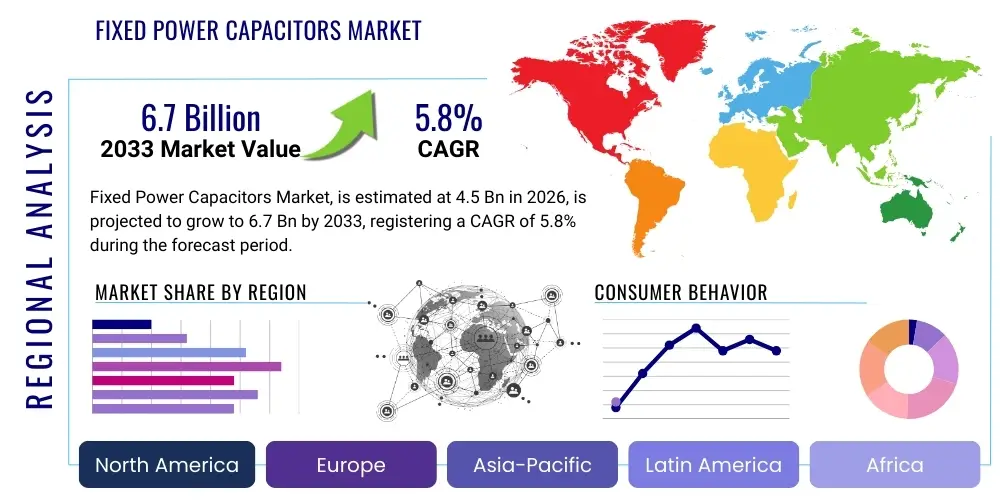

Fixed Power Capacitors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443308 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Fixed Power Capacitors Market Size

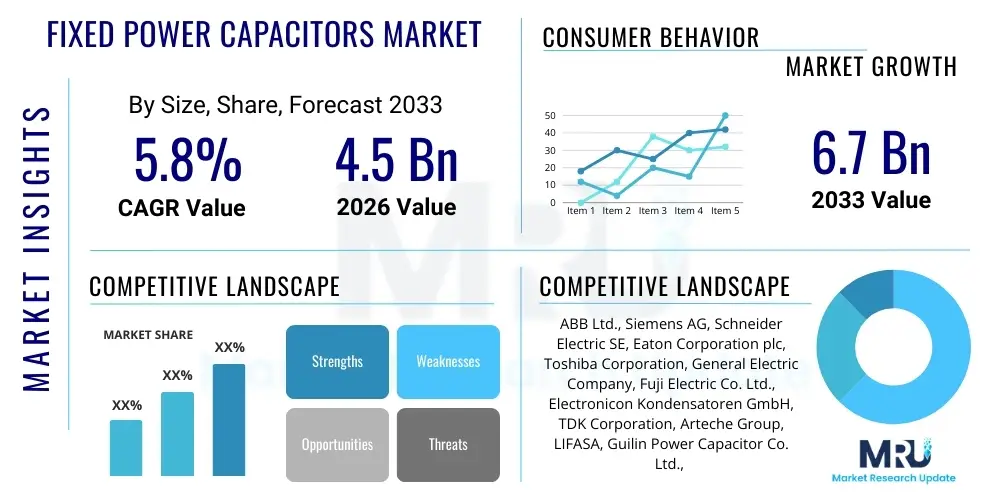

The Fixed Power Capacitors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the escalating global demand for efficient energy management systems, coupled with massive investments in renewable energy infrastructure and the modernization of aging power grids worldwide. The inherent necessity of power factor correction and harmonic filtering in both industrial and utility applications ensures a stable, long-term trajectory for market penetration and revenue growth, even amidst fluctuations in raw material costs and geopolitical stability. Market resilience is further bolstered by the essential nature of these components in maintaining grid reliability and preventing system failures, making them indispensable elements in the energy transition narrative.

Fixed Power Capacitors Market introduction

Fixed Power Capacitors are crucial electrical components designed to improve the power factor of electrical loads, reduce energy losses, and stabilize voltage levels within AC power systems. These devices are utilized extensively across the entire electricity value chain, from generation and transmission to final distribution and industrial consumption. Functionally, they operate by supplying reactive power (kVAR) to inductive loads, thereby reducing the burden on the electrical supply system and lowering overall utility costs. The typical construction involves dielectric materials such as film (polypropylene), paper, or ceramic, encapsulated within robust housings designed for high-voltage and high-temperature environments. Their primary purpose is to enhance system efficiency and capacity utilization, which is becoming increasingly vital as global power demand rises and stringent energy efficiency regulations are enforced.

Major applications for fixed power capacitors span power factor correction in industrial facilities, harmonic filtering in systems utilizing high levels of non-linear loads (like variable speed drives and LED lighting), and voltage regulation in transmission and distribution networks. Their benefits include substantial energy savings, increased system lifespan, reduced maintenance requirements, and improved power quality. In the modern energy landscape, fixed power capacitors are foundational to the successful integration of intermittent renewable energy sources, such as solar and wind, where they help mitigate rapid voltage fluctuations and maintain stable grid connections. Furthermore, the rapid electrification of transportation and heating sectors mandates greater grid stability, further cementing the capacitor market's essential role.

The primary driving factors for this market’s sustained growth include global efforts toward decarbonization, leading to accelerated deployment of utility-scale renewable energy projects; the pervasive trend of industrial automation, which introduces complex electrical loads requiring precise power quality control; and government mandates focused on energy efficiency and reduction of carbon emissions. The ongoing development of smart grid infrastructure, requiring high-reliability components for monitoring and control, also serves as a significant market impetus. Technological advancements, particularly in self-healing and explosion-proof designs, continue to enhance product safety and longevity, thus accelerating adoption rates across sensitive industrial and commercial environments.

Fixed Power Capacitors Market Executive Summary

The Fixed Power Capacitors Market exhibits robust business trends characterized by strong capital expenditure in infrastructure modernization, particularly in Asia Pacific and North America, where aging grids require extensive upgrades for smart technology integration. Key business developments include strategic mergers and acquisitions focused on consolidating technological expertise in high-voltage and specialized application segments, alongside significant R&D spending directed towards materials science to improve energy density and operational lifespan. The market structure is moderately fragmented, with large established players holding dominance through integrated manufacturing capabilities and smaller, specialized firms focusing on niche high-performance applications like DC transmission filtering. Sustainability is emerging as a critical competitive factor, with manufacturers increasingly adopting eco-friendly dielectric fluids and materials, aligning with global green energy initiatives.

Regionally, Asia Pacific maintains its undisputed leadership position, fueled by unprecedented infrastructure development in China and India, coupled with aggressive targets for renewable energy capacity expansion. This region not only accounts for the largest consumption base due to extensive manufacturing and industrial activity but is also rapidly adopting advanced power quality solutions to manage growing urban load centers. Europe and North America demonstrate mature but steady growth, largely driven by regulatory pushes for grid efficiency, smart grid implementation, and substantial electrification projects, including electric vehicle (EV) charging infrastructure. The Middle East and Africa (MEA) and Latin America represent high-potential emerging markets, with growth centered around oil and gas infrastructure expansion, utility scale solar projects, and necessary upgrades to existing, often underdeveloped, transmission networks.

Segment trends reveal that the Automatic Power Factor Correction (APFC) segment, driven by industrial and commercial energy efficiency mandates, is witnessing rapid technological incorporation of smart monitoring and control capabilities. By application, the Transmission and Distribution (T&D) segment remains the largest revenue generator, consistently requiring high-capacity fixed units for voltage support and reactive power compensation. Material-wise, the use of film capacitors, particularly polypropylene, is expanding due to their superior performance characteristics—low loss, high stability, and self-healing properties—making them preferential choices over older technologies in demanding applications like harmonic filtering and renewable energy integration projects. Furthermore, the high-voltage capacitor segment is experiencing disproportionately high growth due to the global shift towards efficient high-voltage DC (HVDC) transmission lines.

AI Impact Analysis on Fixed Power Capacitors Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Fixed Power Capacitors Market commonly revolve around themes of predictive maintenance, optimization of capacitor bank deployment, and enhancement of manufacturing processes. Key concerns center on whether AI can extend capacitor lifespan through precise load management, how machine learning can analyze complex harmonic profiles to recommend optimal filtering solutions, and the integration of AI-driven diagnostics into smart grid components. Users expect AI to move capacitor management from reactive failure replacement to proactive condition monitoring, thereby minimizing downtime and maximizing asset utilization across utility and industrial sectors. The expectation is that AI will transform capacitors from passive components into active, intelligent assets within the smart grid framework.

AI is already beginning to influence both the operational phase and the manufacturing stage of fixed power capacitors. In operations, AI algorithms process vast amounts of real-time grid data, including load fluctuations, voltage profiles, temperature readings, and historical performance metrics. This allows for predictive modeling of potential capacitor failure modes, such as dielectric degradation or thermal runaway, significantly ahead of conventional monitoring methods. This transition to predictive maintenance (PdM) ensures that capacitor banks are replaced or maintained exactly when necessary, rather than based on fixed schedules, reducing operational expenditures and increasing grid reliability. Furthermore, AI-driven analytics optimize the switching cycles and configuration of automatic capacitor banks, ensuring the highest possible power factor correction efficiency under fluctuating load conditions, particularly crucial in environments with intermittent renewable energy inputs.

On the manufacturing front, AI and machine learning are employed to optimize production yields and quality control. For instance, sophisticated image processing and sensor data analysis identify microscopic defects in dielectric films or structural anomalies during the winding process, leading to enhanced product consistency and reliability. Predictive quality models correlate raw material batch data with final product performance metrics, allowing manufacturers to adjust process parameters in real-time. This level of optimization minimizes waste, lowers production costs, and ultimately delivers more reliable and durable fixed power capacitors, meeting the increasingly stringent performance requirements of modern high-density power systems and long-life utility applications. This holistic impact positions AI as a core technology enabling the next generation of capacitor performance and smart grid integration.

- Enhanced Predictive Maintenance (PdM) for capacitor banks, anticipating failure before it occurs.

- Optimized manufacturing processes using machine learning for quality control and yield improvement.

- Real-time dynamic power factor correction and reactive power control via AI-driven algorithms.

- Advanced harmonic analysis and tailored filtering solution deployment based on ML pattern recognition.

- Integration of AI-powered diagnostics for smart grid component health monitoring.

- Automated anomaly detection in grid performance attributed to capacitor degradation.

DRO & Impact Forces Of Fixed Power Capacitors Market

The trajectory of the Fixed Power Capacitors Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and investment decisions. The fundamental driver remains the increasing global emphasis on energy efficiency and grid modernization, necessitating advanced power factor correction and voltage stabilization equipment. Restraints primarily involve the volatile pricing and supply chain complexities associated with key raw materials, such as aluminum foil, dielectric fluids, and specialized films, which can impact profitability and lead times. Opportunities are abundant, particularly in the burgeoning sectors of renewable energy integration (solar and wind farms), the global push for High Voltage Direct Current (HVDC) transmission lines for long-distance power transfer, and the rapid expansion of EV charging infrastructure requiring robust power quality solutions. These forces mandate continuous innovation to maintain market relevance and sustained growth.

The most significant impact forces acting upon this market include the global regulatory environment and the speed of the energy transition. Regulations mandating minimum power factor standards in industrial settings, particularly in major manufacturing economies, directly drive demand for fixed power capacitors. Simultaneously, the accelerating transition toward decentralized and intermittent power generation (renewables) increases grid instability, creating an urgent need for passive and active reactive power compensation solutions. The technological momentum towards smart grids, characterized by bidirectional power flow and complex load management, compels manufacturers to develop highly reliable, interconnected, and long-life capacitors capable of handling frequent switching and transient events. This technological pressure ensures that product lifecycles are shortening, favoring those companies capable of rapid innovation and compliance with evolving technical specifications.

Another crucial impact force is the macroeconomic environment, specifically infrastructure spending across emerging economies. Large-scale government projects focusing on power generation capacity expansion and grid infrastructure upgrades (e.g., smart city development) generate massive, sustained demand. Conversely, the restraint posed by technological substitutes, such as Static VAR Compensators (SVCs) or Flexible AC Transmission System (FACTS) devices, particularly in high-end utility applications, requires fixed capacitor manufacturers to focus on cost-effectiveness and niche application advantages. Success in this market hinges on capitalizing on the universal need for efficiency while mitigating supply chain risks and demonstrating technological superiority in high-stress operational environments.

Segmentation Analysis

The Fixed Power Capacitors Market is comprehensively segmented across several dimensions, including Type, Voltage Level, Application, and End-User, reflecting the diverse operational environments and technical requirements encountered across the power system landscape. Analyzing these segments provides critical insights into market penetration rates, high-growth areas, and regional consumption patterns. Segmentation by Type differentiates between shunt capacitors, which are overwhelmingly used for power factor correction and voltage control in parallel with the load, and series capacitors, which are predominantly employed in transmission lines to improve stability and limit short-circuit currents. The high demand from industrial consumers and utility networks ensures that the shunt capacitor segment remains the volume leader, while increasing long-distance T&D projects bolster the specialized series capacitor market growth.

Voltage Level segmentation is vital for manufacturers, distinguishing between low-voltage (LV, typically below 1 kV), medium-voltage (MV, 1 kV to 36 kV), and high-voltage (HV, above 36 kV) devices. The LV segment is vast, covering commercial buildings and small industrial operations, whereas the MV and HV segments are dominated by utility providers for substation and transmission line applications. The high growth projected in the MV/HV segments is directly tied to global utility spending on grid expansion and the construction of new large-scale renewable generation farms that require specialized high-capacity components. End-User segmentation provides clarity on demand drivers, identifying Utilities (T&D), Industrial (Heavy manufacturing, process industries), and Commercial sectors as the primary consumers, each with unique technical requirements and procurement cycles.

Further segmentation by dielectric material, such as film (polypropylene), paper/plastic, and ceramic/electrolyte, highlights technological preferences. Film capacitors are currently the preferred choice across medium and high-voltage applications due to their self-healing attributes, low dissipation factor, and superior operational lifespan. Understanding these granular segments allows stakeholders to target specific niches—such as harmonic filters tailored for data centers or specialized metallized film capacitors for railway traction—ensuring maximum market coverage and strategic resource allocation in product development and geographical expansion. This detailed view confirms that the market is evolving towards specialized, high-performance units rather than generalized components.

- By Type:

- Shunt Capacitors

- Series Capacitors

- Harmonic Filter Capacitors

- By Voltage Level:

- Low Voltage (LV)

- Medium Voltage (MV)

- High Voltage (HV)

- By Application:

- Power Factor Correction

- Harmonic Filtering

- Voltage Stabilization and Regulation

- By End-User:

- Utilities (Transmission and Distribution)

- Industrial (Manufacturing, Oil & Gas, Mining)

- Commercial (Data Centers, Hospitals, Large Office Buildings)

- Renewable Energy Generation (Solar and Wind Farms)

- By Dielectric Material:

- Film Capacitors (Polypropylene)

- Paper/Plastic Capacitors

- Others (Ceramic, Electrolytic for specific power electronics)

Value Chain Analysis For Fixed Power Capacitors Market

The value chain for the Fixed Power Capacitors Market commences with the upstream segment, focusing on the procurement and processing of fundamental raw materials. This includes specialized dielectric films (e.g., metallized polypropylene), high-purity aluminum foil used for electrodes, insulating materials, dielectric fluids (for liquid-filled units), and durable casing materials (often steel or aluminum enclosures). The performance and cost structure of the final product are highly sensitive to the quality and price stability of these inputs, making robust supplier relationship management a critical competitive advantage. Key challenges in the upstream stage involve ensuring the consistent quality of thin-film materials and managing the volatility of metal commodity prices, which directly influence manufacturing costs. Manufacturers often invest heavily in backward integration or long-term contracts to stabilize supply.

The midstream segment involves the core manufacturing and assembly processes. This includes precision winding or stacking of the capacitor elements, vacuum impregnation with dielectric fluids (if applicable), casing integration, and rigorous testing for capacity, dissipation factor, and insulation resistance. This stage is capital-intensive, requiring specialized machinery and technical expertise in handling high-voltage components. Companies differentiate themselves through proprietary winding technologies, advanced self-healing film preparation, and robust explosion-proof designs. Downstream activities involve the distribution channel, which is typically complex due to the varying scale and technical nature of applications. Direct sales are common for high-voltage utility projects and customized industrial solutions, where technical consultation and engineering support are essential.

Indirect distribution relies heavily on electrical wholesale distributors, specialized power electronics dealers, and System Integrators (SIs) who bundle fixed capacitors with other power quality equipment like switchgear and reactive power controllers (APFC panels). The choice between direct and indirect channels is often dictated by the voltage level; large HV units are almost always direct, while LV standard correction units rely on broad distributor networks for market access. Potential customers include major utilities, EPC contractors specializing in power plant construction, and industrial end-users like steel mills, chemical plants, and automotive manufacturers. Effective service, installation support, and lifecycle management are crucial elements in the downstream segment, driving customer loyalty and repeat business in this specialized field.

Fixed Power Capacitors Market Potential Customers

The potential customer base for Fixed Power Capacitors is extensive, anchored predominantly by entities responsible for generating, transmitting, and consuming large amounts of electrical energy efficiently. Utility companies, including both government-owned and private Transmission and Distribution (T&D) operators, constitute the largest segment. These organizations are critical buyers of high-voltage and medium-voltage series and shunt capacitors required for grid stabilization, reactive power compensation at substations, and improving the operational capacity of long transmission corridors. Their purchasing decisions are heavily influenced by regulatory mandates for grid reliability and massive infrastructure spending cycles, making them high-volume, long-term contractual clients. The rise of renewable energy independent power producers (IPPs) also falls into this category, requiring specialized capacitors for interconnection points and maintaining compliance with grid codes.

The Industrial sector represents the second major tier of buyers, comprising heavy manufacturing, processing industries (e.g., cement, steel, aluminum), oil and gas operations, and large data centers. These end-users are driven by the necessity of managing high inductive loads (motors, furnaces) which naturally lead to poor power factor, incurring steep penalties from utility providers. Industrial customers typically purchase low and medium-voltage shunt capacitors, often integrated into Automatic Power Factor Correction (APFC) banks, alongside harmonic filters to protect sensitive machinery from waveform distortions introduced by variable speed drives and other non-linear loads. The purchasing decision here is primarily cost-driven, focused on achieving rapid ROI through reduced energy bills and prevention of equipment failure.

Finally, the Commercial sector, encompassing large commercial complexes, hospitals, educational institutions, and new smart buildings, constitutes a growing market segment, particularly for LV solutions. These organizations seek to maximize energy efficiency and comply with local energy conservation codes. Beyond traditional end-users, emerging customer segments include railway operators (for traction power systems), microgrid developers, and manufacturers of power electronics and uninterruptible power supplies (UPS), all requiring highly reliable and specific capacitor types for their integrated systems. The global transition to electrification, specifically the development of high-speed rail and pervasive EV charging stations, further broadens the demand profile by introducing new, high-power density requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation plc, Toshiba Corporation, General Electric Company, Fuji Electric Co. Ltd., Electronicon Kondensatoren GmbH, TDK Corporation, Arteche Group, LIFASA, Guilin Power Capacitor Co. Ltd., CIRCUTOR, EPCOS (TDK Group), ZEZ SILKO s.r.o., ICAR S.p.A., Shizuki Electric Company Inc., Frako Power Factor Correction, Samwha Capacitor Group, Cornell Dubilier Electronics (CDE) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fixed Power Capacitors Market Key Technology Landscape

The technology landscape for fixed power capacitors is continuously evolving, driven primarily by the need for higher energy density, longer operational life, and enhanced safety features to meet the demands of modern power systems. A foundational technology is the development of advanced dielectric materials, notably metallized polypropylene film. This technology allows for the creation of "self-healing" capacitors where minor dielectric breakdowns caused by transient overvoltages are instantly isolated, preventing catastrophic failure and significantly extending the component's lifespan. Research is heavily focused on improving the temperature resistance and power handling capability of these films to enable operation in harsh industrial and utility environments, especially those associated with high-frequency harmonic content.

Another crucial technological advancement involves the integration of smart monitoring and control capabilities. Modern fixed capacitor banks, particularly those used for Automatic Power Factor Correction (APFC), are increasingly incorporating microprocessors, sensor technologies, and communication interfaces (e.g., Modbus, Ethernet). This allows for remote diagnostic monitoring of key performance indicators such as voltage, current, temperature, and internal pressure. This integration facilitates proactive maintenance planning and enables dynamic, real-time reactive power compensation, which is essential for stabilizing grids fed by intermittent renewable sources. The movement towards modular designs also allows for easier scalability and replacement, reducing both installation time and long-term maintenance costs.

Furthermore, significant research is directed towards environmentally friendly and non-toxic impregnating materials to replace traditional PCB-based fluids, aligning with stringent environmental regulations, particularly in developed regions. Explosion-proof designs incorporating internal fuses, pressure disconnectors, and sturdy casings are now standard practice for medium and high-voltage fixed capacitors, addressing crucial safety concerns for utility workers and maintaining system integrity during fault conditions. The increasing deployment of HVDC transmission necessitates specialized DC-link fixed capacitors capable of high ripple current handling and exceptionally low Equivalent Series Resistance (ESR), representing a high-growth technological niche requiring specific material and structural engineering expertise.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region, characterized by robust economic growth, rapid industrialization, and massive governmental investment in infrastructure development, particularly in China, India, and Southeast Asia. The region’s extensive push for renewable energy generation (solar and wind) and the continuous expansion of manufacturing capacity necessitate substantial deployment of fixed power capacitors for grid stability and industrial power factor correction. The presence of major domestic and international manufacturers and a high volume of smart grid pilot projects further solidify its market lead, driving demand for both standardized LV units and advanced HV components.

- North America: This region exhibits mature but stable growth, driven primarily by the modernization of aging power infrastructure and the urgent need for enhanced grid reliability against climate events. Regulatory incentives and mandates supporting energy efficiency and the incorporation of distributed energy resources (DERs) are key demand generators. The deployment of smart grid technologies and significant spending on EV charging infrastructure requiring robust power quality management ensure consistent demand for high-reliability medium and high-voltage fixed capacitors.

- Europe: Europe is focused heavily on the energy transition and achieving net-zero targets, fueling investment in advanced power quality solutions. Strict environmental regulations drive the adoption of fixed capacitors featuring non-toxic dielectric fluids and materials. Growth is strongly tied to cross-border grid interconnections, offshore wind projects, and the implementation of sophisticated harmonic filtering solutions in modernized industrial and commercial facilities to comply with European power quality standards.

- Latin America: This region is an emerging market with high potential, driven by urbanization and necessary investments in expanding and stabilizing often fragmented power grids. Utility-scale infrastructure projects, particularly involving hydro and solar power, require significant reactive power compensation equipment. Economic stability remains a key challenge, but long-term demand is secured by industrial expansion in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Growth in MEA is concentrated around Gulf Cooperation Council (GCC) countries investing heavily in massive infrastructure projects, desalination plants, and diversifying their energy mix towards solar power. The harsh operating environment (high temperatures, sand) mandates specialized, robust capacitor designs. Africa’s market is nascent but growing, focused on utility expansion and ensuring power quality in new industrial parks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fixed Power Capacitors Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Eaton Corporation plc

- Toshiba Corporation

- General Electric Company

- Fuji Electric Co. Ltd.

- Electronicon Kondensatoren GmbH

- TDK Corporation

- Arteche Group

- LIFASA

- Guilin Power Capacitor Co. Ltd.

- CIRCUTOR

- EPCOS (TDK Group)

- ZEZ SILKO s.r.o.

- ICAR S.p.A.

- Shizuki Electric Company Inc.

- Frako Power Factor Correction

- Samwha Capacitor Group

- Cornell Dubilier Electronics (CDE)

Frequently Asked Questions

Analyze common user questions about the Fixed Power Capacitors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of fixed power capacitors in an electrical system?

The primary role is Power Factor Correction (PFC), achieved by supplying reactive power (kVAR) to inductive loads. This reduces energy losses, improves voltage stability, and increases the overall efficiency and capacity of the electrical supply system, avoiding utility penalty charges.

How are fixed power capacitors different from variable or switched capacitor banks?

Fixed power capacitors provide a constant amount of reactive power compensation, typically installed where the inductive load is stable. Switched or variable banks (APFC) use contactors or thyristors to automatically connect and disconnect capacitor stages based on real-time load fluctuations, offering dynamic compensation.

Which dielectric materials are most common for high-performance fixed power capacitors?

Metallized polypropylene film capacitors are the most common for high-performance applications due to their self-healing properties, low dielectric loss, and excellent stability, making them ideal for both high-voltage utility applications and harmonic filtering.

What is driving the growth of the High Voltage (HV) fixed capacitor segment?

The growth in the HV segment is primarily driven by global grid modernization efforts, the construction of new High Voltage Direct Current (HVDC) transmission lines for long-distance power transfer, and the connection of massive utility-scale renewable energy farms to the main grid.

How does the implementation of smart grids affect the demand for fixed power capacitors?

Smart grid implementation increases the demand for fixed power capacitors that are integrated with communication and monitoring systems. These "smart capacitors" allow for precise, remote control and predictive maintenance, essential for managing complex, bi-directional power flows and maintaining power quality in decentralized grids.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electrolytic Fixed Power Capacitors Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (High Voltage, Low Voltage), By Application (Reduce Reactive Power, Harmonic Filter, Series Capacitor, Direct Current Transmission), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Inorganic Fixed Power Capacitors Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (High Voltage, Low Voltage), By Application (Reduce Reactive Power, Harmonic Filter, Series Capacitor, Direct Current Transmission), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager