Flatbread Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442901 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Flatbread Market Size

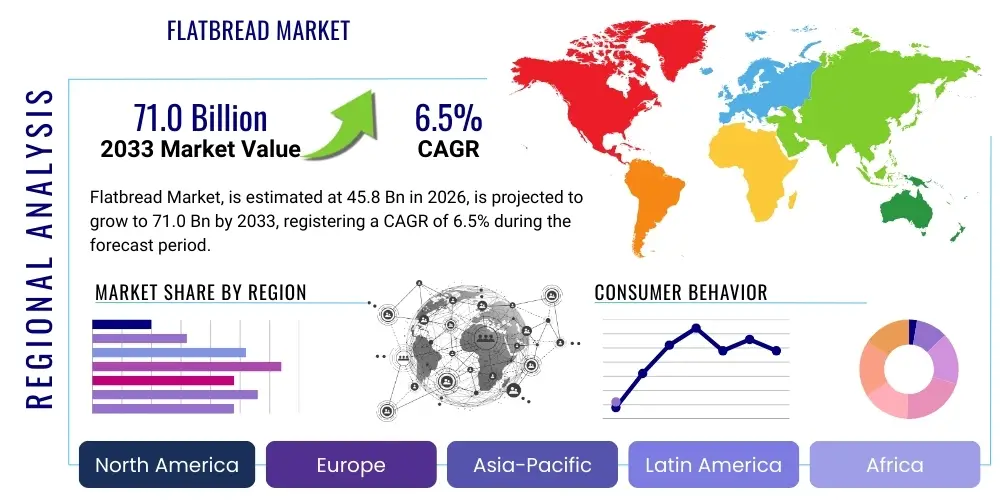

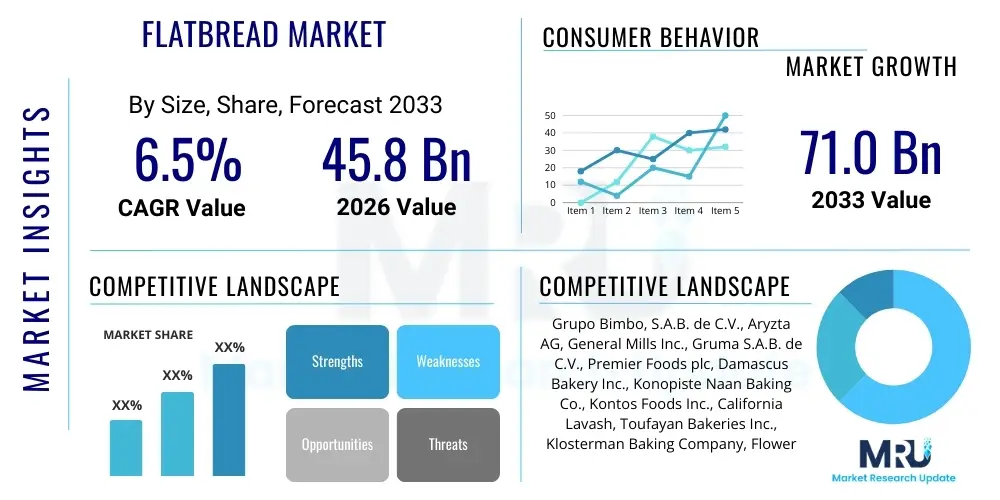

The Flatbread Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. This robust growth trajectory is driven primarily by the escalating demand for convenient, ethnic, and ready-to-eat food options globally, coupled with rapid urbanization and shifting consumer demographics. The versatility of flatbreads, encompassing products like tortillas, naan, pita, and roti, allows them to penetrate various dining occasions, from quick snacks to full meals.

The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 71.0 Billion by the end of the forecast period in 2033. This significant expansion is supported by continuous product innovation, particularly in the health and wellness segment, where manufacturers are increasingly focusing on whole grain, gluten-free, and high-fiber variants. Technological advancements in preservation techniques, such as modified atmosphere packaging (MAP), are also crucial in extending shelf life and facilitating wider geographical distribution, thereby contributing substantially to market size growth.

Regional dynamics play a vital role, with Asia Pacific (APAC) emerging as a high-growth region due to the deep cultural integration of flatbreads as staple foods, combined with rising disposable incomes. Meanwhile, North America and Europe continue to be major revenue generators, driven by the strong presence of international cuisine restaurants and the high adoption rate of convenient packaged foods. The interplay between traditional consumption patterns and modern demand for convenience will define the market trajectory over the forecast period.

Flatbread Market introduction

The Flatbread Market encompasses the production, distribution, and consumption of thin, leavened or unleavened bread products traditionally baked from flour, water, and salt. These products represent a fundamental category within the global baked goods industry, characterized by their simplicity, adaptability, and cultural significance across continents. Key products range from the globally recognized Mexican tortilla and Middle Eastern pita to the Indian naan and roti, each exhibiting distinct ingredient profiles and preparation methods. The primary applications span the food service sector (restaurants, fast-food chains) and the retail segment, where they are utilized as bases for wraps, sandwiches, dips, and complements to main courses.

The market expansion is underpinned by compelling driving factors, most notably the heightened consumer preference for convenience foods that require minimal preparation time. Urbanization and the fast-paced modern lifestyle have increased the reliance on ready-to-eat or easily reheatable options, a niche perfectly filled by packaged flatbreads. Furthermore, the rising globalization of culinary trends has led to widespread acceptance and demand for ethnic foods in non-native markets, boosting the consumption of specific flatbread types such as pita and tortilla chips. The inherent versatility of flatbreads makes them easily adaptable to various flavor profiles and dietary restrictions, further cementing their market position.

Significant benefits associated with flatbreads include their long shelf life in packaged formats, ease of storage, and suitability for bulk preparation in commercial settings. For consumers, the availability of options like whole wheat, multigrain, and specialized gluten-free flatbreads aligns perfectly with the current health and wellness megatrend. This alignment allows the market to cater to diverse dietary requirements while fulfilling the core demand for affordable and flexible meal components. These product characteristics, coupled with strategic marketing and expanded retail distribution networks, continue to fuel sustained market growth globally.

Flatbread Market Executive Summary

The global Flatbread Market is experiencing dynamic growth, propelled by robust business trends focusing on health-conscious innovation and expansive geographical reach. Key business trends indicate a definitive shift toward incorporating functional ingredients such as high fiber, proteins, and ancient grains (e.g., quinoa, millet) to appeal to the nutritionally discerning consumer base. Manufacturers are investing heavily in automation and optimized supply chain logistics to reduce production costs and improve product freshness, a critical determinant of consumer satisfaction. Strategic mergers, acquisitions, and partnerships are also common, particularly as established bakery companies seek to integrate specialized regional flatbread producers into their global portfolios, leveraging local expertise and distribution channels.

Regionally, the market exhibits divergent growth rates and consumption patterns. The Asia Pacific region, characterized by its deep-rooted consumption culture of products like Roti and Naan, is slated for the highest growth due to burgeoning population and rising disposable incomes fueling demand for commercially packaged variants. North America remains a lucrative market, dominated by the demand for tortillas and wraps, driven significantly by the growth of the quick-service restaurant (QSR) sector and strong Mexican food cultural influence. Europe demonstrates steady growth, concentrating on premiumization, organic ingredients, and artisan-style flatbreads that appeal to sophisticated consumer tastes, particularly in countries like the UK and Germany.

Segmentation trends highlight the increasing dominance of the whole grain segment within the ingredient category, responding directly to consumer emphasis on gut health and improved nutrition. The frozen segment is also gaining traction, particularly in Western markets, offering maximum convenience and extended shelf life, addressing the needs of busy households. Furthermore, the distribution channel analysis reveals that supermarkets and hypermarkets maintain the largest market share due to high consumer footfall and broad product availability, although the online retail channel is projected to record the highest CAGR, reflective of the broader e-commerce shift accelerated by recent global events.

AI Impact Analysis on Flatbread Market

Common user questions regarding AI's impact on the Flatbread Market often revolve around operational efficiency, product consistency, and supply chain resilience. Users are keenly interested in understanding how AI-driven predictive maintenance can reduce machine downtime in high-volume flatbread production facilities and how machine learning algorithms optimize recipe formulation for desired texture and flavor profiles based on consumer feedback data. A major theme is also the application of AI in minimizing waste by accurately forecasting demand fluctuations across diverse geographical and seasonal consumption patterns, a critical factor given the relatively short shelf life of fresh flatbread products.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the manufacturing and distribution segments of the Flatbread Market. AI-powered sensors and vision systems are deployed on production lines to ensure rigorous quality control, identifying anomalies in size, shape, color, and density with greater precision and speed than manual inspection. This immediate feedback loop allows manufacturers to maintain exceptional product consistency, which is paramount in the competitive packaged food sector. Furthermore, AI tools are revolutionizing inventory management by integrating real-time sales data, promotional planning, and external variables (like weather or local events) to execute highly accurate demand forecasting, significantly reducing spoilage and optimizing storage costs.

Beyond the factory floor, AI profoundly impacts customer relationship management and new product development (NPD). Natural Language Processing (NLP) tools analyze vast amounts of social media commentary and online reviews to swiftly identify emerging flavor trends, ingredient preferences, or unmet consumer needs, providing actionable insights for R&D departments. This allows flatbread manufacturers to rapidly prototype and launch novel products—such as specialized low-carb or ethnic-fusion flatbreads—with a higher probability of market success. The integration of AI thus acts as a catalyst for both operational excellence and strategic market responsiveness within the flatbread industry.

- AI-driven Predictive Maintenance: Reduces unscheduled downtime for high-speed mixers and ovens.

- Automated Quality Inspection: Ensures precise size, weight, and consistency using machine vision systems.

- Optimized Demand Forecasting: Utilizes ML to analyze complex sales data, reducing waste and overstocking.

- Supply Chain Synchronization: Improves ingredient sourcing and logistics planning based on real-time market needs.

- Rapid New Product Development: Analyzes consumer sentiment (NLP) to identify and prioritize flavor innovation.

- Energy Efficiency Optimization: AI algorithms fine-tune baking temperatures and durations to minimize energy consumption.

DRO & Impact Forces Of Flatbread Market

The Flatbread Market's growth is primarily driven by the expanding global palate and the crucial need for convenient food solutions, especially within rapidly urbanizing populations. Restraints, however, include inherent challenges related to the perishable nature of many fresh flatbread products and intense competition from established staple food categories. The primary opportunity lies in capitalizing on the health and wellness trend through innovation in gluten-free and functional ingredients, coupled with expansion into untapped geographical markets through optimized cold chain logistics. These Drivers, Restraints, and Opportunities (DRO) collectively define the competitive landscape and exert powerful impact forces on market direction.

Key drivers creating positive momentum include the widespread adoption of international cuisines, which inherently boosts the demand for authentic flatbread bases such as tortillas and pitas in non-traditional markets. Furthermore, the demographic shift toward smaller households and working professionals increases reliance on packaged, ready-to-eat bakery items, favoring the convenience offered by flatbreads. The affordability of flatbreads compared to other specialty bakery items also ensures their steady demand across diverse socio-economic segments, reinforcing the market's resilience against economic fluctuations.

Conversely, significant impact forces acting as restraints include the high costs associated with maintaining a robust cold chain necessary to extend the shelf life of fresh products, particularly across vast distribution networks. Another critical restraint is the volatility in raw material costs, specifically flour and edible oils, which directly affects profit margins. Opportunities are being seized through technological innovation, such as the implementation of advanced packaging techniques (e.g., vacuum sealing, nitrogen flushing) to naturally extend freshness without heavy reliance on chemical preservatives, appealing directly to the clean-label consumer segment. The market is also heavily impacted by the consolidation among major food manufacturers aiming to achieve economies of scale and better control over ingredient sourcing.

Segmentation Analysis

The Flatbread Market is broadly segmented based on crucial factors including product type, ingredient composition, nature (fresh or frozen), and primary distribution channels. This granular segmentation allows manufacturers to target specific consumer needs, ranging from cultural authenticity to modern convenience. The product type segment, encompassing tortillas, naan, pita, lavash, and others, demonstrates the market's immense cultural diversity, with regional preferences dictating local dominance. Ingredient-based segmentation, particularly the focus on specialized flours like whole wheat, corn, and increasingly, gluten-free alternatives, reflects the prevailing consumer movement toward healthier, customized dietary choices.

The segmentation by nature—fresh versus frozen—is a major differentiator impacting supply chain complexity and consumer purchasing habits. While fresh flatbreads are highly sought after for superior taste and texture, frozen options offer unparalleled convenience and longevity, crucial for bulk buyers and regions with long supply routes. Furthermore, the distribution channel segmentation underscores the transition in purchasing behavior, with traditional brick-and-mortar stores (supermarkets and convenience stores) currently holding the majority share, yet e-commerce platforms are rapidly gaining ground due to improved logistics and direct-to-consumer models for niche products.

Strategic analysis of these segments reveals that the tortilla category continues to dominate the global market by volume, largely fueled by its penetration in the massive North American QSR and retail sectors. However, the Naan and specialized ethnic flatbreads segments (the 'Others' category) are exhibiting the highest growth rates, driven by the global popularity of Indian, Middle Eastern, and Mediterranean cuisines. Manufacturers are leveraging these trends by developing hybrid products and innovative flavor profiles, such as savory or sweet fillings, to expand flatbread usage beyond traditional meal accompaniments.

- Product Type:

- Tortilla

- Naan

- Pita

- Roti/Chapati

- Lavash

- Other Ethnic Flatbreads (Focaccia, Arepas, etc.)

- Ingredient:

- Wheat Flour

- Corn Flour

- Multigrain

- Gluten-Free Flour (Rice, Tapioca, Almond)

- Nature:

- Fresh

- Frozen

- Dried/Shelf-Stable

- Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Artisan Bakeries and Specialty Stores

- Online Retail

- Food Service (Horeca)

Value Chain Analysis For Flatbread Market

The value chain for the Flatbread Market begins with the upstream sourcing of core agricultural commodities, primarily flour (wheat, corn, specialized grains), yeast, oils, and other stabilizing agents. Upstream analysis focuses heavily on supply chain risk management, including commodity price volatility and ensuring consistent quality and availability of specialized or organic ingredients. Manufacturers often engage in long-term contracts with grain suppliers to mitigate price risks. The midstream involves the intensive processing stage, including mixing, kneading, proofing (for leavened varieties), baking, cooling, and highly automated packaging processes, where efficiency and hygiene standards (HACCP, GMP) are critical determinants of competitive advantage.

The downstream segment encompasses the distribution and end-user engagement. Distribution channels are highly diversified, relying on both direct sales to large food service clients (HORECA) and indirect channels utilizing third-party logistics (3PL) providers to move products from centralized production facilities to retail points. Given the varying shelf-life requirements, efficient cold chain management is mandatory for fresh and frozen flatbreads. Direct distribution allows manufacturers better control over branding and pricing, while indirect distribution offers wider market penetration, particularly into fragmented small-scale retail and independent grocery stores.

The crucial distinction between direct and indirect distribution channels significantly impacts margin capture. Direct sales to large national or international retail chains and HORECA partners often involve high volume but potentially lower margins due to strong buyer negotiating power. Conversely, sales through indirect channels, such as specialized distributors or online platforms focusing on niche gluten-free or artisan flatbreads, can command higher retail price points but incur additional costs from intermediaries. Successful players optimize this balance by utilizing advanced ERP systems to track inventory in real-time across all channels, ensuring minimal waste and maximizing product freshness upon delivery.

Flatbread Market Potential Customers

Potential customers for the Flatbread Market are highly diverse, spanning both commercial and direct consumer sectors, driven by evolving dietary habits and global cuisine adoption. A primary customer segment is the Food Service Industry (HORECA: Hotels, Restaurants, and Catering), including major Quick Service Restaurant (QSR) chains that use flatbreads extensively for wraps, sandwiches, and ethnic menu items. These commercial buyers prioritize consistency, bulk pricing, and reliable supply, often demanding specific sizes and functional characteristics (e.g., flatbreads that do not crack when folded or heated). Their purchasing decisions are highly centralized and focused on cost-efficiency and supply contract robustness.

Another major segment comprises retail consumers, segmented further into general households and specialized diet consumers. General households purchase flatbreads through supermarkets and convenience stores for everyday meal preparation, prioritizing value, family pack sizes, and basic freshness. The specialized diet consumer segment includes individuals seeking gluten-free, organic, high-protein, or vegan flatbread options. These customers are often willing to pay a premium for specialized products found in health food stores or online retail, driven by specific health needs or lifestyle choices rather than just price.

Furthermore, institutional buyers, such as schools, hospitals, and corporate cafeterias, constitute a stable customer base, focusing on nutritional content, compliance with health regulations, and large-volume purchasing. The increasing popularity of home meal kits and meal preparation services also creates a burgeoning segment where pre-portioned, high-quality flatbreads are essential components. Successful market penetration requires tailoring product sizes, ingredient profiles, and packaging formats to meet the distinct functional and volume requirements of each of these diverse end-user/buyer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 71.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grupo Bimbo, S.A.B. de C.V., Aryzta AG, General Mills Inc., Gruma S.A.B. de C.V., Premier Foods plc, Damascus Bakery Inc., Konopiste Naan Baking Co., Kontos Foods Inc., California Lavash, Toufayan Bakeries Inc., Klosterman Baking Company, Flowers Foods, Warburtons, La Brea Bakery, Custom Foods Inc., Quaker Oats Company, Ebro Foods, Mission Foods, Sami's Bread, and Gold Standard Baking. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flatbread Market Key Technology Landscape

The Flatbread Market relies heavily on advanced technological solutions to achieve the dual goals of mass production efficiency and extending product shelf life without compromising sensory quality. Central to the manufacturing process are high-speed, continuous dough mixing and sheeting technologies that ensure homogenous dough texture and consistent thickness, critical for standardized products like tortillas. Advanced tunnel ovens, utilizing infrared or convection heating, enable rapid and uniform baking, maximizing throughput while maintaining the necessary moisture content to prevent product brittleness. The integration of robotics and automation throughout the line, from ingredient batching to stacking and packaging, minimizes labor costs and ensures stringent hygiene standards.

Packaging technology represents another pivotal area of innovation, directly addressing the restraint of short shelf life. Modified Atmosphere Packaging (MAP), which involves flushing packages with inert gases like nitrogen or carbon dioxide, significantly slows microbial growth and oxidation, thereby extending product freshness. High-Pressure Processing (HPP) is an emerging technology utilized, particularly for fresh or ready-to-eat flatbreads, offering a non-thermal pasteurization method that preserves flavor and nutritional integrity while effectively inactivating pathogens. These techniques are essential for accessing distant markets and meeting the demand for preservative-free products.

Furthermore, manufacturers are adopting sophisticated Enterprise Resource Planning (ERP) systems integrated with the Industrial Internet of Things (IIoT) sensors to monitor production metrics in real-time. This digital transformation allows for instant process adjustments, predictive maintenance alerts for machinery, and precise tracking of raw materials and finished goods within the supply chain. The adoption of specialized gluten-free manufacturing lines, which require meticulous control to prevent cross-contamination, also necessitates investment in specific, dedicated equipment and rigorous cleaning protocols, driven by the increasing size of the specialized diet segment.

Regional Highlights

- North America (Dominance in Volume and Innovation): North America holds the largest share of the Flatbread Market, primarily driven by the massive consumption of tortillas, wraps, and pita bread within the QSR and packaged goods sectors. The region benefits from highly efficient, scaled production facilities and a sophisticated distribution network. Consumer demand here is heavily focused on convenience and innovation, fueling the rapid adoption of health-oriented variants such as high-protein, low-carb, and increasingly sophisticated gluten-free flatbreads. The influence of Mexican and Mediterranean cuisines ensures consistent, high-volume demand, making it a critical hub for product testing and strategic investment by global food giants.

- Europe (Focus on Quality and Premiumization): The European market is characterized by a strong emphasis on quality, organic ingredients, and regional specialties. While conventional flatbreads like pita and wraps are popular, there is a distinct preference for artisan-style, clean-label products with traceable origins. Western European countries like the UK, Germany, and France are major importers and consumers, driven by cosmopolitan food trends and immigration. Legislative requirements around food labeling and safety are stringent, necessitating high standards in production and ingredient sourcing, contributing to the premium pricing strategy often observed in this region.

- Asia Pacific (Highest Growth Potential): APAC is projected to register the fastest growth rate, fueled by its huge population, rapid urbanization, and rising disposable incomes leading to greater acceptance of commercially packaged foods. Flatbreads (Roti, Chapati, Naan) are deeply ingrained staple foods, and the shift from traditional home preparation to convenient, ready-made packaged products is a major growth catalyst. Countries like India, China, and Southeast Asian nations present enormous untapped potential, particularly as cold chain logistics improve and modern retail formats (supermarkets) proliferate in Tier 2 and Tier 3 cities, making packaged flatbreads more accessible.

- Latin America (Core Consumption Base): Latin America is a fundamental market, given the inherent cultural significance of tortillas, particularly in Mexico and Central America, where they serve as a daily staple. The market here is characterized by high volume and a focus on affordability. While commercial production is well-established, there is a trend toward healthier corn and specialized flour varieties. Expansion in South American countries is primarily driven by the export potential and the growing QSR sector adopting flatbreads for various menu items.

- Middle East and Africa (MEA) (Staple Food and Export Hub): MEA represents a mature market for traditional flatbreads like Pita and Khubz, which are essential components of the daily diet. Consumption is stable and high. The region also serves as a critical export hub for traditional flatbread varieties to European and North American ethnic food markets. Growth is moderate but steady, centered around expanding production capacity to meet growing domestic demand and catering to the increasing appetite for convenience products across the urban centers of the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flatbread Market.- Grupo Bimbo, S.A.B. de C.V.

- Gruma S.A.B. de C.V. (Mission Foods)

- Aryzta AG

- General Mills Inc.

- Premier Foods plc

- Damascus Bakery Inc.

- Konopiste Naan Baking Co.

- Kontos Foods Inc.

- California Lavash

- Toufayan Bakeries Inc.

- Klosterman Baking Company

- Flowers Foods

- Warburtons

- La Brea Bakery

- Custom Foods Inc.

- Quaker Oats Company

- Ebro Foods

- Sami's Bread

- Gold Standard Baking

- Angel Bakeries Inc.

Frequently Asked Questions

Analyze common user questions about the Flatbread market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Flatbread Market?

The Flatbread Market is projected to exhibit a robust growth trajectory with a CAGR of 6.5% between the forecast years of 2026 and 2033, driven by convenience and global food globalization trends.

Which product type dominates the global Flatbread Market volume?

The Tortilla segment currently dominates the global market in terms of volume consumption, primarily fueled by high demand across North America and the extensive utilization in the quick-service restaurant (QSR) industry worldwide.

What are the key drivers propelling the expansion of the Flatbread Market?

Key market drivers include the accelerating demand for convenient, ready-to-eat food options, the increasing prevalence and acceptance of diverse ethnic cuisines globally, and continuous innovation in healthy flatbread variants like whole grain and gluten-free products.

How is technology influencing the shelf life of flatbread products?

Technology significantly influences shelf life through advanced preservation methods such as Modified Atmosphere Packaging (MAP) and High-Pressure Processing (HPP). These technologies extend freshness and reduce the need for artificial preservatives, meeting clean-label consumer demands.

Which region offers the highest growth opportunity for flatbread manufacturers?

The Asia Pacific (APAC) region is forecasted to demonstrate the highest growth rate, attributed to rising disposable incomes, rapid urbanization, and the shift from home-baked staples to commercially packaged flatbreads across major economies like India and China.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bakery Machine Market Statistics 2025 Analysis By Application (Industrial Use, Commercial Use), By Type (Bread Lines, Biscuits lines, Croissant Lines, Pastry Make Up Lines, Flatbread Lines, Pizza Lines, Pie/Quiche Lines), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Bakery Machine Market Statistics 2025 Analysis By Application (Industrial Application, Commercial Application), By Type (Bread Lines, Croissant Lines, Pastry Make Up Lines, Flatbread and Pizza lines), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Bakery Confectionary Machinery Market Statistics 2025 Analysis By Application (Industrial Use, Commercial Use), By Type (Bread lines, Biscuits lines, Croissant lines, Pastry make up lines, Flatbread lines, Pizza lines, Pie/quiche lines), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager