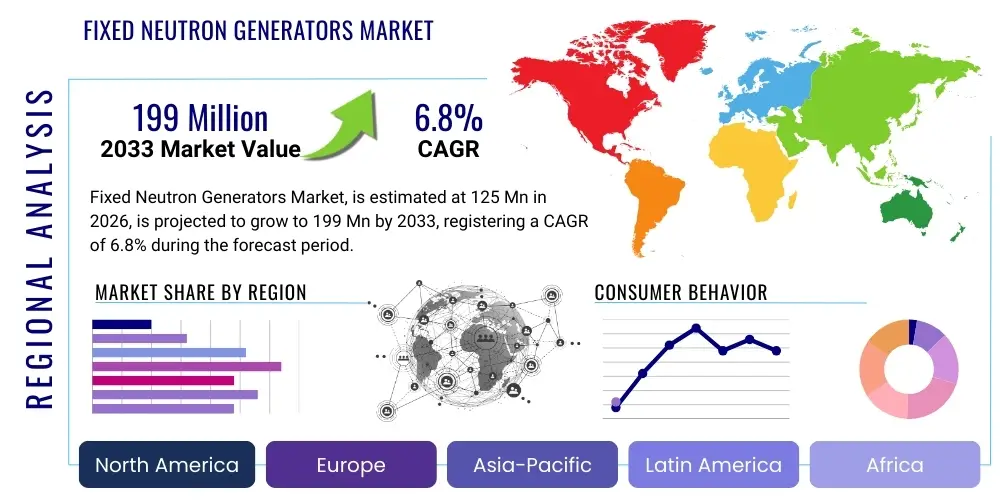

Fixed Neutron Generators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443561 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Fixed Neutron Generators Market Size

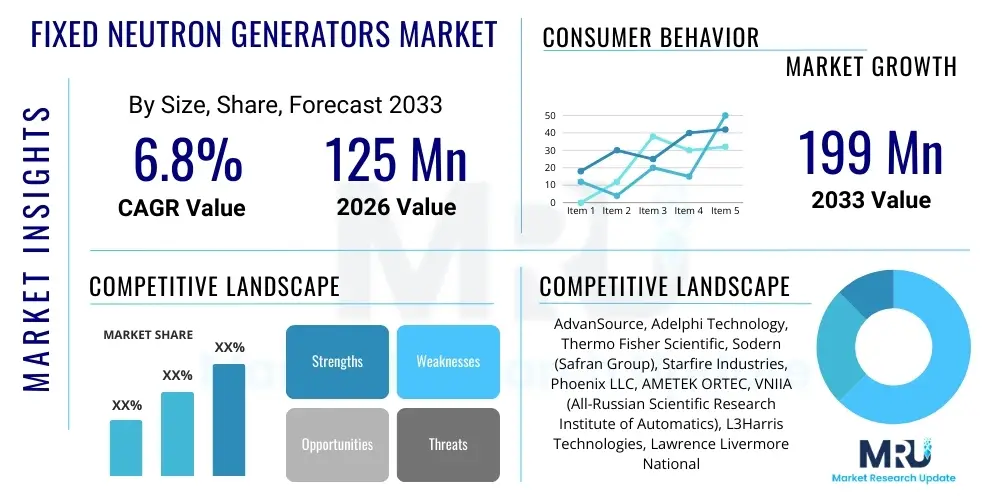

The Fixed Neutron Generators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 125 Million in 2026 and is projected to reach USD 199 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global demand for non-destructive testing (NDT) methodologies, particularly across critical infrastructure sectors such as oil and gas, and the increasing stringency of security and regulatory requirements concerning nuclear materials and border control. The fixed nature of these generators ensures stability and consistency in neutron output, making them essential tools for laboratory research, industrial process control, and advanced material analysis where portability is not a prerequisite but high flux is necessary.

The market expansion is significantly bolstered by technological advancements, specifically in sealed-tube technology which enhances the lifespan and reliability of Deuterium-Tritium (DT) and Deuterium-Deuterium (DD) generators. These advancements allow fixed neutron sources to penetrate dense materials with greater precision than traditional radiographic techniques, facilitating their adoption in specialized applications like Prompt Gamma Neutron Activation Analysis (PGNAA) for bulk materials characterization and elemental composition assessment in geological exploration and mining. Furthermore, the commitment of major global economies to enhancing homeland security measures, involving the detection of concealed explosives and illicit nuclear materials at ports and high-traffic checkpoints, contributes substantially to the overall market valuation and anticipated growth during the forecast period.

Fixed Neutron Generators Market introduction

The Fixed Neutron Generators Market encompasses systems designed to produce controlled streams of neutrons through nuclear fusion reactions, typically by accelerating isotopes of hydrogen (deuterium or tritium) onto a target material. These fixed units, characterized by their stable mounting and often larger scale compared to portable alternatives, offer high neutron yield and extended operational longevity, crucial for intensive industrial and research applications. Key applications span nuclear safeguards, advanced material science research, non-destructive evaluation (NDE) in aerospace and construction, and specialized medical isotope production. The primary benefit of these generators over traditional isotopic sources is the ability to turn the neutron production on and off instantaneously, eliminating residual radiation concerns and enhancing operational safety.

The product description centers around sophisticated vacuum-sealed accelerator tubes that facilitate the fusion process. DD generators produce neutrons with energies around 2.45 MeV, suitable for some elemental analysis and moisture detection, while DT generators produce higher energy neutrons at 14 MeV, preferred for explosive detection, well logging in oil and gas, and simulating fusion environments. Driving factors include the need for highly accurate, real-time elemental analysis in energy exploration, the continuous technological push towards miniaturization and higher flux density, and the regulatory environment prioritizing safe and precise screening technologies in high-security environments. The reliability and low maintenance requirements of modern fixed generators further solidify their indispensable role across various high-value industries globally, stimulating sustained market interest and investment.

Fixed Neutron Generators Market Executive Summary

The Fixed Neutron Generators Market is experiencing robust expansion driven by convergence across industrial, defense, and healthcare sectors. Business trends indicate a strong focus on strategic partnerships between generator manufacturers and integration service providers to offer turnkey solutions, particularly in oilfield services (well-logging) and airport security screening systems. Regional trends highlight North America and Europe as dominant revenue contributors, characterized by significant governmental investment in defense and stringent regulatory frameworks mandating advanced inspection technologies. However, the Asia Pacific region is forecast to exhibit the fastest growth rate, fueled by rapid industrialization, increasing energy demands requiring extensive resource exploration, and burgeoning investments in nuclear power infrastructure demanding sophisticated monitoring tools. Segment trends show that the Deuterium-Tritium (DT) segment maintains market leadership due to its high neutron yield, making it ideal for deep penetration applications, while the non-destructive testing (NDT) application segment represents the largest end-user market due to its necessity in maintaining aging critical infrastructure.

Strategic movements within the market involve key players prioritizing R&D into solid-state targets and alternative neutron-producing reactions to enhance generator lifespan and reduce operational complexities associated with tritium handling. Furthermore, there is a clear shift toward integrating real-time data processing and advanced sensor fusion with neutron analysis outputs, improving detection probability and reducing false alarm rates in security applications. Economically, the market demonstrates resilience against short-term economic fluctuations due to the essential nature of its end-use applications in energy and security. The high initial capital investment and the need for specialized technical expertise, however, present barriers to entry for new competitors, consolidating market share among established, technologically mature enterprises capable of navigating complex international regulatory landscapes pertaining to nuclear material handling and export controls. Successful market navigation relies heavily on continuous product innovation focused on enhanced reliability and decreased size-to-yield ratios.

AI Impact Analysis on Fixed Neutron Generators Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fixed Neutron Generators Market commonly center on how machine learning algorithms can enhance data interpretation, optimize operational efficiency, and potentially automate complex inspection processes. Key themes identified include the integration of AI for anomaly detection in security screening (distinguishing benign materials from threats based on complex neutron signatures), optimizing pulse timing and flux control for higher efficiency, and automating the calibration and maintenance schedules of high-cost fixed units. Concerns often relate to the cybersecurity risks associated with integrating networked, AI-driven control systems and the required volume of high-quality training data necessary to make these systems reliable in diverse, real-world operational environments. Expectations are high regarding AI’s ability to turn complex neutron spectroscopic data into immediate, actionable insights, thereby democratizing the use of sophisticated fixed neutron generator systems beyond highly specialized expert operators.

- AI-Enhanced Signal Processing: Machine learning algorithms are used to rapidly analyze neutron scattering and absorption data, significantly reducing the time required for identifying specific elemental compositions in materials, crucial for PGNAA.

- Optimized Flux Control: AI systems dynamically adjust generator parameters (e.g., beam current, pulse width) in real time to maintain optimal neutron yield and uniformity, maximizing testing throughput and generator lifespan.

- Predictive Maintenance: AI monitors vibrational patterns, temperature fluctuations, and vacuum levels within fixed generators to predict component failure, reducing unexpected downtime and minimizing costly repairs.

- Automated Threat Recognition: In homeland security and cargo scanning, deep learning models are trained on vast datasets of neutron signatures to accurately and instantaneously differentiate between benign cargo and concealed nuclear or explosive materials, enhancing throughput at checkpoints.

- Data Fusion and Correlation: AI integrates neutron analysis results with data from other sensors (e.g., X-ray, visible light) to create more comprehensive material characterization profiles, improving the overall accuracy and reliability of NDT results.

DRO & Impact Forces Of Fixed Neutron Generators Market

The Fixed Neutron Generators Market is primarily driven by the escalating demand for non-invasive, highly penetrating inspection technologies across sectors critical to global stability, coupled with technological advancements increasing generator longevity and efficiency. Restraints largely revolve around the high initial capital expenditure required for purchasing and installing these complex systems, alongside stringent regulatory hurdles governing the handling and disposal of tritium, especially for high-yield DT generators. Opportunities exist in emerging applications such as Boron Neutron Capture Therapy (BNCT) in oncology, and in developing markets where massive infrastructure projects necessitate comprehensive NDT solutions. The impact forces are characterized by rapid technological substitution potential from alternative NDT methods (like advanced computed tomography) and intense regulatory oversight affecting global trade and deployment, necessitating continuous adaptation by manufacturers to maintain competitiveness and compliance.

Specifically, the core drivers include the worldwide focus on energy security, which necessitates advanced well-logging techniques in mature and unconventional oil & gas fields, and the increasing reliance on nuclear power, requiring robust safety monitoring systems. Furthermore, global counter-terrorism efforts have mandated the deployment of advanced cargo and border inspection systems, where fixed neutron generators offer superior detection capabilities compared to passive radiation sensors alone. However, the requirement for highly skilled personnel for both operation and maintenance poses a significant constraint, contributing to higher operational costs. The technical complexity also translates into longer sales cycles and significant integration challenges within existing industrial infrastructure, which slows down widespread adoption in cost-sensitive industrial environments. These opposing forces dictate a measured growth pace, primarily concentrated in high-value, government-backed, or safety-critical industrial applications.

Market opportunities are broadening as fixed generators become smaller and more affordable, opening pathways into specialized industrial environments such as cement production (for real-time elemental analysis of raw materials) and high-value materials processing. The development of accelerator-based neutron sources for research applications, replacing traditional nuclear reactors, provides a secular growth opportunity driven by safety and environmental concerns. The impact of these forces ensures that while the market is niche, it is essential, with barriers to entry preserving the competitive position of established players. The critical impact forces include governmental policy changes regarding infrastructure security and environmental monitoring standards, which can instantaneously create or dampen demand across specific regional markets, highlighting the sensitivity of this sector to external political and regulatory dynamics.

Segmentation Analysis

The Fixed Neutron Generators Market is meticulously segmented based on Type, Application, and End-Use, reflecting the diverse requirements of the global market. Segmentation by Type differentiates between the energy yield and complexity of operation, with Deuterium-Tritium (DT) generators dominating due to their high neutron flux capability, essential for deep-penetration tasks like downhole logging and cargo inspection. Application segmentation reveals Non-Destructive Testing (NDT) as the dominant application, closely followed by nuclear security and research, showcasing the generator's versatility across industrial maintenance and strategic governmental mandates. End-Use segmentation confirms the Energy Sector and Government/Defense entities as the primary revenue generators, driven by critical safety and exploration requirements. Analyzing these segments provides a clear pathway for strategic marketing and product development, allowing companies to tailor their offerings—whether high-flux DT units for oil exploration or lower-yield DD units for educational and material analysis labs—to maximize market penetration.

- Type

- Deuterium-Deuterium (DD) Generators

- Deuterium-Tritium (DT) Generators

- Application

- Non-Destructive Testing (NDT) & Industrial Gauging

- Oil & Gas Exploration (Well Logging)

- Homeland Security & Border Control (Cargo Screening)

- Nuclear Safeguards & Non-Proliferation

- Medical Isotope Production & Therapy (BNCT)

- Research & Education (Material Analysis)

- End-Use

- Energy Sector (Oil & Gas, Nuclear Power)

- Defense & Military

- Government & Research Institutions

- Healthcare & Medical Facilities

- Industrial Manufacturing

Value Chain Analysis For Fixed Neutron Generators Market

The value chain for the Fixed Neutron Generators Market is highly specialized, beginning with the upstream segment focusing on the sourcing and processing of critical materials, particularly vacuum tube components, high-voltage power supplies, and specialized target materials (often titanium or erbium impregnated with deuterium/tritium). Key upstream activities involve precision engineering of accelerator components and meticulous quality control of vacuum integrity, as generator performance is heavily reliant on these foundational elements. Downstream activities involve the highly specialized integration and deployment of the generator units into complex end-user systems, such as mobile well-logging trucks, fixed portal security scanners, or large-scale research facilities. This integration requires significant technical consulting, custom system configuration, and adherence to rigorous safety standards, differentiating basic equipment sales from comprehensive solution provision.

The distribution channel is predominantly direct or through highly specialized authorized distributors and system integrators. Due to the high value, complexity, and inherent safety risks, manufacturers often engage directly with major end-users (e.g., national laboratories, defense agencies, or Tier 1 oilfield service companies). Indirect distribution occurs via specialized integrators who take the base generator unit and build it into a final application-specific system, such as a PGNAA bulk analysis conveyor belt system. This channel model ensures that expert technical support is maintained throughout the installation and operational lifecycle, a critical factor for fixed, high-capital equipment. The necessity for stringent export controls (especially for high-yield DT units that have dual-use potential) further restricts distribution to trusted and government-vetted channels, solidifying a closed and professionalized distribution network.

Successful market participation requires vertical integration in key technology areas, such as proprietary target material coating processes and high-voltage power supply design, which are prerequisites for achieving high neutron yield and extended operational life. The subsequent service and maintenance segment is exceptionally profitable, as fixed neutron generators require regular, highly technical servicing, including target replenishment and vacuum system diagnostics. Therefore, the value creation shifts from manufacturing hardware to providing expert lifecycle support and data analytics services, emphasizing the strategic importance of long-term customer relationships and regional service presence. This structural complexity ensures a high entry barrier but delivers substantial recurring revenue streams for established participants.

Fixed Neutron Generators Market Potential Customers

Potential customers for fixed neutron generators are concentrated in highly regulated, capital-intensive sectors that prioritize safety, precision, and reliable real-time material analysis. The largest buying groups include multinational oil and gas exploration companies and their specialized service providers (e.g., Schlumberger, Baker Hughes) who rely on fixed DT generators for pulsed neutron capture (PNC) and compensated neutron logging (CNL) during reservoir evaluation. Governmental entities, encompassing national nuclear laboratories, defense departments, and customs/border protection agencies, represent another crucial customer segment, utilizing these generators for nuclear material safeguards, treaty verification, and high-throughput non-intrusive cargo inspection (NII).

Furthermore, major research institutions and universities constitute a consistent, albeit smaller, segment of buyers, acquiring fixed DD generators primarily for advanced physics experiments, teaching, and neutron activation analysis research across various scientific disciplines, including material science and geology. The emerging healthcare sector, specifically entities involved in oncology research and therapy development, such as specialized hospitals adopting Boron Neutron Capture Therapy (BNCT), represents a high-growth customer base requiring fixed accelerator-based neutron sources. These customers demand systems with exceptional reliability, verifiable performance metrics, and comprehensive regulatory compliance, reflecting the critical, mission-driven nature of their operations where system downtime is unacceptable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125 Million |

| Market Forecast in 2033 | USD 199 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AdvanSource, Adelphi Technology, Thermo Fisher Scientific, Sodern (Safran Group), Starfire Industries, Phoenix LLC, AMETEK ORTEC, VNIIA (All-Russian Scientific Research Institute of Automatics), L3Harris Technologies, Lawrence Livermore National Laboratory (Commercialized tech), General Atomics, Nutech, NSD-Fusion, QSA Global, Photonis, Science Applications International Corporation (SAIC), Neutronix Inc., IBA Industrial, ETT S.r.l., Advanced Neutron Technology (ANT). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fixed Neutron Generators Market Key Technology Landscape

The Fixed Neutron Generators Market is defined by reliance on high-voltage accelerator technology and specialized vacuum physics. The predominant technology remains the sealed-tube generator, which encapsulates the ion source, accelerator, and target within a single, sealed unit, significantly improving operational safety, reducing maintenance complexity, and extending tube life compared to earlier open-target systems. Modern sealed tubes leverage metal hydrides (like titanium or scandium hydrides) as targets, which can reliably absorb and retain deuterium and tritium ions. The technical distinction between DD and DT generators lies primarily in the gas mixtures used and the resulting neutron energy spectrum, with DT providing the necessary 14 MeV for deep penetration, making it the choice for energy and security applications.

Recent technological advancements focus heavily on enhancing neutron output flux and beam stability while simultaneously reducing the generator's physical footprint and power consumption. Pulsed neutron generators (PNGs) are a critical technology, enabling time-of-flight measurements crucial for accurate elemental analysis in well-logging and screening. Manufacturers are integrating sophisticated solid-state electronics and high-frequency switching power supplies to achieve precise pulse timing and amplitude control, which is essential for differentiation between fast and thermal neutron interactions. Furthermore, there is ongoing research into alternative neutron generation mechanisms, such as deuterium-deuterium-helium-3 (D-D-3He) fusion, though these remain largely in the research phase and have not significantly impacted the commercial fixed generator market yet.

Another crucial technological development involves the integration of advanced diagnostic systems, often leveraging fiber optics and smart sensors, to monitor tube performance, internal pressure, and target depletion in real time. This allows for proactive maintenance planning, a necessity for critical infrastructure applications where unexpected failure is costly. The trend toward higher duty cycles and robust thermal management systems is crucial for fixed installations that often operate continuously for extended periods, such as those used in industrial process control (e.g., continuous elemental analysis of cement feedstock or coal). The longevity and reliability of these specialized accelerator components remain the core competitive differentiator in this technologically demanding market, driving high R&D expenditures among leading market participants.

Regional Highlights

- North America (USA and Canada): North America holds a commanding share of the Fixed Neutron Generators Market, primarily due to the vast expenditures in the oil and gas sector, where pulsed neutron logging is standard practice for reservoir management and production optimization, particularly in the deep-water and shale regions. The presence of major defense contractors and stringent federal mandates for homeland security, including large-scale fixed cargo screening infrastructure at major ports and borders, further cements its dominance. Significant government funding for national laboratories and advanced nuclear research institutions ensures a steady demand for high-end research-grade fixed generators. The region is also a leader in technological innovation and early adoption of accelerator-based medical applications like BNCT, ensuring sustained future growth.

- Europe (Germany, UK, France): The European market is characterized by robust demand stemming from environmental monitoring, industrial non-destructive testing, and nuclear safeguards related to the EU’s non-proliferation efforts. Germany and France, with strong manufacturing and nuclear technology bases, are key regional revenue contributors. The stringent safety and environmental regulations in Europe often necessitate advanced, reliable inspection methods, favoring fixed neutron systems over less controllable alternatives. The region is also heavily focused on industrial optimization, driving the use of PGNAA and similar techniques for quality control in high-value manufacturing and materials recycling facilities.

- Asia Pacific (China, Japan, South Korea, India): APAC is projected to be the fastest-growing region, driven by unparalleled infrastructure development and increasing energy demands. China and India are making massive investments in oil and gas exploration and nuclear power generation, requiring substantial deployment of fixed neutron well-logging and safety monitoring systems. Furthermore, rising security concerns and modernization efforts in military and defense sectors across major economies like China and South Korea boost demand for fixed screening generators at border crossings and critical installations. The rapid growth of material science research and educational facilities also contributes to the increased procurement of fixed DD generators across the region.

- Latin America (Brazil, Mexico): The market in Latin America is primarily tied to the performance of the regional energy sector. Brazil and Mexico, with their considerable offshore oil reserves, represent the core demand areas for fixed neutron generators used in enhanced oil recovery (EOR) assessments and deep-water exploration logging. Market penetration is generally lower compared to developed economies, but opportunities are emerging as governments seek to modernize their customs infrastructure and crack down on illicit trafficking, creating latent demand for fixed security scanners at major logistical hubs.

- Middle East and Africa (MEA): MEA presents a high-potential market, overwhelmingly dominated by the massive oil and gas industry in the Gulf Cooperation Council (GCC) countries. National oil companies consistently invest in the most advanced fixed logging tools to maximize production efficiency and reservoir yield. Defense and security applications are also significant drivers, as geopolitical tensions and counter-terrorism measures necessitate sophisticated, fixed-site detection capabilities for weapons and contraband at vital ports and infrastructure sites throughout the region. The high capital expenditure capacity of oil-rich nations allows for the immediate adoption of the latest, high-flux DT generator systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fixed Neutron Generators Market.- AdvanSource

- Adelphi Technology

- Thermo Fisher Scientific

- Sodern (Safran Group)

- Starfire Industries

- Phoenix LLC

- AMETEK ORTEC

- VNIIA (All-Russian Scientific Research Institute of Automatics)

- L3Harris Technologies

- Lawrence Livermore National Laboratory (Commercialized tech)

- General Atomics

- Nutech

- NSD-Fusion

- QSA Global

- Photonis

- Science Applications International Corporation (SAIC)

- Neutronix Inc.

- IBA Industrial

- ETT S.r.l.

- Advanced Neutron Technology (ANT)

Frequently Asked Questions

Analyze common user questions about the Fixed Neutron Generators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of fixed neutron generators over isotopic neutron sources?

The chief advantage is the ability to turn fixed neutron generators instantaneously on and off, eliminating the need for complex shielding during non-operational periods and significantly improving safety protocols compared to continuously emitting radioisotopic sources (e.g., Californium-252).

Which application segment drives the largest demand for high-flux fixed neutron generators?

Oil and Gas Exploration, specifically through pulsed neutron logging (PNL) and well logging techniques, is the largest demand driver, requiring high-flux Deuterium-Tritium (DT) fixed generators for deep and accurate material analysis of subterranean reservoirs.

What are the key regulatory hurdles affecting the widespread adoption of fixed neutron generators?

Regulatory hurdles primarily involve the management and export control of tritium, which is used in high-yield DT generators, and the necessity for rigorous certification and licensing processes due to the dual-use nature (civilian and military) of the underlying accelerator technology.

How is AI being utilized to improve the performance of fixed neutron generator systems?

AI integration focuses on enhancing data interpretation, utilizing machine learning algorithms for real-time anomaly detection in screening applications, and optimizing the generator's operational parameters for efficiency and predictive maintenance scheduling.

Is the Fixed Neutron Generators Market seeing significant growth in medical applications?

Yes, the market is experiencing growing interest and investment in medical applications, specifically in the development and deployment of accelerator-based neutron sources for Boron Neutron Capture Therapy (BNCT) in advanced cancer treatment facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager