data collection under increasingly difficult conditions. This precision is vital for minimizing environmental externalities associated with human interaction with aquatic ecosystems, from hydroelectric dam operations to large-scale commercial fishing activities.

Further market segmentation by product functionality—such as fixed-site versus portable counters—reveals differing investment priorities among end-users. Governmental agencies often prefer fixed, highly durable, and permanent systems for long-term monitoring sites, ensuring consistent data collection over decades. In contrast, academic researchers and small consulting firms prioritize portable and versatile units that can be quickly deployed and retrieved across multiple temporary locations. This bifurcation in demand drives specialization among manufacturers, requiring tailored product lines that address robustness and longevity for fixed applications, versus lightweight design and ease of use for portable systems. Strategic alliances and collaborations between hardware manufacturers and specialized data science firms are also becoming increasingly common to provide integrated, turn-key solutions that offer validated, AI-processed outputs, addressing the growing client need for readily interpretable biological metrics rather than just raw counts.

In summary, the Fish Counters Market is situated at the nexus of technology, ecology, and regulation. Its future expansion will be defined by the successful deployment of autonomous, energy-efficient counting systems that integrate seamlessly into broader environmental monitoring networks (IoT). Addressing regulatory compliance remains the non-negotiable floor for market entry, while leveraging cutting-edge technology to offer predictive and prescriptive insights will determine market leadership. The shift towards sustainable resource management ensures that accurate fish counting technologies will remain a high-priority investment area for governments and commercial entities alike, cementing the market’s importance in the next decade of environmental stewardship and blue economic growth.

***

The detailed examination of the value chain further emphasizes the importance of robust component supply, particularly high-precision sensors and specialized software development teams capable of designing resilient field systems and sophisticated data handling protocols. The manufacturing segment requires deep expertise in environmental engineering to ensure that devices withstand extreme temperatures, pressures, and biofouling, common challenges in both freshwater and marine environments. The distribution and service components, particularly in providing adequate technical training and ongoing calibration services, are crucial determinants of customer satisfaction and long-term product efficacy, given the highly technical nature of the installation and operational phase. Failure in adequate calibration can render highly advanced systems useless, stressing the necessity of robust post-sales service networks, particularly in globally dispersed markets such as Asia Pacific and Latin America.

Moreover, the analysis of potential customers highlights the market’s reliance on public sector spending. While aquaculture contributes significantly to growth, major projects related to environmental mitigation and regulatory compliance are often funded by governmental or supra-national bodies (e.g., World Bank, regional development banks). This reliance necessitates that market players maintain high standards of transparency, adherence to specific procurement processes, and demonstrable compliance with international environmental assessment protocols. Conversely, serving the commercial aquaculture sector demands a rapid return on investment and seamless integration with existing farm management software, favoring solutions that offer real-time data feeds directly influencing operational decisions regarding stocking, feeding, and harvest timing, thereby maximizing efficiency and minimizing financial risk associated with stock loss or poor growth rates.

The ongoing pursuit of non-invasive and stress-free monitoring methods continues to drive technology innovation. Next-generation systems are moving toward passive integrated transponder (PIT) tags combined with array readers for individual identification tracking, and advanced optical systems utilizing structured light for highly accurate 3D modeling of fish size and shape without physical contact. These innovations address core user concerns about minimizing stress and injury to fish populations during the counting process, which is a paramount ethical and regulatory requirement in many conservation-focused regions. These advancements solidify the market's trajectory towards highly accurate, highly automated, and ecologically sensitive monitoring solutions that promise to revolutionize fishery and aquaculture management globally, ensuring the market's long-term strategic relevance and continuous technological expansion through the forecast period to 2033.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager