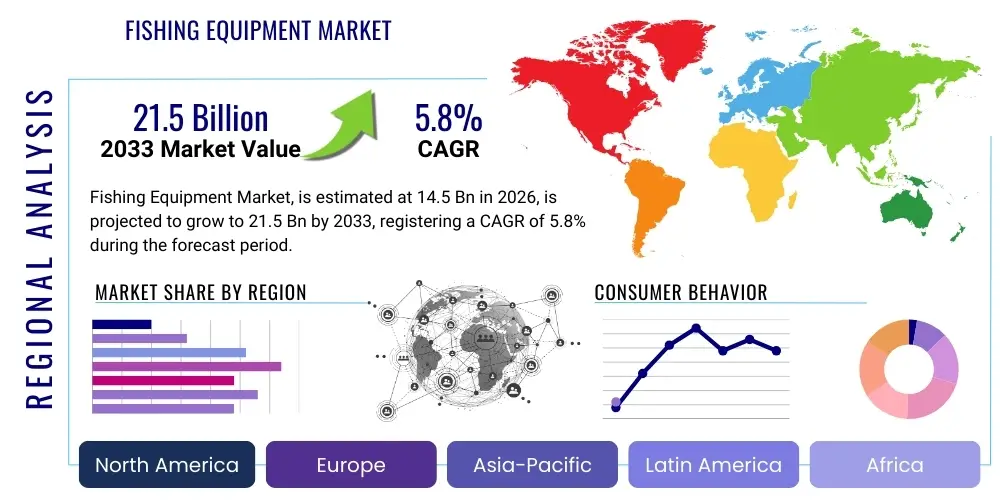

Fishing Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441366 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Fishing Equipment Market Size

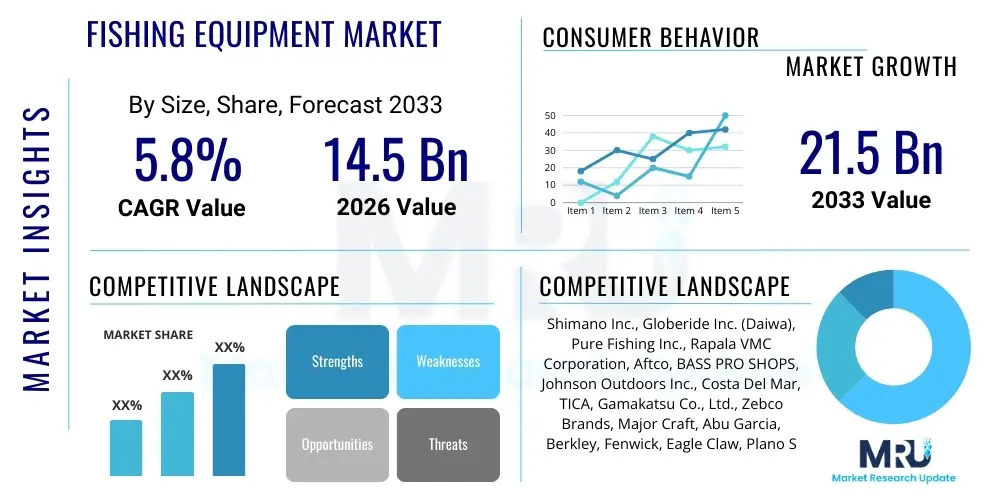

The Fishing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 21.5 Billion by the end of the forecast period in 2033.

Fishing Equipment Market introduction

The Fishing Equipment Market encompasses a wide range of specialized tools and gear designed for both recreational and commercial fishing activities globally. Key product segments include fishing rods, reels, lines, terminal tackle (hooks, swivels, leaders), artificial and natural baits, and essential electronic devices such as fish finders and GPS mapping systems. These products are crucial components supporting a multi-billion dollar leisure industry, as well as providing necessary tools for professional sustenance and commercial harvesting operations. The market landscape is characterized by continuous innovation focused on material science, ergonomic design, and technological integration, particularly relating to durability, casting distance, and real-time aquatic monitoring.

Major applications of fishing equipment span across diverse environments, primarily categorized into freshwater and saltwater applications, each demanding distinct types of specialized gear tailored to specific species, water depths, and environmental pressures. Freshwater fishing often utilizes lighter, more sensitive equipment suited for lakes and rivers, while saltwater applications require robust, corrosion-resistant gear capable of handling larger fish and harsher conditions. The increasing global participation in angling, driven by growing interest in outdoor recreation and eco-tourism, acts as a primary market accelerator, boosting demand for entry-level and high-performance equipment alike.

The core benefits associated with modern fishing equipment include enhanced efficiency, improved catch rates, and a significantly optimized user experience. Driving factors for market expansion include rising disposable incomes in emerging economies, governmental support for conservation efforts that promote responsible angling, and the pervasive influence of digital media showcasing competitive and recreational fishing as a desirable hobby. Furthermore, the push towards sustainable and environmentally friendly manufacturing practices, utilizing biodegradable materials for lures and packaging, is reshaping product development strategies across leading manufacturers.

Fishing Equipment Market Executive Summary

The Fishing Equipment Market is poised for stable and consistent growth, propelled primarily by robust trends in product innovation, particularly the integration of smart technology into traditional gear. Business trends indicate a shift towards direct-to-consumer (D2C) models and sophisticated digital marketing to target niche angler communities, emphasizing sustainability and high-performance materials like carbon fiber and advanced polymers. Mergers and acquisitions remain frequent as larger players seek to consolidate market share and acquire specialized technology firms focusing on sonar imaging and battery life optimization. Supply chain resilience, following recent global disruptions, is a key strategic priority, focusing on regional diversification of manufacturing bases to mitigate risks associated with raw material price volatility.

Regionally, North America and Europe maintain maturity, characterized by high consumer spending on premium and specialized equipment, driven by established fishing cultures and strong conservation organizations. Asia Pacific (APAC), however, emerges as the primary growth engine, fueled by rapidly expanding middle-class populations in China, India, and Southeast Asia that are increasingly adopting recreational leisure activities. Regulatory environments concerning fishing limits and equipment standards vary significantly by region, impacting product design and market entry strategies. Manufacturers are adapting production to meet stringent European environmental standards while simultaneously developing cost-effective solutions for mass markets in APAC.

Segment trends highlight the exceptional growth within the electronic equipment category, including advanced GPS units, sophisticated fish finders (often utilizing CHIRP technology), and underwater cameras, reflecting the tech-savviness of modern anglers. The lure and bait segment is seeing significant specialization, with 3D-printed and hyper-realistic designs gaining traction, appealing to competitive fishermen. The distribution channel analysis confirms the growing importance of the online retail segment, offering consumers unparalleled access to specialized global brands and detailed product reviews, though traditional specialty stores remain critical for high-touch, expert advice, and immediate fulfillment of critical gear components.

AI Impact Analysis on Fishing Equipment Market

User inquiries regarding AI in the Fishing Equipment Market primarily revolve around three key areas: how AI can enhance the actual fishing process (e.g., predictive analytics for fish migration and feeding patterns), the integration of machine learning into existing electronic devices (e.g., autonomous sonar interpretation and target identification), and AI's role in supply chain optimization and retail personalization. Users are concerned about the cost implications of such advanced technology and whether AI could potentially reduce the skill or challenge associated with angling. The consensus expectation is that AI will be leveraged predominantly for conservation efforts (monitoring fish stock health and illegal activities) and in commercial fishing for operational efficiency, rather than entirely replacing traditional methods in the recreational space, focusing on augmenting the angler's capabilities through smart data processing and interpretation.

- AI integration into advanced sonar systems for automated species identification and biomass estimation.

- Machine learning algorithms optimizing lure design based on environmental factors and fish behavior data.

- Predictive modeling tools accessible via mobile apps that forecast optimal fishing times and locations based on weather, lunar cycles, and historical catch data.

- Automated inventory and supply chain management using AI to predict regional demand for specific tackle based on seasonal fishing trends.

- Implementation of AI in monitoring systems within aquaculture and commercial fleets to ensure sustainable harvesting practices and compliance.

DRO & Impact Forces Of Fishing Equipment Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the global increase in leisure time and the persistent emphasis on outdoor recreational activities, accelerated by post-pandemic shifts in consumer lifestyle preferences toward nature-based hobbies. The growing popularity of competitive fishing tournaments, coupled with celebrity endorsement and high media coverage, also fuels demand for professional-grade and high-cost equipment. Furthermore, technological advancements, such as miniaturized electronics, improved battery efficiency, and the development of lightweight, ultra-strong materials (e.g., specialized graphite and carbon composites), continually drive replacement cycles and product innovation, enticing consumers to upgrade their existing gear for marginal performance improvements.

However, the market faces notable restraints. Environmental regulations concerning fishing seasons, protected species, and strict limitations on certain gear types (e.g., specific nets or bait restrictions in sensitive ecological zones) impose limitations on product development and sales in key regions. Seasonal dependency and unpredictable weather patterns inherently affect participation rates, creating cyclical demand challenges for manufacturers. Furthermore, the high initial cost of premium, electronically enhanced fishing gear acts as a barrier to entry for casual anglers, limiting the growth potential of high-end segments. Counterfeit products, particularly in fast-growing Asian markets, pose a significant threat to established brand integrity and intellectual property, requiring robust enforcement mechanisms.

Opportunities for expansion are abundant, particularly through strategic investment in emerging economies where recreational fishing culture is nascent but rapidly adopting Western leisure trends. The sustainable fishing movement offers a massive opportunity for brands to differentiate themselves by developing biodegradable lures, ethically sourced materials, and equipment designed for catch-and-release practices. Furthermore, digital engagement via specialized social media platforms, subscription box services for tackle, and immersive augmented reality experiences related to fishing knowledge provide new avenues for customer acquisition and retention, moving beyond traditional retail models and fostering stronger brand loyalty within the global angling community. These factors collectively define the impactful forces shaping the market trajectory.

Segmentation Analysis

The Fishing Equipment Market segmentation provides a granular view of consumer preferences, product specialization, and distribution effectiveness across various operational categories. Analyzing the market by equipment type reveals distinct expenditure patterns; while rods and reels represent high-value, durable purchases, the terminal tackle and lure segments are characterized by high volume, recurrent purchases necessary for day-to-day fishing. The market is also heavily segmented by the environment of application—freshwater equipment typically dominates in volume due to wider accessibility to lakes and rivers, but saltwater equipment commands higher average selling prices (ASPs) due to the need for greater durability, strength, and specialized corrosion resistance required for marine environments.

Further essential segmentation focuses on the end-user profile, differentiating between recreational anglers, who prioritize convenience and leisure, and commercial/professional fishermen, who demand maximum efficiency, robustness, and reliability to ensure economic viability. The rise of competitive angling forms a sub-segment demanding specialized, high-precision equipment where marginal performance gains justify substantial investments. Understanding these segmentation nuances is crucial for manufacturers to tailor their marketing campaigns, research and development budgets, and inventory allocation, ensuring that product lines are appropriately matched to specific geographical and demographic demands.

Distribution channels also dictate market dynamics, with a persistent shift toward e-commerce offering global reach and competitive pricing, particularly for standardized products. Conversely, specialized brick-and-mortar retailers continue to thrive in segments requiring complex fitting, expert advice (especially for fly fishing or deep-sea trolling gear), and immediate access to replacement parts. This dual-channel approach ensures market penetration across all consumer readiness levels, from the novice seeking comprehensive starter kits to the expert seeking highly technical components available only through exclusive distributors.

- By Equipment Type:

- Rods (Spinning, Casting, Fly, Trolling)

- Reels (Spinning, Baitcasting, Fly, Spincast)

- Lines (Monofilament, Fluorocarbon, Braided)

- Lures and Baits (Hard Baits, Soft Plastics, Jigs, Flies)

- Terminal Tackle (Hooks, Swivels, Leaders, Sinkers)

- Fishing Electronic Equipment (Fish Finders, GPS, Sonar, Underwater Cameras)

- Fishing Apparel and Accessories (Waders, Vests, Tackle Boxes)

- By Application/Environment:

- Freshwater Fishing

- Saltwater Fishing (Inshore, Offshore)

- By End-User:

- Recreational Anglers

- Commercial/Professional Fishing

- Competitive Fishing

- By Distribution Channel:

- Offline (Specialty Stores, Mass Retailers, Department Stores)

- Online (E-commerce Portals, Brand Websites)

Value Chain Analysis For Fishing Equipment Market

The value chain for the Fishing Equipment Market begins with the sourcing of specialized raw materials, primarily focusing on materials like high-modulus graphite and advanced carbon fiber for rods, aerospace-grade aluminum and specialized alloys for reels, and polymers for fishing lines and lures. Upstream analysis involves establishing stable, long-term relationships with material suppliers who can ensure quality consistency and cost-effective pricing, especially critical for manufacturers operating on thin margins in high-volume segments. Key challenges at this stage include managing price volatility of petrochemical derivatives (used in plastics and synthetic lines) and ensuring ethical sourcing of natural components, such as wood or specific resins, adhering to international compliance standards.

Manufacturing and assembly form the core of the value chain. This phase utilizes precision engineering, particularly in reel production where tolerances are extremely tight to ensure smooth operation and durability. Technological investment in automated manufacturing processes, robotics for repetitive tasks, and quality control systems (like non-destructive testing for rod blanks) are essential for maintaining high product standards and scalability. Middle-stream activities include rigorous testing, packaging designed for global shipping protection, and inventory management, often involving just-in-time (JIT) systems to meet seasonal demand spikes typical of the fishing industry.

The downstream segment involves complex distribution networks, encompassing direct sales, wholesalers, and specialized retailers. Direct and indirect distribution channels coexist; major global brands often leverage direct-to-consumer e-commerce platforms to capture higher margins and control brand messaging, while simultaneously relying on vast networks of independent specialty dealers and big-box retailers to ensure broad market accessibility. Effective logistics management, particularly reverse logistics for warranty claims and returns, is vital. The value chain concludes with the end-user (angler), where post-purchase support, educational content (tutorials, maintenance guides), and community engagement significantly influence brand perception and future purchasing decisions.

Fishing Equipment Market Potential Customers

The primary customer base for the Fishing Equipment Market consists of diverse demographics unified by their engagement in angling, ranging from amateur hobbyists to highly skilled professionals. Recreational anglers represent the largest segment by volume, comprising individuals and families seeking relaxation, sport, or bonding experiences in nature. This segment typically purchases mid-range, versatile equipment and is heavily influenced by ease of use, product aesthetic, and peer recommendations. Marketing efforts targeting this group often focus on entry-level kits, comprehensive guides, and family-friendly outdoor campaigns, emphasizing the experiential benefits of the activity.

A crucial and high-value customer segment includes professional and competitive anglers. These users demand specialized, top-tier performance equipment, often customized or featuring the latest technological integrations such as sophisticated sonar or ultra-sensitive rods. Their purchasing decisions are dictated by performance metrics, weight efficiency, and reliability under extreme conditions. They frequently serve as brand ambassadors, and their usage validates the quality of premium products. Targeting this group requires focused sponsorship programs, specialized distribution through expert dealers, and continuous innovation in material science and electronic integration.

Furthermore, commercial fishing fleets and aquaculture operations represent a distinct, B2B customer base, purchasing high-volume, extremely durable gear like commercial lines, nets, specialized terminal tackle, and industrial-grade electronic navigation systems. Their procurement is driven by operational longevity, regulatory compliance, and cost-efficiency over time, rather than leisure appeal. A growing segment also includes charter boat operators and fishing guides who require commercial-grade durability but often focus on high-end recreational features suitable for their clientele, serving as a critical intermediary in demonstrating and promoting premium equipment to high-net-worth recreational customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 21.5 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano Inc., Globeride Inc. (Daiwa), Pure Fishing Inc., Rapala VMC Corporation, Aftco, BASS PRO SHOPS, Johnson Outdoors Inc., Costa Del Mar, TICA, Gamakatsu Co., Ltd., Zebco Brands, Major Craft, Abu Garcia, Berkley, Fenwick, Eagle Claw, Plano Synergy Holdings, Humminbird, Lowrance, St. Croix Rods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fishing Equipment Market Key Technology Landscape

The technological evolution within the Fishing Equipment Market is centered on enhancing precision, stealth, and data accessibility for the angler. The most impactful advancements are observed in marine electronics, specifically high-definition sonar and fish-finding systems. Modern systems utilize CHIRP (Compressed High-Intensity Radiated Pulse) technology, which offers vastly improved target separation and clarity compared to traditional single-frequency sonar, allowing users to distinguish individual fish from structure or bait balls. Integration of GPS and proprietary mapping software enables anglers to precisely locate and revisit productive fishing spots, optimizing their effort. These electronic devices are increasingly connected, allowing for firmware updates, data sharing, and seamless synchronization with mobile applications for real-time analysis.

Beyond electronics, materials science dictates performance improvements in core equipment. The trend towards ultra-light and ultra-strong gear continues, driven by advancements in carbon nanotechnology and high-modulus graphite composites for rod blanks. This results in rods that are significantly more sensitive and lighter, crucial for detecting subtle bites and reducing angler fatigue. Similarly, reel technology focuses on optimizing gear ratios, bearing systems (using corrosion-resistant ceramics), and magnetic or centrifugal braking systems for baitcasting models, ensuring smoother casting and superior longevity, particularly in corrosive saltwater environments. The development of advanced polymer coatings for fishing lines further minimizes visibility and maximizes abrasion resistance.

Emerging technologies also include the use of small, specialized drones equipped with cameras and release mechanisms for offshore bait deployment, expanding the reach of land-based anglers. Furthermore, the concept of "Smart Fishing Gear" is gaining traction, exemplified by reels with integrated sensors that monitor line tension, retrieve speed, and potentially log catch data automatically, linking directly to cloud-based angler profiles for performance tracking and analysis. This pervasive connectivity and reliance on data processing represent the future trajectory of fishing equipment innovation, transforming the activity from a purely manual skill into a technologically augmented sport.

Regional Highlights

- North America: This region holds a significant share of the global market, driven by a deeply ingrained culture of recreational fishing, robust disposable income, and the presence of major industry players like Pure Fishing and BASS PRO SHOPS. The US, in particular, showcases high demand for premium, specialized equipment across vast freshwater and saltwater environments. State and federal conservation programs often stimulate equipment sales through license fees and excise taxes that fund public access and stocking programs. Technological adoption is high, with rapid uptake of advanced electronic fish finders and mapping technologies being a key differentiator. The focus remains on quality, brand loyalty, and high-performance gear suitable for competitive bass fishing and deep-sea angling.

- Europe: Characterized by strong angling traditions, particularly in the UK, Germany, and Scandinavian countries, the European market exhibits a steady demand, though growth rates are moderate compared to APAC. Carp fishing and fly fishing remain culturally significant, driving demand for specialized, high-quality, and aesthetically pleasing equipment. European manufacturers are leaders in sustainability, often focusing on environmentally friendly materials and production processes to meet stringent EU directives. The market dynamics are highly regulated regarding access and seasons, emphasizing the need for compliance-focused product design. Germany and France represent the largest consumer bases for equipment related to both recreational lake and river fishing.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This rapid expansion is primarily attributed to rising middle-class disposable incomes, increased urbanization, and growing interest in outdoor leisure activities in China, India, and Southeast Asian nations. While the demand for commercial fishing equipment remains extremely high, the recreational segment is burgeoning, creating massive opportunities for both global and local manufacturers. The market in Japan and South Korea is highly sophisticated, focusing on highly technical, lightweight gear (JDM - Japanese Domestic Market), often setting global trends in rod and reel design. Investment in e-commerce infrastructure further supports rapid market penetration in highly populated, geographically diverse territories.

- Latin America: This region presents significant growth potential, particularly in countries like Brazil, Argentina, and Mexico, known for their unique biodiversity and world-class sport fishing locations (e.g., peacock bass and dorado). Market penetration is currently lower than in North America, but increasing tourism and local government efforts to promote angling tourism are expanding the customer base. Pricing sensitivity remains a crucial factor; therefore, demand is often focused on durable, mid-range equipment. Distribution channels are often fragmented, relying heavily on local specialty stores and importers to manage trade complexity and duties.

- Middle East and Africa (MEA): The MEA region is developing, with growth concentrated in specific areas such as the UAE and South Africa, driven by both expatriate communities and increasing investment in marine leisure and tourism infrastructure. South Africa has a strong tradition of coastal and deep-sea angling, supporting demand for heavy-duty saltwater equipment. Market growth in the Middle East is linked to luxury tourism and high-end recreational spending, driving demand for premium, technologically advanced equipment often imported from the US and Europe. Localized climate challenges necessitate highly specific gear, such as UV-protective apparel and heat-resistant components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fishing Equipment Market.- Shimano Inc.

- Globeride Inc. (Daiwa)

- Pure Fishing Inc.

- Rapala VMC Corporation

- Johnson Outdoors Inc.

- BASS PRO SHOPS

- Aftco

- Gamakatsu Co., Ltd.

- St. Croix Rods

- Zebco Brands

- Costa Del Mar

- Lowrance (Navico Group)

- Humminbird (Johnson Outdoors)

- TICA

- Plano Synergy Holdings

- Eagle Claw

- Major Craft

- Fenwick

- Abu Garcia

- Berkley

Frequently Asked Questions

Analyze common user questions about the Fishing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Fishing Equipment Market?

The market growth is primarily driven by the increasing global participation in recreational fishing and the accelerated adoption of high-tech electronic equipment, such as advanced fish finders and GPS mapping systems, which enhance the efficiency and accessibility of the sport.

How is sustainability influencing fishing equipment manufacturers?

Sustainability is a crucial factor influencing product development, leading manufacturers to invest in biodegradable materials for lures, ethically sourced packaging, and equipment designed specifically to facilitate responsible catch-and-release practices, meeting growing consumer demand for eco-friendly products.

Which geographical region is expected to exhibit the fastest market growth?

The Asia Pacific (APAC) region is projected to show the fastest compound annual growth rate, fueled by the expansion of the middle class, rising disposable incomes, and the rapid adoption of Western leisure hobbies, driving significant demand across countries like China and India.

What are the most significant technological advancements in fishing reels?

Significant advancements include the integration of corrosion-resistant ceramic bearings, sophisticated magnetic and centrifugal braking systems for precise casting control, and the utilization of high-strength, lightweight aerospace alloys to improve durability and reduce weight without sacrificing strength.

What is the role of e-commerce in the distribution of fishing equipment?

E-commerce plays a critical role by offering competitive pricing, global accessibility to specialized brands, and detailed product information, rapidly becoming the preferred distribution channel for consumers seeking standardized, high-volume products and specific niche items not readily available in local stores.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Spearfishing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fishing Equipment Market Size Report By Type (Rods, Reels and Components, Line, Leaders, Terminal Tackle, Electronics, Others), By Application (Freshwater Fishing, Saltwater Fishing), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Sports Fishing Equipment Market Size Report By Type (Rods, Reels and Components, Line, Leaders, Lures, Files, Baits, Terminal Tackle, Electronics), By Application (Freshwater Fishing, Saltwater Fishing), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager