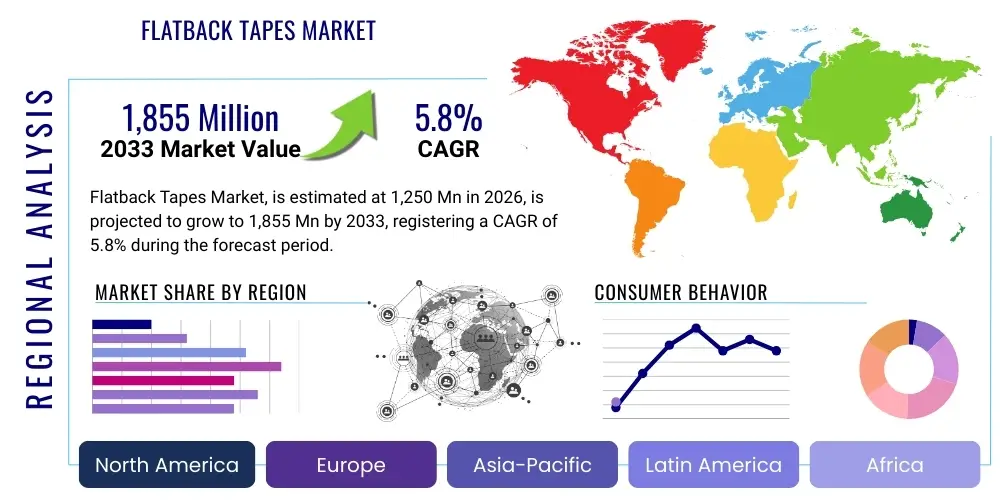

Flatback Tapes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441504 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Flatback Tapes Market Size

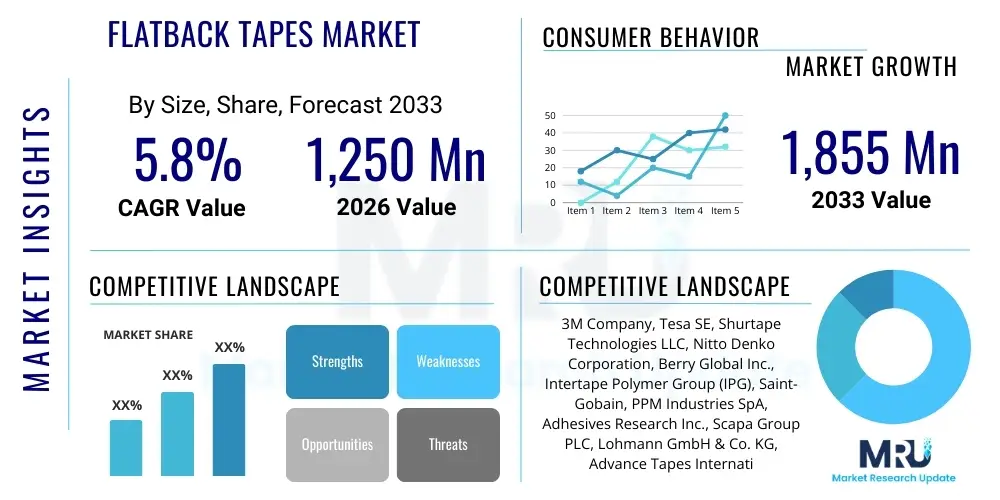

The Flatback Tapes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1,250 Million in 2026 and is projected to reach $1,855 Million by the end of the forecast period in 2033.

Flatback Tapes Market introduction

Flatback tapes are high-performance adhesive solutions characterized by their smooth, non-creped paper backing, which is often saturated for enhanced strength and moisture resistance. This unique construction provides exceptional conformability, superior tensile strength, and critically, a very clean edge definition, making them distinctly suited for demanding industrial applications that require high precision and residue-free removal. The backing material, typically a dense paper or film, is coated with specialized adhesives, frequently based on synthetic rubber or solvent-free acrylics, formulated to adhere strongly to diverse substrates including metal, plastic, wood, and painted surfaces, while maintaining stability across varied environmental conditions. The fundamental appeal of flatback tapes lies in their robust nature, offering a reliable substitute for traditional masking or utility tapes in scenarios demanding higher performance metrics regarding shear strength and thermal stability, contributing substantially to overall process efficiency in manufacturing workflows.

The primary applications of flatback tapes are concentrated within heavy-duty packaging, specialized masking processes, graphic arts, splicing operations in the paper and printing industries, and general industrial holding and bundling. In the packaging sector, these tapes are integral for securing heavy shipments and reinforcing cartons due to their excellent resistance to abrasion and tearing. Their ability to deliver a sharp, clean paint line makes them indispensable in automotive refinishing and aerospace maintenance, where precision masking is crucial for high-quality finishing. Furthermore, in the graphic arts and printing industry, flatback tapes are essential for web splicing, where continuous running of machinery demands tapes that can withstand high speeds and temperatures without failure or adhesive migration, ensuring seamless transitions between paper rolls and minimizing production downtime.

The market expansion is robustly driven by the burgeoning e-commerce and logistics sectors, which are increasingly reliant on durable and tamper-evident packaging materials, where flatback tapes offer superior performance compared to standard packaging tapes. Furthermore, the global proliferation of sophisticated manufacturing techniques, particularly in the automotive and electronics sectors, necessitates the use of high-quality masking materials capable of resisting extreme temperatures and chemical exposure encountered during curing and coating processes. The push toward developing environmentally sound products, specifically flatback tapes utilizing recycled content backings and bio-based adhesives, is also acting as a significant market accelerant. These factors, combined with ongoing product development aimed at improving adhesive longevity and thermal tolerance, underscore the optimistic growth projections for the Flatback Tapes Market globally over the forecast period.

Flatback Tapes Market Executive Summary

The Flatback Tapes Market is characterized by intense focus on adhesive performance enhancement, driven by industrial demands for higher heat resistance and cleaner removal characteristics, particularly within the specialized manufacturing segments. Business trends indicate a marked shift towards sustainable product development, with leading manufacturers heavily investing in solvent-free acrylic adhesives and paper backings derived from sustainably managed forests or recycled materials, responding directly to corporate sustainability mandates from large-scale industrial buyers. Strategic partnerships between raw material suppliers and tape converters are becoming crucial for securing high-quality paper pulp and specialized saturants, ensuring stable supply chains amidst volatile commodity prices. Furthermore, the market is observing a trend toward customized tape solutions, moving away from standardized products to application-specific variants tailored for specific industry requirements such as low-VOC emissions for sensitive environments or high tensile strength for heavy machinery bundling, thereby increasing the average selling price and profitability margins for specialized producers.

Regionally, Asia Pacific (APAC) currently dominates the market share and is poised for the highest growth rate, fueled by rapid industrialization, expansion of the electronics manufacturing hub, and massive investments in infrastructure development, all of which require reliable, high-strength adhesive solutions. North America and Europe, while being mature markets, exhibit steady demand driven by stringent quality standards in automotive and aerospace maintenance, pushing innovation in higher-performance, premium flatback tape categories. These regions are also at the forefront of implementing regulatory changes favoring eco-friendly tapes, pressuring manufacturers to swiftly adopt greener chemistries. Emerging markets in Latin America and the Middle East and Africa (MEA) are contributing significantly to the demand for packaging-grade flatback tapes, linked directly to growth in retail and logistics infrastructure development, although manufacturing complexity remains lower compared to developed regions.

Segment trends reveal that the use of specialized masking flatback tapes, especially those capable of enduring high-temperature bake cycles, is witnessing accelerated adoption, primarily driven by automotive original equipment manufacturers (OEMs) seeking flawless finish quality. By adhesive type, synthetic rubber-based tapes maintain a substantial share due to their cost-effectiveness and good initial tack, whereas acrylic-based tapes are rapidly gaining traction due to superior aging resistance, UV stability, and better performance in exterior or high-stress environments, justifying their higher price point. The packaging end-user segment remains the volume leader, but the specialized industrial segments, including paper splicing and painting, are generating higher revenue growth and profitability due to the advanced technical specifications required for these critical applications, emphasizing the market's trajectory towards performance differentiation rather than pure volume output.

AI Impact Analysis on Flatback Tapes Market

User inquiries regarding AI's impact on the Flatback Tapes Market primarily revolve around operational efficiency, quality control, and predictive maintenance within the tape manufacturing process and its end-user applications. Common questions center on how AI can optimize adhesive formulation based on real-time raw material properties, automate visual inspection to detect micro-defects in the tape backing or coating uniformity, and predict machinery failures in high-speed coating lines, thereby minimizing waste and optimizing throughput. Concerns are often raised about the initial investment cost for integrating AI-driven systems and the necessary expertise required to manage sophisticated machine learning models for quality assurance. Users anticipate that AI will fundamentally transform supply chain logistics, enabling highly accurate demand forecasting for specific tape SKUs and dynamic inventory management, ultimately leading to reduced lead times and improved overall market responsiveness, focusing on data-driven manufacturing excellence to maintain competitive advantage.

- AI-driven optimization of adhesive formulation parameters to enhance specific performance metrics (e.g., thermal resistance, peel strength).

- Implementation of Computer Vision (CV) systems for automated, real-time defect detection during the coating and slitting phases, ensuring superior product consistency.

- Predictive maintenance analytics for continuous coating lines, minimizing unplanned downtime and extending equipment lifespan.

- Enhanced supply chain management through machine learning algorithms for precise demand forecasting and raw material procurement optimization.

- Automated quality assurance reporting and traceability, linking specific tape batches to performance data for faster root cause analysis.

DRO & Impact Forces Of Flatback Tapes Market

The dynamics of the Flatback Tapes Market are shaped by a complex interplay of growth drivers and persistent constraints, with emerging opportunities paving the way for future expansion. Key drivers include the exponential growth of e-commerce necessitating strong packaging solutions, the increasing demand from automotive and aerospace sectors for precision masking tapes, and technological advancements leading to flatback tapes with improved thermal and UV stability. Conversely, market growth is restrained by volatility in the price of key raw materials, particularly paper pulp and petrochemical-derived adhesives, which impacts manufacturing costs and overall market stability. Furthermore, stringent environmental regulations regarding volatile organic compounds (VOCs) in adhesive formulations pose a continuous challenge, requiring costly reformulations and process adjustments. The primary opportunity lies in developing bio-based and fully recyclable flatback tapes, aligning with global corporate sustainability goals, and expanding applications into high-growth areas like renewable energy infrastructure manufacturing, where durable, specialized tapes are essential for assembly and protection.

Segmentation Analysis

The Flatback Tapes Market segmentation provides a detailed operational breakdown across various dimensions including backing material, adhesive type, end-user industry, and application, enabling precise market analysis and strategic positioning. Segmentation by backing material typically includes paper-based and specialized film-based flatback tapes, with paper dominating due to cost and flexibility. Adhesive types—rubber (natural and synthetic), acrylic, and silicone—determine the tape’s performance characteristics regarding adhesion strength, temperature resistance, and aging properties. Crucial segmentation is observed across end-user industries such as automotive, general industrial, packaging, graphic arts, and construction, each utilizing flatback tapes for distinct high-value purposes. This detailed segmentation framework aids stakeholders in identifying niche growth pockets and customizing product offerings to meet highly specific industrial requirements efficiently.

- By Adhesive Type:

- Rubber Based (Natural Rubber, Synthetic Rubber)

- Acrylic Based

- Silicone Based

- By Backing Material:

- Paper

- Film (e.g., Polyester-laminated Flatback)

- By Application:

- Masking

- Splicing and Tabbing

- Packaging and Bundling

- Holding and Protecting

- By End-User Industry:

- Automotive

- Aerospace

- Building and Construction

- Printing and Graphic Arts

- General Industrial

- Logistics and E-commerce Packaging

Value Chain Analysis For Flatback Tapes Market

The value chain for the Flatback Tapes Market commences with the upstream supply of raw materials, primarily focusing on the procurement of specialized paper backing, pulp derivatives, synthetic polymers for saturation, and various chemical components for adhesive formulation. Upstream activities are critical, as the quality of the non-creped paper backing significantly dictates the final product’s tensile strength and conformability. Manufacturers rely heavily on consistent, high-quality sourcing of synthetic rubber polymers (such as block copolymers) or acrylic monomers. Price volatility and supply security for these raw materials, which are often petrochemical derivatives, significantly influence manufacturing costs and final product pricing. Strategic sourcing partnerships and vertical integration into paper coating or polymer synthesis are common strategies employed by major market participants to mitigate supply chain risks and maintain a competitive cost structure across production sites.

The midstream stage involves the core manufacturing processes, encompassing paper saturation, adhesive compounding, coating, drying, and precision slitting. This stage is highly capital-intensive, requiring advanced coating machinery and specialized curing ovens to ensure uniform adhesive thickness and optimal cross-linking. The choice between solvent-based, water-based, and hot melt coating technologies determines the environmental profile and production speed. Direct distribution channels are typically employed for large industrial clients, such as automotive OEMs or major packaging converters, where technical support and bulk customization are required. Indirect channels, including industrial distributors, wholesalers, and specialized e-commerce platforms, are utilized to reach smaller end-users and geographically dispersed markets, ensuring broader market penetration and efficient inventory management across diverse regional demand landscapes.

The downstream analysis focuses on the final consumption and service aspects of flatback tapes. Key downstream activities include inventory management by distributors, application engineering support provided to industrial users for specialized masking or splicing operations, and end-of-life considerations, particularly regarding disposal and recyclability of the used tapes. The market is segmented into high-volume, cost-sensitive packaging applications and low-volume, high-margin specialized industrial applications. End-user feedback loop concerning product performance, such as clean removal characteristics and thermal stability, is vital for continuous product refinement. Effective downstream management, characterized by responsive technical services and geographically optimized stocking points, is essential for maintaining brand loyalty and capturing repeat business in competitive end-user sectors.

Flatback Tapes Market Potential Customers

The primary consumers of flatback tapes span a diversified range of heavy and light industrial sectors, dictated by the product's superior performance attributes over standard adhesive solutions. The most significant customer segment includes multinational automotive manufacturers and their tiered suppliers (Tier 1 and Tier 2). These entities utilize flatback tapes extensively for critical masking during multi-stage painting, coating, and polishing processes, requiring tapes that deliver precise paint line separation and can withstand high-temperature bake cycles without adhesive residue or tape degradation. Similarly, the aerospace industry, requiring meticulous process control and material traceability, represents a high-value customer base, using specialized, solvent-resistant flatback tapes for masking, surface protection, and temporary component holding during assembly and repair operations where safety and component integrity are paramount.

Another dominant customer segment is the global packaging, logistics, and e-commerce industry. Flatback tapes are increasingly preferred for heavy-duty carton sealing, bundling, and palletizing due to their robust tensile strength, which provides enhanced security and reduces the risk of package failure during transit, especially for high-value or fragile goods. The clean, professional appearance of flatback tapes also appeals to brand-conscious companies. Furthermore, the printing and graphic arts sector forms a specialized but critical customer group. Commercial printers and paper converters rely heavily on flatback tapes for essential splicing and tabbing applications, ensuring continuous high-speed operation of printing presses and paper converting machinery, where tape failure could result in significant material waste and costly production halts.

The construction and general industrial fabrication sectors also represent substantial potential buyers. In construction, specialized flatback tapes are used for securing materials, surface protection during finishes, and temporary holding applications where residue-free removal on sensitive surfaces is necessary. General industrial end-users, including metal fabricators, appliance manufacturers, and electronic component assembly plants, utilize flatback tapes for bundling wire harnesses, holding parts in place during automated manufacturing, and temporary protection of finished surfaces against scratches and abrasions. The purchasing decisions across all these customer groups are heavily influenced not only by price but, more critically, by performance criteria such as dimensional stability, certified temperature resistance, and adherence to specific industry quality standards and environmental compliance mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250 Million |

| Market Forecast in 2033 | $1,855 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Tesa SE, Shurtape Technologies LLC, Nitto Denko Corporation, Berry Global Inc., Intertape Polymer Group (IPG), Saint-Gobain, PPM Industries SpA, Adhesives Research Inc., Scapa Group PLC, Lohmann GmbH & Co. KG, Advance Tapes International, Cantech, Ahlstrom-Munksjö, and A&C Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flatback Tapes Market Key Technology Landscape

The technology landscape for the Flatback Tapes Market is dominated by advancements in coating techniques and the continuous refinement of adhesive chemistry, aimed at improving performance while meeting sustainability goals. Solvent-free adhesive technology, particularly the shift towards 100% solid UV-curable acrylics and specialized hot-melt synthetic rubbers (HMSR), is a central focus. These technologies significantly reduce environmental impact by eliminating the need for high-VOC solvents, thereby complying with increasingly rigorous air quality standards globally, especially in Europe and North America. Precision coating technology, including reverse roll coating and gravure coating, ensures highly uniform adhesive application across the flat, non-creped backing. The effectiveness of the final product, especially its clean-removal characteristic and defined edge, is heavily dependent on maintaining tight tolerances in the coating thickness and saturation level of the paper backing during the manufacturing process.

Further technological differentiation is achieved through sophisticated backing treatment processes. The paper backing undergoes specific saturation and release coating treatments to enhance its tensile strength, tear resistance, and moisture stability, simultaneously ensuring controlled unwinding tension and flawless removal post-application. Manufacturers utilize advanced release agents, often fluorosilicones, optimized to provide a controlled adhesion balance: strong enough for securing applications yet weak enough for residue-free separation, crucial for masking tapes. Research and development efforts are focused on integrating nanotechnologies to create functional layers that enhance thermal stability, allowing specific flatback tapes to withstand temperatures exceeding 300°F required in powder coating and specialized composite curing applications, thereby expanding their utility into extreme processing environments.

Process automation and quality control represent another critical technological area. High-speed slitting and winding technologies, combined with inline sensor systems and computer vision inspection tools, ensure that the jumbo rolls are converted into final consumer-sized rolls with minimal waste and maximum precision. Innovations in digital printing technology allow for bespoke branding and custom product information directly onto the flatback backing, adding value for large industrial users. The adoption of IoT sensors throughout the manufacturing plant facilitates real-time monitoring of temperature, humidity, and coating speed, leading to proactive process adjustments. This technological integration not only enhances product quality consistency but also dramatically improves manufacturing efficiency and reduces operational costs, driving the overall competitiveness of market leaders focusing on technical superiority and process optimization.

Regional Highlights

Geographical market analysis reveals significant variance in demand patterns, regulatory pressures, and market maturity across key regions. Asia Pacific (APAC) stands out as the largest and fastest-growing market for flatback tapes, largely attributable to robust manufacturing growth across China, India, and Southeast Asian nations. The region's dominance is driven by high volume consumption in electronics assembly, general industrial fabrication, and the region's position as a global hub for packaging and e-commerce fulfillment. Local manufacturers are increasingly adopting advanced coating techniques and focusing on providing cost-effective, high-performance tapes to service the expansive regional supply chains, though quality variability sometimes exists compared to premium Western brands. Infrastructure development projects across APAC further bolster demand for construction and protective applications of flatback tapes.

North America and Europe constitute mature markets characterized by stringent quality requirements and a high preference for specialized, premium flatback tapes. Demand in these regions is heavily influenced by the automotive, aerospace, and medical sectors, which prioritize high-specification tapes featuring low-VOC formulations, superior temperature tolerance, and certified material traceability. European market growth is particularly constrained by comprehensive environmental directives, driving immediate adoption of sustainable and water-based adhesive solutions, leading to higher average selling prices. North America benefits from a strong domestic automotive manufacturing base and a mature logistics sector, maintaining consistent demand for high-strength packaging and specialized industrial holding applications, with a notable trend towards customization and specialized roll sizing to optimize end-user productivity.

- Asia Pacific (APAC): Dominant market share fueled by industrial expansion (China, India), high demand from consumer electronics manufacturing, and exponential growth in e-commerce packaging, driving volume consumption.

- North America: Stable, high-value market focused on precision applications in automotive masking and aerospace. Strong regulatory pressure pushes for solvent-free and environmentally compliant tapes.

- Europe: Characterized by demanding specifications for performance and sustainability. Key growth drivers include automotive refinishing (aftermarket) and strict industrial manufacturing standards.

- Latin America (LATAM): Emerging growth market driven by regional industrialization and modernization of the logistics sector, creating demand for basic and mid-range flatback packaging tapes.

- Middle East and Africa (MEA): Growth tied to infrastructure investment, construction boom, and expansion of regional logistics hubs, primarily driving demand for general industrial and heavy-duty packaging tapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flatback Tapes Market.- 3M Company

- Tesa SE

- Shurtape Technologies LLC

- Nitto Denko Corporation

- Berry Global Inc.

- Intertape Polymer Group (IPG)

- Saint-Gobain

- PPM Industries SpA

- Adhesives Research Inc.

- Scapa Group PLC

- Lohmann GmbH & Co. KG

- Advance Tapes International

- Cantech

- Ahlstrom-Munksjö

- A&C Medical

- Sika AG

- Vancive Medical Technologies

- Flexcon Company, Inc.

- Lintec Corporation

- Pro Tapes & Specialties, Inc.

Frequently Asked Questions

Analyze common user questions about the Flatback Tapes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes flatback tape from standard masking tape?

Flatback tape features a smooth, non-creped paper backing that offers higher tensile strength, superior conformability, and excellent edge definition, making it ideal for precision masking, splicing, and heavy-duty bundling applications where clean removal is mandatory.

Which end-user industries drive the highest demand for specialized flatback tapes?

The automotive (for high-temperature paint masking), aerospace (for critical surface protection), and high-speed printing/graphic arts (for web splicing) industries drive the highest demand for specialized, high-performance flatback tapes due to their demanding processing requirements.

How are environmental regulations impacting the manufacturing of flatback tapes?

Environmental regulations, particularly regarding VOC emissions, are compelling manufacturers to transition towards solvent-free adhesive systems, such as water-based acrylics and 100% solid hot-melt adhesives, driving up R&D investments and operational costs for compliance.

What is the projected Compound Annual Growth Rate (CAGR) for the Flatback Tapes Market?

The Flatback Tapes Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, primarily driven by growth in e-commerce packaging and specialized industrial application requirements globally.

What technological advancements are currently most significant in flatback tape production?

The most significant technological advancements include the adoption of precision coating techniques for uniform adhesive application, the integration of UV-curable and solvent-free adhesive chemistries, and the use of advanced backing saturation treatments for enhanced thermal resistance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager