Flange Gasket Sheet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441038 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Flange Gasket Sheet Market Size

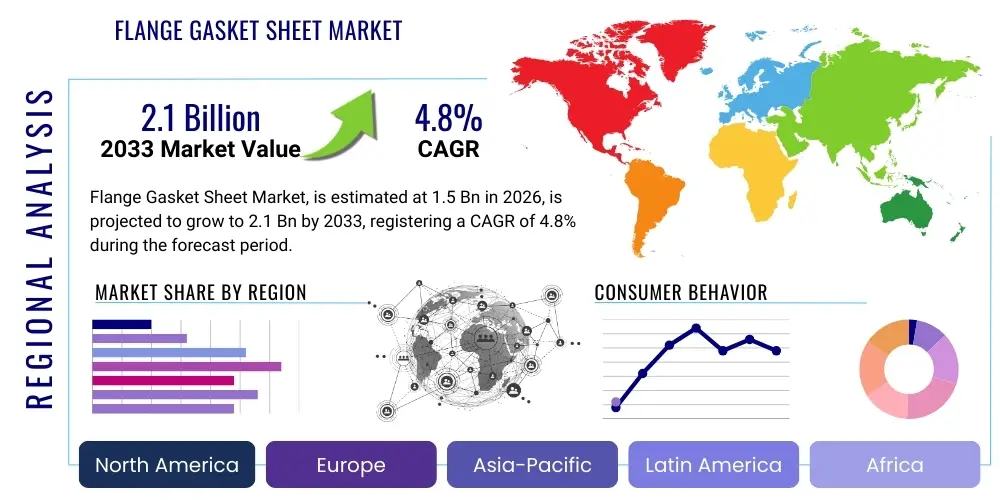

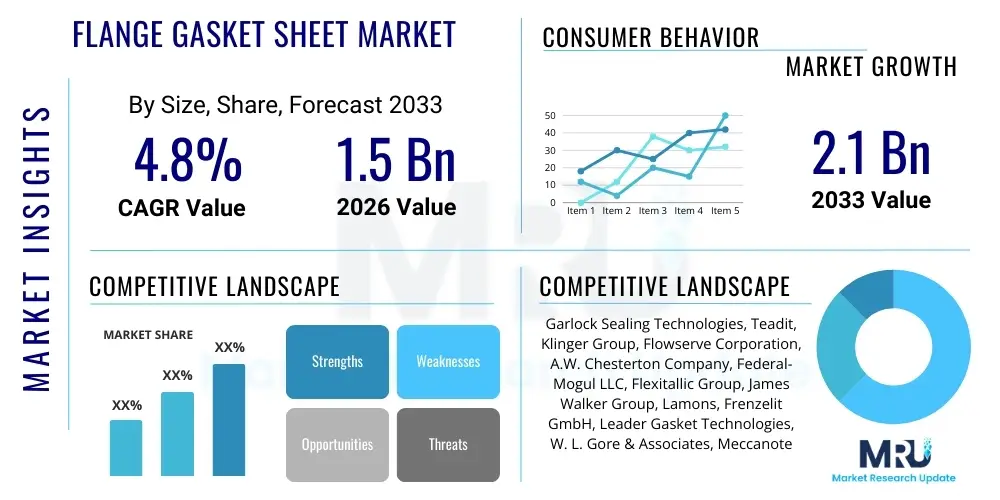

The Flange Gasket Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Flange Gasket Sheet Market introduction

Flange gasket sheets constitute an indispensable category of industrial sealing products essential for achieving fluid and gas containment integrity in pressurized systems across nearly every heavy processing sector. These sheets serve as the raw material from which specific flanged sealing components are cut or fabricated, providing the crucial mechanical seal between two mating flange faces. The performance characteristics of a flange gasket sheet are paramount, defining the operational safety margins, longevity, and efficiency of pipelines, pressure vessels, and heat exchangers. Product requirements are highly demanding, often requiring resistance to extreme temperatures ranging from cryogenic lows (-200°C) to superheated steam environments (550°C+), coupled with immunity to aggressive chemical corrosion, including strong acids, alkalis, and complex hydrocarbon mixtures. This complexity necessitates continuous innovation in material science to produce sheets that meet evolving regulatory and operational challenges, specifically those pertaining to fugitive emissions and system reliability under dynamic loading conditions.

The material composition spectrum is vast, reflecting the diversity of industrial requirements. Non-asbestos fiber (NAF) sheets, based on aramid, carbon, or glass fibers bound with elastomers like NBR or SBR, represent the workhorse segment, offering a cost-effective solution for medium-duty services. Conversely, highly specialized materials such as expanded PTFE (ePTFE) and flexible graphite sheets are deployed in critical applications where chemical inertness, fire safety, and ultra-low fugitive emissions are non-negotiable. The product landscape has been fundamentally shaped by the global prohibition of asbestos, accelerating the development of these advanced composite materials. The transition towards high-performance alternatives has necessitated improved manufacturing controls, including specialized calendering processes and high-pressure curing techniques, to ensure uniform density, thickness control, and superior resistance to hot creep and stress relaxation under load, thereby significantly extending the Mean Time Between Failures (MTBF) of critical joints in high-stakes environments.

The major applications driving consistent demand for flange gasket sheets are deeply embedded in the core global economy, centered around energy, manufacturing, and infrastructure. The petrochemical and oil and gas industries rely on these components to safely transport and process volatile fluids under immense pressure, making leak prevention a critical safety and environmental compliance issue. Furthermore, the power generation sector, especially modern thermal and nuclear plants, demands seals capable of handling superheated steam and high-radiation environments without degradation. Benefits derived from using premium flange gasket sheets include substantial mitigation of environmental fines, significant reduction in system maintenance costs due to extended operational life, and direct operational stability. Driving factors include the continuous expansion of pipeline infrastructure globally, mandatory facility upgrades to meet new safety standards, and the global push towards achieving zero-fugitive-emission targets, which collectively elevates the required quality and specification of all installed sealing components across all industrial verticals.

Flange Gasket Sheet Market Executive Summary

The Flange Gasket Sheet Market is experiencing robust expansion driven by stringent global industrial safety mandates and sustained capital investment in high-hazard infrastructure assets. Key business trends include the increasing necessity for material certification (such as API 622 for low emissions), prompting manufacturers to heavily invest in R&D to develop specialized graphite and structured PTFE solutions that comply with international norms. There is a discernible market shift towards holistic sealing integrity management, where manufacturers provide technical consulting alongside the product, moving beyond simple component sales. Furthermore, consolidation among key global players continues, aimed at optimizing supply chains, standardizing product specifications, and gaining competitive advantages through superior raw material access and advanced manufacturing process control, particularly in high-growth segments.

Regionally, market expansion is highly polarized. The Asia Pacific (APAC) region solidifies its position as the dominant growth engine, fueled by extensive new construction in chemical processing, refining, and power generation sectors, particularly in emerging economies where regulatory standards are rapidly evolving towards global best practices. In contrast, mature markets like North America and Europe demonstrate stable, high-value demand focused almost exclusively on premium replacement products for MRO activities. Growth in these mature regions is critically dependent on materials capable of handling aging infrastructure while meeting demanding new environmental leakage protocols. Latin America and the Middle East & Africa (MEA) offer substantial, project-based growth opportunities tied directly to cycles of hydrocarbon exploration and major industrial capacity expansion, emphasizing robust, highly engineered sealing materials suited for challenging, remote operating conditions.

Segment-wise, the market structure highlights a clear bifurcation in demand. While the Non-asbestos Fiber (NAF) segment remains the largest by sheer volume due to its versatile application in utility services, the fastest revenue acceleration originates from the high-performance segments. Flexible graphite sheets are witnessing exceptional growth, driven by fire-safety requirements in petrochemical complexes and superior thermal resistance in power plants. Expanded PTFE (ePTFE) is also growing rapidly, highly valued for its chemical inertness across the pharmaceutical and chemical synthesis industries. Application trends show that the Oil & Gas and Chemical sectors continue to mandate the highest technical specifications, acting as the primary catalysts for material science innovation and pushing the envelope for zero-fugitive-emission solutions across the entire industrial sealing value proposition.

AI Impact Analysis on Flange Gasket Sheet Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Flange Gasket Sheet Market predominantly center on leveraging sophisticated algorithms to enhance operational reliability, minimize unplanned downtime, and revolutionize material diagnostics. The core concern revolves around how AI and Machine Learning (ML) can effectively process the heterogeneous data streams generated by industrial IoT sensors—including localized vibration analysis, subtle pressure fluctuations, and acoustic monitoring—to accurately predict the exact time frame of potential gasket failure. Stakeholders seek AI solutions that move beyond simple historical analysis to provide prescriptive guidance, such as identifying the optimal bolt tightening sequence or recommending immediate preemptive maintenance based on a correlation of environmental and operational stress factors, thereby transforming passive components into active elements within a smart factory framework.

In the manufacturing domain, AI's impact is focused on achieving unprecedented levels of material consistency and reducing batch variability, which is crucial for high-reliability sealing products. ML models are being applied to analyze complex inputs during the calendering and curing processes of composite sheets, optimizing parameters like temperature gradient, compression force uniformity, and binding agent distribution in real-time. This algorithmic control ensures that every section of the sheet stock meets stringent dimensional and mechanical tolerances, which is vital for preventing premature creep relaxation or localized material degradation under operational stress. Furthermore, the implementation of AI-enhanced vision systems for quality assurance dramatically accelerates the detection of microscopic material defects or inconsistencies that human inspection might miss, elevating the overall quality assurance baseline across the industry.

Strategically, AI is profoundly influencing the market's supply chain and engineering services. Generative AI tools are now assisting material scientists by simulating the behavior of novel fiber and polymer combinations under extreme conditions, drastically shortening the R&D cycle for specialized sealing solutions required for emerging energy sources like green hydrogen and carbon capture. Concurrently, ML-driven demand forecasting is refining inventory strategies for MRO providers. By analyzing global industrial operational schedules, refinery turnaround cycles, and localized regulatory changes, AI systems provide highly accurate demand projections, ensuring the availability of specialized gaskets precisely when required for critical maintenance, thereby reducing logistical risk and maximizing service delivery effectiveness across the global network.

- AI-driven Predictive Maintenance (PdM) leverages complex sensor data analysis (acoustic, thermal) to forecast gasket Remaining Useful Life (RUL), preventing unplanned outages.

- Machine Learning optimizes composite material manufacturing processes (calendering, curing) to enhance sheet density uniformity, minimize material defects, and achieve superior quality control.

- Generative AI accelerates R&D for novel, high-specification sealing materials required for complex, extreme conditions such as high-purity hydrogen service or ultra-high temperature steam.

- AI enhances supply chain operational resilience by accurately simulating and forecasting highly granular, regional MRO demand, optimizing inventory distribution and reducing lead times.

- Integration of specialized smart coatings or micro-sensors with IoT infrastructure allows for real-time monitoring of flange joint integrity, enabling proactive maintenance scheduling based on condition rather than time.

- Automation of application engineering tasks, such as material selection and bolt load calculation based on vast datasets, reduces subjective error and ensures optimal sealing configuration.

DRO & Impact Forces Of Flange Gasket Sheet Market

The operational landscape of the Flange Gasket Sheet Market is significantly shaped by robust drivers rooted in global compliance and infrastructure development. The paramount driver remains the relentless pressure from environmental regulatory bodies worldwide to mitigate fugitive emissions. Global standards like ISO 15848-1 and regional compliance mandates (e.g., U.S. EPA regulations, European TA-Luft) effectively prohibit the use of materials that cannot reliably contain volatile organic compounds (VOCs), driving mandatory upgrades to high-integrity graphite, ePTFE, and proprietary NAF composites. This legislative push creates a non-cyclical, continuous demand for certified replacements, insulating the premium segment of the market from macroeconomic downturns. Furthermore, accelerated industrialization in APAC and the Middle East, necessitating the construction and commissioning of vast new processing facilities, provides a steady, high-volume requirement for OEM-installed sealing components.

Despite strong demand, the market faces notable restraints, chiefly the extreme volatility and geopolitical dependency of key raw material supplies. The primary inputs—high-purity natural graphite, fluoropolymers (PTFE), and specialized aramid fibers—are subject to significant price fluctuations and supply chain disruptions, directly impacting manufacturers' profit margins and the stability of end-product pricing. Another profound restraint is the specialized knowledge required for correct gasket selection and installation. Improper seating or insufficient bolt load application remains a leading cause of joint failure, even with high-quality sheets. This necessitates substantial ongoing investment in end-user training and technical consultation, which increases manufacturers' operational overhead, particularly when dealing with diverse global customer bases with varying technical aptitudes.

Significant opportunities for market expansion are concentrated in sectors undergoing fundamental technological shifts. The global energy transition is generating novel, high-value niches, particularly within the nascent green hydrogen economy and the burgeoning Carbon Capture and Storage (CCS) infrastructure. These applications require gaskets that can handle the unique challenges of extremely small molecules (hydrogen) or dense, high-pressure, often corrosive CO2 streams, demanding entirely new material development and certification protocols. Strategically, the vast installed base of aging industrial assets across North America and Europe represents a continuous and massive MRO opportunity. Suppliers who leverage digitalization to offer integrated asset integrity management solutions, moving beyond component sales to providing predictive maintenance services, are uniquely positioned to capture high-margin, long-term service contracts and dominate these mature markets.

Segmentation Analysis

A detailed segmentation analysis of the Flange Gasket Sheet Market provides clarity on performance requirements, application diversity, and competitive landscape differentiation. The segmentation based on Material Type is foundational, determining the suitability for specific thermal and chemical environments. The segment dominance of Non-asbestos Fiber (NAF) reflects its utility and widespread adoption across general services. However, the high-growth trajectory and revenue significance of the Flexible Graphite and Expanded PTFE segments underscore the industry's unwavering commitment to high-integrity sealing solutions for demanding, critical applications where failure costs are prohibitive. This material split defines strategic production focus and R&D investment priorities for market leaders globally.

Segmentation by Application highlights the crucial role of sealing technology in the critical infrastructure sectors. The Oil & Gas and Chemical Processing industries dominate in terms of technical requirement severity, driving demand for sheets certified for fire safety and ultra-low emission performance. These sectors require materials capable of surviving dynamic thermal cycling and corrosive media exposure. Conversely, sectors like Water Treatment or Pulp and Paper, while requiring high volumes of sheets, often utilize materials optimized for cost-effectiveness and resistance to aqueous or specific process liquors, emphasizing the need for application-specific material portfolios rather than a one-size-fits-all approach to product design.

Further segmenting the market by End-Use—Original Equipment Manufacturing (OEM) versus Maintenance, Repair, and Overhaul (MRO)—reveals crucial differences in procurement timing and logistics. OEM demand is cyclical, characterized by large, often competitive tenders tied to multi-year capital projects (e.g., new refinery builds), requiring centralized technical support. The MRO market, conversely, is stable, continuous, and highly decentralized, requiring widespread geographic distribution and highly responsive local fabrication services. Success in the MRO segment hinges on efficient inventory management and rapid delivery capabilities, often serviced through a complex network of authorized distributors and local stockists who provide cutting services to exact, immediate customer specifications.

- Material Type:

- Non-asbestos Fiber (NAF): High volume, general purpose sealing, cost-efficient for utility and moderate service conditions.

- Expanded PTFE (ePTFE) and Virgin PTFE: Exceptional chemical resistance and high conformability, critical for pharmaceutical and complex chemical processing.

- Flexible Graphite (Homogeneous and Reinforced): Highest thermal stability, excellent fire-safe properties, mandatory for petrochemical and high-temperature steam services.

- Rubber (NBR, EPDM, FKM, Neoprene): Suitable for low pressure, low temperature, and highly specific chemical compatibility requirements (e.g., certain hydrocarbons or potable water).

- Metallic/Semi-Metallic Composites: Used in niche, ultra-high pressure and extreme thermal cycling applications where conventional soft materials lack mechanical strength.

- Application:

- Oil & Gas (Upstream, Midstream, Downstream Refining): Demand for fire-safe, high-pressure, low-emission materials.

- Chemical and Petrochemical Processing: Requirements focused on chemical inertness and adherence to rigorous fugitive emission controls.

- Power Generation (Thermal, Nuclear, Renewables): Focus on resistance to superheated steam, radiation (Nuclear), and thermal cycling durability.

- Pulp and Paper Industry: Requires resistance to caustic process liquors and high mechanical strength against localized damage.

- Water and Wastewater Treatment: High volume demand for low-pressure, corrosion-resistant, and potentially potable water-approved materials.

- Mining and Metallurgy: Emphasis on durability and resistance to abrasive media and heavy mechanical stress.

- Marine and Shipbuilding: Certified materials required for engine systems and hazardous cargo handling under specific classification society rules.

- Pressure Rating:

- Low Pressure (Class 150): Standard flanges and utility lines.

- Medium Pressure (Class 300 - 600): Common in industrial process piping.

- High Pressure (Class 900 and above): Critical service lines requiring maximum mechanical integrity.

- End-Use Market:

- Original Equipment Manufacturing (OEM): Suppliers of sheets to equipment fabricators (heat exchangers, pressure vessels).

- Maintenance, Repair, and Overhaul (MRO): Ongoing, consistent demand for replacement sealing components.

Value Chain Analysis For Flange Gasket Sheet Market

The upstream segment is characterized by the specialized extraction and refinement of base materials crucial for high-performance sealing, including crystalline graphite, aramid polymers, and high-performance fluoro-elastomers. This phase involves significant capital investment in chemical synthesis and mineral processing to achieve the requisite purity and structural characteristics necessary for performance-critical applications. Manufacturers must manage complex global sourcing strategies due to the concentrated geographic availability of certain materials, such as high-purity natural graphite flakes. The ability to lock in stable, long-term supply contracts for these high-specification raw materials is a vital differentiator, directly impacting the final product's cost and reliability profile in the midstream manufacturing phase.

The midstream manufacturing involves transforming these raw materials into finished sheet stock through complex, highly controlled processes. This stage is proprietary, encompassing the mixing of fibers, fillers, and binding agents, followed by specialized techniques such as high-pressure calendering for NAF or advanced expansion and fibrillation for ePTFE. Precision engineering is paramount in this stage; manufacturers utilize advanced automated equipment to ensure uniform sheet thickness, density, and cure, which are direct determinants of the gasket's long-term sealing performance and resistance to creep relaxation. Stringent Quality Control (QC) testing, often including certification tests like API 622 for fugitive emissions, is executed here, validating material performance before the sheet proceeds to final fabrication.

Downstream activities focus on conversion and distribution. The sheet stock is converted into specific flange gasket shapes using highly accurate cutting technology, such as CNC milling or waterjet cutting, particularly for customized or large-diameter gaskets required by project engineers. Distribution channels are optimized for speed and reach, recognizing the time-critical nature of MRO demand. Direct sales channels provide technical consultation and custom sizing for major EPC projects, while indirect channels—relying on a network of certified distributors and regional stockists—manage the high volume, instantaneous replacement needs of the fragmented industrial user base. The efficiency and reliability of this indirect channel are key competitive factors, ensuring that industrial clients minimize system downtime by securing the precise sealing element quickly and reliably.

Flange Gasket Sheet Market Potential Customers

The consumer base for flange gasket sheets is highly specialized, consisting of major industrial operators who prioritize asset integrity, environmental compliance, and long-term operational efficiency. Primary customers include multi-national Oil & Gas companies (NOCs and IOCs) operating complex refining, petrochemical, and exploration sites; large utility providers managing expansive thermal, hydroelectric, and nuclear power generation fleets; and global chemical manufacturers involved in producing aggressive or toxic substances. These entities operate under extremely high safety and environmental scrutiny, meaning their procurement criteria are heavily weighted towards certified material performance, technical support documentation, and proven reliability in service, often necessitating customized engineering solutions over standard products.

Beyond the primary processing industries, significant demand originates from secondary sectors essential to the global supply chain, such as large-scale industrial maintenance contractors (MRO service providers) who manage maintenance and turnaround projects for smaller facilities; major engineering, procurement, and construction (EPC) firms responsible for building new infrastructure; and specialized high-tech manufacturers (e.g., semiconductor and aerospace industries). The high-tech sector, in particular, requires gaskets made of ultra-high purity PTFE for clean room and process fluid handling applications where any level of material contamination is unacceptable, driving demand for the most specialized end of the material spectrum.

Finally, governmental and municipal entities represent a consistent demand segment, including naval and defense operations requiring materials compliant with military specifications, and public works departments managing critical water and wastewater treatment infrastructure. These buyers demand durable, often rubber-based or non-metallic composite sheets that offer longevity and resistance to specific service media, while adhering to public safety and environmental regulations. The complexity of the customer base requires suppliers to maintain broad material portfolios and robust technical training programs to ensure proper application and installation across varied and highly specific end-use environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garlock Sealing Technologies, Teadit, Klinger Group, Flowserve Corporation, A.W. Chesterton Company, Federal-Mogul LLC, Flexitallic Group, James Walker Group, Lamons, Frenzelit GmbH, Leader Gasket Technologies, W. L. Gore & Associates, Meccanotecnica Umbra, Carrara SpA, Donit Tesnit d.o.o., Reinz-Dichtungs-GmbH, SLADE Inc., Top-Sealing Gasket Co., Sepco Sealing Solutions, Sunwell Sealing Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flange Gasket Sheet Market Key Technology Landscape

The contemporary Flange Gasket Sheet market is characterized by profound technological advancements rooted in material science and enhanced manufacturing precision, all aimed at improving sealing integrity under increasingly severe operating conditions. A key focus is the development of next-generation composite Non-asbestos Fiber (NAF) sheets. These advanced NAF formulations utilize complex, proprietary blends of high-modulus inorganic fibers, specialized mineral fillers, and advanced elastomeric binders (such as highly cross-linked NBR or high-performance aramid matrices) to significantly increase thermal stability and chemical resistance while drastically minimizing creep relaxation under high heat and pressure, which has historically been the Achilles' heel of composite sealing materials. This technological push is essential for NAF to remain competitive in moderately critical applications requiring regulatory compliance.

Another dominant technology involves the continuous evolution of flexible graphite sealing materials. Technological innovation here focuses on achieving ultra-high purity graphite foil (>99% carbon content) to maximize resistance to chemical attack and high temperatures (up to 550°C and beyond in non-oxidizing environments). Furthermore, the methods of reinforcement have advanced, employing specialized metallic tangs, adhesive-free bonding, or multi-layered composite foil inserts to improve the material's mechanical strength, handling characteristics, and resistance to radial extrusion or blow-out in critical high-pressure services. These advancements are critical for satisfying the stringent fire-safe requirements (API 6FB) demanded by the hydrocarbon processing industry, ensuring the seal remains intact during catastrophic fire events.

Finally, technology is increasingly integrated into the product lifecycle via computational modeling and smart system enablement. Advanced computational tools, including high-fidelity Finite Element Analysis (FEA), are standard practice for simulating complex bolt load distribution, thermal gradients, and fatigue life of gasket sheets before any physical prototyping, optimizing design for specific flange geometries and operational cycles. Emerging technologies, though still niche, include the development of smart gaskets—sheets containing micro-sensors, specialized pressure-sensitive coatings, or integrated RFID tags—that allow for continuous or periodic integrity monitoring. This convergence of material science with digital intelligence is setting the stage for highly responsive, preventative maintenance regimes, transforming the traditional consumable component into an integral sensor element within the industrial IoT ecosystem.

Regional Highlights

The Flange Gasket Sheet Market's regional segmentation underscores diverse growth patterns driven by local regulatory frameworks, industrial maturity, and capital investment cycles, requiring regionally adapted sales and product strategies.

- Asia Pacific (APAC): This region commands the largest market share and the highest growth rate globally, driven by an unparalleled scale of industrial infrastructure development. Key economic activities include vast chemical park expansions, major thermal and nuclear power generation construction projects, and substantial investments in new oil and gas refining capacity, particularly across China, India, and ASEAN countries. While price remains highly competitive in this market, the increasing requirement for adherence to international project specifications (often dictated by foreign investment) is accelerating the adoption of certified, high-performance graphite and PTFE sheets, gradually displacing lower-quality domestic alternatives.

- North America: North America operates as a mature, high-value, replacement-driven market. Growth is primarily sustained by continuous MRO activities within aging infrastructure in the oil, gas, and chemical sectors, coupled with extremely rigorous enforcement of environmental regulations (e.g., U.S. EPA consent decrees). This legislative environment ensures sustained demand for premium, emissions-compliant sealing solutions (API 622 certified), resulting in higher average selling prices per unit compared to the global average. Technical expertise and long-term performance guarantees are key competitive factors for suppliers in this highly regulated domain.

- Europe: The European market is characterized by technological maturity, stringent environmental protection standards (e.g., TA-Luft compliance), and a strategic focus on sustainability. Demand is strong in high-specification sectors such as pharmaceuticals, specialized chemicals, and the expanding new energy infrastructure (geothermal, carbon capture). European end-users often prioritize suppliers who offer verifiable environmental product declarations (EPDs) and solutions that are non-toxic and recyclable, supporting the region’s broader circular economy objectives. The market demands highly specialized material certification and compliance with numerous local and EU-wide safety directives.

- Middle East & Africa (MEA): Market growth in MEA is almost entirely project-dependent, tied to massive, cyclical investment waves by National Oil Companies (NOCs) in upstream exploration and downstream processing capacity expansion, notably in Saudi Arabia and the UAE. Due to the high-temperature and high-pressure operational environment, and the critical nature of these assets, the market strongly favors high-specification, robust materials, including high-quality metallic and reinforced graphite seals, prioritizing long-term reliability and supplier trust over initial cost considerations. Logistics and ability to deliver on-site technical support are also vital.

- Latin America: This region presents moderate and often fluctuating growth potential, heavily influenced by local economic and political stability, impacting investment in mining, petrochemicals, and energy distribution networks. Key markets such as Brazil and Mexico demonstrate pockets of high technical demand, particularly in deep-water offshore operations and sophisticated manufacturing. While cost sensitivity remains a general factor, increasing local enforcement of safety standards is gradually driving the market towards adopting reliable, certified Non-asbestos Fiber and standard graphite materials for crucial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flange Gasket Sheet Market.- Garlock Sealing Technologies (EnPro Industries)

- Teadit International GmbH

- Klinger Group

- Flowserve Corporation

- A.W. Chesterton Company

- Federal-Mogul LLC (Tenneco)

- Flexitallic Group

- James Walker Group

- Lamons (Gasket Division)

- Frenzelit GmbH

- Leader Gasket Technologies, Inc.

- W. L. Gore & Associates (Gore Sealing Products)

- Meccanotecnica Umbra S.p.A.

- Carrara S.p.A.

- Donit Tesnit d.o.o.

- Reinz-Dichtungs-GmbH

- Slade, Inc.

- Top-Sealing Gasket Co., Ltd.

- Sepco Sealing Solutions

- Sunwell Sealing Materials

Frequently Asked Questions

Analyze common user questions about the Flange Gasket Sheet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers influencing the switch from traditional to high-performance flange gasket materials?

The primary drivers are stringent environmental regulations requiring compliance with low-emission standards (e.g., ISO 15848-1, TA-Luft), the economic necessity to reduce costly operational downtime caused by gasket failure, and enhanced workplace safety mandates. High-performance materials like ePTFE and certified graphite offer superior chemical inertness, high resilience, and significantly reduced fugitive emissions compared to older, legacy sealing products, ensuring asset integrity over longer periods.

How does the Material Type segmentation affect procurement decisions in the Oil & Gas sector?

In Oil & Gas, procurement decisions are strictly governed by temperature, pressure, and media compatibility, demanding certified performance profiles. Graphite and high-quality PTFE derivatives are typically chosen for critical hydrocarbon services and extreme temperature environments (like refining), offering fire-safe capabilities and low creep characteristics. Conversely, robust Non-asbestos Fiber sheets are used for utility and moderate service applications, balancing certified performance with optimized total acquisition cost.

What is the significance of creep relaxation in the context of flange gasket sheet performance?

Creep relaxation is a critical material property referring to the gradual loss of sealing stress (bolt load) applied to the gasket material over time, especially when exposed to high temperatures. Excessive creep relaxation leads to a reduction in contact pressure, potentially causing joint leakage and catastrophic failure. Advanced gasket materials are engineered using specialized binders and fiber structures specifically to minimize this effect, ensuring sustained sealing integrity and compliance with operational lifespan expectations.

Which geographical region exhibits the strongest growth potential for flange gasket sheets, and why?

Asia Pacific (APAC), particularly fueled by extensive investment in industrial capacity across China, India, and Southeast Asia, demonstrates the strongest volumetric growth potential. This surge is driven by large-scale infrastructure build-out, rapid expansion of petrochemical and power generation facilities, and increasing regional compliance with international safety and performance standards, thereby stimulating both OEM and MRO demand simultaneously.

How is digitalization, including AI, beginning to impact the operational lifespan management of gasket sheets?

Digitalization impacts operational management through advanced predictive maintenance (PdM) strategies. AI algorithms analyze continuous data streams from industrial IoT sensors (acoustic, thermal, vibration) near critical flange joints to predict the remaining useful life (RUL) of the installed gasket. This capability enables highly optimized, condition-based replacement planning, maximizing operational uptime, reducing unscheduled outages, and minimizing the environmental footprint associated with premature replacements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager