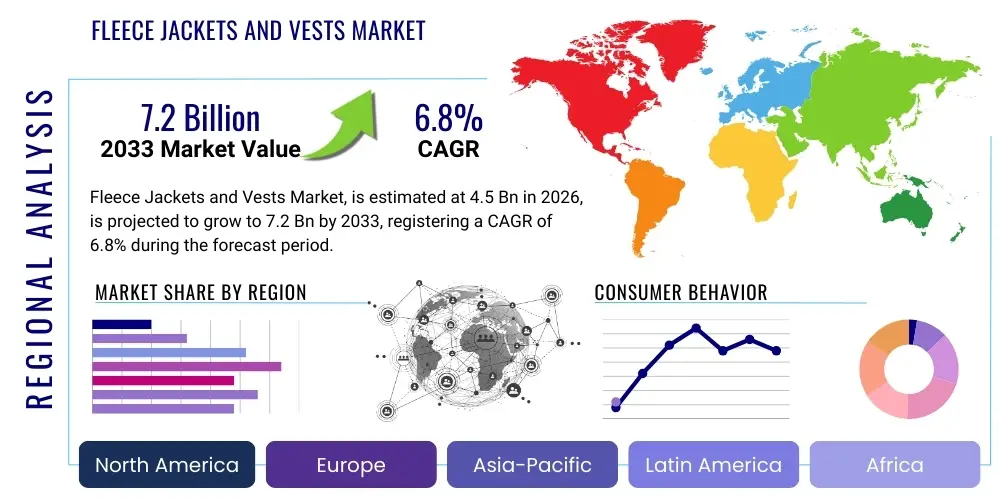

Fleece Jackets and Vests Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441051 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Fleece Jackets and Vests Market Size

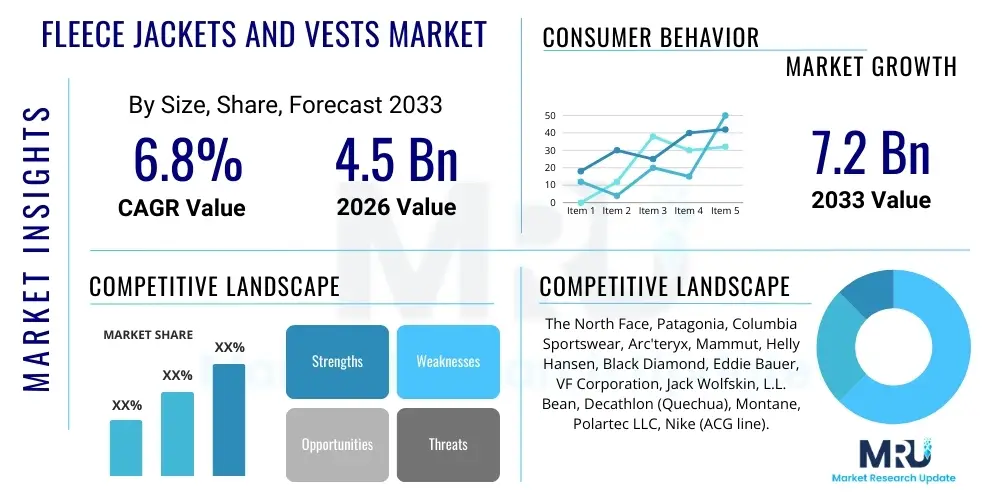

The Fleece Jackets and Vests Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Fleece Jackets and Vests Market introduction

The Fleece Jackets and Vests Market encompasses the manufacturing, distribution, and sale of specialized outerwear primarily constructed from synthetic fleece fabric, generally made from recycled polyethylene terephthalate (PET) or other polymers. This market segment is characterized by high demand for lightweight, insulating, and quick-drying garments suitable for diverse applications ranging from casual everyday wear to strenuous outdoor activities like hiking, climbing, and skiing. The core product, fleece, revolutionized mid-layer insulation due to its superior warmth-to-weight ratio and ability to retain insulating properties even when damp, positioning it as a fundamental component of multi-layer dressing systems used globally by outdoor enthusiasts and professionals.

The product range within this market is extensive, covering full-zip jackets, half-zip pullovers, vests (gilets), and highly technical hybrid garments utilizing varying fleece weights—such as microfleece, 100-weight, 200-weight, and 300-weight—to cater to specific temperature and activity requirements. Major applications span across consumer sectors (fashion, athleisure, travel), industrial uses (uniforms, cold storage environments), and military/tactical applications requiring high performance and durability. A primary benefit of fleece is its sustainability narrative, driven by increasing industry adoption of recycled materials, which resonates strongly with environmentally conscious consumers and drives premium pricing strategies for certified sustainable products.

Key driving factors accelerating market expansion include the surging global interest in outdoor recreational activities, particularly post-pandemic, leading to increased consumer spending on specialized outdoor apparel. Furthermore, technological advancements in fleece manufacturing, such as the integration of moisture-wicking treatments, windproof membranes, and enhanced durability finishes, are widening the garment's functional appeal. The consistent blending of outdoor utility with urban fashion trends, often termed ‘Gorpcore’ or ‘Techwear,’ further ensures fleece garments maintain relevance across both performance and lifestyle segments, underpinning sustained market growth throughout the forecast period.

Fleece Jackets and Vests Market Executive Summary

The Fleece Jackets and Vests Market is exhibiting robust growth, propelled by strong business trends centered on sustainability and technical innovation. Market leaders are intensely focused on integrating circular economy principles, such as utilizing 100% recycled content and implementing repair programs, to meet escalating consumer demand for ethical products. Competitive advantage is increasingly derived from advanced fabric technology, including proprietary blends that offer superior breathability and wind resistance without sacrificing warmth. Business operations are also seeing a digital transformation, with Direct-to-Consumer (D2C) e-commerce channels dominating distribution, allowing brands to capture greater margin and tailor product offerings based on real-time data analytics regarding user preferences and regional climate variations.

Regionally, North America and Europe maintain dominance, driven by established outdoor cultures, high disposable incomes, and the presence of major sportswear and outdoor apparel headquarters. However, the Asia Pacific (APAC) region is forecasted to display the highest growth rate, fueled by the rapid expansion of middle-class consumer segments, increasing participation in winter sports, and the emergence of strong domestic athletic apparel brands, particularly in countries like China and South Korea. Emerging markets in Latin America and the Middle East and Africa (MEA) are also starting to contribute significantly, primarily through the adoption of fleece for casual urban wear and niche utility applications, rather than solely high-performance sports.

Segmentation trends indicate a strong polarization between premium performance wear and budget-friendly casual wear. The type segmentation highlights the sustained popularity of full-zip jackets due to their versatility, although vests are gaining traction for layering in transitional weather. In terms of end-users, the male segment currently accounts for the largest share, but the female and youth segments are growing faster, driven by fashion-forward designs and technical adaptations tailored for diverse body shapes and style preferences. Material-wise, Polartec and similar branded, high-performance recycled polyester options continue to command the highest market share, emphasizing consumer willingness to pay a premium for verified quality and ecological sourcing.

AI Impact Analysis on Fleece Jackets and Vests Market

User queries regarding AI's impact on the Fleece Jackets and Vests Market frequently center on three critical areas: supply chain optimization, personalized product design, and predictive demand forecasting. Consumers and industry stakeholders are keen to understand how Artificial Intelligence (AI) can streamline the notoriously complex textile supply chain, particularly in managing fluctuations in raw material costs (recycled polyester) and accelerating time-to-market for new designs. There is significant interest in AI's role in generating hyper-personalized sizing and style recommendations based on demographic, climatic, and existing purchase data, moving beyond simple preference models. Furthermore, a core concern relates to AI’s ability to accurately predict demand for specific colors, weights, and styles across varying geographical regions and seasons, which is vital for minimizing inventory waste—a major environmental and financial concern in the apparel sector.

The adoption of AI and Machine Learning (ML) is fundamentally altering how fleece garments are conceived, produced, and sold. In the pre-production phase, generative AI tools are assisting designers in iterating on new patterns and technical features, such as mapping ergonomic panel placements for optimal mobility, significantly reducing the traditional design cycle. During manufacturing, ML algorithms are used to optimize cutting patterns to minimize fabric waste (reducing costs and enhancing sustainability metrics) and monitor quality control in real-time, especially regarding the consistency of the fleece pile height and density. This precision ensures performance specifications, such as insulation rating, are met across vast production volumes.

In the post-production and retail landscape, AI-driven analytics are transforming inventory management. Predictive modeling incorporates inputs like localized weather patterns, social media trends, and historical sales data to forecast demand with unprecedented accuracy, allowing brands to implement just-in-time inventory strategies, which is especially important for seasonal apparel like fleece. Moreover, customer service and post-sale engagement are enhanced through AI-powered chatbots and recommendation engines, improving the overall consumer experience and driving repeat purchases by suggesting complementary products, such as base layers or shell jackets, thus maximizing the overall layering system value proposition.

- AI optimizes material cutting, reducing fabric waste and boosting sustainability metrics.

- Generative AI accelerates product design cycles, facilitating rapid iteration on ergonomic features and aesthetics.

- Machine Learning algorithms enhance quality control by monitoring fleece density and thermal consistency during production.

- Predictive analytics forecasts demand based on weather, trends, and sales data, minimizing overstocking and optimizing supply chain responsiveness.

- AI-driven personalization tools improve customer sizing accuracy and product recommendations on e-commerce platforms.

- Natural Language Processing (NLP) enhances customer support and processes consumer feedback for continuous product refinement.

DRO & Impact Forces Of Fleece Jackets and Vests Market

The Fleece Jackets and Vests Market is shaped by a dynamic interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its trajectory. The primary driver is the global consumer shift toward health, wellness, and outdoor recreation, significantly bolstering demand for functional, comfortable, and versatile apparel. This is compounded by persistent marketing efforts by major brands that successfully position fleece not just as utility wear but as a fashion staple suitable for everyday use (athleisure trends). Conversely, the market faces strong restraints, notably the reliance on petrochemical-derived polyester, which despite recycling efforts, still raises environmental concerns regarding microplastic shedding during washing. Furthermore, intense competition from low-cost, unbranded manufacturers, particularly in Asia, pressures pricing strategies for established, quality-focused brands, potentially leading to market commoditization in lower-tier segments. Opportunities lie primarily in material innovation, specifically the development of biodegradable or natural fiber-based fleece substitutes, and expansion into untapped emerging economies where outdoor sports participation is nascent but growing rapidly. Overall, these forces create a market environment where innovation in sustainable materials and efficient supply chain management are paramount for maintaining profitability and market share.

Drivers emphasize the superior functional benefits of fleece, such as its lightweight warmth, durability, and quick-drying properties, making it an essential layer for variable climates. The continued standardization and certification of recycled content (e.g., Global Recycled Standard – GRS) also acts as a driver, reassuring consumers about the environmental claims of high-end products. However, restraints are further amplified by fluctuating raw material costs (crude oil derivatives for virgin polyester) and geopolitical instability affecting international trade, which adds complexity and risk to global sourcing strategies. The challenge of counterfeit goods, which often mimic the aesthetics but fail to deliver on performance specifications, also restrains the growth potential of authentic, high-quality fleece products.

Significant opportunities are presented by leveraging digital technology to foster customer loyalty through subscription models for apparel replacement or repair services, reinforcing the longevity aspect of high-quality fleece. The expansion of utility applications, such as incorporating conductive threads for heating elements or integrating sophisticated sensor technology for vital sign monitoring in specialized professional garments, opens up high-margin niche markets. Impact forces, beyond immediate DROs, include increasingly stringent international regulations concerning textile waste disposal and microplastic pollution, compelling manufacturers to invest heavily in material science R&D. Furthermore, macroeconomic factors, such as inflation and consumer discretionary spending shifts, exert a substantial impact, determining consumer willingness to invest in durable, performance-focused outerwear versus cheaper, fast-fashion alternatives.

Key DRO & Impact Forces:

- Drivers: Global rise in outdoor and adventure tourism; superior warmth-to-weight ratio and quick-drying capability of fleece; strong adoption of athleisure and technical fashion trends.

- Restraints: Environmental concerns related to microplastic shedding and non-biodegradability of conventional polyester fleece; intense price competition from generic brands; volatility in petrochemical raw material prices.

- Opportunities: Innovation in bio-based and fully biodegradable fleece materials; expansion into military, industrial, and specialized professional uniform markets; growth in D2C e-commerce channels maximizing consumer reach.

- Impact Forces: Strict government regulations on textile manufacturing waste and chemical usage; global economic climate influencing consumer discretionary spending on premium apparel; advancements in textile recycling infrastructure.

Segmentation Analysis

The Fleece Jackets and Vests Market is meticulously segmented across several key dimensions, including Product Type, Weight/Thickness, End-User, Distribution Channel, and Material Composition, enabling manufacturers to target distinct consumer needs with specialized product lines. Analyzing these segments is critical for understanding market dynamics, as consumer purchasing behavior varies significantly based on whether the garment is intended for high-intensity activity (requiring lightweight, breathable fleece) or static warmth in extreme cold (demanding high-loft, heavy-weight fleece). The overall market segmentation reflects a sophisticated apparel landscape where versatility and performance are key differentiating factors, driving strategic decisions regarding material sourcing and retail placement across the globe.

Segmentation by Product Type, specifically the distinction between jackets and vests, reveals differing utility patterns. Fleece jackets are the dominant segment, valued for their full body coverage and thermal regulation, making them suitable as primary outerwear or insulating mid-layers. Fleece vests, conversely, are gaining prominence for their ability to provide core warmth without restricting arm movement, making them highly favored by climbers, runners, and individuals needing professional uniforms where mobility is prioritized. The Weight/Thickness segmentation (Microfleece to 300-weight) is crucial for aligning products with specific climate zones and intended use cases, with heavier weights commanding higher price points due to increased material density and warmth capability.

The End-User segment shows the importance of catering to male, female, and youth demographics, with significant investment being directed towards female-specific design features (fit, colorways, and urban styling) to capture this rapidly growing segment. Distribution Channel analysis underscores the shift towards online retail and brand-owned stores, offering better customer data collection and control over brand narrative, although multi-brand sporting goods stores remain vital for high-volume sales and product visibility. Furthermore, the material composition segment highlights the technological maturity of the market, differentiating commodity fleece from specialized, patented performance fabrics often carrying a substantial price premium based on verified recycled content and proprietary treatments like wind resistance or anti-pilling finishes.

- By Product Type:

- Fleece Jackets (Full-Zip, Half-Zip/Pullover, Hooded)

- Fleece Vests (Gilets)

- Fleece Hybrid Apparel (Softshell combinations)

- By Weight/Thickness:

- Microfleece (100-weight equivalent or less)

- Mid-Weight Fleece (200-weight equivalent)

- Heavy-Weight Fleece (300-weight equivalent or higher)

- By End-User:

- Men

- Women

- Youth/Children

- By Material Composition:

- Standard Polyester Fleece (Virgin PET)

- Recycled Polyester Fleece (rPET)

- Specialty/Branded Fleece (e.g., Polartec, proprietary blends)

- Natural/Blended Fiber Fleece (e.g., Merino wool blends, Tencel)

- By Distribution Channel:

- Online Retail (E-commerce, Brand Websites)

- Specialty Retail Stores (Outdoor/Sports Goods Stores)

- Department Stores and Supermarkets

- Other Channels (Uniform Suppliers, Institutional Sales)

Value Chain Analysis For Fleece Jackets and Vests Market

The value chain for the Fleece Jackets and Vests Market is characterized by a high degree of integration between specialized raw material suppliers and high-volume garment manufacturers, followed by complex multi-channel distribution networks. The upstream segment begins with the procurement of raw materials, primarily polyester pellets (both virgin and recycled PET), sourced from global chemical and plastics producers. This raw material is then processed by specialized textile manufacturers into yarn, which subsequently undergoes knitting or weaving processes to create the fleece fabric. Critical steps at this early stage include anti-pilling treatments, application of water-repellent finishes (DWR), and dyeing. Efficiency and sustainability certifications (e.g., bluesign) at the fabric production stage are paramount, as they determine the quality, performance characteristics, and marketing narrative of the final product.

The midstream stage involves garment manufacturing, where the fleece fabric is cut, stitched, and finished according to specific technical designs. This phase is heavily concentrated in low-cost manufacturing hubs, predominantly across Southeast Asia (Vietnam, Bangladesh) and China, leveraging economies of scale. Direct relationships between apparel brands and highly capable Contract Manufacturers (CMs) are crucial here for maintaining quality consistency and ethical labor standards. Downstream activities involve warehousing, logistics, and distribution. Distribution channels are polarized: high-end technical brands often prioritize direct channels (D2C websites, brand stores) to maintain margin and control the customer experience, while volume-focused brands rely on indirect channels such as wholesale distribution to large department stores and hypermarkets to achieve broad market penetration.

The complexity of the downstream distribution is heightened by the seasonal nature of outerwear, requiring sophisticated inventory management and rapid fulfillment capabilities. Direct distribution allows brands immediate feedback on consumer preferences, facilitating faster product development cycles (fast fashion adaptation). Indirect channels, while offering scale, require effective collaboration with retailers regarding merchandising and promotional activities. Furthermore, the rise of specialized industrial and institutional channels, catering to uniform suppliers for organizations in cold environments, adds another layer of complexity, demanding specific technical certifications and large-volume, long-term contracts. The entire chain is underpinned by strong branding and marketing efforts, transforming a functional textile into a desirable consumer item.

Fleece Jackets and Vests Market Potential Customers

Potential customers for Fleece Jackets and Vests are incredibly diverse, reflecting the garment’s versatility across climates, activities, and budgets. The primary end-user base consists of Outdoor Enthusiasts, including hikers, mountaineers, campers, and winter sports participants (skiers/snowboarders), who rely on fleece as an indispensable mid-layer for thermal regulation within a multi-layer clothing system. These consumers prioritize technical performance, low weight, high durability, and moisture management, often leading them to purchase premium, branded fleece products with verified performance specifications. Brand loyalty within this segment is high, driven by a perception of quality and reliability in extreme conditions, making them a high-value customer group for established technical apparel companies.

The second major segment comprises the Everyday Casual Wear and Athleisure consumers. This segment uses fleece jackets and vests as comfortable, stylish outerwear for daily activities, commuting, or light exercise. For these buyers, aesthetic appeal, fashionable colorways, softness, and price point are more influential than technical performance features. This demographic drives the demand for soft, fashion-forward microfleece and blends often sold through general retailers and major e-commerce platforms. This group is highly susceptible to fast-fashion cycles and influencer marketing, demanding constant stylistic updates and competitive pricing, making volume and efficient mass production critical for manufacturers targeting this market.

A third significant customer segment encompasses Institutional and Professional Buyers. This includes procurement departments for military forces, first responders (police, ambulance), industrial workers operating in cold environments (e.g., logistics, refrigerated warehouses), and corporate entities purchasing branded fleece for employee uniforms or promotional merchandise. These buyers focus intensely on bulk pricing, long-term durability, adherence to specific safety standards (e.g., flame resistance or high visibility features, if required), and consistent supply chain management. Establishing long-term contracts with large government and corporate institutions represents a highly stable revenue stream, although it often involves rigorous qualification processes and detailed technical specifications for the garments supplied.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The North Face, Patagonia, Columbia Sportswear, Arc'teryx, Mammut, Helly Hansen, Black Diamond, Eddie Bauer, VF Corporation, Jack Wolfskin, L.L. Bean, Decathlon (Quechua), Montane, Polartec LLC, Nike (ACG line). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fleece Jackets and Vests Market Key Technology Landscape

The technological landscape of the Fleece Jackets and Vests Market is driven by continuous innovation in material science aimed at improving thermal efficiency, reducing environmental impact, and enhancing overall user comfort and durability. A fundamental technology breakthrough has been the widespread adoption of recycled polyester (rPET) derived from plastic bottles. While not strictly new, the refinement of rPET processing ensures that recycled fibers meet or exceed the performance specifications of virgin polyester, enabling brands to market highly sustainable products without compromising on quality. Advanced fleece structures, such as proprietary knitting techniques creating high-loft fibers or channel-backed fabrics (e.g., grid fleece), are critical for maximizing the warmth-to-weight ratio and promoting superior breathability by creating air channels for moisture vapor transfer. This focus on thermal regulation without bulk is essential for the performance-oriented segments of the market.

Another crucial technological area involves the application of specialized fabric finishes and membranes. Windproof technology, often achieved through laminated membranes or tightly woven exteriors bonded to the fleece (softshell hybridization), significantly expands the functional range of fleece garments, transforming them from simple mid-layers into versatile outerwear suitable for windy conditions. Furthermore, anti-pilling and anti-microbial treatments are standard technological inclusions; anti-pilling treatments extend the garment's lifespan and aesthetic appeal, directly addressing a common consumer complaint, while anti-microbial finishes inhibit odor-causing bacteria, particularly important for multi-day use in outdoor environments where washing facilities are scarce. These treatments are now frequently being engineered using environmentally benign processes to align with broader sustainability objectives.

Digital technologies also play a pivotal role beyond the physical product. Advanced 3D modeling and computer-aided design (CAD) systems allow brands to visualize and test garment fit, drape, and ergonomic performance digitally before physical prototyping, drastically reducing development time and material waste. Furthermore, manufacturing technologies utilize sophisticated ultrasonic welding and bonding instead of traditional stitching in some technical garments. This process minimizes bulk, enhances water resistance at seams, and provides a cleaner finish, catering to the aesthetic demands of high-performance and urban-tech segments. Traceability technology, leveraging blockchain or QR codes integrated into product labels, is also becoming prevalent, allowing consumers to verify the origin of the recycled materials and the ethical production pathway, significantly bolstering brand trust and facilitating compliance with global supply chain transparency mandates.

Regional Highlights

Regional dynamics within the Fleece Jackets and Vests Market demonstrate strong maturity in Western markets alongside explosive growth potential in Asia Pacific, driven by varying climatic conditions, consumer income levels, and established outdoor traditions. North America remains a cornerstone of the market, fueled by high consumer disposable income, a deeply ingrained culture of hiking and camping, and the presence of globally dominant outdoor apparel brands such as Patagonia, Columbia, and The North Face. Demand in this region is highly seasonal but consistent, with a strong preference for high-quality, technically advanced fleece garments utilizing sustainable materials. The United States specifically leads in institutional demand, including large-scale orders for corporate, medical, and public service uniforms, ensuring consistent baseline sales volume.

Europe represents another key established market, characterized by stringent consumer expectations regarding ethical sourcing and environmental performance (e.g., high demand for bluesign certified products). Countries in the Alpine region—such as Germany, France, Switzerland, and Austria—show particularly high per capita consumption of technical fleece due to widespread participation in mountaineering and skiing. The European market is fragmented, with strong regional brands competing alongside international giants, forcing companies to maintain a sharp focus on specialized niche products and strong localization of marketing efforts to appeal to diverse national tastes and preferences regarding style and color palettes. E-commerce penetration is extremely high across Western Europe, facilitating direct consumer access to premium international brands.

The Asia Pacific (APAC) region is projected to experience the fastest growth during the forecast period. This growth is predominantly driven by China, Japan, and South Korea, where urbanization is increasing, disposable incomes are rising, and Western outdoor leisure activities (like hiking and trail running) are becoming immensely popular. In particular, the younger, affluent urban demographic in APAC is embracing fleece as a fashion statement, often incorporating it into urban street style, driving demand for collaborations and aesthetically differentiated products. Market entry strategies in APAC often involve navigating complex regulatory environments and establishing robust local distribution partnerships to counter strong domestic competition and cater to unique cultural preferences, such as preferences for lighter weights and different sizing standards compared to Western markets.

Latin America presents an emerging, yet complex, market. Demand is concentrated in cooler mountainous regions (e.g., the Andes) and major metropolitan areas where fleece is utilized for daily comfort. Economic instability and fluctuating currency values often influence consumer purchasing power, making price sensitivity a significant factor. Mid-range and value-oriented fleece products dominate the sales landscape, although premium technical brands maintain a small, loyal customer base focused on high-altitude expeditions. Distribution relies heavily on traditional wholesale channels and specialized sporting goods retailers, as e-commerce infrastructure adoption is more varied across countries like Brazil, Mexico, and Chile.

The Middle East and Africa (MEA) market is highly segmented by climate and income. Demand in the cooler, mountainous regions of the Middle East (e.g., parts of Saudi Arabia and Iran) and South Africa exhibits steady growth, mainly focused on general outerwear and travel apparel. The MEA region is also a key destination for institutional purchases, notably for military, infrastructure, and oil/gas industry workwear in colder operational zones. Market growth is constrained by high logistical costs and political instability in certain areas, yet increasing international tourism and luxury retail developments offer opportunities for high-end international fleece brands targeting expatriates and wealthy locals seeking specialized performance apparel for global travel and recreation.

- North America: Market leader; mature demand for sustainable, high-performance fleece; strong institutional sales (uniforms); dominant presence of major global brands.

- Europe: High demand for ethically and environmentally certified products; strong concentration in Alpine regions; fragmented market requiring localized strategies.

- Asia Pacific (APAC): Fastest growing region; urbanization and rising middle class drive demand; strong integration of fleece into fashion/athleisure trends, especially in China and South Korea.

- Latin America: Price-sensitive market; demand concentrated in mountainous and cooler urban areas; focus on value-oriented and mid-range products; complex distribution landscape.

- Middle East and Africa (MEA): Growth driven by industrial/utility applications and regional tourism; highly varied climate dictates product mix; slower adoption of premium consumer brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fleece Jackets and Vests Market.- The North Face (VF Corporation)

- Patagonia, Inc.

- Columbia Sportswear Company

- Arc'teryx (Amer Sports)

- Mammut Sports Group AG

- Helly Hansen (Canadian Tire Corporation)

- Black Diamond Equipment

- Eddie Bauer LLC

- Jack Wolfskin (Callaway Golf Company)

- L.L. Bean, Inc.

- Decathlon (Quechua/Forclaz)

- Montane Ltd.

- Marmot (Newell Brands)

- Outdoor Research

- Mountain Hardwear (Columbia Sportswear)

- REI Co-op

- Polyester Fibers & Yarn Manufacturers (e.g., Polartec LLC)

- Adidas AG

- Nike Inc. (ACG line)

- Under Armour, Inc.

Frequently Asked Questions

Analyze common user questions about the Fleece Jackets and Vests market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Fleece Jackets and Vests Market between 2026 and 2033?

The Fleece Jackets and Vests Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven primarily by increasing outdoor participation and innovation in sustainable materials.

Which material type dominates the current Fleece Jackets and Vests market?

Recycled Polyester Fleece (rPET) is rapidly increasing its market share and dominates consumer preference, particularly in premium and performance segments, due to its sustainability advantages combined with high technical performance metrics, such as warmth and durability.

What are the primary factors driving the growth of the Fleece Jackets and Vests Market?

Key growth drivers include the sustained global rise in outdoor recreational activities, strong consumer demand for versatile athleisure apparel, and technological advancements that enhance fleece performance, such as wind resistance and improved breathability.

How is AI impacting the manufacturing and supply chain of fleece apparel?

AI impacts the market by optimizing manufacturing processes, specifically through Machine Learning for demand forecasting and cutting pattern optimization to minimize fabric waste, leading to more efficient inventory management and sustainable production cycles.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region, particularly driven by markets in China and South Korea, is anticipated to exhibit the highest growth rate due to increasing disposable income, rising participation in outdoor sports, and the integration of fleece into urban fashion trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager